Key Insights

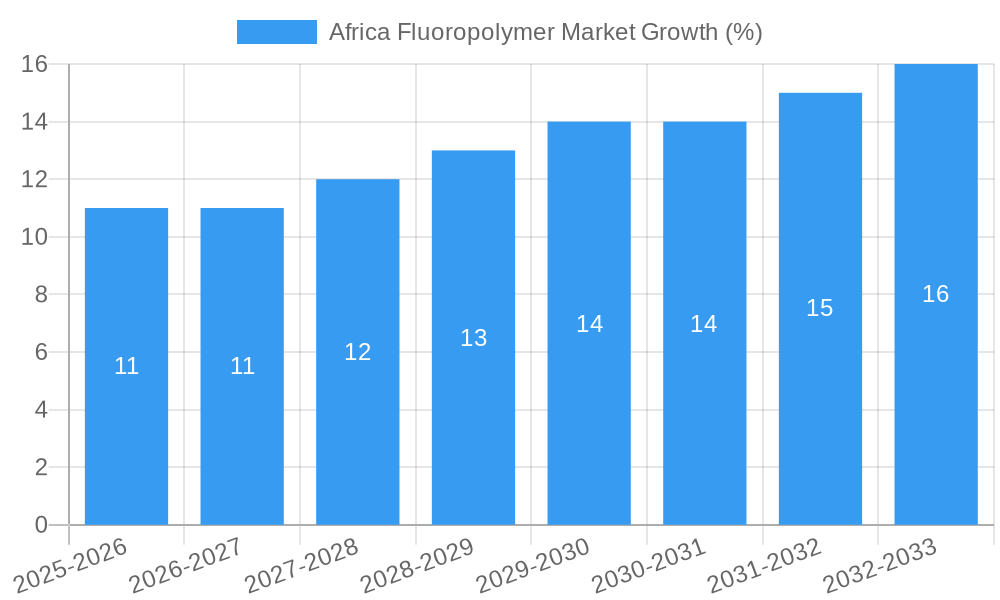

The Africa fluoropolymer market is poised for substantial growth, driven by increasing demand across diverse sectors. While precise market size figures for 2019-2024 are unavailable, a reasonable estimation, considering global fluoropolymer market trends and Africa's expanding industrial base, suggests a market valued at approximately $150 million in 2025. This robust growth is fueled by several key factors. The burgeoning automotive industry in several African nations is significantly increasing the demand for fluoropolymer-based coatings and components offering enhanced durability and resistance to harsh weather conditions. Similarly, the expansion of the construction sector, particularly in infrastructure development, further contributes to market growth, with fluoropolymers finding use in high-performance coatings and insulation materials. The growing adoption of fluoropolymers in the chemical processing and electronics industries also plays a crucial role. Furthermore, government initiatives promoting industrial development and infrastructure modernization across the continent are creating a favorable environment for market expansion.

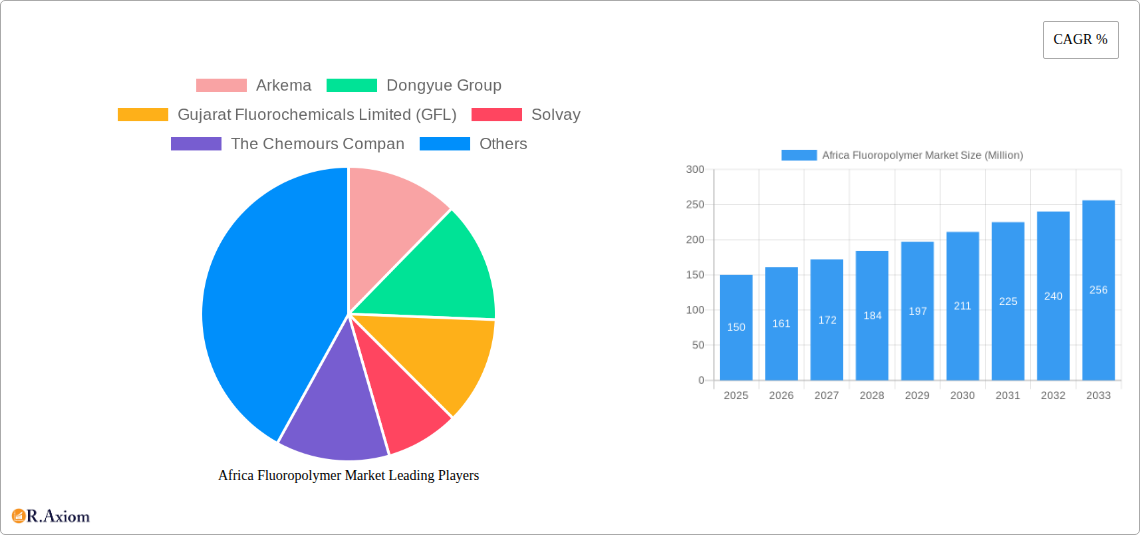

However, challenges persist. High raw material costs, coupled with volatile global pricing fluctuations, pose a significant restraint. The lack of advanced manufacturing facilities in certain regions may also limit the growth potential. Furthermore, competition from alternative materials and the need to navigate complex regulatory landscapes present ongoing obstacles. Despite these challenges, the long-term outlook for the Africa fluoropolymer market remains positive, particularly with the potential for increased investment in manufacturing and infrastructure, creating new opportunities for players like Arkema, Dongyue Group, Gujarat Fluorochemicals Limited (GFL), Solvay, and The Chemours Company. Market segmentation analysis (not provided in the prompt) revealing specific applications and regional performance would refine the analysis further. A conservative Compound Annual Growth Rate (CAGR) of 7% is projected for the 2025-2033 forecast period, leading to a substantial market expansion.

Africa Fluoropolymer Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Africa Fluoropolymer Market, offering invaluable insights for stakeholders seeking to navigate this dynamic industry. The study covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report meticulously examines market trends, competitive landscapes, and growth opportunities, offering actionable intelligence for informed decision-making. Key players such as Arkema, Dongyue Group, Gujarat Fluorochemicals Limited (GFL), Solvay, and The Chemours Company are analyzed in detail.

Africa Fluoropolymer Market Concentration & Innovation

This section analyzes the market concentration, identifying key players and their market share. We explore innovation drivers such as technological advancements and regulatory changes, examining their impact on market dynamics. The analysis also delves into the regulatory frameworks governing the fluoropolymer industry in Africa, the availability of product substitutes, and evolving end-user trends. Furthermore, the report examines mergers and acquisitions (M&A) activities within the sector, providing insights into deal values and their implications for market consolidation.

- Market Concentration: The market exhibits a moderately concentrated structure with the top five players holding an estimated xx% market share in 2025.

- Innovation Drivers: Focus on sustainability, driven by increasing demand for eco-friendly materials, is a key innovation driver. Advancements in material science are leading to the development of high-performance fluoropolymers with enhanced properties.

- Regulatory Frameworks: Varying regulatory landscapes across African nations impact market growth, posing both challenges and opportunities.

- Product Substitutes: The availability of alternative materials limits the growth of fluoropolymers to some extent; however, the unique properties of fluoropolymers often outweigh the cost or availability issues.

- M&A Activities: Recent M&A activities, such as Arkema's acquisition of Agiplast in May 2021, indicate a trend towards consolidation and the integration of bio-based and recycled materials. The total value of M&A deals in the period 2019-2024 is estimated at $XX Million.

Africa Fluoropolymer Market Industry Trends & Insights

This section provides a detailed analysis of the Africa Fluoropolymer Market's growth trajectory, identifying key market drivers and challenges. We examine technological advancements and disruptions influencing market dynamics, exploring consumer preferences and competitive dynamics. Specific metrics such as CAGR (Compound Annual Growth Rate) and market penetration are provided to quantify market growth. The impact of macroeconomic factors, such as economic growth and infrastructure development, on market demand is carefully assessed. The analysis also considers the influence of geopolitical events and policy changes. The projected CAGR for the forecast period (2025-2033) is estimated at xx%. Market penetration in key sectors is analyzed, providing insights into the adoption rate of fluoropolymers.

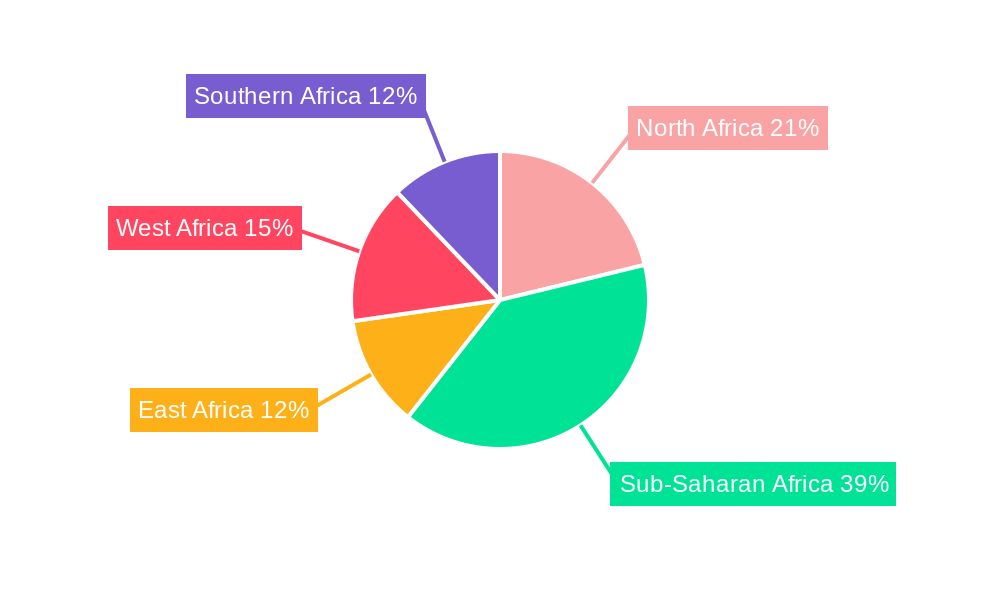

Dominant Markets & Segments in Africa Fluoropolymer Market

This section identifies the leading regions, countries, and segments within the Africa Fluoropolymer Market. A detailed analysis of market dominance is presented, highlighting the key factors contributing to the leadership of specific regions or segments.

- Leading Region/Country: [Insert dominant region/country, e.g., South Africa] is projected to be the leading market due to [Reasons: e.g., robust industrial sector, favorable government policies, well-established infrastructure].

- Key Drivers:

- Economic Policies: Government initiatives promoting industrial development and infrastructure investment positively impact market growth.

- Infrastructure Development: Expansion of infrastructure projects, including energy and transportation, creates high demand for fluoropolymers.

- [Other key drivers specific to the dominant region/country]: [List and explain]

Africa Fluoropolymer Market Product Developments

This section summarizes recent product innovations in the African fluoropolymer market, highlighting key applications and competitive advantages. The focus is on technological trends driving product development and the market fit of new products. The launch of new sustainable Kynar PVDF grades by Arkema in June 2021, specifically for lithium-ion batteries, exemplifies the shift towards eco-friendly solutions. This innovation showcases the potential for growth in the renewable energy sector.

Report Scope & Segmentation Analysis

This report segments the Africa Fluoropolymer Market based on [Insert segmentation criteria, e.g., type, application, and end-use industry]. Growth projections, market sizes, and competitive dynamics are provided for each segment. For example, the PTFE segment is expected to show a CAGR of xx% during the forecast period due to its widespread applications. Similarly, the PVDF segment is anticipated to witness a substantial growth driven by increasing demand from the renewable energy sector. Each segment's competitive landscape is unique, with varying degrees of market concentration and player dominance.

Key Drivers of Africa Fluoropolymer Market Growth

Several factors are driving the growth of the Africa Fluoropolymer Market. Increasing industrialization and infrastructure development across the continent are creating significant demand for fluoropolymers in various applications. The burgeoning renewable energy sector, particularly in the lithium-ion battery manufacturing, is also a significant growth driver. Furthermore, technological advancements leading to the development of high-performance fluoropolymers with improved properties are contributing to market expansion.

Challenges in the Africa Fluoropolymer Market Sector

The Africa Fluoropolymer Market faces certain challenges, including the volatility of raw material prices, supply chain disruptions, and varying regulatory environments across different African nations. These factors can impact both the cost and availability of fluoropolymers. Competition from substitute materials also presents a challenge. The impact of these challenges is quantified through market analysis and projections.

Emerging Opportunities in Africa Fluoropolymer Market

Despite challenges, significant opportunities exist for growth in the Africa Fluoropolymer Market. The increasing adoption of fluoropolymers in emerging sectors such as renewable energy and advanced manufacturing presents lucrative prospects. Government initiatives aimed at promoting industrial development and infrastructure investment further enhance market opportunities. The development of sustainable and eco-friendly fluoropolymers will also unlock new market segments.

Leading Players in the Africa Fluoropolymer Market Market

- Arkema

- Dongyue Group

- Gujarat Fluorochemicals Limited (GFL)

- Solvay

- The Chemours Company

Key Developments in Africa Fluoropolymer Market Industry

- June 2021: Arkema launched new sustainable Kynar PVDF grades for lithium-ion batteries, made from 100% renewable attributed carbon. This launch significantly impacts the market by catering to the growing demand for sustainable materials in the renewable energy sector.

- May 2021: Arkema acquired Agiplast, becoming a fully integrated high-performance polymer manufacturer offering bio-based and recycled materials. This acquisition strengthens Arkema's position in the market and addresses resource scarcity concerns.

Strategic Outlook for Africa Fluoropolymer Market Market

The Africa Fluoropolymer Market is poised for significant growth, driven by factors such as increasing industrialization, infrastructure development, and the expansion of the renewable energy sector. The development of innovative and sustainable fluoropolymer products will further contribute to market expansion. Opportunities exist for companies to capitalize on this growth by focusing on sustainable practices, technological innovation, and strategic partnerships. The market’s long-term growth is projected to remain positive, presenting lucrative opportunities for investors and industry participants.

Africa Fluoropolymer Market Segmentation

-

1. End User Industry

- 1.1. Aerospace

- 1.2. Automotive

- 1.3. Building and Construction

- 1.4. Electrical and Electronics

- 1.5. Industrial and Machinery

- 1.6. Other End-user Industries

-

2. Sub Resin Type

- 2.1. Ethylenetetrafluoroethylene (ETFE)

- 2.2. Fluorinated Ethylene-propylene (FEP)

- 2.3. Polytetrafluoroethylene (PTFE)

- 2.4. Polyvinylfluoride (PVF)

- 2.5. Polyvinylidene Fluoride (PVDF)

- 2.6. Other Sub Resin Types

Africa Fluoropolymer Market Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Fluoropolymer Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of % from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Fluoropolymer Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Aerospace

- 5.1.2. Automotive

- 5.1.3. Building and Construction

- 5.1.4. Electrical and Electronics

- 5.1.5. Industrial and Machinery

- 5.1.6. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Sub Resin Type

- 5.2.1. Ethylenetetrafluoroethylene (ETFE)

- 5.2.2. Fluorinated Ethylene-propylene (FEP)

- 5.2.3. Polytetrafluoroethylene (PTFE)

- 5.2.4. Polyvinylfluoride (PVF)

- 5.2.5. Polyvinylidene Fluoride (PVDF)

- 5.2.6. Other Sub Resin Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Arkema

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Dongyue Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Gujarat Fluorochemicals Limited (GFL)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Solvay

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 The Chemours Compan

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Arkema

List of Figures

- Figure 1: Africa Fluoropolymer Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Africa Fluoropolymer Market Share (%) by Company 2024

List of Tables

- Table 1: Africa Fluoropolymer Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Africa Fluoropolymer Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 3: Africa Fluoropolymer Market Revenue Million Forecast, by Sub Resin Type 2019 & 2032

- Table 4: Africa Fluoropolymer Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Africa Fluoropolymer Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 6: Africa Fluoropolymer Market Revenue Million Forecast, by Sub Resin Type 2019 & 2032

- Table 7: Africa Fluoropolymer Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Nigeria Africa Fluoropolymer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Africa Africa Fluoropolymer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Egypt Africa Fluoropolymer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Kenya Africa Fluoropolymer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Ethiopia Africa Fluoropolymer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Morocco Africa Fluoropolymer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Ghana Africa Fluoropolymer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Algeria Africa Fluoropolymer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Tanzania Africa Fluoropolymer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Ivory Coast Africa Fluoropolymer Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Fluoropolymer Market?

The projected CAGR is approximately N/A%.

2. Which companies are prominent players in the Africa Fluoropolymer Market?

Key companies in the market include Arkema, Dongyue Group, Gujarat Fluorochemicals Limited (GFL), Solvay, The Chemours Compan.

3. What are the main segments of the Africa Fluoropolymer Market?

The market segments include End User Industry, Sub Resin Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

June 2021: Arkema launched new sustainable Kynar PVDF grades for lithium-ion batteries that claim to be made of 100% renewable attributed carbon derived from crude tall oil bio-feedstock.May 2021: Arkema acquired Agiplast to become the first fully integrated high-performance polymer manufacturer offering both bio-based and recycled materials. The acquisition was aimed at addressing the challenges of resource scarcity and end-of-life products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Fluoropolymer Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Fluoropolymer Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Fluoropolymer Market?

To stay informed about further developments, trends, and reports in the Africa Fluoropolymer Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence