Key Insights

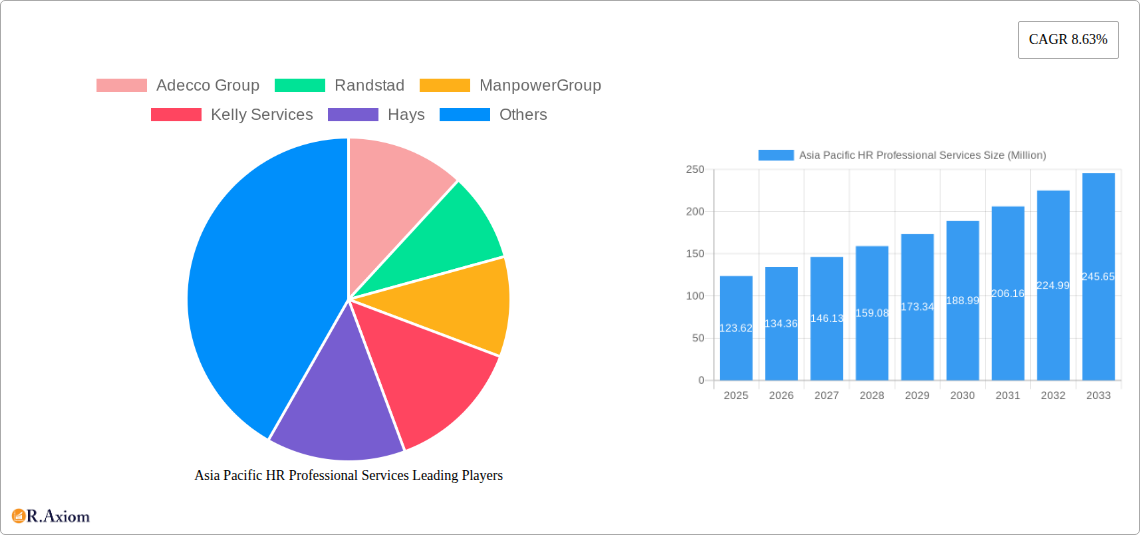

The Asia Pacific HR professional services market, valued at $123.62 million in 2025, is projected to experience robust growth, driven by several key factors. A rapidly expanding workforce, particularly in emerging economies like India and China, fuels significant demand for recruitment, talent management, and HR consulting services. The increasing adoption of technology, such as AI-powered recruitment tools and HR analytics platforms, is further boosting market expansion. Organizations are increasingly outsourcing HR functions to focus on core business activities, creating opportunities for specialized service providers. Furthermore, a growing emphasis on employee well-being and a competitive talent landscape are driving demand for strategic HR solutions. This trend is further supported by increasing investments in employee training and development initiatives across various industries. The market's growth is expected to continue at a Compound Annual Growth Rate (CAGR) of 8.63% from 2025 to 2033.

Asia Pacific HR Professional Services Market Size (In Million)

However, market expansion might face some challenges. The fluctuating economic conditions in certain regions within the Asia Pacific could impact spending on HR services. Additionally, intense competition among established players and the emergence of new entrants could put pressure on pricing and profitability. To maintain a competitive edge, firms are likely to focus on differentiation through specialized service offerings, technology integration, and regional expertise. Nevertheless, the long-term outlook for the Asia Pacific HR professional services market remains positive, driven by sustained economic growth and a constantly evolving HR landscape. Major players like Adecco Group, Randstad, ManpowerGroup, Kelly Services, Hays, Robert Half, Allegis Group, Hudson, Michael Page, and Mercer are well-positioned to capitalize on this growth, although the level of success will depend upon their ability to adapt to changing market dynamics.

Asia Pacific HR Professional Services Company Market Share

Asia Pacific HR Professional Services Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Asia Pacific HR professional services market, offering crucial insights for stakeholders, investors, and industry professionals. The study covers the period from 2019 to 2033, with a focus on the base year 2025 and a forecast period spanning 2025-2033. The report leverages extensive data analysis, incorporating market sizing, growth projections, competitive landscapes, and key trends influencing this dynamic sector. This report’s detailed segmentation and analysis of leading companies like Adecco Group, Randstad, ManpowerGroup, Kelly Services, Hays, Robert Half, Allegis Group, Hudson, Michael Page, and Mercer, provides a 360° view of this multi-billion dollar market.

Asia Pacific HR Professional Services Market Concentration & Innovation

The Asia Pacific HR professional services market exhibits a moderately concentrated landscape, with the top 10 players commanding an estimated xx% market share in 2025. This concentration is driven by the significant investments these companies make in technology, global reach, and brand recognition. However, a significant number of smaller, specialized firms are also thriving, particularly those catering to niche industry sectors or employing innovative HR technologies.

Market Concentration Metrics (2025 Estimates):

- Top 3 Players Market Share: xx%

- Top 5 Players Market Share: xx%

- Top 10 Players Market Share: xx%

Innovation Drivers:

- Technological advancements: The integration of AI, machine learning, and big data analytics is transforming recruitment processes, talent management, and HR analytics.

- Regulatory changes: Evolving labor laws and compliance requirements drive demand for specialized HR services.

- Globalization and talent mobility: The increasing need to manage diverse global workforces fuels demand for international HR solutions.

- M&A Activity: Strategic mergers and acquisitions are reshaping the market landscape, consolidating market share and accelerating innovation. Total M&A deal value in the past 5 years is estimated at $xx Million. Examples include [mention specific significant M&A deals if available].

Product Substitutes:

- In-house HR departments (increasingly leveraging technology) pose a competitive threat to some aspects of the professional services market.

- Automation tools offer alternative solutions for certain HR functions.

End-User Trends:

- Increasing focus on employee experience and well-being drives demand for specialized HR services in areas such as employee engagement and talent development.

- Demand for flexible work arrangements and remote work solutions continues to grow, driving innovation in talent acquisition and management.

Asia Pacific HR Professional Services Industry Trends & Insights

The Asia Pacific HR professional services market is experiencing robust growth, driven by several key factors. The region's burgeoning economies, particularly in Southeast Asia, are contributing significantly to market expansion. Furthermore, technological disruptions, changing consumer preferences (focus on employee experience), and intense competition are reshaping the industry.

- Market Growth Drivers: Rapid economic growth across the region, increasing demand for skilled labor, rising adoption of HR technologies, and the growth of the gig economy all contribute to a substantial CAGR of xx% during the forecast period (2025-2033).

- Technological Disruptions: AI-powered recruitment tools, HR analytics platforms, and learning management systems are transforming HR practices. Market penetration of these technologies is projected to reach xx% by 2033.

- Consumer Preferences: Employers increasingly prioritize employee well-being, diversity and inclusion, and creating a positive work environment. This is driving demand for specialized HR consulting and talent development services.

- Competitive Dynamics: The market is characterized by intense competition, with established players and emerging firms vying for market share. This competition is stimulating innovation and driving down prices in certain segments.

Dominant Markets & Segments in Asia Pacific HR Professional Services

China and India are currently the dominant markets within the Asia Pacific region, driven by their large and rapidly growing economies. However, other countries like Singapore, Australia, and Japan also represent significant market opportunities. Within the segment analysis, recruitment process outsourcing (RPO) and talent acquisition are experiencing the fastest growth, fueled by increasing demand for efficient and cost-effective hiring solutions.

Key Drivers of Dominance:

- China: Rapid economic expansion, massive workforce, and increasing adoption of advanced HR technologies.

- India: Large and skilled talent pool, growing IT sector, and increasing foreign investment.

- Singapore: Strong economic fundamentals, focus on innovation, and a highly skilled workforce.

- Australia: Developed economy, high demand for skilled workers, and robust regulatory framework.

- Japan: Mature economy, focus on improving worker productivity and efficiency, and significant investment in HR technology.

Asia Pacific HR Professional Services Product Developments

Recent product innovations include AI-powered recruitment platforms that automate candidate screening and matching, HR analytics dashboards that provide real-time insights into workforce trends, and learning management systems that personalize employee training and development programs. These advancements are enhancing efficiency, improving decision-making, and creating a more engaging employee experience. The market fit is strong due to the increasing demand for data-driven HR solutions and the growing recognition of the importance of employee experience.

Report Scope & Segmentation Analysis

This report segments the Asia Pacific HR professional services market based on service type (e.g., recruitment, talent management, HR consulting, payroll), industry vertical (e.g., IT, finance, healthcare), company size (small, medium, large), and country. Each segment exhibits unique growth trajectories and competitive dynamics, providing a granular view of the market’s complexities. Detailed growth projections and market sizes for each segment are provided in the full report. For example, the RPO segment is expected to exhibit a CAGR of xx% during the forecast period, driven by the increasing need for cost optimization and enhanced efficiency in talent acquisition.

Key Drivers of Asia Pacific HR Professional Services Growth

Several key factors drive the growth of the Asia Pacific HR professional services market. These include:

- Technological advancements: AI, machine learning, and big data analytics are transforming HR functions, leading to improved efficiency and decision-making.

- Economic growth: The region's rapid economic growth fuels demand for skilled labor, creating opportunities for HR service providers.

- Regulatory changes: Evolving labor laws and compliance requirements necessitate specialized HR expertise.

- Globalization and talent mobility: The increasing need to manage diverse global workforces drives demand for international HR solutions.

Challenges in the Asia Pacific HR Professional Services Sector

The Asia Pacific HR professional services sector faces several challenges, including:

- Intense competition: The market is highly competitive, with both established players and new entrants vying for market share.

- Regulatory hurdles: Navigating varying labor laws and compliance requirements across different countries can be complex and costly.

- Supply chain issues: The availability of skilled HR professionals can be a constraint, particularly in rapidly growing markets.

- Data security and privacy concerns: The increasing use of data-driven HR solutions raises concerns about data security and privacy. Breaches could cost companies millions of dollars in remediation and legal fees.

Emerging Opportunities in Asia Pacific HR Professional Services

The Asia Pacific HR professional services market presents several emerging opportunities:

- Growth in the gig economy: The increasing prevalence of freelance and contract work creates demand for specialized HR solutions to manage contingent workforces.

- Expansion into new markets: Untapped potential exists in smaller and less developed markets across the region.

- Focus on employee well-being: There is growing demand for HR services focused on improving employee engagement, well-being, and mental health.

- Adoption of new technologies: Innovative technologies such as AI, blockchain, and VR/AR offer opportunities to enhance HR processes and create new service offerings.

Leading Players in the Asia Pacific HR Professional Services Market

Key Developments in Asia Pacific HR Professional Services Industry

- July 2023: Kelly Services announced strategic restructuring measures to improve efficiency and effectiveness.

- May 2024: ManpowerGroup reaffirmed its commitment to VivaTech as a Platinum Partner.

Strategic Outlook for Asia Pacific HR Professional Services Market

The Asia Pacific HR professional services market is poised for continued growth, driven by technological advancements, economic expansion, and evolving workforce dynamics. The focus on employee experience, the rise of the gig economy, and the increasing adoption of data-driven HR solutions will create significant opportunities for service providers. Companies that successfully adapt to these trends and invest in innovative solutions will be well-positioned to capitalize on the market's potential.

Asia Pacific HR Professional Services Segmentation

-

1. Provider Type

- 1.1. Consulting Companies

- 1.2. Software-as-a-Service Providers Companies

-

2. Function Type

- 2.1. Recruitment and Talent Acquisition

- 2.2. Benefits and Claims Management

- 2.3. Workforce Planning and Analytics

- 2.4. Payroll And Compensation Management

- 2.5. Other Functions

-

3. End-user Industry

- 3.1. BFSI

- 3.2. Healthcare

- 3.3. IT & Telecom

- 3.4. Manufacturing

- 3.5. Retail

- 3.6. Government

- 3.7. Other Industries

-

4. Geography

-

4.1. Asia-Pacific

- 4.1.1. China

- 4.1.2. India

- 4.1.3. Japan

- 4.1.4. Australia

- 4.1.5. Rest of Asia-Pacific

-

4.1. Asia-Pacific

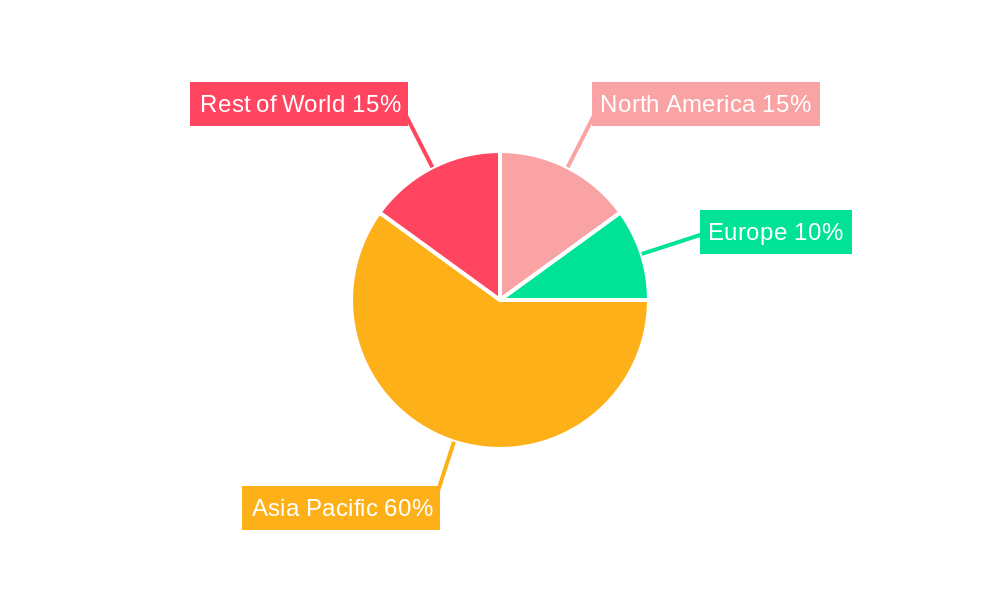

Asia Pacific HR Professional Services Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. Australia

- 1.5. Rest of Asia Pacific

Asia Pacific HR Professional Services Regional Market Share

Geographic Coverage of Asia Pacific HR Professional Services

Asia Pacific HR Professional Services REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.63% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Focus on Talent Acquisition and Retention; Adoption of Technology is Driving Demand for HR Services

- 3.3. Market Restrains

- 3.3.1. Growing Focus on Talent Acquisition and Retention; Adoption of Technology is Driving Demand for HR Services

- 3.4. Market Trends

- 3.4.1. Recruitment and Talent Acquisition is the Largest Segment in the Market Studied

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Asia Pacific HR Professional Services Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Provider Type

- 5.1.1. Consulting Companies

- 5.1.2. Software-as-a-Service Providers Companies

- 5.2. Market Analysis, Insights and Forecast - by Function Type

- 5.2.1. Recruitment and Talent Acquisition

- 5.2.2. Benefits and Claims Management

- 5.2.3. Workforce Planning and Analytics

- 5.2.4. Payroll And Compensation Management

- 5.2.5. Other Functions

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. BFSI

- 5.3.2. Healthcare

- 5.3.3. IT & Telecom

- 5.3.4. Manufacturing

- 5.3.5. Retail

- 5.3.6. Government

- 5.3.7. Other Industries

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Asia-Pacific

- 5.4.1.1. China

- 5.4.1.2. India

- 5.4.1.3. Japan

- 5.4.1.4. Australia

- 5.4.1.5. Rest of Asia-Pacific

- 5.4.1. Asia-Pacific

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Provider Type

- 6. Competitive Analysis

- 6.1. Global Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Adecco Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Randstad

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ManpowerGroup

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Kelly Services

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hays

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Robert Half

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Allegis Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Hudson

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Michael Page

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Mercer

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Adecco Group

List of Figures

- Figure 1: Global Asia Pacific HR Professional Services Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Asia Pacific HR Professional Services Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: Asia Pacific Asia Pacific HR Professional Services Revenue (Million), by Provider Type 2025 & 2033

- Figure 4: Asia Pacific Asia Pacific HR Professional Services Volume (Billion), by Provider Type 2025 & 2033

- Figure 5: Asia Pacific Asia Pacific HR Professional Services Revenue Share (%), by Provider Type 2025 & 2033

- Figure 6: Asia Pacific Asia Pacific HR Professional Services Volume Share (%), by Provider Type 2025 & 2033

- Figure 7: Asia Pacific Asia Pacific HR Professional Services Revenue (Million), by Function Type 2025 & 2033

- Figure 8: Asia Pacific Asia Pacific HR Professional Services Volume (Billion), by Function Type 2025 & 2033

- Figure 9: Asia Pacific Asia Pacific HR Professional Services Revenue Share (%), by Function Type 2025 & 2033

- Figure 10: Asia Pacific Asia Pacific HR Professional Services Volume Share (%), by Function Type 2025 & 2033

- Figure 11: Asia Pacific Asia Pacific HR Professional Services Revenue (Million), by End-user Industry 2025 & 2033

- Figure 12: Asia Pacific Asia Pacific HR Professional Services Volume (Billion), by End-user Industry 2025 & 2033

- Figure 13: Asia Pacific Asia Pacific HR Professional Services Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 14: Asia Pacific Asia Pacific HR Professional Services Volume Share (%), by End-user Industry 2025 & 2033

- Figure 15: Asia Pacific Asia Pacific HR Professional Services Revenue (Million), by Geography 2025 & 2033

- Figure 16: Asia Pacific Asia Pacific HR Professional Services Volume (Billion), by Geography 2025 & 2033

- Figure 17: Asia Pacific Asia Pacific HR Professional Services Revenue Share (%), by Geography 2025 & 2033

- Figure 18: Asia Pacific Asia Pacific HR Professional Services Volume Share (%), by Geography 2025 & 2033

- Figure 19: Asia Pacific Asia Pacific HR Professional Services Revenue (Million), by Country 2025 & 2033

- Figure 20: Asia Pacific Asia Pacific HR Professional Services Volume (Billion), by Country 2025 & 2033

- Figure 21: Asia Pacific Asia Pacific HR Professional Services Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Pacific Asia Pacific HR Professional Services Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Asia Pacific HR Professional Services Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 2: Global Asia Pacific HR Professional Services Volume Billion Forecast, by Provider Type 2020 & 2033

- Table 3: Global Asia Pacific HR Professional Services Revenue Million Forecast, by Function Type 2020 & 2033

- Table 4: Global Asia Pacific HR Professional Services Volume Billion Forecast, by Function Type 2020 & 2033

- Table 5: Global Asia Pacific HR Professional Services Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Asia Pacific HR Professional Services Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 7: Global Asia Pacific HR Professional Services Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: Global Asia Pacific HR Professional Services Volume Billion Forecast, by Geography 2020 & 2033

- Table 9: Global Asia Pacific HR Professional Services Revenue Million Forecast, by Region 2020 & 2033

- Table 10: Global Asia Pacific HR Professional Services Volume Billion Forecast, by Region 2020 & 2033

- Table 11: Global Asia Pacific HR Professional Services Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 12: Global Asia Pacific HR Professional Services Volume Billion Forecast, by Provider Type 2020 & 2033

- Table 13: Global Asia Pacific HR Professional Services Revenue Million Forecast, by Function Type 2020 & 2033

- Table 14: Global Asia Pacific HR Professional Services Volume Billion Forecast, by Function Type 2020 & 2033

- Table 15: Global Asia Pacific HR Professional Services Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 16: Global Asia Pacific HR Professional Services Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 17: Global Asia Pacific HR Professional Services Revenue Million Forecast, by Geography 2020 & 2033

- Table 18: Global Asia Pacific HR Professional Services Volume Billion Forecast, by Geography 2020 & 2033

- Table 19: Global Asia Pacific HR Professional Services Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Global Asia Pacific HR Professional Services Volume Billion Forecast, by Country 2020 & 2033

- Table 21: China Asia Pacific HR Professional Services Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: China Asia Pacific HR Professional Services Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: India Asia Pacific HR Professional Services Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: India Asia Pacific HR Professional Services Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Japan Asia Pacific HR Professional Services Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Japan Asia Pacific HR Professional Services Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Australia Asia Pacific HR Professional Services Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Australia Asia Pacific HR Professional Services Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Rest of Asia Pacific Asia Pacific HR Professional Services Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of Asia Pacific Asia Pacific HR Professional Services Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific HR Professional Services?

The projected CAGR is approximately 8.63%.

2. Which companies are prominent players in the Asia Pacific HR Professional Services?

Key companies in the market include Adecco Group, Randstad, ManpowerGroup, Kelly Services, Hays, Robert Half, Allegis Group, Hudson, Michael Page, Mercer.

3. What are the main segments of the Asia Pacific HR Professional Services?

The market segments include Provider Type, Function Type, End-user Industry, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 123.62 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Focus on Talent Acquisition and Retention; Adoption of Technology is Driving Demand for HR Services.

6. What are the notable trends driving market growth?

Recruitment and Talent Acquisition is the Largest Segment in the Market Studied.

7. Are there any restraints impacting market growth?

Growing Focus on Talent Acquisition and Retention; Adoption of Technology is Driving Demand for HR Services.

8. Can you provide examples of recent developments in the market?

May 2024: ManpowerGroup is set to reaffirm its status as a critical contributor to the 8th edition of Europe's largest startup and tech event, VivaTech, by returning as a Platinum Partner.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific HR Professional Services," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific HR Professional Services report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific HR Professional Services?

To stay informed about further developments, trends, and reports in the Asia Pacific HR Professional Services, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence