Key Insights

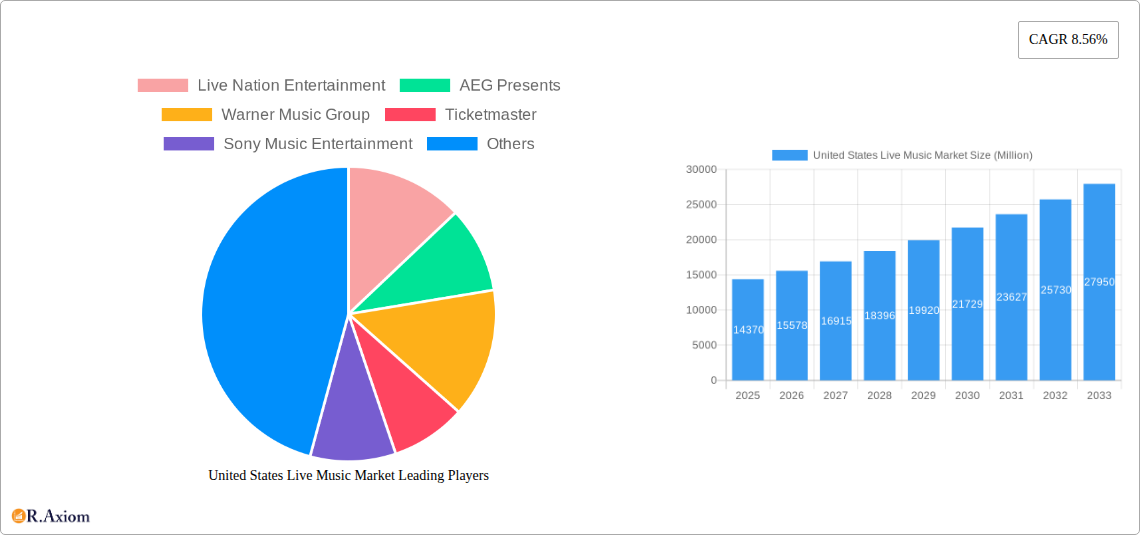

The United States Live Music Market is a dynamic and robust sector, projected to reach an estimated USD 14.37 billion in 2025. With a compelling Compound Annual Growth Rate (CAGR) of 8.56% anticipated from 2025 to 2033, the market is poised for substantial expansion. This growth is fueled by a confluence of powerful drivers. A significant trend is the increasing consumer demand for experiential entertainment, with live concerts and festivals leading the charge. The market is also benefiting from a resurgence in live events post-pandemic, as audiences are eager to reconnect with artists and fellow music enthusiasts. Furthermore, technological advancements in ticketing platforms and digital marketing are enhancing accessibility and engagement, drawing in a wider demographic. The diverse range of applications, from intimate theater performances and large-scale corporate events to celebratory weddings, demonstrates the market's adaptability and broad appeal.

United States Live Music Market Market Size (In Billion)

Revenue streams within the live music ecosystem are multifaceted, with ticket sales forming the primary income source. However, sponsorship deals and merchandise sales are increasingly contributing to the overall profitability of events. The market caters to a wide age spectrum, with strong engagement from teenagers and adults attending concerts and festivals, while children and seniors also participate in specific event types. Venue size plays a crucial role, with small, medium, and large venues each serving distinct segments of the market, from local gigs to massive stadium tours. Key players like Live Nation Entertainment and AEG Presents are instrumental in shaping the market landscape through their extensive portfolios and strategic investments in talent and infrastructure. While the market exhibits strong growth, potential restraints such as rising operational costs, fluctuating artist fees, and the ongoing impact of global health concerns could present challenges that stakeholders will need to navigate strategically.

United States Live Music Market Company Market Share

United States Live Music Market Analysis: Comprehensive Industry Report

This in-depth report provides a strategic analysis of the United States Live Music Market, offering critical insights for stakeholders navigating this dynamic sector. With a study period spanning 2019 to 2033, including a historical analysis from 2019-2024, a base year of 2025, and a detailed forecast period from 2025-2033, this report leverages extensive data and expert commentary. We delve into market concentration, innovation, growth drivers, segment dominance, and future opportunities, presenting actionable intelligence to inform your business strategies. Key players such as Live Nation Entertainment, AEG Presents, Warner Music Group, Ticketmaster, and Sony Music Entertainment are meticulously examined, alongside recent industry developments like the BMAC and Live Nation's music business intensive course and Sony Music Entertainment's "For The Music" campaign.

United States Live Music Market Market Concentration & Innovation

The United States live music market exhibits a moderate to high degree of concentration, with a few major players like Live Nation Entertainment and AEG Presents wielding significant influence over event promotion, venue management, and ticketing. The market is characterized by continuous innovation driven by technological advancements and evolving consumer preferences. Key innovation drivers include the integration of virtual reality (VR) and augmented reality (AR) for enhanced fan experiences, the adoption of AI for personalized recommendations and dynamic pricing, and the increasing demand for sustainable event practices. Regulatory frameworks, while generally supportive of the industry, can impact ticketing practices and artist contracts. Product substitutes, such as at-home entertainment streaming services, present a constant challenge, necessitating the delivery of unique and compelling live experiences. End-user trends indicate a growing appetite for diverse genres and intimate, unique venue experiences, alongside a strong demand for major festivals. Mergers and acquisitions (M&A) remain a significant strategy for market consolidation and expansion, with recent deal values estimated in the hundreds of millions of dollars, further shaping market concentration.

United States Live Music Market Industry Trends & Insights

The United States live music market is experiencing robust growth, projected to achieve a Compound Annual Growth Rate (CAGR) of approximately 8.5% over the forecast period. This expansion is propelled by several key trends, including a post-pandemic resurgence in demand for in-person entertainment, a growing disposable income among target demographics, and the enduring cultural significance of live performances. Technological disruptions are playing a pivotal role, with advancements in ticketing platforms, such as Ticketmaster, enhancing convenience and combating scalping through features like dynamic pricing and verified fan programs. The rise of streaming services, while a potential substitute, also acts as a powerful discovery tool for new artists, driving demand for their live shows. Consumer preferences are shifting towards more experiential and personalized events, with a notable increase in demand for boutique festivals and niche genre gatherings. Furthermore, the growing influence of social media in driving event awareness and engagement continues to shape market penetration for both established and emerging artists. The competitive landscape remains intense, with established giants actively acquiring smaller promoters and ticketing platforms to broaden their reach and service offerings. The overall market penetration for live music experiences is expected to deepen as artists continue to connect with fans through authentic, in-person interactions, solidifying the market's resilience and appeal. The estimated market revenue is projected to reach $50 Billion in 2025.

Dominant Markets & Segments in United States Live Music Market

The United States live music market is undeniably dominated by Concerts as the primary application, accounting for over 60% of the total market revenue. This segment's dominance is fueled by the unwavering popularity of major artists and bands across various genres, attracting massive audiences and significant ticket sales.

Tickets represent the largest revenue stream within the market, contributing over 75% of the overall revenue. The sheer volume of ticket sales for concerts, festivals, and other live events underscores their critical role in the industry's financial health.

Adults constitute the largest age demographic, representing approximately 70% of the live music audience. This segment possesses higher disposable incomes and a strong inclination towards leisure activities, making them the most consistent attendees of live events.

Large Venue sizes, typically arenas and stadiums, are the dominant force in terms of capacity and revenue generation for major tours and headlining acts. These venues are capable of hosting tens of thousands of attendees, maximizing ticket sales and ancillary revenue.

- Concerts: The consistent touring schedules of established artists, coupled with the emergence of new talent, ensures a steady demand for concert tickets. Economic policies supporting entertainment spending and robust infrastructure for hosting large-scale events further bolster this segment.

- Tickets: The widespread adoption of online ticketing platforms has streamlined the purchase process, contributing to higher sales volumes. Furthermore, the demand for premium seating and VIP experiences, often bundled with tickets, adds to their revenue dominance.

- Adults: A combination of increased leisure time, a greater appreciation for live performances as a form of social interaction, and targeted marketing efforts by promoters contribute to the dominance of this age group.

- Large Venue: The ability of large venues to attract major artists and generate significant revenue through ticket sales, concessions, and sponsorships solidifies their leading position. Investments in modern facilities and fan-friendly amenities enhance their appeal.

United States Live Music Market Product Developments

Product developments in the United States live music market are increasingly focused on enhancing the fan experience through technology and personalization. Innovations include advanced ticketing solutions offering dynamic pricing and secure resale markets, aiming to improve accessibility and fairness. Furthermore, the integration of augmented reality (AR) filters and interactive digital content for social media sharing, along with the exploration of virtual reality (VR) for immersive pre- or post-show experiences, are gaining traction. These developments aim to create deeper fan engagement, foster brand loyalty, and generate additional revenue streams beyond traditional ticket sales, offering distinct competitive advantages in a crowded entertainment landscape.

Report Scope & Segmentation Analysis

This report meticulously segments the United States live music market across several key dimensions to provide a granular understanding of its various components.

- Application: The market is analyzed by application, encompassing Concerts, Festivals, Theater, Corporate Events, and Weddings. Concerts and festivals are anticipated to lead in market size and growth projections, driven by consistent demand.

- Revenue: Revenue streams are segmented into Tickets, Sponsorship, and Merchandising. Tickets are projected to maintain the largest market share, though sponsorship deals are expected to grow significantly with increasing brand investment in live events.

- Age Group: The analysis covers Children, Teenagers, Adults, and Seniors. Adults are expected to represent the largest segment, with teenagers showing strong growth potential due to their active engagement with trending artists.

- Venue Size: The market is segmented by venue size, including Small, Medium, and Large. Large venues are expected to generate the highest revenue, while small and medium venues will cater to niche audiences and emerging artists, offering distinct competitive dynamics.

Key Drivers of United States Live Music Market Growth

The United States live music market's growth is propelled by a confluence of factors. Technologically, the increasing accessibility and adoption of online ticketing and fan engagement platforms streamline the customer journey. Economically, rising disposable incomes and a post-pandemic surge in consumer spending on experiences provide a strong tailwind. Regulatory environments, while needing careful navigation, generally support the expansion of the entertainment sector. Furthermore, the intrinsic human desire for shared experiences and the cultural significance of live performances by beloved artists remain fundamental growth catalysts. The robust infrastructure for hosting large-scale events and the consistent innovation in fan engagement further amplify these drivers, ensuring sustained market expansion.

Challenges in the United States Live Music Market Sector

Despite its growth trajectory, the United States live music market faces several significant challenges. Regulatory hurdles, particularly concerning ticketing practices and potential antitrust issues, can impact operational flexibility and profitability. Supply chain disruptions, though less pronounced than in other sectors, can still affect venue availability and artist touring logistics. Intense competitive pressures, both from established players and emerging digital entertainment alternatives, necessitate continuous innovation and strategic differentiation. Additionally, fluctuating economic conditions and consumer spending patterns can lead to unpredictable demand, requiring agile business models. The rising cost of production, artist fees, and venue rentals also presents a constant pressure on profit margins, demanding efficient cost management and creative revenue generation strategies.

Emerging Opportunities in United States Live Music Market

The United States live music market is ripe with emerging opportunities, driven by evolving consumer preferences and technological advancements. The increasing demand for unique and personalized experiences opens doors for boutique festivals, intimate artist showcases, and experiential fan events. The integration of emerging technologies like augmented and virtual reality offers avenues for enhanced fan engagement and the creation of novel revenue streams. Furthermore, the growing focus on diversity and inclusion presents opportunities for promoting underrepresented genres and artists, tapping into new audience segments. The expansion of international artist tours into the US market and the growing popularity of domestic artists on a global scale also present significant growth prospects, promising a dynamic and evolving market landscape.

Leading Players in the United States Live Music Market Market

- Live Nation Entertainment

- AEG Presents

- Warner Music Group

- Ticketmaster

- Sony Music Entertainment

- C3 Presents

- Wasserman Music

- Anschutz Entertainment Group (AEG)

- Goldenvoice

- Bandsintown

Key Developments in United States Live Music Market Industry

- February 2024: The Black Music Action Coalition (BMAC) and Live Nation announced the launch of a music business intensive course and paid internship program for Summer 2024. Aimed at aspiring music professionals nationwide, it includes a week-long Los Angeles course, keynote talks, and opportunities for internships and apprenticeships with Live Nation to foster industry access and equity.

- July 2023: Sony Corporation, a subsidiary of Sony Music Entertainment, a leading advocate of creative freedom, unveiled its latest brand platform and campaign, "For The Music," highlighting its top-notch audio offerings and services.

Strategic Outlook for United States Live Music Market Market

The strategic outlook for the United States live music market remains highly positive, driven by sustained consumer demand for authentic, in-person entertainment. Key growth catalysts include the continued expansion of festival culture, the increasing sophistication of ticketing and fan engagement technologies, and the ongoing efforts to democratize access to the music industry. Strategic investments in infrastructure, partnerships with emerging artists, and a focus on delivering unique, memorable experiences will be crucial for stakeholders. Furthermore, adapting to evolving consumer preferences, such as the demand for diverse genres and sustainable practices, will shape future success. The market is poised for continued innovation and expansion, offering significant potential for growth and profitability for those who can effectively navigate its dynamic landscape.

United States Live Music Market Segmentation

-

1. Application

- 1.1. Concerts

- 1.2. Festivals

- 1.3. Theater

- 1.4. Corporate Events

- 1.5. Weddings

-

2. Revenue

- 2.1. Tickets

- 2.2. Sponsorship

- 2.3. Merchandising

-

3. Age Group

- 3.1. Children

- 3.2. Teenagers

- 3.3. Adults

- 3.4. Seniors

-

4. Venue Size

- 4.1. Small

- 4.2. Medium

- 4.3. Large

United States Live Music Market Segmentation By Geography

- 1. United States

United States Live Music Market Regional Market Share

Geographic Coverage of United States Live Music Market

United States Live Music Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.56% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Growing Consumer Preference for Live Music Events and Experiences; Diverse Range of Events

- 3.2.2 Including Concerts

- 3.2.3 Festivals

- 3.2.4 and Special Performances

- 3.3. Market Restrains

- 3.3.1 Growing Consumer Preference for Live Music Events and Experiences; Diverse Range of Events

- 3.3.2 Including Concerts

- 3.3.3 Festivals

- 3.3.4 and Special Performances

- 3.4. Market Trends

- 3.4.1. The Live Music Ticket Sales Type is Thriving in the US Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Live Music Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Concerts

- 5.1.2. Festivals

- 5.1.3. Theater

- 5.1.4. Corporate Events

- 5.1.5. Weddings

- 5.2. Market Analysis, Insights and Forecast - by Revenue

- 5.2.1. Tickets

- 5.2.2. Sponsorship

- 5.2.3. Merchandising

- 5.3. Market Analysis, Insights and Forecast - by Age Group

- 5.3.1. Children

- 5.3.2. Teenagers

- 5.3.3. Adults

- 5.3.4. Seniors

- 5.4. Market Analysis, Insights and Forecast - by Venue Size

- 5.4.1. Small

- 5.4.2. Medium

- 5.4.3. Large

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Live Nation Entertainment

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 AEG Presents

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Warner Music Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ticketmaster

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sony Music Entertainment

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 C3 Presents

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Wasserman Music

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Anschutz Entertainment Group (AEG)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Goldenvoice

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Bandsintown**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Live Nation Entertainment

List of Figures

- Figure 1: United States Live Music Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Live Music Market Share (%) by Company 2025

List of Tables

- Table 1: United States Live Music Market Revenue Million Forecast, by Application 2020 & 2033

- Table 2: United States Live Music Market Volume Billion Forecast, by Application 2020 & 2033

- Table 3: United States Live Music Market Revenue Million Forecast, by Revenue 2020 & 2033

- Table 4: United States Live Music Market Volume Billion Forecast, by Revenue 2020 & 2033

- Table 5: United States Live Music Market Revenue Million Forecast, by Age Group 2020 & 2033

- Table 6: United States Live Music Market Volume Billion Forecast, by Age Group 2020 & 2033

- Table 7: United States Live Music Market Revenue Million Forecast, by Venue Size 2020 & 2033

- Table 8: United States Live Music Market Volume Billion Forecast, by Venue Size 2020 & 2033

- Table 9: United States Live Music Market Revenue Million Forecast, by Region 2020 & 2033

- Table 10: United States Live Music Market Volume Billion Forecast, by Region 2020 & 2033

- Table 11: United States Live Music Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: United States Live Music Market Volume Billion Forecast, by Application 2020 & 2033

- Table 13: United States Live Music Market Revenue Million Forecast, by Revenue 2020 & 2033

- Table 14: United States Live Music Market Volume Billion Forecast, by Revenue 2020 & 2033

- Table 15: United States Live Music Market Revenue Million Forecast, by Age Group 2020 & 2033

- Table 16: United States Live Music Market Volume Billion Forecast, by Age Group 2020 & 2033

- Table 17: United States Live Music Market Revenue Million Forecast, by Venue Size 2020 & 2033

- Table 18: United States Live Music Market Volume Billion Forecast, by Venue Size 2020 & 2033

- Table 19: United States Live Music Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: United States Live Music Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Live Music Market?

The projected CAGR is approximately 8.56%.

2. Which companies are prominent players in the United States Live Music Market?

Key companies in the market include Live Nation Entertainment, AEG Presents, Warner Music Group, Ticketmaster, Sony Music Entertainment, C3 Presents, Wasserman Music, Anschutz Entertainment Group (AEG), Goldenvoice, Bandsintown**List Not Exhaustive.

3. What are the main segments of the United States Live Music Market?

The market segments include Application, Revenue, Age Group, Venue Size.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.37 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Consumer Preference for Live Music Events and Experiences; Diverse Range of Events. Including Concerts. Festivals. and Special Performances.

6. What are the notable trends driving market growth?

The Live Music Ticket Sales Type is Thriving in the US Market.

7. Are there any restraints impacting market growth?

Growing Consumer Preference for Live Music Events and Experiences; Diverse Range of Events. Including Concerts. Festivals. and Special Performances.

8. Can you provide examples of recent developments in the market?

February 2024: The Black Music Action Coalition (BMAC) and Live Nation announced the launch of a music business intensive course and paid internship program for Summer 2024. Aimed at aspiring music professionals nationwide, it includes a week-long Los Angeles course, keynote talks, and opportunities for internships and apprenticeships with Live Nation to foster industry access and equity.July 2023: Sony Corporation, a subsidiary of Sony Music Entertainment, a leading advocate of creative freedom, unveiled its latest brand platform and campaign, "For The Music," highlighting its top-notch audio offerings and services.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Live Music Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Live Music Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Live Music Market?

To stay informed about further developments, trends, and reports in the United States Live Music Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence