Key Insights

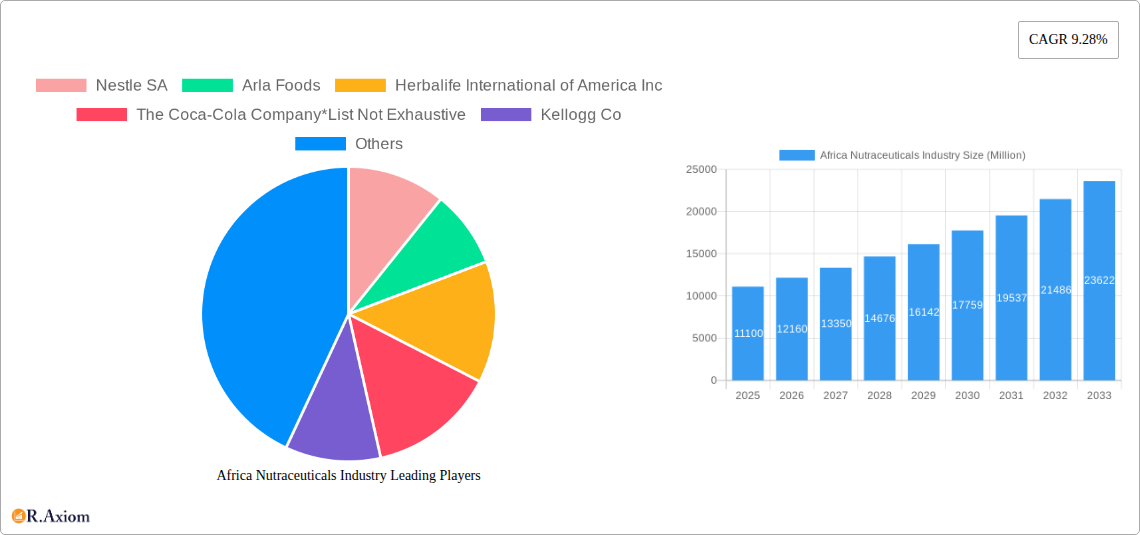

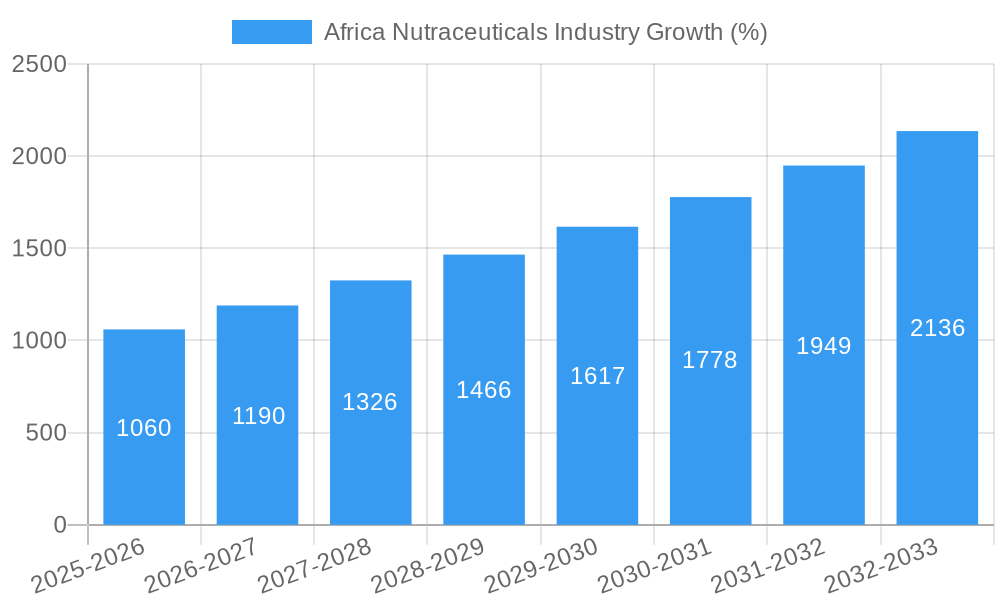

The African nutraceuticals market, valued at $11.10 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 9.28% from 2025 to 2033. This surge is driven by several key factors. Rising health consciousness among African consumers, coupled with increasing disposable incomes, fuels demand for products enhancing immunity, energy levels, and overall well-being. The prevalence of lifestyle diseases like diabetes and cardiovascular issues further contributes to the market's expansion. Furthermore, the growing popularity of functional foods and beverages, including dairy and dairy alternatives fortified with vitamins and minerals, significantly boosts market growth. The expanding distribution network, encompassing supermarkets, convenience stores, pharmacies, and especially online retail channels, enhances accessibility and market penetration. Specific product segments like functional beverages and dietary supplements within the dairy and dairy alternative categories demonstrate significant potential for growth. Leading companies like Nestlé, Danone, and Red Bull, alongside regional players, actively contribute to this market’s dynamism. However, challenges such as limited awareness about nutraceuticals in certain regions and regulatory hurdles related to product labeling and claims necessitate careful navigation.

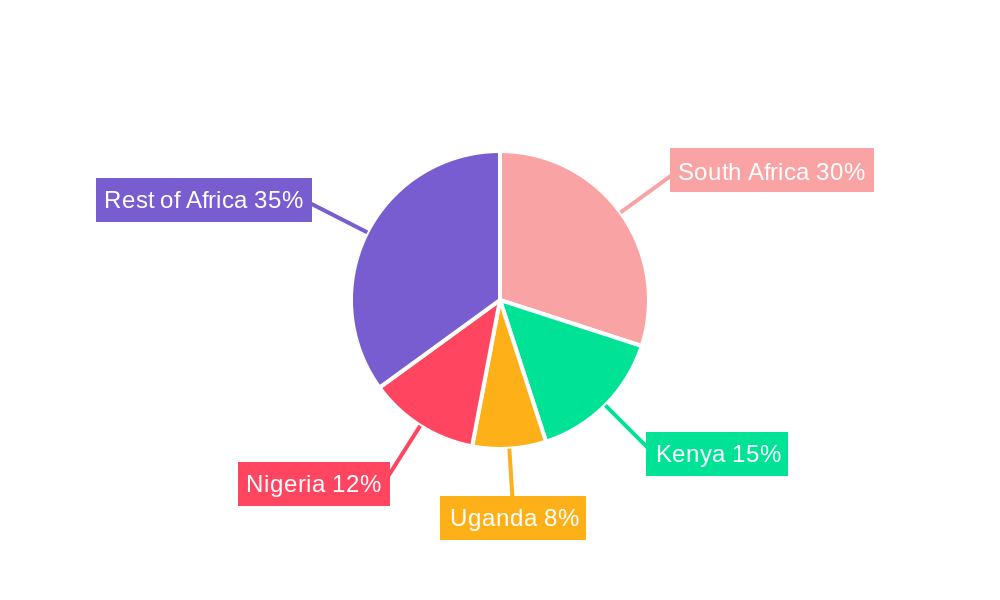

The regional diversity within Africa presents both opportunities and challenges. While countries like South Africa, Kenya, and Uganda represent significant markets due to their advanced economies and higher purchasing power, substantial growth potential lies in untapped regions with rapidly developing economies and growing populations. Targeted marketing strategies focusing on educating consumers about the benefits of nutraceuticals and overcoming price sensitivity are crucial for maximizing market penetration. Furthermore, collaborations with local manufacturers and distributors can facilitate broader market reach and affordability. The strategic focus on key segments like functional beverages and dietary supplements, alongside proactive engagement with regulatory bodies to ensure product compliance, will be instrumental in sustaining the remarkable growth trajectory of the African nutraceuticals market.

This detailed report provides a comprehensive analysis of the Africa nutraceuticals industry, covering market size, segmentation, growth drivers, challenges, and key players. The study period spans 2019-2033, with 2025 as the base and estimated year, and a forecast period of 2025-2033. This report is essential for industry stakeholders, investors, and businesses seeking to understand and capitalize on opportunities within this dynamic market.

Africa Nutraceuticals Industry Market Concentration & Innovation

The African nutraceuticals market is characterized by a blend of multinational corporations and local players. Market concentration is moderate, with a few major players holding significant shares, but a substantial number of smaller companies also contributing significantly. Nestlé SA, Danone, and The Coca-Cola Company, for example, command considerable market share through established brands and extensive distribution networks. However, the market is witnessing increased competition from regional and local companies focusing on specific niche products or utilizing innovative marketing strategies.

- Market Share: Nestlé SA holds an estimated xx% market share in 2025, followed by Danone at xx% and The Coca-Cola Company at xx%. The remaining market share is distributed amongst numerous smaller players.

- M&A Activity: The value of M&A deals in the African nutraceuticals industry reached approximately $xx Million in 2024, driven primarily by strategic acquisitions by larger players seeking to expand their product portfolios and market reach. Future M&A activity is expected to increase with the growth of the sector.

- Innovation Drivers: The increasing prevalence of lifestyle diseases, rising consumer awareness of health and wellness, and government initiatives promoting healthy eating are key drivers of innovation. This leads to the development of functional foods, dietary supplements, and fortified beverages tailored to specific health needs.

- Regulatory Frameworks: Varying regulatory landscapes across African nations impact market entry and product standardization. Harmonization of regulations is crucial for seamless market access.

- Product Substitutes: The industry faces competition from traditional food and beverage products, as well as from herbal remedies and other alternative health solutions.

- End-User Trends: Growing demand for convenient, portable, and healthy food options is influencing product development and packaging strategies. Consumers are increasingly seeking products with natural ingredients, minimal processing, and added health benefits.

Africa Nutraceuticals Industry Industry Trends & Insights

The African nutraceuticals market exhibits strong growth potential, driven by multiple factors. The rising prevalence of chronic diseases such as diabetes, cardiovascular disease, and obesity is fueling the demand for functional foods and dietary supplements aimed at disease prevention and management. Furthermore, increasing disposable incomes, particularly within the burgeoning middle class, are enhancing purchasing power and boosting consumer spending on premium health-focused products. Technological advancements in food processing and packaging are facilitating the production of innovative nutraceutical products with enhanced shelf life and improved nutritional profiles.

The market's Compound Annual Growth Rate (CAGR) is projected to be xx% during the forecast period (2025-2033), exceeding the global average growth for the nutraceutical sector. Market penetration remains relatively low compared to developed markets, offering substantial growth potential. However, competitive intensity is rising as both multinational and regional players increase their investment in product development, marketing, and distribution channels. Consumer preference shifts toward natural and organic products present both opportunities and challenges, requiring businesses to adapt their product offerings and marketing strategies.

Dominant Markets & Segments in Africa Nutraceuticals Industry

The South African market currently holds the largest share of the African nutraceuticals market, followed by Nigeria and Kenya. This dominance is driven by several factors:

- Key Drivers:

- Economic Policies: Government initiatives promoting health and wellness, coupled with favorable investment policies, attract both domestic and international investment.

- Infrastructure: Well-developed infrastructure, especially in major urban centers, facilitates efficient product distribution and supply chain management.

- Consumer Awareness: Increased awareness of health issues and a growing preference for functional foods are major contributing factors.

This region exhibits significant growth potential due to a large and rapidly expanding population base, increasing disposable incomes, and improving healthcare infrastructure. The dietary supplements segment within the nutraceuticals industry holds the largest market share, driven by increasing awareness of micronutrient deficiencies and growing demand for products that enhance immunity and overall well-being. Supermarkets/hypermarkets constitute the dominant distribution channel, given their extensive reach and established presence across various regions in Africa. However, online retail stores are witnessing rapid growth, signifying an increase in the adoption of e-commerce for consumer goods within the region. The functional food segment is witnessing a rapid expansion, fueled by the demand for convenient, health-conscious options. Snacks with functional benefits also show strong growth potential, catering to health-conscious consumers seeking healthy alternatives.

Africa Nutraceuticals Industry Product Developments

Recent product innovations within the African nutraceuticals industry focus heavily on incorporating local ingredients with proven health benefits. This includes the utilization of traditional African herbs and botanicals, as well as locally sourced fruits and vegetables. Companies are also focusing on customized formulations tailored to the specific nutritional needs of diverse population groups, addressing common dietary deficiencies across the continent. Technological advancements in food processing and packaging are essential in enhancing the shelf life, nutritional value, and sensory appeal of these products. Furthermore, a strong focus on product differentiation and value-added attributes is observed, enabling brands to differentiate themselves from competitors and tap into niche markets.

Report Scope & Segmentation Analysis

This report segments the Africa nutraceuticals market across various parameters:

By Product Type: Functional foods, dietary supplements, functional beverages, snacks. Each segment displays varying growth trajectories, influenced by consumer preferences, health priorities, and the availability of substitutes. Functional foods are expected to be the most rapidly growing segment.

By Distribution Channel: Supermarkets/hypermarkets, convenience stores, drug/pharmacies, online retail stores, and other channels. Online retail shows the highest growth potential, while traditional channels remain significant.

By Region: The report focuses on key African markets including South Africa, Nigeria, Kenya, and others, analyzing regional growth drivers and market dynamics.

Key Drivers of Africa Nutraceuticals Industry Growth

Several factors propel the growth of the Africa nutraceuticals industry:

- Rising prevalence of chronic diseases: The increasing incidence of lifestyle-related illnesses drives demand for products aimed at prevention and management.

- Growing health consciousness: Consumers are increasingly aware of the link between diet and health, increasing the demand for functional foods and supplements.

- Rising disposable incomes: Economic growth and improved living standards fuel greater spending on health-related products.

- Government support: Several African governments are enacting policies and regulations to promote healthy eating and enhance the availability of nutritious foods.

Challenges in the Africa Nutraceuticals Industry Sector

Significant challenges hinder the growth of the nutraceuticals industry in Africa:

- Regulatory hurdles: Inconsistent regulations across different countries create barriers to market entry and standardization.

- Supply chain limitations: Inadequate infrastructure and logistical challenges impact product distribution and availability, especially in rural areas.

- Counterfeit products: The presence of substandard or counterfeit products undermines consumer trust and negatively impacts the industry’s reputation.

- Limited consumer awareness: Lack of awareness regarding the benefits of nutraceuticals hinders market penetration in some regions.

Emerging Opportunities in Africa Nutraceuticals Industry

Several opportunities exist within the African nutraceuticals market:

- Growth of the middle class: The expanding middle class represents a significant consumer base with increased purchasing power.

- Focus on personalized nutrition: Tailoring products to specific dietary needs and health conditions presents a significant opportunity.

- Development of innovative products: Creating products using locally sourced ingredients with unique health benefits can enhance market competitiveness.

- Expansion into rural markets: Reaching underserved populations in rural areas offers significant growth potential.

Leading Players in the Africa Nutraceuticals Industry Market

- Nestle SA

- Arla Foods

- Herbalife International of America Inc

- The Coca-Cola Company

- Kellogg Co

- Danone

- Real Foods Group

- RedBull Corporation

- Amway International

- GlaxoSmithKline PLC

Key Developments in Africa Nutraceuticals Industry Industry

- April 2021: Danone selected Wavemaker South Africa as its agency of record for media buying, planning, and integrated channel strategy. This signifies a strategic investment in market penetration within the South African region.

- March 2021: Kellogg's South Africa launched new Granola flavors, indicating product innovation to cater to evolving consumer preferences.

- April 2021: Nestlé NIDO 3+ launched an improved recipe, highlighting a focus on addressing micronutrient deficiencies in young children and enhancing product quality.

Strategic Outlook for Africa Nutraceuticals Industry Market

The African nutraceuticals market holds considerable potential for future growth, driven by evolving consumer preferences, increased health awareness, and favorable economic conditions. Continued innovation in product development, coupled with strategic investments in distribution and marketing strategies, will be crucial for players seeking to establish a strong market presence. Addressing challenges related to regulatory harmonization and infrastructure development is vital for unlocking the market's full potential. Opportunities for personalized nutrition and the utilization of indigenous ingredients offer promising avenues for expansion and market leadership.

Africa Nutraceuticals Industry Segmentation

-

1. Type

-

1.1. Functional Food

- 1.1.1. Cereal

- 1.1.2. Bakery

- 1.1.3. Confectionery

- 1.1.4. Dairy

- 1.1.5. Snacks

-

1.2. Functional Beverages

- 1.2.1. Energy Drinks

- 1.2.2. Sports Drinks

- 1.2.3. Fortified Food

- 1.2.4. Dairy and Dairy Alternative Beverages

-

1.3. Dietary Supplements

- 1.3.1. Vitamins

- 1.3.2. Minerals

- 1.3.3. Botanicals

- 1.3.4. Enzymes

- 1.3.5. Fatty Acids

- 1.3.6. Proteins

- 1.3.7. Other Dietary Supplements

-

1.1. Functional Food

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Drug/Pharamacies

- 2.4. Online Retail Stores

- 2.5. Other Distribution Channels

-

3. Geography

- 3.1. South Africa

- 3.2. Nigeria

- 3.3. Egypt

- 3.4. Rest of Africa

Africa Nutraceuticals Industry Segmentation By Geography

- 1. South Africa

- 2. Nigeria

- 3. Egypt

- 4. Rest of Africa

Africa Nutraceuticals Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.28% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing awareness towards fitness among consumers; Demand for convenient fortified foods

- 3.3. Market Restrains

- 3.3.1. Increasing vegan culture in the market

- 3.4. Market Trends

- 3.4.1. Emerging Trends for Health and Wellness

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Nutraceuticals Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Functional Food

- 5.1.1.1. Cereal

- 5.1.1.2. Bakery

- 5.1.1.3. Confectionery

- 5.1.1.4. Dairy

- 5.1.1.5. Snacks

- 5.1.2. Functional Beverages

- 5.1.2.1. Energy Drinks

- 5.1.2.2. Sports Drinks

- 5.1.2.3. Fortified Food

- 5.1.2.4. Dairy and Dairy Alternative Beverages

- 5.1.3. Dietary Supplements

- 5.1.3.1. Vitamins

- 5.1.3.2. Minerals

- 5.1.3.3. Botanicals

- 5.1.3.4. Enzymes

- 5.1.3.5. Fatty Acids

- 5.1.3.6. Proteins

- 5.1.3.7. Other Dietary Supplements

- 5.1.1. Functional Food

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Drug/Pharamacies

- 5.2.4. Online Retail Stores

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. South Africa

- 5.3.2. Nigeria

- 5.3.3. Egypt

- 5.3.4. Rest of Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South Africa

- 5.4.2. Nigeria

- 5.4.3. Egypt

- 5.4.4. Rest of Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. South Africa Africa Nutraceuticals Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Functional Food

- 6.1.1.1. Cereal

- 6.1.1.2. Bakery

- 6.1.1.3. Confectionery

- 6.1.1.4. Dairy

- 6.1.1.5. Snacks

- 6.1.2. Functional Beverages

- 6.1.2.1. Energy Drinks

- 6.1.2.2. Sports Drinks

- 6.1.2.3. Fortified Food

- 6.1.2.4. Dairy and Dairy Alternative Beverages

- 6.1.3. Dietary Supplements

- 6.1.3.1. Vitamins

- 6.1.3.2. Minerals

- 6.1.3.3. Botanicals

- 6.1.3.4. Enzymes

- 6.1.3.5. Fatty Acids

- 6.1.3.6. Proteins

- 6.1.3.7. Other Dietary Supplements

- 6.1.1. Functional Food

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Convenience Stores

- 6.2.3. Drug/Pharamacies

- 6.2.4. Online Retail Stores

- 6.2.5. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. South Africa

- 6.3.2. Nigeria

- 6.3.3. Egypt

- 6.3.4. Rest of Africa

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Nigeria Africa Nutraceuticals Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Functional Food

- 7.1.1.1. Cereal

- 7.1.1.2. Bakery

- 7.1.1.3. Confectionery

- 7.1.1.4. Dairy

- 7.1.1.5. Snacks

- 7.1.2. Functional Beverages

- 7.1.2.1. Energy Drinks

- 7.1.2.2. Sports Drinks

- 7.1.2.3. Fortified Food

- 7.1.2.4. Dairy and Dairy Alternative Beverages

- 7.1.3. Dietary Supplements

- 7.1.3.1. Vitamins

- 7.1.3.2. Minerals

- 7.1.3.3. Botanicals

- 7.1.3.4. Enzymes

- 7.1.3.5. Fatty Acids

- 7.1.3.6. Proteins

- 7.1.3.7. Other Dietary Supplements

- 7.1.1. Functional Food

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Convenience Stores

- 7.2.3. Drug/Pharamacies

- 7.2.4. Online Retail Stores

- 7.2.5. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. South Africa

- 7.3.2. Nigeria

- 7.3.3. Egypt

- 7.3.4. Rest of Africa

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Egypt Africa Nutraceuticals Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Functional Food

- 8.1.1.1. Cereal

- 8.1.1.2. Bakery

- 8.1.1.3. Confectionery

- 8.1.1.4. Dairy

- 8.1.1.5. Snacks

- 8.1.2. Functional Beverages

- 8.1.2.1. Energy Drinks

- 8.1.2.2. Sports Drinks

- 8.1.2.3. Fortified Food

- 8.1.2.4. Dairy and Dairy Alternative Beverages

- 8.1.3. Dietary Supplements

- 8.1.3.1. Vitamins

- 8.1.3.2. Minerals

- 8.1.3.3. Botanicals

- 8.1.3.4. Enzymes

- 8.1.3.5. Fatty Acids

- 8.1.3.6. Proteins

- 8.1.3.7. Other Dietary Supplements

- 8.1.1. Functional Food

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Convenience Stores

- 8.2.3. Drug/Pharamacies

- 8.2.4. Online Retail Stores

- 8.2.5. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. South Africa

- 8.3.2. Nigeria

- 8.3.3. Egypt

- 8.3.4. Rest of Africa

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of Africa Africa Nutraceuticals Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Functional Food

- 9.1.1.1. Cereal

- 9.1.1.2. Bakery

- 9.1.1.3. Confectionery

- 9.1.1.4. Dairy

- 9.1.1.5. Snacks

- 9.1.2. Functional Beverages

- 9.1.2.1. Energy Drinks

- 9.1.2.2. Sports Drinks

- 9.1.2.3. Fortified Food

- 9.1.2.4. Dairy and Dairy Alternative Beverages

- 9.1.3. Dietary Supplements

- 9.1.3.1. Vitamins

- 9.1.3.2. Minerals

- 9.1.3.3. Botanicals

- 9.1.3.4. Enzymes

- 9.1.3.5. Fatty Acids

- 9.1.3.6. Proteins

- 9.1.3.7. Other Dietary Supplements

- 9.1.1. Functional Food

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Convenience Stores

- 9.2.3. Drug/Pharamacies

- 9.2.4. Online Retail Stores

- 9.2.5. Other Distribution Channels

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. South Africa

- 9.3.2. Nigeria

- 9.3.3. Egypt

- 9.3.4. Rest of Africa

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. South Africa Africa Nutraceuticals Industry Analysis, Insights and Forecast, 2019-2031

- 11. Sudan Africa Nutraceuticals Industry Analysis, Insights and Forecast, 2019-2031

- 12. Uganda Africa Nutraceuticals Industry Analysis, Insights and Forecast, 2019-2031

- 13. Tanzania Africa Nutraceuticals Industry Analysis, Insights and Forecast, 2019-2031

- 14. Kenya Africa Nutraceuticals Industry Analysis, Insights and Forecast, 2019-2031

- 15. Rest of Africa Africa Nutraceuticals Industry Analysis, Insights and Forecast, 2019-2031

- 16. Competitive Analysis

- 16.1. Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Nestle SA

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Arla Foods

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Herbalife International of America Inc

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 The Coca-Cola Company*List Not Exhaustive

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Kellogg Co

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Danone

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Real Foods Group

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 RedBull Corporation

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Amway International

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 GlaxoSmithKline PLC

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Nestle SA

List of Figures

- Figure 1: Africa Nutraceuticals Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Africa Nutraceuticals Industry Share (%) by Company 2024

List of Tables

- Table 1: Africa Nutraceuticals Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Africa Nutraceuticals Industry Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: Africa Nutraceuticals Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Africa Nutraceuticals Industry Volume K Tons Forecast, by Type 2019 & 2032

- Table 5: Africa Nutraceuticals Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 6: Africa Nutraceuticals Industry Volume K Tons Forecast, by Distribution Channel 2019 & 2032

- Table 7: Africa Nutraceuticals Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 8: Africa Nutraceuticals Industry Volume K Tons Forecast, by Geography 2019 & 2032

- Table 9: Africa Nutraceuticals Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Africa Nutraceuticals Industry Volume K Tons Forecast, by Region 2019 & 2032

- Table 11: Africa Nutraceuticals Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Africa Nutraceuticals Industry Volume K Tons Forecast, by Country 2019 & 2032

- Table 13: South Africa Africa Nutraceuticals Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: South Africa Africa Nutraceuticals Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 15: Sudan Africa Nutraceuticals Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Sudan Africa Nutraceuticals Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 17: Uganda Africa Nutraceuticals Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Uganda Africa Nutraceuticals Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 19: Tanzania Africa Nutraceuticals Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Tanzania Africa Nutraceuticals Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 21: Kenya Africa Nutraceuticals Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Kenya Africa Nutraceuticals Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 23: Rest of Africa Africa Nutraceuticals Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Africa Africa Nutraceuticals Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 25: Africa Nutraceuticals Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 26: Africa Nutraceuticals Industry Volume K Tons Forecast, by Type 2019 & 2032

- Table 27: Africa Nutraceuticals Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 28: Africa Nutraceuticals Industry Volume K Tons Forecast, by Distribution Channel 2019 & 2032

- Table 29: Africa Nutraceuticals Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 30: Africa Nutraceuticals Industry Volume K Tons Forecast, by Geography 2019 & 2032

- Table 31: Africa Nutraceuticals Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Africa Nutraceuticals Industry Volume K Tons Forecast, by Country 2019 & 2032

- Table 33: Africa Nutraceuticals Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 34: Africa Nutraceuticals Industry Volume K Tons Forecast, by Type 2019 & 2032

- Table 35: Africa Nutraceuticals Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 36: Africa Nutraceuticals Industry Volume K Tons Forecast, by Distribution Channel 2019 & 2032

- Table 37: Africa Nutraceuticals Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 38: Africa Nutraceuticals Industry Volume K Tons Forecast, by Geography 2019 & 2032

- Table 39: Africa Nutraceuticals Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 40: Africa Nutraceuticals Industry Volume K Tons Forecast, by Country 2019 & 2032

- Table 41: Africa Nutraceuticals Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 42: Africa Nutraceuticals Industry Volume K Tons Forecast, by Type 2019 & 2032

- Table 43: Africa Nutraceuticals Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 44: Africa Nutraceuticals Industry Volume K Tons Forecast, by Distribution Channel 2019 & 2032

- Table 45: Africa Nutraceuticals Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 46: Africa Nutraceuticals Industry Volume K Tons Forecast, by Geography 2019 & 2032

- Table 47: Africa Nutraceuticals Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 48: Africa Nutraceuticals Industry Volume K Tons Forecast, by Country 2019 & 2032

- Table 49: Africa Nutraceuticals Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 50: Africa Nutraceuticals Industry Volume K Tons Forecast, by Type 2019 & 2032

- Table 51: Africa Nutraceuticals Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 52: Africa Nutraceuticals Industry Volume K Tons Forecast, by Distribution Channel 2019 & 2032

- Table 53: Africa Nutraceuticals Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 54: Africa Nutraceuticals Industry Volume K Tons Forecast, by Geography 2019 & 2032

- Table 55: Africa Nutraceuticals Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 56: Africa Nutraceuticals Industry Volume K Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Nutraceuticals Industry?

The projected CAGR is approximately 9.28%.

2. Which companies are prominent players in the Africa Nutraceuticals Industry?

Key companies in the market include Nestle SA, Arla Foods, Herbalife International of America Inc, The Coca-Cola Company*List Not Exhaustive, Kellogg Co, Danone, Real Foods Group, RedBull Corporation, Amway International, GlaxoSmithKline PLC.

3. What are the main segments of the Africa Nutraceuticals Industry?

The market segments include Type, Distribution Channel, Geography .

4. Can you provide details about the market size?

The market size is estimated to be USD 11.10 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing awareness towards fitness among consumers; Demand for convenient fortified foods.

6. What are the notable trends driving market growth?

Emerging Trends for Health and Wellness.

7. Are there any restraints impacting market growth?

Increasing vegan culture in the market.

8. Can you provide examples of recent developments in the market?

In April 2021, Danone chose Wavemaker South Africa as the Agency of Record to handle its media buying, planning, and integrated channel strategy development in South Africa. Herbalife International of America Inc The Coca-Cola Company*List Not Exhaustive Kellogg Co Real Foods Group RedBull Corporation Amway International GlaxoSmithKline PLC

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Nutraceuticals Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Nutraceuticals Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Nutraceuticals Industry?

To stay informed about further developments, trends, and reports in the Africa Nutraceuticals Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence