Key Insights

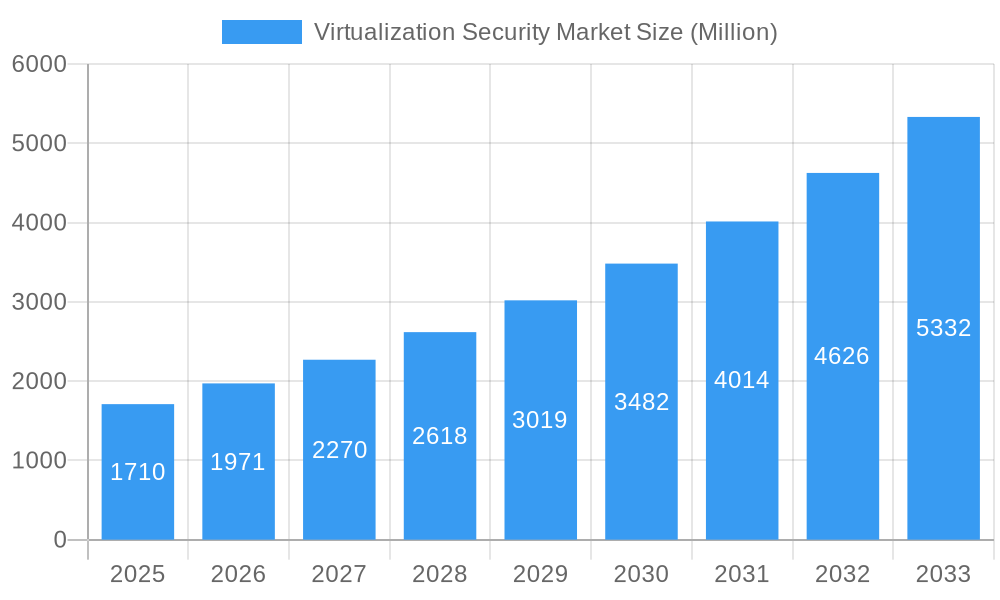

The Virtualization Security market is poised for significant expansion, projected to reach a substantial $1.71 billion in market size, driven by a robust Compound Annual Growth Rate (CAGR) of 15.20% over the forecast period from 2019 to 2033. This remarkable growth trajectory is fueled by several key factors. The escalating adoption of cloud computing, the increasing complexity of IT infrastructure, and the inherent vulnerabilities associated with virtualized environments necessitate advanced security solutions. Organizations across all sectors are prioritizing the protection of their virtualized assets, including sensitive data and critical applications, against evolving cyber threats. The demand for both hardware and application virtualization security is expected to surge, with IT & Telecom, Data Center, and Cloud Service Providers emerging as primary end-users. These sectors are at the forefront of digital transformation and rely heavily on virtualized infrastructure, making them prime targets for cyberattacks and thus driving the need for comprehensive virtualization security.

Virtualization Security Market Market Size (In Billion)

Emerging trends such as the integration of AI and machine learning in security solutions, the rise of containerization and its security implications, and the increasing regulatory compliance requirements are further bolstering market growth. The growing awareness of the financial and reputational damage caused by security breaches is compelling organizations to invest proactively in robust virtualization security measures. While the market is experiencing dynamic growth, certain challenges remain. The complexity of implementing and managing virtualization security solutions, coupled with the shortage of skilled cybersecurity professionals, could present hurdles. However, the continuous innovation by leading companies like Oracle Corporation, Trend Micro Inc., and VMware Inc., alongside strategic partnerships and mergers, is actively addressing these challenges and paving the way for a more secure and resilient virtualized future. The market is expected to witness a strong performance across all major regions, with North America, Europe, and Asia leading the adoption rates.

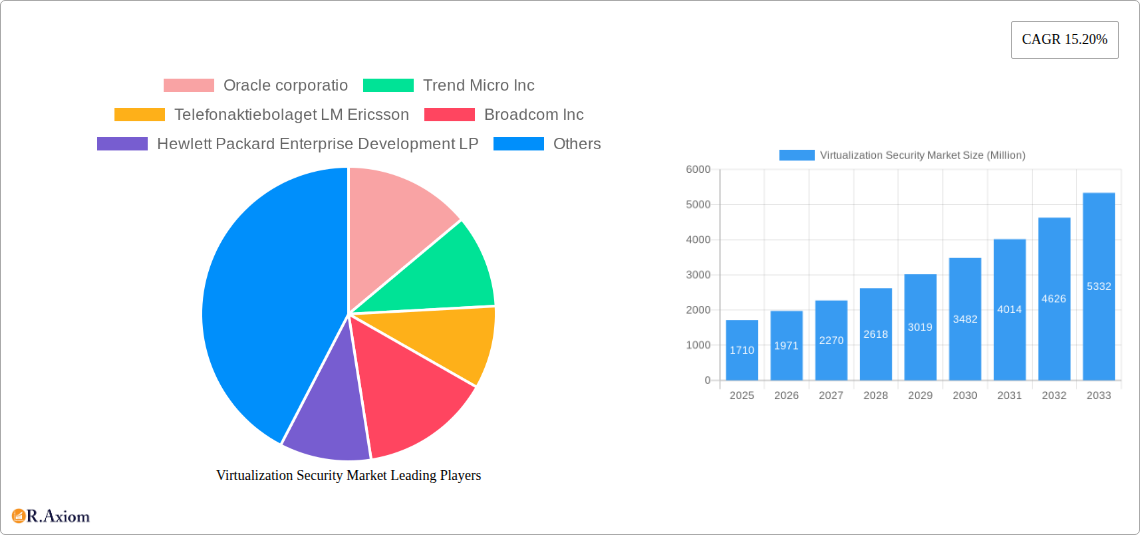

Virtualization Security Market Company Market Share

This in-depth report provides a comprehensive analysis of the global Virtualization Security Market, offering critical insights into market dynamics, growth drivers, segmentation, and future prospects. Covering the historical period from 2019 to 2024, with a base year of 2025 and a forecast period extending to 2033, this study is an essential resource for stakeholders seeking to understand and capitalize on the evolving virtualization security landscape. The report delves into market concentration, innovation trends, key industry developments, dominant segments, product innovations, and the strategic outlook for leading players.

Virtualization Security Market Market Concentration & Innovation

The Virtualization Security Market is characterized by a moderate level of concentration, with key players investing heavily in research and development to address the escalating threat landscape within virtualized environments. Innovation is primarily driven by the need for advanced threat detection, automated security workflows, and compliance with evolving data protection regulations. The market is witnessing a surge in solutions designed to secure complex multi-cloud and hybrid cloud infrastructures, as organizations increasingly adopt these models. Regulatory frameworks, such as GDPR and CCPA, are also acting as significant innovation catalysts, compelling vendors to embed robust data privacy and security features into their offerings. Product substitutes, while present in the form of traditional security solutions, are often deemed insufficient for the unique challenges posed by virtualization. End-user trends indicate a strong demand for scalable, flexible, and integrated security solutions that can adapt to dynamic virtualized workloads. Mergers and acquisitions (M&A) are a notable aspect of market dynamics, with strategic acquisitions aimed at consolidating market share, expanding product portfolios, and gaining access to new technologies. For instance, the acquisition of Axis Security by Hewlett Packard Enterprise in March 2023 highlights the trend of integrating security service edge capabilities into broader network security solutions. The overall market value is projected to reach approximately $35,000 Million by 2033. M&A deal values, while varying, are estimated to be in the hundreds of millions of dollars for significant transactions.

Virtualization Security Market Industry Trends & Insights

The Virtualization Security Market is experiencing robust growth, driven by the pervasive adoption of virtualization technologies across enterprises of all sizes. The increasing complexity of IT infrastructures, fueled by the rise of cloud computing, containerization, and the Internet of Things (IoT), presents a fertile ground for virtualization security solutions. As businesses migrate critical applications and sensitive data to virtualized environments, the demand for sophisticated security measures to protect these assets escalates. The market penetration of virtualization security solutions is estimated to be approximately 65% in 2025, with a projected Compound Annual Growth Rate (CAGR) of 12.5% from 2025 to 2033. This strong growth trajectory is underpinned by several key factors. Firstly, the evolving threat landscape, with increasingly sophisticated cyberattacks targeting virtual machines and cloud environments, necessitates advanced security capabilities. Ransomware, advanced persistent threats (APTs), and insider threats are constant concerns for organizations relying on virtualized infrastructure. Secondly, the growing emphasis on data privacy and regulatory compliance mandates stricter security controls. Regulations such as HIPAA, PCI DSS, and the aforementioned GDPR and CCPA require robust protection of sensitive data, which is often hosted in virtualized environments. Thirdly, the economic benefits of virtualization, including cost savings and improved resource utilization, continue to drive its adoption, thereby expanding the addressable market for security solutions. The shift towards remote work and hybrid work models has further amplified the need for secure access to virtualized resources, regardless of location. Technological disruptions, such as the advancements in AI and machine learning, are being leveraged to develop more intelligent and proactive virtualization security solutions, capable of detecting and responding to threats in real-time. Predictive analytics and behavioral analysis are becoming integral components of modern virtualization security platforms. Furthermore, the integration of security into the DevOps lifecycle, known as DevSecOps, is gaining traction, ensuring security is considered from the initial stages of application development and deployment within virtualized environments. Consumer preferences are leaning towards unified security platforms that offer comprehensive protection across diverse virtualized landscapes, simplifying security management and reducing operational overhead. Competitive dynamics within the market are characterized by intense innovation, strategic partnerships, and consolidation, as vendors strive to offer compelling solutions that meet the evolving needs of businesses operating in a hyper-connected and increasingly virtualized world.

Dominant Markets & Segments in Virtualization Security Market

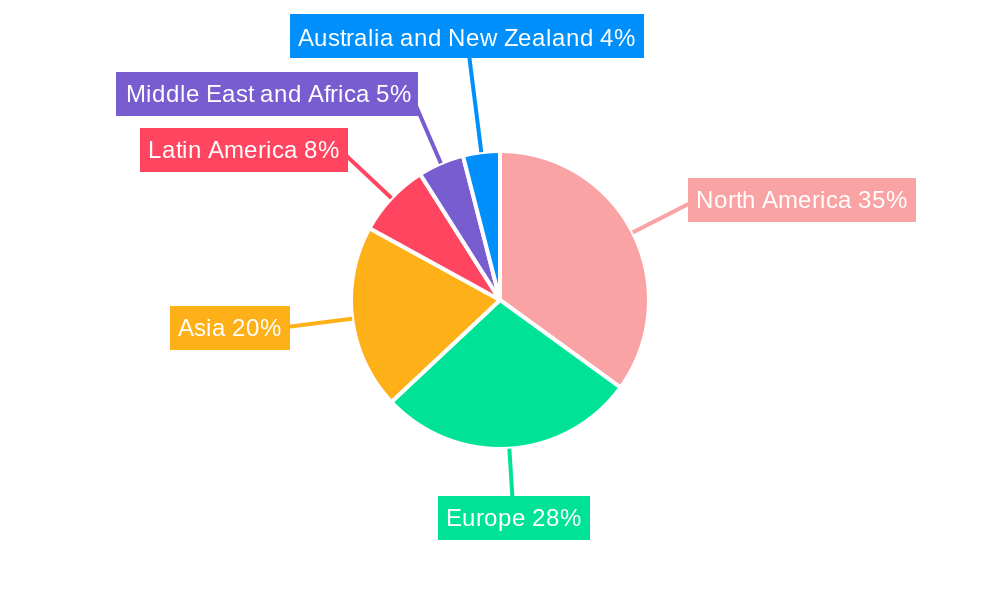

The Virtualization Security Market exhibits distinct regional and segment-wise dominance, shaped by economic policies, technological infrastructure, and the prevalence of key end-user industries. North America currently leads the market, driven by its mature IT infrastructure, high adoption of cloud computing, and stringent regulatory environment, particularly concerning data protection. The United States, in particular, accounts for a significant share due to the presence of numerous large enterprises and government entities that are early adopters of advanced virtualization technologies.

Dominant Segments by Type:

Hardware Virtualization Security: This segment holds the largest market share due to the foundational nature of hardware virtualization in enabling server consolidation, efficient resource allocation, and the creation of virtual machines. The demand for secure hypervisors and virtual machine introspection technologies is paramount for organizations seeking to protect their core infrastructure. Key drivers include the continued need for data center efficiency and the deployment of private and hybrid cloud solutions. The market size for hardware virtualization security is estimated at $18,000 Million in 2025.

- Key Drivers:

- Cost Optimization: Enterprises continue to leverage hardware virtualization to reduce hardware costs and power consumption.

- Scalability and Flexibility: The ability to quickly spin up and scale virtual machines is a major advantage.

- Legacy System Support: Virtualization allows for the continued use of older applications on modern hardware.

- Key Drivers:

Application Virtualization Security: This segment is experiencing rapid growth, fueled by the increasing adoption of software-as-a-service (SaaS) and the need to isolate and secure individual applications within virtualized environments. Application virtualization enhances portability, manageability, and security by decoupling applications from the underlying operating system. The market size for application virtualization security is projected to reach $17,000 Million by 2033.

- Key Drivers:

- Application Isolation: Prevents conflicts between applications and enhances security by limiting the impact of malware.

- Streamlined Deployment and Management: Simplifies the rollout and updating of applications across virtualized desktops and servers.

- BYOD and Remote Access Security: Enables secure delivery of applications to various devices.

- Key Drivers:

Dominant Segments by End-User Application:

Data Center: This segment is the largest contributor to the Virtualization Security Market. Data centers, whether on-premises or cloud-based, are the epicenters of virtualization. The security of virtual machines, storage, and networks within data centers is critical for business continuity and data integrity. The escalating sophistication of cyber threats targeting data centers necessitates comprehensive virtualization security solutions. The market size for data center virtualization security is estimated at $20,000 Million in 2025.

- Key Drivers:

- High Concentration of Sensitive Data: Data centers house critical business and customer information.

- Regulatory Compliance: Strict compliance requirements for data protection and privacy.

- Business Continuity and Disaster Recovery: Ensuring uninterrupted operations through secure virtualization.

- Key Drivers:

Cloud Service Providers (CSPs): CSPs are significant adopters and providers of virtualization technologies, offering virtualized infrastructure to their clients. Securing their multi-tenant cloud environments is paramount for maintaining customer trust and compliance. The growth of public and hybrid cloud adoption directly fuels the demand for robust CSP-focused virtualization security. The market size for cloud service provider virtualization security is projected to reach $12,000 Million by 2033.

- Key Drivers:

- Multi-tenancy Security: Ensuring isolation and security between different customer environments.

- Scalability and Elasticity: Security solutions must scale dynamically with cloud resource demands.

- Compliance as a Service: CSPs often provide compliance assurances to their customers.

- Key Drivers:

IT & Telecom: The IT and Telecommunications sectors are major drivers of virtualization adoption, utilizing it for network function virtualization (NFV), service delivery, and operational efficiency. The intricate nature of telecommunication networks and the sensitive data they handle make virtualization security a critical component. The market size for IT & Telecom virtualization security is estimated at $3,000 Million in 2025.

- Key Drivers:

- Network Function Virtualization (NFV): Modernizing network infrastructure with virtualized components.

- Service Agility: Enabling rapid deployment and modification of services.

- IoT Security: Securing the vast number of connected devices within telecom networks.

- Key Drivers:

Virtualization Security Market Product Developments

Product developments in the Virtualization Security Market are intensely focused on enhancing threat detection, response, and management capabilities within complex virtualized environments. Vendors are introducing AI-powered solutions for anomaly detection, behavioral analysis, and automated incident response. Innovations include enhanced micro-segmentation technologies for granular security control within virtual networks, improved vulnerability management for virtual machines, and advanced data loss prevention (DLP) features tailored for cloud and virtualized data. Many solutions are being designed for seamless integration with existing security stacks and cloud orchestration platforms, offering unified visibility and control. Competitive advantages are derived from offering solutions that provide zero-trust security postures, support for emerging containerization technologies like Kubernetes, and robust compliance reporting features for various industry regulations.

Report Scope & Segmentation Analysis

The scope of this report encompasses the global Virtualization Security Market, analyzing its dynamics from 2019 to 2033. The segmentation analysis covers key areas crucial for understanding market penetration and growth projections.

Type: The market is segmented into Hardware Virtualization and Application Virtualization. Hardware virtualization security is projected to maintain a dominant position due to its foundational role in cloud infrastructure. Application virtualization security is expected to witness higher growth rates as businesses increasingly rely on containerized applications and microservices.

End-User Application: This segmentation includes IT & Telecom, Data Center, and Cloud Service Providers. The Data Center segment is anticipated to be the largest market contributor throughout the forecast period, given the extensive use of virtualization for server consolidation and cloud infrastructure. Cloud Service Providers represent a rapidly growing segment, driven by the ongoing expansion of public and hybrid cloud services. The IT & Telecom segment, while smaller, is also a significant driver, especially with the adoption of Network Function Virtualization (NFV).

Key Drivers of Virtualization Security Market Growth

The Virtualization Security Market is propelled by several critical growth drivers. The escalating sophistication and frequency of cyber threats targeting virtualized environments necessitate robust security solutions to protect sensitive data and ensure business continuity. The widespread adoption of cloud computing, including public, private, and hybrid models, inherently expands the attack surface, thereby increasing the demand for comprehensive virtualization security. Stringent regulatory compliance mandates, such as GDPR, CCPA, and HIPAA, compel organizations to implement advanced security measures to protect personal and sensitive information stored in virtualized systems. The ongoing digital transformation initiatives across industries are leading to increased reliance on virtualized infrastructure, creating a sustained demand for related security solutions. Furthermore, the economic benefits of virtualization, such as cost savings and improved resource utilization, continue to encourage its adoption, indirectly fueling the virtualization security market.

Challenges in the Virtualization Security Market Sector

Despite its robust growth, the Virtualization Security Market faces several challenges. The complexity of virtualized and hybrid cloud environments can make security management difficult, leading to potential oversight and misconfigurations. The dynamic nature of virtual machines, with frequent creation, deletion, and migration, poses challenges for traditional security solutions that rely on static IP addresses or fixed network configurations. A significant hurdle is the shortage of skilled cybersecurity professionals with expertise in virtualization and cloud security, which can hinder effective implementation and management of security solutions. Ensuring consistent security policies across heterogeneous virtualized environments, spanning on-premises data centers and multiple cloud platforms, presents an integration challenge. The rapid pace of technological evolution in virtualization and cloud technologies requires continuous adaptation and updates of security solutions, leading to higher development costs and potential obsolescence.

Emerging Opportunities in Virtualization Security Market

The Virtualization Security Market presents numerous emerging opportunities. The growing adoption of containerization technologies, such as Docker and Kubernetes, opens up new avenues for specialized container security solutions within virtualized infrastructures. The increasing demand for zero-trust security architectures, which assume no implicit trust and continuously verify every access request, is driving innovation in identity and access management for virtualized resources. The expansion of edge computing, where data processing occurs closer to the source, creates opportunities for securing edge-based virtualized workloads. The integration of security solutions with AI and machine learning for predictive threat intelligence and automated remediation is a significant growth area. Furthermore, the increasing focus on DevSecOps practices presents opportunities for vendors to offer security solutions that can be seamlessly integrated into the CI/CD pipeline for virtualized applications.

Leading Players in the Virtualization Security Market Market

- Oracle corporation

- Trend Micro Inc

- Telefonaktiebolaget LM Ericsson

- Broadcom Inc

- Hewlett Packard Enterprise Development LP

- Dell Inc

- Altor Networks

- VMware Inc

Key Developments in Virtualization Security Market Industry

- August 2023: Lenovo and VMware expanded their partnership to bring new NVIDIA-powered turnkey generative AI and multi-cloud solutions to every business. They will deliver modern hybrid multi-cloud capabilities to mid-size companies and help customers more easily harness data to empower their intelligent transformation.

- March 2023: Hewlett Packard Enterprise fortified network security with the acquisition of security service edge provider Axis Security, where the collaboration to meet the growing demand for integrated networking and safety solutions made available as a service, security capabilities can be offered by providing an open access secure services edge solution.

Strategic Outlook for Virtualization Security Market Market

The strategic outlook for the Virtualization Security Market remains exceptionally strong, driven by the fundamental shift towards digital-first business models and the increasing reliance on virtualized and cloud-native infrastructures. The market is poised for sustained growth as organizations continue to prioritize cybersecurity to protect their digital assets from an ever-evolving threat landscape. Key growth catalysts include the ongoing digital transformation initiatives, the need for robust compliance with data protection regulations, and the growing adoption of advanced technologies such as AI and containerization. Strategic partnerships, mergers, and acquisitions will continue to shape the competitive landscape, as companies seek to consolidate their offerings and expand their technological capabilities. The demand for integrated, automated, and intelligent security solutions that can provide comprehensive protection across diverse virtual environments will be a primary focus for vendors, ensuring their relevance and driving future market expansion.

Virtualization Security Market Segmentation

-

1. Type

- 1.1. Hardware Virtualization

- 1.2. Application Virtualization

-

2. End-user Application

- 2.1. IT & Telecom

- 2.2. Data Center

- 2.3. Cloud Service Providers

Virtualization Security Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

-

3. Asia

- 3.1. China

- 3.2. Japan

- 4. Australia and New Zealand

-

5. Latin America

- 5.1. Mexico

- 5.2. Brazil

- 6. Middle East and Africa

Virtualization Security Market Regional Market Share

Geographic Coverage of Virtualization Security Market

Virtualization Security Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid Increase in Data Generated to Witness the Growth

- 3.3. Market Restrains

- 3.3.1. High Up-front Costs Involved

- 3.4. Market Trends

- 3.4.1. IT & Telecom is Expected to Hold a Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Virtualization Security Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hardware Virtualization

- 5.1.2. Application Virtualization

- 5.2. Market Analysis, Insights and Forecast - by End-user Application

- 5.2.1. IT & Telecom

- 5.2.2. Data Center

- 5.2.3. Cloud Service Providers

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Virtualization Security Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Hardware Virtualization

- 6.1.2. Application Virtualization

- 6.2. Market Analysis, Insights and Forecast - by End-user Application

- 6.2.1. IT & Telecom

- 6.2.2. Data Center

- 6.2.3. Cloud Service Providers

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Virtualization Security Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Hardware Virtualization

- 7.1.2. Application Virtualization

- 7.2. Market Analysis, Insights and Forecast - by End-user Application

- 7.2.1. IT & Telecom

- 7.2.2. Data Center

- 7.2.3. Cloud Service Providers

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Virtualization Security Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Hardware Virtualization

- 8.1.2. Application Virtualization

- 8.2. Market Analysis, Insights and Forecast - by End-user Application

- 8.2.1. IT & Telecom

- 8.2.2. Data Center

- 8.2.3. Cloud Service Providers

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Australia and New Zealand Virtualization Security Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Hardware Virtualization

- 9.1.2. Application Virtualization

- 9.2. Market Analysis, Insights and Forecast - by End-user Application

- 9.2.1. IT & Telecom

- 9.2.2. Data Center

- 9.2.3. Cloud Service Providers

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Latin America Virtualization Security Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Hardware Virtualization

- 10.1.2. Application Virtualization

- 10.2. Market Analysis, Insights and Forecast - by End-user Application

- 10.2.1. IT & Telecom

- 10.2.2. Data Center

- 10.2.3. Cloud Service Providers

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Middle East and Africa Virtualization Security Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Hardware Virtualization

- 11.1.2. Application Virtualization

- 11.2. Market Analysis, Insights and Forecast - by End-user Application

- 11.2.1. IT & Telecom

- 11.2.2. Data Center

- 11.2.3. Cloud Service Providers

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Oracle corporatio

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Trend Micro Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Telefonaktiebolaget LM Ericsson

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Broadcom Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Hewlett Packard Enterprise Development LP

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Dell Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Altor Networks

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 VMware Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.1 Oracle corporatio

List of Figures

- Figure 1: Global Virtualization Security Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Virtualization Security Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Virtualization Security Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Virtualization Security Market Revenue (Million), by End-user Application 2025 & 2033

- Figure 5: North America Virtualization Security Market Revenue Share (%), by End-user Application 2025 & 2033

- Figure 6: North America Virtualization Security Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Virtualization Security Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Virtualization Security Market Revenue (Million), by Type 2025 & 2033

- Figure 9: Europe Virtualization Security Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Virtualization Security Market Revenue (Million), by End-user Application 2025 & 2033

- Figure 11: Europe Virtualization Security Market Revenue Share (%), by End-user Application 2025 & 2033

- Figure 12: Europe Virtualization Security Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Virtualization Security Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Virtualization Security Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Asia Virtualization Security Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Virtualization Security Market Revenue (Million), by End-user Application 2025 & 2033

- Figure 17: Asia Virtualization Security Market Revenue Share (%), by End-user Application 2025 & 2033

- Figure 18: Asia Virtualization Security Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Virtualization Security Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Australia and New Zealand Virtualization Security Market Revenue (Million), by Type 2025 & 2033

- Figure 21: Australia and New Zealand Virtualization Security Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Australia and New Zealand Virtualization Security Market Revenue (Million), by End-user Application 2025 & 2033

- Figure 23: Australia and New Zealand Virtualization Security Market Revenue Share (%), by End-user Application 2025 & 2033

- Figure 24: Australia and New Zealand Virtualization Security Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Australia and New Zealand Virtualization Security Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Virtualization Security Market Revenue (Million), by Type 2025 & 2033

- Figure 27: Latin America Virtualization Security Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Latin America Virtualization Security Market Revenue (Million), by End-user Application 2025 & 2033

- Figure 29: Latin America Virtualization Security Market Revenue Share (%), by End-user Application 2025 & 2033

- Figure 30: Latin America Virtualization Security Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Latin America Virtualization Security Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East and Africa Virtualization Security Market Revenue (Million), by Type 2025 & 2033

- Figure 33: Middle East and Africa Virtualization Security Market Revenue Share (%), by Type 2025 & 2033

- Figure 34: Middle East and Africa Virtualization Security Market Revenue (Million), by End-user Application 2025 & 2033

- Figure 35: Middle East and Africa Virtualization Security Market Revenue Share (%), by End-user Application 2025 & 2033

- Figure 36: Middle East and Africa Virtualization Security Market Revenue (Million), by Country 2025 & 2033

- Figure 37: Middle East and Africa Virtualization Security Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Virtualization Security Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Virtualization Security Market Revenue Million Forecast, by End-user Application 2020 & 2033

- Table 3: Global Virtualization Security Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Virtualization Security Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Virtualization Security Market Revenue Million Forecast, by End-user Application 2020 & 2033

- Table 6: Global Virtualization Security Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Virtualization Security Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Virtualization Security Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Virtualization Security Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global Virtualization Security Market Revenue Million Forecast, by End-user Application 2020 & 2033

- Table 11: Global Virtualization Security Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Virtualization Security Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Germany Virtualization Security Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France Virtualization Security Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Global Virtualization Security Market Revenue Million Forecast, by Type 2020 & 2033

- Table 16: Global Virtualization Security Market Revenue Million Forecast, by End-user Application 2020 & 2033

- Table 17: Global Virtualization Security Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: China Virtualization Security Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Japan Virtualization Security Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Global Virtualization Security Market Revenue Million Forecast, by Type 2020 & 2033

- Table 21: Global Virtualization Security Market Revenue Million Forecast, by End-user Application 2020 & 2033

- Table 22: Global Virtualization Security Market Revenue Million Forecast, by Country 2020 & 2033

- Table 23: Global Virtualization Security Market Revenue Million Forecast, by Type 2020 & 2033

- Table 24: Global Virtualization Security Market Revenue Million Forecast, by End-user Application 2020 & 2033

- Table 25: Global Virtualization Security Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Mexico Virtualization Security Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Brazil Virtualization Security Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Virtualization Security Market Revenue Million Forecast, by Type 2020 & 2033

- Table 29: Global Virtualization Security Market Revenue Million Forecast, by End-user Application 2020 & 2033

- Table 30: Global Virtualization Security Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Virtualization Security Market?

The projected CAGR is approximately 15.20%.

2. Which companies are prominent players in the Virtualization Security Market?

Key companies in the market include Oracle corporatio, Trend Micro Inc, Telefonaktiebolaget LM Ericsson, Broadcom Inc, Hewlett Packard Enterprise Development LP, Dell Inc, Altor Networks, VMware Inc.

3. What are the main segments of the Virtualization Security Market?

The market segments include Type, End-user Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.71 Million as of 2022.

5. What are some drivers contributing to market growth?

Rapid Increase in Data Generated to Witness the Growth.

6. What are the notable trends driving market growth?

IT & Telecom is Expected to Hold a Major Market Share.

7. Are there any restraints impacting market growth?

High Up-front Costs Involved.

8. Can you provide examples of recent developments in the market?

August 2023: Lenovo and VMware expanded their partnership to bring new NVIDIA-powered turnkey generative AI and multi-cloud solutions to every business. They will deliver modern hybrid multi-cloud capabilities to mid-size companies and help customers more easily harness data to empower their intelligent transformation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Virtualization Security Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Virtualization Security Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Virtualization Security Market?

To stay informed about further developments, trends, and reports in the Virtualization Security Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence