Key Insights

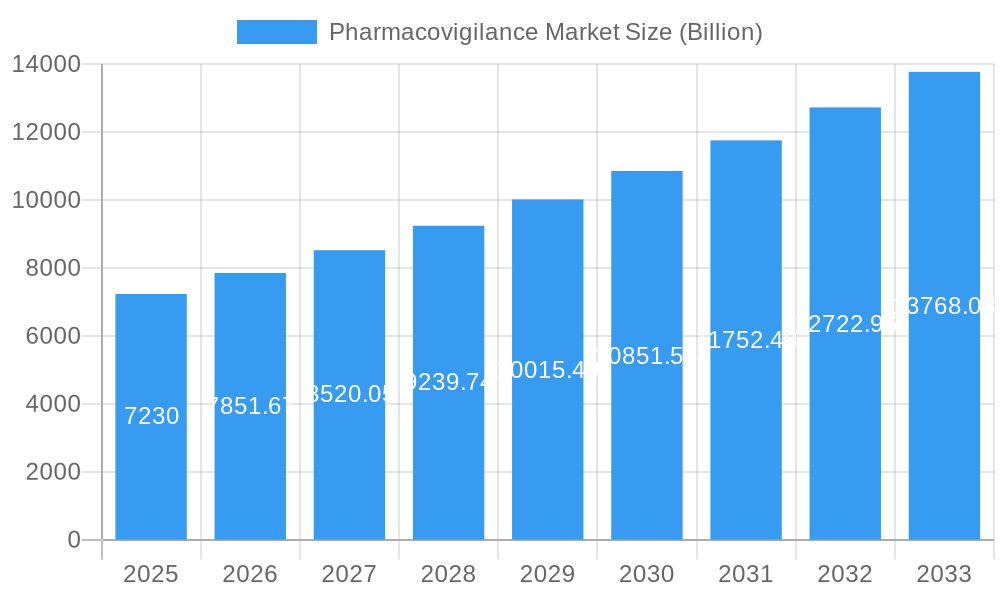

The global Pharmacovigilance market is poised for substantial expansion, projected to reach approximately USD 7.23 billion in the base year of 2025, with a robust Compound Annual Growth Rate (CAGR) of 8.65%. This significant growth trajectory is underpinned by several critical drivers. The escalating complexity of drug development, coupled with the increasing stringency of regulatory requirements worldwide, necessitates comprehensive and proactive safety monitoring. Furthermore, the growing emphasis on patient safety and the rise in post-market surveillance activities are key contributors. Technological advancements, including the integration of artificial intelligence and machine learning in adverse drug reaction (ADR) detection and reporting, are revolutionizing the field, enabling more efficient and accurate data analysis. The increasing prevalence of chronic diseases globally also contributes to a larger patient pool, subsequently leading to a greater volume of drug usage and a higher likelihood of adverse events, thereby fueling the demand for pharmacovigilance services.

Pharmacovigilance Market Market Size (In Billion)

The market is segmented across various clinical trial phases, service provider models, reporting types, and end-users, indicating a diverse and evolving landscape. The dominance of Contract Outsourcing is expected to continue, as pharmaceutical companies increasingly leverage specialized expertise and infrastructure to manage their pharmacovigilance activities efficiently. Intensified ADR reporting and Electronic Health Record (EHR) mining are emerging as significant reporting types, driven by the need for real-time data and proactive safety insights. Geographically, North America and Europe are anticipated to lead the market due to the presence of major pharmaceutical hubs and stringent regulatory frameworks. However, the Asia Pacific region is expected to exhibit the fastest growth, fueled by expanding healthcare infrastructure, increasing drug consumption, and growing awareness regarding drug safety in emerging economies. Key players like IQVIA, Accenture, and PAREXEL are actively investing in advanced technological solutions and strategic collaborations to capture a larger market share amidst this dynamic environment.

Pharmacovigilance Market Company Market Share

This in-depth pharmacovigilance market report provides a definitive analysis of the global landscape, projected to reach a valuation of XX Billion by 2033, growing at a Compound Annual Growth Rate (CAGR) of XX% from the base year 2025. Spanning the historical period of 2019-2024, the study period 2019-2033, and offering detailed forecasts for 2025-2033, this report is an indispensable resource for stakeholders seeking to understand drug safety monitoring, adverse event reporting, and pharmacovigilance solutions. It meticulously dissects market drivers, challenges, opportunities, and competitive strategies, offering actionable insights for pharmaceutical companies, biotechnology firms, contract research organizations (CROs), and regulatory bodies.

Pharmacovigilance Market Market Concentration & Innovation

The pharmacovigilance market exhibits a moderate to high concentration, with a significant portion of the market share held by a select group of global players. Innovation is a key differentiator, driven by the increasing complexity of drug development, stringent regulatory mandates, and the demand for efficient and cost-effective safety monitoring solutions. The market is influenced by robust regulatory frameworks across regions like North America, Europe, and Asia Pacific, which necessitate sophisticated pharmacovigilance systems and adverse drug reaction (ADR) reporting. Product substitutes, such as manual reporting systems or less integrated software, are gradually being phased out in favor of advanced digital solutions. End-user trends point towards a growing preference for outsourced pharmacovigilance services and the adoption of artificial intelligence (AI) and machine learning (ML) for enhanced data analysis and signal detection. Mergers and acquisitions (M&A) activities are prevalent as larger players seek to expand their service portfolios, geographical reach, and technological capabilities. Notable M&A deals have involved valuations in the range of $XX million to $XX billion, solidifying market dominance and fostering innovation through the integration of new technologies and expertise.

- Market Share Distribution: Top 5 players estimated to hold XX% of the market share.

- Innovation Drivers: AI/ML integration, real-world data (RWD) utilization, decentralized clinical trials (DCT) support, cloud-based solutions.

- Regulatory Influence: FDA, EMA, ICH guidelines driving compliance and technology adoption.

- M&A Activity: Strategic acquisitions to gain market access and technological advantage, with reported deal values between $XX million and $XX billion.

Pharmacovigilance Market Industry Trends & Insights

The global pharmacovigilance market is experiencing robust growth, propelled by an escalating number of new drug approvals, increasing global drug consumption, and the ever-present imperative to ensure patient safety. The pharmacovigilance market size is expanding significantly as regulatory bodies worldwide strengthen their oversight and mandate comprehensive drug safety surveillance. Technological disruptions are playing a pivotal role, with the integration of Artificial Intelligence (AI), Machine Learning (ML), and Big Data analytics transforming how adverse events are detected, analyzed, and reported. These advancements enable proactive identification of potential safety signals, thereby reducing the risk of post-market drug failures and safeguarding public health. Consumer preferences are shifting towards a greater demand for transparency and readily accessible information regarding drug safety profiles, which in turn compels pharmaceutical companies to invest more heavily in their pharmacovigilance operations. The competitive dynamics are characterized by intense innovation, with companies striving to offer end-to-end solutions that encompass case processing, signal detection, regulatory reporting, and risk management. The growing emphasis on real-world evidence (RWE) and real-world data (RWD) further fuels the need for advanced pharmacovigilance platforms capable of processing and analyzing vast datasets from diverse sources. The market penetration of cloud-based pharmacovigilance software is also on the rise, offering scalability, accessibility, and cost-effectiveness to organizations of all sizes. The CAGR of the pharmacovigilance market is projected to be a healthy XX% over the forecast period, underscoring its significant growth trajectory. The increasing complexity of pharmacovigilance activities, coupled with the rising volume of data generated from clinical trials and post-market surveillance, necessitates sophisticated technological solutions and expert services, driving sustained market expansion.

Dominant Markets & Segments in Pharmacovigilance Market

The pharmacovigilance market is currently dominated by North America, driven by the presence of a robust pharmaceutical industry, stringent regulatory requirements from the FDA, and substantial investments in R&D. Within this region, the United States stands out as the leading country due to its large pharmaceutical market and proactive adoption of advanced safety monitoring technologies.

Clinical Trial Phase Dominance:

- Phase IV (Post-Marketing Surveillance): This segment holds the largest market share. The continuous monitoring of drugs after they have entered the market generates a vast amount of safety data, necessitating comprehensive pharmacovigilance services for long-term safety assessment and compliance. Economic policies supporting post-market studies and increasing patient reporting contribute to this dominance.

Service Provider Dominance:

- Contract Outsourcing: This segment is experiencing rapid growth and is expected to become increasingly dominant. Pharmaceutical and biotechnology companies are increasingly outsourcing their pharmacovigilance activities to specialized Contract Research Organizations (CROs) and service providers to leverage expertise, reduce operational costs, and improve efficiency. Regulatory frameworks that encourage outsourcing for specialized tasks also contribute to this trend.

Type of Reporting Dominance:

- Spontaneous Reporting: While other methods are gaining traction, spontaneous reporting, where healthcare professionals and patients voluntarily report suspected adverse reactions, remains a cornerstone of pharmacovigilance. The sheer volume of data generated through this channel, coupled with ongoing efforts to improve reporting systems globally, sustains its dominance.

End User Dominance:

Pharmaceutical Companies: These are the primary end-users, accounting for the largest share of the pharmacovigilance market. The inherent responsibility for drug safety from development to post-market surveillance places them at the forefront of demand for pharmacovigilance solutions.

Key Drivers for Dominance:

- Regulatory Landscape: Strict adherence to regulations like ICH guidelines, FDA's Adverse Event Reporting System (AERS), and EMA's EudraVigilance.

- R&D Investments: High levels of investment in new drug development by leading pharmaceutical hubs.

- Technological Adoption: Early and widespread adoption of digital pharmacovigilance tools and AI-driven solutions.

- Healthcare Infrastructure: Well-established healthcare systems that facilitate data collection and reporting.

Pharmacovigilance Market Product Developments

Product developments in the pharmacovigilance market are sharply focused on enhancing efficiency, accuracy, and compliance in drug safety monitoring. Innovations include the integration of Artificial Intelligence (AI) and Machine Learning (ML) for automated case processing, intelligent signal detection, and predictive analytics to identify potential safety trends earlier. Cloud-based pharmacovigilance software platforms are gaining prominence, offering scalable and accessible solutions for managing vast amounts of adverse event data. Advancements in natural language processing (NLP) are improving the extraction of relevant safety information from unstructured data sources like medical literature and social media. These developments provide competitive advantages by enabling real-time insights, reducing human error, and streamlining regulatory reporting.

Report Scope & Segmentation Analysis

This report meticulously segments the pharmacovigilance market across several key dimensions to provide a granular understanding of market dynamics. The segmentation includes:

- Clinical Trial Phase: Preclinical, Phase I, Phase II, Phase III, and Phase IV.

- Service Provider: In-house operations and Contract Outsourcing.

- Type of Reporting: Spontaneous Reporting, Intensified ADR Reporting, Targeted Spontaneous Reporting, Cohort Event Monitoring, and EHR Mining.

- End User: Hospitals, Pharmaceutical Companies, and Other End Users.

Each segment is analyzed for its market size, growth projections, and competitive landscape. The Phase IV segment is anticipated to lead in market size and growth, driven by continuous post-market surveillance needs. Contract Outsourcing is projected to witness the highest CAGR as organizations seek specialized expertise. Spontaneous Reporting continues to be a foundational element, while EHR Mining is an emerging segment with significant growth potential. Pharmaceutical Companies remain the dominant end-user segment, with hospitals and other research institutions also contributing to market demand.

Key Drivers of Pharmacovigilance Market Growth

Several key factors are propelling the pharmacovigilance market forward.

- Increasingly Stringent Regulatory Requirements: Global health authorities are continuously tightening regulations around drug safety monitoring, compelling companies to invest in robust pharmacovigilance systems and processes to ensure compliance.

- Growing Number of Drug Approvals and Global Drug Consumption: As more new drugs enter the market and global pharmaceutical sales rise, the volume of data requiring safety surveillance escalates, directly impacting the demand for pharmacovigilance services.

- Advancements in Technology: The integration of AI, ML, Big Data analytics, and cloud computing is revolutionizing pharmacovigilance, enabling more efficient data processing, faster signal detection, and proactive risk management.

- Rising Awareness of Drug Safety: Increased public and healthcare provider awareness regarding the importance of reporting adverse events contributes to a larger data pool for analysis and improved patient safety.

Challenges in the Pharmacovigilance Market Sector

Despite its strong growth trajectory, the pharmacovigilance market faces several challenges.

- Data Management Complexity: The sheer volume and diversity of data generated from various sources (clinical trials, post-market surveillance, social media) pose significant challenges for efficient collection, processing, and analysis.

- Regulatory Compliance and Evolving Frameworks: Keeping pace with ever-changing global regulatory guidelines and ensuring consistent compliance across different jurisdictions requires constant vigilance and investment.

- Shortage of Skilled Personnel: There is a persistent demand for qualified pharmacovigilance professionals with expertise in data analysis, regulatory affairs, and specialized software systems.

- Cost Pressures: Pharmaceutical companies face pressure to manage costs, which can sometimes lead to delays in investing in advanced pharmacovigilance technologies or services. The estimated cost of non-compliance can range from $XX million to $XX billion in fines and recalls.

Emerging Opportunities in Pharmacovigilance Market

The pharmacovigilance market is ripe with emerging opportunities driven by technological innovation and evolving healthcare landscapes.

- Leveraging Real-World Data (RWD) and Real-World Evidence (RWE): The increasing availability of RWD from electronic health records, wearables, and patient registries presents a significant opportunity for more comprehensive and timely safety assessments.

- AI and ML for Predictive Safety Analytics: Advanced algorithms can predict potential safety issues before they become widespread, offering a proactive approach to risk management.

- Decentralized Clinical Trials (DCTs): The rise of DCTs generates new data streams and requires innovative pharmacovigilance strategies to ensure safety oversight in remote patient settings.

- Growth in Emerging Markets: As pharmaceutical industries expand in regions like Asia Pacific and Latin America, the demand for pharmacovigilance solutions is expected to surge.

- Integration with Other Healthcare Data: Opportunities exist to integrate pharmacovigilance data with other health information systems to gain a holistic view of patient outcomes and drug efficacy.

Leading Players in the Pharmacovigilance Market Market

- ArisGlobal

- Laboratory Corporation of America Holdings

- Cognizant

- PAREXEL International Corporation

- IBM Corporation

- Wipro Ltd

- ICON PLC

- Accenture

- BioClinica

- Linical Accelovance

- IQVIA

- TAKE Solutions Ltd

- ITClinical

- Capgemini

- United BioSource Corporation

Key Developments in Pharmacovigilance Market Industry

- February 2022: Cognizant entered into a partnership with Medable Inc. to jointly deliver clinical research solutions based on Medable's software-as-a-service platform for decentralized clinical trials. This collaboration aims to enhance the efficiency and accessibility of clinical research, directly impacting the data flow for pharmacovigilance.

- February 2022: LINK Medical and Viedoc entered into a partnership established by Viedoc and designed to improve trial efficiency for LINK Medical and its clients. The partnership allows for a continuous exchange of experience, needs, and ideas, as well as the testing of new features, contributing to streamlined data collection and potentially improved adverse event reporting from trials.

Strategic Outlook for Pharmacovigilance Market Market

The strategic outlook for the pharmacovigilance market is overwhelmingly positive, driven by an increasing emphasis on patient safety and the relentless pursuit of operational efficiency within the pharmaceutical and biotechnology sectors. The market is poised for continued expansion as regulatory landscapes evolve and technological advancements unlock new possibilities for drug safety monitoring. Companies that invest in AI-driven analytics, cloud-based platforms, and integrated data management solutions will be best positioned to capitalize on emerging opportunities. The growing adoption of real-world data and the expansion into emerging markets will further fuel growth. Strategic collaborations and partnerships, such as those observed between Cognizant and Medable, and LINK Medical and Viedoc, will play a crucial role in shaping the future of pharmacovigilance, leading to more innovative, efficient, and patient-centric safety practices. The estimated future market potential is projected to reach XX Billion by 2033, indicating a significant and sustained growth trajectory.

Pharmacovigilance Market Segmentation

-

1. Clinical Trial Phase

- 1.1. Preclinical

- 1.2. Phase I

- 1.3. Phase II

- 1.4. Phase III

- 1.5. Phase IV

-

2. Service Provider

- 2.1. In-house

- 2.2. Contract Outsourcing

-

3. Type of Reporting

- 3.1. Spontaneous Reporting

- 3.2. Intensified ADR Reporting

- 3.3. Targeted Spontaneous Reporting

- 3.4. Cohort Event Monitoring

- 3.5. EHR Mining

-

4. End User

- 4.1. Hospitals

- 4.2. Pharmaceutical Companies

- 4.3. Other End Users

Pharmacovigilance Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Pharmacovigilance Market Regional Market Share

Geographic Coverage of Pharmacovigilance Market

Pharmacovigilance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.65% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Drug Consumption and Drug Development Rates; Growing Incidence Rates of Adverse Drug Reaction and Drug Toxicity; Increasing Trend of Outsourcing Pharmacovigilance Services

- 3.3. Market Restrains

- 3.3.1. High Risk Associated with Data Security; Lack of Global Regulatory Harmonization and Lack of Data Standardization for Adverse Event Collection

- 3.4. Market Trends

- 3.4.1. The Pharmaceutical Companies Segment is Expected to Hold a Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Pharmacovigilance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Clinical Trial Phase

- 5.1.1. Preclinical

- 5.1.2. Phase I

- 5.1.3. Phase II

- 5.1.4. Phase III

- 5.1.5. Phase IV

- 5.2. Market Analysis, Insights and Forecast - by Service Provider

- 5.2.1. In-house

- 5.2.2. Contract Outsourcing

- 5.3. Market Analysis, Insights and Forecast - by Type of Reporting

- 5.3.1. Spontaneous Reporting

- 5.3.2. Intensified ADR Reporting

- 5.3.3. Targeted Spontaneous Reporting

- 5.3.4. Cohort Event Monitoring

- 5.3.5. EHR Mining

- 5.4. Market Analysis, Insights and Forecast - by End User

- 5.4.1. Hospitals

- 5.4.2. Pharmaceutical Companies

- 5.4.3. Other End Users

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Middle East and Africa

- 5.5.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Clinical Trial Phase

- 6. North America Pharmacovigilance Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Clinical Trial Phase

- 6.1.1. Preclinical

- 6.1.2. Phase I

- 6.1.3. Phase II

- 6.1.4. Phase III

- 6.1.5. Phase IV

- 6.2. Market Analysis, Insights and Forecast - by Service Provider

- 6.2.1. In-house

- 6.2.2. Contract Outsourcing

- 6.3. Market Analysis, Insights and Forecast - by Type of Reporting

- 6.3.1. Spontaneous Reporting

- 6.3.2. Intensified ADR Reporting

- 6.3.3. Targeted Spontaneous Reporting

- 6.3.4. Cohort Event Monitoring

- 6.3.5. EHR Mining

- 6.4. Market Analysis, Insights and Forecast - by End User

- 6.4.1. Hospitals

- 6.4.2. Pharmaceutical Companies

- 6.4.3. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Clinical Trial Phase

- 7. Europe Pharmacovigilance Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Clinical Trial Phase

- 7.1.1. Preclinical

- 7.1.2. Phase I

- 7.1.3. Phase II

- 7.1.4. Phase III

- 7.1.5. Phase IV

- 7.2. Market Analysis, Insights and Forecast - by Service Provider

- 7.2.1. In-house

- 7.2.2. Contract Outsourcing

- 7.3. Market Analysis, Insights and Forecast - by Type of Reporting

- 7.3.1. Spontaneous Reporting

- 7.3.2. Intensified ADR Reporting

- 7.3.3. Targeted Spontaneous Reporting

- 7.3.4. Cohort Event Monitoring

- 7.3.5. EHR Mining

- 7.4. Market Analysis, Insights and Forecast - by End User

- 7.4.1. Hospitals

- 7.4.2. Pharmaceutical Companies

- 7.4.3. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Clinical Trial Phase

- 8. Asia Pacific Pharmacovigilance Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Clinical Trial Phase

- 8.1.1. Preclinical

- 8.1.2. Phase I

- 8.1.3. Phase II

- 8.1.4. Phase III

- 8.1.5. Phase IV

- 8.2. Market Analysis, Insights and Forecast - by Service Provider

- 8.2.1. In-house

- 8.2.2. Contract Outsourcing

- 8.3. Market Analysis, Insights and Forecast - by Type of Reporting

- 8.3.1. Spontaneous Reporting

- 8.3.2. Intensified ADR Reporting

- 8.3.3. Targeted Spontaneous Reporting

- 8.3.4. Cohort Event Monitoring

- 8.3.5. EHR Mining

- 8.4. Market Analysis, Insights and Forecast - by End User

- 8.4.1. Hospitals

- 8.4.2. Pharmaceutical Companies

- 8.4.3. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Clinical Trial Phase

- 9. Middle East and Africa Pharmacovigilance Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Clinical Trial Phase

- 9.1.1. Preclinical

- 9.1.2. Phase I

- 9.1.3. Phase II

- 9.1.4. Phase III

- 9.1.5. Phase IV

- 9.2. Market Analysis, Insights and Forecast - by Service Provider

- 9.2.1. In-house

- 9.2.2. Contract Outsourcing

- 9.3. Market Analysis, Insights and Forecast - by Type of Reporting

- 9.3.1. Spontaneous Reporting

- 9.3.2. Intensified ADR Reporting

- 9.3.3. Targeted Spontaneous Reporting

- 9.3.4. Cohort Event Monitoring

- 9.3.5. EHR Mining

- 9.4. Market Analysis, Insights and Forecast - by End User

- 9.4.1. Hospitals

- 9.4.2. Pharmaceutical Companies

- 9.4.3. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Clinical Trial Phase

- 10. South America Pharmacovigilance Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Clinical Trial Phase

- 10.1.1. Preclinical

- 10.1.2. Phase I

- 10.1.3. Phase II

- 10.1.4. Phase III

- 10.1.5. Phase IV

- 10.2. Market Analysis, Insights and Forecast - by Service Provider

- 10.2.1. In-house

- 10.2.2. Contract Outsourcing

- 10.3. Market Analysis, Insights and Forecast - by Type of Reporting

- 10.3.1. Spontaneous Reporting

- 10.3.2. Intensified ADR Reporting

- 10.3.3. Targeted Spontaneous Reporting

- 10.3.4. Cohort Event Monitoring

- 10.3.5. EHR Mining

- 10.4. Market Analysis, Insights and Forecast - by End User

- 10.4.1. Hospitals

- 10.4.2. Pharmaceutical Companies

- 10.4.3. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Clinical Trial Phase

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 ArisGlobal

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Laboratory Corporation of America Holdings

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Cognizant

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 PAREXEL International Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 IBM Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Wipro Ltd*List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 ICON PLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Accenture

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 BioClinica

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Linical Accelovance

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 IQVIA

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 TAKE Solutions Ltd

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 ITClinical

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Capgemini

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 United BioSource Corporation

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 ArisGlobal

List of Figures

- Figure 1: Global Pharmacovigilance Market Revenue Breakdown (Billion, %) by Region 2025 & 2033

- Figure 2: North America Pharmacovigilance Market Revenue (Billion), by Clinical Trial Phase 2025 & 2033

- Figure 3: North America Pharmacovigilance Market Revenue Share (%), by Clinical Trial Phase 2025 & 2033

- Figure 4: North America Pharmacovigilance Market Revenue (Billion), by Service Provider 2025 & 2033

- Figure 5: North America Pharmacovigilance Market Revenue Share (%), by Service Provider 2025 & 2033

- Figure 6: North America Pharmacovigilance Market Revenue (Billion), by Type of Reporting 2025 & 2033

- Figure 7: North America Pharmacovigilance Market Revenue Share (%), by Type of Reporting 2025 & 2033

- Figure 8: North America Pharmacovigilance Market Revenue (Billion), by End User 2025 & 2033

- Figure 9: North America Pharmacovigilance Market Revenue Share (%), by End User 2025 & 2033

- Figure 10: North America Pharmacovigilance Market Revenue (Billion), by Country 2025 & 2033

- Figure 11: North America Pharmacovigilance Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: Europe Pharmacovigilance Market Revenue (Billion), by Clinical Trial Phase 2025 & 2033

- Figure 13: Europe Pharmacovigilance Market Revenue Share (%), by Clinical Trial Phase 2025 & 2033

- Figure 14: Europe Pharmacovigilance Market Revenue (Billion), by Service Provider 2025 & 2033

- Figure 15: Europe Pharmacovigilance Market Revenue Share (%), by Service Provider 2025 & 2033

- Figure 16: Europe Pharmacovigilance Market Revenue (Billion), by Type of Reporting 2025 & 2033

- Figure 17: Europe Pharmacovigilance Market Revenue Share (%), by Type of Reporting 2025 & 2033

- Figure 18: Europe Pharmacovigilance Market Revenue (Billion), by End User 2025 & 2033

- Figure 19: Europe Pharmacovigilance Market Revenue Share (%), by End User 2025 & 2033

- Figure 20: Europe Pharmacovigilance Market Revenue (Billion), by Country 2025 & 2033

- Figure 21: Europe Pharmacovigilance Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Pacific Pharmacovigilance Market Revenue (Billion), by Clinical Trial Phase 2025 & 2033

- Figure 23: Asia Pacific Pharmacovigilance Market Revenue Share (%), by Clinical Trial Phase 2025 & 2033

- Figure 24: Asia Pacific Pharmacovigilance Market Revenue (Billion), by Service Provider 2025 & 2033

- Figure 25: Asia Pacific Pharmacovigilance Market Revenue Share (%), by Service Provider 2025 & 2033

- Figure 26: Asia Pacific Pharmacovigilance Market Revenue (Billion), by Type of Reporting 2025 & 2033

- Figure 27: Asia Pacific Pharmacovigilance Market Revenue Share (%), by Type of Reporting 2025 & 2033

- Figure 28: Asia Pacific Pharmacovigilance Market Revenue (Billion), by End User 2025 & 2033

- Figure 29: Asia Pacific Pharmacovigilance Market Revenue Share (%), by End User 2025 & 2033

- Figure 30: Asia Pacific Pharmacovigilance Market Revenue (Billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Pharmacovigilance Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East and Africa Pharmacovigilance Market Revenue (Billion), by Clinical Trial Phase 2025 & 2033

- Figure 33: Middle East and Africa Pharmacovigilance Market Revenue Share (%), by Clinical Trial Phase 2025 & 2033

- Figure 34: Middle East and Africa Pharmacovigilance Market Revenue (Billion), by Service Provider 2025 & 2033

- Figure 35: Middle East and Africa Pharmacovigilance Market Revenue Share (%), by Service Provider 2025 & 2033

- Figure 36: Middle East and Africa Pharmacovigilance Market Revenue (Billion), by Type of Reporting 2025 & 2033

- Figure 37: Middle East and Africa Pharmacovigilance Market Revenue Share (%), by Type of Reporting 2025 & 2033

- Figure 38: Middle East and Africa Pharmacovigilance Market Revenue (Billion), by End User 2025 & 2033

- Figure 39: Middle East and Africa Pharmacovigilance Market Revenue Share (%), by End User 2025 & 2033

- Figure 40: Middle East and Africa Pharmacovigilance Market Revenue (Billion), by Country 2025 & 2033

- Figure 41: Middle East and Africa Pharmacovigilance Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: South America Pharmacovigilance Market Revenue (Billion), by Clinical Trial Phase 2025 & 2033

- Figure 43: South America Pharmacovigilance Market Revenue Share (%), by Clinical Trial Phase 2025 & 2033

- Figure 44: South America Pharmacovigilance Market Revenue (Billion), by Service Provider 2025 & 2033

- Figure 45: South America Pharmacovigilance Market Revenue Share (%), by Service Provider 2025 & 2033

- Figure 46: South America Pharmacovigilance Market Revenue (Billion), by Type of Reporting 2025 & 2033

- Figure 47: South America Pharmacovigilance Market Revenue Share (%), by Type of Reporting 2025 & 2033

- Figure 48: South America Pharmacovigilance Market Revenue (Billion), by End User 2025 & 2033

- Figure 49: South America Pharmacovigilance Market Revenue Share (%), by End User 2025 & 2033

- Figure 50: South America Pharmacovigilance Market Revenue (Billion), by Country 2025 & 2033

- Figure 51: South America Pharmacovigilance Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Pharmacovigilance Market Revenue Billion Forecast, by Clinical Trial Phase 2020 & 2033

- Table 2: Global Pharmacovigilance Market Revenue Billion Forecast, by Service Provider 2020 & 2033

- Table 3: Global Pharmacovigilance Market Revenue Billion Forecast, by Type of Reporting 2020 & 2033

- Table 4: Global Pharmacovigilance Market Revenue Billion Forecast, by End User 2020 & 2033

- Table 5: Global Pharmacovigilance Market Revenue Billion Forecast, by Region 2020 & 2033

- Table 6: Global Pharmacovigilance Market Revenue Billion Forecast, by Clinical Trial Phase 2020 & 2033

- Table 7: Global Pharmacovigilance Market Revenue Billion Forecast, by Service Provider 2020 & 2033

- Table 8: Global Pharmacovigilance Market Revenue Billion Forecast, by Type of Reporting 2020 & 2033

- Table 9: Global Pharmacovigilance Market Revenue Billion Forecast, by End User 2020 & 2033

- Table 10: Global Pharmacovigilance Market Revenue Billion Forecast, by Country 2020 & 2033

- Table 11: United States Pharmacovigilance Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 12: Canada Pharmacovigilance Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 13: Mexico Pharmacovigilance Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 14: Global Pharmacovigilance Market Revenue Billion Forecast, by Clinical Trial Phase 2020 & 2033

- Table 15: Global Pharmacovigilance Market Revenue Billion Forecast, by Service Provider 2020 & 2033

- Table 16: Global Pharmacovigilance Market Revenue Billion Forecast, by Type of Reporting 2020 & 2033

- Table 17: Global Pharmacovigilance Market Revenue Billion Forecast, by End User 2020 & 2033

- Table 18: Global Pharmacovigilance Market Revenue Billion Forecast, by Country 2020 & 2033

- Table 19: Germany Pharmacovigilance Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 20: United Kingdom Pharmacovigilance Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 21: France Pharmacovigilance Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 22: Italy Pharmacovigilance Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Pharmacovigilance Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 24: Rest of Europe Pharmacovigilance Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 25: Global Pharmacovigilance Market Revenue Billion Forecast, by Clinical Trial Phase 2020 & 2033

- Table 26: Global Pharmacovigilance Market Revenue Billion Forecast, by Service Provider 2020 & 2033

- Table 27: Global Pharmacovigilance Market Revenue Billion Forecast, by Type of Reporting 2020 & 2033

- Table 28: Global Pharmacovigilance Market Revenue Billion Forecast, by End User 2020 & 2033

- Table 29: Global Pharmacovigilance Market Revenue Billion Forecast, by Country 2020 & 2033

- Table 30: China Pharmacovigilance Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 31: Japan Pharmacovigilance Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 32: India Pharmacovigilance Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 33: Australia Pharmacovigilance Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 34: South Korea Pharmacovigilance Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 35: Rest of Asia Pacific Pharmacovigilance Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 36: Global Pharmacovigilance Market Revenue Billion Forecast, by Clinical Trial Phase 2020 & 2033

- Table 37: Global Pharmacovigilance Market Revenue Billion Forecast, by Service Provider 2020 & 2033

- Table 38: Global Pharmacovigilance Market Revenue Billion Forecast, by Type of Reporting 2020 & 2033

- Table 39: Global Pharmacovigilance Market Revenue Billion Forecast, by End User 2020 & 2033

- Table 40: Global Pharmacovigilance Market Revenue Billion Forecast, by Country 2020 & 2033

- Table 41: GCC Pharmacovigilance Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 42: South Africa Pharmacovigilance Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 43: Rest of Middle East and Africa Pharmacovigilance Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 44: Global Pharmacovigilance Market Revenue Billion Forecast, by Clinical Trial Phase 2020 & 2033

- Table 45: Global Pharmacovigilance Market Revenue Billion Forecast, by Service Provider 2020 & 2033

- Table 46: Global Pharmacovigilance Market Revenue Billion Forecast, by Type of Reporting 2020 & 2033

- Table 47: Global Pharmacovigilance Market Revenue Billion Forecast, by End User 2020 & 2033

- Table 48: Global Pharmacovigilance Market Revenue Billion Forecast, by Country 2020 & 2033

- Table 49: Brazil Pharmacovigilance Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 50: Argentina Pharmacovigilance Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 51: Rest of South America Pharmacovigilance Market Revenue (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pharmacovigilance Market?

The projected CAGR is approximately 8.65%.

2. Which companies are prominent players in the Pharmacovigilance Market?

Key companies in the market include ArisGlobal, Laboratory Corporation of America Holdings, Cognizant, PAREXEL International Corporation, IBM Corporation, Wipro Ltd*List Not Exhaustive, ICON PLC, Accenture, BioClinica, Linical Accelovance, IQVIA, TAKE Solutions Ltd, ITClinical, Capgemini, United BioSource Corporation.

3. What are the main segments of the Pharmacovigilance Market?

The market segments include Clinical Trial Phase, Service Provider, Type of Reporting, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.23 Billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Drug Consumption and Drug Development Rates; Growing Incidence Rates of Adverse Drug Reaction and Drug Toxicity; Increasing Trend of Outsourcing Pharmacovigilance Services.

6. What are the notable trends driving market growth?

The Pharmaceutical Companies Segment is Expected to Hold a Major Market Share.

7. Are there any restraints impacting market growth?

High Risk Associated with Data Security; Lack of Global Regulatory Harmonization and Lack of Data Standardization for Adverse Event Collection.

8. Can you provide examples of recent developments in the market?

In February 2022, Cognizant entered into a partnership with Medable Inc. to jointly deliver clinical research solutions based on Medable's software-as-a-service platform for decentralized clinical trials.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Pharmacovigilance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Pharmacovigilance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Pharmacovigilance Market?

To stay informed about further developments, trends, and reports in the Pharmacovigilance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence