Key Insights

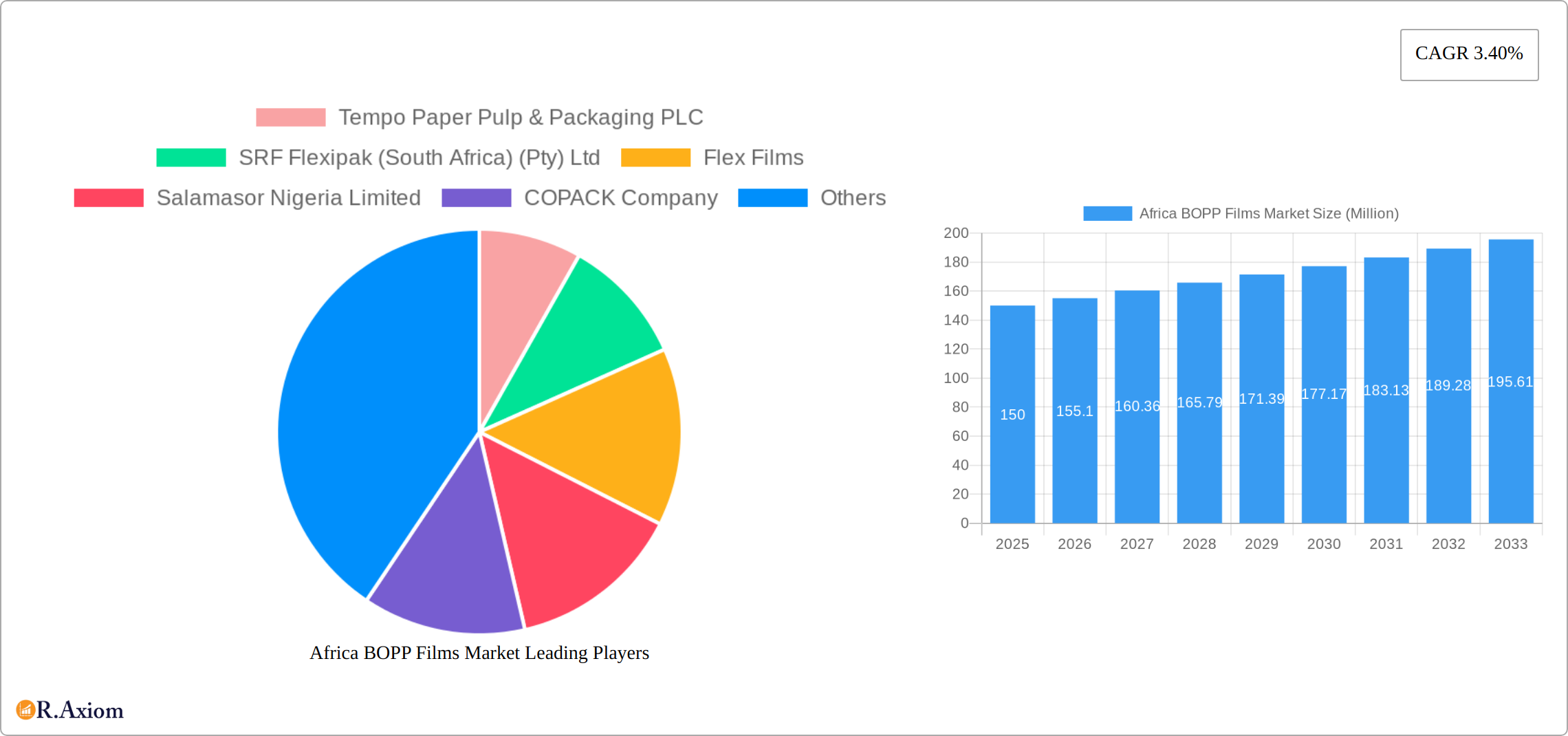

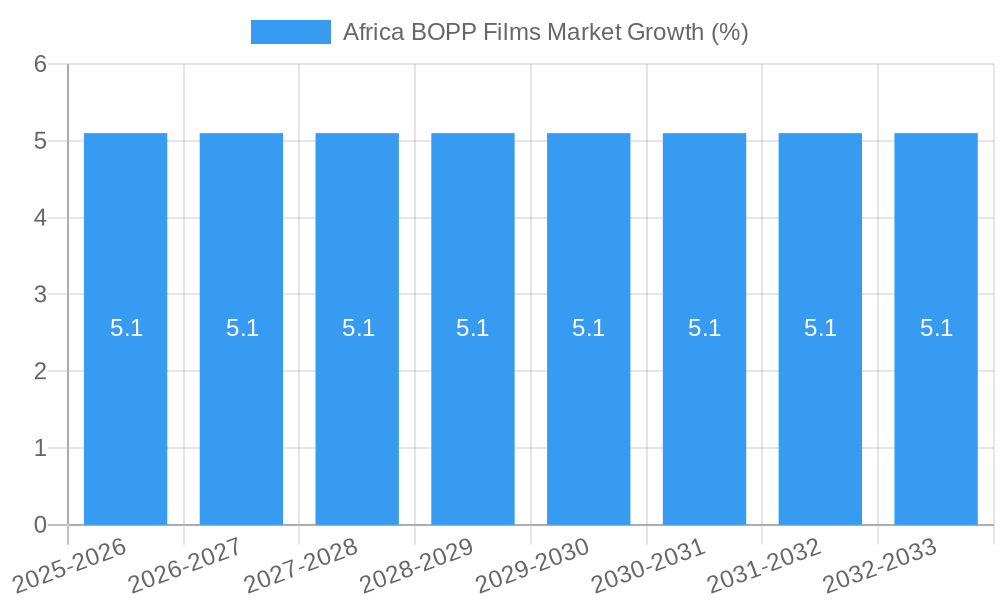

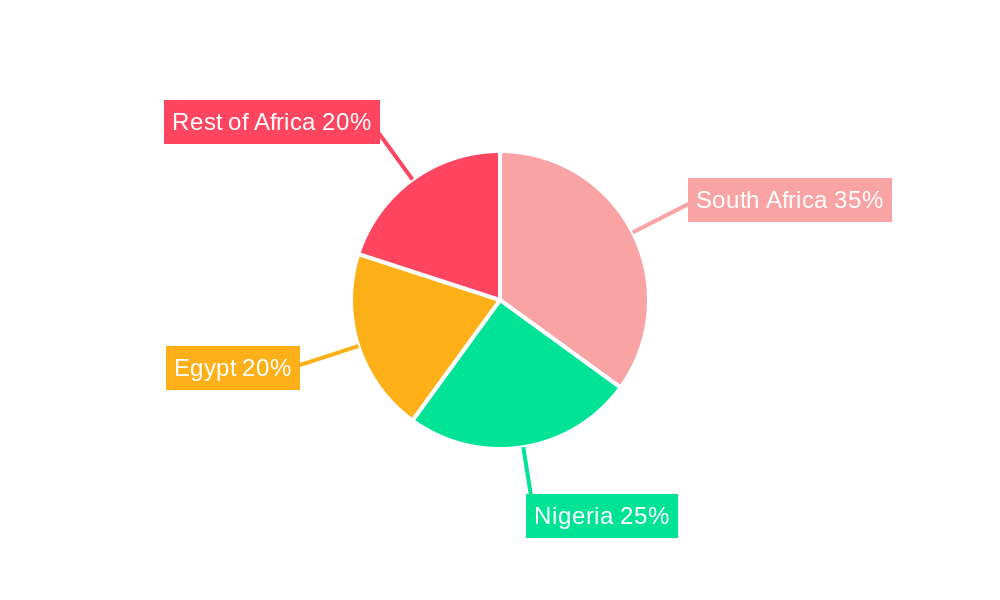

The Africa BOPP (Biaxially Oriented Polypropylene) films market, valued at approximately $XX million in 2025, is projected to experience steady growth, with a Compound Annual Growth Rate (CAGR) of 3.40% from 2025 to 2033. This expansion is driven primarily by the burgeoning flexible packaging industry across the continent, fueled by increasing consumer demand for packaged goods and the rising popularity of convenience foods. Growth in the industrial sector, particularly in lamination, adhesives, and capacitor applications, further contributes to market expansion. South Africa, Nigeria, and Egypt represent the largest national markets, reflecting their more developed economies and established manufacturing sectors. However, significant untapped potential exists in other African nations, promising future growth as economies develop and consumer spending increases. While the market faces challenges such as fluctuating raw material prices and infrastructural limitations in certain regions, the overall trend points toward sustained expansion. The adoption of sustainable and eco-friendly BOPP film alternatives and advancements in film technology will be influential factors in shaping the market's trajectory in the coming years. Key players are strategically investing in capacity expansion and product diversification to meet the increasing demand.

The market segmentation by end-user vertical highlights the dominance of flexible packaging, indicating the strong reliance on BOPP films for food and beverage, consumer goods, and other packaged products. The industrial segment, encompassing lamination, adhesives, and capacitors, showcases promising growth opportunities driven by the increasing industrialization across Africa. The geographical segmentation reveals a concentration of market activity in South Africa, Nigeria, and Egypt. Companies operating within this market need to adapt their strategies to leverage the emerging market opportunities while mitigating potential risks. A focus on building strong distribution networks, tailoring products to regional preferences, and incorporating sustainable manufacturing practices will be crucial for achieving long-term success in the dynamic and evolving Africa BOPP films market.

Africa BOPP Films Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Africa BOPP films market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report examines market dynamics, competitive landscapes, and future growth potential. The study period (2019-2024) is analyzed alongside projected data covering the forecast period (2025-2033), using 2025 as the base year and estimated year.

Note: All values are in Millions.

Africa BOPP Films Market Market Concentration & Innovation

This section analyzes the level of market concentration within the African BOPP films industry, identifying key players and assessing their market share. We examine innovation drivers such as technological advancements, regulatory changes impacting product development, and the role of mergers and acquisitions (M&A) in shaping the market landscape. Substitute products and evolving end-user trends are also thoroughly discussed.

The report includes a detailed assessment of:

- Market Concentration: Analysis of market share held by key players including Tempo Paper Pulp & Packaging PLC, SRF Flexipak (South Africa) (Pty) Ltd, Flex Films, Salamasor Nigeria Limited, COPACK Company, Flexible Packages Convertors (Pty) Ltd, elm films, Richflex (Pty) Ltd, Taghleef Industries S A E, and Cosmo Films Ltd. We will quantify market concentration using metrics such as the Herfindahl-Hirschman Index (HHI) where data permits. If data is unavailable for a precise HHI calculation, descriptive analysis will be provided.

- Innovation Drivers: Examination of factors driving innovation, including government regulations promoting sustainable packaging, advancements in film technology (e.g., improved barrier properties, enhanced printability), and the rising demand for specialized BOPP films for niche applications.

- Regulatory Framework: Analysis of relevant regulations and their impact on market players, including import/export policies and environmental regulations.

- Product Substitutes: Evaluation of alternative packaging materials and their competitive impact on the BOPP films market.

- End-user Trends: Assessment of shifting consumer preferences and their influence on BOPP film demand across various end-use sectors.

- M&A Activity: Review of past and potential future mergers and acquisitions, including deal values and their impact on market consolidation. xx Million in M&A deal value is predicted for the period 2025-2033.

Africa BOPP Films Market Industry Trends & Insights

This section delves into the key trends shaping the African BOPP films market. We examine market growth drivers, technological advancements, evolving consumer preferences, and the competitive dynamics at play, providing a comprehensive overview of the market's trajectory. Specific metrics such as the Compound Annual Growth Rate (CAGR) and market penetration rates for key segments will be included. The analysis will cover:

- Market growth drivers: Factors such as the expanding packaging industry, rising disposable incomes, and increasing demand for consumer goods drive BOPP film consumption. We will provide a quantitative analysis of each driver's contribution to overall market growth.

- Technological disruptions: Innovative BOPP film manufacturing processes and the introduction of specialized film types with enhanced functionalities will be explored.

- Consumer preferences: Shifting preferences towards sustainable and convenient packaging solutions impact BOPP film demand.

- Competitive dynamics: Analysis of the competitive landscape, including market share dynamics, pricing strategies, and competitive advantages of leading players. The xx% CAGR in the period 2025-2033 is expected. The market penetration rate is projected at xx% by 2033.

Dominant Markets & Segments in Africa BOPP Films Market

This section identifies the leading regions, countries, and segments within the African BOPP films market. A detailed dominance analysis will be provided, examining the key factors contributing to their success.

By End-user Vertical:

- Flexible Packaging: This segment is expected to dominate due to the significant demand for BOPP films in food and beverage, consumer goods, and other packaging applications. Key growth drivers include increased urbanization and changes in lifestyles.

- Industrial (Lamination, Adhesives, and Capacitor): Growth in this segment is linked to the expansion of manufacturing industries across Africa.

- Other End-user Verticals: This segment includes smaller applications of BOPP films.

By Country:

- Egypt: Expected to be a leading market due to its substantial manufacturing sector and population size. Key growth drivers: Robust manufacturing sector, improving infrastructure, and rising disposable incomes.

- South Africa: A key market due to its relatively advanced economy and well-developed infrastructure. Key growth drivers: Well-established manufacturing base, strong consumer demand.

- Nigeria: A large and rapidly growing market driven by its expanding population and increasing consumer spending. Key growth drivers: Large and growing population, rising middle class.

- Rest of Africa: A diversified market with varying growth rates depending on economic development and infrastructure in each country. Key growth drivers: Investment in infrastructure, expanding manufacturing sectors in several countries.

Each segment's dominance will be analyzed in detail, considering factors like economic policies, infrastructure development, and consumer preferences.

Africa BOPP Films Market Product Developments

This section summarizes recent product innovations, applications, and competitive advantages in the African BOPP films market. We highlight technological trends and assess their market fit, focusing on advancements in film properties (e.g., enhanced barrier performance, improved heat sealability, enhanced printability) and the development of specialized BOPP films for niche applications.

Report Scope & Segmentation Analysis

This report segments the Africa BOPP films market by end-user vertical (flexible packaging, industrial, other) and by country (Egypt, South Africa, Nigeria, Rest of Africa). Growth projections, market sizes, and competitive dynamics are provided for each segment. For example, the flexible packaging segment is projected to show xx% growth, while the South African market is expected to reach xx Million in value by 2033. The competitive landscape differs across segments and countries, with some areas exhibiting higher levels of market concentration than others.

Key Drivers of Africa BOPP Films Market Growth

Several factors are driving the growth of the Africa BOPP films market. Key among these are:

- Expanding Packaging Industry: The rapid growth of the food and beverage, consumer goods, and other industries is fueling demand for flexible packaging.

- Economic Growth: Rising disposable incomes and increasing consumer spending contribute to higher demand for packaged goods.

- Technological Advancements: Innovations in BOPP film manufacturing technology lead to improved film quality, functionality, and cost-effectiveness.

- Favorable Government Policies: Government initiatives to support industrial development and improve infrastructure create a positive environment for market growth.

Challenges in the Africa BOPP Films Market Sector

Despite the significant growth potential, challenges exist for the African BOPP films market.

- Infrastructure Limitations: Inadequate infrastructure in some regions can hinder efficient transportation and distribution.

- Supply Chain Disruptions: Global supply chain issues can affect raw material availability and production costs.

- Competition from Substitute Materials: Alternative packaging materials pose competition to BOPP films.

- Regulatory Hurdles: Varying regulatory requirements across different countries can pose challenges for market players. For instance, xx% of companies face challenges in compliance with specific regulations in the region.

Emerging Opportunities in Africa BOPP Films Market

Despite these challenges, the Africa BOPP films market presents several promising opportunities.

- Growth of E-commerce: The expansion of e-commerce is boosting demand for flexible packaging suitable for online delivery.

- Demand for Sustainable Packaging: The growing awareness of environmental concerns is driving demand for eco-friendly BOPP films.

- Development of Specialized Films: Opportunities exist for specialized BOPP films tailored to specific applications, such as retort pouches for food preservation.

- Expansion into Untapped Markets: Significant potential exists for expansion into less developed regions with growing consumer markets.

Leading Players in the Africa BOPP Films Market Market

- Tempo Paper Pulp & Packaging PLC

- SRF Flexipak (South Africa) (Pty) Ltd

- Flex Films

- Salamasor Nigeria Limited

- COPACK Company

- Flexible Packages Convertors (Pty) Ltd

- elm films

- Richflex (Pty) Ltd

- Taghleef Industries S A E

- Cosmo Films Ltd

Key Developments in Africa BOPP Films Market Industry

- February 2022: SRF, an Indian chemical and film conglomerate, announced plans to expand its global BOPP film production capacity. This includes a new facility in Indore, India, adding to existing facilities in South Africa, India, and Thailand. This expansion significantly impacts the market by increasing overall supply and potentially influencing pricing dynamics. SRF's total BOPP capacity across its facilities will reach xx Million MTPA post-expansion.

Strategic Outlook for Africa BOPP Films Market Market

The Africa BOPP films market is poised for continued growth over the forecast period. Driven by strong economic growth, rising consumer spending, and ongoing technological advancements, the market is expected to exhibit significant expansion. Opportunities exist for both established players and new entrants to capitalize on the growing demand for flexible packaging and specialized BOPP film applications. The market is expected to reach xx Million by 2033, presenting a significant opportunity for both domestic and international companies.

Africa BOPP Films Market Segmentation

-

1. End-user Vertical

- 1.1. Flexible Packaging

- 1.2. Industrial (Lamination, Adhesives, and Capacitor)

- 1.3. Other End-user Verticals

Africa BOPP Films Market Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa BOPP Films Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand from Retail Sector; Increasing Demand for Packaged Food

- 3.3. Market Restrains

- 3.3.1. Growing Threat from Other Environmentally Friendly Films

- 3.4. Market Trends

- 3.4.1. Growing Demand from the Retail Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa BOPP Films Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.1.1. Flexible Packaging

- 5.1.2. Industrial (Lamination, Adhesives, and Capacitor)

- 5.1.3. Other End-user Verticals

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 6. South Africa Africa BOPP Films Market Analysis, Insights and Forecast, 2019-2031

- 7. Sudan Africa BOPP Films Market Analysis, Insights and Forecast, 2019-2031

- 8. Uganda Africa BOPP Films Market Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania Africa BOPP Films Market Analysis, Insights and Forecast, 2019-2031

- 10. Kenya Africa BOPP Films Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa Africa BOPP Films Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Tempo Paper Pulp & Packaging PLC

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 SRF Flexipak (South Africa) (Pty) Ltd

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Flex Films

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Salamasor Nigeria Limited

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 COPACK Company

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Flexible Packages Convertors (Pty) Ltd*List Not Exhaustive

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 elm films

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Richflex (Pty) Ltd

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Taghleef Industries S A E

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Cosmo Films Ltd

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Tempo Paper Pulp & Packaging PLC

List of Figures

- Figure 1: Africa BOPP Films Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Africa BOPP Films Market Share (%) by Company 2024

List of Tables

- Table 1: Africa BOPP Films Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Africa BOPP Films Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 3: Africa BOPP Films Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Africa BOPP Films Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: South Africa Africa BOPP Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Sudan Africa BOPP Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Uganda Africa BOPP Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Tanzania Africa BOPP Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Kenya Africa BOPP Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of Africa Africa BOPP Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Africa BOPP Films Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 12: Africa BOPP Films Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Nigeria Africa BOPP Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: South Africa Africa BOPP Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Egypt Africa BOPP Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Kenya Africa BOPP Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Ethiopia Africa BOPP Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Morocco Africa BOPP Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Ghana Africa BOPP Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Algeria Africa BOPP Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Tanzania Africa BOPP Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Ivory Coast Africa BOPP Films Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa BOPP Films Market?

The projected CAGR is approximately 3.40%.

2. Which companies are prominent players in the Africa BOPP Films Market?

Key companies in the market include Tempo Paper Pulp & Packaging PLC, SRF Flexipak (South Africa) (Pty) Ltd, Flex Films, Salamasor Nigeria Limited, COPACK Company, Flexible Packages Convertors (Pty) Ltd*List Not Exhaustive, elm films, Richflex (Pty) Ltd, Taghleef Industries S A E, Cosmo Films Ltd.

3. What are the main segments of the Africa BOPP Films Market?

The market segments include End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand from Retail Sector; Increasing Demand for Packaged Food.

6. What are the notable trends driving market growth?

Growing Demand from the Retail Sector.

7. Are there any restraints impacting market growth?

Growing Threat from Other Environmentally Friendly Films.

8. Can you provide examples of recent developments in the market?

February 2022: SRF, an Indian chemical and film conglomerate, will expand its global network of BOPP production facilities by opening a second BOPP film manufacturing facility in Indore, Madhya Pradesh. SRF now has BOPP production facilities in South Africa, India, and Thailand. At a new location in Jaitapur, Indore, the company will also establish an aluminium foil manufacturing facility. With a total capacity of 140,000 metric tonnes per year for BOPET and BOPP film capacity in India, 120,000 MTPA in Thailand, 45,000 MTPA in Hungary, and 30,000 MTPA in South Africa, SRF's Packaging Films Business stands out.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa BOPP Films Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa BOPP Films Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa BOPP Films Market?

To stay informed about further developments, trends, and reports in the Africa BOPP Films Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence