Key Insights

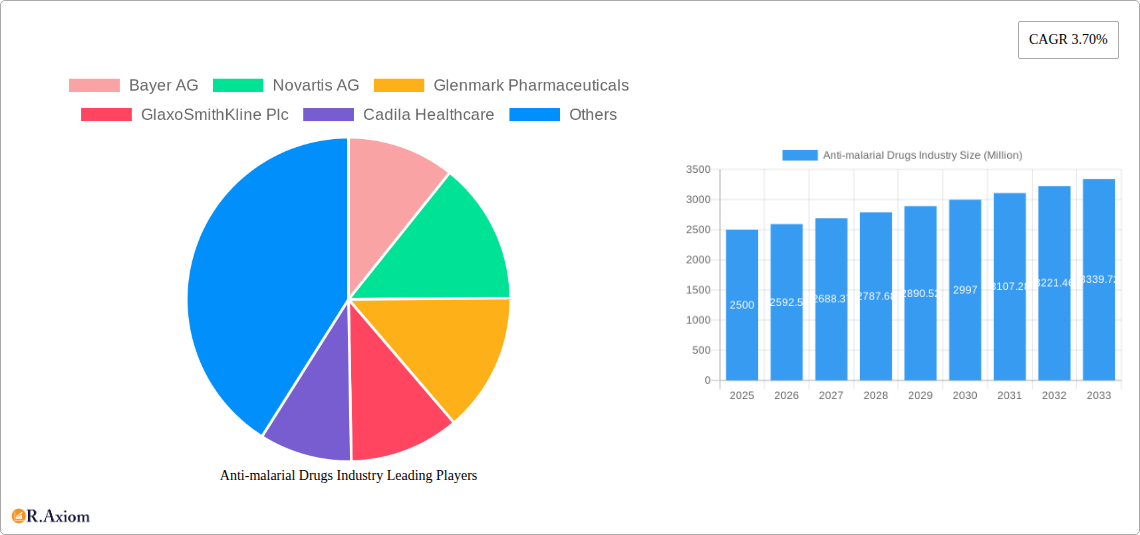

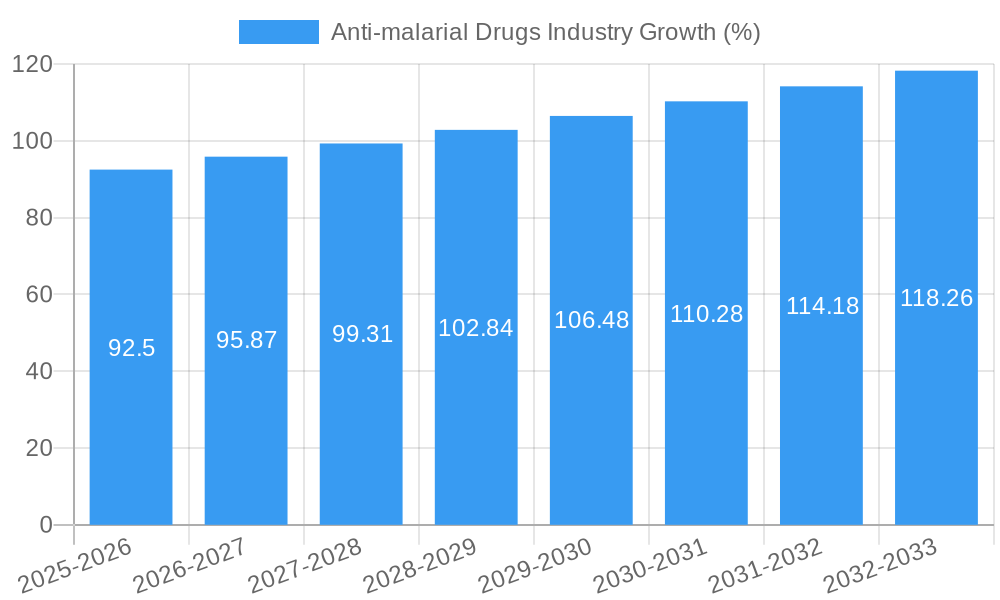

The global antimalarial drug market, currently valued at approximately $XX million (assuming a logical value based on typical market sizes for similar pharmaceutical sectors and the provided CAGR), is projected to experience steady growth, exhibiting a compound annual growth rate (CAGR) of 3.70% from 2025 to 2033. This growth is driven by several factors, including the persistent prevalence of malaria in endemic regions, particularly in sub-Saharan Africa and parts of Asia, ongoing research and development efforts focused on novel drug formulations to combat drug resistance, and increased government initiatives and public health programs aimed at malaria eradication. The market is segmented by drug class (aryl aminoalcohol compounds, antifolate compounds, artemisinin-based combination therapies (ACTs), and others), malaria type (Plasmodium falciparum, Plasmodium vivax, Plasmodium malariae, Plasmodium ovale), and mechanism of action (treatment and prevention). Artemisinin-based combination therapies, given their efficacy, currently dominate the market, but the emergence of drug-resistant strains necessitates continuous innovation and the development of new antimalarial agents.

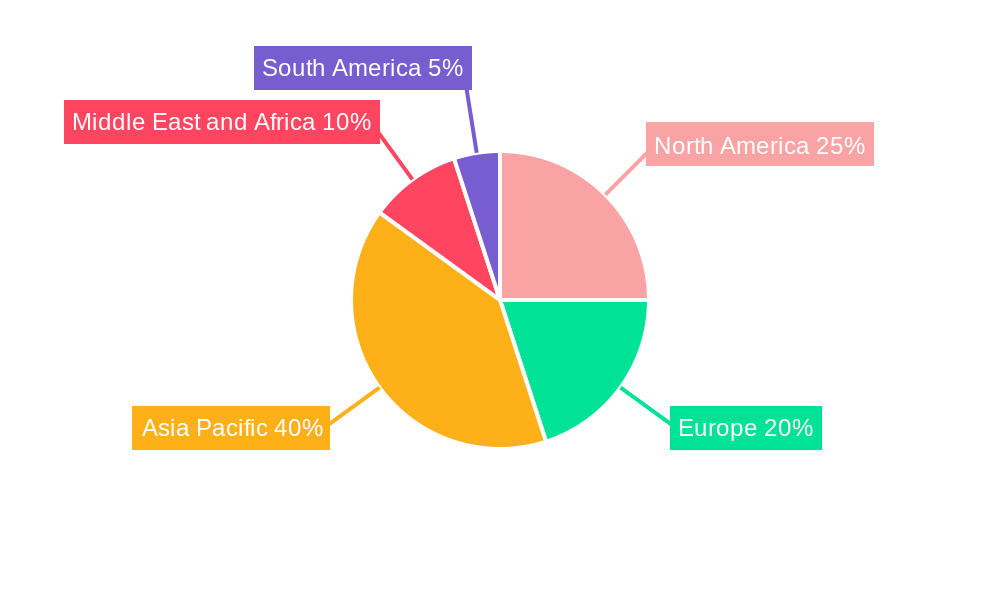

Significant growth opportunities exist in regions with high malaria burdens. While North America and Europe hold a substantial market share due to advanced healthcare infrastructure and research capabilities, the Asia-Pacific region, particularly India and China, is expected to witness substantial growth due to expanding populations and increased healthcare access. However, challenges such as inadequate healthcare infrastructure in several endemic areas, the high cost of some antimalarial drugs, and the emergence of drug resistance pose significant restraints to market expansion. Leading pharmaceutical companies like Bayer AG, Novartis AG, and GlaxoSmithKline Plc are actively involved in research, development, and distribution, shaping the competitive landscape of this crucial sector. Future growth hinges on tackling drug resistance, improving access to affordable treatments, and continuing to invest in innovative antimalarial drug development.

This comprehensive report provides a detailed analysis of the global anti-malarial drugs industry, offering invaluable insights for stakeholders, investors, and industry professionals. The report covers the period from 2019 to 2033, with 2025 as the base and estimated year. It offers a granular segmentation across drug classes, malaria types, mechanisms of action, and geographic regions, coupled with in-depth analyses of market trends, leading players, and future growth prospects.

Anti-malarial Drugs Industry Market Concentration & Innovation

The anti-malarial drug market exhibits a moderately concentrated landscape, with several multinational pharmaceutical companies holding significant market share. Companies such as Bayer AG, Novartis AG, and GlaxoSmithKline Plc dominate the market, leveraging their established research and development capabilities, global distribution networks, and brand recognition. However, the market also features several regional players and emerging companies, contributing to a dynamic competitive environment. Market share data for 2025 estimates Bayer AG at 15%, Novartis AG at 12%, and GSK at 10%, with the remaining share distributed amongst other players including Glenmark Pharmaceuticals, Cadila Healthcare, Strides Pharma Science Limited, Cipla Limited, Lincoln Pharmaceuticals, and Alvizia Healthcare.

Innovation in the anti-malarial drug market is driven by the persistent need for improved efficacy, reduced side effects, and the emergence of drug-resistant strains of malaria parasites. The regulatory landscape plays a crucial role, influencing drug development timelines and market access. The increasing prevalence of drug resistance is fostering innovation, leading to the development of novel drug classes and combination therapies. Mergers and acquisitions (M&A) activities, while not as frequent as in other pharmaceutical sectors, continue to reshape the market landscape, allowing larger companies to acquire smaller firms with promising drug candidates or enhance their existing portfolios. Estimated total M&A deal value for 2019-2024 is xx Million. The market also faces pressure from the development of potential drug substitutes, particularly those targeting alternative pathways in the parasite's life cycle. Finally, end-user trends, particularly in regions with high malaria burden, influence treatment strategies and drug preferences.

Anti-malarial Drugs Industry Industry Trends & Insights

The global anti-malarial drugs market is projected to experience robust growth during the forecast period (2025-2033), driven by several key factors. The increasing prevalence of malaria in endemic regions, coupled with the emergence of drug-resistant strains, necessitates the development and deployment of new and effective therapies. Technological advancements in drug discovery and development are streamlining the process, enabling the creation of more targeted and potent anti-malarial drugs. Changing consumer preferences are also shaping the market, with an increasing demand for convenient and accessible treatment options. Furthermore, government initiatives and public health programs aimed at malaria eradication or control are supporting market growth. The market's competitive landscape is marked by both intense rivalry amongst established players and the emergence of new entrants, driving innovation and expanding treatment options. The CAGR for the forecast period is estimated at xx%, reflecting the significant market potential and unmet needs. Market penetration is currently highest in Sub-Saharan Africa, driven by high malaria incidence rates, but growing steadily in other endemic areas.

Dominant Markets & Segments in Anti-malarial Drugs Industry

The Sub-Saharan African region dominates the anti-malarial drugs market, driven by the highest prevalence of malaria cases. Within this region, countries such as Nigeria, Democratic Republic of Congo, and Mozambique represent key markets.

By Drug Class: Artemisinin-based combination therapies (ACTs) currently hold the largest market share, owing to their high efficacy and wide usage. However, the increasing resistance to artemisinin necessitates the development and adoption of alternative drug classes, such as antifolate compounds and aryl aminoalcohol compounds. Other drug types are also gaining prominence due to their unique mechanisms of action and potential for addressing drug resistance.

By Malaria Type: Plasmodium falciparum accounts for the majority of malaria cases globally and thus holds the largest segment in the market. However, the market also caters to treatments for Plasmodium vivax, Plasmodium malariae, and Plasmodium ovale, although the incidence rates of these malaria types are comparatively lower.

By Mechanism of Action: The market is primarily driven by the need for effective treatment of malaria infections. However, preventive measures are also gaining traction, with the development of prophylactic drugs and vector control measures. The market is witnessing growing demand for both treatment and prevention strategies. Key drivers for this dominance include high disease burden, increased government initiatives (including funding for preventative measures), and technological advancements in drug discovery and development leading to improved efficacy and safety profiles.

Anti-malarial Drugs Industry Product Developments

Recent product innovations focus on improved efficacy, reduced side effects, and resistance-breaking mechanisms. New combination therapies are being developed to overcome the limitations of single-drug regimens and address the growing challenge of drug resistance. Advancements in drug delivery systems, such as sustained-release formulations, are also improving patient compliance and treatment outcomes. These developments reflect the ongoing efforts to enhance the effectiveness and safety of anti-malarial drugs, aligning with the growing market needs and ensuring optimal therapeutic benefits for patients.

Report Scope & Segmentation Analysis

This report segments the anti-malarial drugs market across various parameters.

By Drug Class: Aryl aminoalcohol compounds, Antifolate compounds, Artemisinin compounds, and Other Drug Types are analyzed based on their market size, growth projections, and competitive dynamics.

By Malaria Type: Plasmodium Falciparum, Plasmodium Vivax, Plasmodium Malariae, and Plasmodium Ovale are analyzed based on their treatment requirements and market needs.

By Mechanism of Action: Treatment for Malaria and Prevention from Malaria segments are analyzed separately, outlining growth trajectories and competitive landscapes. Each segment's market size and growth projections are provided, along with analysis of competitive intensity within each.

Key Drivers of Anti-malarial Drugs Industry Growth

Several factors fuel the growth of the anti-malarial drugs market. These include: the persistent high prevalence of malaria in endemic regions, particularly in Sub-Saharan Africa; the continuous emergence of drug-resistant strains of malaria parasites; increased funding for malaria research and development from both public and private sectors; advancements in drug discovery technologies leading to the development of novel and more effective anti-malarial drugs; and supportive government initiatives and public health programs aimed at malaria control and eradication.

Challenges in the Anti-malarial Drugs Industry Sector

The anti-malarial drugs market faces significant challenges, including: the increasing prevalence of drug resistance, necessitating the continuous development of new drugs; the complex regulatory landscape governing drug development and approval; supply chain disruptions affecting the availability and affordability of essential medicines, particularly in resource-limited settings; and the intense competition among numerous pharmaceutical companies. The combined impact of these factors can significantly impede market growth and access to life-saving treatments.

Emerging Opportunities in Anti-malarial Drugs Industry

Despite the challenges, significant opportunities exist within the anti-malarial drugs market. These include: the development of novel drugs targeting specific parasite pathways and addressing drug resistance; the exploration of new drug delivery systems; the expansion of access to treatment and prevention programs in underserved regions; and the development of point-of-care diagnostic tools for rapid and accurate diagnosis of malaria. These opportunities represent a significant potential for market expansion and improved patient outcomes.

Leading Players in the Anti-malarial Drugs Industry Market

- Bayer AG

- Novartis AG

- Glenmark Pharmaceuticals

- GlaxoSmithKline Plc

- Cadila Healthcare

- Alliance Pharma PLC

- Strides Pharma Science Limited

- Cipla Limited

- Lincoln Pharmaceuticals

- Alvizia Healthcare

Key Developments in Anti-malarial Drugs Industry Industry

- August 2022: The British Heart Foundation funded a University of Surrey study on the cardiac effects of anti-malarial drugs.

- March 2022: Tafenoquine, a new drug for a specific malaria type, was approved in Australia by Medicines for Malaria Venture (MMV) and GlaxoSmithKline (GSK).

Strategic Outlook for Anti-malarial Drugs Industry Market

The future of the anti-malarial drugs market is promising, driven by continuous innovation, increased funding for research and development, and a growing awareness of the global burden of malaria. The focus on developing new drugs that address drug resistance, coupled with improved access to existing treatments, will be instrumental in shaping the market's growth trajectory. Expansion into new markets and the development of more user-friendly formulations will also play a significant role in future market success. The market is poised for substantial growth, driven by unmet medical needs and ongoing efforts towards malaria eradication.

Anti-malarial Drugs Industry Segmentation

-

1. Drug Class

- 1.1. Aryl aminoalcohol compounds

- 1.2. Antifolate compounds

- 1.3. Artemisinin compounds

- 1.4. Other Drug Types

-

2. Malaria Type

- 2.1. Plasmodium Falciparum

- 2.2. Plasmodium Vivax

- 2.3. Plasmodium Malariae

- 2.4. Plasmodium Ovale

-

3. Mechanism of Action

- 3.1. Treatment for Malaria

- 3.2. Prevention from Malaria

Anti-malarial Drugs Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Anti-malarial Drugs Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High Prevalence of Malaria in Developing and Under Developed Countries; Increasing Awareness Initiatives Undertaken by Government; Increasing Research for New Drugs and New Combinations Therapies

- 3.3. Market Restrains

- 3.3.1. Side Effects of Anti-malaria Drugs; Presence of Counterfeit and Substandard Antimalarial Drugs

- 3.4. Market Trends

- 3.4.1. Artemisinin Compounds Segment is Expected to Register High Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Anti-malarial Drugs Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Drug Class

- 5.1.1. Aryl aminoalcohol compounds

- 5.1.2. Antifolate compounds

- 5.1.3. Artemisinin compounds

- 5.1.4. Other Drug Types

- 5.2. Market Analysis, Insights and Forecast - by Malaria Type

- 5.2.1. Plasmodium Falciparum

- 5.2.2. Plasmodium Vivax

- 5.2.3. Plasmodium Malariae

- 5.2.4. Plasmodium Ovale

- 5.3. Market Analysis, Insights and Forecast - by Mechanism of Action

- 5.3.1. Treatment for Malaria

- 5.3.2. Prevention from Malaria

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Drug Class

- 6. North America Anti-malarial Drugs Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Drug Class

- 6.1.1. Aryl aminoalcohol compounds

- 6.1.2. Antifolate compounds

- 6.1.3. Artemisinin compounds

- 6.1.4. Other Drug Types

- 6.2. Market Analysis, Insights and Forecast - by Malaria Type

- 6.2.1. Plasmodium Falciparum

- 6.2.2. Plasmodium Vivax

- 6.2.3. Plasmodium Malariae

- 6.2.4. Plasmodium Ovale

- 6.3. Market Analysis, Insights and Forecast - by Mechanism of Action

- 6.3.1. Treatment for Malaria

- 6.3.2. Prevention from Malaria

- 6.1. Market Analysis, Insights and Forecast - by Drug Class

- 7. Europe Anti-malarial Drugs Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Drug Class

- 7.1.1. Aryl aminoalcohol compounds

- 7.1.2. Antifolate compounds

- 7.1.3. Artemisinin compounds

- 7.1.4. Other Drug Types

- 7.2. Market Analysis, Insights and Forecast - by Malaria Type

- 7.2.1. Plasmodium Falciparum

- 7.2.2. Plasmodium Vivax

- 7.2.3. Plasmodium Malariae

- 7.2.4. Plasmodium Ovale

- 7.3. Market Analysis, Insights and Forecast - by Mechanism of Action

- 7.3.1. Treatment for Malaria

- 7.3.2. Prevention from Malaria

- 7.1. Market Analysis, Insights and Forecast - by Drug Class

- 8. Asia Pacific Anti-malarial Drugs Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Drug Class

- 8.1.1. Aryl aminoalcohol compounds

- 8.1.2. Antifolate compounds

- 8.1.3. Artemisinin compounds

- 8.1.4. Other Drug Types

- 8.2. Market Analysis, Insights and Forecast - by Malaria Type

- 8.2.1. Plasmodium Falciparum

- 8.2.2. Plasmodium Vivax

- 8.2.3. Plasmodium Malariae

- 8.2.4. Plasmodium Ovale

- 8.3. Market Analysis, Insights and Forecast - by Mechanism of Action

- 8.3.1. Treatment for Malaria

- 8.3.2. Prevention from Malaria

- 8.1. Market Analysis, Insights and Forecast - by Drug Class

- 9. Middle East and Africa Anti-malarial Drugs Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Drug Class

- 9.1.1. Aryl aminoalcohol compounds

- 9.1.2. Antifolate compounds

- 9.1.3. Artemisinin compounds

- 9.1.4. Other Drug Types

- 9.2. Market Analysis, Insights and Forecast - by Malaria Type

- 9.2.1. Plasmodium Falciparum

- 9.2.2. Plasmodium Vivax

- 9.2.3. Plasmodium Malariae

- 9.2.4. Plasmodium Ovale

- 9.3. Market Analysis, Insights and Forecast - by Mechanism of Action

- 9.3.1. Treatment for Malaria

- 9.3.2. Prevention from Malaria

- 9.1. Market Analysis, Insights and Forecast - by Drug Class

- 10. South America Anti-malarial Drugs Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Drug Class

- 10.1.1. Aryl aminoalcohol compounds

- 10.1.2. Antifolate compounds

- 10.1.3. Artemisinin compounds

- 10.1.4. Other Drug Types

- 10.2. Market Analysis, Insights and Forecast - by Malaria Type

- 10.2.1. Plasmodium Falciparum

- 10.2.2. Plasmodium Vivax

- 10.2.3. Plasmodium Malariae

- 10.2.4. Plasmodium Ovale

- 10.3. Market Analysis, Insights and Forecast - by Mechanism of Action

- 10.3.1. Treatment for Malaria

- 10.3.2. Prevention from Malaria

- 10.1. Market Analysis, Insights and Forecast - by Drug Class

- 11. North America Anti-malarial Drugs Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Anti-malarial Drugs Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Italy

- 12.1.5 Spain

- 12.1.6 Rest of Europe

- 13. Asia Pacific Anti-malarial Drugs Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 Australia

- 13.1.5 South Korea

- 13.1.6 Rest of Asia Pacific

- 14. Middle East and Africa Anti-malarial Drugs Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 GCC

- 14.1.2 South Africa

- 14.1.3 Rest of Middle East and Africa

- 15. South America Anti-malarial Drugs Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Brazil

- 15.1.2 Argentina

- 15.1.3 Rest of South America

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Bayer AG

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Novartis AG

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Glenmark Pharmaceuticals

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 GlaxoSmithKline Plc

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Cadila Healthcare

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Alliance Pharma PLC

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Strides Pharma Science Limited

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Cipla Limited

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Lincoln Pharmaceuticals

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Alvizia Healthcare

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Bayer AG

List of Figures

- Figure 1: Global Anti-malarial Drugs Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global Anti-malarial Drugs Industry Volume Breakdown (Dosage, %) by Region 2024 & 2032

- Figure 3: North America Anti-malarial Drugs Industry Revenue (Million), by Country 2024 & 2032

- Figure 4: North America Anti-malarial Drugs Industry Volume (Dosage), by Country 2024 & 2032

- Figure 5: North America Anti-malarial Drugs Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: North America Anti-malarial Drugs Industry Volume Share (%), by Country 2024 & 2032

- Figure 7: Europe Anti-malarial Drugs Industry Revenue (Million), by Country 2024 & 2032

- Figure 8: Europe Anti-malarial Drugs Industry Volume (Dosage), by Country 2024 & 2032

- Figure 9: Europe Anti-malarial Drugs Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Europe Anti-malarial Drugs Industry Volume Share (%), by Country 2024 & 2032

- Figure 11: Asia Pacific Anti-malarial Drugs Industry Revenue (Million), by Country 2024 & 2032

- Figure 12: Asia Pacific Anti-malarial Drugs Industry Volume (Dosage), by Country 2024 & 2032

- Figure 13: Asia Pacific Anti-malarial Drugs Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: Asia Pacific Anti-malarial Drugs Industry Volume Share (%), by Country 2024 & 2032

- Figure 15: Middle East and Africa Anti-malarial Drugs Industry Revenue (Million), by Country 2024 & 2032

- Figure 16: Middle East and Africa Anti-malarial Drugs Industry Volume (Dosage), by Country 2024 & 2032

- Figure 17: Middle East and Africa Anti-malarial Drugs Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Middle East and Africa Anti-malarial Drugs Industry Volume Share (%), by Country 2024 & 2032

- Figure 19: South America Anti-malarial Drugs Industry Revenue (Million), by Country 2024 & 2032

- Figure 20: South America Anti-malarial Drugs Industry Volume (Dosage), by Country 2024 & 2032

- Figure 21: South America Anti-malarial Drugs Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: South America Anti-malarial Drugs Industry Volume Share (%), by Country 2024 & 2032

- Figure 23: North America Anti-malarial Drugs Industry Revenue (Million), by Drug Class 2024 & 2032

- Figure 24: North America Anti-malarial Drugs Industry Volume (Dosage), by Drug Class 2024 & 2032

- Figure 25: North America Anti-malarial Drugs Industry Revenue Share (%), by Drug Class 2024 & 2032

- Figure 26: North America Anti-malarial Drugs Industry Volume Share (%), by Drug Class 2024 & 2032

- Figure 27: North America Anti-malarial Drugs Industry Revenue (Million), by Malaria Type 2024 & 2032

- Figure 28: North America Anti-malarial Drugs Industry Volume (Dosage), by Malaria Type 2024 & 2032

- Figure 29: North America Anti-malarial Drugs Industry Revenue Share (%), by Malaria Type 2024 & 2032

- Figure 30: North America Anti-malarial Drugs Industry Volume Share (%), by Malaria Type 2024 & 2032

- Figure 31: North America Anti-malarial Drugs Industry Revenue (Million), by Mechanism of Action 2024 & 2032

- Figure 32: North America Anti-malarial Drugs Industry Volume (Dosage), by Mechanism of Action 2024 & 2032

- Figure 33: North America Anti-malarial Drugs Industry Revenue Share (%), by Mechanism of Action 2024 & 2032

- Figure 34: North America Anti-malarial Drugs Industry Volume Share (%), by Mechanism of Action 2024 & 2032

- Figure 35: North America Anti-malarial Drugs Industry Revenue (Million), by Country 2024 & 2032

- Figure 36: North America Anti-malarial Drugs Industry Volume (Dosage), by Country 2024 & 2032

- Figure 37: North America Anti-malarial Drugs Industry Revenue Share (%), by Country 2024 & 2032

- Figure 38: North America Anti-malarial Drugs Industry Volume Share (%), by Country 2024 & 2032

- Figure 39: Europe Anti-malarial Drugs Industry Revenue (Million), by Drug Class 2024 & 2032

- Figure 40: Europe Anti-malarial Drugs Industry Volume (Dosage), by Drug Class 2024 & 2032

- Figure 41: Europe Anti-malarial Drugs Industry Revenue Share (%), by Drug Class 2024 & 2032

- Figure 42: Europe Anti-malarial Drugs Industry Volume Share (%), by Drug Class 2024 & 2032

- Figure 43: Europe Anti-malarial Drugs Industry Revenue (Million), by Malaria Type 2024 & 2032

- Figure 44: Europe Anti-malarial Drugs Industry Volume (Dosage), by Malaria Type 2024 & 2032

- Figure 45: Europe Anti-malarial Drugs Industry Revenue Share (%), by Malaria Type 2024 & 2032

- Figure 46: Europe Anti-malarial Drugs Industry Volume Share (%), by Malaria Type 2024 & 2032

- Figure 47: Europe Anti-malarial Drugs Industry Revenue (Million), by Mechanism of Action 2024 & 2032

- Figure 48: Europe Anti-malarial Drugs Industry Volume (Dosage), by Mechanism of Action 2024 & 2032

- Figure 49: Europe Anti-malarial Drugs Industry Revenue Share (%), by Mechanism of Action 2024 & 2032

- Figure 50: Europe Anti-malarial Drugs Industry Volume Share (%), by Mechanism of Action 2024 & 2032

- Figure 51: Europe Anti-malarial Drugs Industry Revenue (Million), by Country 2024 & 2032

- Figure 52: Europe Anti-malarial Drugs Industry Volume (Dosage), by Country 2024 & 2032

- Figure 53: Europe Anti-malarial Drugs Industry Revenue Share (%), by Country 2024 & 2032

- Figure 54: Europe Anti-malarial Drugs Industry Volume Share (%), by Country 2024 & 2032

- Figure 55: Asia Pacific Anti-malarial Drugs Industry Revenue (Million), by Drug Class 2024 & 2032

- Figure 56: Asia Pacific Anti-malarial Drugs Industry Volume (Dosage), by Drug Class 2024 & 2032

- Figure 57: Asia Pacific Anti-malarial Drugs Industry Revenue Share (%), by Drug Class 2024 & 2032

- Figure 58: Asia Pacific Anti-malarial Drugs Industry Volume Share (%), by Drug Class 2024 & 2032

- Figure 59: Asia Pacific Anti-malarial Drugs Industry Revenue (Million), by Malaria Type 2024 & 2032

- Figure 60: Asia Pacific Anti-malarial Drugs Industry Volume (Dosage), by Malaria Type 2024 & 2032

- Figure 61: Asia Pacific Anti-malarial Drugs Industry Revenue Share (%), by Malaria Type 2024 & 2032

- Figure 62: Asia Pacific Anti-malarial Drugs Industry Volume Share (%), by Malaria Type 2024 & 2032

- Figure 63: Asia Pacific Anti-malarial Drugs Industry Revenue (Million), by Mechanism of Action 2024 & 2032

- Figure 64: Asia Pacific Anti-malarial Drugs Industry Volume (Dosage), by Mechanism of Action 2024 & 2032

- Figure 65: Asia Pacific Anti-malarial Drugs Industry Revenue Share (%), by Mechanism of Action 2024 & 2032

- Figure 66: Asia Pacific Anti-malarial Drugs Industry Volume Share (%), by Mechanism of Action 2024 & 2032

- Figure 67: Asia Pacific Anti-malarial Drugs Industry Revenue (Million), by Country 2024 & 2032

- Figure 68: Asia Pacific Anti-malarial Drugs Industry Volume (Dosage), by Country 2024 & 2032

- Figure 69: Asia Pacific Anti-malarial Drugs Industry Revenue Share (%), by Country 2024 & 2032

- Figure 70: Asia Pacific Anti-malarial Drugs Industry Volume Share (%), by Country 2024 & 2032

- Figure 71: Middle East and Africa Anti-malarial Drugs Industry Revenue (Million), by Drug Class 2024 & 2032

- Figure 72: Middle East and Africa Anti-malarial Drugs Industry Volume (Dosage), by Drug Class 2024 & 2032

- Figure 73: Middle East and Africa Anti-malarial Drugs Industry Revenue Share (%), by Drug Class 2024 & 2032

- Figure 74: Middle East and Africa Anti-malarial Drugs Industry Volume Share (%), by Drug Class 2024 & 2032

- Figure 75: Middle East and Africa Anti-malarial Drugs Industry Revenue (Million), by Malaria Type 2024 & 2032

- Figure 76: Middle East and Africa Anti-malarial Drugs Industry Volume (Dosage), by Malaria Type 2024 & 2032

- Figure 77: Middle East and Africa Anti-malarial Drugs Industry Revenue Share (%), by Malaria Type 2024 & 2032

- Figure 78: Middle East and Africa Anti-malarial Drugs Industry Volume Share (%), by Malaria Type 2024 & 2032

- Figure 79: Middle East and Africa Anti-malarial Drugs Industry Revenue (Million), by Mechanism of Action 2024 & 2032

- Figure 80: Middle East and Africa Anti-malarial Drugs Industry Volume (Dosage), by Mechanism of Action 2024 & 2032

- Figure 81: Middle East and Africa Anti-malarial Drugs Industry Revenue Share (%), by Mechanism of Action 2024 & 2032

- Figure 82: Middle East and Africa Anti-malarial Drugs Industry Volume Share (%), by Mechanism of Action 2024 & 2032

- Figure 83: Middle East and Africa Anti-malarial Drugs Industry Revenue (Million), by Country 2024 & 2032

- Figure 84: Middle East and Africa Anti-malarial Drugs Industry Volume (Dosage), by Country 2024 & 2032

- Figure 85: Middle East and Africa Anti-malarial Drugs Industry Revenue Share (%), by Country 2024 & 2032

- Figure 86: Middle East and Africa Anti-malarial Drugs Industry Volume Share (%), by Country 2024 & 2032

- Figure 87: South America Anti-malarial Drugs Industry Revenue (Million), by Drug Class 2024 & 2032

- Figure 88: South America Anti-malarial Drugs Industry Volume (Dosage), by Drug Class 2024 & 2032

- Figure 89: South America Anti-malarial Drugs Industry Revenue Share (%), by Drug Class 2024 & 2032

- Figure 90: South America Anti-malarial Drugs Industry Volume Share (%), by Drug Class 2024 & 2032

- Figure 91: South America Anti-malarial Drugs Industry Revenue (Million), by Malaria Type 2024 & 2032

- Figure 92: South America Anti-malarial Drugs Industry Volume (Dosage), by Malaria Type 2024 & 2032

- Figure 93: South America Anti-malarial Drugs Industry Revenue Share (%), by Malaria Type 2024 & 2032

- Figure 94: South America Anti-malarial Drugs Industry Volume Share (%), by Malaria Type 2024 & 2032

- Figure 95: South America Anti-malarial Drugs Industry Revenue (Million), by Mechanism of Action 2024 & 2032

- Figure 96: South America Anti-malarial Drugs Industry Volume (Dosage), by Mechanism of Action 2024 & 2032

- Figure 97: South America Anti-malarial Drugs Industry Revenue Share (%), by Mechanism of Action 2024 & 2032

- Figure 98: South America Anti-malarial Drugs Industry Volume Share (%), by Mechanism of Action 2024 & 2032

- Figure 99: South America Anti-malarial Drugs Industry Revenue (Million), by Country 2024 & 2032

- Figure 100: South America Anti-malarial Drugs Industry Volume (Dosage), by Country 2024 & 2032

- Figure 101: South America Anti-malarial Drugs Industry Revenue Share (%), by Country 2024 & 2032

- Figure 102: South America Anti-malarial Drugs Industry Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Anti-malarial Drugs Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Anti-malarial Drugs Industry Volume Dosage Forecast, by Region 2019 & 2032

- Table 3: Global Anti-malarial Drugs Industry Revenue Million Forecast, by Drug Class 2019 & 2032

- Table 4: Global Anti-malarial Drugs Industry Volume Dosage Forecast, by Drug Class 2019 & 2032

- Table 5: Global Anti-malarial Drugs Industry Revenue Million Forecast, by Malaria Type 2019 & 2032

- Table 6: Global Anti-malarial Drugs Industry Volume Dosage Forecast, by Malaria Type 2019 & 2032

- Table 7: Global Anti-malarial Drugs Industry Revenue Million Forecast, by Mechanism of Action 2019 & 2032

- Table 8: Global Anti-malarial Drugs Industry Volume Dosage Forecast, by Mechanism of Action 2019 & 2032

- Table 9: Global Anti-malarial Drugs Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Global Anti-malarial Drugs Industry Volume Dosage Forecast, by Region 2019 & 2032

- Table 11: Global Anti-malarial Drugs Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Global Anti-malarial Drugs Industry Volume Dosage Forecast, by Country 2019 & 2032

- Table 13: United States Anti-malarial Drugs Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: United States Anti-malarial Drugs Industry Volume (Dosage) Forecast, by Application 2019 & 2032

- Table 15: Canada Anti-malarial Drugs Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada Anti-malarial Drugs Industry Volume (Dosage) Forecast, by Application 2019 & 2032

- Table 17: Mexico Anti-malarial Drugs Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Mexico Anti-malarial Drugs Industry Volume (Dosage) Forecast, by Application 2019 & 2032

- Table 19: Global Anti-malarial Drugs Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global Anti-malarial Drugs Industry Volume Dosage Forecast, by Country 2019 & 2032

- Table 21: Germany Anti-malarial Drugs Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Germany Anti-malarial Drugs Industry Volume (Dosage) Forecast, by Application 2019 & 2032

- Table 23: United Kingdom Anti-malarial Drugs Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: United Kingdom Anti-malarial Drugs Industry Volume (Dosage) Forecast, by Application 2019 & 2032

- Table 25: France Anti-malarial Drugs Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: France Anti-malarial Drugs Industry Volume (Dosage) Forecast, by Application 2019 & 2032

- Table 27: Italy Anti-malarial Drugs Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Italy Anti-malarial Drugs Industry Volume (Dosage) Forecast, by Application 2019 & 2032

- Table 29: Spain Anti-malarial Drugs Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Spain Anti-malarial Drugs Industry Volume (Dosage) Forecast, by Application 2019 & 2032

- Table 31: Rest of Europe Anti-malarial Drugs Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Rest of Europe Anti-malarial Drugs Industry Volume (Dosage) Forecast, by Application 2019 & 2032

- Table 33: Global Anti-malarial Drugs Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Global Anti-malarial Drugs Industry Volume Dosage Forecast, by Country 2019 & 2032

- Table 35: China Anti-malarial Drugs Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: China Anti-malarial Drugs Industry Volume (Dosage) Forecast, by Application 2019 & 2032

- Table 37: Japan Anti-malarial Drugs Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Japan Anti-malarial Drugs Industry Volume (Dosage) Forecast, by Application 2019 & 2032

- Table 39: India Anti-malarial Drugs Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: India Anti-malarial Drugs Industry Volume (Dosage) Forecast, by Application 2019 & 2032

- Table 41: Australia Anti-malarial Drugs Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Australia Anti-malarial Drugs Industry Volume (Dosage) Forecast, by Application 2019 & 2032

- Table 43: South Korea Anti-malarial Drugs Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Anti-malarial Drugs Industry Volume (Dosage) Forecast, by Application 2019 & 2032

- Table 45: Rest of Asia Pacific Anti-malarial Drugs Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Rest of Asia Pacific Anti-malarial Drugs Industry Volume (Dosage) Forecast, by Application 2019 & 2032

- Table 47: Global Anti-malarial Drugs Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 48: Global Anti-malarial Drugs Industry Volume Dosage Forecast, by Country 2019 & 2032

- Table 49: GCC Anti-malarial Drugs Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: GCC Anti-malarial Drugs Industry Volume (Dosage) Forecast, by Application 2019 & 2032

- Table 51: South Africa Anti-malarial Drugs Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: South Africa Anti-malarial Drugs Industry Volume (Dosage) Forecast, by Application 2019 & 2032

- Table 53: Rest of Middle East and Africa Anti-malarial Drugs Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Rest of Middle East and Africa Anti-malarial Drugs Industry Volume (Dosage) Forecast, by Application 2019 & 2032

- Table 55: Global Anti-malarial Drugs Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 56: Global Anti-malarial Drugs Industry Volume Dosage Forecast, by Country 2019 & 2032

- Table 57: Brazil Anti-malarial Drugs Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Brazil Anti-malarial Drugs Industry Volume (Dosage) Forecast, by Application 2019 & 2032

- Table 59: Argentina Anti-malarial Drugs Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Argentina Anti-malarial Drugs Industry Volume (Dosage) Forecast, by Application 2019 & 2032

- Table 61: Rest of South America Anti-malarial Drugs Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Rest of South America Anti-malarial Drugs Industry Volume (Dosage) Forecast, by Application 2019 & 2032

- Table 63: Global Anti-malarial Drugs Industry Revenue Million Forecast, by Drug Class 2019 & 2032

- Table 64: Global Anti-malarial Drugs Industry Volume Dosage Forecast, by Drug Class 2019 & 2032

- Table 65: Global Anti-malarial Drugs Industry Revenue Million Forecast, by Malaria Type 2019 & 2032

- Table 66: Global Anti-malarial Drugs Industry Volume Dosage Forecast, by Malaria Type 2019 & 2032

- Table 67: Global Anti-malarial Drugs Industry Revenue Million Forecast, by Mechanism of Action 2019 & 2032

- Table 68: Global Anti-malarial Drugs Industry Volume Dosage Forecast, by Mechanism of Action 2019 & 2032

- Table 69: Global Anti-malarial Drugs Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 70: Global Anti-malarial Drugs Industry Volume Dosage Forecast, by Country 2019 & 2032

- Table 71: United States Anti-malarial Drugs Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 72: United States Anti-malarial Drugs Industry Volume (Dosage) Forecast, by Application 2019 & 2032

- Table 73: Canada Anti-malarial Drugs Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 74: Canada Anti-malarial Drugs Industry Volume (Dosage) Forecast, by Application 2019 & 2032

- Table 75: Mexico Anti-malarial Drugs Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 76: Mexico Anti-malarial Drugs Industry Volume (Dosage) Forecast, by Application 2019 & 2032

- Table 77: Global Anti-malarial Drugs Industry Revenue Million Forecast, by Drug Class 2019 & 2032

- Table 78: Global Anti-malarial Drugs Industry Volume Dosage Forecast, by Drug Class 2019 & 2032

- Table 79: Global Anti-malarial Drugs Industry Revenue Million Forecast, by Malaria Type 2019 & 2032

- Table 80: Global Anti-malarial Drugs Industry Volume Dosage Forecast, by Malaria Type 2019 & 2032

- Table 81: Global Anti-malarial Drugs Industry Revenue Million Forecast, by Mechanism of Action 2019 & 2032

- Table 82: Global Anti-malarial Drugs Industry Volume Dosage Forecast, by Mechanism of Action 2019 & 2032

- Table 83: Global Anti-malarial Drugs Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 84: Global Anti-malarial Drugs Industry Volume Dosage Forecast, by Country 2019 & 2032

- Table 85: Germany Anti-malarial Drugs Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 86: Germany Anti-malarial Drugs Industry Volume (Dosage) Forecast, by Application 2019 & 2032

- Table 87: United Kingdom Anti-malarial Drugs Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 88: United Kingdom Anti-malarial Drugs Industry Volume (Dosage) Forecast, by Application 2019 & 2032

- Table 89: France Anti-malarial Drugs Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 90: France Anti-malarial Drugs Industry Volume (Dosage) Forecast, by Application 2019 & 2032

- Table 91: Italy Anti-malarial Drugs Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 92: Italy Anti-malarial Drugs Industry Volume (Dosage) Forecast, by Application 2019 & 2032

- Table 93: Spain Anti-malarial Drugs Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 94: Spain Anti-malarial Drugs Industry Volume (Dosage) Forecast, by Application 2019 & 2032

- Table 95: Rest of Europe Anti-malarial Drugs Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 96: Rest of Europe Anti-malarial Drugs Industry Volume (Dosage) Forecast, by Application 2019 & 2032

- Table 97: Global Anti-malarial Drugs Industry Revenue Million Forecast, by Drug Class 2019 & 2032

- Table 98: Global Anti-malarial Drugs Industry Volume Dosage Forecast, by Drug Class 2019 & 2032

- Table 99: Global Anti-malarial Drugs Industry Revenue Million Forecast, by Malaria Type 2019 & 2032

- Table 100: Global Anti-malarial Drugs Industry Volume Dosage Forecast, by Malaria Type 2019 & 2032

- Table 101: Global Anti-malarial Drugs Industry Revenue Million Forecast, by Mechanism of Action 2019 & 2032

- Table 102: Global Anti-malarial Drugs Industry Volume Dosage Forecast, by Mechanism of Action 2019 & 2032

- Table 103: Global Anti-malarial Drugs Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 104: Global Anti-malarial Drugs Industry Volume Dosage Forecast, by Country 2019 & 2032

- Table 105: China Anti-malarial Drugs Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 106: China Anti-malarial Drugs Industry Volume (Dosage) Forecast, by Application 2019 & 2032

- Table 107: Japan Anti-malarial Drugs Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 108: Japan Anti-malarial Drugs Industry Volume (Dosage) Forecast, by Application 2019 & 2032

- Table 109: India Anti-malarial Drugs Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 110: India Anti-malarial Drugs Industry Volume (Dosage) Forecast, by Application 2019 & 2032

- Table 111: Australia Anti-malarial Drugs Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 112: Australia Anti-malarial Drugs Industry Volume (Dosage) Forecast, by Application 2019 & 2032

- Table 113: South Korea Anti-malarial Drugs Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 114: South Korea Anti-malarial Drugs Industry Volume (Dosage) Forecast, by Application 2019 & 2032

- Table 115: Rest of Asia Pacific Anti-malarial Drugs Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 116: Rest of Asia Pacific Anti-malarial Drugs Industry Volume (Dosage) Forecast, by Application 2019 & 2032

- Table 117: Global Anti-malarial Drugs Industry Revenue Million Forecast, by Drug Class 2019 & 2032

- Table 118: Global Anti-malarial Drugs Industry Volume Dosage Forecast, by Drug Class 2019 & 2032

- Table 119: Global Anti-malarial Drugs Industry Revenue Million Forecast, by Malaria Type 2019 & 2032

- Table 120: Global Anti-malarial Drugs Industry Volume Dosage Forecast, by Malaria Type 2019 & 2032

- Table 121: Global Anti-malarial Drugs Industry Revenue Million Forecast, by Mechanism of Action 2019 & 2032

- Table 122: Global Anti-malarial Drugs Industry Volume Dosage Forecast, by Mechanism of Action 2019 & 2032

- Table 123: Global Anti-malarial Drugs Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 124: Global Anti-malarial Drugs Industry Volume Dosage Forecast, by Country 2019 & 2032

- Table 125: GCC Anti-malarial Drugs Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 126: GCC Anti-malarial Drugs Industry Volume (Dosage) Forecast, by Application 2019 & 2032

- Table 127: South Africa Anti-malarial Drugs Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 128: South Africa Anti-malarial Drugs Industry Volume (Dosage) Forecast, by Application 2019 & 2032

- Table 129: Rest of Middle East and Africa Anti-malarial Drugs Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 130: Rest of Middle East and Africa Anti-malarial Drugs Industry Volume (Dosage) Forecast, by Application 2019 & 2032

- Table 131: Global Anti-malarial Drugs Industry Revenue Million Forecast, by Drug Class 2019 & 2032

- Table 132: Global Anti-malarial Drugs Industry Volume Dosage Forecast, by Drug Class 2019 & 2032

- Table 133: Global Anti-malarial Drugs Industry Revenue Million Forecast, by Malaria Type 2019 & 2032

- Table 134: Global Anti-malarial Drugs Industry Volume Dosage Forecast, by Malaria Type 2019 & 2032

- Table 135: Global Anti-malarial Drugs Industry Revenue Million Forecast, by Mechanism of Action 2019 & 2032

- Table 136: Global Anti-malarial Drugs Industry Volume Dosage Forecast, by Mechanism of Action 2019 & 2032

- Table 137: Global Anti-malarial Drugs Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 138: Global Anti-malarial Drugs Industry Volume Dosage Forecast, by Country 2019 & 2032

- Table 139: Brazil Anti-malarial Drugs Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 140: Brazil Anti-malarial Drugs Industry Volume (Dosage) Forecast, by Application 2019 & 2032

- Table 141: Argentina Anti-malarial Drugs Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 142: Argentina Anti-malarial Drugs Industry Volume (Dosage) Forecast, by Application 2019 & 2032

- Table 143: Rest of South America Anti-malarial Drugs Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 144: Rest of South America Anti-malarial Drugs Industry Volume (Dosage) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Anti-malarial Drugs Industry?

The projected CAGR is approximately 3.70%.

2. Which companies are prominent players in the Anti-malarial Drugs Industry?

Key companies in the market include Bayer AG, Novartis AG, Glenmark Pharmaceuticals, GlaxoSmithKline Plc, Cadila Healthcare, Alliance Pharma PLC , Strides Pharma Science Limited, Cipla Limited, Lincoln Pharmaceuticals, Alvizia Healthcare.

3. What are the main segments of the Anti-malarial Drugs Industry?

The market segments include Drug Class, Malaria Type, Mechanism of Action.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

High Prevalence of Malaria in Developing and Under Developed Countries; Increasing Awareness Initiatives Undertaken by Government; Increasing Research for New Drugs and New Combinations Therapies.

6. What are the notable trends driving market growth?

Artemisinin Compounds Segment is Expected to Register High Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

Side Effects of Anti-malaria Drugs; Presence of Counterfeit and Substandard Antimalarial Drugs.

8. Can you provide examples of recent developments in the market?

In August 2022, the British Heart Foundation planned to fund the University of Surrey to study on the implications of anti-malaria medicines on cardiac rhythm. It is to understand how drugs used to treat malaria impact the human heart.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Dosage.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Anti-malarial Drugs Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Anti-malarial Drugs Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Anti-malarial Drugs Industry?

To stay informed about further developments, trends, and reports in the Anti-malarial Drugs Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence