Key Insights

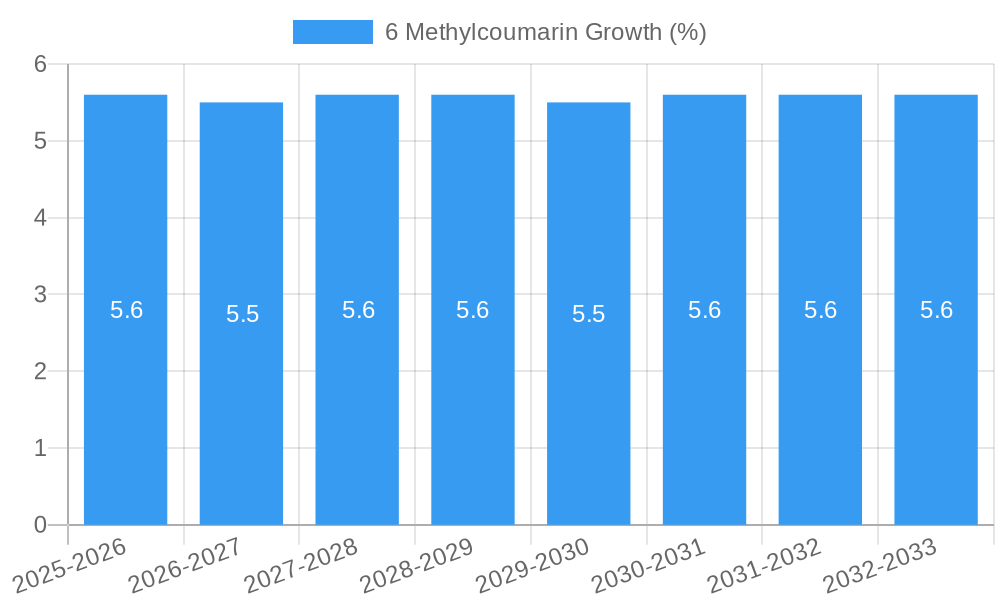

The global 6-Methylcoumarin market is projected to experience significant growth, reaching an estimated market size of approximately $50 million by 2025. This expansion is driven by its increasing application in the cosmetic industry, particularly as a fragrance ingredient and for its potential skin-whitening properties. The market is expected to maintain a healthy Compound Annual Growth Rate (CAGR) of around 5.5% from 2025 to 2033, indicating a robust and sustained demand. The primary drivers fueling this growth include rising consumer preferences for natural and effective cosmetic formulations, coupled with increasing disposable incomes in emerging economies that enable greater spending on personal care products. Furthermore, ongoing research into the photoprotective and antioxidant benefits of coumarin derivatives may unlock new avenues for market penetration.

The market is segmented by purity, with 98% and 99% purity grades dominating demand due to their suitability for high-end cosmetic applications. The "Others" category, encompassing various purity levels and specialized grades, also contributes to the market's diversity. While the cosmetic segment is the leading application, other uses in pharmaceuticals and industrial applications are also present, though smaller in scale. The market faces certain restraints, including regulatory hurdles and potential concerns regarding skin sensitization for certain coumarin derivatives, which necessitate careful formulation and adherence to safety standards. However, the overall positive outlook is supported by the strong presence of key players like Advanced Biotech, Inc., Ernesto Ventós SA, and TCI Chemicals, who are actively involved in product development and market expansion, particularly in the Asia Pacific region, which is anticipated to be a major growth hub.

6 Methylcoumarin Market Concentration & Innovation

The 6 Methylcoumarin market exhibits moderate to high concentration, with leading players such as Advanced Biotech, Inc., Ernesto Ventós SA, and Yunnan Xili Biotechnology Co., Ltd. holding significant market share, estimated to be over 40% collectively. Innovation is a key driver, with continuous research and development focused on enhancing purity levels (99% Purity and 98% Purity) and exploring novel applications beyond traditional uses. Regulatory frameworks, particularly concerning cosmetic ingredients and safety standards, play a crucial role in shaping product development and market entry. The threat of product substitutes, while present, is limited due to the unique olfactory properties of 6 Methylcoumarin in perfumery and its specific functional roles in other applications. End-user trends are leaning towards demand for natural and sustainably sourced ingredients, prompting manufacturers to invest in greener production methods. Mergers and acquisitions (M&A) activity in the sector is anticipated to increase, with estimated deal values in the tens of millions, aimed at consolidating market presence and acquiring innovative technologies.

6 Methylcoumarin Industry Trends & Insights

The global 6 Methylcoumarin market is poised for robust growth, driven by a confluence of factors that are reshaping its landscape. The estimated Compound Annual Growth Rate (CAGR) for the forecast period (2025–2033) is projected to be between 5.5% and 7.0%, reflecting strong underlying demand. Market penetration is expected to deepen, particularly in emerging economies, as awareness of 6 Methylcoumarin's diverse applications grows. A primary growth driver is the flourishing cosmetics and personal care industry, where 6 Methylcoumarin is a valued ingredient for its fragrance properties and use in sunscreens. The “Others” application segment, encompassing pharmaceuticals, agrochemicals, and specialty chemicals, is also witnessing significant expansion, driven by ongoing research into its bioactive properties and its utility as a chemical intermediate. Technological disruptions, such as advancements in synthetic chemistry and bioprocessing, are enabling more efficient and cost-effective production of high-purity 6 Methylcoumarin, thus influencing market dynamics. Consumer preferences for unique and long-lasting fragrances are directly boosting demand for coumarin derivatives. Furthermore, the increasing emphasis on specialty ingredients in formulations across various industries is creating new avenues for 6 Methylcoumarin. The competitive landscape is characterized by a mix of established chemical manufacturers and specialized biotechnology firms, all striving to capture market share through product differentiation, quality assurance, and strategic partnerships. The interplay between these trends suggests a dynamic and evolving market, ripe with opportunities for stakeholders who can adapt to changing consumer needs and leverage technological advancements.

Dominant Markets & Segments in 6 Methylcoumarin

The Cosmetic application segment stands as the dominant force in the 6 Methylcoumarin market, projected to command a market share exceeding 60% during the forecast period. This dominance is primarily driven by the robust global cosmetics and personal care industry, which is valued in the hundreds of millions. Key drivers for this segment include:

- Consumer Demand for Fragrances: 6 Methylcoumarin is a crucial component in a wide array of perfumes, colognes, and scented personal care products due to its sweet, herbaceous, and hay-like aroma, often described as reminiscent of tonka bean. The sustained consumer preference for these scent profiles ensures consistent demand.

- Sunscreen Formulations: Its photoprotective properties make it a valuable ingredient in sunscreen formulations, contributing to UV absorption. The growing awareness of sun protection and the expansion of the global sunscreen market, valued in the tens of millions, directly fuels 6 Methylcoumarin demand.

- Regulatory Approval: Established regulatory approvals for its use in cosmetics in major markets like the United States, European Union, and Asia provide a stable foundation for its application.

Within product types, 99% Purity 6 Methylcoumarin is expected to be the leading segment, holding an estimated market share of over 50%. This preference for higher purity is dictated by stringent quality requirements in the cosmetic and pharmaceutical industries.

- High-End Fragrances: Luxury and premium perfumes often demand the highest purity grades to ensure nuanced scent profiles and to avoid potential allergenic reactions or off-notes.

- Pharmaceutical Applications: When used in pharmaceutical research or as an intermediate, exceptionally high purity is paramount for efficacy and safety, thus commanding a premium.

Geographically, North America and Europe are currently the dominant regions, collectively accounting for approximately 70% of the global market. This is attributed to:

- Mature Cosmetic Industries: These regions possess well-established and sophisticated cosmetic industries with a high propensity for innovation and premium product development.

- Strong R&D Investment: Significant investments in research and development by major chemical and cosmetic companies in these regions drive the demand for specialty ingredients like 6 Methylcoumarin.

- High Disposable Income: Consumers in these regions have a higher disposable income, enabling them to spend more on premium personal care and cosmetic products.

However, the Asia-Pacific region is projected to witness the highest growth rate, driven by a rapidly expanding middle class, increasing urbanization, and a growing preference for Western-style cosmetic products. Economic policies supporting manufacturing and trade, coupled with infrastructural development, are further bolstering its market presence.

6 Methylcoumarin Product Developments

The 6 Methylcoumarin market is witnessing product development focused on enhancing purity and expanding application horizons. Innovations are geared towards synthesizing higher grades, such as 99% Purity, essential for premium cosmetic and pharmaceutical applications, and improving production efficiency. Research into novel applications, particularly within the pharmaceutical sector for potential therapeutic properties and in the development of advanced materials, is a key trend. These developments aim to provide competitive advantages through superior product quality, cost-effectiveness, and expanded market reach, aligning with evolving industry demands for specialized and high-performance chemical ingredients.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the 6 Methylcoumarin market across key segments.

Application Segmentation: The market is segmented into Cosmetic and Others. The Cosmetic segment, projected to reach market sizes in the hundreds of millions, is driven by its extensive use in fragrances and sunscreens. The Others segment, encompassing pharmaceutical intermediates, agrochemicals, and specialty chemical applications, is also showing promising growth, with projected market sizes in the tens of millions, fueled by ongoing research and niche industrial demands.

Type Segmentation: The market is further segmented by purity levels into 98% Purity, 99% Purity, and Others. The 99% Purity segment is expected to dominate, with market sizes in the hundreds of millions, due to stringent quality requirements in high-value applications. The 98% Purity segment, with market sizes in the tens of millions, serves broader industrial applications. The "Others" category covers various custom or less common purity grades.

Key Drivers of 6 Methylcoumarin Growth

The growth of the 6 Methylcoumarin market is propelled by several key factors. Technologically, advancements in synthetic organic chemistry and purification techniques are enabling higher purity grades and more cost-effective production, with R&D investments in the tens of millions. Economically, the expanding global cosmetics and personal care industry, valued in the hundreds of billions, directly translates to increased demand for fragrance ingredients like 6 Methylcoumarin. Regulatory environments, while presenting some hurdles, also create opportunities for compliant and quality-assured products. The increasing consumer demand for sophisticated fragrances and the growing awareness of sun protection are significant market drivers. Furthermore, emerging applications in pharmaceuticals and specialty chemicals, supported by substantial research funding in the millions, are opening new growth avenues.

Challenges in the 6 Methylcoumarin Sector

Despite its growth potential, the 6 Methylcoumarin sector faces several challenges. Regulatory hurdles, particularly concerning environmental impact and safety assessments for new applications, can slow down market entry and product development, potentially costing companies millions in compliance. Supply chain disruptions, exacerbated by global geopolitical events or raw material availability, can lead to price volatility and impact production schedules. Intense competition from both established players and new entrants, particularly from regions with lower production costs, can exert downward pressure on profit margins. Furthermore, the development of novel synthetic alternatives or natural ingredients that mimic its olfactory properties could pose a long-term threat, requiring continuous innovation to maintain market position.

Emerging Opportunities in 6 Methylcoumarin

Emerging opportunities in the 6 Methylcoumarin market are multifaceted. The growing trend towards natural and sustainable ingredients presents an opportunity for bio-based production methods or sourcing from renewable feedstocks, potentially attracting a premium market share valued in the millions. The expanding pharmaceutical sector's interest in coumarin derivatives for their potential therapeutic properties offers significant research and development prospects, with substantial investment in the tens of millions. Niche applications in advanced materials and specialty polymers are also emerging, driven by specific functional requirements. Furthermore, the untapped potential in emerging economies, particularly in the Asia-Pacific region, for both cosmetic and industrial applications, represents a substantial growth opportunity, with market penetration efforts requiring investments in the millions.

Leading Players in the 6 Methylcoumarin Market

- Advanced Biotech, Inc.

- Ernesto Ventós SA

- Yunnan Xili Biotechnology Co., Ltd.

- Shanghai Jizhi Biochemical Technology Co., Ltd.

- Shanghai Aladdin Biochemical Technology Co., Ltd.

- Shanghai Chuangsai Technology Co., Ltd.

- Zhongshan Dixin Chemical Co., Ltd.

- Selleck Chemicals

- TCI Chemicals

- BioCrick

- Hubei Hongjing Chemical Co., Ltd.

- Shanghai Yuanye Biotechnology Co., Ltd.

Key Developments in 6 Methylcoumarin Industry

- 2024 January: Launch of a new range of high-purity 6 Methylcoumarin (99% Purity) by Shanghai Aladdin Biochemical Technology Co., Ltd. to cater to the premium cosmetic fragrance market, aiming to capture a significant share.

- 2023 December: Advanced Biotech, Inc. announces strategic expansion of its production facility, investing millions to increase capacity by 20% to meet growing global demand.

- 2023 October: Ernesto Ventós SA secures new patent for an innovative extraction method for coumarin derivatives, promising more sustainable and cost-effective production.

- 2023 July: Yunnan Xili Biotechnology Co., Ltd. enters into a partnership with a leading European cosmetic brand to supply a key fragrance ingredient, signaling increased international market penetration.

- 2023 April: Hubei Hongjing Chemical Co., Ltd. showcases its commitment to quality control with ISO 9001 certification, reinforcing its position as a reliable supplier in the tens of millions market segment.

Strategic Outlook for 6 Methylcoumarin Market

- 2024 January: Launch of a new range of high-purity 6 Methylcoumarin (99% Purity) by Shanghai Aladdin Biochemical Technology Co., Ltd. to cater to the premium cosmetic fragrance market, aiming to capture a significant share.

- 2023 December: Advanced Biotech, Inc. announces strategic expansion of its production facility, investing millions to increase capacity by 20% to meet growing global demand.

- 2023 October: Ernesto Ventós SA secures new patent for an innovative extraction method for coumarin derivatives, promising more sustainable and cost-effective production.

- 2023 July: Yunnan Xili Biotechnology Co., Ltd. enters into a partnership with a leading European cosmetic brand to supply a key fragrance ingredient, signaling increased international market penetration.

- 2023 April: Hubei Hongjing Chemical Co., Ltd. showcases its commitment to quality control with ISO 9001 certification, reinforcing its position as a reliable supplier in the tens of millions market segment.

Strategic Outlook for 6 Methylcoumarin Market

The strategic outlook for the 6 Methylcoumarin market remains exceptionally positive, driven by consistent demand from the thriving cosmetic industry and the burgeoning potential in pharmaceutical and specialty chemical applications. Future growth will be shaped by companies that can prioritize high-purity product development (e.g., 99% Purity), invest in sustainable production methods, and forge strategic alliances to expand their global footprint. The focus on innovation, particularly in exploring novel applications and enhancing product efficacy, will be crucial for gaining competitive advantages and capturing a larger share of the market, estimated to be worth billions by the end of the forecast period. Strategic investments in research and development, coupled with agile supply chain management, will be paramount for navigating market dynamics and capitalizing on emerging opportunities.

6 Methylcoumarin Segmentation

-

1. Application

- 1.1. Cosmetic

- 1.2. Others

-

2. Type

- 2.1. 98% Purity

- 2.2. 99% Purity

- 2.3. Others

6 Methylcoumarin Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

6 Methylcoumarin REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global 6 Methylcoumarin Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Cosmetic

- 5.1.2. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. 98% Purity

- 5.2.2. 99% Purity

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America 6 Methylcoumarin Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Cosmetic

- 6.1.2. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. 98% Purity

- 6.2.2. 99% Purity

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America 6 Methylcoumarin Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Cosmetic

- 7.1.2. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. 98% Purity

- 7.2.2. 99% Purity

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe 6 Methylcoumarin Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Cosmetic

- 8.1.2. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. 98% Purity

- 8.2.2. 99% Purity

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa 6 Methylcoumarin Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Cosmetic

- 9.1.2. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. 98% Purity

- 9.2.2. 99% Purity

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific 6 Methylcoumarin Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Cosmetic

- 10.1.2. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. 98% Purity

- 10.2.2. 99% Purity

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Advanced BiotechInc.

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Ernesto Ventós SA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Yunnan Xili Biotechnology Co. Ltd.

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Shanghai Jizhi Biochemical Technology Co. Ltd.

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Shanghai Aladdin Biochemical Technology Co. Ltd.

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Shanghai Chuangsai Technology Co. Ltd.

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Zhongshan Dixin Chemical Co. Ltd.

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Selleck Chemicals

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 TCI Chemicals

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 BioCrick

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Hubei Hongjing Chemical Co. Ltd.

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Shanghai Yuanye Biotechnology Co. Ltd.

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Advanced BiotechInc.

List of Figures

- Figure 1: Global 6 Methylcoumarin Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America 6 Methylcoumarin Revenue (million), by Application 2024 & 2032

- Figure 3: North America 6 Methylcoumarin Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America 6 Methylcoumarin Revenue (million), by Type 2024 & 2032

- Figure 5: North America 6 Methylcoumarin Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America 6 Methylcoumarin Revenue (million), by Country 2024 & 2032

- Figure 7: North America 6 Methylcoumarin Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America 6 Methylcoumarin Revenue (million), by Application 2024 & 2032

- Figure 9: South America 6 Methylcoumarin Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America 6 Methylcoumarin Revenue (million), by Type 2024 & 2032

- Figure 11: South America 6 Methylcoumarin Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America 6 Methylcoumarin Revenue (million), by Country 2024 & 2032

- Figure 13: South America 6 Methylcoumarin Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe 6 Methylcoumarin Revenue (million), by Application 2024 & 2032

- Figure 15: Europe 6 Methylcoumarin Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe 6 Methylcoumarin Revenue (million), by Type 2024 & 2032

- Figure 17: Europe 6 Methylcoumarin Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe 6 Methylcoumarin Revenue (million), by Country 2024 & 2032

- Figure 19: Europe 6 Methylcoumarin Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa 6 Methylcoumarin Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa 6 Methylcoumarin Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa 6 Methylcoumarin Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa 6 Methylcoumarin Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa 6 Methylcoumarin Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa 6 Methylcoumarin Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific 6 Methylcoumarin Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific 6 Methylcoumarin Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific 6 Methylcoumarin Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific 6 Methylcoumarin Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific 6 Methylcoumarin Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific 6 Methylcoumarin Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global 6 Methylcoumarin Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global 6 Methylcoumarin Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global 6 Methylcoumarin Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global 6 Methylcoumarin Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global 6 Methylcoumarin Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global 6 Methylcoumarin Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global 6 Methylcoumarin Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States 6 Methylcoumarin Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada 6 Methylcoumarin Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico 6 Methylcoumarin Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global 6 Methylcoumarin Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global 6 Methylcoumarin Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global 6 Methylcoumarin Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil 6 Methylcoumarin Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina 6 Methylcoumarin Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America 6 Methylcoumarin Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global 6 Methylcoumarin Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global 6 Methylcoumarin Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global 6 Methylcoumarin Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom 6 Methylcoumarin Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany 6 Methylcoumarin Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France 6 Methylcoumarin Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy 6 Methylcoumarin Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain 6 Methylcoumarin Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia 6 Methylcoumarin Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux 6 Methylcoumarin Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics 6 Methylcoumarin Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe 6 Methylcoumarin Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global 6 Methylcoumarin Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global 6 Methylcoumarin Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global 6 Methylcoumarin Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey 6 Methylcoumarin Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel 6 Methylcoumarin Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC 6 Methylcoumarin Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa 6 Methylcoumarin Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa 6 Methylcoumarin Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa 6 Methylcoumarin Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global 6 Methylcoumarin Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global 6 Methylcoumarin Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global 6 Methylcoumarin Revenue million Forecast, by Country 2019 & 2032

- Table 41: China 6 Methylcoumarin Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India 6 Methylcoumarin Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan 6 Methylcoumarin Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea 6 Methylcoumarin Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN 6 Methylcoumarin Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania 6 Methylcoumarin Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific 6 Methylcoumarin Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the 6 Methylcoumarin?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the 6 Methylcoumarin?

Key companies in the market include Advanced Biotech,Inc., Ernesto Ventós SA, Yunnan Xili Biotechnology Co., Ltd., Shanghai Jizhi Biochemical Technology Co., Ltd., Shanghai Aladdin Biochemical Technology Co., Ltd., Shanghai Chuangsai Technology Co., Ltd., Zhongshan Dixin Chemical Co., Ltd., Selleck Chemicals, TCI Chemicals, BioCrick, Hubei Hongjing Chemical Co., Ltd., Shanghai Yuanye Biotechnology Co., Ltd..

3. What are the main segments of the 6 Methylcoumarin?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "6 Methylcoumarin," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the 6 Methylcoumarin report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the 6 Methylcoumarin?

To stay informed about further developments, trends, and reports in the 6 Methylcoumarin, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence