Key Insights

The global 802.15.4 chipset market is poised for significant expansion, projected to reach an estimated $24 billion in 2025. This robust growth is fueled by a CAGR of 7.3% over the forecast period of 2025-2033, indicating sustained demand for these critical components. The proliferation of the Internet of Things (IoT) across various sectors is the primary driver, with smart home automation and industrial automation leading the charge. As more devices become interconnected, the need for reliable, low-power, and cost-effective wireless communication solutions, such as those provided by 802.15.4 chipsets, intensifies. The increasing adoption of smart technologies in residential, commercial, and industrial settings, coupled with advancements in chip design leading to enhanced performance and reduced power consumption, are further propelling market growth.

802.15.4 Chipset Industry Market Size (In Billion)

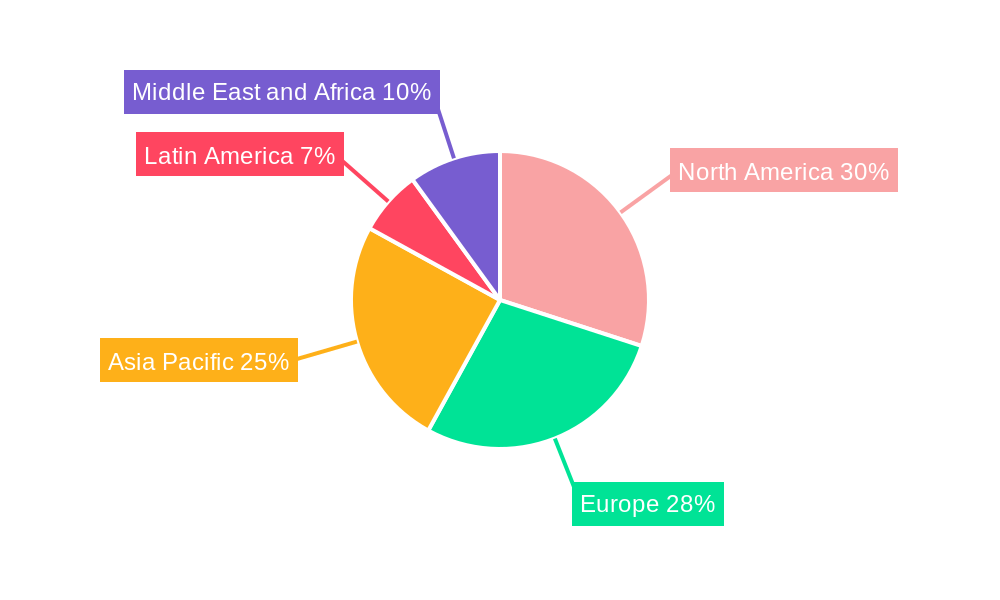

Further dissecting the market, the demand for multi-protocol chipsets is expected to outpace that of single-protocol/standalone variants as industries seek greater interoperability and flexibility. Beyond the dominant applications of smart home and industrial automation, emerging areas like smart meetings and smart cities are contributing to market diversification. However, the market is not without its challenges. Intense competition among established players and the constant need for innovation to keep pace with evolving technological standards and evolving consumer demands represent significant restraints. Geographically, North America and Europe are anticipated to maintain their strong market positions due to early adoption of IoT technologies and established industrial infrastructure, while the Asia Pacific region presents substantial growth opportunities driven by rapid industrialization and increasing consumer adoption of smart devices.

802.15.4 Chipset Industry Company Market Share

802.15.4 Chipset Industry Market Analysis: 2019–2033 Comprehensive Report

This in-depth report provides a comprehensive analysis of the global 802.15.4 Chipset Industry, encompassing market dynamics, technological advancements, competitive landscapes, and future projections from 2019 to 2033. With a base year of 2025 and a robust forecast period extending to 2033, this study offers critical insights for industry stakeholders navigating the rapidly evolving IoT connectivity market. Our analysis leverages a wealth of data, including historical trends from 2019-2024 and estimated figures for 2025, painting a complete picture of market evolution. The global 802.15.4 chipset market is projected to reach an estimated value exceeding $10 billion by 2025, with a projected compound annual growth rate (CAGR) of approximately 20% during the forecast period.

802.15.4 Chipset Industry Market Concentration & Innovation

The 802.15.4 chipset industry exhibits a moderate to high level of market concentration, with a few key players holding significant market share. Major companies like Microchip Technology Inc., NXP Semiconductors NV, Silicon Laboratories Inc., Marvell International Ltd, Texas Instruments Inc., STMicroelectronics NV, ON Semiconductor Corporation, Qorvo Inc, Nordic Semiconductors ASA, Qualcomm Inc, and Panasonic Corporation are actively shaping the market through continuous innovation and strategic partnerships. Innovation drivers are primarily fueled by the escalating demand for low-power, reliable wireless connectivity in a burgeoning Internet of Things (IoT) ecosystem. Key areas of innovation include the development of multi-protocol chipsets that support Zigbee, Thread, Bluetooth Low Energy (BLE), and Wi-Fi, alongside enhanced security features and improved power efficiency for extended battery life. Regulatory frameworks, such as those governing spectrum allocation and device certifications, play a crucial role in market entry and product development, ensuring interoperability and safety. Product substitutes, while present in some niche applications, struggle to match the cost-effectiveness and low-power attributes of 802.15.4 chipsets for their core use cases. End-user trends are overwhelmingly positive, driven by the widespread adoption of smart home devices, industrial automation systems, smart city infrastructure, and connected healthcare solutions. Mergers and acquisitions (M&A) activities, such as the acquisition of Silicon Laboratories' infrastructure and automotive business by Skyworks Solutions for approximately $2.7 billion, highlight the industry's consolidation efforts and strategic moves to enhance product portfolios and market reach. The overall market value is estimated to be around $9 billion in 2025, with M&A deal values expected to fluctuate but remain significant as companies seek to expand their IoT offerings.

802.15.4 Chipset Industry Industry Trends & Insights

The 802.15.4 Chipset Industry is experiencing robust growth fueled by an insatiable demand for connected devices across diverse sectors. The market penetration of 802.15.4-enabled solutions is steadily increasing, projected to exceed 70% in key smart home applications by 2030. This growth is intrinsically linked to the expanding Internet of Things (IoT) ecosystem, where low-power, reliable, and cost-effective wireless communication is paramount. Technological disruptions are at the forefront, with the evolution of standards like Zigbee 3.0 and Thread significantly enhancing interoperability and ease of use, driving adoption. The development of multi-protocol chipsets, integrating 802.15.4 with technologies like Bluetooth Low Energy (BLE) and Wi-Fi, offers a compelling value proposition for device manufacturers seeking versatile connectivity options. This trend is reflected in the market share of multi-protocol chipsets, which is projected to grow from approximately 40% in 2025 to over 60% by 2033. Consumer preferences are increasingly leaning towards smart and automated living. Smart home devices, including smart lighting, thermostats, security systems, and appliances, are becoming mainstream, directly increasing the demand for 802.15.4 chipsets that power these innovations. The average selling price (ASP) of 802.15.4 chipsets is expected to see a gradual decline due to increased production volumes and manufacturing efficiencies, potentially reaching an average of $0.80 per unit by 2030, further stimulating adoption. Competitive dynamics are characterized by intense innovation and strategic alliances. Companies are investing heavily in research and development to create more power-efficient, secure, and feature-rich chipsets. The market capitalization of leading 802.15.4 chipset manufacturers collectively stands at over $100 billion, indicating substantial investor confidence. The market size for 802.15.4 chipsets is estimated to reach $12 billion by 2028, with a projected CAGR of 18% from 2025 onwards. This sustained growth trajectory underscores the fundamental importance of 802.15.4 technology in enabling the future of connected devices.

Dominant Markets & Segments in 802.15.4 Chipset Industry

The global 802.15.4 chipset industry is experiencing significant growth across various regions and application segments. North America currently holds a dominant position in the market, driven by a strong economy, advanced technological infrastructure, and a high consumer adoption rate for smart home and industrial automation solutions. The United States, in particular, is a key market, contributing an estimated 35% to the global market revenue in 2025. This dominance is further bolstered by proactive government initiatives and substantial investments in smart city projects.

Key Drivers of Regional Dominance:

- Economic Policies: Favorable government policies and incentives supporting IoT development and adoption.

- Infrastructure Development: Robust existing and developing smart infrastructure supporting wireless connectivity.

- Consumer Spending Power: High disposable income leading to increased demand for smart devices.

- Technological Adoption Rates: Early and widespread acceptance of new technologies and connected solutions.

Within the Type segmentation, Multi-protocol Chipsets are rapidly gaining traction and are projected to outpace Single-protocol/Standalone chipsets in terms of growth. This shift is attributed to the increasing need for devices to communicate across different wireless standards simultaneously, offering greater flexibility and interoperability. The market share of multi-protocol chipsets is expected to grow from approximately 45% in 2025 to over 65% by 2033, with a projected market value exceeding $7 billion by 2030.

In terms of Application segmentation, Smart Home applications currently represent the largest and fastest-growing segment. The escalating consumer demand for convenience, energy efficiency, and enhanced security is driving the widespread adoption of 802.15.4-enabled smart home devices. This segment is estimated to account for over 40% of the total market revenue in 2025, with a projected market size of $5 billion.

Key Drivers of Segment Dominance:

- Smart Home: Growing consumer awareness, falling device prices, and a wide array of interconnected devices.

- Industrial Automation: Increasing need for real-time monitoring, control, and data acquisition in manufacturing and logistics.

- Smart City: Government initiatives for smart grids, intelligent transportation systems, and public safety.

- Smart Ci (Connected Infrastructure/Industrial): Focus on predictive maintenance, asset tracking, and operational efficiency.

The Industrial Automation segment is the second-largest contributor, driven by the Industry 4.0 revolution, which emphasizes smart factories, efficient supply chains, and predictive maintenance. The market value for this segment is expected to reach $3.5 billion by 2030. The Smart City and Smart Ci segments are also showing significant growth potential, driven by global urbanization and the need for efficient resource management and public services.

802.15.4 Chipset Industry Product Developments

Product developments in the 802.15.4 chipset industry are characterized by a relentless pursuit of enhanced performance, lower power consumption, and integrated functionalities. Manufacturers are focusing on developing chipsets that support multiple protocols, enabling seamless connectivity across Zigbee, Thread, and other relevant IoT standards. Innovations in security, such as hardware-accelerated encryption and secure boot capabilities, are crucial for building trust in connected ecosystems. Furthermore, advancements in low-power design are extending battery life for battery-operated devices, a critical factor for widespread adoption in applications like smart sensors and wearables. Competitive advantages are being carved out through superior integration, reduced bill of materials (BOM) costs, and comprehensive software development kits (SDKs) that simplify the design process for product manufacturers.

Report Scope & Segmentation Analysis

This report meticulously analyzes the 802.15.4 Chipset Industry by segmentation. The Type segmentation includes Single-protocol/Standalone 802.15.4 Chipsets, which offer dedicated functionality for specific applications and are projected to grow at a CAGR of 15%, and Multi-protocol Chipsets, which integrate support for various wireless standards and are expected to witness a higher CAGR of 20% due to their versatility.

The Application segmentation covers Smart Home, the largest segment with an estimated market size of $5 billion in 2025 and a projected CAGR of 19%. Industrial Automation follows with an estimated market size of $3 billion in 2025 and a CAGR of 17%. Smart Meeting, Smart Ci, and Other Applications represent emerging and niche markets, each with unique growth trajectories and competitive dynamics, collectively projected to reach $3 billion by 2030.

Key Drivers of 802.15.4 Chipset Industry Growth

The growth of the 802.15.4 chipset industry is primarily driven by the ubiquitous expansion of the Internet of Things (IoT). Key technological drivers include the increasing demand for low-power, reliable wireless connectivity essential for battery-operated sensors and devices across smart homes, industrial automation, and smart cities. Economic factors such as declining manufacturing costs and the growing global demand for connected consumer electronics further fuel this expansion. Regulatory support for IoT deployments and standardization efforts that promote interoperability also play a significant role.

Challenges in the 802.15.4 Chipset Industry Sector

Despite the promising growth, the 802.15.4 chipset industry faces several challenges. Regulatory hurdles, including spectrum availability and varying certification requirements across different regions, can impede market entry and increase development costs. Supply chain disruptions, as witnessed in recent years, can lead to component shortages and price volatility. Intense competitive pressures from established players and emerging technologies also necessitate continuous innovation and cost optimization. The threat of alternative wireless technologies, while often not a direct substitute for the core benefits of 802.15.4, can pose a challenge in specific application niches.

Emerging Opportunities in 802.15.4 Chipset Industry

Emerging opportunities in the 802.15.4 chipset industry lie in the burgeoning fields of connected healthcare, smart agriculture, and advanced building automation. The increasing adoption of wearables and remote patient monitoring systems presents a significant market for low-power, reliable connectivity. In smart agriculture, 802.15.4 chipsets enable precision farming through wireless sensor networks for soil monitoring, irrigation control, and crop health tracking. Furthermore, the drive towards more energy-efficient and intelligent buildings offers substantial growth potential, with applications in HVAC control, lighting management, and occupancy sensing.

Leading Players in the 802.15.4 Chipset Industry Market

- Microchip Technology Inc.

- NXP Semiconductors NV

- Silicon Laboratories Inc.

- Marvell International Ltd

- Texas Instruments Inc.

- STMicroelectronics NV

- ON Semiconductor Corporation

- Qorvo Inc

- Nordic Semiconductors ASA

- Qualcomm Inc.

- Panasonic Corporation

Key Developments in 802.15.4 Chipset Industry Industry

- 2023: Introduction of Zigbee 3.0 certified chipsets with enhanced interoperability and security features by multiple vendors.

- 2023: Launch of new multi-protocol chipsets supporting Thread and Matter, enabling seamless integration into the evolving smart home ecosystem.

- 2022: Significant investments in R&D for ultra-low-power 802.15.4 solutions for extended battery life in industrial IoT applications.

- 2022: Increased focus on hardware-based security features and secure element integration for enhanced device protection.

- 2021: Expansion of 802.15.4 adoption in the growing smart city infrastructure for applications like smart metering and traffic management.

Strategic Outlook for 802.15.4 Chipset Industry Market

The strategic outlook for the 802.15.4 chipset industry remains exceptionally positive, driven by the unyielding global demand for ubiquitous, low-power wireless connectivity. The continued evolution of IoT applications, coupled with the increasing importance of interoperability standards like Matter, will sustain robust market growth. Companies that focus on delivering highly integrated, secure, and power-efficient chipsets, while also embracing multi-protocol capabilities, are poised for significant success. Strategic partnerships and acquisitions will continue to play a crucial role in consolidating market positions and expanding product portfolios. The industry's ability to innovate and adapt to emerging technological trends will be paramount in capturing the vast opportunities presented by the connected future.

802.15.4 Chipset Industry Segmentation

-

1. Type

- 1.1. Single-protocol/Standalone 802.15.4 Chipsets

- 1.2. Multi-protocol Chipsets

-

2. Application

- 2.1. Smart Home

- 2.2. Industrial Automation

- 2.3. Smart Meeting

- 2.4. Smart Ci

- 2.5. Other Applications

802.15.4 Chipset Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Rest of Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

802.15.4 Chipset Industry Regional Market Share

Geographic Coverage of 802.15.4 Chipset Industry

802.15.4 Chipset Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 ; Increasing Acceptance of Home Networking

- 3.2.2 Industrial Control

- 3.2.3 and Building Automation; Introduction of Multi-protocol 802.15.4/Bluetooth/WiFi Chips to Address IoT Fragmentation and Support for Interoperability

- 3.3. Market Restrains

- 3.3.1 ; Alternative Protocols

- 3.3.2 such as Bluetooth

- 3.3.3 Wi-Fi

- 3.3.4 and Z-Wave

- 3.3.5 Among Others

- 3.4. Market Trends

- 3.4.1. Increasing Adoption of ZigBee Communication Protocol is Expected to Drive the Market Positively

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global 802.15.4 Chipset Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Single-protocol/Standalone 802.15.4 Chipsets

- 5.1.2. Multi-protocol Chipsets

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Smart Home

- 5.2.2. Industrial Automation

- 5.2.3. Smart Meeting

- 5.2.4. Smart Ci

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America 802.15.4 Chipset Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Single-protocol/Standalone 802.15.4 Chipsets

- 6.1.2. Multi-protocol Chipsets

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Smart Home

- 6.2.2. Industrial Automation

- 6.2.3. Smart Meeting

- 6.2.4. Smart Ci

- 6.2.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe 802.15.4 Chipset Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Single-protocol/Standalone 802.15.4 Chipsets

- 7.1.2. Multi-protocol Chipsets

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Smart Home

- 7.2.2. Industrial Automation

- 7.2.3. Smart Meeting

- 7.2.4. Smart Ci

- 7.2.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific 802.15.4 Chipset Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Single-protocol/Standalone 802.15.4 Chipsets

- 8.1.2. Multi-protocol Chipsets

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Smart Home

- 8.2.2. Industrial Automation

- 8.2.3. Smart Meeting

- 8.2.4. Smart Ci

- 8.2.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America 802.15.4 Chipset Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Single-protocol/Standalone 802.15.4 Chipsets

- 9.1.2. Multi-protocol Chipsets

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Smart Home

- 9.2.2. Industrial Automation

- 9.2.3. Smart Meeting

- 9.2.4. Smart Ci

- 9.2.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa 802.15.4 Chipset Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Single-protocol/Standalone 802.15.4 Chipsets

- 10.1.2. Multi-protocol Chipsets

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Smart Home

- 10.2.2. Industrial Automation

- 10.2.3. Smart Meeting

- 10.2.4. Smart Ci

- 10.2.5. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Microchip Technology Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 NXP Semiconductors NV

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Silicon Laboratories Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Marvell International Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Texas Instruments Inc *List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 STMicroelectronics NV

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 ON Semiconductor Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Qorvo Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Nordic Semiconductors ASA

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Qualcomm Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Panasonic Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Microchip Technology Inc

List of Figures

- Figure 1: Global 802.15.4 Chipset Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America 802.15.4 Chipset Industry Revenue (billion), by Type 2025 & 2033

- Figure 3: North America 802.15.4 Chipset Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America 802.15.4 Chipset Industry Revenue (billion), by Application 2025 & 2033

- Figure 5: North America 802.15.4 Chipset Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America 802.15.4 Chipset Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America 802.15.4 Chipset Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe 802.15.4 Chipset Industry Revenue (billion), by Type 2025 & 2033

- Figure 9: Europe 802.15.4 Chipset Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe 802.15.4 Chipset Industry Revenue (billion), by Application 2025 & 2033

- Figure 11: Europe 802.15.4 Chipset Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe 802.15.4 Chipset Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe 802.15.4 Chipset Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific 802.15.4 Chipset Industry Revenue (billion), by Type 2025 & 2033

- Figure 15: Asia Pacific 802.15.4 Chipset Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific 802.15.4 Chipset Industry Revenue (billion), by Application 2025 & 2033

- Figure 17: Asia Pacific 802.15.4 Chipset Industry Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific 802.15.4 Chipset Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific 802.15.4 Chipset Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America 802.15.4 Chipset Industry Revenue (billion), by Type 2025 & 2033

- Figure 21: Latin America 802.15.4 Chipset Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Latin America 802.15.4 Chipset Industry Revenue (billion), by Application 2025 & 2033

- Figure 23: Latin America 802.15.4 Chipset Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Latin America 802.15.4 Chipset Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Latin America 802.15.4 Chipset Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa 802.15.4 Chipset Industry Revenue (billion), by Type 2025 & 2033

- Figure 27: Middle East and Africa 802.15.4 Chipset Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa 802.15.4 Chipset Industry Revenue (billion), by Application 2025 & 2033

- Figure 29: Middle East and Africa 802.15.4 Chipset Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa 802.15.4 Chipset Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa 802.15.4 Chipset Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global 802.15.4 Chipset Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global 802.15.4 Chipset Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global 802.15.4 Chipset Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global 802.15.4 Chipset Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global 802.15.4 Chipset Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Global 802.15.4 Chipset Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States 802.15.4 Chipset Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada 802.15.4 Chipset Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Global 802.15.4 Chipset Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 10: Global 802.15.4 Chipset Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 11: Global 802.15.4 Chipset Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Germany 802.15.4 Chipset Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: United Kingdom 802.15.4 Chipset Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: France 802.15.4 Chipset Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe 802.15.4 Chipset Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global 802.15.4 Chipset Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 17: Global 802.15.4 Chipset Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 18: Global 802.15.4 Chipset Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 19: India 802.15.4 Chipset Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: China 802.15.4 Chipset Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Japan 802.15.4 Chipset Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Rest of Asia Pacific 802.15.4 Chipset Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Global 802.15.4 Chipset Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 24: Global 802.15.4 Chipset Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 25: Global 802.15.4 Chipset Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Global 802.15.4 Chipset Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 27: Global 802.15.4 Chipset Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 28: Global 802.15.4 Chipset Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the 802.15.4 Chipset Industry?

The projected CAGR is approximately 7.3%.

2. Which companies are prominent players in the 802.15.4 Chipset Industry?

Key companies in the market include Microchip Technology Inc, NXP Semiconductors NV, Silicon Laboratories Inc, Marvell International Ltd, Texas Instruments Inc *List Not Exhaustive, STMicroelectronics NV, ON Semiconductor Corporation, Qorvo Inc, Nordic Semiconductors ASA, Qualcomm Inc, Panasonic Corporation.

3. What are the main segments of the 802.15.4 Chipset Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 24 billion as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Acceptance of Home Networking. Industrial Control. and Building Automation; Introduction of Multi-protocol 802.15.4/Bluetooth/WiFi Chips to Address IoT Fragmentation and Support for Interoperability.

6. What are the notable trends driving market growth?

Increasing Adoption of ZigBee Communication Protocol is Expected to Drive the Market Positively.

7. Are there any restraints impacting market growth?

; Alternative Protocols. such as Bluetooth. Wi-Fi. and Z-Wave. Among Others.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "802.15.4 Chipset Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the 802.15.4 Chipset Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the 802.15.4 Chipset Industry?

To stay informed about further developments, trends, and reports in the 802.15.4 Chipset Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence