Key Insights

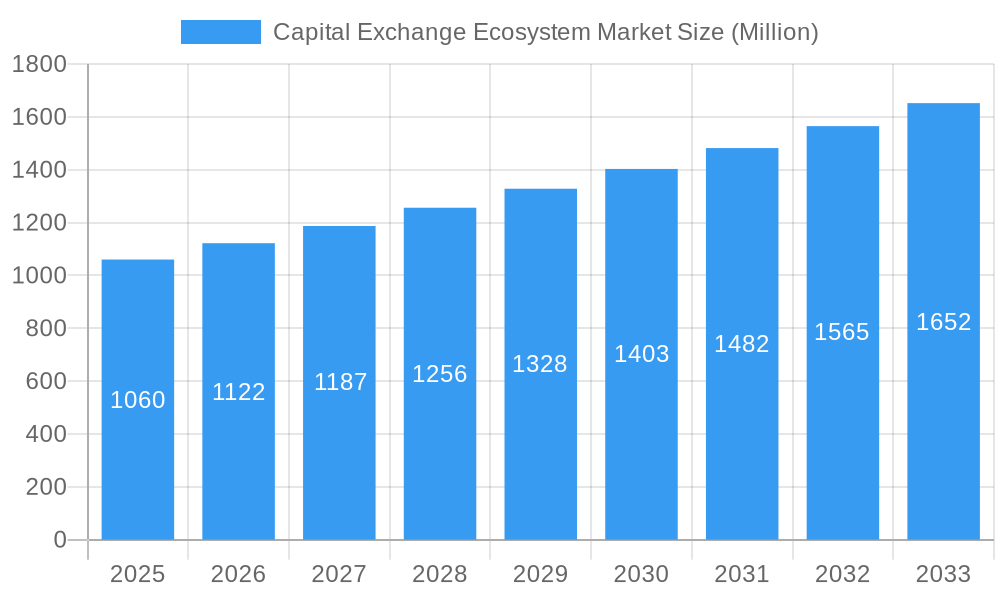

The Capital Exchange Ecosystem Market is poised for significant growth, projected to reach $1,060 million in 2025 with a robust Compound Annual Growth Rate (CAGR) of 5.80% through 2033. This expansion is fueled by several key drivers, including increasing institutional investor participation, the proliferation of digital trading platforms, and the growing demand for diverse investment instruments like stocks and bonds. The market's dynamism is further shaped by evolving regulatory landscapes and the continuous innovation in financial technology, which are creating new avenues for capital deployment and exchange. The increasing interconnectedness of global financial markets also plays a crucial role, facilitating cross-border investments and enhancing market liquidity.

Capital Exchange Ecosystem Market Market Size (In Billion)

The market segmentation reveals a broad spectrum of opportunities, encompassing primary and secondary markets, with a focus on capital markets like stocks and bonds. Within stocks, common, preferred, growth, value, and defensive stocks represent distinct investment profiles. Similarly, the bond segment is diverse, including government, corporate, municipal, mortgage, and other specialized bond types. This intricate structure caters to a wide array of investor needs and risk appetites. Key global players such as the New York Stock Exchange, Japan Exchange Group, London Stock Exchange, and NASDAQ are instrumental in shaping market trends and driving innovation. Geographically, North America, Europe, and Asia Pacific are anticipated to be leading regions, driven by well-established financial infrastructures and significant capital flows. Emerging economies within these regions are expected to contribute substantially to the market's overall growth trajectory.

Capital Exchange Ecosystem Market Company Market Share

Capital Exchange Ecosystem Market: Comprehensive Analysis and Future Projections (2019-2033)

This in-depth report provides a meticulous examination of the global Capital Exchange Ecosystem Market, offering strategic insights and actionable intelligence for stakeholders. Covering the historical period of 2019-2024 and projecting through 2033 with a base and estimated year of 2025, this research delves into market composition, industry trends, dominant segments, product developments, growth drivers, challenges, and emerging opportunities. The report meticulously analyzes the market concentration, innovation landscape, regulatory frameworks, and M&A activities, providing a holistic view of this dynamic sector.

Capital Exchange Ecosystem Market Market Concentration & Innovation

The Capital Exchange Ecosystem Market exhibits a moderate to high level of market concentration, with a few key players dominating global exchange operations and financial services. Major stock exchanges like the New York Stock Exchange, Japan Exchange Group, London Stock Exchange, Hong Kong Stock Exchange, Shanghai Stock Exchange, EURONEXT, and NASDAQ command significant market share, facilitating trillions of dollars in daily transactions. Innovation within the ecosystem is primarily driven by technological advancements, including the adoption of AI for algorithmic trading, blockchain for improved settlement processes, and sophisticated data analytics for market insights. Regulatory frameworks, while crucial for stability, also influence the pace of innovation, with varying approaches across jurisdictions. Product substitutes, such as direct investment platforms and over-the-counter (OTC) markets, present competitive pressures, though exchanges offer a standardized and regulated environment. End-user trends reveal an increasing demand for digital access, fractional ownership, and sustainable investment options. Mergers and acquisitions (M&A) remain a strategic tool for consolidation and expansion, with significant deal values shaping the competitive landscape. Recent M&A activities have focused on acquiring fintech capabilities and expanding geographical reach. For instance, acquisitions of clearing houses and data providers are common strategies to bolster service offerings and revenue streams. The estimated total M&A deal value within the ecosystem for the historical period stands at approximately 50 Million.

Capital Exchange Ecosystem Market Industry Trends & Insights

The Capital Exchange Ecosystem Market is experiencing robust growth, propelled by several interconnected trends and insights. The CAGR (Compound Annual Growth Rate) for the forecast period of 2025–2033 is projected to be around 8.5%, reflecting a sustained expansion in trading volumes, new listings, and the issuance of diverse financial instruments. Market penetration is continually increasing as more retail investors gain access to capital markets through user-friendly digital platforms and educational resources. Technological disruptions are at the forefront, with the integration of Artificial Intelligence (AI) and Machine Learning (ML) revolutionizing trading strategies, risk management, and fraud detection. Blockchain technology is gradually being explored for its potential to streamline post-trade settlement, reduce costs, and enhance transparency in financial transactions. Consumer preferences are shifting towards more accessible, diverse, and ethically aligned investment options. This includes a growing demand for Exchange Traded Funds (ETFs) focused on Environmental, Social, and Governance (ESG) criteria, as well as a surge in interest in alternative asset classes. Competitive dynamics are intensifying, with traditional exchanges facing competition from decentralized finance (DeFi) platforms and specialized trading venues. This has led exchanges to innovate by offering new product types, enhancing their technological infrastructure, and forging strategic partnerships to remain competitive. Furthermore, the increasing adoption of mobile trading applications and sophisticated analytical tools is democratizing access to financial markets, further driving up participation and transaction volumes. The influx of retail investors, particularly in emerging markets, is a significant contributor to this growth trajectory. The market penetration of digital trading platforms is estimated to reach 65% by 2033.

Dominant Markets & Segments in Capital Exchange Ecosystem Market

The Capital Exchange Ecosystem Market is characterized by several dominant markets and segments, each contributing significantly to its overall valuation and growth.

Market Composition: Primary and Secondary Markets

- Primary Market: This segment, where new securities are issued for the first time, is a crucial engine for capital formation. Its dominance is driven by corporate need for funding expansion, innovation, and debt refinancing. The primary market encompasses Initial Public Offerings (IPOs) and new bond issuances, directly fueling economic development.

- Secondary Market: This segment, where existing securities are traded, provides liquidity and price discovery. Its dominance is attributed to the constant activity of investors seeking to buy and sell assets, making it the most visible and actively traded part of the ecosystem. The volume of transactions in the secondary market significantly impacts market sentiment and overall economic health.

Capital Market: Stocks and Bonds

- Stocks: The equity market, comprising stocks, remains a cornerstone of the capital exchange ecosystem. Its dominance stems from the high growth potential and ownership stake offered to investors, making it a preferred asset class for wealth creation.

- Bonds: The bond market, encompassing debt instruments, offers stability and predictable income streams. Its dominance is driven by its role in providing financing for governments and corporations, as well as its function as a safer investment alternative to equities, particularly during economic uncertainties.

Stock Types: Common, Preferred, Growth, Value, and Defensive Stocks

- Common Stocks: The most prevalent type, offering voting rights and potential for capital appreciation. Their dominance is a direct reflection of the widespread appeal of ownership in publicly traded companies.

- Preferred Stocks: Offering a fixed dividend and priority over common stocks in liquidation, these appeal to income-seeking investors.

- Growth Stocks: Companies with high growth potential, attracting investors looking for capital gains.

- Value Stocks: Undervalued stocks perceived to be trading below their intrinsic worth, appealing to bargain hunters.

- Defensive Stocks: Companies in essential sectors like utilities and consumer staples, providing stability during economic downturns, making them crucial for portfolio diversification.

Bond Types: Government, Corporate, Municipal, Mortgage, and Other Bond Types

- Government Bonds: Issued by national governments, these are considered among the safest investments, driving demand for funding sovereign operations and infrastructure projects. Their dominance is fueled by their perceived security.

- Corporate Bonds: Issued by corporations to raise capital, offering higher yields than government bonds, thus attracting a broader investor base seeking better returns.

- Municipal Bonds: Issued by local governments to fund public projects, often offering tax advantages, making them popular among certain investor segments.

- Mortgage-Backed Securities (MBS): These bonds are backed by pools of mortgages, playing a significant role in the housing finance market.

- Other Bond Types: This includes various specialized debt instruments like convertible bonds and high-yield bonds, catering to specific investor appetites for risk and return.

The dominance of these segments is a result of their fundamental roles in capital formation, wealth management, and economic stability. The United States, with its large and liquid markets like the New York Stock Exchange and NASDAQ, along with significant bond markets, often represents the largest single national market within this ecosystem. Asia-Pacific, particularly China and Japan, also holds substantial dominance due to the sheer volume of listed companies and trading activity. Economic policies encouraging investment, robust financial infrastructure, and a large pool of domestic and international investors are key drivers of dominance in these regions and segments.

Capital Exchange Ecosystem Market Product Developments

Product developments in the Capital Exchange Ecosystem Market are increasingly focused on enhancing accessibility, efficiency, and investor experience. Innovations include the launch of new ETF products offering targeted exposure to specific markets and asset classes, such as the Defiance Israel Bond ETF (CHAI). Exchanges are also investing in advanced trading platforms that leverage AI for personalized insights and automated strategies. The development of digital asset listing services and platforms is an emerging trend, reflecting the growing interest in cryptocurrencies and tokenized securities. These product advancements aim to attract a broader investor base, including younger demographics, and cater to evolving investment preferences for diversification and thematic investing. The competitive advantage lies in offering seamless integration, robust security, and a diverse range of investment opportunities.

Report Scope & Segmentation Analysis

This report segments the Capital Exchange Ecosystem Market based on critical components. The Primary Market focuses on initial offerings, while the Secondary Market analyzes trading of existing securities. Within the Capital Market, we dissect Stocks and Bonds. Stock segmentation includes Common and Preferred shares, alongside Growth, Value, and Defensive Stock classifications. Bond segmentation covers Government, Corporate, Municipal, Mortgage, and Other Bond Types. Each segment's growth projections, estimated market sizes, and competitive dynamics are analyzed to provide a granular understanding of the ecosystem. For instance, the Stocks segment is projected to grow at a CAGR of 9.2%, reaching an estimated market size of 70 Million by 2033, driven by increasing retail participation and corporate listings. The Bonds segment is estimated to reach 55 Million by 2033, with a CAGR of 7.8%, influenced by stable demand from institutional investors and government borrowing needs.

Key Drivers of Capital Exchange Ecosystem Market Growth

The Capital Exchange Ecosystem Market's growth is fueled by several pivotal factors. Technological advancements, including AI-powered trading, blockchain for settlement, and enhanced data analytics, are streamlining operations and creating new investment opportunities. Economic factors, such as global economic recovery, rising disposable incomes, and low-interest-rate environments in certain periods, encourage investment and capital inflow. Regulatory reforms that promote market transparency, investor protection, and ease of doing business further stimulate growth. The increasing participation of retail investors, empowered by user-friendly digital platforms and mobile trading apps, is a significant driver. For example, the 22% rise in the National Stock Exchange's (NSE) investor base in 2023 exemplifies this trend.

Challenges in the Capital Exchange Ecosystem Market Sector

Despite its growth, the Capital Exchange Ecosystem Market faces notable challenges. Regulatory complexities and compliance costs vary significantly across jurisdictions, creating hurdles for international expansion and innovation. Cybersecurity threats pose a constant risk to the integrity of trading platforms and investor data, requiring substantial investment in security measures. Market volatility and geopolitical uncertainties can lead to reduced trading volumes and investor confidence. Competition from alternative investment avenues, including decentralized finance (DeFi) and private equity, presents a challenge to traditional exchange models. The need for continuous technological upgrades to keep pace with rapid innovation also represents a significant capital expenditure.

Emerging Opportunities in Capital Exchange Ecosystem Market

Emerging opportunities within the Capital Exchange Ecosystem Market are diverse and promising. The tokenization of real-world assets (RWAs) presents a significant avenue for expanding product offerings and attracting new investor classes. Growth in sustainable and ESG investing continues to drive demand for specialized ETFs and investment products. The expansion of emerging markets, particularly in Asia and Africa, offers substantial untapped potential for new listings and increased investor participation. Development of AI-driven personalized investment advisory services can enhance user engagement and retention. Furthermore, the integration of digital asset exchanges alongside traditional ones can create synergistic benefits and cater to evolving investor needs.

Leading Players in the Capital Exchange Ecosystem Market Market

- New York Stock Exchange

- Japan Exchange Group

- London Stock Exchange

- Hong Kong Stock Exchange

- Shanghai Stock Exchange

- National Stock Exchange

- EURONEXT

- NASDAQ

- Bombay Stock Exchange

- Saudi Stock Exchange

Key Developments in Capital Exchange Ecosystem Market Industry

- December 2023: Defiance ETFs launched the Defiance Israel Bond ETF (NYSE Arca: CHAI) on the New York Stock Exchange. This ETF mirrors the MCM (Migdal Capital Markets) BlueStar Israel Bond Index, providing investors access to both Israeli government and corporate bonds denominated in USD and shekels.

- January 2024: The National Stock Exchange (NSE) recorded a substantial 22% increase in its investor base, growing from 70 million to 85.4 million during the calendar year 2023. This surge underscores the growing engagement of retail investors in the stock market.

Strategic Outlook for Capital Exchange Ecosystem Market Market

The strategic outlook for the Capital Exchange Ecosystem Market is overwhelmingly positive, characterized by sustained growth and transformative innovation. The increasing digitalization of financial services, coupled with a growing global appetite for investment, will continue to fuel expansion. Key growth catalysts include the ongoing integration of advanced technologies like AI and blockchain, which promise to enhance efficiency and introduce novel financial products. The rising prominence of ESG investing and the burgeoning opportunities in emerging markets present significant avenues for diversification and revenue generation. Strategic alliances and acquisitions are expected to remain prevalent as companies seek to expand their product portfolios, geographical reach, and technological capabilities. Furthermore, the evolving regulatory landscape, while posing challenges, also presents opportunities for proactive market participants who can adapt and innovate within established frameworks, ensuring long-term sustainability and profitability.

Capital Exchange Ecosystem Market Segmentation

-

1. Market Composition

- 1.1. Primary

- 1.2. Secondary

-

2. Capital Market

- 2.1. Stocks

- 2.2. Bonds

-

3. Stock Type

- 3.1. Common and Preferred

- 3.2. Growth Stock

- 3.3. Value Stock

- 3.4. Defensive stock

-

4. Bond Type

- 4.1. Government

- 4.2. Corporate

- 4.3. Municiple

- 4.4. Mortgage

- 4.5. Other Bond Types

Capital Exchange Ecosystem Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Capital Exchange Ecosystem Market Regional Market Share

Geographic Coverage of Capital Exchange Ecosystem Market

Capital Exchange Ecosystem Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.80% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Automating all processes; Regulatory Landscape

- 3.3. Market Restrains

- 3.3.1. Automating all processes; Regulatory Landscape

- 3.4. Market Trends

- 3.4.1. Increasing Stock Exchanges Index affecting Capital Market Exchange Ecosystem

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Capital Exchange Ecosystem Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Market Composition

- 5.1.1. Primary

- 5.1.2. Secondary

- 5.2. Market Analysis, Insights and Forecast - by Capital Market

- 5.2.1. Stocks

- 5.2.2. Bonds

- 5.3. Market Analysis, Insights and Forecast - by Stock Type

- 5.3.1. Common and Preferred

- 5.3.2. Growth Stock

- 5.3.3. Value Stock

- 5.3.4. Defensive stock

- 5.4. Market Analysis, Insights and Forecast - by Bond Type

- 5.4.1. Government

- 5.4.2. Corporate

- 5.4.3. Municiple

- 5.4.4. Mortgage

- 5.4.5. Other Bond Types

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Europe

- 5.5.4. Middle East & Africa

- 5.5.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Market Composition

- 6. North America Capital Exchange Ecosystem Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Market Composition

- 6.1.1. Primary

- 6.1.2. Secondary

- 6.2. Market Analysis, Insights and Forecast - by Capital Market

- 6.2.1. Stocks

- 6.2.2. Bonds

- 6.3. Market Analysis, Insights and Forecast - by Stock Type

- 6.3.1. Common and Preferred

- 6.3.2. Growth Stock

- 6.3.3. Value Stock

- 6.3.4. Defensive stock

- 6.4. Market Analysis, Insights and Forecast - by Bond Type

- 6.4.1. Government

- 6.4.2. Corporate

- 6.4.3. Municiple

- 6.4.4. Mortgage

- 6.4.5. Other Bond Types

- 6.1. Market Analysis, Insights and Forecast - by Market Composition

- 7. South America Capital Exchange Ecosystem Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Market Composition

- 7.1.1. Primary

- 7.1.2. Secondary

- 7.2. Market Analysis, Insights and Forecast - by Capital Market

- 7.2.1. Stocks

- 7.2.2. Bonds

- 7.3. Market Analysis, Insights and Forecast - by Stock Type

- 7.3.1. Common and Preferred

- 7.3.2. Growth Stock

- 7.3.3. Value Stock

- 7.3.4. Defensive stock

- 7.4. Market Analysis, Insights and Forecast - by Bond Type

- 7.4.1. Government

- 7.4.2. Corporate

- 7.4.3. Municiple

- 7.4.4. Mortgage

- 7.4.5. Other Bond Types

- 7.1. Market Analysis, Insights and Forecast - by Market Composition

- 8. Europe Capital Exchange Ecosystem Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Market Composition

- 8.1.1. Primary

- 8.1.2. Secondary

- 8.2. Market Analysis, Insights and Forecast - by Capital Market

- 8.2.1. Stocks

- 8.2.2. Bonds

- 8.3. Market Analysis, Insights and Forecast - by Stock Type

- 8.3.1. Common and Preferred

- 8.3.2. Growth Stock

- 8.3.3. Value Stock

- 8.3.4. Defensive stock

- 8.4. Market Analysis, Insights and Forecast - by Bond Type

- 8.4.1. Government

- 8.4.2. Corporate

- 8.4.3. Municiple

- 8.4.4. Mortgage

- 8.4.5. Other Bond Types

- 8.1. Market Analysis, Insights and Forecast - by Market Composition

- 9. Middle East & Africa Capital Exchange Ecosystem Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Market Composition

- 9.1.1. Primary

- 9.1.2. Secondary

- 9.2. Market Analysis, Insights and Forecast - by Capital Market

- 9.2.1. Stocks

- 9.2.2. Bonds

- 9.3. Market Analysis, Insights and Forecast - by Stock Type

- 9.3.1. Common and Preferred

- 9.3.2. Growth Stock

- 9.3.3. Value Stock

- 9.3.4. Defensive stock

- 9.4. Market Analysis, Insights and Forecast - by Bond Type

- 9.4.1. Government

- 9.4.2. Corporate

- 9.4.3. Municiple

- 9.4.4. Mortgage

- 9.4.5. Other Bond Types

- 9.1. Market Analysis, Insights and Forecast - by Market Composition

- 10. Asia Pacific Capital Exchange Ecosystem Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Market Composition

- 10.1.1. Primary

- 10.1.2. Secondary

- 10.2. Market Analysis, Insights and Forecast - by Capital Market

- 10.2.1. Stocks

- 10.2.2. Bonds

- 10.3. Market Analysis, Insights and Forecast - by Stock Type

- 10.3.1. Common and Preferred

- 10.3.2. Growth Stock

- 10.3.3. Value Stock

- 10.3.4. Defensive stock

- 10.4. Market Analysis, Insights and Forecast - by Bond Type

- 10.4.1. Government

- 10.4.2. Corporate

- 10.4.3. Municiple

- 10.4.4. Mortgage

- 10.4.5. Other Bond Types

- 10.1. Market Analysis, Insights and Forecast - by Market Composition

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 New York Stock Exchange

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Japan Exchange Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 London Stock Exchange

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 HongKong Stock Exchange

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Shanghai Stock Exchange

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 National Stock Exchange

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 EURONEXT

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 NASDAQ

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bombay Stock Exchange

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Saudi Stock Exchange**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 New York Stock Exchange

List of Figures

- Figure 1: Global Capital Exchange Ecosystem Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Capital Exchange Ecosystem Market Volume Breakdown (Trillion, %) by Region 2025 & 2033

- Figure 3: North America Capital Exchange Ecosystem Market Revenue (Million), by Market Composition 2025 & 2033

- Figure 4: North America Capital Exchange Ecosystem Market Volume (Trillion), by Market Composition 2025 & 2033

- Figure 5: North America Capital Exchange Ecosystem Market Revenue Share (%), by Market Composition 2025 & 2033

- Figure 6: North America Capital Exchange Ecosystem Market Volume Share (%), by Market Composition 2025 & 2033

- Figure 7: North America Capital Exchange Ecosystem Market Revenue (Million), by Capital Market 2025 & 2033

- Figure 8: North America Capital Exchange Ecosystem Market Volume (Trillion), by Capital Market 2025 & 2033

- Figure 9: North America Capital Exchange Ecosystem Market Revenue Share (%), by Capital Market 2025 & 2033

- Figure 10: North America Capital Exchange Ecosystem Market Volume Share (%), by Capital Market 2025 & 2033

- Figure 11: North America Capital Exchange Ecosystem Market Revenue (Million), by Stock Type 2025 & 2033

- Figure 12: North America Capital Exchange Ecosystem Market Volume (Trillion), by Stock Type 2025 & 2033

- Figure 13: North America Capital Exchange Ecosystem Market Revenue Share (%), by Stock Type 2025 & 2033

- Figure 14: North America Capital Exchange Ecosystem Market Volume Share (%), by Stock Type 2025 & 2033

- Figure 15: North America Capital Exchange Ecosystem Market Revenue (Million), by Bond Type 2025 & 2033

- Figure 16: North America Capital Exchange Ecosystem Market Volume (Trillion), by Bond Type 2025 & 2033

- Figure 17: North America Capital Exchange Ecosystem Market Revenue Share (%), by Bond Type 2025 & 2033

- Figure 18: North America Capital Exchange Ecosystem Market Volume Share (%), by Bond Type 2025 & 2033

- Figure 19: North America Capital Exchange Ecosystem Market Revenue (Million), by Country 2025 & 2033

- Figure 20: North America Capital Exchange Ecosystem Market Volume (Trillion), by Country 2025 & 2033

- Figure 21: North America Capital Exchange Ecosystem Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: North America Capital Exchange Ecosystem Market Volume Share (%), by Country 2025 & 2033

- Figure 23: South America Capital Exchange Ecosystem Market Revenue (Million), by Market Composition 2025 & 2033

- Figure 24: South America Capital Exchange Ecosystem Market Volume (Trillion), by Market Composition 2025 & 2033

- Figure 25: South America Capital Exchange Ecosystem Market Revenue Share (%), by Market Composition 2025 & 2033

- Figure 26: South America Capital Exchange Ecosystem Market Volume Share (%), by Market Composition 2025 & 2033

- Figure 27: South America Capital Exchange Ecosystem Market Revenue (Million), by Capital Market 2025 & 2033

- Figure 28: South America Capital Exchange Ecosystem Market Volume (Trillion), by Capital Market 2025 & 2033

- Figure 29: South America Capital Exchange Ecosystem Market Revenue Share (%), by Capital Market 2025 & 2033

- Figure 30: South America Capital Exchange Ecosystem Market Volume Share (%), by Capital Market 2025 & 2033

- Figure 31: South America Capital Exchange Ecosystem Market Revenue (Million), by Stock Type 2025 & 2033

- Figure 32: South America Capital Exchange Ecosystem Market Volume (Trillion), by Stock Type 2025 & 2033

- Figure 33: South America Capital Exchange Ecosystem Market Revenue Share (%), by Stock Type 2025 & 2033

- Figure 34: South America Capital Exchange Ecosystem Market Volume Share (%), by Stock Type 2025 & 2033

- Figure 35: South America Capital Exchange Ecosystem Market Revenue (Million), by Bond Type 2025 & 2033

- Figure 36: South America Capital Exchange Ecosystem Market Volume (Trillion), by Bond Type 2025 & 2033

- Figure 37: South America Capital Exchange Ecosystem Market Revenue Share (%), by Bond Type 2025 & 2033

- Figure 38: South America Capital Exchange Ecosystem Market Volume Share (%), by Bond Type 2025 & 2033

- Figure 39: South America Capital Exchange Ecosystem Market Revenue (Million), by Country 2025 & 2033

- Figure 40: South America Capital Exchange Ecosystem Market Volume (Trillion), by Country 2025 & 2033

- Figure 41: South America Capital Exchange Ecosystem Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: South America Capital Exchange Ecosystem Market Volume Share (%), by Country 2025 & 2033

- Figure 43: Europe Capital Exchange Ecosystem Market Revenue (Million), by Market Composition 2025 & 2033

- Figure 44: Europe Capital Exchange Ecosystem Market Volume (Trillion), by Market Composition 2025 & 2033

- Figure 45: Europe Capital Exchange Ecosystem Market Revenue Share (%), by Market Composition 2025 & 2033

- Figure 46: Europe Capital Exchange Ecosystem Market Volume Share (%), by Market Composition 2025 & 2033

- Figure 47: Europe Capital Exchange Ecosystem Market Revenue (Million), by Capital Market 2025 & 2033

- Figure 48: Europe Capital Exchange Ecosystem Market Volume (Trillion), by Capital Market 2025 & 2033

- Figure 49: Europe Capital Exchange Ecosystem Market Revenue Share (%), by Capital Market 2025 & 2033

- Figure 50: Europe Capital Exchange Ecosystem Market Volume Share (%), by Capital Market 2025 & 2033

- Figure 51: Europe Capital Exchange Ecosystem Market Revenue (Million), by Stock Type 2025 & 2033

- Figure 52: Europe Capital Exchange Ecosystem Market Volume (Trillion), by Stock Type 2025 & 2033

- Figure 53: Europe Capital Exchange Ecosystem Market Revenue Share (%), by Stock Type 2025 & 2033

- Figure 54: Europe Capital Exchange Ecosystem Market Volume Share (%), by Stock Type 2025 & 2033

- Figure 55: Europe Capital Exchange Ecosystem Market Revenue (Million), by Bond Type 2025 & 2033

- Figure 56: Europe Capital Exchange Ecosystem Market Volume (Trillion), by Bond Type 2025 & 2033

- Figure 57: Europe Capital Exchange Ecosystem Market Revenue Share (%), by Bond Type 2025 & 2033

- Figure 58: Europe Capital Exchange Ecosystem Market Volume Share (%), by Bond Type 2025 & 2033

- Figure 59: Europe Capital Exchange Ecosystem Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Europe Capital Exchange Ecosystem Market Volume (Trillion), by Country 2025 & 2033

- Figure 61: Europe Capital Exchange Ecosystem Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Europe Capital Exchange Ecosystem Market Volume Share (%), by Country 2025 & 2033

- Figure 63: Middle East & Africa Capital Exchange Ecosystem Market Revenue (Million), by Market Composition 2025 & 2033

- Figure 64: Middle East & Africa Capital Exchange Ecosystem Market Volume (Trillion), by Market Composition 2025 & 2033

- Figure 65: Middle East & Africa Capital Exchange Ecosystem Market Revenue Share (%), by Market Composition 2025 & 2033

- Figure 66: Middle East & Africa Capital Exchange Ecosystem Market Volume Share (%), by Market Composition 2025 & 2033

- Figure 67: Middle East & Africa Capital Exchange Ecosystem Market Revenue (Million), by Capital Market 2025 & 2033

- Figure 68: Middle East & Africa Capital Exchange Ecosystem Market Volume (Trillion), by Capital Market 2025 & 2033

- Figure 69: Middle East & Africa Capital Exchange Ecosystem Market Revenue Share (%), by Capital Market 2025 & 2033

- Figure 70: Middle East & Africa Capital Exchange Ecosystem Market Volume Share (%), by Capital Market 2025 & 2033

- Figure 71: Middle East & Africa Capital Exchange Ecosystem Market Revenue (Million), by Stock Type 2025 & 2033

- Figure 72: Middle East & Africa Capital Exchange Ecosystem Market Volume (Trillion), by Stock Type 2025 & 2033

- Figure 73: Middle East & Africa Capital Exchange Ecosystem Market Revenue Share (%), by Stock Type 2025 & 2033

- Figure 74: Middle East & Africa Capital Exchange Ecosystem Market Volume Share (%), by Stock Type 2025 & 2033

- Figure 75: Middle East & Africa Capital Exchange Ecosystem Market Revenue (Million), by Bond Type 2025 & 2033

- Figure 76: Middle East & Africa Capital Exchange Ecosystem Market Volume (Trillion), by Bond Type 2025 & 2033

- Figure 77: Middle East & Africa Capital Exchange Ecosystem Market Revenue Share (%), by Bond Type 2025 & 2033

- Figure 78: Middle East & Africa Capital Exchange Ecosystem Market Volume Share (%), by Bond Type 2025 & 2033

- Figure 79: Middle East & Africa Capital Exchange Ecosystem Market Revenue (Million), by Country 2025 & 2033

- Figure 80: Middle East & Africa Capital Exchange Ecosystem Market Volume (Trillion), by Country 2025 & 2033

- Figure 81: Middle East & Africa Capital Exchange Ecosystem Market Revenue Share (%), by Country 2025 & 2033

- Figure 82: Middle East & Africa Capital Exchange Ecosystem Market Volume Share (%), by Country 2025 & 2033

- Figure 83: Asia Pacific Capital Exchange Ecosystem Market Revenue (Million), by Market Composition 2025 & 2033

- Figure 84: Asia Pacific Capital Exchange Ecosystem Market Volume (Trillion), by Market Composition 2025 & 2033

- Figure 85: Asia Pacific Capital Exchange Ecosystem Market Revenue Share (%), by Market Composition 2025 & 2033

- Figure 86: Asia Pacific Capital Exchange Ecosystem Market Volume Share (%), by Market Composition 2025 & 2033

- Figure 87: Asia Pacific Capital Exchange Ecosystem Market Revenue (Million), by Capital Market 2025 & 2033

- Figure 88: Asia Pacific Capital Exchange Ecosystem Market Volume (Trillion), by Capital Market 2025 & 2033

- Figure 89: Asia Pacific Capital Exchange Ecosystem Market Revenue Share (%), by Capital Market 2025 & 2033

- Figure 90: Asia Pacific Capital Exchange Ecosystem Market Volume Share (%), by Capital Market 2025 & 2033

- Figure 91: Asia Pacific Capital Exchange Ecosystem Market Revenue (Million), by Stock Type 2025 & 2033

- Figure 92: Asia Pacific Capital Exchange Ecosystem Market Volume (Trillion), by Stock Type 2025 & 2033

- Figure 93: Asia Pacific Capital Exchange Ecosystem Market Revenue Share (%), by Stock Type 2025 & 2033

- Figure 94: Asia Pacific Capital Exchange Ecosystem Market Volume Share (%), by Stock Type 2025 & 2033

- Figure 95: Asia Pacific Capital Exchange Ecosystem Market Revenue (Million), by Bond Type 2025 & 2033

- Figure 96: Asia Pacific Capital Exchange Ecosystem Market Volume (Trillion), by Bond Type 2025 & 2033

- Figure 97: Asia Pacific Capital Exchange Ecosystem Market Revenue Share (%), by Bond Type 2025 & 2033

- Figure 98: Asia Pacific Capital Exchange Ecosystem Market Volume Share (%), by Bond Type 2025 & 2033

- Figure 99: Asia Pacific Capital Exchange Ecosystem Market Revenue (Million), by Country 2025 & 2033

- Figure 100: Asia Pacific Capital Exchange Ecosystem Market Volume (Trillion), by Country 2025 & 2033

- Figure 101: Asia Pacific Capital Exchange Ecosystem Market Revenue Share (%), by Country 2025 & 2033

- Figure 102: Asia Pacific Capital Exchange Ecosystem Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Capital Exchange Ecosystem Market Revenue Million Forecast, by Market Composition 2020 & 2033

- Table 2: Global Capital Exchange Ecosystem Market Volume Trillion Forecast, by Market Composition 2020 & 2033

- Table 3: Global Capital Exchange Ecosystem Market Revenue Million Forecast, by Capital Market 2020 & 2033

- Table 4: Global Capital Exchange Ecosystem Market Volume Trillion Forecast, by Capital Market 2020 & 2033

- Table 5: Global Capital Exchange Ecosystem Market Revenue Million Forecast, by Stock Type 2020 & 2033

- Table 6: Global Capital Exchange Ecosystem Market Volume Trillion Forecast, by Stock Type 2020 & 2033

- Table 7: Global Capital Exchange Ecosystem Market Revenue Million Forecast, by Bond Type 2020 & 2033

- Table 8: Global Capital Exchange Ecosystem Market Volume Trillion Forecast, by Bond Type 2020 & 2033

- Table 9: Global Capital Exchange Ecosystem Market Revenue Million Forecast, by Region 2020 & 2033

- Table 10: Global Capital Exchange Ecosystem Market Volume Trillion Forecast, by Region 2020 & 2033

- Table 11: Global Capital Exchange Ecosystem Market Revenue Million Forecast, by Market Composition 2020 & 2033

- Table 12: Global Capital Exchange Ecosystem Market Volume Trillion Forecast, by Market Composition 2020 & 2033

- Table 13: Global Capital Exchange Ecosystem Market Revenue Million Forecast, by Capital Market 2020 & 2033

- Table 14: Global Capital Exchange Ecosystem Market Volume Trillion Forecast, by Capital Market 2020 & 2033

- Table 15: Global Capital Exchange Ecosystem Market Revenue Million Forecast, by Stock Type 2020 & 2033

- Table 16: Global Capital Exchange Ecosystem Market Volume Trillion Forecast, by Stock Type 2020 & 2033

- Table 17: Global Capital Exchange Ecosystem Market Revenue Million Forecast, by Bond Type 2020 & 2033

- Table 18: Global Capital Exchange Ecosystem Market Volume Trillion Forecast, by Bond Type 2020 & 2033

- Table 19: Global Capital Exchange Ecosystem Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Global Capital Exchange Ecosystem Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 21: United States Capital Exchange Ecosystem Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: United States Capital Exchange Ecosystem Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 23: Canada Capital Exchange Ecosystem Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Canada Capital Exchange Ecosystem Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 25: Mexico Capital Exchange Ecosystem Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Mexico Capital Exchange Ecosystem Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 27: Global Capital Exchange Ecosystem Market Revenue Million Forecast, by Market Composition 2020 & 2033

- Table 28: Global Capital Exchange Ecosystem Market Volume Trillion Forecast, by Market Composition 2020 & 2033

- Table 29: Global Capital Exchange Ecosystem Market Revenue Million Forecast, by Capital Market 2020 & 2033

- Table 30: Global Capital Exchange Ecosystem Market Volume Trillion Forecast, by Capital Market 2020 & 2033

- Table 31: Global Capital Exchange Ecosystem Market Revenue Million Forecast, by Stock Type 2020 & 2033

- Table 32: Global Capital Exchange Ecosystem Market Volume Trillion Forecast, by Stock Type 2020 & 2033

- Table 33: Global Capital Exchange Ecosystem Market Revenue Million Forecast, by Bond Type 2020 & 2033

- Table 34: Global Capital Exchange Ecosystem Market Volume Trillion Forecast, by Bond Type 2020 & 2033

- Table 35: Global Capital Exchange Ecosystem Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Capital Exchange Ecosystem Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 37: Brazil Capital Exchange Ecosystem Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Brazil Capital Exchange Ecosystem Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 39: Argentina Capital Exchange Ecosystem Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Argentina Capital Exchange Ecosystem Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 41: Rest of South America Capital Exchange Ecosystem Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Rest of South America Capital Exchange Ecosystem Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 43: Global Capital Exchange Ecosystem Market Revenue Million Forecast, by Market Composition 2020 & 2033

- Table 44: Global Capital Exchange Ecosystem Market Volume Trillion Forecast, by Market Composition 2020 & 2033

- Table 45: Global Capital Exchange Ecosystem Market Revenue Million Forecast, by Capital Market 2020 & 2033

- Table 46: Global Capital Exchange Ecosystem Market Volume Trillion Forecast, by Capital Market 2020 & 2033

- Table 47: Global Capital Exchange Ecosystem Market Revenue Million Forecast, by Stock Type 2020 & 2033

- Table 48: Global Capital Exchange Ecosystem Market Volume Trillion Forecast, by Stock Type 2020 & 2033

- Table 49: Global Capital Exchange Ecosystem Market Revenue Million Forecast, by Bond Type 2020 & 2033

- Table 50: Global Capital Exchange Ecosystem Market Volume Trillion Forecast, by Bond Type 2020 & 2033

- Table 51: Global Capital Exchange Ecosystem Market Revenue Million Forecast, by Country 2020 & 2033

- Table 52: Global Capital Exchange Ecosystem Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 53: United Kingdom Capital Exchange Ecosystem Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: United Kingdom Capital Exchange Ecosystem Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 55: Germany Capital Exchange Ecosystem Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Germany Capital Exchange Ecosystem Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 57: France Capital Exchange Ecosystem Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: France Capital Exchange Ecosystem Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 59: Italy Capital Exchange Ecosystem Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Italy Capital Exchange Ecosystem Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 61: Spain Capital Exchange Ecosystem Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Spain Capital Exchange Ecosystem Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 63: Russia Capital Exchange Ecosystem Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Russia Capital Exchange Ecosystem Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 65: Benelux Capital Exchange Ecosystem Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: Benelux Capital Exchange Ecosystem Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 67: Nordics Capital Exchange Ecosystem Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: Nordics Capital Exchange Ecosystem Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 69: Rest of Europe Capital Exchange Ecosystem Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: Rest of Europe Capital Exchange Ecosystem Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 71: Global Capital Exchange Ecosystem Market Revenue Million Forecast, by Market Composition 2020 & 2033

- Table 72: Global Capital Exchange Ecosystem Market Volume Trillion Forecast, by Market Composition 2020 & 2033

- Table 73: Global Capital Exchange Ecosystem Market Revenue Million Forecast, by Capital Market 2020 & 2033

- Table 74: Global Capital Exchange Ecosystem Market Volume Trillion Forecast, by Capital Market 2020 & 2033

- Table 75: Global Capital Exchange Ecosystem Market Revenue Million Forecast, by Stock Type 2020 & 2033

- Table 76: Global Capital Exchange Ecosystem Market Volume Trillion Forecast, by Stock Type 2020 & 2033

- Table 77: Global Capital Exchange Ecosystem Market Revenue Million Forecast, by Bond Type 2020 & 2033

- Table 78: Global Capital Exchange Ecosystem Market Volume Trillion Forecast, by Bond Type 2020 & 2033

- Table 79: Global Capital Exchange Ecosystem Market Revenue Million Forecast, by Country 2020 & 2033

- Table 80: Global Capital Exchange Ecosystem Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 81: Turkey Capital Exchange Ecosystem Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 82: Turkey Capital Exchange Ecosystem Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 83: Israel Capital Exchange Ecosystem Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 84: Israel Capital Exchange Ecosystem Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 85: GCC Capital Exchange Ecosystem Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 86: GCC Capital Exchange Ecosystem Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 87: North Africa Capital Exchange Ecosystem Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 88: North Africa Capital Exchange Ecosystem Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 89: South Africa Capital Exchange Ecosystem Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 90: South Africa Capital Exchange Ecosystem Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 91: Rest of Middle East & Africa Capital Exchange Ecosystem Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 92: Rest of Middle East & Africa Capital Exchange Ecosystem Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 93: Global Capital Exchange Ecosystem Market Revenue Million Forecast, by Market Composition 2020 & 2033

- Table 94: Global Capital Exchange Ecosystem Market Volume Trillion Forecast, by Market Composition 2020 & 2033

- Table 95: Global Capital Exchange Ecosystem Market Revenue Million Forecast, by Capital Market 2020 & 2033

- Table 96: Global Capital Exchange Ecosystem Market Volume Trillion Forecast, by Capital Market 2020 & 2033

- Table 97: Global Capital Exchange Ecosystem Market Revenue Million Forecast, by Stock Type 2020 & 2033

- Table 98: Global Capital Exchange Ecosystem Market Volume Trillion Forecast, by Stock Type 2020 & 2033

- Table 99: Global Capital Exchange Ecosystem Market Revenue Million Forecast, by Bond Type 2020 & 2033

- Table 100: Global Capital Exchange Ecosystem Market Volume Trillion Forecast, by Bond Type 2020 & 2033

- Table 101: Global Capital Exchange Ecosystem Market Revenue Million Forecast, by Country 2020 & 2033

- Table 102: Global Capital Exchange Ecosystem Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 103: China Capital Exchange Ecosystem Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 104: China Capital Exchange Ecosystem Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 105: India Capital Exchange Ecosystem Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 106: India Capital Exchange Ecosystem Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 107: Japan Capital Exchange Ecosystem Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 108: Japan Capital Exchange Ecosystem Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 109: South Korea Capital Exchange Ecosystem Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 110: South Korea Capital Exchange Ecosystem Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 111: ASEAN Capital Exchange Ecosystem Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 112: ASEAN Capital Exchange Ecosystem Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 113: Oceania Capital Exchange Ecosystem Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 114: Oceania Capital Exchange Ecosystem Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 115: Rest of Asia Pacific Capital Exchange Ecosystem Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 116: Rest of Asia Pacific Capital Exchange Ecosystem Market Volume (Trillion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Capital Exchange Ecosystem Market?

The projected CAGR is approximately 5.80%.

2. Which companies are prominent players in the Capital Exchange Ecosystem Market?

Key companies in the market include New York Stock Exchange, Japan Exchange Group, London Stock Exchange, HongKong Stock Exchange, Shanghai Stock Exchange, National Stock Exchange, EURONEXT, NASDAQ, Bombay Stock Exchange, Saudi Stock Exchange**List Not Exhaustive.

3. What are the main segments of the Capital Exchange Ecosystem Market?

The market segments include Market Composition, Capital Market, Stock Type, Bond Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.06 Million as of 2022.

5. What are some drivers contributing to market growth?

Automating all processes; Regulatory Landscape.

6. What are the notable trends driving market growth?

Increasing Stock Exchanges Index affecting Capital Market Exchange Ecosystem.

7. Are there any restraints impacting market growth?

Automating all processes; Regulatory Landscape.

8. Can you provide examples of recent developments in the market?

In December 2023, Defiance ETFs, introduced the Defiance Israel Bond ETF (NYSE Arca: CHAI) to facilitate investors' access to the Israeli bond market. CHAI commenced trading on the New York Stock Exchange. The ETF, CHAI, mirrors the MCM (Migdal Capital Markets) BlueStar Israel Bond Index, enabling investors to tap into both Israel government and corporate bonds. This index specifically monitors the performance of bonds, denominated in USD and shekels, issued by either the Israeli government or Israeli corporations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Trillion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Capital Exchange Ecosystem Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Capital Exchange Ecosystem Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Capital Exchange Ecosystem Market?

To stay informed about further developments, trends, and reports in the Capital Exchange Ecosystem Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence