Key Insights

The Financial Advisory Services market is projected for significant expansion, forecasting a Compound Annual Growth Rate (CAGR) of 8.9%. This growth trajectory is supported by increasing demand for wealth management solutions from high-net-worth individuals and a rising number of retail investors seeking expert financial guidance. The escalating complexity of financial instruments and evolving regulatory landscapes further propel the need for specialized advisory services in areas such as investment management, retirement planning, and tax optimization. Technological innovations, including robo-advisors and advanced data analytics, are enhancing market efficiency and accessibility. Despite potential challenges from regulatory oversight and economic volatility, the market's long-term outlook remains strong, driven by sustained economic development and demographic shifts, such as an aging global population requiring comprehensive financial planning. The projected market size is 134.87 billion by 2025.

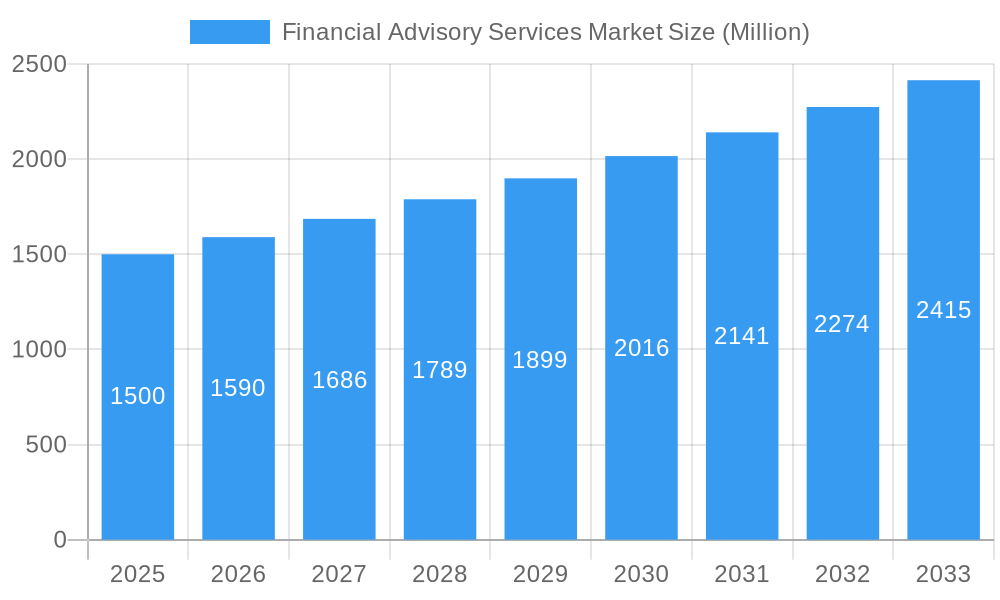

Financial Advisory Services Market Market Size (In Billion)

Key market players include Bank of America, BCG Group, Goldman Sachs, JP Morgan Chase, Morgan Stanley, Deloitte, EY Financial Services, KPMG, PwC, and Wells Fargo, indicating a competitive and consolidating sector. The emergence of fintech companies and independent advisory firms is fostering a more dynamic and fragmented market. North America and Europe are anticipated to retain substantial market share due to high per capita income and robust financial infrastructure, while emerging markets are expected to experience accelerated growth driven by increasing affluence and financial literacy. Future market dynamics will be shaped by evolving investor preferences, technological advancements, and regulatory changes. Strategic innovation, partnerships, and a client-centric approach focused on delivering personalized, value-added services will be crucial for maintaining a competitive advantage.

Financial Advisory Services Market Company Market Share

Financial Advisory Services Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Financial Advisory Services market, encompassing market size, segmentation, key players, growth drivers, challenges, and future opportunities. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period spans 2025-2033, and the historical period encompasses 2019-2024. The report is essential for industry stakeholders, investors, and businesses seeking to understand and navigate this dynamic market.

Financial Advisory Services Market Concentration & Innovation

The Financial Advisory Services market exhibits a moderately concentrated landscape, dominated by a few large global players and numerous smaller, specialized firms. Key players such as Bank of America Corporation, BCG Group, Goldman Sachs Group Inc, JP Morgan Chase & Co, Morgan Stanley, Deloitte, EY Financial Services, KPMG, PwC, and Wells Fargo & Co (list not exhaustive) hold significant market share, collectively accounting for approximately xx% of the total market revenue in 2024. Market share data for individual players varies considerably based on the specific segment and geographical region. Mergers and acquisitions (M&A) activity has been a significant driver of market consolidation, with deal values exceeding $xx Million in the past five years. Innovation in the sector is driven by technological advancements, evolving regulatory frameworks, and shifting client preferences. These factors are compelling financial advisory firms to adopt digital platforms, implement advanced analytics, and offer personalized services. Product substitutes, such as robo-advisors, are emerging but still hold a relatively small market share, posing a growing threat to the traditional players. End-user trends toward greater transparency, accountability, and personalized financial planning are further shaping the market's evolution.

- Market Concentration: High in certain segments, moderate overall.

- Innovation Drivers: Technological advancements, regulatory changes, client preferences.

- M&A Activity: Significant consolidation, with deal values exceeding $xx Million in the past five years.

- Market Share: Top 10 players hold approximately xx% of the market in 2024.

Financial Advisory Services Market Industry Trends & Insights

The Financial Advisory Services market is experiencing robust growth, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is primarily fueled by increasing wealth management needs across global populations, rising disposable incomes in developing economies, and the growing adoption of sophisticated investment strategies. The market penetration of financial advisory services remains relatively low in several emerging markets, signifying significant untapped potential. Technological disruptions, such as the rise of fintech and robo-advisors, are reshaping the competitive landscape, prompting traditional players to adapt and integrate innovative solutions. Consumer preferences are increasingly geared toward personalized, digitally-enabled services, pushing firms to enhance their client experience and technology capabilities. Competitive dynamics are characterized by price competition, service differentiation, and strategic partnerships. The market is witnessing a shift towards comprehensive wealth management solutions, integrating financial planning, investment management, and tax advisory services under one umbrella.

Dominant Markets & Segments in Financial Advisory Services Market

The North American region currently dominates the global Financial Advisory Services market, accounting for approximately xx% of the total revenue in 2024. This dominance is attributed to several key factors:

- Strong Economic Growth: A robust economy and high levels of disposable income drive demand for financial advisory services.

- Developed Financial Infrastructure: Well-established financial markets and regulatory frameworks facilitate market growth.

- High Adoption of Technology: Early adoption of fintech and digital platforms fuels innovation and market expansion.

Other key regions, such as Europe and Asia-Pacific, are also experiencing significant growth, driven by their own unique economic and demographic trends. Within the market segmentation, the wealth management segment holds the largest market share due to the substantial growth in high-net-worth individuals. Other segments include retirement planning, investment banking, and corporate finance, each experiencing variable rates of growth. A detailed breakdown of regional and segmental performance and associated market sizes is provided in the complete report.

Financial Advisory Services Market Product Developments

Recent product innovations in the Financial Advisory Services market focus on leveraging technology to enhance client experience and improve service efficiency. This includes the development of sophisticated investment platforms, digital tools for financial planning, and AI-powered robo-advisors offering personalized investment strategies at lower costs. These innovations address evolving client preferences for personalized and cost-effective solutions, enhancing competitiveness within the market. The market fit of these new products hinges on their ability to seamlessly integrate with existing financial systems and effectively meet the specific needs of diverse customer segments.

Report Scope & Segmentation Analysis

This report provides a comprehensive segmentation of the Financial Advisory Services market across various parameters, including geography (North America, Europe, Asia-Pacific, Middle East & Africa, South America), service type (wealth management, retirement planning, investment banking, corporate finance), client type (individuals, institutions, corporations), and delivery channel (online, offline, hybrid). Each segment's projected growth, market size, and competitive dynamics are analyzed in detail within the complete report. For instance, the wealth management segment is projected to experience significant growth driven by rising affluence and changing consumer preferences.

Key Drivers of Financial Advisory Services Market Growth

Several factors drive the growth of the Financial Advisory Services market:

- Rising Disposable Incomes: Increased purchasing power leads to higher demand for financial planning and investment services.

- Aging Population: Growing elderly populations create a need for retirement planning and wealth management services.

- Technological Advancements: Digital solutions enhance efficiency, personalize offerings, and improve client engagement.

- Favorable Regulatory Environment: Supportive government policies encourage market expansion and innovation.

Challenges in the Financial Advisory Services Market Sector

The Financial Advisory Services market faces several challenges:

- Regulatory Compliance: Stricter regulations increase operational costs and compliance complexities.

- Cybersecurity Threats: Increased digitalization heightens the risk of cyberattacks and data breaches.

- Intense Competition: The market is becoming increasingly competitive, with new entrants and technological disruptions posing pressure on margins.

- Economic Downturns: Market volatility and economic uncertainties can impact client investment behavior and demand for services. This impact can be quantified by observing a decrease in new client acquisitions and a slowdown in asset under management (AUM) growth.

Emerging Opportunities in Financial Advisory Services Market

The Financial Advisory Services market presents significant opportunities for growth:

- Expansion in Emerging Markets: Untapped potential in developing economies presents substantial growth opportunities.

- Sustainable and ESG Investing: Increasing demand for environmentally and socially responsible investments creates new market segments.

- AI-powered Solutions: Leveraging AI and machine learning to enhance efficiency and personalize services offers significant potential.

Leading Players in the Financial Advisory Services Market Market

- Bank of America Corporation

- BCG Group

- Goldman Sachs Group Inc

- JP Morgan Chase & Co

- Morgan Stanley

- Deloitte

- EY Financial Services

- KPMG

- PwC

- Wells Fargo & Co (List Not Exhaustive)

Key Developments in Financial Advisory Services Market Industry

- February 2023: Morgan Stanley Investment Management received approval from the China Securities Regulatory Commission (CSRC) to take full control of Morgan Stanley Huaxin Funds, expanding its presence in China. This signifies a strategic move to tap into the growing Chinese market.

- February 2023: Boston Consulting Group hired Axel Weber, former president of Germany's central bank and UBS chairman, as a senior advisor. This strengthens BCG's expertise and network in the financial services sector, potentially impacting their advisory capabilities and market positioning.

Strategic Outlook for Financial Advisory Services Market Market

The Financial Advisory Services market is poised for continued growth, driven by long-term trends such as rising wealth, technological advancements, and evolving consumer preferences. Future opportunities lie in leveraging emerging technologies, expanding into new markets, and developing innovative products and services tailored to the evolving needs of clients. A focus on personalized, digitally-enabled solutions will be critical for success in this competitive landscape. The market is expected to remain dynamic, with ongoing consolidation and innovation shaping the competitive landscape in the coming years.

Financial Advisory Services Market Segmentation

-

1. Type

- 1.1. Corporate Finance

- 1.2. Accounting Advisory

- 1.3. Tax Advisory

- 1.4. Transaction Services

- 1.5. Risk Management

-

2. Organization Size

- 2.1. Large Enterprises

- 2.2. Small & Medium-Sized Enterprises

-

3. Industry Vertical

- 3.1. Bfsi

- 3.2. It And Telecom

- 3.3. Manufacturing

- 3.4. Retail And E-Commerce

- 3.5. Public Sector

- 3.6. Healthcare

Financial Advisory Services Market Segmentation By Geography

-

1. North America

- 1.1. USA

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. UK

- 2.2. Germany

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. Australia

- 3.4. India

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. Saudi Arabia

- 4.2. Egypt

- 4.3. UAE

- 4.4. Rest of Middle East and Africa

-

5. South America

- 5.1. Argentina

- 5.2. Colombia

- 5.3. Rest of South America

Financial Advisory Services Market Regional Market Share

Geographic Coverage of Financial Advisory Services Market

Financial Advisory Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Majority of Revenues generated from United states

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Financial Advisory Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Corporate Finance

- 5.1.2. Accounting Advisory

- 5.1.3. Tax Advisory

- 5.1.4. Transaction Services

- 5.1.5. Risk Management

- 5.2. Market Analysis, Insights and Forecast - by Organization Size

- 5.2.1. Large Enterprises

- 5.2.2. Small & Medium-Sized Enterprises

- 5.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 5.3.1. Bfsi

- 5.3.2. It And Telecom

- 5.3.3. Manufacturing

- 5.3.4. Retail And E-Commerce

- 5.3.5. Public Sector

- 5.3.6. Healthcare

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Financial Advisory Services Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Corporate Finance

- 6.1.2. Accounting Advisory

- 6.1.3. Tax Advisory

- 6.1.4. Transaction Services

- 6.1.5. Risk Management

- 6.2. Market Analysis, Insights and Forecast - by Organization Size

- 6.2.1. Large Enterprises

- 6.2.2. Small & Medium-Sized Enterprises

- 6.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 6.3.1. Bfsi

- 6.3.2. It And Telecom

- 6.3.3. Manufacturing

- 6.3.4. Retail And E-Commerce

- 6.3.5. Public Sector

- 6.3.6. Healthcare

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Financial Advisory Services Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Corporate Finance

- 7.1.2. Accounting Advisory

- 7.1.3. Tax Advisory

- 7.1.4. Transaction Services

- 7.1.5. Risk Management

- 7.2. Market Analysis, Insights and Forecast - by Organization Size

- 7.2.1. Large Enterprises

- 7.2.2. Small & Medium-Sized Enterprises

- 7.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 7.3.1. Bfsi

- 7.3.2. It And Telecom

- 7.3.3. Manufacturing

- 7.3.4. Retail And E-Commerce

- 7.3.5. Public Sector

- 7.3.6. Healthcare

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Financial Advisory Services Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Corporate Finance

- 8.1.2. Accounting Advisory

- 8.1.3. Tax Advisory

- 8.1.4. Transaction Services

- 8.1.5. Risk Management

- 8.2. Market Analysis, Insights and Forecast - by Organization Size

- 8.2.1. Large Enterprises

- 8.2.2. Small & Medium-Sized Enterprises

- 8.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 8.3.1. Bfsi

- 8.3.2. It And Telecom

- 8.3.3. Manufacturing

- 8.3.4. Retail And E-Commerce

- 8.3.5. Public Sector

- 8.3.6. Healthcare

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East and Africa Financial Advisory Services Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Corporate Finance

- 9.1.2. Accounting Advisory

- 9.1.3. Tax Advisory

- 9.1.4. Transaction Services

- 9.1.5. Risk Management

- 9.2. Market Analysis, Insights and Forecast - by Organization Size

- 9.2.1. Large Enterprises

- 9.2.2. Small & Medium-Sized Enterprises

- 9.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 9.3.1. Bfsi

- 9.3.2. It And Telecom

- 9.3.3. Manufacturing

- 9.3.4. Retail And E-Commerce

- 9.3.5. Public Sector

- 9.3.6. Healthcare

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. South America Financial Advisory Services Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Corporate Finance

- 10.1.2. Accounting Advisory

- 10.1.3. Tax Advisory

- 10.1.4. Transaction Services

- 10.1.5. Risk Management

- 10.2. Market Analysis, Insights and Forecast - by Organization Size

- 10.2.1. Large Enterprises

- 10.2.2. Small & Medium-Sized Enterprises

- 10.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 10.3.1. Bfsi

- 10.3.2. It And Telecom

- 10.3.3. Manufacturing

- 10.3.4. Retail And E-Commerce

- 10.3.5. Public Sector

- 10.3.6. Healthcare

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Bank of America Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 BCG Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Goldman Sachs Group Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 JP Morgan Chase & Co

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Morgan Stanley

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Deloitte

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 EY Financial Services

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 KPMG

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Pwc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Wells Fargo & Co**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Bank of America Corporation

List of Figures

- Figure 1: Global Financial Advisory Services Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Financial Advisory Services Market Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Financial Advisory Services Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Financial Advisory Services Market Revenue (billion), by Organization Size 2025 & 2033

- Figure 5: North America Financial Advisory Services Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 6: North America Financial Advisory Services Market Revenue (billion), by Industry Vertical 2025 & 2033

- Figure 7: North America Financial Advisory Services Market Revenue Share (%), by Industry Vertical 2025 & 2033

- Figure 8: North America Financial Advisory Services Market Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Financial Advisory Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Financial Advisory Services Market Revenue (billion), by Type 2025 & 2033

- Figure 11: Europe Financial Advisory Services Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Financial Advisory Services Market Revenue (billion), by Organization Size 2025 & 2033

- Figure 13: Europe Financial Advisory Services Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 14: Europe Financial Advisory Services Market Revenue (billion), by Industry Vertical 2025 & 2033

- Figure 15: Europe Financial Advisory Services Market Revenue Share (%), by Industry Vertical 2025 & 2033

- Figure 16: Europe Financial Advisory Services Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Financial Advisory Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Financial Advisory Services Market Revenue (billion), by Type 2025 & 2033

- Figure 19: Asia Pacific Financial Advisory Services Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Pacific Financial Advisory Services Market Revenue (billion), by Organization Size 2025 & 2033

- Figure 21: Asia Pacific Financial Advisory Services Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 22: Asia Pacific Financial Advisory Services Market Revenue (billion), by Industry Vertical 2025 & 2033

- Figure 23: Asia Pacific Financial Advisory Services Market Revenue Share (%), by Industry Vertical 2025 & 2033

- Figure 24: Asia Pacific Financial Advisory Services Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Financial Advisory Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Financial Advisory Services Market Revenue (billion), by Type 2025 & 2033

- Figure 27: Middle East and Africa Financial Advisory Services Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Financial Advisory Services Market Revenue (billion), by Organization Size 2025 & 2033

- Figure 29: Middle East and Africa Financial Advisory Services Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 30: Middle East and Africa Financial Advisory Services Market Revenue (billion), by Industry Vertical 2025 & 2033

- Figure 31: Middle East and Africa Financial Advisory Services Market Revenue Share (%), by Industry Vertical 2025 & 2033

- Figure 32: Middle East and Africa Financial Advisory Services Market Revenue (billion), by Country 2025 & 2033

- Figure 33: Middle East and Africa Financial Advisory Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Financial Advisory Services Market Revenue (billion), by Type 2025 & 2033

- Figure 35: South America Financial Advisory Services Market Revenue Share (%), by Type 2025 & 2033

- Figure 36: South America Financial Advisory Services Market Revenue (billion), by Organization Size 2025 & 2033

- Figure 37: South America Financial Advisory Services Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 38: South America Financial Advisory Services Market Revenue (billion), by Industry Vertical 2025 & 2033

- Figure 39: South America Financial Advisory Services Market Revenue Share (%), by Industry Vertical 2025 & 2033

- Figure 40: South America Financial Advisory Services Market Revenue (billion), by Country 2025 & 2033

- Figure 41: South America Financial Advisory Services Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Financial Advisory Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Financial Advisory Services Market Revenue billion Forecast, by Organization Size 2020 & 2033

- Table 3: Global Financial Advisory Services Market Revenue billion Forecast, by Industry Vertical 2020 & 2033

- Table 4: Global Financial Advisory Services Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Financial Advisory Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Global Financial Advisory Services Market Revenue billion Forecast, by Organization Size 2020 & 2033

- Table 7: Global Financial Advisory Services Market Revenue billion Forecast, by Industry Vertical 2020 & 2033

- Table 8: Global Financial Advisory Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: USA Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global Financial Advisory Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 13: Global Financial Advisory Services Market Revenue billion Forecast, by Organization Size 2020 & 2033

- Table 14: Global Financial Advisory Services Market Revenue billion Forecast, by Industry Vertical 2020 & 2033

- Table 15: Global Financial Advisory Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: UK Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Germany Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: France Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Italy Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Spain Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Global Financial Advisory Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 23: Global Financial Advisory Services Market Revenue billion Forecast, by Organization Size 2020 & 2033

- Table 24: Global Financial Advisory Services Market Revenue billion Forecast, by Industry Vertical 2020 & 2033

- Table 25: Global Financial Advisory Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 26: China Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Japan Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Australia Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: India Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: South Korea Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Financial Advisory Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 33: Global Financial Advisory Services Market Revenue billion Forecast, by Organization Size 2020 & 2033

- Table 34: Global Financial Advisory Services Market Revenue billion Forecast, by Industry Vertical 2020 & 2033

- Table 35: Global Financial Advisory Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Saudi Arabia Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Egypt Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: UAE Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Rest of Middle East and Africa Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Global Financial Advisory Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 41: Global Financial Advisory Services Market Revenue billion Forecast, by Organization Size 2020 & 2033

- Table 42: Global Financial Advisory Services Market Revenue billion Forecast, by Industry Vertical 2020 & 2033

- Table 43: Global Financial Advisory Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 44: Argentina Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Colombia Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of South America Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Financial Advisory Services Market?

The projected CAGR is approximately 8.9%.

2. Which companies are prominent players in the Financial Advisory Services Market?

Key companies in the market include Bank of America Corporation, BCG Group, Goldman Sachs Group Inc, JP Morgan Chase & Co, Morgan Stanley, Deloitte, EY Financial Services, KPMG, Pwc, Wells Fargo & Co**List Not Exhaustive.

3. What are the main segments of the Financial Advisory Services Market?

The market segments include Type, Organization Size, Industry Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 134.87 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Majority of Revenues generated from United states.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2023: Morgan Stanley Investment Management announced that it had received approval from the China Securities Regulatory Commission (CSRC) to take a full controlling stake in Morgan Stanley Huaxin Funds, marking a key strategic advancement for the company's broader footprint in China.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Financial Advisory Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Financial Advisory Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Financial Advisory Services Market?

To stay informed about further developments, trends, and reports in the Financial Advisory Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence