Key Insights

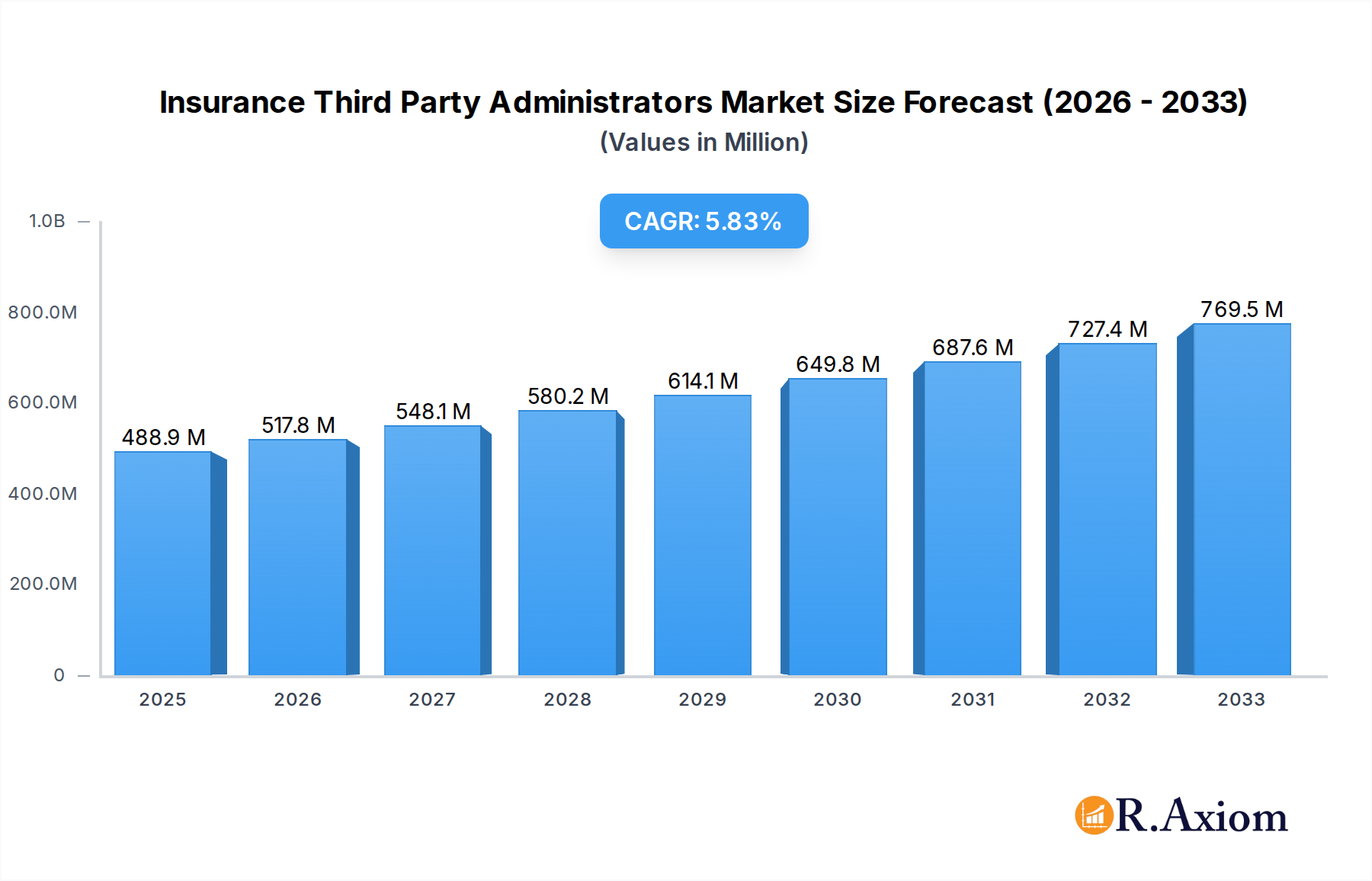

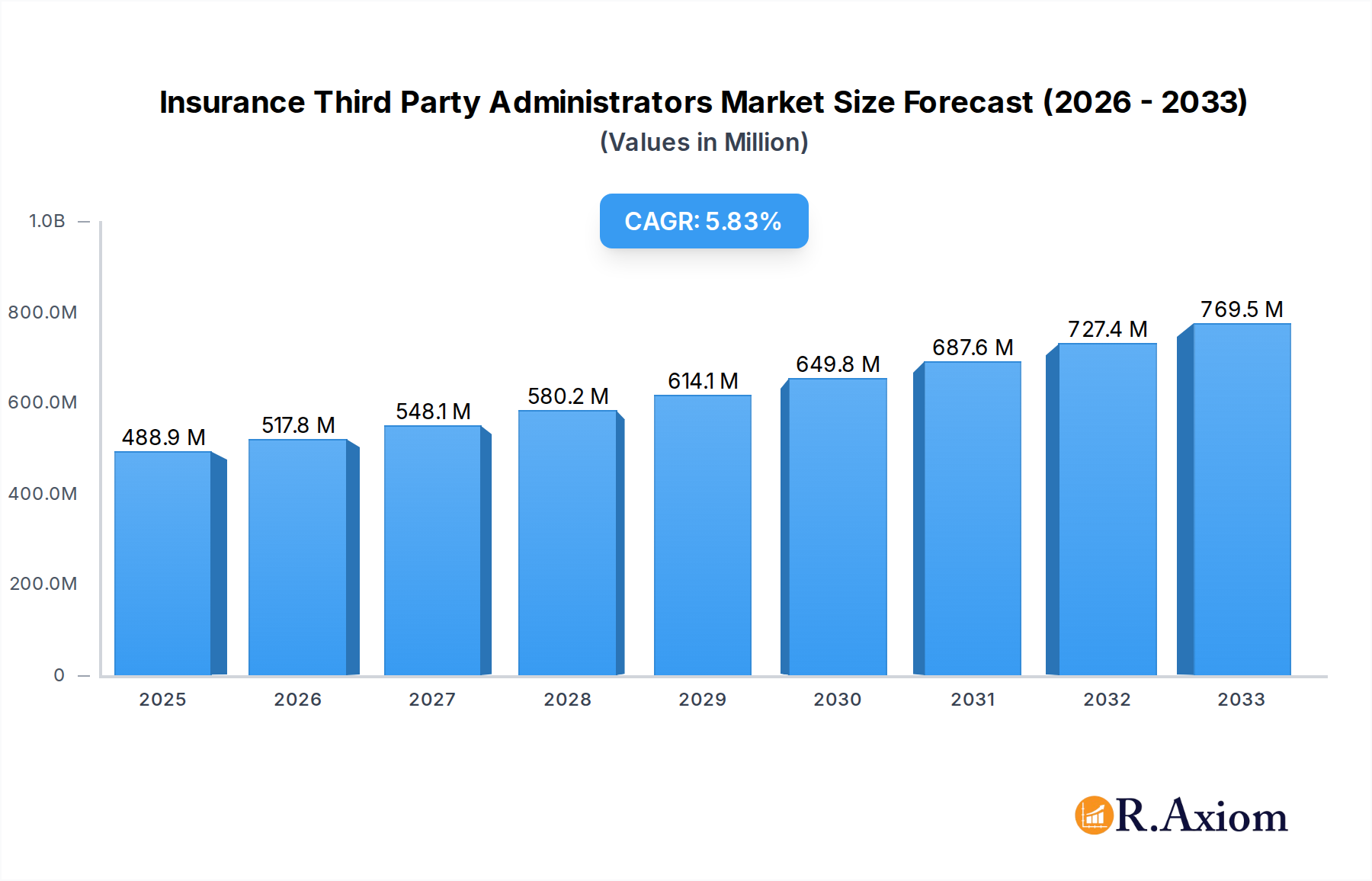

The global Insurance Third Party Administrators (TPA) market is poised for significant expansion, driven by increasing demand for specialized claims management and administrative services across various insurance sectors. With a current market size of approximately $488.90 Million, the industry is projected to grow at a robust Compound Annual Growth Rate (CAGR) of 5.90% from 2025 through 2033. This upward trajectory is underpinned by several key drivers, including the growing complexity of insurance products, the need for cost-efficiency in claims processing, and the strategic outsourcing of non-core functions by insurance carriers. The rise of innovative technologies such as AI and blockchain in claims management is also a significant trend, promising enhanced efficiency, fraud detection, and customer experience. Furthermore, evolving regulatory landscapes and the increasing penetration of health and retirement plans are fueling demand for TPA services.

Insurance Third Party Administrators Market Market Size (In Million)

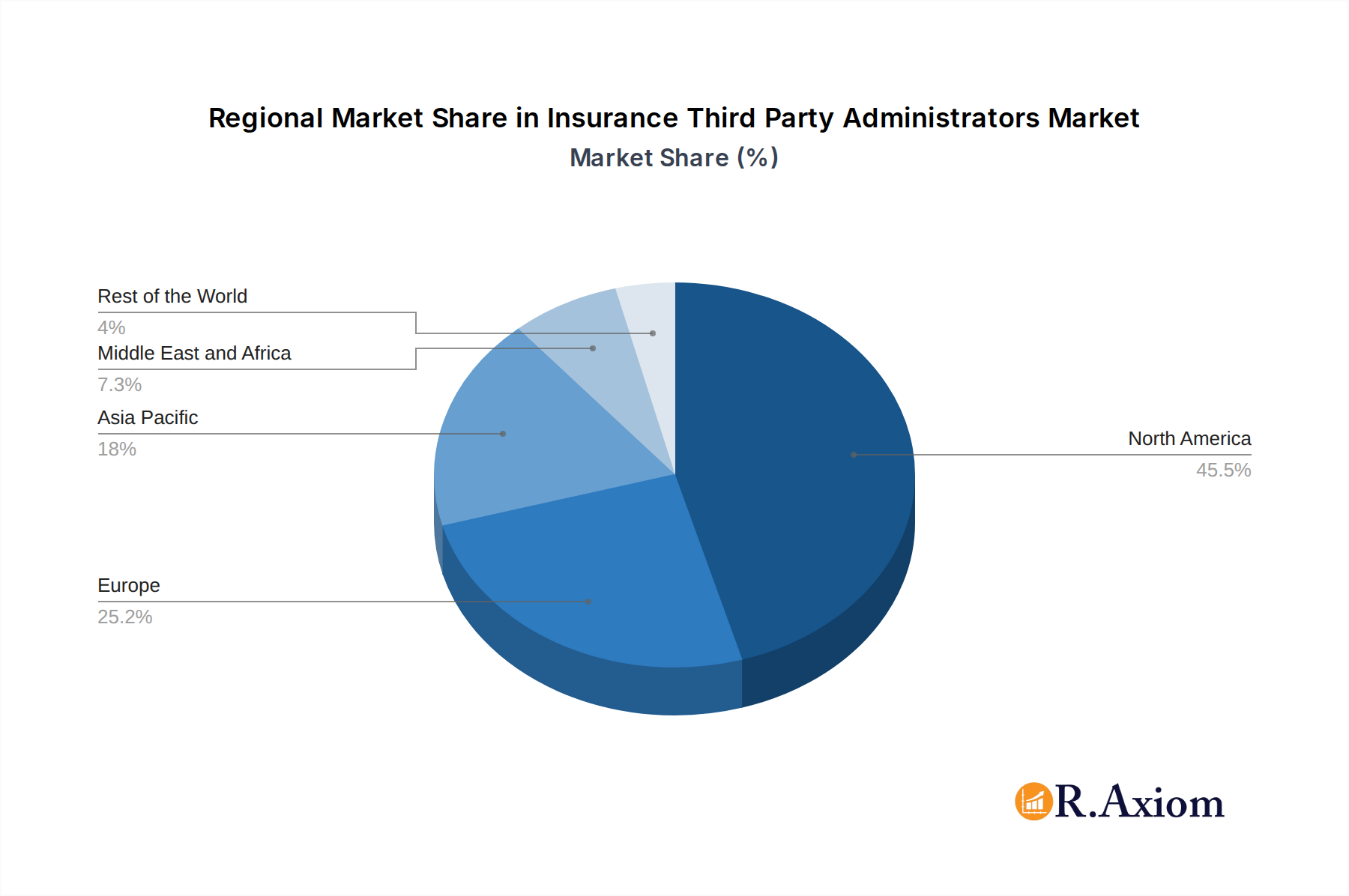

The market's growth is further bolstered by the expansion of insurance penetration globally, especially in emerging economies within the Asia Pacific and Middle East & Africa regions. Specialized insurance types like Healthcare Insurance and Retirement Plans are leading the charge in TPA adoption due to their intricate administrative requirements and regulatory compliance needs. While the market presents substantial opportunities, it also faces certain restraints, such as the initial investment required for technology adoption and the potential for data security breaches, which require careful management and robust cybersecurity measures. Leading companies like Sedgwick Claims Management Services Inc., UMR Inc., and Crawford & Company are actively shaping the market landscape through strategic acquisitions and technological advancements, catering to a diverse range of insurance needs. North America currently dominates the market, though significant growth is anticipated in other regions as insurance markets mature and outsourcing trends gain momentum.

Insurance Third Party Administrators Market Company Market Share

This in-depth market research report offers a comprehensive analysis of the global Insurance Third Party Administrators (TPAs) Market, covering historical performance, current trends, and future projections. The study spans from 2019 to 2033, with a base and estimated year of 2025, and a forecast period from 2025 to 2033. This report is an indispensable resource for stakeholders seeking to understand the evolving landscape of TPA services, including insurers, TPAs, investors, and regulatory bodies. We provide actionable insights into market dynamics, competitive strategies, and emerging opportunities within this critical sector of the insurance industry.

Insurance Third Party Administrators Market Market Concentration & Innovation

The Insurance Third Party Administrators (TPAs) Market exhibits moderate to high concentration, with a few dominant players holding significant market share. Leading entities like Sedgwick Claims Management Services Inc., UMR Inc., and Crawford & Company are instrumental in shaping market trends through continuous innovation and strategic acquisitions. The market's growth is fueled by a relentless pursuit of operational efficiency, cost reduction for insurers, and enhanced customer experience. Innovation is primarily driven by advancements in claims processing technology, data analytics for risk assessment, and the integration of artificial intelligence (AI) and machine learning (ML) to automate tasks and improve fraud detection. Regulatory frameworks, while sometimes posing compliance challenges, also create opportunities for TPAs specializing in navigating complex insurance laws and mandates. Product substitutes are minimal, as the core function of claims administration and risk management requires specialized expertise that TPAs uniquely provide. End-user trends highlight a growing preference for outsourced TPA services due to the increasing complexity of insurance products and the need for specialized handling of diverse insurance types, including healthcare, retirement plans, and commercial general liability. Mergers and acquisitions (M&A) are a significant feature of this market, with deal values often running into hundreds of millions of dollars, as companies seek to expand their service portfolios, geographical reach, and client base. For instance, the acquisition of Raksha Insurance by Medi Assist in March 2023 signifies a strategic move to bolster retail capabilities and expand market penetration. The M&A activity, with estimated deal values in the tens to hundreds of millions, is a testament to the market's consolidation and the pursuit of synergistic growth.

Insurance Third Party Administrators Market Industry Trends & Insights

The Insurance Third Party Administrators (TPAs) Market is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 7.5% from 2025 to 2033. This expansion is primarily driven by the increasing outsourcing trend among insurance carriers seeking to optimize costs, enhance claims processing efficiency, and focus on core competencies like product development and marketing. The growing complexity of insurance regulations and the rising volume of claims across various sectors, including healthcare insurance, retirement plans, and commercial general liability insurance, further necessitate the specialized services offered by TPAs. Technological disruptions are profoundly reshaping the TPA landscape. The integration of advanced analytics, artificial intelligence (AI), and machine learning (ML) is revolutionizing claims adjudication, fraud detection, and risk management. Automation of routine tasks, such as data entry and initial claim assessment, is leading to significant improvements in turnaround times and operational efficiency. The adoption of digital platforms and mobile applications is also enhancing customer engagement and providing policyholders with self-service options, thereby improving the overall claims experience. Consumer preferences are evolving towards faster, more transparent, and personalized insurance services. Policyholders expect seamless digital interactions, quick claim settlements, and proactive communication. TPAs that can leverage technology to meet these expectations are gaining a competitive edge. The competitive dynamics within the TPA market are characterized by a mix of large, established players and smaller, niche providers. Consolidation through mergers and acquisitions continues to be a prominent trend, as companies aim to achieve economies of scale, broaden their service offerings, and expand their geographical footprint. The market penetration of specialized TPA services is steadily increasing as more insurers recognize the strategic value of outsourcing non-core functions. The increasing demand for personalized insurance solutions and the growing awareness of the benefits of efficient claims management are key factors contributing to sustained market growth.

Dominant Markets & Segments in Insurance Third Party Administrators Market

The Healthcare Insurance segment stands as a dominant force within the Insurance Third Party Administrators (TPAs) Market, driven by several compelling factors. The escalating costs of healthcare, coupled with the intricate nature of health insurance policies and a continuously evolving regulatory landscape, compel many healthcare providers and payers to rely on specialized TPAs for efficient claims processing, benefit administration, and cost containment. The sheer volume of medical claims processed daily, the need for accurate coding and adjudication, and the imperative to manage fraud and abuse contribute significantly to the dominance of this segment. For instance, the implementation of health reforms and the increasing prevalence of chronic diseases globally have amplified the demand for sophisticated TPA solutions.

Key Drivers for Healthcare Insurance Dominance:

- Regulatory Complexity: Navigating intricate healthcare regulations such as HIPAA in the United States or similar mandates in other regions requires specialized expertise that TPAs possess.

- Cost Containment Pressures: Insurers and employers are constantly seeking ways to reduce healthcare expenditure, making TPA services essential for negotiating provider rates and managing utilization.

- Technological Advancements: The integration of AI and data analytics for claims processing, fraud detection, and personalized member engagement is crucial in the healthcare TPA space.

- Aging Population & Chronic Diseases: The increasing prevalence of chronic conditions and an aging demographic lead to a higher volume and complexity of medical claims.

The United States emerges as the dominant geographical market for TPA services, largely due to its mature insurance industry, complex regulatory environment, and substantial healthcare expenditure. The presence of major insurance carriers and a significant number of self-insured employers seeking to optimize their risk management and claims administration functions further solidifies the US market's leadership. Economic policies in the US, focused on market-based healthcare solutions and regulatory oversight, create a fertile ground for TPA operations.

Key Drivers for US Market Dominance:

- Fragmented Insurance Landscape: A vast number of insurance providers and self-insured entities require specialized administrative support.

- High Healthcare Spending: The substantial investment in healthcare services in the US translates into a high volume of claims to be administered.

- Strong Regulatory Framework: The intricate web of federal and state regulations necessitates expert navigation, a core competency of TPAs.

The Commercial General Liability Insurance segment also represents a significant and growing area for TPA services. Businesses across all industries are exposed to various liabilities, and effectively managing claims related to property damage, bodily injury, and professional errors is crucial. TPAs provide expertise in claims investigation, negotiation, and settlement, helping businesses mitigate financial risks and protect their reputation. The increasing frequency and severity of liability claims, coupled with rising litigation costs, drive the demand for specialized TPA solutions in this segment.

Key Drivers for Commercial General Liability Dominance:

- Increasing Litigation: The rising trend of lawsuits and legal disputes across industries drives demand for expert claims handling.

- Complex Risk Profiles: Businesses face diverse and evolving liability risks, requiring specialized knowledge for effective management.

- Focus on Risk Mitigation: Companies are increasingly prioritizing proactive risk management and efficient claims resolution to safeguard their operations and finances.

Insurance Third Party Administrators Market Product Developments

Product developments in the Insurance Third Party Administrators (TPAs) Market are heavily influenced by technological advancements and the pursuit of enhanced efficiency and customer satisfaction. Leading TPAs are investing in robust digital platforms that offer end-to-end claims management solutions, from initial intake to final settlement. Innovations include AI-powered claims adjudication systems that expedite processing and reduce human error, advanced data analytics for predictive modeling and fraud detection, and secure cloud-based systems for seamless data sharing and accessibility. The integration of chatbots and virtual assistants is also improving customer engagement by providing instant support and information. These product developments aim to offer competitive advantages through faster claims turnaround, greater accuracy, improved cost control for insurers, and a more positive experience for policyholders.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Insurance Third Party Administrators (TPAs) Market, segmented by Insurance Type, Industry Vertical, and Region. The detailed segmentation includes:

- Healthcare Insurance: This segment encompasses TPAs that administer claims and benefits for health insurance plans, including individual, group, and government-sponsored programs. The market size for this segment is projected to reach approximately USD 50,000 Million by 2033, with a CAGR of 8.1% during the forecast period. Competitive dynamics are intense, driven by technology adoption and service quality.

- Retirement Plans: This segment focuses on TPAs managing claims and administrative services for various retirement plans, such as defined benefit and defined contribution plans. The market size is estimated at around USD 15,000 Million in 2025, with a projected CAGR of 6.5% through 2033. Key competitive factors include regulatory compliance and participant services.

- Commercial General Liability Insurance: This segment covers TPAs specializing in claims administration for commercial liability policies, including professional liability, directors & officers liability, and general liability. The market size is anticipated to reach approximately USD 25,000 Million by 2033, growing at a CAGR of 7.2%. Competition is driven by expertise in complex claims and risk management.

- Others Insurance Types (Motor Insurance): This broad category includes TPAs handling claims for motor insurance, property insurance, travel insurance, and other miscellaneous lines. The market size is estimated at around USD 20,000 Million in 2025, with a CAGR of 6.8% through 2033. This segment is characterized by a diverse range of service providers and a focus on operational efficiency.

Key Drivers of Insurance Third Party Administrators Market Growth

The Insurance Third Party Administrators (TPAs) Market is propelled by several key drivers, including the increasing trend of outsourcing by insurance carriers to focus on core competencies and reduce operational costs. The growing complexity of insurance products and regulatory frameworks worldwide necessitates specialized expertise that TPAs provide, leading to more efficient claims processing and risk management. Technological advancements, such as the adoption of AI, ML, and advanced analytics, are enhancing TPA capabilities in areas like fraud detection, predictive modeling, and automated claims adjudication. Furthermore, the escalating healthcare costs and the demand for better patient experiences are driving the growth of TPAs in the healthcare insurance sector. Economic stability and the increasing per capita income in emerging economies also contribute to the overall growth of the insurance market, indirectly boosting the demand for TPA services.

Challenges in the Insurance Third Party Administrators Market Sector

Despite robust growth, the Insurance Third Party Administrators (TPAs) Market faces several challenges. Stringent regulatory compliance requirements across different jurisdictions can be complex and costly to navigate, posing a significant hurdle. Cybersecurity threats and the need to protect sensitive policyholder data are paramount concerns, requiring substantial investment in advanced security measures. The highly competitive nature of the market can lead to price pressures, impacting profit margins for TPAs. Furthermore, the talent gap, particularly in specialized areas like data analytics and AI within claims processing, can hinder the adoption of new technologies and the expansion of services. Resistance to change from traditional insurance carriers and the inherent complexities of integrating new TPA systems with legacy infrastructure can also present implementation challenges.

Emerging Opportunities in Insurance Third Party Administrators Market

Emerging opportunities in the Insurance Third Party Administrators (TPAs) Market are abundant, fueled by innovation and evolving consumer demands. The growing adoption of InsurTech solutions presents significant opportunities for TPAs to leverage cutting-edge technologies, such as blockchain for enhanced transparency and security in claims, and IoT devices for real-time risk monitoring. The expanding gig economy and the rise of micro-insurance products create new avenues for TPAs to develop specialized administrative solutions. The increasing focus on personalized insurance offerings and proactive customer engagement opens doors for TPAs to provide value-added services like wellness programs and preventative care management. Furthermore, the untapped potential in emerging economies, with their rapidly growing middle class and increasing insurance penetration, represents a substantial growth frontier for TPA services. The demand for niche TPA services catering to specific industries, such as cyber insurance or parametric insurance, is also on the rise.

Leading Players in the Insurance Third Party Administrators Market Market

- Sedgwick Claims Management Services Inc.

- UMR Inc.

- Crawford & Company

- Gallagher Bassett Services Inc.

- CorVel Corporation

- Helmsman Management Services LLC

- ESIS Inc.

- Healthscope Benefits

- Maritain Health

Key Developments in Insurance Third Party Administrators Market Industry

- March 2023: To grow, Medi Assist, a third-party administrator for health insurance, acquired Raksha Insurance. Medi Assist, based in Bengaluru, will be able to increase significantly its retail capabilities and fortify its position in the nation's interior thanks to the agreement. This strategic acquisition is expected to enhance Medi Assist's market share and expand its service offerings in the Indian healthcare TPA sector.

- December 2022: Sedgwick set up a new business unit focused on resource solutions for its insurance clients in the United Kingdom. Sedgwick's experience and technical expertise help clients with temporary and permanent placements across claims handling divisions. This development underscores Sedgwick's commitment to providing comprehensive support and specialized staffing solutions to the UK insurance market, bolstering its operational capabilities.

Strategic Outlook for Insurance Third Party Administrators Market Market

The strategic outlook for the Insurance Third Party Administrators (TPAs) Market is exceptionally positive, characterized by sustained growth and evolving service offerings. Future market potential lies in the continued adoption of advanced technologies like AI, ML, and blockchain to drive efficiency, enhance customer experience, and mitigate risks. TPAs that can successfully integrate these innovations into their core operations will be well-positioned for success. The growing demand for personalized insurance solutions and the increasing emphasis on proactive risk management present opportunities for TPAs to expand their value-added services beyond traditional claims administration. Furthermore, the expansion into emerging markets and the development of specialized TPA solutions for niche insurance sectors will be crucial growth catalysts. Strategic partnerships and collaborations between TPAs and InsurTech companies will also play a pivotal role in shaping the future landscape, fostering innovation and creating new service delivery models.

Insurance Third Party Administrators Market Segmentation

-

1. Insurance Type

- 1.1. Healthcare Insurance

- 1.2. Retirement Plans

- 1.3. Commercial General Liability Insurance

- 1.4. Others Insurance Types (Motor Insurance)

Insurance Third Party Administrators Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. United Arab Emirates

- 4.2. Saudi Arabia

- 4.3. Rest of Middle East and Africa

- 5. Rest of the World

Insurance Third Party Administrators Market Regional Market Share

Geographic Coverage of Insurance Third Party Administrators Market

Insurance Third Party Administrators Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.90% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Cost Effective Healthcare Solutions; Rise in Digitalization and Automation is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Increasing Demand for Cost Effective Healthcare Solutions; Rise in Digitalization and Automation is Driving the Market

- 3.4. Market Trends

- 3.4.1. Increasing Healthcare Insurance TPAs is Fuelling the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Insurance Third Party Administrators Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 5.1.1. Healthcare Insurance

- 5.1.2. Retirement Plans

- 5.1.3. Commercial General Liability Insurance

- 5.1.4. Others Insurance Types (Motor Insurance)

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Middle East and Africa

- 5.2.5. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 6. North America Insurance Third Party Administrators Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Insurance Type

- 6.1.1. Healthcare Insurance

- 6.1.2. Retirement Plans

- 6.1.3. Commercial General Liability Insurance

- 6.1.4. Others Insurance Types (Motor Insurance)

- 6.1. Market Analysis, Insights and Forecast - by Insurance Type

- 7. Europe Insurance Third Party Administrators Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Insurance Type

- 7.1.1. Healthcare Insurance

- 7.1.2. Retirement Plans

- 7.1.3. Commercial General Liability Insurance

- 7.1.4. Others Insurance Types (Motor Insurance)

- 7.1. Market Analysis, Insights and Forecast - by Insurance Type

- 8. Asia Pacific Insurance Third Party Administrators Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Insurance Type

- 8.1.1. Healthcare Insurance

- 8.1.2. Retirement Plans

- 8.1.3. Commercial General Liability Insurance

- 8.1.4. Others Insurance Types (Motor Insurance)

- 8.1. Market Analysis, Insights and Forecast - by Insurance Type

- 9. Middle East and Africa Insurance Third Party Administrators Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Insurance Type

- 9.1.1. Healthcare Insurance

- 9.1.2. Retirement Plans

- 9.1.3. Commercial General Liability Insurance

- 9.1.4. Others Insurance Types (Motor Insurance)

- 9.1. Market Analysis, Insights and Forecast - by Insurance Type

- 10. Rest of the World Insurance Third Party Administrators Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Insurance Type

- 10.1.1. Healthcare Insurance

- 10.1.2. Retirement Plans

- 10.1.3. Commercial General Liability Insurance

- 10.1.4. Others Insurance Types (Motor Insurance)

- 10.1. Market Analysis, Insights and Forecast - by Insurance Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Sedgwick Claims Management Services Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 UMR Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Crawford & Company

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Gallagher Bassett Services Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 CorVel Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Helmsman Management Services LLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 ESIS Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Healthscope Benefits

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Maritain Health**List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Sedgwick Claims Management Services Inc

List of Figures

- Figure 1: Global Insurance Third Party Administrators Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Insurance Third Party Administrators Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America Insurance Third Party Administrators Market Revenue (Million), by Insurance Type 2025 & 2033

- Figure 4: North America Insurance Third Party Administrators Market Volume (Billion), by Insurance Type 2025 & 2033

- Figure 5: North America Insurance Third Party Administrators Market Revenue Share (%), by Insurance Type 2025 & 2033

- Figure 6: North America Insurance Third Party Administrators Market Volume Share (%), by Insurance Type 2025 & 2033

- Figure 7: North America Insurance Third Party Administrators Market Revenue (Million), by Country 2025 & 2033

- Figure 8: North America Insurance Third Party Administrators Market Volume (Billion), by Country 2025 & 2033

- Figure 9: North America Insurance Third Party Administrators Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Insurance Third Party Administrators Market Volume Share (%), by Country 2025 & 2033

- Figure 11: Europe Insurance Third Party Administrators Market Revenue (Million), by Insurance Type 2025 & 2033

- Figure 12: Europe Insurance Third Party Administrators Market Volume (Billion), by Insurance Type 2025 & 2033

- Figure 13: Europe Insurance Third Party Administrators Market Revenue Share (%), by Insurance Type 2025 & 2033

- Figure 14: Europe Insurance Third Party Administrators Market Volume Share (%), by Insurance Type 2025 & 2033

- Figure 15: Europe Insurance Third Party Administrators Market Revenue (Million), by Country 2025 & 2033

- Figure 16: Europe Insurance Third Party Administrators Market Volume (Billion), by Country 2025 & 2033

- Figure 17: Europe Insurance Third Party Administrators Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Insurance Third Party Administrators Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Asia Pacific Insurance Third Party Administrators Market Revenue (Million), by Insurance Type 2025 & 2033

- Figure 20: Asia Pacific Insurance Third Party Administrators Market Volume (Billion), by Insurance Type 2025 & 2033

- Figure 21: Asia Pacific Insurance Third Party Administrators Market Revenue Share (%), by Insurance Type 2025 & 2033

- Figure 22: Asia Pacific Insurance Third Party Administrators Market Volume Share (%), by Insurance Type 2025 & 2033

- Figure 23: Asia Pacific Insurance Third Party Administrators Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Asia Pacific Insurance Third Party Administrators Market Volume (Billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Insurance Third Party Administrators Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Insurance Third Party Administrators Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Middle East and Africa Insurance Third Party Administrators Market Revenue (Million), by Insurance Type 2025 & 2033

- Figure 28: Middle East and Africa Insurance Third Party Administrators Market Volume (Billion), by Insurance Type 2025 & 2033

- Figure 29: Middle East and Africa Insurance Third Party Administrators Market Revenue Share (%), by Insurance Type 2025 & 2033

- Figure 30: Middle East and Africa Insurance Third Party Administrators Market Volume Share (%), by Insurance Type 2025 & 2033

- Figure 31: Middle East and Africa Insurance Third Party Administrators Market Revenue (Million), by Country 2025 & 2033

- Figure 32: Middle East and Africa Insurance Third Party Administrators Market Volume (Billion), by Country 2025 & 2033

- Figure 33: Middle East and Africa Insurance Third Party Administrators Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Insurance Third Party Administrators Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Rest of the World Insurance Third Party Administrators Market Revenue (Million), by Insurance Type 2025 & 2033

- Figure 36: Rest of the World Insurance Third Party Administrators Market Volume (Billion), by Insurance Type 2025 & 2033

- Figure 37: Rest of the World Insurance Third Party Administrators Market Revenue Share (%), by Insurance Type 2025 & 2033

- Figure 38: Rest of the World Insurance Third Party Administrators Market Volume Share (%), by Insurance Type 2025 & 2033

- Figure 39: Rest of the World Insurance Third Party Administrators Market Revenue (Million), by Country 2025 & 2033

- Figure 40: Rest of the World Insurance Third Party Administrators Market Volume (Billion), by Country 2025 & 2033

- Figure 41: Rest of the World Insurance Third Party Administrators Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Rest of the World Insurance Third Party Administrators Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Insurance Third Party Administrators Market Revenue Million Forecast, by Insurance Type 2020 & 2033

- Table 2: Global Insurance Third Party Administrators Market Volume Billion Forecast, by Insurance Type 2020 & 2033

- Table 3: Global Insurance Third Party Administrators Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Insurance Third Party Administrators Market Volume Billion Forecast, by Region 2020 & 2033

- Table 5: Global Insurance Third Party Administrators Market Revenue Million Forecast, by Insurance Type 2020 & 2033

- Table 6: Global Insurance Third Party Administrators Market Volume Billion Forecast, by Insurance Type 2020 & 2033

- Table 7: Global Insurance Third Party Administrators Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Global Insurance Third Party Administrators Market Volume Billion Forecast, by Country 2020 & 2033

- Table 9: United States Insurance Third Party Administrators Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: United States Insurance Third Party Administrators Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 11: Canada Insurance Third Party Administrators Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada Insurance Third Party Administrators Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 13: Global Insurance Third Party Administrators Market Revenue Million Forecast, by Insurance Type 2020 & 2033

- Table 14: Global Insurance Third Party Administrators Market Volume Billion Forecast, by Insurance Type 2020 & 2033

- Table 15: Global Insurance Third Party Administrators Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Insurance Third Party Administrators Market Volume Billion Forecast, by Country 2020 & 2033

- Table 17: United Kingdom Insurance Third Party Administrators Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United Kingdom Insurance Third Party Administrators Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Germany Insurance Third Party Administrators Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Insurance Third Party Administrators Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Insurance Third Party Administrators Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Rest of Europe Insurance Third Party Administrators Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Global Insurance Third Party Administrators Market Revenue Million Forecast, by Insurance Type 2020 & 2033

- Table 24: Global Insurance Third Party Administrators Market Volume Billion Forecast, by Insurance Type 2020 & 2033

- Table 25: Global Insurance Third Party Administrators Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Global Insurance Third Party Administrators Market Volume Billion Forecast, by Country 2020 & 2033

- Table 27: China Insurance Third Party Administrators Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: China Insurance Third Party Administrators Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: India Insurance Third Party Administrators Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: India Insurance Third Party Administrators Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Insurance Third Party Administrators Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Rest of Asia Pacific Insurance Third Party Administrators Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Global Insurance Third Party Administrators Market Revenue Million Forecast, by Insurance Type 2020 & 2033

- Table 34: Global Insurance Third Party Administrators Market Volume Billion Forecast, by Insurance Type 2020 & 2033

- Table 35: Global Insurance Third Party Administrators Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Insurance Third Party Administrators Market Volume Billion Forecast, by Country 2020 & 2033

- Table 37: United Arab Emirates Insurance Third Party Administrators Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: United Arab Emirates Insurance Third Party Administrators Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 39: Saudi Arabia Insurance Third Party Administrators Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Saudi Arabia Insurance Third Party Administrators Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East and Africa Insurance Third Party Administrators Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Rest of Middle East and Africa Insurance Third Party Administrators Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 43: Global Insurance Third Party Administrators Market Revenue Million Forecast, by Insurance Type 2020 & 2033

- Table 44: Global Insurance Third Party Administrators Market Volume Billion Forecast, by Insurance Type 2020 & 2033

- Table 45: Global Insurance Third Party Administrators Market Revenue Million Forecast, by Country 2020 & 2033

- Table 46: Global Insurance Third Party Administrators Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Insurance Third Party Administrators Market?

The projected CAGR is approximately 5.90%.

2. Which companies are prominent players in the Insurance Third Party Administrators Market?

Key companies in the market include Sedgwick Claims Management Services Inc, UMR Inc, Crawford & Company, Gallagher Bassett Services Inc, CorVel Corporation, Helmsman Management Services LLC, ESIS Inc, Healthscope Benefits, Maritain Health**List Not Exhaustive.

3. What are the main segments of the Insurance Third Party Administrators Market?

The market segments include Insurance Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 488.90 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Cost Effective Healthcare Solutions; Rise in Digitalization and Automation is Driving the Market.

6. What are the notable trends driving market growth?

Increasing Healthcare Insurance TPAs is Fuelling the Market.

7. Are there any restraints impacting market growth?

Increasing Demand for Cost Effective Healthcare Solutions; Rise in Digitalization and Automation is Driving the Market.

8. Can you provide examples of recent developments in the market?

March 2023: To grow, Medi Assist, a third-party administrator for health insurance, acquired Raksha Insurance. Medi Assist, based in Bengaluru, will be able to increase significantly its retail capabilities and fortify its position in the nation's interior thanks to the agreement.December 2022: Sedgwick set up a new business unit focused on resource solutions for its insurance clients in the United Kingdom. Sedgwick's experience and technical expertise help clients with temporary and permanent placements across claims handling divisions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Insurance Third Party Administrators Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Insurance Third Party Administrators Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Insurance Third Party Administrators Market?

To stay informed about further developments, trends, and reports in the Insurance Third Party Administrators Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence