Key Insights

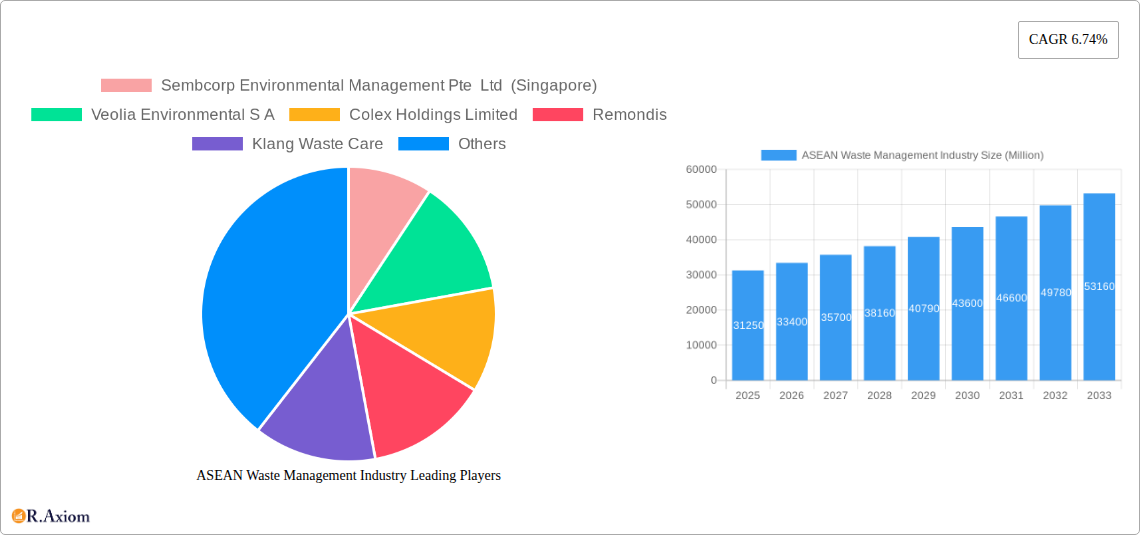

The ASEAN waste management market, valued at $31.25 billion in 2025, is projected to experience robust growth, driven by increasing urbanization, rising environmental awareness, and stringent government regulations aimed at improving waste management infrastructure. A compound annual growth rate (CAGR) of 6.74% from 2025 to 2033 signifies significant market expansion. Key drivers include the growing generation of industrial and municipal solid waste, coupled with a rising demand for sustainable waste solutions like recycling, composting, and waste-to-energy technologies. This trend is further amplified by increasing public-private partnerships focusing on enhancing waste collection, processing, and disposal capabilities across the region. Challenges remain, however, including inadequate infrastructure in certain areas, inconsistent waste management practices, and the need for greater investment in advanced waste treatment technologies. The market is fragmented, with several regional and international players competing, including Sembcorp Environmental Management, Veolia, and Remondis. These companies are actively investing in capacity expansion and technological advancements to meet the burgeoning demand. The long-term outlook for the ASEAN waste management market is highly positive, presenting significant opportunities for businesses involved in waste collection, processing, recycling, and disposal services.

ASEAN Waste Management Industry Market Size (In Billion)

The segment breakdown within the ASEAN waste management market is likely diversified, encompassing industrial waste management, municipal solid waste management, and specialized waste streams such as e-waste and medical waste. Each segment is characterized by distinct growth trajectories influenced by factors such as industrial activity levels, population density, and specific regulatory frameworks. Future growth will be strongly correlated to the successful implementation of national waste management strategies, improved recycling rates, and the adoption of innovative technologies to address the challenges of increasing waste volumes and environmental protection. This requires collaboration between governments, private sector stakeholders, and communities to promote sustainable waste management practices throughout the region.

ASEAN Waste Management Industry Company Market Share

ASEAN Waste Management Industry: A Comprehensive Market Report (2019-2033)

This detailed report provides a comprehensive analysis of the ASEAN waste management industry, offering invaluable insights for industry stakeholders, investors, and policymakers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages historical data (2019-2024) to project future market trends and opportunities. The report covers market size, segmentation, competitive landscape, key drivers and challenges, and emerging opportunities across the ASEAN region. Expect detailed analysis of market concentration, technological advancements, regulatory changes, and leading companies shaping the industry's future.

ASEAN Waste Management Industry Market Concentration & Innovation

This section analyzes the level of market concentration within the ASEAN waste management industry, identifying key players and assessing their market share. We delve into the innovative drivers shaping the sector, including technological advancements, regulatory pressures, and evolving consumer preferences. The report examines the impact of mergers and acquisitions (M&A) activities, including deal values, on market consolidation and competitive dynamics. We will also explore the role of product substitutes and end-user trends in influencing market growth.

Market Concentration: The ASEAN waste management market shows a moderately concentrated landscape, with a few large multinational companies and several regional players dominating specific segments. Market share data for leading companies will be presented, along with an analysis of their competitive strategies. We estimate the top 5 players hold approximately xx% of the market share in 2025.

Innovation Drivers: Technological advancements such as AI-powered waste sorting, advanced recycling technologies, and digital waste management platforms are driving innovation. Stringent environmental regulations are also pushing companies to adopt sustainable practices and invest in innovative solutions.

Regulatory Frameworks: Government policies and regulations play a significant role in shaping the industry, influencing investment decisions and driving adoption of sustainable technologies. The report analyzes the impact of various regulatory frameworks across different ASEAN countries.

M&A Activities: Consolidation through mergers and acquisitions is expected to continue, driven by the need for economies of scale and access to advanced technologies. The report will analyze significant M&A deals in recent years, estimating their value in Millions.

Product Substitutes & End-User Trends: The report considers the role of alternative waste management solutions and the shifting preferences of end-users towards more sustainable practices.

ASEAN Waste Management Industry Industry Trends & Insights

This section presents a detailed analysis of the major trends and insights shaping the ASEAN waste management market. We will explore market growth drivers, technological disruptions, evolving consumer preferences, and the competitive dynamics within the industry. Key performance indicators (KPIs) such as Compound Annual Growth Rate (CAGR) and market penetration will be used to quantify market growth and segment performance. The analysis will incorporate macroeconomic factors impacting the industry's trajectory, alongside shifts in consumer behaviour and waste generation patterns.

Market Growth Drivers: Rising urbanization, increasing industrial activity, and growing environmental awareness are key drivers of market growth. Government initiatives promoting waste reduction, reuse, and recycling are further contributing to market expansion.

Technological Disruptions: Technological advancements such as AI-powered waste sorting, advanced recycling technologies, and the use of IoT sensors for waste management are disrupting the traditional methods. We will examine their adoption rates and impacts on the market.

Consumer Preferences: Changing consumer preferences towards sustainable consumption patterns and responsible waste management are influencing market demand for eco-friendly solutions.

Competitive Dynamics: The report provides an in-depth analysis of the competitive landscape, including the strategies employed by key players to maintain market share and capture new business opportunities.

CAGR and Market Penetration: The report projects a CAGR of xx% for the ASEAN waste management market during the forecast period (2025-2033), with market penetration of xx% by 2033.

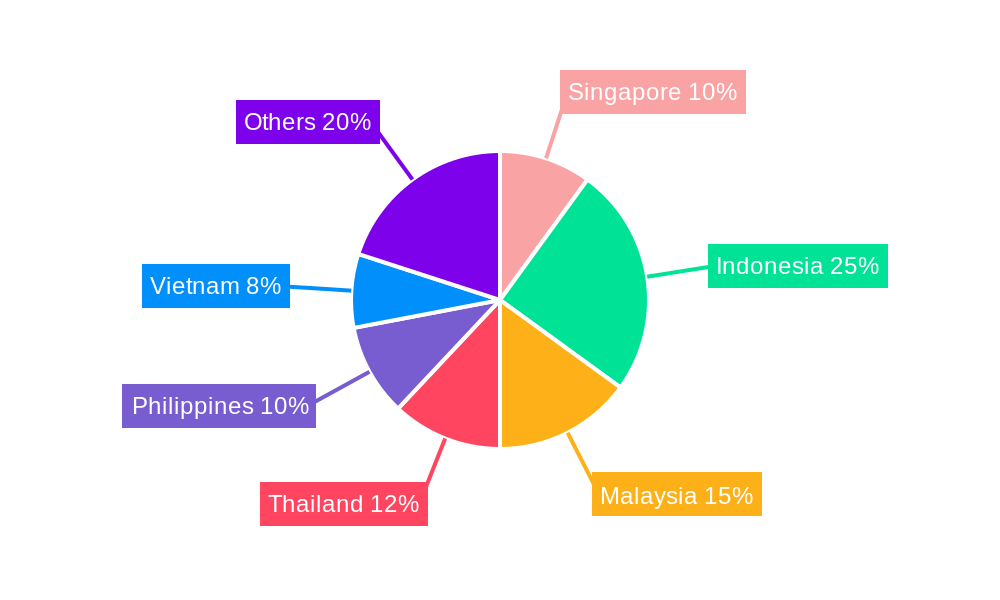

Dominant Markets & Segments in ASEAN Waste Management Industry

This section identifies the leading regions, countries, and segments within the ASEAN waste management industry. We will analyze the factors contributing to their dominance, including economic policies, infrastructure development, and regulatory frameworks, with a focus on current trends and projected growth areas.

-

Key Drivers of Market Dominance:

- Economic Policies: Strategic government initiatives and financial incentives are crucial for attracting investment in modern waste management infrastructure, including advanced processing facilities and robust collection networks.

- Infrastructure Development: The presence of state-of-the-art waste processing technologies, such as automated sorting, advanced recycling plants, and integrated waste-to-energy facilities, alongside efficient and widespread collection systems, significantly drives market dominance.

- Regulatory Frameworks: Increasingly stringent environmental regulations, coupled with effective enforcement mechanisms, are compelling businesses and municipalities to adopt higher waste management standards, including targets for diversion and recycling.

- High Waste Generation & Consumption Patterns: Rapid urbanization, burgeoning industrial sectors, and rising consumer spending in certain ASEAN economies lead to substantial waste volumes, creating a strong demand for comprehensive waste management solutions.

-

Dominance Analysis: Singapore consistently emerges as a dominant market due to its highly advanced waste management infrastructure, pioneering waste-to-energy technologies, and exceptionally stringent regulatory environment that mandates high diversion rates and promotes a circular economy. Indonesia, with its vast population and rapidly expanding industrial base, presents significant opportunities and challenges, often driving the need for scalable and adaptable waste management solutions. Vietnam is rapidly gaining prominence, driven by strong economic growth, increasing foreign investment in manufacturing, and a growing emphasis on environmental sustainability. In terms of segments, the management of municipal solid waste (MSW) remains the largest, but specialized segments like electronic waste (e-waste) recycling and plastic waste valorization are experiencing rapid growth due to policy interventions and increasing public awareness.

ASEAN Waste Management Industry Product Developments

This section summarizes recent product innovations, applications, and competitive advantages in the ASEAN waste management industry. It highlights technological trends that are impacting market fit and adoption. The key focus is on innovative solutions addressing the challenges of waste management in the region. Examples will include advancements in waste-to-energy technologies, innovative recycling processes, and smart waste management solutions.

Report Scope & Segmentation Analysis

This report segments the ASEAN waste management market based on various factors, including waste type (municipal solid waste, industrial waste, hazardous waste), waste management method (collection, treatment, disposal, recycling), and geography (country-specific analysis). Each segment's market size, growth projections, and competitive dynamics will be analyzed separately.

Waste Type Segmentation: Analysis of market size and growth for different waste types, including municipal solid waste, industrial waste, and hazardous waste.

Waste Management Method Segmentation: Examination of the market for collection, treatment, disposal, and recycling services.

Geographical Segmentation: Country-level analysis of the market size and growth for each ASEAN country.

Key Drivers of ASEAN Waste Management Industry Growth

The ASEAN waste management industry is propelled by a confluence of factors, including rapid technological advancements, robust economic expansion, and evolving, more supportive regulatory landscapes.

-

Technological Advancements: The integration of Artificial Intelligence (AI) in waste sorting, the development of novel advanced recycling technologies for complex materials, and the widespread adoption of waste-to-energy (WtE) solutions are revolutionizing operational efficiency and contributing significantly to the sector's sustainability goals.

-

Economic Growth & Urbanization: Sustained economic development, coupled with rapid urbanization and a growing middle class with increasing disposable incomes, directly translates to higher waste generation rates, thereby stimulating the demand for advanced and comprehensive waste management services and infrastructure.

-

Regulatory Frameworks & Policy Support: Proactive government regulations and forward-thinking policies aimed at promoting waste reduction at source, enhancing recycling rates, and fostering sustainable waste management practices are powerful catalysts for market expansion. Examples include the implementation of Extended Producer Responsibility (EPR) schemes, which effectively incentivize manufacturers to design products with recyclability and end-of-life management in mind, and bans on single-use plastics.

Challenges in the ASEAN Waste Management Industry Sector

The dynamic ASEAN waste management industry navigates a complex landscape marked by regulatory inconsistencies, supply chain inefficiencies, and evolving competitive pressures.

-

Regulatory Hurdles: Significant disparities in waste management regulations, standards, and enforcement across different ASEAN member states present substantial complexities for companies seeking to operate and scale their services regionally, requiring tailored approaches for each market.

-

Supply Chain Issues & Infrastructure Gaps: Inadequate or fragmented waste collection systems, particularly in emerging economies and rural areas, along with a deficit in essential processing and treatment infrastructure, continue to impede the efficient and environmentally sound management of waste streams across the region.

-

Competitive Pressures & Investment Needs: The sector experiences intense competition from both established international players and emerging local enterprises, which can impact pricing and profit margins. Furthermore, the substantial capital investment required for deploying advanced technologies and developing robust infrastructure presents an ongoing challenge.

Emerging Opportunities in ASEAN Waste Management Industry

The ASEAN waste management sector is ripe with burgeoning opportunities, driven by the emergence of new market segments, the adoption of cutting-edge technologies, and a palpable shift in consumer and corporate environmental consciousness.

-

New Market Segments & Circular Economy Models: The escalating demand for sustainable products, resource recovery, and the adoption of circular economy principles are creating significant opportunities in specialized waste streams such as industrial waste valorization, food waste management, and the development of closed-loop systems for materials like plastics and textiles.

-

Innovative Technologies & Digitalization: Advancements in disruptive technologies, including the Internet of Things (IoT) for smart waste collection, Big Data analytics for optimizing operations, advanced biotechnology for waste treatment, and sophisticated AI-driven sorting systems, are paving the way for more efficient, cost-effective, and environmentally superior waste management solutions.

-

Evolving Consumer & Corporate Preferences: A heightened global and regional awareness of environmental issues is significantly influencing consumer purchasing decisions and corporate social responsibility (CSR) strategies. This growing preference for eco-friendly products, services, and transparent waste management practices creates a strong market pull for sustainable solutions and green business models.

Leading Players in the ASEAN Waste Management Industry Market

- Sembcorp Environmental Management Pte Ltd (Singapore)

- Veolia Environmental S A

- Colex Holdings Limited

- Remondis

- Klang Waste Care

- Starpal Pte Ltd

- Blue Planet Environmental Solutions

- Greenway Environmental

- PT Prasadha Pamunah Limbah Industri - PPLI

- Boon Poh Refuse Disposal Pte Ltd

- Suez Environment

- Earth Recycling Services Ltd

- ALBA Group Asia

- Se Cure Waste Management

Key Developments in ASEAN Waste Management Industry Industry

December 2022: Rebottle, a joint venture between Singapore Polytechnic (SP) and SembWaste (Sembcorp Industries), aims to boost PET bottle recycling in Singapore, starting with the Punggol Shore area. This initiative reflects the growing focus on plastic recycling and circular economy models.

June 2022: PT Prasadha Pamunah Waste Industries (PPLI) opened a representative office in the Wijayakusuma Industrial Area in Indonesia. This expansion signifies increased investment and activity in the Indonesian waste management market.

Strategic Outlook for ASEAN Waste Management Industry Market

The ASEAN waste management market is poised for significant growth, driven by increasing urbanization, industrialization, and a heightened focus on sustainability. Government initiatives supporting waste management infrastructure development and technological advancements will further accelerate market expansion. Companies adopting innovative technologies and sustainable practices are well-positioned to capitalize on the growth opportunities in this dynamic sector. The market is expected to see continued consolidation through mergers and acquisitions, with larger players seeking to expand their market share and geographic reach.

ASEAN Waste Management Industry Segmentation

-

1. Waste type

- 1.1. Industrial waste

- 1.2. Municipal solid waste

- 1.3. E-waste

- 1.4. Other Waste types

-

2. Disposal methods

- 2.1. Collection

- 2.2. Landfill

- 2.3. Others

-

3. Geography

- 3.1. Indonesia

- 3.2. Thailand

- 3.3. Malaysia

- 3.4. Singapore

- 3.5. Rest of ASEAN

ASEAN Waste Management Industry Segmentation By Geography

- 1. Indonesia

- 2. Thailand

- 3. Malaysia

- 4. Singapore

- 5. Rest of ASEAN

ASEAN Waste Management Industry Regional Market Share

Geographic Coverage of ASEAN Waste Management Industry

ASEAN Waste Management Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.74% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Indonesia Advances Zero-Plastic Waste Ambitions with Public-Private Partnership to Build Waste Management Capacity and Capability

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global ASEAN Waste Management Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Waste type

- 5.1.1. Industrial waste

- 5.1.2. Municipal solid waste

- 5.1.3. E-waste

- 5.1.4. Other Waste types

- 5.2. Market Analysis, Insights and Forecast - by Disposal methods

- 5.2.1. Collection

- 5.2.2. Landfill

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Indonesia

- 5.3.2. Thailand

- 5.3.3. Malaysia

- 5.3.4. Singapore

- 5.3.5. Rest of ASEAN

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Indonesia

- 5.4.2. Thailand

- 5.4.3. Malaysia

- 5.4.4. Singapore

- 5.4.5. Rest of ASEAN

- 5.1. Market Analysis, Insights and Forecast - by Waste type

- 6. Indonesia ASEAN Waste Management Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Waste type

- 6.1.1. Industrial waste

- 6.1.2. Municipal solid waste

- 6.1.3. E-waste

- 6.1.4. Other Waste types

- 6.2. Market Analysis, Insights and Forecast - by Disposal methods

- 6.2.1. Collection

- 6.2.2. Landfill

- 6.2.3. Others

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Indonesia

- 6.3.2. Thailand

- 6.3.3. Malaysia

- 6.3.4. Singapore

- 6.3.5. Rest of ASEAN

- 6.1. Market Analysis, Insights and Forecast - by Waste type

- 7. Thailand ASEAN Waste Management Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Waste type

- 7.1.1. Industrial waste

- 7.1.2. Municipal solid waste

- 7.1.3. E-waste

- 7.1.4. Other Waste types

- 7.2. Market Analysis, Insights and Forecast - by Disposal methods

- 7.2.1. Collection

- 7.2.2. Landfill

- 7.2.3. Others

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Indonesia

- 7.3.2. Thailand

- 7.3.3. Malaysia

- 7.3.4. Singapore

- 7.3.5. Rest of ASEAN

- 7.1. Market Analysis, Insights and Forecast - by Waste type

- 8. Malaysia ASEAN Waste Management Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Waste type

- 8.1.1. Industrial waste

- 8.1.2. Municipal solid waste

- 8.1.3. E-waste

- 8.1.4. Other Waste types

- 8.2. Market Analysis, Insights and Forecast - by Disposal methods

- 8.2.1. Collection

- 8.2.2. Landfill

- 8.2.3. Others

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Indonesia

- 8.3.2. Thailand

- 8.3.3. Malaysia

- 8.3.4. Singapore

- 8.3.5. Rest of ASEAN

- 8.1. Market Analysis, Insights and Forecast - by Waste type

- 9. Singapore ASEAN Waste Management Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Waste type

- 9.1.1. Industrial waste

- 9.1.2. Municipal solid waste

- 9.1.3. E-waste

- 9.1.4. Other Waste types

- 9.2. Market Analysis, Insights and Forecast - by Disposal methods

- 9.2.1. Collection

- 9.2.2. Landfill

- 9.2.3. Others

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Indonesia

- 9.3.2. Thailand

- 9.3.3. Malaysia

- 9.3.4. Singapore

- 9.3.5. Rest of ASEAN

- 9.1. Market Analysis, Insights and Forecast - by Waste type

- 10. Rest of ASEAN ASEAN Waste Management Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Waste type

- 10.1.1. Industrial waste

- 10.1.2. Municipal solid waste

- 10.1.3. E-waste

- 10.1.4. Other Waste types

- 10.2. Market Analysis, Insights and Forecast - by Disposal methods

- 10.2.1. Collection

- 10.2.2. Landfill

- 10.2.3. Others

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. Indonesia

- 10.3.2. Thailand

- 10.3.3. Malaysia

- 10.3.4. Singapore

- 10.3.5. Rest of ASEAN

- 10.1. Market Analysis, Insights and Forecast - by Waste type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Sembcorp Environmental Management Pte Ltd (Singapore)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Veolia Environmental S A

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Colex Holdings Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Remondis

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Klang Waste Care

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Starpal Pte Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Blue Planet Environmental Solutions

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Greenway Environmental

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 PT Prasadha Pamunah Limbah Industri - PPLI

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Boon Poh Refuse Disposal Pte Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Suez Environment

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Earth Recycling Services Ltd

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 ALBA Group Asia

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Se Cure Waste Management**List Not Exhaustive

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Sembcorp Environmental Management Pte Ltd (Singapore)

List of Figures

- Figure 1: Global ASEAN Waste Management Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global ASEAN Waste Management Industry Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: Indonesia ASEAN Waste Management Industry Revenue (Million), by Waste type 2025 & 2033

- Figure 4: Indonesia ASEAN Waste Management Industry Volume (Billion), by Waste type 2025 & 2033

- Figure 5: Indonesia ASEAN Waste Management Industry Revenue Share (%), by Waste type 2025 & 2033

- Figure 6: Indonesia ASEAN Waste Management Industry Volume Share (%), by Waste type 2025 & 2033

- Figure 7: Indonesia ASEAN Waste Management Industry Revenue (Million), by Disposal methods 2025 & 2033

- Figure 8: Indonesia ASEAN Waste Management Industry Volume (Billion), by Disposal methods 2025 & 2033

- Figure 9: Indonesia ASEAN Waste Management Industry Revenue Share (%), by Disposal methods 2025 & 2033

- Figure 10: Indonesia ASEAN Waste Management Industry Volume Share (%), by Disposal methods 2025 & 2033

- Figure 11: Indonesia ASEAN Waste Management Industry Revenue (Million), by Geography 2025 & 2033

- Figure 12: Indonesia ASEAN Waste Management Industry Volume (Billion), by Geography 2025 & 2033

- Figure 13: Indonesia ASEAN Waste Management Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 14: Indonesia ASEAN Waste Management Industry Volume Share (%), by Geography 2025 & 2033

- Figure 15: Indonesia ASEAN Waste Management Industry Revenue (Million), by Country 2025 & 2033

- Figure 16: Indonesia ASEAN Waste Management Industry Volume (Billion), by Country 2025 & 2033

- Figure 17: Indonesia ASEAN Waste Management Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Indonesia ASEAN Waste Management Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: Thailand ASEAN Waste Management Industry Revenue (Million), by Waste type 2025 & 2033

- Figure 20: Thailand ASEAN Waste Management Industry Volume (Billion), by Waste type 2025 & 2033

- Figure 21: Thailand ASEAN Waste Management Industry Revenue Share (%), by Waste type 2025 & 2033

- Figure 22: Thailand ASEAN Waste Management Industry Volume Share (%), by Waste type 2025 & 2033

- Figure 23: Thailand ASEAN Waste Management Industry Revenue (Million), by Disposal methods 2025 & 2033

- Figure 24: Thailand ASEAN Waste Management Industry Volume (Billion), by Disposal methods 2025 & 2033

- Figure 25: Thailand ASEAN Waste Management Industry Revenue Share (%), by Disposal methods 2025 & 2033

- Figure 26: Thailand ASEAN Waste Management Industry Volume Share (%), by Disposal methods 2025 & 2033

- Figure 27: Thailand ASEAN Waste Management Industry Revenue (Million), by Geography 2025 & 2033

- Figure 28: Thailand ASEAN Waste Management Industry Volume (Billion), by Geography 2025 & 2033

- Figure 29: Thailand ASEAN Waste Management Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 30: Thailand ASEAN Waste Management Industry Volume Share (%), by Geography 2025 & 2033

- Figure 31: Thailand ASEAN Waste Management Industry Revenue (Million), by Country 2025 & 2033

- Figure 32: Thailand ASEAN Waste Management Industry Volume (Billion), by Country 2025 & 2033

- Figure 33: Thailand ASEAN Waste Management Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Thailand ASEAN Waste Management Industry Volume Share (%), by Country 2025 & 2033

- Figure 35: Malaysia ASEAN Waste Management Industry Revenue (Million), by Waste type 2025 & 2033

- Figure 36: Malaysia ASEAN Waste Management Industry Volume (Billion), by Waste type 2025 & 2033

- Figure 37: Malaysia ASEAN Waste Management Industry Revenue Share (%), by Waste type 2025 & 2033

- Figure 38: Malaysia ASEAN Waste Management Industry Volume Share (%), by Waste type 2025 & 2033

- Figure 39: Malaysia ASEAN Waste Management Industry Revenue (Million), by Disposal methods 2025 & 2033

- Figure 40: Malaysia ASEAN Waste Management Industry Volume (Billion), by Disposal methods 2025 & 2033

- Figure 41: Malaysia ASEAN Waste Management Industry Revenue Share (%), by Disposal methods 2025 & 2033

- Figure 42: Malaysia ASEAN Waste Management Industry Volume Share (%), by Disposal methods 2025 & 2033

- Figure 43: Malaysia ASEAN Waste Management Industry Revenue (Million), by Geography 2025 & 2033

- Figure 44: Malaysia ASEAN Waste Management Industry Volume (Billion), by Geography 2025 & 2033

- Figure 45: Malaysia ASEAN Waste Management Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 46: Malaysia ASEAN Waste Management Industry Volume Share (%), by Geography 2025 & 2033

- Figure 47: Malaysia ASEAN Waste Management Industry Revenue (Million), by Country 2025 & 2033

- Figure 48: Malaysia ASEAN Waste Management Industry Volume (Billion), by Country 2025 & 2033

- Figure 49: Malaysia ASEAN Waste Management Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Malaysia ASEAN Waste Management Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Singapore ASEAN Waste Management Industry Revenue (Million), by Waste type 2025 & 2033

- Figure 52: Singapore ASEAN Waste Management Industry Volume (Billion), by Waste type 2025 & 2033

- Figure 53: Singapore ASEAN Waste Management Industry Revenue Share (%), by Waste type 2025 & 2033

- Figure 54: Singapore ASEAN Waste Management Industry Volume Share (%), by Waste type 2025 & 2033

- Figure 55: Singapore ASEAN Waste Management Industry Revenue (Million), by Disposal methods 2025 & 2033

- Figure 56: Singapore ASEAN Waste Management Industry Volume (Billion), by Disposal methods 2025 & 2033

- Figure 57: Singapore ASEAN Waste Management Industry Revenue Share (%), by Disposal methods 2025 & 2033

- Figure 58: Singapore ASEAN Waste Management Industry Volume Share (%), by Disposal methods 2025 & 2033

- Figure 59: Singapore ASEAN Waste Management Industry Revenue (Million), by Geography 2025 & 2033

- Figure 60: Singapore ASEAN Waste Management Industry Volume (Billion), by Geography 2025 & 2033

- Figure 61: Singapore ASEAN Waste Management Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 62: Singapore ASEAN Waste Management Industry Volume Share (%), by Geography 2025 & 2033

- Figure 63: Singapore ASEAN Waste Management Industry Revenue (Million), by Country 2025 & 2033

- Figure 64: Singapore ASEAN Waste Management Industry Volume (Billion), by Country 2025 & 2033

- Figure 65: Singapore ASEAN Waste Management Industry Revenue Share (%), by Country 2025 & 2033

- Figure 66: Singapore ASEAN Waste Management Industry Volume Share (%), by Country 2025 & 2033

- Figure 67: Rest of ASEAN ASEAN Waste Management Industry Revenue (Million), by Waste type 2025 & 2033

- Figure 68: Rest of ASEAN ASEAN Waste Management Industry Volume (Billion), by Waste type 2025 & 2033

- Figure 69: Rest of ASEAN ASEAN Waste Management Industry Revenue Share (%), by Waste type 2025 & 2033

- Figure 70: Rest of ASEAN ASEAN Waste Management Industry Volume Share (%), by Waste type 2025 & 2033

- Figure 71: Rest of ASEAN ASEAN Waste Management Industry Revenue (Million), by Disposal methods 2025 & 2033

- Figure 72: Rest of ASEAN ASEAN Waste Management Industry Volume (Billion), by Disposal methods 2025 & 2033

- Figure 73: Rest of ASEAN ASEAN Waste Management Industry Revenue Share (%), by Disposal methods 2025 & 2033

- Figure 74: Rest of ASEAN ASEAN Waste Management Industry Volume Share (%), by Disposal methods 2025 & 2033

- Figure 75: Rest of ASEAN ASEAN Waste Management Industry Revenue (Million), by Geography 2025 & 2033

- Figure 76: Rest of ASEAN ASEAN Waste Management Industry Volume (Billion), by Geography 2025 & 2033

- Figure 77: Rest of ASEAN ASEAN Waste Management Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 78: Rest of ASEAN ASEAN Waste Management Industry Volume Share (%), by Geography 2025 & 2033

- Figure 79: Rest of ASEAN ASEAN Waste Management Industry Revenue (Million), by Country 2025 & 2033

- Figure 80: Rest of ASEAN ASEAN Waste Management Industry Volume (Billion), by Country 2025 & 2033

- Figure 81: Rest of ASEAN ASEAN Waste Management Industry Revenue Share (%), by Country 2025 & 2033

- Figure 82: Rest of ASEAN ASEAN Waste Management Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global ASEAN Waste Management Industry Revenue Million Forecast, by Waste type 2020 & 2033

- Table 2: Global ASEAN Waste Management Industry Volume Billion Forecast, by Waste type 2020 & 2033

- Table 3: Global ASEAN Waste Management Industry Revenue Million Forecast, by Disposal methods 2020 & 2033

- Table 4: Global ASEAN Waste Management Industry Volume Billion Forecast, by Disposal methods 2020 & 2033

- Table 5: Global ASEAN Waste Management Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: Global ASEAN Waste Management Industry Volume Billion Forecast, by Geography 2020 & 2033

- Table 7: Global ASEAN Waste Management Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global ASEAN Waste Management Industry Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Global ASEAN Waste Management Industry Revenue Million Forecast, by Waste type 2020 & 2033

- Table 10: Global ASEAN Waste Management Industry Volume Billion Forecast, by Waste type 2020 & 2033

- Table 11: Global ASEAN Waste Management Industry Revenue Million Forecast, by Disposal methods 2020 & 2033

- Table 12: Global ASEAN Waste Management Industry Volume Billion Forecast, by Disposal methods 2020 & 2033

- Table 13: Global ASEAN Waste Management Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 14: Global ASEAN Waste Management Industry Volume Billion Forecast, by Geography 2020 & 2033

- Table 15: Global ASEAN Waste Management Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global ASEAN Waste Management Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 17: Global ASEAN Waste Management Industry Revenue Million Forecast, by Waste type 2020 & 2033

- Table 18: Global ASEAN Waste Management Industry Volume Billion Forecast, by Waste type 2020 & 2033

- Table 19: Global ASEAN Waste Management Industry Revenue Million Forecast, by Disposal methods 2020 & 2033

- Table 20: Global ASEAN Waste Management Industry Volume Billion Forecast, by Disposal methods 2020 & 2033

- Table 21: Global ASEAN Waste Management Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 22: Global ASEAN Waste Management Industry Volume Billion Forecast, by Geography 2020 & 2033

- Table 23: Global ASEAN Waste Management Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global ASEAN Waste Management Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 25: Global ASEAN Waste Management Industry Revenue Million Forecast, by Waste type 2020 & 2033

- Table 26: Global ASEAN Waste Management Industry Volume Billion Forecast, by Waste type 2020 & 2033

- Table 27: Global ASEAN Waste Management Industry Revenue Million Forecast, by Disposal methods 2020 & 2033

- Table 28: Global ASEAN Waste Management Industry Volume Billion Forecast, by Disposal methods 2020 & 2033

- Table 29: Global ASEAN Waste Management Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 30: Global ASEAN Waste Management Industry Volume Billion Forecast, by Geography 2020 & 2033

- Table 31: Global ASEAN Waste Management Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Global ASEAN Waste Management Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 33: Global ASEAN Waste Management Industry Revenue Million Forecast, by Waste type 2020 & 2033

- Table 34: Global ASEAN Waste Management Industry Volume Billion Forecast, by Waste type 2020 & 2033

- Table 35: Global ASEAN Waste Management Industry Revenue Million Forecast, by Disposal methods 2020 & 2033

- Table 36: Global ASEAN Waste Management Industry Volume Billion Forecast, by Disposal methods 2020 & 2033

- Table 37: Global ASEAN Waste Management Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 38: Global ASEAN Waste Management Industry Volume Billion Forecast, by Geography 2020 & 2033

- Table 39: Global ASEAN Waste Management Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Global ASEAN Waste Management Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 41: Global ASEAN Waste Management Industry Revenue Million Forecast, by Waste type 2020 & 2033

- Table 42: Global ASEAN Waste Management Industry Volume Billion Forecast, by Waste type 2020 & 2033

- Table 43: Global ASEAN Waste Management Industry Revenue Million Forecast, by Disposal methods 2020 & 2033

- Table 44: Global ASEAN Waste Management Industry Volume Billion Forecast, by Disposal methods 2020 & 2033

- Table 45: Global ASEAN Waste Management Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 46: Global ASEAN Waste Management Industry Volume Billion Forecast, by Geography 2020 & 2033

- Table 47: Global ASEAN Waste Management Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Global ASEAN Waste Management Industry Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the ASEAN Waste Management Industry?

The projected CAGR is approximately 6.74%.

2. Which companies are prominent players in the ASEAN Waste Management Industry?

Key companies in the market include Sembcorp Environmental Management Pte Ltd (Singapore), Veolia Environmental S A, Colex Holdings Limited, Remondis, Klang Waste Care, Starpal Pte Ltd, Blue Planet Environmental Solutions, Greenway Environmental, PT Prasadha Pamunah Limbah Industri - PPLI, Boon Poh Refuse Disposal Pte Ltd, Suez Environment, Earth Recycling Services Ltd, ALBA Group Asia, Se Cure Waste Management**List Not Exhaustive.

3. What are the main segments of the ASEAN Waste Management Industry?

The market segments include Waste type, Disposal methods, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 31.25 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Indonesia Advances Zero-Plastic Waste Ambitions with Public-Private Partnership to Build Waste Management Capacity and Capability.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

December 2022: A cooperative venture called Rebottle between Singapore Polytechnic (SP) and SembWaste, a fully owned subsidiary of Sembcorp Industries (Sembcorp) intends to increase the amount of PET bottles that are recycled in Singapore, beginning with the Punggol Shore area.June 2022: The introduction of a representative office in the Wijayakusuma Industrial Area was conducted on Thursday, June 30, 2022, making it a significant day in the history of PT Prasadha Pamunah Waste Industries (PPLI). The Wijayakusuma Industrial Estate's management, PT KIW, has leased space to the newly established PT PPLI representative office (Persero). Selling land for industrial usage, renting Ready-to-Use Factory Buildings (BPSP), and leasing space for offices are all part of PT KIW's primary business. The PT PPLI-DESI representative office will be opened with the intention of being a dependable partner for businesses, the Indonesian government, and other stakeholders, and contributing to Indonesia's economic and environmental growth.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "ASEAN Waste Management Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the ASEAN Waste Management Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the ASEAN Waste Management Industry?

To stay informed about further developments, trends, and reports in the ASEAN Waste Management Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence