Key Insights

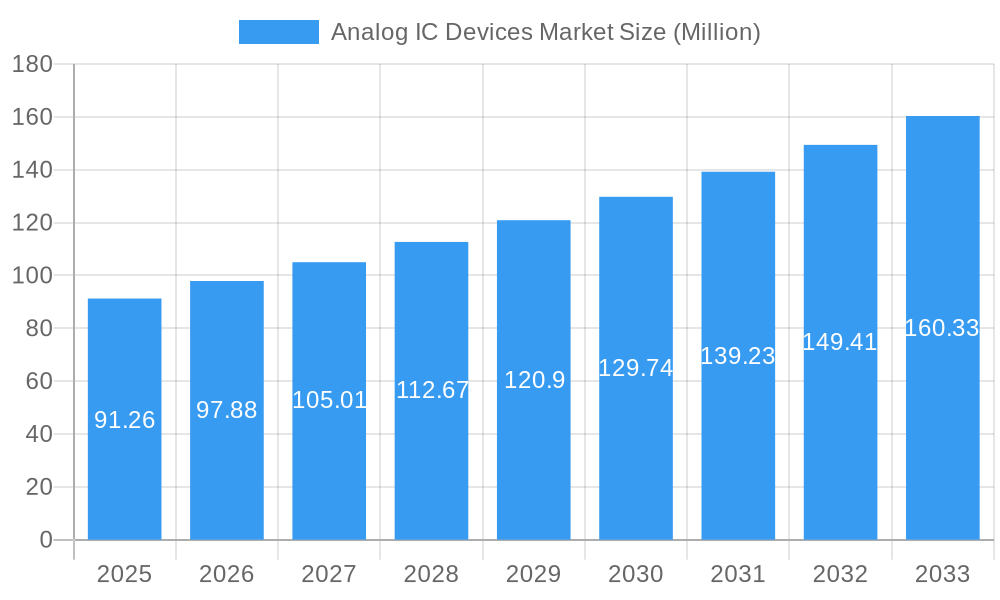

The global Analog IC Devices Market is poised for significant expansion, projecting a substantial market size of $91.26 million with a robust Compound Annual Growth Rate (CAGR) of 7.28% during the forecast period of 2025-2033. This growth is primarily fueled by the escalating demand for sophisticated electronic devices across a multitude of sectors. Key drivers include the pervasive adoption of consumer electronics, the rapid advancements in automotive technologies such as autonomous driving and enhanced infotainment systems, and the ever-growing need for efficient communication infrastructure. The industrial sector's increasing reliance on automation and smart manufacturing processes, coupled with the continuous innovation in computing and data storage, further bolsters the market's trajectory. Moreover, the persistent trend towards miniaturization and power efficiency in electronic components directly translates to a higher demand for advanced analog integrated circuits that can meet these stringent requirements.

Analog IC Devices Market Market Size (In Million)

The market's segmentation highlights its broad applicability. General-Purpose ICs, encompassing interface, power management, signal conversion, and amplifiers/comparators, are foundational to nearly all electronic systems. Simultaneously, Application-Specific ICs (ASICs) are experiencing substantial growth driven by specialized needs in consumer electronics (audio/video, cameras), automotive (infotainment), and telecommunications (cell phones, infrastructure, wireless communication). The computer and industrial segments also represent significant demand areas. While the market exhibits strong growth potential, certain restraints, such as the complexity of design and manufacturing processes and the fluctuating raw material costs, may pose challenges. Nonetheless, the sustained innovation from leading companies like Infineon Technologies, Texas Instruments, and NXP Semiconductors, alongside burgeoning markets in Asia, are expected to propel the analog IC market to new heights, solidifying its crucial role in the modern technological landscape.

Analog IC Devices Market Company Market Share

This in-depth report provides a detailed examination of the global Analog IC Devices market, offering critical insights into its current state, historical trajectory, and future potential. Spanning the period from 2019 to 2033, with a base year of 2025 and a forecast period extending to 2033, this analysis delves into key market drivers, technological advancements, competitive landscapes, and emerging opportunities. It is meticulously designed to equip industry stakeholders, investors, and decision-makers with actionable intelligence for strategic planning and investment.

Analog IC Devices Market Market Concentration & Innovation

The Analog IC Devices market exhibits a moderate to high concentration, driven by the significant capital investment required for research, development, and manufacturing. Innovation is a paramount differentiator, with companies continuously investing in R&D to develop more efficient, smaller, and feature-rich analog integrated circuits. Key innovation drivers include the increasing demand for high-performance analog solutions in emerging technologies like 5G, IoT, electric vehicles (EVs), and advanced healthcare devices. Regulatory frameworks, particularly concerning environmental standards and device safety, also play a crucial role in shaping product development and manufacturing processes. Product substitutes, while present in some basic applications, are often outpaced by the specialized performance and integration offered by analog ICs. End-user trends are strongly influenced by the miniaturization and power efficiency demands across all application sectors. Mergers & Acquisitions (M&A) activities are a significant factor in market consolidation, with strategic acquisitions aimed at broadening product portfolios, gaining access to new technologies, and expanding geographical reach. The aggregate value of M&A deals in the analog IC sector has been substantial, reflecting the ongoing consolidation and strategic repositioning of major players.

Analog IC Devices Market Industry Trends & Insights

The Analog IC Devices market is experiencing robust growth, fueled by a confluence of technological advancements and escalating demand across diverse end-use industries. The Compound Annual Growth Rate (CAGR) for this sector is projected to remain healthy, driven by the indispensable role of analog ICs in translating real-world analog signals into digital data and vice-versa, a fundamental requirement for virtually all electronic systems. Technological disruptions, such as the advent of advanced sensor technologies, low-power wireless communication protocols, and highly integrated power management solutions, are creating new avenues for analog IC adoption. Consumer preferences are increasingly leaning towards smart, connected, and energy-efficient devices, necessitating sophisticated analog components for optimal performance. The competitive dynamics are characterized by intense innovation, strategic partnerships, and a focus on developing application-specific integrated circuits (ASICs) tailored to the unique needs of rapidly evolving sectors like automotive and industrial automation. Market penetration is expanding as analog ICs become integral to an ever-wider array of consumer electronics, automotive systems, and industrial equipment. The ongoing digital transformation across all industries is a primary catalyst, ensuring sustained demand for high-quality analog solutions.

Dominant Markets & Segments in Analog IC Devices Market

The Automotive segment stands as a dominant force within the Analog IC Devices market, propelled by the burgeoning electric vehicle revolution and the increasing sophistication of automotive electronics. Within Automotive, Infotainment and Other Infotainment applications are experiencing significant expansion, driven by consumer demand for advanced in-car entertainment, navigation, and connectivity systems. The broader adoption of Advanced Driver-Assistance Systems (ADAS) also requires a vast array of high-performance analog ICs for sensors, signal processing, and power management.

Key drivers for this dominance include:

- Electric Vehicle (EV) Growth: The transition to EVs necessitates advanced power management ICs for battery management systems (BMS), motor controllers, and onboard chargers, all of which rely heavily on analog components.

- ADAS Expansion: The integration of cameras, radar, LiDAR, and other sensors in ADAS requires sophisticated analog front-ends for signal conditioning and data acquisition.

- Connectivity and Infotainment Demands: The demand for seamless connectivity, high-fidelity audio, and advanced display technologies in vehicles drives the need for specialized analog ICs.

- Safety Regulations: Increasingly stringent automotive safety regulations mandate the use of advanced electronic systems, many of which incorporate critical analog components.

Beyond Automotive, the Communication sector, particularly Cell Phone and Infrastructure applications, also represents a substantial market share. The ongoing rollout of 5G technology demands high-frequency analog ICs for base stations and mobile devices, driving innovation in areas like RF front-ends and signal amplifiers. The Industrial and Others segment also exhibits strong growth, fueled by the industrial automation, smart manufacturing (Industry 4.0), and the proliferation of the Internet of Things (IoT) devices, all requiring precise analog sensing, control, and power management capabilities. The Consumer segment, while mature in some areas, continues to drive demand through innovation in audio/video devices, wearable technology, and smart home appliances. General-Purpose ICs, especially Power Management and Signal Conversion types, serve as foundational components across all these application segments, underpinning their overall growth.

Analog IC Devices Market Product Developments

Recent product developments in the Analog IC Devices market focus on enhancing performance, reducing power consumption, and enabling new functionalities. Innovations in areas like high-resolution data converters, advanced sensor interfaces, and ultra-low-power power management ICs are critical. Companies are also introducing highly integrated solutions that combine multiple analog functions onto a single chip, offering space and cost savings. The competitive advantage lies in developing analog ICs that precisely meet the stringent requirements of emerging applications, such as miniaturization for wearable devices, high-speed signaling for 5G infrastructure, and robust performance for automotive and industrial environments.

Report Scope & Segmentation Analysis

This report offers a comprehensive segmentation of the Analog IC Devices market.

- General-Purpose IC: This segment encompasses essential analog functions. Interface ICs are crucial for signal translation and isolation in various systems. Power Management ICs are fundamental for efficient energy utilization and battery life in all electronic devices. Signal Conversion ICs, including Analog-to-Digital Converters (ADCs) and Digital-to-Analog Converters (DACs), are vital for bridging the analog and digital worlds. Amplifiers/Comparators (Signal Conditioning) are essential for signal amplification and threshold detection, with projected growth driven by increasing sensor integration.

- Application-Specific IC (ASIC): This segment is further divided by end-use applications. The Consumer segment, covering Audio/Video, Digital Still Camera and Camcorder, and Other Consumers, continues to evolve with demand for enhanced multimedia experiences. The Automotive segment, encompassing Infotainment and Other Infotainment, is a key growth engine due to EV and ADAS advancements. The Communication sector, including Cell Phone, Infrastructure, Wired Communication, Short Range, and Other Wireless, is propelled by 5G and IoT deployments. The Computer segment (Computer System and Display, Computer Periphery, Storage, Other Computers) sees sustained demand for performance and efficiency. The Industrial and Others segment is a rapidly expanding area, driven by Industry 4.0 and IoT adoption, requiring specialized analog solutions for automation and control.

Key Drivers of Analog IC Devices Market Growth

The Analog IC Devices market's growth is propelled by several interconnected factors:

- Digital Transformation: The pervasive digitalization across industries necessitates analog ICs for interfacing with the physical world.

- Emerging Technologies: The proliferation of IoT, 5G, artificial intelligence (AI), and electric vehicles (EVs) creates a strong demand for advanced analog solutions.

- Miniaturization and Power Efficiency: Consumer and industrial demand for smaller, more power-efficient devices drives innovation in low-power analog IC design.

- Automotive Electrification and Autonomy: The increasing complexity of automotive electronics, including EVs and ADAS, is a significant growth catalyst.

- Industrial Automation (Industry 4.0): Smart manufacturing and the IoT in industrial settings require precise analog sensing, control, and power management.

Challenges in the Analog IC Devices Market Sector

Despite robust growth, the Analog IC Devices market faces several challenges:

- Supply Chain Volatility: Global semiconductor supply chain disruptions and geopolitical factors can impact production and lead times.

- Intense Competition: The market is highly competitive, with a constant need for innovation to maintain market share.

- Technological Obsolescence: Rapid technological advancements can lead to shorter product lifecycles.

- High R&D Costs: Developing cutting-edge analog ICs requires substantial investment in research and development.

- Talent Shortage: A scarcity of skilled analog IC design engineers can hinder innovation and production.

Emerging Opportunities in Analog IC Devices Market

The Analog IC Devices market presents significant emerging opportunities:

- AI and Machine Learning Hardware: Development of specialized analog and mixed-signal ICs for AI accelerators and neuromorphic computing.

- Edge Computing: Analog ICs for efficient data processing and sensing at the edge in IoT devices.

- Advanced Healthcare Devices: Analog solutions for sophisticated medical sensors, wearable health monitors, and diagnostic equipment.

- Smart Grid and Renewable Energy: Analog ICs for efficient power management and monitoring in smart grids and renewable energy systems.

- Augmented and Virtual Reality (AR/VR): Analog components for high-performance display drivers, sensor interfaces, and audio processing in AR/VR devices.

Leading Players in the Analog IC Devices Market Market

- Infineon Technologies AG

- Microchip Technology Inc

- NXP Semiconductors NV

- Texas Instruments Inc

- Skyworks Solutions Inc

- STMicroelectronics NV

- ON Semiconductor

- Renesas Electronics Corporation

- Qorvo Inc

- Richtek Technology Corporation (MediaTek Inc)

- Analog Devices Inc

Key Developments in Analog IC Devices Market Industry

- October 2023: Vitesco Technologies and Infineon Technologies AG announced the reinforcement of their longstanding collaboration. In the forthcoming generation of master and zone controllers for electric-electronic vehicle architectures (E/E architectures), as well as in their new electrification system solutions, Vitesco Technologies will incorporate the AURIX TC4x microcontroller family from Infineon. This strategic partnership, set to commence in 2027, is expected to span multiple years.

- September 2023: Intelligent Hardware Korea (IHWK), an AI solutions provider, recently disclosed its ongoing development of a neuromorphic analog computing platform for neurotechnology devices and field programmable neuromorphic devices. In collaboration with Microchip Technology, IHWK aims to leverage the company's silicon storage technology to create this advanced computing platform. Additionally, Microchip Technology will contribute by offering an evaluation system for its SuperFlash memBrain neuromorphic memory solution.

Strategic Outlook for Analog IC Devices Market Market

The strategic outlook for the Analog IC Devices market is highly positive, driven by sustained demand from critical growth sectors. The increasing sophistication of electronic systems in automotive, communication, industrial, and consumer applications will continue to fuel the need for advanced analog ICs. Innovations in power management, sensor integration, and high-frequency signal processing will be key to capturing future market share. Strategic partnerships and a focus on application-specific solutions will enable companies to navigate the competitive landscape and capitalize on emerging technological trends, ensuring continued market expansion and profitability.

Analog IC Devices Market Segmentation

-

1. Type

-

1.1. General-Purpose IC

- 1.1.1. Interface

- 1.1.2. Power Management

- 1.1.3. Signal Conversion

- 1.1.4. Amplifiers/Comparators (Signal Conditioning)

-

1.2. Application-Specific IC

-

1.2.1. Consumer

- 1.2.1.1. Audio/Video

- 1.2.1.2. Digital Still Camera and Camcorder

- 1.2.1.3. Other Consumers

-

1.2.2. Automotive

- 1.2.2.1. Infotainment

- 1.2.2.2. Other Infotainment

-

1.2.3. Communication

- 1.2.3.1. Cell Phone

- 1.2.3.2. Infrastructure

- 1.2.3.3. Wired Communication

- 1.2.3.4. Short Range

- 1.2.3.5. Other Wireless

-

1.2.4. Computer

- 1.2.4.1. Computer System and Display

- 1.2.4.2. Computer Periphery

- 1.2.4.3. Storage

- 1.2.4.4. Other Computers

- 1.2.5. Industrial and Others

-

1.2.1. Consumer

-

1.1. General-Purpose IC

Analog IC Devices Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Analog IC Devices Market Regional Market Share

Geographic Coverage of Analog IC Devices Market

Analog IC Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.28% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Rising Penetration of Smartphones

- 3.2.2 Feature Phones

- 3.2.3 and Tablets

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations; Lack of Skilled Radiation Professionals

- 3.4. Market Trends

- 3.4.1. Cell Phone within Communication Segment to Hold Major Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Analog IC Devices Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. General-Purpose IC

- 5.1.1.1. Interface

- 5.1.1.2. Power Management

- 5.1.1.3. Signal Conversion

- 5.1.1.4. Amplifiers/Comparators (Signal Conditioning)

- 5.1.2. Application-Specific IC

- 5.1.2.1. Consumer

- 5.1.2.1.1. Audio/Video

- 5.1.2.1.2. Digital Still Camera and Camcorder

- 5.1.2.1.3. Other Consumers

- 5.1.2.2. Automotive

- 5.1.2.2.1. Infotainment

- 5.1.2.2.2. Other Infotainment

- 5.1.2.3. Communication

- 5.1.2.3.1. Cell Phone

- 5.1.2.3.2. Infrastructure

- 5.1.2.3.3. Wired Communication

- 5.1.2.3.4. Short Range

- 5.1.2.3.5. Other Wireless

- 5.1.2.4. Computer

- 5.1.2.4.1. Computer System and Display

- 5.1.2.4.2. Computer Periphery

- 5.1.2.4.3. Storage

- 5.1.2.4.4. Other Computers

- 5.1.2.5. Industrial and Others

- 5.1.2.1. Consumer

- 5.1.1. General-Purpose IC

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia

- 5.2.4. Australia and New Zealand

- 5.2.5. Latin America

- 5.2.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Analog IC Devices Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. General-Purpose IC

- 6.1.1.1. Interface

- 6.1.1.2. Power Management

- 6.1.1.3. Signal Conversion

- 6.1.1.4. Amplifiers/Comparators (Signal Conditioning)

- 6.1.2. Application-Specific IC

- 6.1.2.1. Consumer

- 6.1.2.1.1. Audio/Video

- 6.1.2.1.2. Digital Still Camera and Camcorder

- 6.1.2.1.3. Other Consumers

- 6.1.2.2. Automotive

- 6.1.2.2.1. Infotainment

- 6.1.2.2.2. Other Infotainment

- 6.1.2.3. Communication

- 6.1.2.3.1. Cell Phone

- 6.1.2.3.2. Infrastructure

- 6.1.2.3.3. Wired Communication

- 6.1.2.3.4. Short Range

- 6.1.2.3.5. Other Wireless

- 6.1.2.4. Computer

- 6.1.2.4.1. Computer System and Display

- 6.1.2.4.2. Computer Periphery

- 6.1.2.4.3. Storage

- 6.1.2.4.4. Other Computers

- 6.1.2.5. Industrial and Others

- 6.1.2.1. Consumer

- 6.1.1. General-Purpose IC

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Analog IC Devices Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. General-Purpose IC

- 7.1.1.1. Interface

- 7.1.1.2. Power Management

- 7.1.1.3. Signal Conversion

- 7.1.1.4. Amplifiers/Comparators (Signal Conditioning)

- 7.1.2. Application-Specific IC

- 7.1.2.1. Consumer

- 7.1.2.1.1. Audio/Video

- 7.1.2.1.2. Digital Still Camera and Camcorder

- 7.1.2.1.3. Other Consumers

- 7.1.2.2. Automotive

- 7.1.2.2.1. Infotainment

- 7.1.2.2.2. Other Infotainment

- 7.1.2.3. Communication

- 7.1.2.3.1. Cell Phone

- 7.1.2.3.2. Infrastructure

- 7.1.2.3.3. Wired Communication

- 7.1.2.3.4. Short Range

- 7.1.2.3.5. Other Wireless

- 7.1.2.4. Computer

- 7.1.2.4.1. Computer System and Display

- 7.1.2.4.2. Computer Periphery

- 7.1.2.4.3. Storage

- 7.1.2.4.4. Other Computers

- 7.1.2.5. Industrial and Others

- 7.1.2.1. Consumer

- 7.1.1. General-Purpose IC

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Analog IC Devices Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. General-Purpose IC

- 8.1.1.1. Interface

- 8.1.1.2. Power Management

- 8.1.1.3. Signal Conversion

- 8.1.1.4. Amplifiers/Comparators (Signal Conditioning)

- 8.1.2. Application-Specific IC

- 8.1.2.1. Consumer

- 8.1.2.1.1. Audio/Video

- 8.1.2.1.2. Digital Still Camera and Camcorder

- 8.1.2.1.3. Other Consumers

- 8.1.2.2. Automotive

- 8.1.2.2.1. Infotainment

- 8.1.2.2.2. Other Infotainment

- 8.1.2.3. Communication

- 8.1.2.3.1. Cell Phone

- 8.1.2.3.2. Infrastructure

- 8.1.2.3.3. Wired Communication

- 8.1.2.3.4. Short Range

- 8.1.2.3.5. Other Wireless

- 8.1.2.4. Computer

- 8.1.2.4.1. Computer System and Display

- 8.1.2.4.2. Computer Periphery

- 8.1.2.4.3. Storage

- 8.1.2.4.4. Other Computers

- 8.1.2.5. Industrial and Others

- 8.1.2.1. Consumer

- 8.1.1. General-Purpose IC

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Australia and New Zealand Analog IC Devices Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. General-Purpose IC

- 9.1.1.1. Interface

- 9.1.1.2. Power Management

- 9.1.1.3. Signal Conversion

- 9.1.1.4. Amplifiers/Comparators (Signal Conditioning)

- 9.1.2. Application-Specific IC

- 9.1.2.1. Consumer

- 9.1.2.1.1. Audio/Video

- 9.1.2.1.2. Digital Still Camera and Camcorder

- 9.1.2.1.3. Other Consumers

- 9.1.2.2. Automotive

- 9.1.2.2.1. Infotainment

- 9.1.2.2.2. Other Infotainment

- 9.1.2.3. Communication

- 9.1.2.3.1. Cell Phone

- 9.1.2.3.2. Infrastructure

- 9.1.2.3.3. Wired Communication

- 9.1.2.3.4. Short Range

- 9.1.2.3.5. Other Wireless

- 9.1.2.4. Computer

- 9.1.2.4.1. Computer System and Display

- 9.1.2.4.2. Computer Periphery

- 9.1.2.4.3. Storage

- 9.1.2.4.4. Other Computers

- 9.1.2.5. Industrial and Others

- 9.1.2.1. Consumer

- 9.1.1. General-Purpose IC

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Latin America Analog IC Devices Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. General-Purpose IC

- 10.1.1.1. Interface

- 10.1.1.2. Power Management

- 10.1.1.3. Signal Conversion

- 10.1.1.4. Amplifiers/Comparators (Signal Conditioning)

- 10.1.2. Application-Specific IC

- 10.1.2.1. Consumer

- 10.1.2.1.1. Audio/Video

- 10.1.2.1.2. Digital Still Camera and Camcorder

- 10.1.2.1.3. Other Consumers

- 10.1.2.2. Automotive

- 10.1.2.2.1. Infotainment

- 10.1.2.2.2. Other Infotainment

- 10.1.2.3. Communication

- 10.1.2.3.1. Cell Phone

- 10.1.2.3.2. Infrastructure

- 10.1.2.3.3. Wired Communication

- 10.1.2.3.4. Short Range

- 10.1.2.3.5. Other Wireless

- 10.1.2.4. Computer

- 10.1.2.4.1. Computer System and Display

- 10.1.2.4.2. Computer Periphery

- 10.1.2.4.3. Storage

- 10.1.2.4.4. Other Computers

- 10.1.2.5. Industrial and Others

- 10.1.2.1. Consumer

- 10.1.1. General-Purpose IC

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Middle East and Africa Analog IC Devices Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. General-Purpose IC

- 11.1.1.1. Interface

- 11.1.1.2. Power Management

- 11.1.1.3. Signal Conversion

- 11.1.1.4. Amplifiers/Comparators (Signal Conditioning)

- 11.1.2. Application-Specific IC

- 11.1.2.1. Consumer

- 11.1.2.1.1. Audio/Video

- 11.1.2.1.2. Digital Still Camera and Camcorder

- 11.1.2.1.3. Other Consumers

- 11.1.2.2. Automotive

- 11.1.2.2.1. Infotainment

- 11.1.2.2.2. Other Infotainment

- 11.1.2.3. Communication

- 11.1.2.3.1. Cell Phone

- 11.1.2.3.2. Infrastructure

- 11.1.2.3.3. Wired Communication

- 11.1.2.3.4. Short Range

- 11.1.2.3.5. Other Wireless

- 11.1.2.4. Computer

- 11.1.2.4.1. Computer System and Display

- 11.1.2.4.2. Computer Periphery

- 11.1.2.4.3. Storage

- 11.1.2.4.4. Other Computers

- 11.1.2.5. Industrial and Others

- 11.1.2.1. Consumer

- 11.1.1. General-Purpose IC

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Infineon Technologies AG

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Microchip Technology Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 NXP Semiconductors NV

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Texas Instruments Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Skyworks Solutions Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 STMicroelectronics NV

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 ON Semiconductor

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Renesas Electronics Corporation

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Qorvo Inc

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Richtek Technology Corporation (MediaTek Inc )

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Analog Devices Inc

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 Infineon Technologies AG

List of Figures

- Figure 1: Global Analog IC Devices Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Analog IC Devices Market Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Analog IC Devices Market Revenue (Million), by Type 2025 & 2033

- Figure 4: North America Analog IC Devices Market Volume (K Unit), by Type 2025 & 2033

- Figure 5: North America Analog IC Devices Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Analog IC Devices Market Volume Share (%), by Type 2025 & 2033

- Figure 7: North America Analog IC Devices Market Revenue (Million), by Country 2025 & 2033

- Figure 8: North America Analog IC Devices Market Volume (K Unit), by Country 2025 & 2033

- Figure 9: North America Analog IC Devices Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Analog IC Devices Market Volume Share (%), by Country 2025 & 2033

- Figure 11: Europe Analog IC Devices Market Revenue (Million), by Type 2025 & 2033

- Figure 12: Europe Analog IC Devices Market Volume (K Unit), by Type 2025 & 2033

- Figure 13: Europe Analog IC Devices Market Revenue Share (%), by Type 2025 & 2033

- Figure 14: Europe Analog IC Devices Market Volume Share (%), by Type 2025 & 2033

- Figure 15: Europe Analog IC Devices Market Revenue (Million), by Country 2025 & 2033

- Figure 16: Europe Analog IC Devices Market Volume (K Unit), by Country 2025 & 2033

- Figure 17: Europe Analog IC Devices Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Analog IC Devices Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Asia Analog IC Devices Market Revenue (Million), by Type 2025 & 2033

- Figure 20: Asia Analog IC Devices Market Volume (K Unit), by Type 2025 & 2033

- Figure 21: Asia Analog IC Devices Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Asia Analog IC Devices Market Volume Share (%), by Type 2025 & 2033

- Figure 23: Asia Analog IC Devices Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Asia Analog IC Devices Market Volume (K Unit), by Country 2025 & 2033

- Figure 25: Asia Analog IC Devices Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Analog IC Devices Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Australia and New Zealand Analog IC Devices Market Revenue (Million), by Type 2025 & 2033

- Figure 28: Australia and New Zealand Analog IC Devices Market Volume (K Unit), by Type 2025 & 2033

- Figure 29: Australia and New Zealand Analog IC Devices Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: Australia and New Zealand Analog IC Devices Market Volume Share (%), by Type 2025 & 2033

- Figure 31: Australia and New Zealand Analog IC Devices Market Revenue (Million), by Country 2025 & 2033

- Figure 32: Australia and New Zealand Analog IC Devices Market Volume (K Unit), by Country 2025 & 2033

- Figure 33: Australia and New Zealand Analog IC Devices Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Australia and New Zealand Analog IC Devices Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Latin America Analog IC Devices Market Revenue (Million), by Type 2025 & 2033

- Figure 36: Latin America Analog IC Devices Market Volume (K Unit), by Type 2025 & 2033

- Figure 37: Latin America Analog IC Devices Market Revenue Share (%), by Type 2025 & 2033

- Figure 38: Latin America Analog IC Devices Market Volume Share (%), by Type 2025 & 2033

- Figure 39: Latin America Analog IC Devices Market Revenue (Million), by Country 2025 & 2033

- Figure 40: Latin America Analog IC Devices Market Volume (K Unit), by Country 2025 & 2033

- Figure 41: Latin America Analog IC Devices Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Latin America Analog IC Devices Market Volume Share (%), by Country 2025 & 2033

- Figure 43: Middle East and Africa Analog IC Devices Market Revenue (Million), by Type 2025 & 2033

- Figure 44: Middle East and Africa Analog IC Devices Market Volume (K Unit), by Type 2025 & 2033

- Figure 45: Middle East and Africa Analog IC Devices Market Revenue Share (%), by Type 2025 & 2033

- Figure 46: Middle East and Africa Analog IC Devices Market Volume Share (%), by Type 2025 & 2033

- Figure 47: Middle East and Africa Analog IC Devices Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Middle East and Africa Analog IC Devices Market Volume (K Unit), by Country 2025 & 2033

- Figure 49: Middle East and Africa Analog IC Devices Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East and Africa Analog IC Devices Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Analog IC Devices Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Analog IC Devices Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: Global Analog IC Devices Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Analog IC Devices Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 5: Global Analog IC Devices Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Analog IC Devices Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 7: Global Analog IC Devices Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Global Analog IC Devices Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 9: Global Analog IC Devices Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global Analog IC Devices Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 11: Global Analog IC Devices Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Analog IC Devices Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: Global Analog IC Devices Market Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Analog IC Devices Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 15: Global Analog IC Devices Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Analog IC Devices Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: Global Analog IC Devices Market Revenue Million Forecast, by Type 2020 & 2033

- Table 18: Global Analog IC Devices Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 19: Global Analog IC Devices Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Global Analog IC Devices Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 21: Global Analog IC Devices Market Revenue Million Forecast, by Type 2020 & 2033

- Table 22: Global Analog IC Devices Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 23: Global Analog IC Devices Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Analog IC Devices Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Global Analog IC Devices Market Revenue Million Forecast, by Type 2020 & 2033

- Table 26: Global Analog IC Devices Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 27: Global Analog IC Devices Market Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Global Analog IC Devices Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Analog IC Devices Market?

The projected CAGR is approximately 7.28%.

2. Which companies are prominent players in the Analog IC Devices Market?

Key companies in the market include Infineon Technologies AG, Microchip Technology Inc, NXP Semiconductors NV, Texas Instruments Inc, Skyworks Solutions Inc, STMicroelectronics NV, ON Semiconductor, Renesas Electronics Corporation, Qorvo Inc, Richtek Technology Corporation (MediaTek Inc ), Analog Devices Inc.

3. What are the main segments of the Analog IC Devices Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 91.26 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Penetration of Smartphones. Feature Phones. and Tablets.

6. What are the notable trends driving market growth?

Cell Phone within Communication Segment to Hold Major Share.

7. Are there any restraints impacting market growth?

Stringent Government Regulations; Lack of Skilled Radiation Professionals.

8. Can you provide examples of recent developments in the market?

October 2023 - Vitesco Technologies and Infineon Technologies AG announced the reinforcement of their longstanding collaboration. In the forthcoming generation of master and zone controllers for electric-electronic vehicle architectures (E/E architectures), as well as in their new electrification system solutions, Vitesco Technologies will incorporate the AURIX TC4x microcontroller family from Infineon. This strategic partnership, set to commence in 2027, is expected to span multiple years.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Analog IC Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Analog IC Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Analog IC Devices Market?

To stay informed about further developments, trends, and reports in the Analog IC Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence