Key Insights

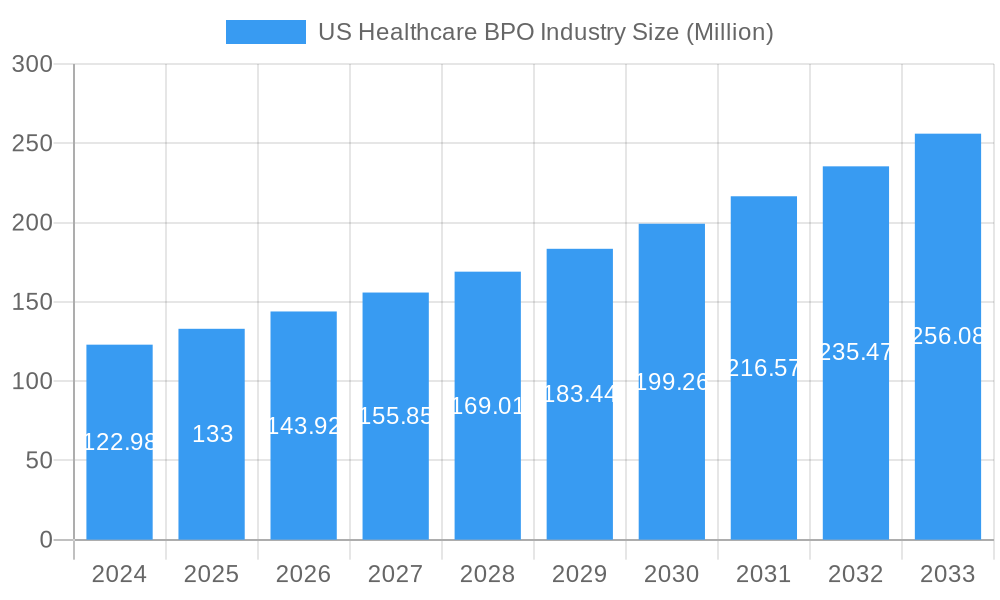

The US Healthcare BPO (Business Process Outsourcing) market is poised for robust expansion, projected to reach $133 Million by 2025. This significant growth is underpinned by a Compound Annual Growth Rate (CAGR) of 8.11% between 2025 and 2033. The primary drivers fueling this upward trajectory include the relentless pressure on healthcare providers and payers to optimize operational efficiencies, reduce administrative burdens, and enhance patient care delivery. The increasing complexity of healthcare regulations, the growing need for specialized expertise in areas like claims management and revenue cycle management, and the strategic advantage of leveraging third-party specialists for non-core functions are all contributing to the escalating adoption of BPO services. Furthermore, the digital transformation within the healthcare sector, with its emphasis on data analytics, AI-powered solutions, and telehealth, is creating new avenues for BPO providers to offer innovative and value-added services.

US Healthcare BPO Industry Market Size (In Million)

The market's segmentation reveals a dynamic landscape where both payer and pharmaceutical services are experiencing considerable demand. Within payer services, Human Resource Management, Claims Management, and Customer Relationship Management (CRM) are emerging as key areas of focus, reflecting the industry's commitment to improving member satisfaction and streamlining administrative processes. Simultaneously, the pharmaceutical sector is increasingly outsourcing Research and Development, Manufacturing support, and various Non-clinical Services, such as Supply Chain Management and Sales and Marketing, to gain agility and access specialized capabilities. Leading companies like Accenture PLC, Cognizant, and UnitedHealth Group Incorporated are at the forefront, offering comprehensive BPO solutions. However, the market also presents opportunities for specialized players and emerging technologies to carve out their niche, driven by the constant pursuit of cost-effectiveness and superior service quality across the entire healthcare ecosystem.

US Healthcare BPO Industry Company Market Share

This in-depth report provides a definitive analysis of the US Healthcare BPO industry, examining its current landscape, future trajectory, and the strategic imperatives for stakeholders. Spanning a comprehensive study period from 2019 to 2033, with a base year of 2025, this report offers critical insights into market dynamics, growth drivers, competitive strategies, and emerging opportunities. Dive deep into the evolving needs of payer services and pharmaceutical services, understanding how business process outsourcing is revolutionizing efficiency, cost-effectiveness, and patient outcomes across the healthcare ecosystem.

US Healthcare BPO Industry Market Concentration & Innovation

The US Healthcare BPO industry exhibits a moderate to high market concentration, with a few dominant players holding significant market share. Key innovators are driving advancements through AI, automation, and data analytics, significantly impacting operational efficiency and cost reduction. Regulatory frameworks, such as HIPAA compliance, continue to shape service offerings and data security protocols, while the threat of product substitutes remains relatively low due to the specialized nature of healthcare outsourcing. End-user trends are increasingly focused on digital transformation, personalized patient experiences, and value-based care. Mergers and acquisitions (M&A) are a notable feature, with an estimated $500 million in deal values observed in the historical period, as companies seek to expand service portfolios and geographical reach. Accenture PLC and Cognizant are consistently at the forefront of these strategic moves, demonstrating significant investment in innovation.

US Healthcare BPO Industry Industry Trends & Insights

The US Healthcare BPO industry is poised for robust growth, driven by the escalating complexities of healthcare administration, rising operational costs, and the persistent need for specialized expertise. A projected Compound Annual Growth Rate (CAGR) of 12.5% from 2025 to 2033 underscores this upward trajectory. Technological disruptions, including the widespread adoption of Robotic Process Automation (RPA), Artificial Intelligence (AI) for claims processing and customer service, and cloud-based solutions, are fundamentally reshaping how healthcare organizations operate. Consumer preferences are increasingly demanding seamless, personalized, and digitally enabled healthcare experiences, pushing BPO providers to enhance their customer relationship management (CRM) capabilities and focus on patient engagement strategies. Competitive dynamics are intensifying, with a continuous drive for greater efficiency, enhanced data security, and adherence to stringent regulatory requirements. Market penetration is expected to reach 75% for core administrative functions by 2033, as more organizations recognize the strategic advantage of outsourcing non-core but critical processes. The shift towards value-based care models further incentivizes outsourcing to manage data analytics and population health management more effectively.

Dominant Markets & Segments in US Healthcare BPO Industry

Within the US Healthcare BPO industry, Payer Services consistently emerges as the dominant market segment, driven by the intricate demands of managing large patient populations, processing claims, and ensuring regulatory compliance. Specifically, Claims Management and Customer Relationship Management (CRM) are leading sub-segments, accounting for an estimated 35% and 25% of the total payer service market respectively. The economic policies aimed at healthcare cost containment and the robust infrastructure supporting digital healthcare initiatives in the US contribute significantly to this dominance.

- Payer Service: Claims Management: This segment is propelled by the sheer volume of claims, the complexity of coding and adjudication processes, and the need for rapid, accurate processing to ensure provider and patient satisfaction. Outsourcing offers economies of scale and specialized expertise, leading to reduced error rates and faster reimbursement cycles.

- Payer Service: Customer Relationship Management (CRM): With a growing emphasis on patient experience, healthcare payers are increasingly outsourcing CRM functions to enhance member engagement, provide efficient support, and manage inquiries effectively. This includes managing call centers, digital communication channels, and personalized outreach programs.

- Payer Service: Operational/Administrative Management: This broad category encompasses a range of back-office functions such as enrollment and eligibility verification, billing, and accounts receivable management. Outsourcing these functions allows payers to focus on core competencies while leveraging BPO providers for cost-effective execution.

- Payer Service: Care Management: As value-based care gains traction, outsourcing of care management services, including patient outreach, chronic disease management support, and care coordination, is on the rise. BPO providers facilitate data aggregation and patient engagement initiatives.

- Pharmaceutical Service: Non-clinical Services: While Payer Services dominate, Pharmaceutical Services, particularly Non-clinical Services, are showing significant growth. Within this, Supply Chain Management and Logistics and Sales and Marketing Services are key areas, driven by the need for efficient drug distribution and market access strategies. The estimated market share for non-clinical pharmaceutical services is around 20% and is projected to grow at a faster CAGR than some payer segments due to ongoing innovation in drug development and global market expansion.

US Healthcare BPO Industry Product Developments

Product developments in the US Healthcare BPO industry are heavily influenced by advancements in AI, machine learning, and automation. Companies are rolling out intelligent automation solutions for claims processing, revenue cycle management, and patient onboarding. Innovations in data analytics platforms are providing deeper insights into patient behavior and operational performance. Competitive advantages are being carved out through enhanced cybersecurity measures, cloud-native architectures, and integrated digital platforms that offer end-to-end solutions for payers and providers. The market fit is strong as these developments directly address the industry's core needs for efficiency, compliance, and improved patient outcomes.

US Healthcare BPO Industry Report Scope & Segmentation Analysis

This report meticulously segments the US Healthcare BPO Industry across key areas. Payer Services encompass Human Resource Management, Claims Management, Customer Relationship Management (CRM), Operational/Administrative Management, Care Management, Provider Management, and Other Payer Services. Pharmaceutical Services are further categorized into Research and Development, Manufacturing, and Non-clinical Services, with sub-segments including Supply Chain Management and Logistics, Sales and Marketing Services, and Other Non-clinical Services. Each segment is analyzed for its specific market size, growth projections, and competitive dynamics, providing a granular view of the outsourcing landscape.

Key Drivers of US Healthcare BPO Industry Growth

The US Healthcare BPO industry is propelled by several critical growth drivers. Technological advancements like AI and RPA are automating complex processes, leading to significant cost savings and improved accuracy. The economic imperative to reduce healthcare expenditure while enhancing service quality pushes organizations towards outsourcing non-core functions. Furthermore, evolving regulatory landscapes, such as the increasing focus on data privacy and interoperability, necessitate specialized expertise that BPO providers can offer. The growing demand for value-based care models also drives the need for advanced data analytics and patient engagement solutions, which are often outsourced.

Challenges in the US Healthcare BPO Industry Sector

Despite its growth, the US Healthcare BPO Industry Sector faces considerable challenges. Stringent regulatory compliance requirements, particularly concerning data privacy (HIPAA) and security, pose a constant hurdle. Cybersecurity threats remain a significant concern, demanding robust protective measures. Integration complexities with existing legacy systems within healthcare organizations can slow down implementation. Additionally, finding and retaining skilled talent with both technical and healthcare domain expertise is an ongoing challenge, impacting service delivery and innovation. Competitive pressures to offer increasingly sophisticated services at competitive prices also add to the operational strain.

Emerging Opportunities in US Healthcare BPO Industry

Emerging opportunities in the US Healthcare BPO Industry lie in the burgeoning fields of predictive analytics for population health management, AI-powered virtual assistants for patient engagement, and blockchain for secure data sharing. The increasing focus on telehealth and remote patient monitoring presents new avenues for BPO providers to manage associated administrative and data management tasks. Furthermore, the growing demand for personalized medicine and associated data management offers niche opportunities. The expansion of digital health platforms and the need for seamless integration across these platforms are creating a demand for specialized BPO services.

Leading Players in the US Healthcare BPO Industry Market

- Accenture PLC

- Cognizant

- UnitedHealth Group Incorporated*List Not Exhaustive

- GeBBs Healthcare Solutions

- IBM Corporation

- Sutherland Healthcare Solutions

- Parexel International

- IQVIA

- Capgemini

- Genpact Limited

Key Developments in US Healthcare BPO Industry Industry

- May 2023: Atento, a major provider of customer relationship and business process outsourcing (CRM/BPO) services, reported that Frost & Sullivan recognized it as a leader in the Frost Radar for Customer Experience and Outsourcing services in Latin America for 2022.

- March 2022: CPSI, a healthcare solutions company, acquired Healthcare Resource Group Inc., based in Spokane, Washington. HRG is a leading provider of customized revenue cycle management ('RCM') solutions and consulting services that enable hospitals and clinics to improve efficiency, profitability, and patient satisfaction.

Strategic Outlook for US Healthcare BPO Industry Market

The strategic outlook for the US Healthcare BPO Industry Market is exceptionally positive, driven by a confluence of factors. The ongoing digital transformation within healthcare, coupled with the persistent need for cost optimization and operational efficiency, will continue to fuel demand for outsourcing services. Providers that can effectively leverage AI, automation, and advanced analytics to offer end-to-end solutions and demonstrate clear ROI will be best positioned for success. Strategic partnerships, focus on specialized segments like cybersecurity and data management, and a commitment to enhancing patient and member experiences will be crucial for sustained growth and market leadership in the coming years.

US Healthcare BPO Industry Segmentation

-

1. Payer Service

- 1.1. Human Resource Management

- 1.2. Claims Management

- 1.3. Customer Relationship Management (CRM)

- 1.4. Operational/Administrative Management

- 1.5. Care Management

- 1.6. Provider Management

- 1.7. Other Payer Services

-

2. Pharmaceutical Service

- 2.1. Research and Development

- 2.2. Manufacturing

-

2.3. Non-clinical Services

- 2.3.1. Supply Chain Management and Logistics

- 2.3.2. Sales and Marketing Services

- 2.3.3. Other Non-clinical Services

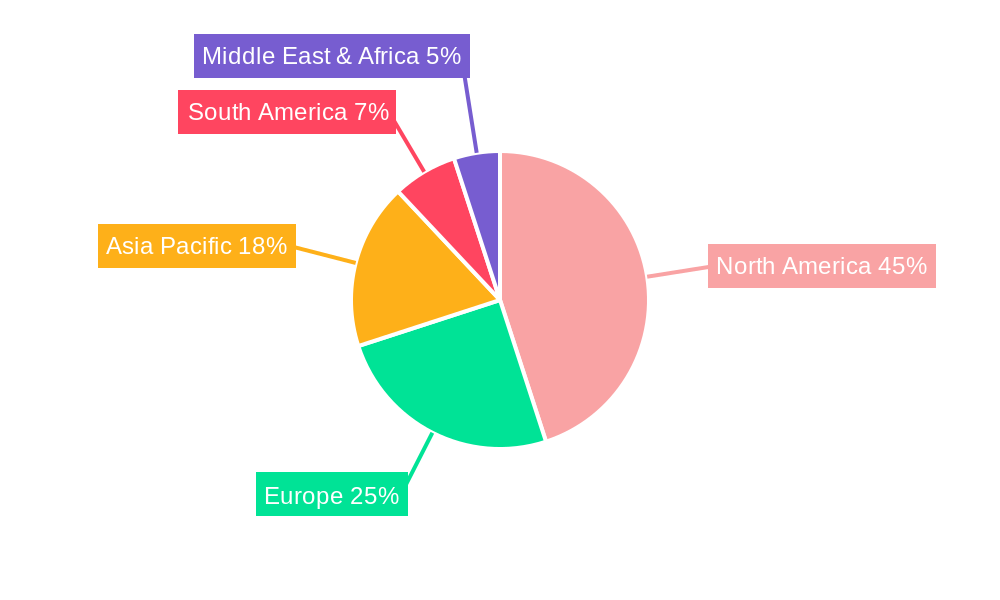

US Healthcare BPO Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Healthcare BPO Industry Regional Market Share

Geographic Coverage of US Healthcare BPO Industry

US Healthcare BPO Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.11% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid Increase in Clinical Process Outsourcing (CPO); Increasing R&D in the Healthcare Industry

- 3.3. Market Restrains

- 3.3.1. Data Integrity and Confidentiality

- 3.4. Market Trends

- 3.4.1. Claims Management is Expected to Grow with High CAGR in the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Healthcare BPO Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Payer Service

- 5.1.1. Human Resource Management

- 5.1.2. Claims Management

- 5.1.3. Customer Relationship Management (CRM)

- 5.1.4. Operational/Administrative Management

- 5.1.5. Care Management

- 5.1.6. Provider Management

- 5.1.7. Other Payer Services

- 5.2. Market Analysis, Insights and Forecast - by Pharmaceutical Service

- 5.2.1. Research and Development

- 5.2.2. Manufacturing

- 5.2.3. Non-clinical Services

- 5.2.3.1. Supply Chain Management and Logistics

- 5.2.3.2. Sales and Marketing Services

- 5.2.3.3. Other Non-clinical Services

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Payer Service

- 6. North America US Healthcare BPO Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Payer Service

- 6.1.1. Human Resource Management

- 6.1.2. Claims Management

- 6.1.3. Customer Relationship Management (CRM)

- 6.1.4. Operational/Administrative Management

- 6.1.5. Care Management

- 6.1.6. Provider Management

- 6.1.7. Other Payer Services

- 6.2. Market Analysis, Insights and Forecast - by Pharmaceutical Service

- 6.2.1. Research and Development

- 6.2.2. Manufacturing

- 6.2.3. Non-clinical Services

- 6.2.3.1. Supply Chain Management and Logistics

- 6.2.3.2. Sales and Marketing Services

- 6.2.3.3. Other Non-clinical Services

- 6.1. Market Analysis, Insights and Forecast - by Payer Service

- 7. South America US Healthcare BPO Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Payer Service

- 7.1.1. Human Resource Management

- 7.1.2. Claims Management

- 7.1.3. Customer Relationship Management (CRM)

- 7.1.4. Operational/Administrative Management

- 7.1.5. Care Management

- 7.1.6. Provider Management

- 7.1.7. Other Payer Services

- 7.2. Market Analysis, Insights and Forecast - by Pharmaceutical Service

- 7.2.1. Research and Development

- 7.2.2. Manufacturing

- 7.2.3. Non-clinical Services

- 7.2.3.1. Supply Chain Management and Logistics

- 7.2.3.2. Sales and Marketing Services

- 7.2.3.3. Other Non-clinical Services

- 7.1. Market Analysis, Insights and Forecast - by Payer Service

- 8. Europe US Healthcare BPO Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Payer Service

- 8.1.1. Human Resource Management

- 8.1.2. Claims Management

- 8.1.3. Customer Relationship Management (CRM)

- 8.1.4. Operational/Administrative Management

- 8.1.5. Care Management

- 8.1.6. Provider Management

- 8.1.7. Other Payer Services

- 8.2. Market Analysis, Insights and Forecast - by Pharmaceutical Service

- 8.2.1. Research and Development

- 8.2.2. Manufacturing

- 8.2.3. Non-clinical Services

- 8.2.3.1. Supply Chain Management and Logistics

- 8.2.3.2. Sales and Marketing Services

- 8.2.3.3. Other Non-clinical Services

- 8.1. Market Analysis, Insights and Forecast - by Payer Service

- 9. Middle East & Africa US Healthcare BPO Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Payer Service

- 9.1.1. Human Resource Management

- 9.1.2. Claims Management

- 9.1.3. Customer Relationship Management (CRM)

- 9.1.4. Operational/Administrative Management

- 9.1.5. Care Management

- 9.1.6. Provider Management

- 9.1.7. Other Payer Services

- 9.2. Market Analysis, Insights and Forecast - by Pharmaceutical Service

- 9.2.1. Research and Development

- 9.2.2. Manufacturing

- 9.2.3. Non-clinical Services

- 9.2.3.1. Supply Chain Management and Logistics

- 9.2.3.2. Sales and Marketing Services

- 9.2.3.3. Other Non-clinical Services

- 9.1. Market Analysis, Insights and Forecast - by Payer Service

- 10. Asia Pacific US Healthcare BPO Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Payer Service

- 10.1.1. Human Resource Management

- 10.1.2. Claims Management

- 10.1.3. Customer Relationship Management (CRM)

- 10.1.4. Operational/Administrative Management

- 10.1.5. Care Management

- 10.1.6. Provider Management

- 10.1.7. Other Payer Services

- 10.2. Market Analysis, Insights and Forecast - by Pharmaceutical Service

- 10.2.1. Research and Development

- 10.2.2. Manufacturing

- 10.2.3. Non-clinical Services

- 10.2.3.1. Supply Chain Management and Logistics

- 10.2.3.2. Sales and Marketing Services

- 10.2.3.3. Other Non-clinical Services

- 10.1. Market Analysis, Insights and Forecast - by Payer Service

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Accenture PLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Cognizant

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 UnitedHealth Group Incorporated*List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 GeBBs Healthcare Solutions

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 IBM Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Sutherland Healthcare Solutions

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Parexel International

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 IQVIA

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Capgemini

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Genpact Limited

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Accenture PLC

List of Figures

- Figure 1: Global US Healthcare BPO Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America US Healthcare BPO Industry Revenue (Million), by Payer Service 2025 & 2033

- Figure 3: North America US Healthcare BPO Industry Revenue Share (%), by Payer Service 2025 & 2033

- Figure 4: North America US Healthcare BPO Industry Revenue (Million), by Pharmaceutical Service 2025 & 2033

- Figure 5: North America US Healthcare BPO Industry Revenue Share (%), by Pharmaceutical Service 2025 & 2033

- Figure 6: North America US Healthcare BPO Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America US Healthcare BPO Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America US Healthcare BPO Industry Revenue (Million), by Payer Service 2025 & 2033

- Figure 9: South America US Healthcare BPO Industry Revenue Share (%), by Payer Service 2025 & 2033

- Figure 10: South America US Healthcare BPO Industry Revenue (Million), by Pharmaceutical Service 2025 & 2033

- Figure 11: South America US Healthcare BPO Industry Revenue Share (%), by Pharmaceutical Service 2025 & 2033

- Figure 12: South America US Healthcare BPO Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: South America US Healthcare BPO Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe US Healthcare BPO Industry Revenue (Million), by Payer Service 2025 & 2033

- Figure 15: Europe US Healthcare BPO Industry Revenue Share (%), by Payer Service 2025 & 2033

- Figure 16: Europe US Healthcare BPO Industry Revenue (Million), by Pharmaceutical Service 2025 & 2033

- Figure 17: Europe US Healthcare BPO Industry Revenue Share (%), by Pharmaceutical Service 2025 & 2033

- Figure 18: Europe US Healthcare BPO Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe US Healthcare BPO Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa US Healthcare BPO Industry Revenue (Million), by Payer Service 2025 & 2033

- Figure 21: Middle East & Africa US Healthcare BPO Industry Revenue Share (%), by Payer Service 2025 & 2033

- Figure 22: Middle East & Africa US Healthcare BPO Industry Revenue (Million), by Pharmaceutical Service 2025 & 2033

- Figure 23: Middle East & Africa US Healthcare BPO Industry Revenue Share (%), by Pharmaceutical Service 2025 & 2033

- Figure 24: Middle East & Africa US Healthcare BPO Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa US Healthcare BPO Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific US Healthcare BPO Industry Revenue (Million), by Payer Service 2025 & 2033

- Figure 27: Asia Pacific US Healthcare BPO Industry Revenue Share (%), by Payer Service 2025 & 2033

- Figure 28: Asia Pacific US Healthcare BPO Industry Revenue (Million), by Pharmaceutical Service 2025 & 2033

- Figure 29: Asia Pacific US Healthcare BPO Industry Revenue Share (%), by Pharmaceutical Service 2025 & 2033

- Figure 30: Asia Pacific US Healthcare BPO Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific US Healthcare BPO Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Healthcare BPO Industry Revenue Million Forecast, by Payer Service 2020 & 2033

- Table 2: Global US Healthcare BPO Industry Revenue Million Forecast, by Pharmaceutical Service 2020 & 2033

- Table 3: Global US Healthcare BPO Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global US Healthcare BPO Industry Revenue Million Forecast, by Payer Service 2020 & 2033

- Table 5: Global US Healthcare BPO Industry Revenue Million Forecast, by Pharmaceutical Service 2020 & 2033

- Table 6: Global US Healthcare BPO Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States US Healthcare BPO Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada US Healthcare BPO Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico US Healthcare BPO Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global US Healthcare BPO Industry Revenue Million Forecast, by Payer Service 2020 & 2033

- Table 11: Global US Healthcare BPO Industry Revenue Million Forecast, by Pharmaceutical Service 2020 & 2033

- Table 12: Global US Healthcare BPO Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil US Healthcare BPO Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina US Healthcare BPO Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America US Healthcare BPO Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global US Healthcare BPO Industry Revenue Million Forecast, by Payer Service 2020 & 2033

- Table 17: Global US Healthcare BPO Industry Revenue Million Forecast, by Pharmaceutical Service 2020 & 2033

- Table 18: Global US Healthcare BPO Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom US Healthcare BPO Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany US Healthcare BPO Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France US Healthcare BPO Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy US Healthcare BPO Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain US Healthcare BPO Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia US Healthcare BPO Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux US Healthcare BPO Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics US Healthcare BPO Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe US Healthcare BPO Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global US Healthcare BPO Industry Revenue Million Forecast, by Payer Service 2020 & 2033

- Table 29: Global US Healthcare BPO Industry Revenue Million Forecast, by Pharmaceutical Service 2020 & 2033

- Table 30: Global US Healthcare BPO Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey US Healthcare BPO Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel US Healthcare BPO Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC US Healthcare BPO Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa US Healthcare BPO Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa US Healthcare BPO Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa US Healthcare BPO Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global US Healthcare BPO Industry Revenue Million Forecast, by Payer Service 2020 & 2033

- Table 38: Global US Healthcare BPO Industry Revenue Million Forecast, by Pharmaceutical Service 2020 & 2033

- Table 39: Global US Healthcare BPO Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China US Healthcare BPO Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India US Healthcare BPO Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan US Healthcare BPO Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea US Healthcare BPO Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN US Healthcare BPO Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania US Healthcare BPO Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific US Healthcare BPO Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Healthcare BPO Industry?

The projected CAGR is approximately 8.11%.

2. Which companies are prominent players in the US Healthcare BPO Industry?

Key companies in the market include Accenture PLC, Cognizant, UnitedHealth Group Incorporated*List Not Exhaustive, GeBBs Healthcare Solutions, IBM Corporation, Sutherland Healthcare Solutions, Parexel International, IQVIA, Capgemini, Genpact Limited.

3. What are the main segments of the US Healthcare BPO Industry?

The market segments include Payer Service, Pharmaceutical Service.

4. Can you provide details about the market size?

The market size is estimated to be USD 133 Million as of 2022.

5. What are some drivers contributing to market growth?

Rapid Increase in Clinical Process Outsourcing (CPO); Increasing R&D in the Healthcare Industry.

6. What are the notable trends driving market growth?

Claims Management is Expected to Grow with High CAGR in the Forecast Period.

7. Are there any restraints impacting market growth?

Data Integrity and Confidentiality.

8. Can you provide examples of recent developments in the market?

May 2023: Atento, a major provider of customer relationship and business process outsourcing (CRM/BPO) services, reported that Frost & Sullivan recognized it as a leader in the Frost Radar for Customer Experience and Outsourcing services in Latin America for 2022.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Healthcare BPO Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Healthcare BPO Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Healthcare BPO Industry?

To stay informed about further developments, trends, and reports in the US Healthcare BPO Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence