Key Insights

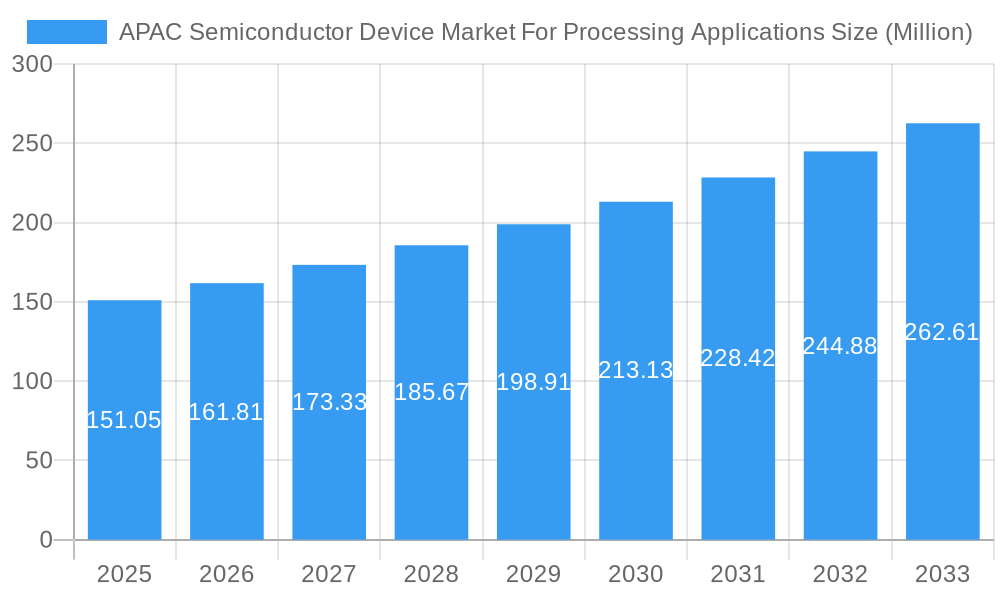

The APAC Semiconductor Device Market for Processing Applications is poised for robust expansion, projected to reach an estimated market size of USD 151.05 million in 2025, with a compelling Compound Annual Growth Rate (CAGR) of 7.30% anticipated between 2025 and 2033. This dynamic growth is underpinned by several significant drivers. The escalating demand for advanced consumer electronics, including smartphones, wearables, and smart home devices, is a primary catalyst. Furthermore, the rapid proliferation of 5G technology necessitates a substantial upgrade in semiconductor components for network infrastructure and user devices, thereby fueling market expansion. The burgeoning automotive sector, with its increasing integration of sophisticated electronic control units (ECUs), advanced driver-assistance systems (ADAS), and the pursuit of autonomous driving, represents another crucial growth engine for semiconductor devices in processing applications. The ongoing digital transformation across various industries, including healthcare, manufacturing, and finance, coupled with the widespread adoption of the Internet of Things (IoT), further amplifies the need for high-performance and specialized semiconductor solutions.

APAC Semiconductor Device Market For Processing Applications Market Size (In Million)

The market's trajectory is also shaped by key trends and potential restraints. The relentless pursuit of miniaturization, increased power efficiency, and enhanced performance in semiconductor devices continues to drive innovation in fabrication technologies and materials. The growing importance of AI and machine learning applications is creating a surge in demand for specialized processors, such as GPUs and NPUs, which are integral to the APAC region's strong manufacturing and R&D capabilities in these areas. However, the market faces challenges related to supply chain disruptions, geopolitical tensions impacting trade and manufacturing, and the high capital expenditure required for advanced semiconductor fabrication. The increasing complexity of semiconductor design and manufacturing also presents a hurdle, demanding significant investment in research and development. Despite these restraints, the region's commitment to technological advancement and its position as a global manufacturing hub are expected to navigate these challenges, ensuring sustained growth and innovation in the APAC semiconductor device market for processing applications.

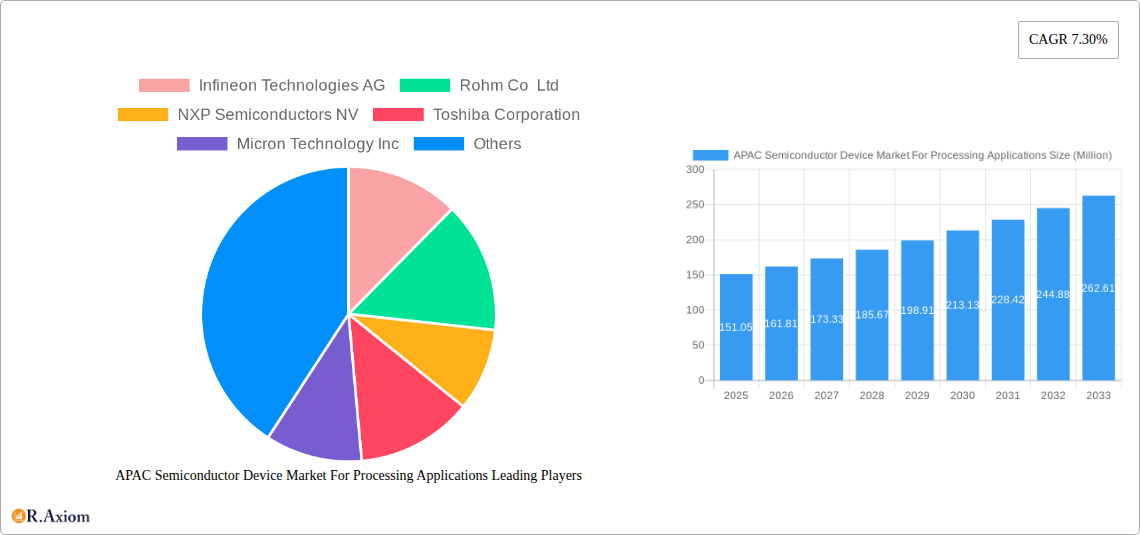

APAC Semiconductor Device Market For Processing Applications Company Market Share

This detailed report provides an in-depth analysis of the APAC Semiconductor Device Market For Processing Applications, offering critical insights into market dynamics, growth drivers, emerging trends, and competitive landscapes. Covering the study period of 2019–2033, with a base year of 2025 and a forecast period of 2025–2033, this research is essential for stakeholders seeking to understand and capitalize on opportunities within this rapidly evolving sector. The report delves into key segments including Discrete Semiconductors, Optoelectronics, Sensors, and Integrated Circuits (Analog, Logic, Memory, Microprocessors (MPU), Microcontrollers (MCU), Digital Signal Processors), providing granular data and actionable intelligence.

APAC Semiconductor Device Market For Processing Applications Market Concentration & Innovation

The APAC Semiconductor Device Market For Processing Applications exhibits a dynamic concentration, with key players like Taiwan Semiconductor Manufacturing Company (TSMC) Limited, Samsung Electronics Co Ltd, and Intel Corporation holding significant market share, particularly in advanced integrated circuits. Innovation is primarily driven by the escalating demand for high-performance processing units in sectors such as Artificial Intelligence (AI), 5G, automotive, and the Internet of Things (IoT). Regulatory frameworks across APAC nations, including government subsidies and R&D incentives, play a crucial role in shaping market entry and expansion strategies. Product substitutes are increasingly sophisticated, with advancements in materials science and chip architecture constantly pushing performance boundaries. End-user trends are leaning towards miniaturization, increased power efficiency, and enhanced functionality, necessitating continuous innovation in semiconductor design and manufacturing. Merger and acquisition (M&A) activities, such as potential consolidation within the foundry space or strategic partnerships for access to specialized technologies, are key indicators of market evolution. For instance, a significant M&A deal valued at approximately $15,000 Million in the last five years aimed to bolster integrated circuit capabilities.

APAC Semiconductor Device Market For Processing Applications Industry Trends & Insights

The APAC Semiconductor Device Market For Processing Applications is experiencing robust growth, projected to achieve a Compound Annual Growth Rate (CAGR) of approximately 8.5% during the forecast period. This expansion is fueled by the relentless digital transformation across industries, driving unprecedented demand for advanced semiconductor solutions. The increasing penetration of smart devices, the proliferation of data centers, and the rapid adoption of AI and machine learning are key market growth drivers. Technological disruptions, including the development of novel materials like Gallium Nitride (GaN) and Silicon Carbide (SiC) for power electronics, are transforming performance and efficiency benchmarks. Furthermore, the ongoing miniaturization of electronic components, driven by Moore's Law and advancements in lithography, enables more powerful processing capabilities in smaller form factors. Consumer preferences are increasingly geared towards personalized and connected experiences, requiring sophisticated microcontrollers (MCU) and logic ICs for smart home devices, wearables, and automotive infotainment systems. Competitive dynamics are characterized by intense innovation cycles, strategic alliances, and significant investments in research and development. Companies are focusing on developing specialized chips for niche applications, such as autonomous driving systems requiring high-performance MPUs and advanced sensor fusion capabilities. The market penetration of advanced semiconductor devices is expanding beyond traditional electronics into emerging sectors like healthcare and industrial automation, further accelerating growth.

Dominant Markets & Segments in APAC Semiconductor Device Market For Processing Applications

Within the APAC Semiconductor Device Market For Processing Applications, Integrated Circuits (ICs) emerge as the dominant segment, accounting for an estimated 70% of the total market value. This dominance is further segmented into crucial sub-categories.

Microprocessors (MPU) and Microcontrollers (MCU): These are the powerhouse of modern processing, with widespread adoption in consumer electronics, automotive, industrial automation, and emerging IoT devices. Key drivers for their dominance include:

- Economic Policies: Favorable government policies in countries like China, South Korea, and Taiwan supporting semiconductor manufacturing and R&D.

- Infrastructure Development: Extensive investment in digital infrastructure, including 5G networks and smart city initiatives, requires vast quantities of these processing units.

- Technological Advancements: Continuous innovation in architecture, power efficiency, and integration capabilities by companies such as Intel Corporation, Samsung Electronics Co Ltd, and Nvidia Corporation.

Memory ICs: Essential for data storage and retrieval, the memory segment is critical for AI, big data analytics, and cloud computing.

- Market Penetration: High penetration in smartphones, personal computers, and servers fuels sustained demand.

- Industry Developments: Significant expansion of data centers and the growth of cloud services are major growth catalysts. Companies like Micron Technology Inc and SK Hynix Inc are key players.

Analog ICs: Vital for signal conversion and power management, analog ICs are indispensable in almost all electronic devices.

- End-User Trends: The growing complexity of electronic systems and the need for efficient power management in battery-operated devices bolster demand.

- Applications: Used extensively in automotive electronics, communication systems, and industrial controls. Texas Instruments Inc and Broadcom Inc are significant contributors.

Logic ICs: These chips perform logical operations and are fundamental to digital computing.

- Innovation: Constant evolution in gate density and power consumption efficiency drives adoption in advanced computing and communication systems.

Discrete Semiconductors, Optoelectronics, and Sensors also represent significant, albeit smaller, market segments. Discrete semiconductors are crucial for power management and signal switching. Optoelectronics, including LEDs and image sensors, are vital for display technologies and imaging applications, with Sony Semiconductor Solutions Corporation being a prominent player. Sensors are increasingly integrated into IoT devices for data acquisition, driving growth in areas like environmental monitoring and wearable technology.

APAC Semiconductor Device Market For Processing Applications Product Developments

Product innovations in the APAC Semiconductor Device Market For Processing Applications are characterized by a relentless pursuit of higher performance, increased power efficiency, and enhanced integration. Companies are developing advanced MPUs and MCUs with specialized architectures for AI acceleration and edge computing, enabling faster on-device processing. Advances in memory technology, such as high-bandwidth memory (HBM) and next-generation NAND flash, are crucial for handling massive datasets. The development of wide-bandgap semiconductors like GaN and SiC is leading to more efficient discrete semiconductors for power electronics, reducing energy loss. Furthermore, innovations in optoelectronics are enhancing image sensor capabilities and display technologies, while advancements in sensors are enabling more sophisticated data capture for IoT applications. These developments provide competitive advantages by meeting the evolving demands for next-generation electronic systems across various industries.

Report Scope & Segmentation Analysis

This report comprehensively segments the APAC Semiconductor Device Market For Processing Applications. The primary segmentation is by Device Type:

- Discrete Semiconductors: This segment includes diodes, transistors, and other basic semiconductor components crucial for power management and signal amplification. Projected to experience steady growth driven by industrial applications and renewable energy solutions.

- Optoelectronics: Encompassing LEDs, lasers, and image sensors, this segment is vital for displays, lighting, and imaging technologies. Expected to witness significant growth due to the expanding market for advanced displays and automotive imaging systems.

- Sensors: This segment covers a wide range of sensors, including MEMS, optical, and environmental sensors, critical for IoT, automotive, and consumer electronics. Anticipated to exhibit strong growth driven by the increasing adoption of smart devices and connected ecosystems.

- Integrated Circuits (ICs): This is the largest and most dynamic segment, further divided into:

- Analog ICs: Essential for signal conditioning and power management, with sustained demand across all electronic applications.

- Logic ICs: The building blocks of digital systems, with growth fueled by advancements in computing and communication technologies.

- Memory ICs: Critical for data storage, this segment's growth is tied to the explosion of data from AI, cloud computing, and big data.

- Microprocessors (MPU): High-performance processors for complex computing tasks, with demand surging for AI, gaming, and high-performance computing.

- Microcontrollers (MCU): Embedded processors for control functions, experiencing rapid growth in IoT, automotive, and industrial automation.

- Digital Signal Processors (DSP): Specialized processors for signal manipulation, crucial for telecommunications, audio, and imaging.

Key Drivers of APAC Semiconductor Device Market For Processing Applications Growth

Several factors are propelling the growth of the APAC Semiconductor Device Market For Processing Applications. The pervasive digital transformation across industries, from automotive and healthcare to manufacturing and consumer electronics, necessitates a constant supply of advanced semiconductor devices. The rapid expansion of the Internet of Things (IoT) ecosystem, with its myriad connected devices, is a significant demand driver. Furthermore, the escalating adoption of Artificial Intelligence (AI) and Machine Learning (ML) applications, requiring high-performance processing and memory capabilities, is fueling innovation and market expansion. Government initiatives in various APAC countries to promote domestic semiconductor manufacturing, coupled with substantial investments in R&D, create a supportive ecosystem. The ongoing evolution of telecommunications infrastructure, particularly the rollout of 5G networks, demands sophisticated semiconductor components for base stations, mobile devices, and network infrastructure.

Challenges in the APAC Semiconductor Device Market For Processing Applications Sector

Despite its robust growth trajectory, the APAC Semiconductor Device Market For Processing Applications faces several challenges. Geopolitical tensions and trade disputes can disrupt global supply chains, leading to component shortages and price volatility. The capital-intensive nature of semiconductor manufacturing requires substantial upfront investment, posing a barrier for new entrants. Intense competition among established players can lead to pricing pressures and reduced profit margins. The rapid pace of technological advancement necessitates continuous innovation, making it challenging for companies to keep up with evolving industry standards and customer demands. Regulatory hurdles, including evolving environmental standards and import/export regulations, can also impact market operations. Furthermore, the skilled labor shortage in specialized semiconductor engineering roles presents a persistent challenge across the region.

Emerging Opportunities in APAC Semiconductor Device Market For Processing Applications

The APAC Semiconductor Device Market For Processing Applications is ripe with emerging opportunities. The burgeoning electric vehicle (EV) market presents a significant opportunity for advanced power semiconductors and sophisticated automotive ICs. The continuous growth of the AI sector, from edge AI to large-scale AI infrastructure, will drive demand for specialized processors and memory solutions. The expansion of smart city initiatives worldwide requires a vast array of sensors, communication chips, and processing units. Furthermore, the increasing demand for advanced healthcare technologies, including medical devices and diagnostics, presents a substantial market for specialized semiconductor solutions. The ongoing miniaturization trend and the development of heterogeneous integration technologies offer opportunities for companies to create more compact and powerful devices. Investments in advanced packaging technologies are also opening new avenues for product differentiation and performance enhancement.

Leading Players in the APAC Semiconductor Device Market For Processing Applications Market

- Infineon Technologies AG

- Rohm Co Ltd

- NXP Semiconductors NV

- Toshiba Corporation

- Micron Technology Inc

- Kyocera Corporation

- Xilinx Inc

- Texas Instruments Inc

- Samsung Electronics Co Ltd

- Broadcom Inc

- STMicroelectronics NV

- Qualcomm Incorporated

- ON Semiconductor Corporation

- Renesas Electronics Corporation

- SK Hynix Inc

- Advanced Semiconductor Engineering Inc

- Nvidia Corporation

- Taiwan Semiconductor Manufacturing Company (TSMC) Limited

- Intel Corporation

- Fujitsu Semiconductor Ltd

Key Developments in APAC Semiconductor Device Market For Processing Applications Industry

- April 2024: Silvaco and GaN Valley have joined forces in semiconductor research, combining Silvaco's technology computer-aided design (TCAD) and EDA software with GaN Valley's gallium nitride production expertise to advance semiconductor technology.

- April 2024: Sony Semiconductor Solutions Corporation initiated operations on multiple production lines at its new fab within Sony Device Technology (Thailand) Co., Ltd. (“SDT”), a move designed to bolster production capacity and streamline efficiency for high-performance semiconductor devices.

Strategic Outlook for APAC Semiconductor Device Market For Processing Applications Market

The strategic outlook for the APAC Semiconductor Device Market For Processing Applications is overwhelmingly positive, driven by sustained demand from burgeoning sectors like AI, IoT, automotive, and 5G. Future growth will be significantly influenced by advancements in material science, such as the wider adoption of GaN and SiC, and innovations in chip architecture for enhanced processing power and energy efficiency. Strategic partnerships and collaborations, particularly in R&D and manufacturing, will be crucial for navigating the complex technological landscape and supply chain dynamics. Companies that can effectively address the growing demand for specialized, high-performance chips while maintaining competitive pricing and robust supply chains are poised for significant success. Continued investment in advanced packaging techniques and exploration of novel semiconductor technologies will further shape the market's future potential.

APAC Semiconductor Device Market For Processing Applications Segmentation

-

1. Device Type

- 1.1. Discrete Semiconductors

- 1.2. Optoelectronics

- 1.3. Sensors

-

1.4. Integrated Circuits

- 1.4.1. Analog

- 1.4.2. Logic

- 1.4.3. Memory

-

1.4.4. Micro

- 1.4.4.1. Microprocessors (MPU)

- 1.4.4.2. Microcontrollers (MCU)

- 1.4.4.3. Digital Signal Processors

APAC Semiconductor Device Market For Processing Applications Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

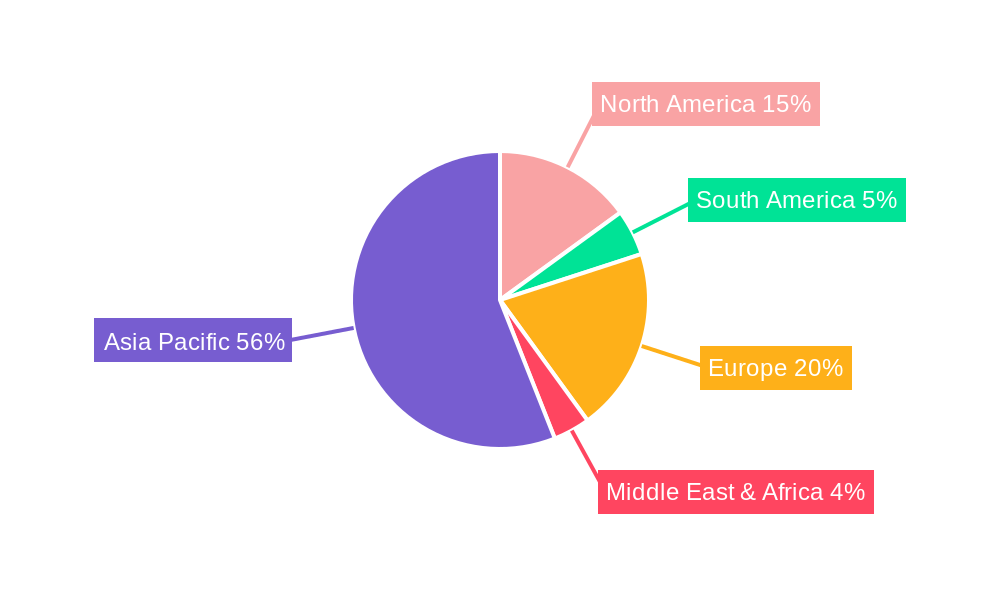

APAC Semiconductor Device Market For Processing Applications Regional Market Share

Geographic Coverage of APAC Semiconductor Device Market For Processing Applications

APAC Semiconductor Device Market For Processing Applications REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.30% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption of Technologies like IoT and AI; Growing Adoption of Advanced Technologies for Food Processing

- 3.3. Market Restrains

- 3.3.1. Supply Chain Disruptions Resulting in Semiconductor Chip Shortage

- 3.4. Market Trends

- 3.4.1. Sensors is Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Semiconductor Device Market For Processing Applications Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 5.1.1. Discrete Semiconductors

- 5.1.2. Optoelectronics

- 5.1.3. Sensors

- 5.1.4. Integrated Circuits

- 5.1.4.1. Analog

- 5.1.4.2. Logic

- 5.1.4.3. Memory

- 5.1.4.4. Micro

- 5.1.4.4.1. Microprocessors (MPU)

- 5.1.4.4.2. Microcontrollers (MCU)

- 5.1.4.4.3. Digital Signal Processors

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 6. North America APAC Semiconductor Device Market For Processing Applications Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Device Type

- 6.1.1. Discrete Semiconductors

- 6.1.2. Optoelectronics

- 6.1.3. Sensors

- 6.1.4. Integrated Circuits

- 6.1.4.1. Analog

- 6.1.4.2. Logic

- 6.1.4.3. Memory

- 6.1.4.4. Micro

- 6.1.4.4.1. Microprocessors (MPU)

- 6.1.4.4.2. Microcontrollers (MCU)

- 6.1.4.4.3. Digital Signal Processors

- 6.1. Market Analysis, Insights and Forecast - by Device Type

- 7. South America APAC Semiconductor Device Market For Processing Applications Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Device Type

- 7.1.1. Discrete Semiconductors

- 7.1.2. Optoelectronics

- 7.1.3. Sensors

- 7.1.4. Integrated Circuits

- 7.1.4.1. Analog

- 7.1.4.2. Logic

- 7.1.4.3. Memory

- 7.1.4.4. Micro

- 7.1.4.4.1. Microprocessors (MPU)

- 7.1.4.4.2. Microcontrollers (MCU)

- 7.1.4.4.3. Digital Signal Processors

- 7.1. Market Analysis, Insights and Forecast - by Device Type

- 8. Europe APAC Semiconductor Device Market For Processing Applications Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Device Type

- 8.1.1. Discrete Semiconductors

- 8.1.2. Optoelectronics

- 8.1.3. Sensors

- 8.1.4. Integrated Circuits

- 8.1.4.1. Analog

- 8.1.4.2. Logic

- 8.1.4.3. Memory

- 8.1.4.4. Micro

- 8.1.4.4.1. Microprocessors (MPU)

- 8.1.4.4.2. Microcontrollers (MCU)

- 8.1.4.4.3. Digital Signal Processors

- 8.1. Market Analysis, Insights and Forecast - by Device Type

- 9. Middle East & Africa APAC Semiconductor Device Market For Processing Applications Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Device Type

- 9.1.1. Discrete Semiconductors

- 9.1.2. Optoelectronics

- 9.1.3. Sensors

- 9.1.4. Integrated Circuits

- 9.1.4.1. Analog

- 9.1.4.2. Logic

- 9.1.4.3. Memory

- 9.1.4.4. Micro

- 9.1.4.4.1. Microprocessors (MPU)

- 9.1.4.4.2. Microcontrollers (MCU)

- 9.1.4.4.3. Digital Signal Processors

- 9.1. Market Analysis, Insights and Forecast - by Device Type

- 10. Asia Pacific APAC Semiconductor Device Market For Processing Applications Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Device Type

- 10.1.1. Discrete Semiconductors

- 10.1.2. Optoelectronics

- 10.1.3. Sensors

- 10.1.4. Integrated Circuits

- 10.1.4.1. Analog

- 10.1.4.2. Logic

- 10.1.4.3. Memory

- 10.1.4.4. Micro

- 10.1.4.4.1. Microprocessors (MPU)

- 10.1.4.4.2. Microcontrollers (MCU)

- 10.1.4.4.3. Digital Signal Processors

- 10.1. Market Analysis, Insights and Forecast - by Device Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Infineon Technologies AG

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Rohm Co Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 NXP Semiconductors NV

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Toshiba Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Micron Technology Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Kyocera Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Xilinx Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Texas Instruments Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Samsung Electronics Co Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Broadcom Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 STMicroelectronics NV

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Qualcomm Incorporated

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 ON Semiconductor Corporatio

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Renesas Electronics Corporation

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 SK Hynix Inc

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Advanced Semiconductor Engineering Inc

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Nvidia Corporation

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Taiwan Semiconductor Manufacturing Company (TSMC) Limited

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Intel Corporation

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Fujitsu Semiconductor Ltd

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.1 Infineon Technologies AG

List of Figures

- Figure 1: Global APAC Semiconductor Device Market For Processing Applications Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America APAC Semiconductor Device Market For Processing Applications Revenue (Million), by Device Type 2025 & 2033

- Figure 3: North America APAC Semiconductor Device Market For Processing Applications Revenue Share (%), by Device Type 2025 & 2033

- Figure 4: North America APAC Semiconductor Device Market For Processing Applications Revenue (Million), by Country 2025 & 2033

- Figure 5: North America APAC Semiconductor Device Market For Processing Applications Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America APAC Semiconductor Device Market For Processing Applications Revenue (Million), by Device Type 2025 & 2033

- Figure 7: South America APAC Semiconductor Device Market For Processing Applications Revenue Share (%), by Device Type 2025 & 2033

- Figure 8: South America APAC Semiconductor Device Market For Processing Applications Revenue (Million), by Country 2025 & 2033

- Figure 9: South America APAC Semiconductor Device Market For Processing Applications Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe APAC Semiconductor Device Market For Processing Applications Revenue (Million), by Device Type 2025 & 2033

- Figure 11: Europe APAC Semiconductor Device Market For Processing Applications Revenue Share (%), by Device Type 2025 & 2033

- Figure 12: Europe APAC Semiconductor Device Market For Processing Applications Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe APAC Semiconductor Device Market For Processing Applications Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa APAC Semiconductor Device Market For Processing Applications Revenue (Million), by Device Type 2025 & 2033

- Figure 15: Middle East & Africa APAC Semiconductor Device Market For Processing Applications Revenue Share (%), by Device Type 2025 & 2033

- Figure 16: Middle East & Africa APAC Semiconductor Device Market For Processing Applications Revenue (Million), by Country 2025 & 2033

- Figure 17: Middle East & Africa APAC Semiconductor Device Market For Processing Applications Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific APAC Semiconductor Device Market For Processing Applications Revenue (Million), by Device Type 2025 & 2033

- Figure 19: Asia Pacific APAC Semiconductor Device Market For Processing Applications Revenue Share (%), by Device Type 2025 & 2033

- Figure 20: Asia Pacific APAC Semiconductor Device Market For Processing Applications Revenue (Million), by Country 2025 & 2033

- Figure 21: Asia Pacific APAC Semiconductor Device Market For Processing Applications Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC Semiconductor Device Market For Processing Applications Revenue Million Forecast, by Device Type 2020 & 2033

- Table 2: Global APAC Semiconductor Device Market For Processing Applications Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global APAC Semiconductor Device Market For Processing Applications Revenue Million Forecast, by Device Type 2020 & 2033

- Table 4: Global APAC Semiconductor Device Market For Processing Applications Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States APAC Semiconductor Device Market For Processing Applications Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada APAC Semiconductor Device Market For Processing Applications Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Mexico APAC Semiconductor Device Market For Processing Applications Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global APAC Semiconductor Device Market For Processing Applications Revenue Million Forecast, by Device Type 2020 & 2033

- Table 9: Global APAC Semiconductor Device Market For Processing Applications Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Brazil APAC Semiconductor Device Market For Processing Applications Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Argentina APAC Semiconductor Device Market For Processing Applications Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America APAC Semiconductor Device Market For Processing Applications Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global APAC Semiconductor Device Market For Processing Applications Revenue Million Forecast, by Device Type 2020 & 2033

- Table 14: Global APAC Semiconductor Device Market For Processing Applications Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom APAC Semiconductor Device Market For Processing Applications Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany APAC Semiconductor Device Market For Processing Applications Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France APAC Semiconductor Device Market For Processing Applications Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Italy APAC Semiconductor Device Market For Processing Applications Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Spain APAC Semiconductor Device Market For Processing Applications Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Russia APAC Semiconductor Device Market For Processing Applications Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Benelux APAC Semiconductor Device Market For Processing Applications Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Nordics APAC Semiconductor Device Market For Processing Applications Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe APAC Semiconductor Device Market For Processing Applications Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global APAC Semiconductor Device Market For Processing Applications Revenue Million Forecast, by Device Type 2020 & 2033

- Table 25: Global APAC Semiconductor Device Market For Processing Applications Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Turkey APAC Semiconductor Device Market For Processing Applications Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Israel APAC Semiconductor Device Market For Processing Applications Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: GCC APAC Semiconductor Device Market For Processing Applications Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: North Africa APAC Semiconductor Device Market For Processing Applications Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Africa APAC Semiconductor Device Market For Processing Applications Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa APAC Semiconductor Device Market For Processing Applications Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global APAC Semiconductor Device Market For Processing Applications Revenue Million Forecast, by Device Type 2020 & 2033

- Table 33: Global APAC Semiconductor Device Market For Processing Applications Revenue Million Forecast, by Country 2020 & 2033

- Table 34: China APAC Semiconductor Device Market For Processing Applications Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: India APAC Semiconductor Device Market For Processing Applications Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Japan APAC Semiconductor Device Market For Processing Applications Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: South Korea APAC Semiconductor Device Market For Processing Applications Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: ASEAN APAC Semiconductor Device Market For Processing Applications Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Oceania APAC Semiconductor Device Market For Processing Applications Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific APAC Semiconductor Device Market For Processing Applications Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Semiconductor Device Market For Processing Applications?

The projected CAGR is approximately 7.30%.

2. Which companies are prominent players in the APAC Semiconductor Device Market For Processing Applications?

Key companies in the market include Infineon Technologies AG, Rohm Co Ltd, NXP Semiconductors NV, Toshiba Corporation, Micron Technology Inc, Kyocera Corporation, Xilinx Inc, Texas Instruments Inc, Samsung Electronics Co Ltd, Broadcom Inc, STMicroelectronics NV, Qualcomm Incorporated, ON Semiconductor Corporatio, Renesas Electronics Corporation, SK Hynix Inc, Advanced Semiconductor Engineering Inc, Nvidia Corporation, Taiwan Semiconductor Manufacturing Company (TSMC) Limited, Intel Corporation, Fujitsu Semiconductor Ltd.

3. What are the main segments of the APAC Semiconductor Device Market For Processing Applications?

The market segments include Device Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 151.05 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption of Technologies like IoT and AI; Growing Adoption of Advanced Technologies for Food Processing.

6. What are the notable trends driving market growth?

Sensors is Expected to Drive the Market.

7. Are there any restraints impacting market growth?

Supply Chain Disruptions Resulting in Semiconductor Chip Shortage.

8. Can you provide examples of recent developments in the market?

April 2024 - Silvaco and GaN Valley have joined forces in semiconductor research. Silvaco brings its technology computer-aided design (TCAD) and EDA software to the table, complemented by GaN Valley's gallium nitride production prowess. Together, they aim to push the boundaries of semiconductor technology, ensuring both compatibility and advancements.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Semiconductor Device Market For Processing Applications," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Semiconductor Device Market For Processing Applications report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Semiconductor Device Market For Processing Applications?

To stay informed about further developments, trends, and reports in the APAC Semiconductor Device Market For Processing Applications, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence