Key Insights

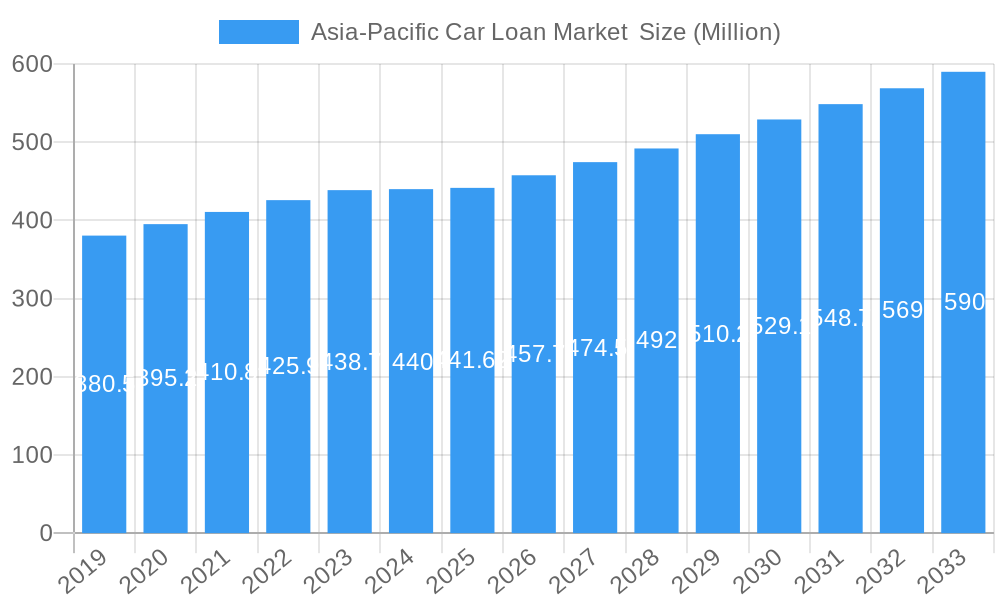

The Asia-Pacific car loan market is projected for robust growth, standing at an estimated USD 441.62 million in 2025 and anticipated to expand at a Compound Annual Growth Rate (CAGR) of 4.02% through 2033. This expansion is primarily fueled by a burgeoning middle class with increasing disposable incomes across key economies like India and China, driving demand for both new and used passenger vehicles. The significant presence of major financial institutions, including banks and non-banking financial services (NBFCs), alongside active participation from Original Equipment Manufacturers (OEMs) offering captive finance options, indicates a competitive and dynamic lending landscape. This ecosystem is further supported by the rise of fintech companies, innovating to provide accessible and user-friendly car financing solutions. The market also benefits from evolving consumer preferences, with a growing interest in flexible loan tenures, including options for less than three years, alongside traditional longer-term commitments.

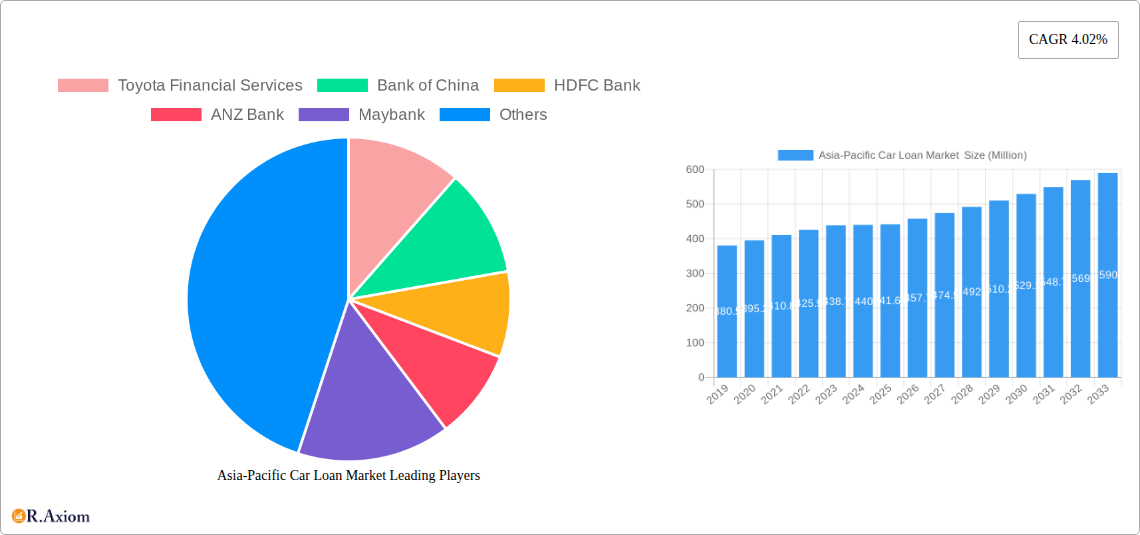

Asia-Pacific Car Loan Market Market Size (In Million)

The automotive sector's recovery and continued expansion across the Asia-Pacific region are intrinsically linked to the health of its car loan market. Emerging economies, particularly India and China, are poised to be the primary growth engines, capitalizing on rapid urbanization and a growing need for personal mobility. While new vehicle financing remains a dominant segment, the market for used car loans is also witnessing substantial traction as consumers seek more affordable ownership options. Factors such as government initiatives promoting vehicle ownership and economic development play a crucial role in driving this growth. However, potential restraints such as rising interest rates, stricter lending regulations in certain countries, and economic downturns could moderate the pace of expansion. Nonetheless, the overall outlook remains positive, driven by sustained demand and innovation within the financial services sector.

Asia-Pacific Car Loan Market Company Market Share

Here is an SEO-optimized, detailed report description for the Asia-Pacific Car Loan Market, incorporating high-traffic keywords and adhering to all your specifications.

Gain unparalleled insights into the dynamic Asia-Pacific car loan market with this in-depth report. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this analysis provides a robust understanding of current trends, future projections, and strategic opportunities. We delve into the evolving landscape of vehicle financing, crucial for automotive manufacturers, financial institutions, fintech innovators, and investors seeking to capitalize on this burgeoning sector. Explore market drivers, challenges, competitive intelligence, and detailed segmentation for informed decision-making.

Asia-Pacific Car Loan Market Market Concentration & Innovation

The Asia-Pacific car loan market exhibits a moderately fragmented landscape, characterized by the presence of major banking institutions, specialized non-banking financial companies (NBFCs), and increasingly, OEM captive finance arms. Market concentration is influenced by the varying regulatory environments across key economies like India, China, and Japan. Innovation is primarily driven by the digitalization of loan application processes, the adoption of AI for credit risk assessment, and the development of tailored financing solutions for electric vehicles (EVs) and used car segments. Regulatory frameworks, such as evolving lending norms and data privacy laws, play a significant role in shaping competitive dynamics. Product substitutes include personal loans and leasing options, though car loans remain the dominant financing method for vehicle acquisition. End-user trends indicate a growing preference for convenient online applications and flexible repayment options. Mergers & Acquisitions (M&A) activities are strategically focused on expanding geographic reach and enhancing technological capabilities. For instance, M&A deal values are estimated to be in the billions of US Dollars as larger players consolidate to gain market share.

- Market Share Dynamics: Dominated by a mix of established banks and growing NBFCs.

- Innovation Drivers: Digitalization, AI-driven credit scoring, EV financing solutions.

- Regulatory Impact: Evolving lending norms, data privacy, consumer protection.

- Product Substitutes: Personal loans, leasing.

- End-User Trends: Online applications, flexible tenures, EV focus.

- M&A Activities: Strategic consolidation for market expansion and technology acquisition.

Asia-Pacific Car Loan Market Industry Trends & Insights

The Asia-Pacific car loan market is poised for substantial growth, driven by a confluence of robust economic expansion, increasing disposable incomes, and a rising demand for personal mobility across its diverse nations. The Compound Annual Growth Rate (CAGR) is projected to be in the range of 7% to 9% over the forecast period (2025-2033). Market penetration for car loans, while already significant, continues to deepen, especially in developing economies within the region. Technological disruptions are at the forefront of this evolution. The proliferation of fintech companies is revolutionizing loan origination, underwriting, and servicing through advanced digital platforms. This has led to faster approval times, more transparent processes, and the ability to cater to a wider spectrum of credit profiles. Consumer preferences are shifting towards digital-first experiences, with a strong demand for personalized loan products that align with individual financial circumstances and vehicle choices, particularly for new and used passenger vehicles. The competitive dynamics are intensifying, with traditional banks facing pressure from agile NBFCs and OEM captive finance divisions that offer bundled deals with vehicle purchases. The growing interest in sustainable mobility is also a key trend, with a surge in financing options specifically designed for electric vehicles, supported by government incentives and growing environmental awareness among consumers. Furthermore, the expansion of the used car market is creating new financing opportunities as consumers seek more affordable mobility solutions.

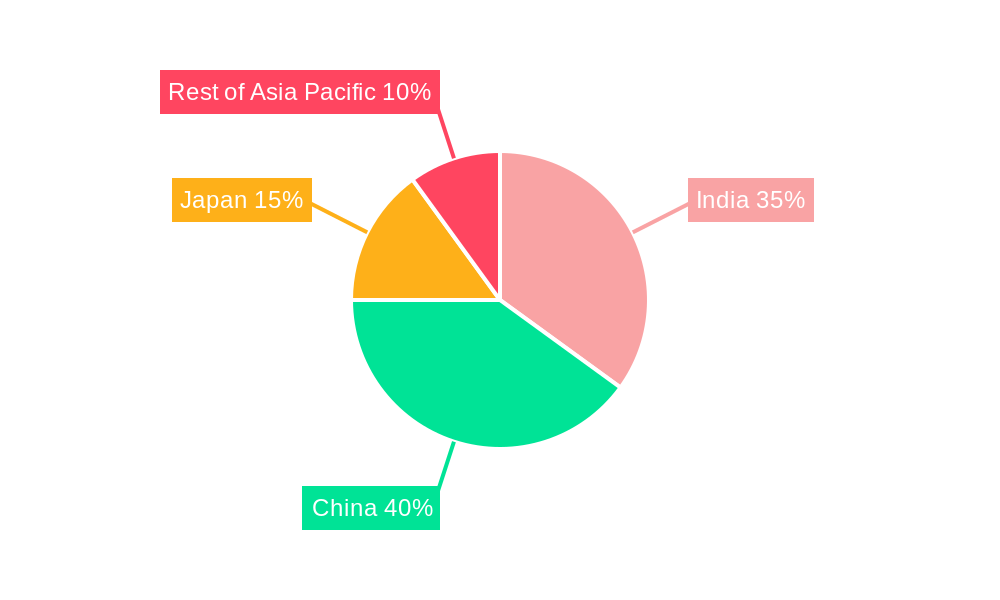

Dominant Markets & Segments in Asia-Pacific Car Loan Market

India and China are poised to remain the dominant markets within the Asia-Pacific car loan landscape, driven by their vast populations, rapidly expanding middle class, and significant automotive manufacturing hubs. India's market is propelled by strong economic policies favoring manufacturing and consumption, a large and young demographic, and a burgeoning used car market that is increasingly accessible through financing. Government initiatives promoting financial inclusion and digital payments further bolster loan uptake. China's dominance is fueled by its position as the world's largest automotive market, with a strong emphasis on electric vehicle adoption and government support for green transportation. Robust infrastructure development and a high savings rate also contribute to the accessibility of car loans.

- Product Type: The Passenger Vehicle segment significantly leads the market, reflecting higher individual car ownership aspirations compared to commercial vehicles. However, the Commercial Vehicle segment is experiencing steady growth, especially in logistics and transportation-reliant economies.

- Ownership: New Vehicles continue to command a larger share due to aspiration and perceived reliability. Nevertheless, the Used Vehicles segment is exhibiting a higher growth trajectory, driven by affordability and the increasing availability of quality pre-owned cars backed by specialized financing.

- Provider Type: Banks historically hold a dominant position due to their established trust and extensive customer base. However, Non-Banking Financial Services (NBFCs) are rapidly gaining market share by offering more flexible terms and faster processing, particularly in markets like India. Original Equipment Manufacturers (OEMs) also play a crucial role through their captive finance arms, offering attractive bundled financing deals that influence purchasing decisions. The "Other Provider Types (Fintech Companies)" segment is witnessing the most significant growth, disrupting traditional models with innovative digital solutions.

- Tenure: The 3-5 Years tenure remains the most popular choice, balancing monthly affordability with manageable loan durations. However, there is a growing demand for Less Than Three Years tenures, particularly for shorter-term vehicle needs or anticipated upgrades, and More Than 5 Years options are gaining traction for larger vehicle purchases and for consumers seeking lower monthly outlays.

- Geography: Beyond India and China, Japan remains a mature market with stable demand, characterized by high quality standards and a focus on technological advancements in financing. The Rest of Asia-Pacific, encompassing countries like South Korea, Southeast Asian nations (e.g., Indonesia, Thailand, Vietnam), and Australia, presents diverse growth opportunities driven by economic development and increasing vehicle ownership.

Asia-Pacific Car Loan Market Product Developments

Recent product developments in the Asia-Pacific car loan market are heavily influenced by digitalization and sustainability. Fintech companies are introducing AI-powered instant loan approval platforms, offering personalized interest rates based on granular credit data. OEMs are enhancing their captive finance offerings with integrated insurance, maintenance packages, and flexible lease-to-own options, particularly for electric vehicles. Innovations include pay-as-you-go financing models, kilometer-based loan repayments, and digital loan management portals for enhanced customer convenience and transparency. These developments aim to reduce application friction, improve credit accessibility, and align loan products with evolving consumer mobility patterns.

Report Scope & Segmentation Analysis

This report provides an exhaustive analysis of the Asia-Pacific car loan market segmented across several key dimensions. The Product Type segmentation includes Passenger Vehicles and Commercial Vehicles, detailing their respective market sizes and growth forecasts. The Ownership segmentation covers New Vehicles and Used Vehicles, highlighting the shifting dynamics and opportunities in each. Provider Type analysis delves into Banks, Non-Banking Financial Services, Original Equipment Manufacturers, and Other Provider Types (Fintech Companies), examining their market share, strategies, and competitive positioning. The Tenure segmentation explores options like Less Than Three Years, 3-5 Years, and More Than 5 Years, identifying consumer preferences and loan structuring trends. Finally, the Geography segmentation provides in-depth insights into India, China, Japan, and the Rest of Asia-Pacific, analyzing country-specific growth drivers, regulatory landscapes, and market potential.

Key Drivers of Asia-Pacific Car Loan Market Growth

Several factors are driving the robust growth of the Asia-Pacific car loan market. Economic expansion and rising disposable incomes are fueling increased vehicle ownership aspirations. A youthful demographic in many Asia-Pacific nations translates to a growing pool of first-time car buyers. The rapid digitalization of financial services is making loan application and approval processes faster and more accessible. Government policies supporting automotive manufacturing and consumer financing, coupled with growing incentives for electric vehicle adoption, are further stimulating demand. The expanding used car market also presents significant financing opportunities, catering to budget-conscious consumers.

Challenges in the Asia-Pacific Car Loan Market Sector

Despite strong growth prospects, the Asia-Pacific car loan market faces several challenges. Stringent and varying regulatory frameworks across different countries can create compliance complexities for lenders. Economic volatility and potential interest rate hikes can impact affordability for consumers and increase credit risk for financial institutions. Intense competition from a growing number of players, including fintech startups, puts pressure on profit margins. Supply chain disruptions affecting vehicle availability can indirectly hinder loan demand. Furthermore, rising cybersecurity threats and data breaches pose risks to digital lending platforms.

Emerging Opportunities in Asia-Pacific Car Loan Market

The Asia-Pacific car loan market presents numerous emerging opportunities. The burgeoning electric vehicle segment offers a significant avenue for specialized financing products, supported by government subsidies and increasing consumer environmental consciousness. The growing pre-owned car market provides substantial potential for lenders willing to develop tailored financing solutions. Fintech innovation in areas like blockchain for loan origination and AI for predictive analytics can enhance operational efficiency and risk management. Emerging economies within the "Rest of Asia-Pacific" region, with their rapidly developing infrastructure and rising middle class, represent untapped potential for market expansion.

Leading Players in the Asia-Pacific Car Loan Market Market

- Toyota Financial Services

- Bank of China

- HDFC Bank

- ANZ Bank

- Maybank

- DBS Bank

- Commonwealth Bank of Australia

- State Bank of India

- Mitsubishi UFJ Financial Group

- Bangkok Bank

Key Developments in Asia-Pacific Car Loan Market Industry

- September 2023: CSB Bank and Daimler India Commercial Vehicle (DICV) announced a strategic partnership for vehicle financing. This collaboration offers enhanced support to dealerships and customers while fostering growth and innovation within the sector.

- July 2023: Volkswagen and Chinese EV startup Xpeng announced a partnership and joint venture partner SAIC to build new models and potentially co-create platforms as it attempts to use local expertise to protect market share.

Strategic Outlook for Asia-Pacific Car Loan Market Market

The strategic outlook for the Asia-Pacific car loan market remains highly positive, driven by ongoing economic development and evolving consumer mobility trends. The continued digital transformation of financial services will be a critical growth catalyst, enabling greater efficiency and customer reach. Increased focus on sustainable financing for electric vehicles and innovative solutions for the used car market will unlock new revenue streams. Strategic partnerships between traditional financial institutions and fintech companies are expected to accelerate innovation and market penetration. As governments continue to support automotive industries and financial inclusion, the market is set to witness sustained growth and evolving competitive dynamics.

Asia-Pacific Car Loan Market Segmentation

-

1. Product Type

- 1.1. Passenger Vehicle

- 1.2. Commercial Vehicle

-

2. Ownership

- 2.1. New Vehicles

- 2.2. Used Vehicles

-

3. Provider Type

- 3.1. Banks

- 3.2. Non-Banking Financial Services

- 3.3. Original Equipment Manufacturers

- 3.4. Other Provider Types (Fintech Companies)

-

4. Tenure

- 4.1. Less Than Three Years

- 4.2. 3-5 Years

- 4.3. More Than 5 Years

-

5. Geography

- 5.1. India

- 5.2. China

- 5.3. Japan

- 5.4. Rest of Asia-Pacific

Asia-Pacific Car Loan Market Segmentation By Geography

- 1. India

- 2. China

- 3. Japan

- 4. Rest of Asia Pacific

Asia-Pacific Car Loan Market Regional Market Share

Geographic Coverage of Asia-Pacific Car Loan Market

Asia-Pacific Car Loan Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.02% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Middle-Class Population

- 3.3. Market Restrains

- 3.3.1. Growing Middle-Class Population

- 3.4. Market Trends

- 3.4.1. Increasing Passenger Cars in Asia-Pacific

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Asia-Pacific Car Loan Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Passenger Vehicle

- 5.1.2. Commercial Vehicle

- 5.2. Market Analysis, Insights and Forecast - by Ownership

- 5.2.1. New Vehicles

- 5.2.2. Used Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Provider Type

- 5.3.1. Banks

- 5.3.2. Non-Banking Financial Services

- 5.3.3. Original Equipment Manufacturers

- 5.3.4. Other Provider Types (Fintech Companies)

- 5.4. Market Analysis, Insights and Forecast - by Tenure

- 5.4.1. Less Than Three Years

- 5.4.2. 3-5 Years

- 5.4.3. More Than 5 Years

- 5.5. Market Analysis, Insights and Forecast - by Geography

- 5.5.1. India

- 5.5.2. China

- 5.5.3. Japan

- 5.5.4. Rest of Asia-Pacific

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. India

- 5.6.2. China

- 5.6.3. Japan

- 5.6.4. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. India Asia-Pacific Car Loan Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Passenger Vehicle

- 6.1.2. Commercial Vehicle

- 6.2. Market Analysis, Insights and Forecast - by Ownership

- 6.2.1. New Vehicles

- 6.2.2. Used Vehicles

- 6.3. Market Analysis, Insights and Forecast - by Provider Type

- 6.3.1. Banks

- 6.3.2. Non-Banking Financial Services

- 6.3.3. Original Equipment Manufacturers

- 6.3.4. Other Provider Types (Fintech Companies)

- 6.4. Market Analysis, Insights and Forecast - by Tenure

- 6.4.1. Less Than Three Years

- 6.4.2. 3-5 Years

- 6.4.3. More Than 5 Years

- 6.5. Market Analysis, Insights and Forecast - by Geography

- 6.5.1. India

- 6.5.2. China

- 6.5.3. Japan

- 6.5.4. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. China Asia-Pacific Car Loan Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Passenger Vehicle

- 7.1.2. Commercial Vehicle

- 7.2. Market Analysis, Insights and Forecast - by Ownership

- 7.2.1. New Vehicles

- 7.2.2. Used Vehicles

- 7.3. Market Analysis, Insights and Forecast - by Provider Type

- 7.3.1. Banks

- 7.3.2. Non-Banking Financial Services

- 7.3.3. Original Equipment Manufacturers

- 7.3.4. Other Provider Types (Fintech Companies)

- 7.4. Market Analysis, Insights and Forecast - by Tenure

- 7.4.1. Less Than Three Years

- 7.4.2. 3-5 Years

- 7.4.3. More Than 5 Years

- 7.5. Market Analysis, Insights and Forecast - by Geography

- 7.5.1. India

- 7.5.2. China

- 7.5.3. Japan

- 7.5.4. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Japan Asia-Pacific Car Loan Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Passenger Vehicle

- 8.1.2. Commercial Vehicle

- 8.2. Market Analysis, Insights and Forecast - by Ownership

- 8.2.1. New Vehicles

- 8.2.2. Used Vehicles

- 8.3. Market Analysis, Insights and Forecast - by Provider Type

- 8.3.1. Banks

- 8.3.2. Non-Banking Financial Services

- 8.3.3. Original Equipment Manufacturers

- 8.3.4. Other Provider Types (Fintech Companies)

- 8.4. Market Analysis, Insights and Forecast - by Tenure

- 8.4.1. Less Than Three Years

- 8.4.2. 3-5 Years

- 8.4.3. More Than 5 Years

- 8.5. Market Analysis, Insights and Forecast - by Geography

- 8.5.1. India

- 8.5.2. China

- 8.5.3. Japan

- 8.5.4. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of Asia Pacific Asia-Pacific Car Loan Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Passenger Vehicle

- 9.1.2. Commercial Vehicle

- 9.2. Market Analysis, Insights and Forecast - by Ownership

- 9.2.1. New Vehicles

- 9.2.2. Used Vehicles

- 9.3. Market Analysis, Insights and Forecast - by Provider Type

- 9.3.1. Banks

- 9.3.2. Non-Banking Financial Services

- 9.3.3. Original Equipment Manufacturers

- 9.3.4. Other Provider Types (Fintech Companies)

- 9.4. Market Analysis, Insights and Forecast - by Tenure

- 9.4.1. Less Than Three Years

- 9.4.2. 3-5 Years

- 9.4.3. More Than 5 Years

- 9.5. Market Analysis, Insights and Forecast - by Geography

- 9.5.1. India

- 9.5.2. China

- 9.5.3. Japan

- 9.5.4. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Toyota Financial Services

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Bank of China

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 HDFC Bank

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 ANZ Bank

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Maybank

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 DBS Bank

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Commonwealth Bank of Australia

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 State Bank of India

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Mitsubishi UFJ Financial Group

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Bangkok Bank**List Not Exhaustive

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Toyota Financial Services

List of Figures

- Figure 1: Global Asia-Pacific Car Loan Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Asia-Pacific Car Loan Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: India Asia-Pacific Car Loan Market Revenue (Million), by Product Type 2025 & 2033

- Figure 4: India Asia-Pacific Car Loan Market Volume (Billion), by Product Type 2025 & 2033

- Figure 5: India Asia-Pacific Car Loan Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: India Asia-Pacific Car Loan Market Volume Share (%), by Product Type 2025 & 2033

- Figure 7: India Asia-Pacific Car Loan Market Revenue (Million), by Ownership 2025 & 2033

- Figure 8: India Asia-Pacific Car Loan Market Volume (Billion), by Ownership 2025 & 2033

- Figure 9: India Asia-Pacific Car Loan Market Revenue Share (%), by Ownership 2025 & 2033

- Figure 10: India Asia-Pacific Car Loan Market Volume Share (%), by Ownership 2025 & 2033

- Figure 11: India Asia-Pacific Car Loan Market Revenue (Million), by Provider Type 2025 & 2033

- Figure 12: India Asia-Pacific Car Loan Market Volume (Billion), by Provider Type 2025 & 2033

- Figure 13: India Asia-Pacific Car Loan Market Revenue Share (%), by Provider Type 2025 & 2033

- Figure 14: India Asia-Pacific Car Loan Market Volume Share (%), by Provider Type 2025 & 2033

- Figure 15: India Asia-Pacific Car Loan Market Revenue (Million), by Tenure 2025 & 2033

- Figure 16: India Asia-Pacific Car Loan Market Volume (Billion), by Tenure 2025 & 2033

- Figure 17: India Asia-Pacific Car Loan Market Revenue Share (%), by Tenure 2025 & 2033

- Figure 18: India Asia-Pacific Car Loan Market Volume Share (%), by Tenure 2025 & 2033

- Figure 19: India Asia-Pacific Car Loan Market Revenue (Million), by Geography 2025 & 2033

- Figure 20: India Asia-Pacific Car Loan Market Volume (Billion), by Geography 2025 & 2033

- Figure 21: India Asia-Pacific Car Loan Market Revenue Share (%), by Geography 2025 & 2033

- Figure 22: India Asia-Pacific Car Loan Market Volume Share (%), by Geography 2025 & 2033

- Figure 23: India Asia-Pacific Car Loan Market Revenue (Million), by Country 2025 & 2033

- Figure 24: India Asia-Pacific Car Loan Market Volume (Billion), by Country 2025 & 2033

- Figure 25: India Asia-Pacific Car Loan Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: India Asia-Pacific Car Loan Market Volume Share (%), by Country 2025 & 2033

- Figure 27: China Asia-Pacific Car Loan Market Revenue (Million), by Product Type 2025 & 2033

- Figure 28: China Asia-Pacific Car Loan Market Volume (Billion), by Product Type 2025 & 2033

- Figure 29: China Asia-Pacific Car Loan Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: China Asia-Pacific Car Loan Market Volume Share (%), by Product Type 2025 & 2033

- Figure 31: China Asia-Pacific Car Loan Market Revenue (Million), by Ownership 2025 & 2033

- Figure 32: China Asia-Pacific Car Loan Market Volume (Billion), by Ownership 2025 & 2033

- Figure 33: China Asia-Pacific Car Loan Market Revenue Share (%), by Ownership 2025 & 2033

- Figure 34: China Asia-Pacific Car Loan Market Volume Share (%), by Ownership 2025 & 2033

- Figure 35: China Asia-Pacific Car Loan Market Revenue (Million), by Provider Type 2025 & 2033

- Figure 36: China Asia-Pacific Car Loan Market Volume (Billion), by Provider Type 2025 & 2033

- Figure 37: China Asia-Pacific Car Loan Market Revenue Share (%), by Provider Type 2025 & 2033

- Figure 38: China Asia-Pacific Car Loan Market Volume Share (%), by Provider Type 2025 & 2033

- Figure 39: China Asia-Pacific Car Loan Market Revenue (Million), by Tenure 2025 & 2033

- Figure 40: China Asia-Pacific Car Loan Market Volume (Billion), by Tenure 2025 & 2033

- Figure 41: China Asia-Pacific Car Loan Market Revenue Share (%), by Tenure 2025 & 2033

- Figure 42: China Asia-Pacific Car Loan Market Volume Share (%), by Tenure 2025 & 2033

- Figure 43: China Asia-Pacific Car Loan Market Revenue (Million), by Geography 2025 & 2033

- Figure 44: China Asia-Pacific Car Loan Market Volume (Billion), by Geography 2025 & 2033

- Figure 45: China Asia-Pacific Car Loan Market Revenue Share (%), by Geography 2025 & 2033

- Figure 46: China Asia-Pacific Car Loan Market Volume Share (%), by Geography 2025 & 2033

- Figure 47: China Asia-Pacific Car Loan Market Revenue (Million), by Country 2025 & 2033

- Figure 48: China Asia-Pacific Car Loan Market Volume (Billion), by Country 2025 & 2033

- Figure 49: China Asia-Pacific Car Loan Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: China Asia-Pacific Car Loan Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Japan Asia-Pacific Car Loan Market Revenue (Million), by Product Type 2025 & 2033

- Figure 52: Japan Asia-Pacific Car Loan Market Volume (Billion), by Product Type 2025 & 2033

- Figure 53: Japan Asia-Pacific Car Loan Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 54: Japan Asia-Pacific Car Loan Market Volume Share (%), by Product Type 2025 & 2033

- Figure 55: Japan Asia-Pacific Car Loan Market Revenue (Million), by Ownership 2025 & 2033

- Figure 56: Japan Asia-Pacific Car Loan Market Volume (Billion), by Ownership 2025 & 2033

- Figure 57: Japan Asia-Pacific Car Loan Market Revenue Share (%), by Ownership 2025 & 2033

- Figure 58: Japan Asia-Pacific Car Loan Market Volume Share (%), by Ownership 2025 & 2033

- Figure 59: Japan Asia-Pacific Car Loan Market Revenue (Million), by Provider Type 2025 & 2033

- Figure 60: Japan Asia-Pacific Car Loan Market Volume (Billion), by Provider Type 2025 & 2033

- Figure 61: Japan Asia-Pacific Car Loan Market Revenue Share (%), by Provider Type 2025 & 2033

- Figure 62: Japan Asia-Pacific Car Loan Market Volume Share (%), by Provider Type 2025 & 2033

- Figure 63: Japan Asia-Pacific Car Loan Market Revenue (Million), by Tenure 2025 & 2033

- Figure 64: Japan Asia-Pacific Car Loan Market Volume (Billion), by Tenure 2025 & 2033

- Figure 65: Japan Asia-Pacific Car Loan Market Revenue Share (%), by Tenure 2025 & 2033

- Figure 66: Japan Asia-Pacific Car Loan Market Volume Share (%), by Tenure 2025 & 2033

- Figure 67: Japan Asia-Pacific Car Loan Market Revenue (Million), by Geography 2025 & 2033

- Figure 68: Japan Asia-Pacific Car Loan Market Volume (Billion), by Geography 2025 & 2033

- Figure 69: Japan Asia-Pacific Car Loan Market Revenue Share (%), by Geography 2025 & 2033

- Figure 70: Japan Asia-Pacific Car Loan Market Volume Share (%), by Geography 2025 & 2033

- Figure 71: Japan Asia-Pacific Car Loan Market Revenue (Million), by Country 2025 & 2033

- Figure 72: Japan Asia-Pacific Car Loan Market Volume (Billion), by Country 2025 & 2033

- Figure 73: Japan Asia-Pacific Car Loan Market Revenue Share (%), by Country 2025 & 2033

- Figure 74: Japan Asia-Pacific Car Loan Market Volume Share (%), by Country 2025 & 2033

- Figure 75: Rest of Asia Pacific Asia-Pacific Car Loan Market Revenue (Million), by Product Type 2025 & 2033

- Figure 76: Rest of Asia Pacific Asia-Pacific Car Loan Market Volume (Billion), by Product Type 2025 & 2033

- Figure 77: Rest of Asia Pacific Asia-Pacific Car Loan Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 78: Rest of Asia Pacific Asia-Pacific Car Loan Market Volume Share (%), by Product Type 2025 & 2033

- Figure 79: Rest of Asia Pacific Asia-Pacific Car Loan Market Revenue (Million), by Ownership 2025 & 2033

- Figure 80: Rest of Asia Pacific Asia-Pacific Car Loan Market Volume (Billion), by Ownership 2025 & 2033

- Figure 81: Rest of Asia Pacific Asia-Pacific Car Loan Market Revenue Share (%), by Ownership 2025 & 2033

- Figure 82: Rest of Asia Pacific Asia-Pacific Car Loan Market Volume Share (%), by Ownership 2025 & 2033

- Figure 83: Rest of Asia Pacific Asia-Pacific Car Loan Market Revenue (Million), by Provider Type 2025 & 2033

- Figure 84: Rest of Asia Pacific Asia-Pacific Car Loan Market Volume (Billion), by Provider Type 2025 & 2033

- Figure 85: Rest of Asia Pacific Asia-Pacific Car Loan Market Revenue Share (%), by Provider Type 2025 & 2033

- Figure 86: Rest of Asia Pacific Asia-Pacific Car Loan Market Volume Share (%), by Provider Type 2025 & 2033

- Figure 87: Rest of Asia Pacific Asia-Pacific Car Loan Market Revenue (Million), by Tenure 2025 & 2033

- Figure 88: Rest of Asia Pacific Asia-Pacific Car Loan Market Volume (Billion), by Tenure 2025 & 2033

- Figure 89: Rest of Asia Pacific Asia-Pacific Car Loan Market Revenue Share (%), by Tenure 2025 & 2033

- Figure 90: Rest of Asia Pacific Asia-Pacific Car Loan Market Volume Share (%), by Tenure 2025 & 2033

- Figure 91: Rest of Asia Pacific Asia-Pacific Car Loan Market Revenue (Million), by Geography 2025 & 2033

- Figure 92: Rest of Asia Pacific Asia-Pacific Car Loan Market Volume (Billion), by Geography 2025 & 2033

- Figure 93: Rest of Asia Pacific Asia-Pacific Car Loan Market Revenue Share (%), by Geography 2025 & 2033

- Figure 94: Rest of Asia Pacific Asia-Pacific Car Loan Market Volume Share (%), by Geography 2025 & 2033

- Figure 95: Rest of Asia Pacific Asia-Pacific Car Loan Market Revenue (Million), by Country 2025 & 2033

- Figure 96: Rest of Asia Pacific Asia-Pacific Car Loan Market Volume (Billion), by Country 2025 & 2033

- Figure 97: Rest of Asia Pacific Asia-Pacific Car Loan Market Revenue Share (%), by Country 2025 & 2033

- Figure 98: Rest of Asia Pacific Asia-Pacific Car Loan Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Asia-Pacific Car Loan Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Asia-Pacific Car Loan Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 3: Global Asia-Pacific Car Loan Market Revenue Million Forecast, by Ownership 2020 & 2033

- Table 4: Global Asia-Pacific Car Loan Market Volume Billion Forecast, by Ownership 2020 & 2033

- Table 5: Global Asia-Pacific Car Loan Market Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 6: Global Asia-Pacific Car Loan Market Volume Billion Forecast, by Provider Type 2020 & 2033

- Table 7: Global Asia-Pacific Car Loan Market Revenue Million Forecast, by Tenure 2020 & 2033

- Table 8: Global Asia-Pacific Car Loan Market Volume Billion Forecast, by Tenure 2020 & 2033

- Table 9: Global Asia-Pacific Car Loan Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: Global Asia-Pacific Car Loan Market Volume Billion Forecast, by Geography 2020 & 2033

- Table 11: Global Asia-Pacific Car Loan Market Revenue Million Forecast, by Region 2020 & 2033

- Table 12: Global Asia-Pacific Car Loan Market Volume Billion Forecast, by Region 2020 & 2033

- Table 13: Global Asia-Pacific Car Loan Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 14: Global Asia-Pacific Car Loan Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 15: Global Asia-Pacific Car Loan Market Revenue Million Forecast, by Ownership 2020 & 2033

- Table 16: Global Asia-Pacific Car Loan Market Volume Billion Forecast, by Ownership 2020 & 2033

- Table 17: Global Asia-Pacific Car Loan Market Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 18: Global Asia-Pacific Car Loan Market Volume Billion Forecast, by Provider Type 2020 & 2033

- Table 19: Global Asia-Pacific Car Loan Market Revenue Million Forecast, by Tenure 2020 & 2033

- Table 20: Global Asia-Pacific Car Loan Market Volume Billion Forecast, by Tenure 2020 & 2033

- Table 21: Global Asia-Pacific Car Loan Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 22: Global Asia-Pacific Car Loan Market Volume Billion Forecast, by Geography 2020 & 2033

- Table 23: Global Asia-Pacific Car Loan Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Asia-Pacific Car Loan Market Volume Billion Forecast, by Country 2020 & 2033

- Table 25: Global Asia-Pacific Car Loan Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 26: Global Asia-Pacific Car Loan Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 27: Global Asia-Pacific Car Loan Market Revenue Million Forecast, by Ownership 2020 & 2033

- Table 28: Global Asia-Pacific Car Loan Market Volume Billion Forecast, by Ownership 2020 & 2033

- Table 29: Global Asia-Pacific Car Loan Market Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 30: Global Asia-Pacific Car Loan Market Volume Billion Forecast, by Provider Type 2020 & 2033

- Table 31: Global Asia-Pacific Car Loan Market Revenue Million Forecast, by Tenure 2020 & 2033

- Table 32: Global Asia-Pacific Car Loan Market Volume Billion Forecast, by Tenure 2020 & 2033

- Table 33: Global Asia-Pacific Car Loan Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 34: Global Asia-Pacific Car Loan Market Volume Billion Forecast, by Geography 2020 & 2033

- Table 35: Global Asia-Pacific Car Loan Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Asia-Pacific Car Loan Market Volume Billion Forecast, by Country 2020 & 2033

- Table 37: Global Asia-Pacific Car Loan Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 38: Global Asia-Pacific Car Loan Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 39: Global Asia-Pacific Car Loan Market Revenue Million Forecast, by Ownership 2020 & 2033

- Table 40: Global Asia-Pacific Car Loan Market Volume Billion Forecast, by Ownership 2020 & 2033

- Table 41: Global Asia-Pacific Car Loan Market Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 42: Global Asia-Pacific Car Loan Market Volume Billion Forecast, by Provider Type 2020 & 2033

- Table 43: Global Asia-Pacific Car Loan Market Revenue Million Forecast, by Tenure 2020 & 2033

- Table 44: Global Asia-Pacific Car Loan Market Volume Billion Forecast, by Tenure 2020 & 2033

- Table 45: Global Asia-Pacific Car Loan Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 46: Global Asia-Pacific Car Loan Market Volume Billion Forecast, by Geography 2020 & 2033

- Table 47: Global Asia-Pacific Car Loan Market Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Global Asia-Pacific Car Loan Market Volume Billion Forecast, by Country 2020 & 2033

- Table 49: Global Asia-Pacific Car Loan Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 50: Global Asia-Pacific Car Loan Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 51: Global Asia-Pacific Car Loan Market Revenue Million Forecast, by Ownership 2020 & 2033

- Table 52: Global Asia-Pacific Car Loan Market Volume Billion Forecast, by Ownership 2020 & 2033

- Table 53: Global Asia-Pacific Car Loan Market Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 54: Global Asia-Pacific Car Loan Market Volume Billion Forecast, by Provider Type 2020 & 2033

- Table 55: Global Asia-Pacific Car Loan Market Revenue Million Forecast, by Tenure 2020 & 2033

- Table 56: Global Asia-Pacific Car Loan Market Volume Billion Forecast, by Tenure 2020 & 2033

- Table 57: Global Asia-Pacific Car Loan Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 58: Global Asia-Pacific Car Loan Market Volume Billion Forecast, by Geography 2020 & 2033

- Table 59: Global Asia-Pacific Car Loan Market Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Global Asia-Pacific Car Loan Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Car Loan Market ?

The projected CAGR is approximately 4.02%.

2. Which companies are prominent players in the Asia-Pacific Car Loan Market ?

Key companies in the market include Toyota Financial Services, Bank of China, HDFC Bank, ANZ Bank, Maybank, DBS Bank, Commonwealth Bank of Australia, State Bank of India, Mitsubishi UFJ Financial Group, Bangkok Bank**List Not Exhaustive.

3. What are the main segments of the Asia-Pacific Car Loan Market ?

The market segments include Product Type, Ownership, Provider Type, Tenure , Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 441.62 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Middle-Class Population.

6. What are the notable trends driving market growth?

Increasing Passenger Cars in Asia-Pacific.

7. Are there any restraints impacting market growth?

Growing Middle-Class Population.

8. Can you provide examples of recent developments in the market?

September 2023: CSB Bank and Daimler India Commercial Vehicle (DICV) announced a strategic partnership for vehicle financing. This collaboration offers enhanced support to dealerships and customers while fostering growth and innovation within the sector.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Car Loan Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Car Loan Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Car Loan Market ?

To stay informed about further developments, trends, and reports in the Asia-Pacific Car Loan Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence