Key Insights

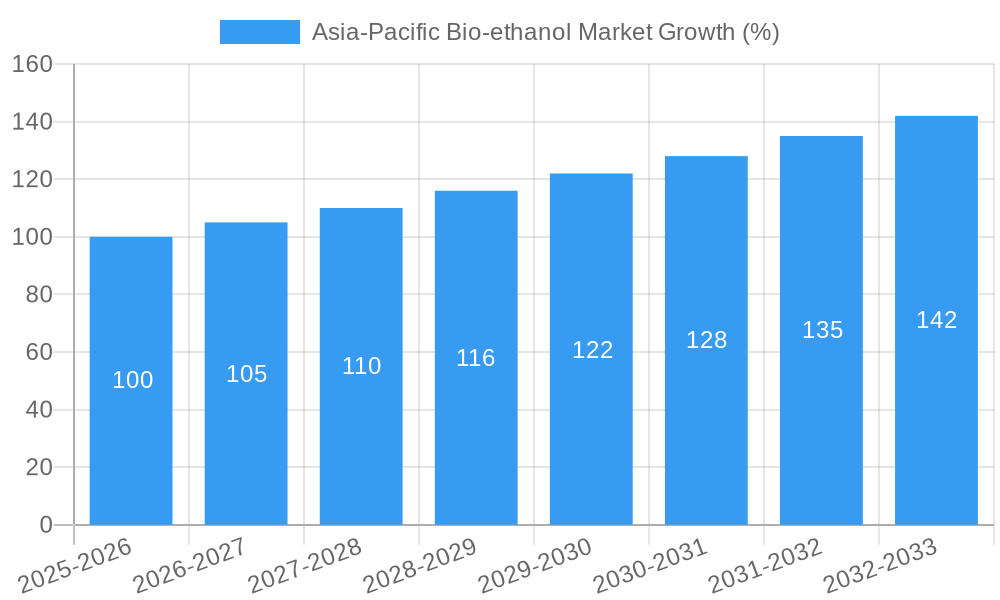

The Asia-Pacific bio-ethanol market, currently valued at approximately $XX million (assuming a logical market size based on global trends and the provided CAGR of >5%), is projected to experience robust growth throughout the forecast period (2025-2033). This expansion is fueled by several key drivers. Firstly, increasing government mandates and supportive policies promoting renewable energy sources across countries like China, India, and Japan are significantly boosting demand. Secondly, the burgeoning automotive and transportation sector, coupled with rising consumer awareness of environmental sustainability, is driving the adoption of bio-ethanol as a cleaner alternative fuel. Furthermore, growing demand from the food and beverage, pharmaceutical, and cosmetics industries for bio-ethanol as a solvent and ingredient contributes to market expansion. The market's segmentation, encompassing diverse feedstocks (sugarcane, corn, wheat, and others) and applications, offers further avenues for growth. China, India, and other rapidly developing economies within the region present significant untapped potential for bio-ethanol adoption.

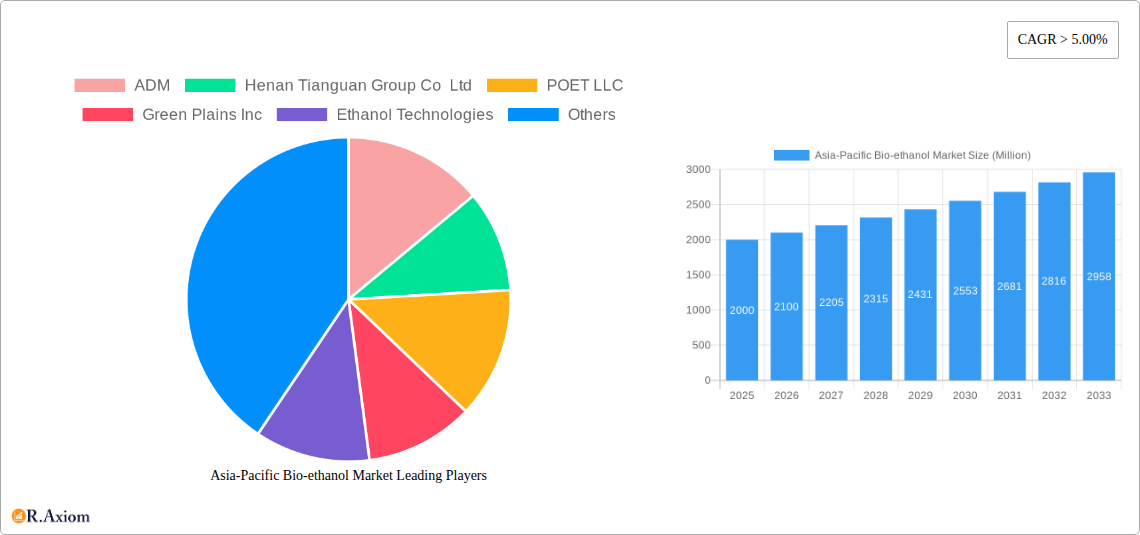

However, the market faces certain challenges. Fluctuations in feedstock prices and agricultural yields can impact profitability. Competition from other renewable energy sources and technological advancements in alternative fuels pose potential restraints. Despite these factors, the consistent CAGR of over 5% indicates a positive long-term outlook for the Asia-Pacific bio-ethanol market. Key players like ADM, Henan Tianguan Group, and POET LLC are strategically positioning themselves to capitalize on this growth, leveraging technological advancements and expanding their production capabilities to meet the rising demand. The focus on sustainable practices and technological innovations to enhance efficiency and reduce production costs is expected to shape the future trajectory of this dynamic market.

Asia-Pacific Bio-ethanol Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Asia-Pacific bio-ethanol market, covering historical data (2019-2024), the base year (2025), and a detailed forecast for 2025-2033. It delves into market dynamics, competitive landscapes, and future growth prospects, offering actionable insights for stakeholders across the biofuel value chain. The report utilizes rigorous data analysis and industry expertise to provide a clear understanding of this rapidly evolving market.

Asia-Pacific Bio-ethanol Market Concentration & Innovation

This section analyzes the Asia-Pacific bio-ethanol market's competitive landscape, focusing on market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and mergers & acquisitions (M&A) activities. The market exhibits moderate concentration, with a few large players holding significant market share. However, a large number of smaller, regional players also contribute substantially to the overall output. Innovation is driven by the need for cost-effective production, advancements in feedstock utilization, and the development of next-generation bioethanol technologies. Stringent environmental regulations, coupled with government incentives, are major drivers of innovation and market growth. Key substitute products include gasoline and other fossil fuels, though bioethanol’s environmental benefits are increasingly recognized. End-user trends show a growing demand for sustainable fuels in the automotive and transportation sector, alongside expanding applications in food and beverages, pharmaceuticals, and personal care.

- Market Share: The top five players account for approximately xx% of the market share in 2025, with ADM and Henan Tianguan Group Co Ltd holding the largest shares individually.

- M&A Activity: While specific deal values are confidential, an increase in M&A activity has been observed since 2020. The average deal value is estimated at USD xx million.

- Innovation Focus: Research is heavily focused on improving feedstock efficiency, optimizing fermentation processes, and exploring cellulosic ethanol technologies.

- Regulatory Landscape: Government policies supporting biofuel adoption vary across the region, impacting market growth and investment decisions.

Asia-Pacific Bio-ethanol Market Industry Trends & Insights

The Asia-Pacific bio-ethanol market is experiencing significant growth, driven by several key factors. Rising fuel demand, growing environmental concerns, and government support for renewable energy initiatives are creating a favorable environment for bioethanol adoption. Technological advancements, such as improved fermentation technologies and the development of cellulosic ethanol, are enhancing production efficiency and reducing costs. Consumer preferences are shifting towards sustainable and eco-friendly products, bolstering demand for bioethanol. The competitive landscape is dynamic, with both established players and new entrants vying for market share. This leads to intense price competition and a continuous drive for innovation. The market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market penetration in the automotive fuel market is expected to reach xx% by 2033, driven by government mandates and consumer demand. Technological disruptions, such as the development of advanced biofuels, present both opportunities and challenges.

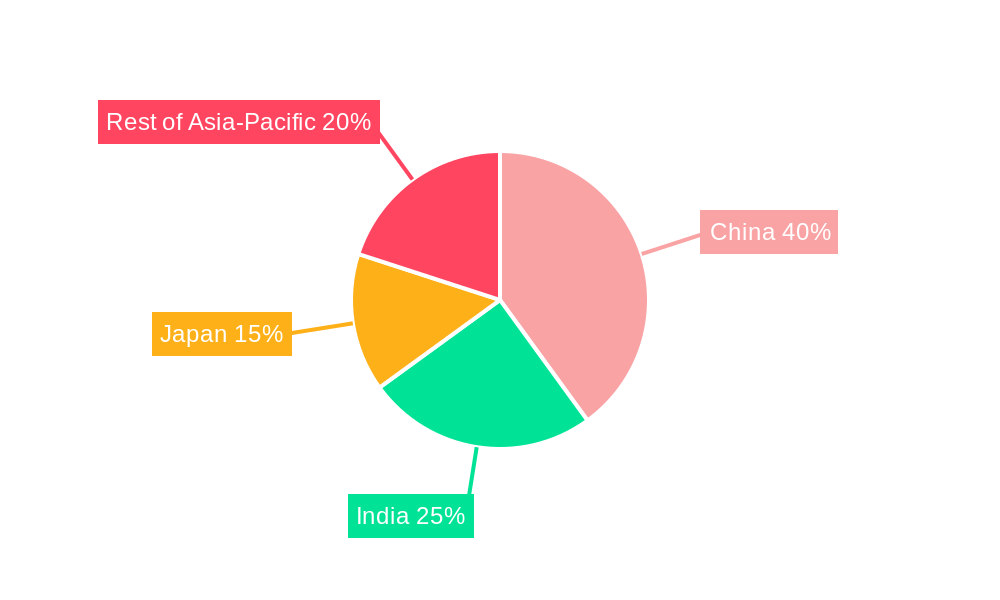

Dominant Markets & Segments in Asia-Pacific Bio-ethanol Market

China and India are the dominant markets within the Asia-Pacific region, driven by large populations, robust automotive sectors, and supportive government policies. Within feedstock types, sugarcane is the most prevalent feedstock, owing to its high sugar content and established cultivation practices in several countries. The automotive and transportation segment accounts for the largest share of bioethanol consumption, followed by the food and beverage industry.

- Key Drivers for China and India:

- Government Incentives: Substantial subsidies and mandates for biofuel blending.

- Established Infrastructure: Existing ethanol production facilities and distribution networks.

- Large Agricultural Base: Abundant supply of suitable feedstocks like sugarcane and corn.

- Dominant Feedstock: Sugarcane dominates due to high yields and established supply chains. Corn is a significant feedstock in certain regions like China.

- Dominant Application: The automotive and transportation sector consumes the majority of bioethanol production.

The dominance of sugarcane and the automotive and transportation segments is expected to continue throughout the forecast period, although the share of other feedstocks and applications may increase moderately.

Asia-Pacific Bio-ethanol Market Product Developments

Recent product developments focus on enhancing efficiency and reducing production costs. This includes advancements in fermentation technology, exploring alternative feedstocks, and improving the quality of bioethanol for specific applications. Furthermore, the development of cellulosic ethanol, which utilizes non-food biomass, is gaining traction, addressing concerns related to food security. Companies are also concentrating on integrating bioethanol production with other biofuel streams to improve profitability and environmental sustainability. The market fit for these innovations is strong due to growing environmental regulations and consumer preferences.

Report Scope & Segmentation Analysis

This report segments the Asia-Pacific bio-ethanol market based on feedstock type (sugarcane, corn, wheat, other feedstocks) and application (automotive and transportation, food and beverage, pharmaceutical, cosmetics and personal care, other applications). Each segment’s growth projection, market size (in Million USD), and competitive dynamics are analyzed in detail. The sugarcane segment is expected to maintain its dominance, while the corn segment displays steady growth. The automotive and transportation application continues to drive market expansion, alongside growing demand from the food and beverage industry.

- Feedstock Type: Sugarcane's share is projected to be xx% in 2033, Corn xx%, Wheat xx%, and Other Feedstock xx%.

- Application: Automotive and Transportation will hold the largest share (xx% in 2033), while Food and Beverage will exhibit steady growth.

Key Drivers of Asia-Pacific Bio-ethanol Market Growth

The Asia-Pacific bio-ethanol market is driven by several factors, including increasing fuel demand, environmental regulations promoting renewable energy adoption (like stricter emission standards), supportive government policies (mandates and subsidies), and growing consumer preference for eco-friendly fuels. Technological advancements, like improved fermentation processes and development of cellulosic ethanol, are also significant contributors. Furthermore, the abundant availability of suitable feedstocks like sugarcane and corn in certain regions fuels market expansion.

Challenges in the Asia-Pacific Bio-ethanol Market Sector

Challenges facing the Asia-Pacific bio-ethanol market include volatile feedstock prices, competition from fossil fuels, and the need for substantial infrastructure investments. Regulatory inconsistencies across different countries and high production costs pose additional barriers. Supply chain complexities and the need for consistent policy support remain concerns affecting market growth and stability. The reliance on arable land for feedstock production also impacts food security. These factors lead to an estimated xx% decrease in potential growth annually.

Emerging Opportunities in Asia-Pacific Bio-ethanol Market

Emerging opportunities lie in the development and adoption of advanced biofuels, such as cellulosic ethanol, which utilizes non-food biomass. Expanding bioethanol applications in chemicals and other industrial sectors present significant potential for market expansion. Further technological advancements to reduce production costs, and creating more efficient supply chains, could unlock significant growth. The market for bio-based plastics and other materials also presents substantial opportunities.

Leading Players in the Asia-Pacific Bio-ethanol Market Market

- ADM

- Henan Tianguan Group Co Ltd

- POET LLC

- Green Plains Inc

- Ethanol Technologies

- Abengoa

- GranBio Investimentos SA

- Jilin Fuel Ethanol Co Ltd (CNPC)

- Cenovus Energy

- Valero *List Not Exhaustive

Key Developments in Asia-Pacific Bio-ethanol Market Industry

- November 2022: Andhra Pradesh, India, received a USD 32.67 Million bioethanol facility.

- August 2021: VERBIO AG and Indian Oil Corporation Ltd. signed an MOU to establish biofuel projects.

Strategic Outlook for Asia-Pacific Bio-ethanol Market Market

The Asia-Pacific bio-ethanol market presents significant growth potential, driven by increasing fuel demand, government support, and technological advancements. Opportunities exist in developing advanced biofuels, expanding applications, and optimizing production processes. Addressing challenges related to feedstock costs, infrastructure development, and policy consistency will be crucial for realizing the full potential of this market. The market is expected to witness strong growth over the forecast period, driven by the factors outlined in this report, creating ample opportunities for investors and industry players.

Asia-Pacific Bio-ethanol Market Segmentation

-

1. Feedstock Type

- 1.1. Sugarcane

- 1.2. Corn

- 1.3. Wheat

- 1.4. Other Feedstocks

-

2. Application

- 2.1. Automotive and Transportation

- 2.2. Food and Beverage

- 2.3. Pharmaceutical

- 2.4. Cosmetics and Personal Care

- 2.5. Other Applications

-

3. Geography

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia-Pacific

Asia-Pacific Bio-ethanol Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. South Korea

- 5. Rest of Asia Pacific

Asia-Pacific Bio-ethanol Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Favorable Initiatives and Blending Mandates by Regulatory Bodies; Growing Environmental Concerns due to the Use of Fossil Fuels and the Need for Biofuels

- 3.3. Market Restrains

- 3.3.1. Phasing out of Fuel-based Vehicles Due to Rising Demand for Electric Vehicles; Shifting Focus to Bio-butanol

- 3.4. Market Trends

- 3.4.1. Automotive and Transportation Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Bio-ethanol Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Feedstock Type

- 5.1.1. Sugarcane

- 5.1.2. Corn

- 5.1.3. Wheat

- 5.1.4. Other Feedstocks

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Automotive and Transportation

- 5.2.2. Food and Beverage

- 5.2.3. Pharmaceutical

- 5.2.4. Cosmetics and Personal Care

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. South Korea

- 5.3.5. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. South Korea

- 5.4.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Feedstock Type

- 6. China Asia-Pacific Bio-ethanol Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Feedstock Type

- 6.1.1. Sugarcane

- 6.1.2. Corn

- 6.1.3. Wheat

- 6.1.4. Other Feedstocks

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Automotive and Transportation

- 6.2.2. Food and Beverage

- 6.2.3. Pharmaceutical

- 6.2.4. Cosmetics and Personal Care

- 6.2.5. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. India

- 6.3.3. Japan

- 6.3.4. South Korea

- 6.3.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Feedstock Type

- 7. India Asia-Pacific Bio-ethanol Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Feedstock Type

- 7.1.1. Sugarcane

- 7.1.2. Corn

- 7.1.3. Wheat

- 7.1.4. Other Feedstocks

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Automotive and Transportation

- 7.2.2. Food and Beverage

- 7.2.3. Pharmaceutical

- 7.2.4. Cosmetics and Personal Care

- 7.2.5. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. India

- 7.3.3. Japan

- 7.3.4. South Korea

- 7.3.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Feedstock Type

- 8. Japan Asia-Pacific Bio-ethanol Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Feedstock Type

- 8.1.1. Sugarcane

- 8.1.2. Corn

- 8.1.3. Wheat

- 8.1.4. Other Feedstocks

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Automotive and Transportation

- 8.2.2. Food and Beverage

- 8.2.3. Pharmaceutical

- 8.2.4. Cosmetics and Personal Care

- 8.2.5. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. India

- 8.3.3. Japan

- 8.3.4. South Korea

- 8.3.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Feedstock Type

- 9. South Korea Asia-Pacific Bio-ethanol Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Feedstock Type

- 9.1.1. Sugarcane

- 9.1.2. Corn

- 9.1.3. Wheat

- 9.1.4. Other Feedstocks

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Automotive and Transportation

- 9.2.2. Food and Beverage

- 9.2.3. Pharmaceutical

- 9.2.4. Cosmetics and Personal Care

- 9.2.5. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. India

- 9.3.3. Japan

- 9.3.4. South Korea

- 9.3.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Feedstock Type

- 10. Rest of Asia Pacific Asia-Pacific Bio-ethanol Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Feedstock Type

- 10.1.1. Sugarcane

- 10.1.2. Corn

- 10.1.3. Wheat

- 10.1.4. Other Feedstocks

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Automotive and Transportation

- 10.2.2. Food and Beverage

- 10.2.3. Pharmaceutical

- 10.2.4. Cosmetics and Personal Care

- 10.2.5. Other Applications

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. India

- 10.3.3. Japan

- 10.3.4. South Korea

- 10.3.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Feedstock Type

- 11. China Asia-Pacific Bio-ethanol Market Analysis, Insights and Forecast, 2019-2031

- 12. Japan Asia-Pacific Bio-ethanol Market Analysis, Insights and Forecast, 2019-2031

- 13. India Asia-Pacific Bio-ethanol Market Analysis, Insights and Forecast, 2019-2031

- 14. South Korea Asia-Pacific Bio-ethanol Market Analysis, Insights and Forecast, 2019-2031

- 15. Taiwan Asia-Pacific Bio-ethanol Market Analysis, Insights and Forecast, 2019-2031

- 16. Australia Asia-Pacific Bio-ethanol Market Analysis, Insights and Forecast, 2019-2031

- 17. Rest of Asia-Pacific Asia-Pacific Bio-ethanol Market Analysis, Insights and Forecast, 2019-2031

- 18. Competitive Analysis

- 18.1. Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 ADM

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Henan Tianguan Group Co Ltd

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 POET LLC

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Green Plains Inc

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 Ethanol Technologies

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Abengoa

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 GranBio Investimentos SA

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 Jilin Fuel Ethanol Co Ltd (CNPC)

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 Cenovus Energy

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 Valero*List Not Exhaustive

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.1 ADM

List of Figures

- Figure 1: Asia-Pacific Bio-ethanol Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Bio-ethanol Market Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Bio-ethanol Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Bio-ethanol Market Revenue Million Forecast, by Feedstock Type 2019 & 2032

- Table 3: Asia-Pacific Bio-ethanol Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Asia-Pacific Bio-ethanol Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Asia-Pacific Bio-ethanol Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Asia-Pacific Bio-ethanol Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: China Asia-Pacific Bio-ethanol Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Japan Asia-Pacific Bio-ethanol Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: India Asia-Pacific Bio-ethanol Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South Korea Asia-Pacific Bio-ethanol Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Taiwan Asia-Pacific Bio-ethanol Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Australia Asia-Pacific Bio-ethanol Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Asia-Pacific Asia-Pacific Bio-ethanol Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Asia-Pacific Bio-ethanol Market Revenue Million Forecast, by Feedstock Type 2019 & 2032

- Table 15: Asia-Pacific Bio-ethanol Market Revenue Million Forecast, by Application 2019 & 2032

- Table 16: Asia-Pacific Bio-ethanol Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: Asia-Pacific Bio-ethanol Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Asia-Pacific Bio-ethanol Market Revenue Million Forecast, by Feedstock Type 2019 & 2032

- Table 19: Asia-Pacific Bio-ethanol Market Revenue Million Forecast, by Application 2019 & 2032

- Table 20: Asia-Pacific Bio-ethanol Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: Asia-Pacific Bio-ethanol Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Asia-Pacific Bio-ethanol Market Revenue Million Forecast, by Feedstock Type 2019 & 2032

- Table 23: Asia-Pacific Bio-ethanol Market Revenue Million Forecast, by Application 2019 & 2032

- Table 24: Asia-Pacific Bio-ethanol Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 25: Asia-Pacific Bio-ethanol Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Asia-Pacific Bio-ethanol Market Revenue Million Forecast, by Feedstock Type 2019 & 2032

- Table 27: Asia-Pacific Bio-ethanol Market Revenue Million Forecast, by Application 2019 & 2032

- Table 28: Asia-Pacific Bio-ethanol Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 29: Asia-Pacific Bio-ethanol Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Asia-Pacific Bio-ethanol Market Revenue Million Forecast, by Feedstock Type 2019 & 2032

- Table 31: Asia-Pacific Bio-ethanol Market Revenue Million Forecast, by Application 2019 & 2032

- Table 32: Asia-Pacific Bio-ethanol Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 33: Asia-Pacific Bio-ethanol Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Bio-ethanol Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Asia-Pacific Bio-ethanol Market?

Key companies in the market include ADM, Henan Tianguan Group Co Ltd, POET LLC, Green Plains Inc, Ethanol Technologies, Abengoa, GranBio Investimentos SA, Jilin Fuel Ethanol Co Ltd (CNPC), Cenovus Energy, Valero*List Not Exhaustive.

3. What are the main segments of the Asia-Pacific Bio-ethanol Market?

The market segments include Feedstock Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Favorable Initiatives and Blending Mandates by Regulatory Bodies; Growing Environmental Concerns due to the Use of Fossil Fuels and the Need for Biofuels.

6. What are the notable trends driving market growth?

Automotive and Transportation Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

Phasing out of Fuel-based Vehicles Due to Rising Demand for Electric Vehicles; Shifting Focus to Bio-butanol.

8. Can you provide examples of recent developments in the market?

In November 2022, Andhra Pradesh received a bioethanol facility worth Rs 270 crore (USD 32.67 million). Chief Minister YS Jagan Mohan Reddy laid the foundation stone at Gummalladoddi village of East Godavari district. The facility will be built by Assago Industrial Private Limited and employ 300 people directly and 400 indirectly.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Bio-ethanol Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Bio-ethanol Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Bio-ethanol Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Bio-ethanol Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence