Key Insights

The Asia Pacific photography services market, valued at $12.21 billion in 2025, is projected to experience robust growth, with a compound annual growth rate (CAGR) of 8.13% from 2025 to 2033. This expansion is fueled by several key drivers. The rising popularity of social media platforms, coupled with increased disposable incomes across many Asian countries, is driving demand for professional photography services for personal use, including portraits, events, and travel photography. Furthermore, the booming e-commerce sector necessitates high-quality product photography, boosting the market for commercial photography services. The increasing adoption of advanced photographic technologies, such as drones and high-resolution cameras, is further enhancing the quality and efficiency of photography services, driving market growth. While challenges such as intense competition and the availability of cost-effective amateur photography solutions exist, the overall market outlook remains positive, largely due to continuous technological advancements and increasing consumer demand for visually appealing content across various sectors.

Asia Pacific Photography Service Market Market Size (In Billion)

The market segmentation within the Asia Pacific region is diverse, with a mix of established players like Ricoh and Panasonic alongside numerous smaller, specialized firms such as Educreate Films and Filmapia India. These companies cater to a wide range of needs, from individual consumers to large corporate clients. Geographical variations in market penetration and growth rates are expected, with countries experiencing rapid economic development likely exhibiting faster growth trajectories than more mature economies. The forecast period, 2025-2033, will likely witness a consolidation of market players, with larger companies acquiring smaller ones to enhance their service offerings and geographical reach. The continued integration of artificial intelligence (AI) and other technological advancements in image processing and editing will also play a significant role in shaping the future of the market. The focus on creating high-quality, engaging visual content will continue to drive demand for professional photography services across various segments within the Asia Pacific region.

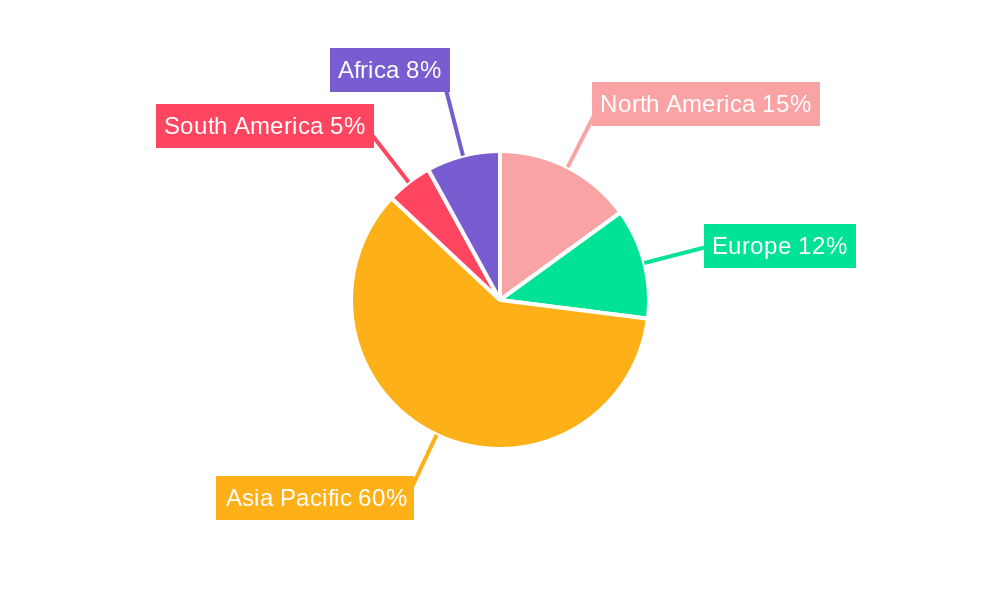

Asia Pacific Photography Service Market Company Market Share

Asia Pacific Photography Service Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Asia Pacific photography service market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report meticulously examines market dynamics, competitive landscapes, emerging trends, and growth opportunities, providing actionable intelligence to navigate this dynamic sector. The market size is projected to reach xx Million by 2033.

Asia Pacific Photography Service Market Concentration & Innovation

This section analyzes the market concentration, innovation drivers, regulatory landscape, product substitutes, end-user trends, and mergers & acquisitions (M&A) activities within the Asia Pacific photography service market. The market is characterized by a moderately fragmented structure, with several large players and numerous smaller, specialized firms competing for market share. Key factors driving innovation include advancements in camera technology, image processing software, and drone photography. Stringent regulatory frameworks concerning data privacy and intellectual property rights influence market operations. The rise of digital platforms and readily available editing software presents significant substitution threats. End-user trends towards high-quality, personalized photography experiences shape demand.

- Market Share: The top 5 players collectively hold approximately xx% of the market share in 2025, with Educreate Films, Filmapia India, and Vortic Designs among the leading companies.

- M&A Activities: While precise M&A deal values are not publicly available for all transactions, the average deal value in the past five years is estimated at xx Million, reflecting consolidation trends within the sector. Several smaller acquisitions have occurred, driven by strategic expansion and technology integration efforts.

Asia Pacific Photography Service Market Industry Trends & Insights

This section delves into the key industry trends and insights shaping the Asia Pacific photography service market. The market exhibits a robust Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), fueled by rising disposable incomes, growing demand for professional photography services across various sectors (e.g., weddings, events, corporate), and increasing adoption of mobile photography. Technological disruptions, such as the proliferation of high-resolution cameras in smartphones and advancements in AI-powered image editing, are transforming the landscape. Consumer preferences are shifting toward personalized experiences and unique photographic styles.

- Market Penetration: The market penetration rate for professional photography services in urban areas is considerably higher compared to rural regions, driven by increased awareness and accessibility.

Dominant Markets & Segments in Asia Pacific Photography Service Market

This section identifies the leading regions, countries, and segments within the Asia Pacific photography service market. China and India are expected to dominate the market due to their vast populations, rapidly expanding middle class, and increasing demand for photography services.

- Key Drivers in China:

- Favorable government policies promoting creative industries.

- Robust infrastructure supporting digital technology adoption.

- High concentration of photography-related businesses and talent.

- Key Drivers in India:

- Rising disposable incomes and a growing middle class driving demand for high-quality photography.

- A thriving wedding photography market and associated sub-segments.

- Increasing adoption of digital platforms for photography services.

The wedding photography segment is the largest, followed by event photography and corporate photography. These segments are projected to experience significant growth due to the factors mentioned above. The dominance of these countries and segments is primarily attributed to their economic growth, favorable regulatory environments, and rapidly evolving consumer preferences.

Asia Pacific Photography Service Market Product Developments

Recent product developments involve integrating advanced technologies like AI-powered image enhancement, virtual reality (VR) and augmented reality (AR) integration in photography services, and drone-based aerial photography. These innovations offer enhanced image quality, unique perspectives, and personalized experiences, making them highly competitive. The market fit is strong, given the increasing consumer demand for technologically advanced services and immersive experiences.

Report Scope & Segmentation Analysis

The report segments the Asia Pacific photography service market based on service type (wedding, event, commercial, portrait, etc.), end-user (corporate, individuals, government, etc.), and geography (country-level analysis for key markets). Each segment's growth projections, market sizes, and competitive dynamics are comprehensively analyzed. For example, the wedding photography segment is expected to show the highest growth rate. The market is fragmented, with smaller players specializing in niche segments.

Key Drivers of Asia Pacific Photography Service Market Growth

The market's growth is fueled by rising disposable incomes, the burgeoning middle class, the increasing popularity of social media (driving demand for high-quality images), and advancements in camera and imaging technology. Government initiatives supporting creative industries and favorable regulatory environments also contribute to market expansion.

Challenges in the Asia Pacific Photography Service Market Sector

Challenges include intense competition, price pressure from emerging players, the rise of amateur photographers and readily available editing software, and the need to adapt to rapidly evolving technological advancements. Supply chain disruptions caused by geopolitical instability also impact operations and costs. The average profit margin for photography service providers is estimated to be at xx%, indicating some margin pressure.

Emerging Opportunities in Asia Pacific Photography Service Market

Emerging opportunities involve exploring new applications of AI and VR in photography, expanding into untapped rural markets, and offering specialized photography services catering to specific niche interests (e.g., real estate, travel, food photography). The integration of drone photography and virtual tours also presents significant growth potential.

Leading Players in the Asia Pacific Photography Service Market Market

- Educreate Films

- Filmapia India

- Vortic Designs

- RedFern Digital

- Orange Studios

- First Light Films

- Rimagine Graphic Design (Shanghai) Co Ltd

- Royal Creative Team

- Ricoh Co Ltd

- Panasonic Holdings Corp

- List Not Exhaustive

Key Developments in Asia Pacific Photography Service Market Industry

- 2023 Q4: Launch of a new AI-powered photo editing software by a major player, significantly impacting the market.

- 2022 Q3: Merger between two mid-sized photography companies, leading to increased market consolidation.

Strategic Outlook for Asia Pacific Photography Service Market Market

The Asia Pacific photography service market holds substantial growth potential. Strategic partnerships, technological advancements, and market expansion into emerging segments will be key to future success. Companies focusing on innovation, customer experience, and strategic partnerships will be best positioned for sustained growth and market leadership in the coming years.

Asia Pacific Photography Service Market Segmentation

-

1. Type Outlook

- 1.1. Shooting Service

- 1.2. After Sales Service

-

2. Application

- 2.1. Consumer

- 2.2. Commercial

Asia Pacific Photography Service Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Photography Service Market Regional Market Share

Geographic Coverage of Asia Pacific Photography Service Market

Asia Pacific Photography Service Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.13% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Impact of Social Media Users in Asia Pacific

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Photography Service Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type Outlook

- 5.1.1. Shooting Service

- 5.1.2. After Sales Service

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Consumer

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type Outlook

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Educreate Films

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Filmapia India

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Vortic Designs

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 RedFern Digital

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Orange Studios

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 First Light Films

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Rimagine Graphic Design (Shanghai) Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Royal Creative Team

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Ricoh Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Panasonic Holdings Corp**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Educreate Films

List of Figures

- Figure 1: Asia Pacific Photography Service Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Photography Service Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Photography Service Market Revenue Million Forecast, by Type Outlook 2020 & 2033

- Table 2: Asia Pacific Photography Service Market Volume Billion Forecast, by Type Outlook 2020 & 2033

- Table 3: Asia Pacific Photography Service Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Asia Pacific Photography Service Market Volume Billion Forecast, by Application 2020 & 2033

- Table 5: Asia Pacific Photography Service Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Asia Pacific Photography Service Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Asia Pacific Photography Service Market Revenue Million Forecast, by Type Outlook 2020 & 2033

- Table 8: Asia Pacific Photography Service Market Volume Billion Forecast, by Type Outlook 2020 & 2033

- Table 9: Asia Pacific Photography Service Market Revenue Million Forecast, by Application 2020 & 2033

- Table 10: Asia Pacific Photography Service Market Volume Billion Forecast, by Application 2020 & 2033

- Table 11: Asia Pacific Photography Service Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Asia Pacific Photography Service Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: China Asia Pacific Photography Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: China Asia Pacific Photography Service Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Japan Asia Pacific Photography Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Japan Asia Pacific Photography Service Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: South Korea Asia Pacific Photography Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: South Korea Asia Pacific Photography Service Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: India Asia Pacific Photography Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: India Asia Pacific Photography Service Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Australia Asia Pacific Photography Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Australia Asia Pacific Photography Service Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: New Zealand Asia Pacific Photography Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: New Zealand Asia Pacific Photography Service Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Indonesia Asia Pacific Photography Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Indonesia Asia Pacific Photography Service Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Malaysia Asia Pacific Photography Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Malaysia Asia Pacific Photography Service Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Singapore Asia Pacific Photography Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Singapore Asia Pacific Photography Service Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Thailand Asia Pacific Photography Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Thailand Asia Pacific Photography Service Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Vietnam Asia Pacific Photography Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Vietnam Asia Pacific Photography Service Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 35: Philippines Asia Pacific Photography Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Philippines Asia Pacific Photography Service Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Photography Service Market?

The projected CAGR is approximately 8.13%.

2. Which companies are prominent players in the Asia Pacific Photography Service Market?

Key companies in the market include Educreate Films, Filmapia India, Vortic Designs, RedFern Digital, Orange Studios, First Light Films, Rimagine Graphic Design (Shanghai) Co Ltd, Royal Creative Team, Ricoh Co Ltd, Panasonic Holdings Corp**List Not Exhaustive.

3. What are the main segments of the Asia Pacific Photography Service Market?

The market segments include Type Outlook, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.21 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Impact of Social Media Users in Asia Pacific.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Photography Service Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Photography Service Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Photography Service Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Photography Service Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence