Key Insights

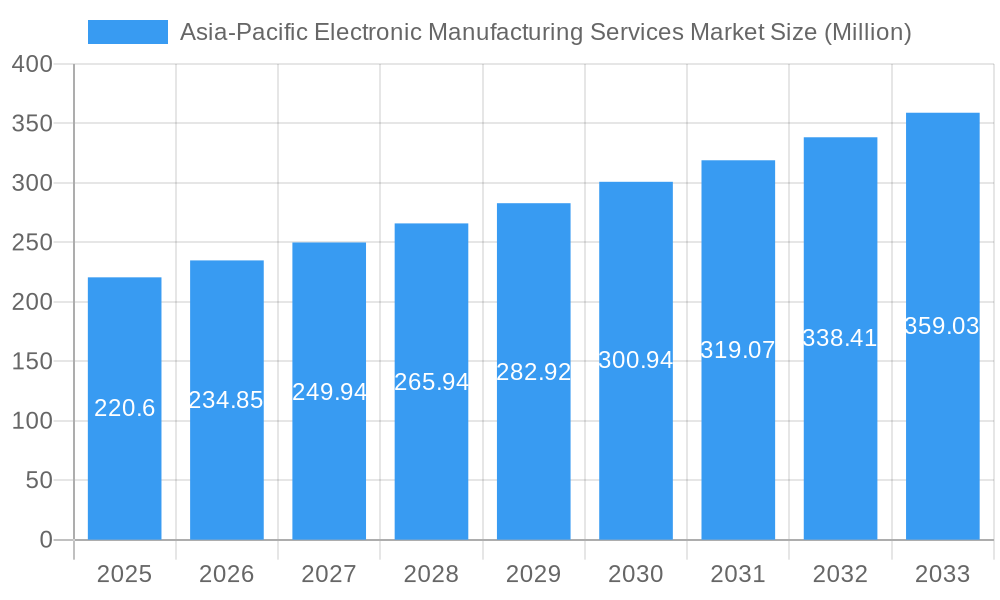

The Asia-Pacific Electronic Manufacturing Services (EMS) market is projected to experience robust growth, driven by its pivotal role in global electronics production. With a current market size estimated at USD 220.60 million, the region is poised to expand at a Compound Annual Growth Rate (CAGR) of 6.20% throughout the forecast period of 2025-2033. This impressive expansion is fueled by significant demand across key application sectors, including Consumer Electronics, Automotive, Industrial, and IT & Telecom. The increasing complexity and miniaturization of electronic devices, coupled with a growing reliance on outsourcing for cost-efficiency and specialized expertise, are primary growth drivers. Furthermore, the region's established manufacturing infrastructure, skilled workforce, and favorable government policies supporting technological advancements contribute to its dominant position. Innovations in areas like IoT, 5G, and electric vehicles are creating new avenues for EMS providers, necessitating advanced design and engineering capabilities, and sophisticated assembly and manufacturing processes.

Asia-Pacific Electronic Manufacturing Services Market Market Size (In Million)

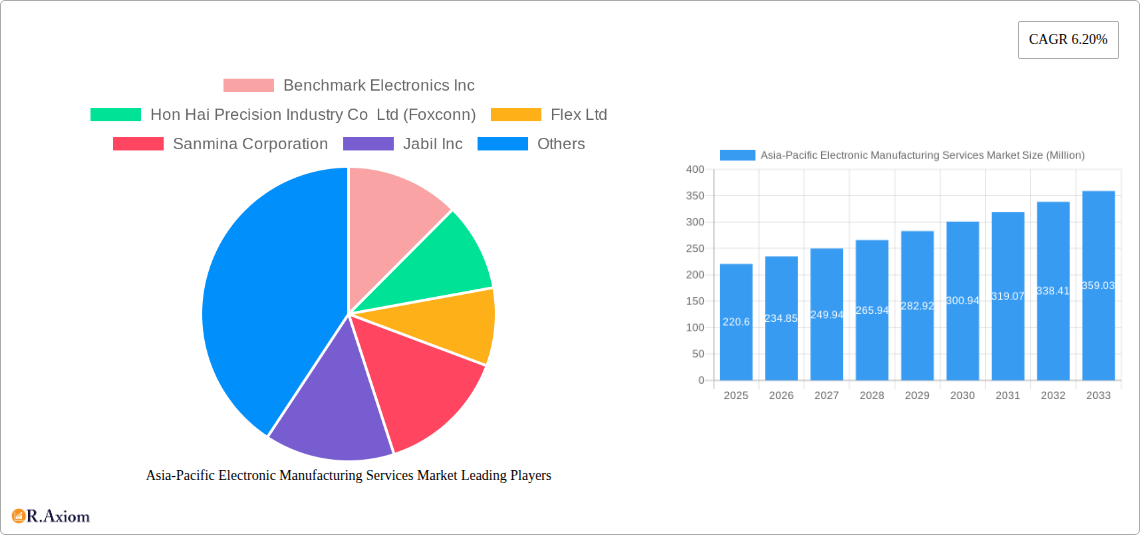

The competitive landscape of the Asia-Pacific EMS market is characterized by the presence of major global players, alongside a strong contingent of local manufacturers. Companies like Hon Hai Precision Industry Co Ltd (Foxconn), Flex Ltd, and Jabil Inc are at the forefront, leveraging their extensive supply chains and technological prowess. The market is segmented by Service Type, with Electronics Design and Engineering, and Electronics Assembly being critical areas of focus, alongside Electronics Manufacturing. Emerging trends such as the adoption of Industry 4.0 technologies like AI, automation, and advanced analytics in manufacturing processes, along with a growing emphasis on sustainable and ethical manufacturing practices, are shaping the industry's future. While the region benefits from a vast and growing consumer base and export potential, challenges such as supply chain disruptions, geopolitical uncertainties, and rising labor costs in some sub-regions may present headwinds. However, the overall trajectory remains strongly positive, with continuous innovation and strategic investments expected to sustain its growth momentum.

Asia-Pacific Electronic Manufacturing Services Market Company Market Share

Asia-Pacific Electronic Manufacturing Services Market: Comprehensive Report Description

The Asia-Pacific Electronic Manufacturing Services (EMS) market is experiencing robust growth, driven by escalating demand across consumer electronics, automotive, industrial, and healthcare sectors. This report provides an in-depth analysis of market dynamics, emerging trends, and competitive landscapes from 2019 to 2033, with a base year of 2025. It offers actionable insights for industry stakeholders seeking to capitalize on opportunities within this dynamic region.

Asia-Pacific Electronic Manufacturing Services Market Market Concentration & Innovation

The Asia-Pacific EMS market exhibits a moderate to high concentration, with a few key players dominating a significant portion of the market share. Hon Hai Precision Industry Co Ltd (Foxconn) and Flex Ltd are consistently leading the market, holding substantial market share estimated in the billions of USD. Innovation is a critical differentiator, with companies investing heavily in advanced manufacturing technologies such as AI-driven automation, IoT integration, and advanced robotics to enhance efficiency and product quality. Regulatory frameworks, while varying across countries, are increasingly focused on supply chain resilience, data security, and environmental sustainability, impacting manufacturing processes. Product substitutes are limited in the core EMS offerings, but advancements in in-house manufacturing capabilities by some large electronics brands present a potential competitive pressure. End-user trends, particularly the rapid evolution of consumer electronics and the increasing complexity of automotive and industrial electronics, are powerful drivers for EMS adoption. Merger and Acquisition (M&A) activities are a significant part of market strategy, with deal values often reaching hundreds of millions of USD, aimed at expanding geographical reach, acquiring technological capabilities, and consolidating market position. For instance, recent M&A activities have focused on companies with specialized expertise in areas like printed circuit board assembly (PCBA) and specialized testing.

Asia-Pacific Electronic Manufacturing Services Market Industry Trends & Insights

The Asia-Pacific Electronic Manufacturing Services market is poised for substantial expansion, projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period of 2025-2033. This growth is propelled by several interconnected industry trends and insights. The relentless demand for cutting-edge consumer electronics, including smartphones, wearables, and smart home devices, continues to fuel the need for high-volume, cost-effective manufacturing solutions. Simultaneously, the automotive sector's rapid electrification and the increasing integration of advanced driver-assistance systems (ADAS) are creating significant opportunities for EMS providers capable of handling complex and safety-critical components. The industrial sector's ongoing digital transformation, encompassing Industry 4.0 initiatives and the proliferation of the Internet of Things (IoT) devices, necessitates sophisticated manufacturing expertise for a wide range of industrial equipment and control systems. Furthermore, the healthcare industry's growing reliance on advanced medical devices and diagnostic equipment, coupled with stringent regulatory requirements, presents a lucrative segment for specialized EMS providers. Technological disruptions, such as advancements in 5G connectivity, artificial intelligence (AI), and machine learning (ML), are transforming manufacturing processes, enabling smarter factories, predictive maintenance, and enhanced quality control. Consumer preferences are shifting towards more personalized and feature-rich products, requiring EMS partners to offer agile and flexible manufacturing capabilities. Competitive dynamics are intensifying, with established players expanding their service portfolios and emerging players focusing on niche markets and advanced technologies. Market penetration is steadily increasing as more companies, from startups to established enterprises, recognize the strategic advantages of outsourcing their manufacturing operations to specialized EMS providers in the cost-competitive and technologically advanced Asia-Pacific region.

Dominant Markets & Segments in Asia-Pacific Electronic Manufacturing Services Market

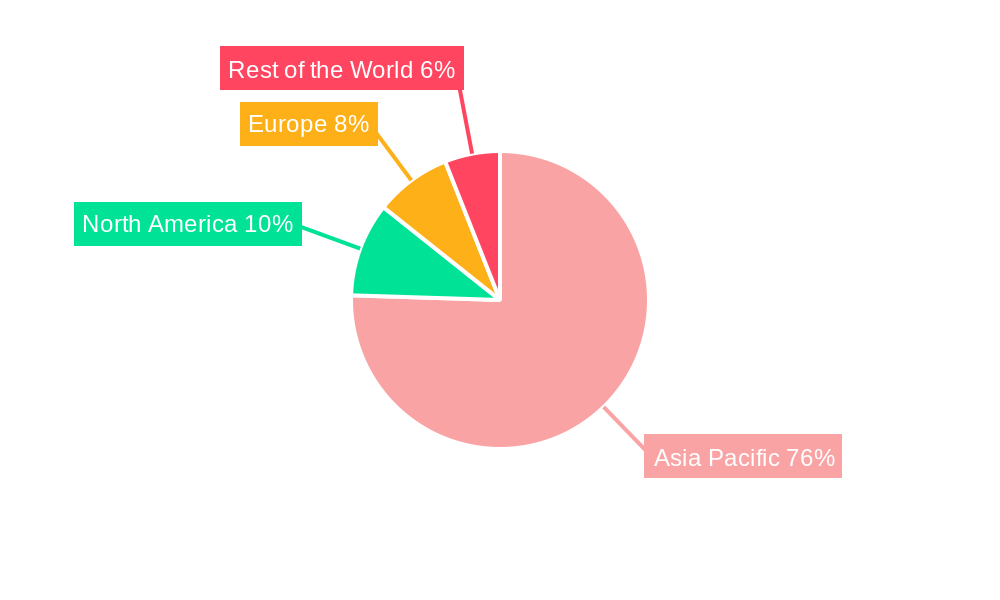

The Asia-Pacific EMS market's dominance is characterized by a clear regional and segmental leadership. China continues to be the undisputed leader in terms of market size and volume, owing to its established manufacturing infrastructure, extensive supply chain networks, and a vast pool of skilled labor. However, countries like Vietnam, India, and Taiwan are rapidly gaining prominence due to strategic government initiatives, increasing foreign direct investment, and a focus on diversifying supply chains.

Service Type Dominance:

- Electronics Manufacturing: This segment holds the largest market share, driven by the sheer volume of electronic products manufactured in the region. Key drivers include the demand for mass production of consumer electronics and the assembly of complex industrial and automotive components.

- Electronics Assembly: Closely following manufacturing, electronics assembly, particularly Printed Circuit Board Assembly (PCBA), is a cornerstone of the EMS market. Its growth is fueled by the miniaturization of components and the need for precise and high-quality assembly processes.

- Electronics Design and Engineering: While a smaller segment, this area is experiencing significant growth as clients increasingly seek end-to-end solutions, from concept to production. Key drivers include the need for product customization, rapid prototyping, and optimization of designs for manufacturability.

Application Dominance:

- Consumer Electronics: This segment remains the largest contributor to the EMS market, driven by continuous product innovation and the insatiable global demand for smartphones, laptops, tablets, and other personal electronic devices.

- IT and Telecom: The ongoing rollout of 5G infrastructure, the expansion of data centers, and the proliferation of networking equipment contribute significantly to this segment's growth.

- Automotive: The electric vehicle (EV) revolution and the increasing sophistication of automotive electronics, including infotainment systems and advanced driver-assistance systems (ADAS), are making this a rapidly expanding and highly lucrative segment for EMS providers.

- Industrial: The adoption of Industry 4.0, automation, and IoT in manufacturing and other industrial sectors is driving demand for specialized industrial electronic components and systems.

Asia-Pacific Electronic Manufacturing Services Market Product Developments

Product developments in the Asia-Pacific EMS market are closely aligned with technological advancements and evolving industry demands. EMS providers are increasingly offering integrated solutions that span from initial product design and engineering to sophisticated manufacturing and post-production support. Innovations focus on smart manufacturing, including the implementation of AI for quality control and predictive maintenance, and the utilization of robotics for enhanced efficiency and precision. Companies are also developing specialized capabilities for emerging technologies such as advanced semiconductor packaging, flexible electronics, and IoT-enabled devices. Competitive advantages are being built on the ability to provide high-mix, low-volume production with rapid turnaround times, catering to the growing demand for customized solutions across various applications.

Report Scope & Segmentation Analysis

This report meticulously analyzes the Asia-Pacific Electronic Manufacturing Services market across key segmentations to provide a granular understanding of market dynamics.

Service Type Segmentation: The market is segmented into Electronics Design and Engineering, Electronics Assembly, Electronics Manufacturing, and Other Service Types. Electronics Manufacturing is projected to hold the largest market share due to the sheer volume of production, while Electronics Design and Engineering is expected to witness the highest growth rate, driven by demand for integrated solutions.

Application Segmentation: The report examines the market across Consumer Electronics, Automotive, Industrial, Aerospace and Defense, Healthcare, IT and Telecom, and Other Applications. Consumer Electronics currently dominates, but the Automotive and Healthcare segments are anticipated to exhibit strong growth trajectories owing to technological advancements and increasing regulatory demands respectively.

Key Drivers of Asia-Pacific Electronic Manufacturing Services Market Growth

The Asia-Pacific EMS market's growth is propelled by several potent drivers. The burgeoning demand for sophisticated consumer electronics, coupled with the rapid expansion of the automotive sector's electrification and autonomous driving technologies, represents a significant catalyst. Furthermore, the ongoing digital transformation across industrial sectors, marked by the widespread adoption of Industry 4.0 and IoT solutions, fuels the need for specialized electronic manufacturing capabilities. Government initiatives in countries like India and Vietnam, aimed at boosting domestic manufacturing and attracting foreign investment through favorable policies and incentives, are also crucial growth factors. The increasing focus on supply chain diversification by global corporations seeking to mitigate risks further bolsters the region's EMS market.

Challenges in the Asia-Pacific Electronic Manufacturing Services Market Sector

Despite its robust growth, the Asia-Pacific EMS market faces several challenges. Intense competition among a large number of players, including both established giants and emerging local enterprises, leads to significant pricing pressures and can impact profit margins. Fluctuations in raw material costs, particularly for semiconductors and rare earth elements, pose a constant threat to production economics. Evolving geopolitical landscapes and trade tensions can disrupt supply chains and introduce market uncertainties. Additionally, the increasing stringency of environmental regulations and the demand for sustainable manufacturing practices require substantial investment in new technologies and processes, which can be a barrier for smaller players. The constant need for upskilling the workforce to adapt to advanced automation and Industry 4.0 technologies also presents an ongoing challenge.

Emerging Opportunities in Asia-Pacific Electronic Manufacturing Services Market

Emerging opportunities in the Asia-Pacific EMS market are abundant, driven by technological innovation and shifting global trends. The accelerating adoption of Electric Vehicles (EVs) and the development of advanced automotive electronics, including battery management systems and autonomous driving components, present a massive growth avenue. The expansion of 5G infrastructure and the proliferation of IoT devices across various sectors, from smart cities to industrial automation, create substantial demand for connected electronic products. The healthcare sector's growing reliance on advanced medical devices, remote patient monitoring, and wearable health trackers offers a lucrative niche for EMS providers with specialized expertise and adherence to stringent quality standards. Furthermore, the increasing trend of nearshoring and friend-shoring by global companies seeking to de-risk their supply chains opens doors for regional EMS players to capture new business.

Leading Players in the Asia-Pacific Electronic Manufacturing Services Market Market

- Benchmark Electronics Inc

- Hon Hai Precision Industry Co Ltd (Foxconn)

- Flex Ltd

- Sanmina Corporation

- Jabil Inc

- SIIX Corporation

- Nortech Systems Incorporated

- Celestica Inc

- Integrated Micro-electronics Inc

- Creation Technologies LP

- Wistron Corporation

- Plexus Corporation

- Sumitronics Corporation

Key Developments in Asia-Pacific Electronic Manufacturing Services Market Industry

- February 2024: TSMC, Sony Semiconductor Solutions Corporation, DENSO Corporation, and Toyota Motor Corporation revealed plans for additional investments in Japan Advanced Semiconductor Manufacturing Inc. (JASM), a manufacturing subsidiary primarily owned by TSMC, located in Kumamoto Prefecture, Japan. This investment aims to establish a second fab, slated to commence operations by the close of 2027. Coupled with JASM's first fab, set to be operational in 2024, the collective investment in JASM is poised to surpass USD 20 billion, bolstered by significant backing from the Japanese government.

- February 2024: Tata Electronics and PSMC collaborated on a USD 11 billion investment to set up India's first 300 mm wafer fab in Gujarat. Additionally, they are establishing a USD 3 billion ATMP plant in Assam. PSMC will primarily manage the construction of the wafer fab, earning fees for both hardware and software. PSMC will maintain a hands-off stance concerning day-to-day operations and customer orders.

Strategic Outlook for Asia-Pacific Electronic Manufacturing Services Market Market

The strategic outlook for the Asia-Pacific EMS market is exceptionally positive, driven by sustained technological advancements and evolving global supply chain strategies. The region's established manufacturing prowess, coupled with increasing investments in cutting-edge technologies like AI, IoT, and advanced automation, positions it as a critical hub for global electronics production. The ongoing electrification of vehicles and the burgeoning demand for smart devices across all sectors will continue to be major growth catalysts. Furthermore, the strategic focus of various governments on fostering high-tech manufacturing and attracting foreign direct investment will create a conducive environment for expansion. Companies that can offer end-to-end solutions, from design to sophisticated manufacturing and robust supply chain management, will be well-positioned to capture significant market share and capitalize on the immense future potential of this dynamic market.

Asia-Pacific Electronic Manufacturing Services Market Segmentation

-

1. Service Type

- 1.1. Electronics Design and Engineering

- 1.2. Electronics Assembly

- 1.3. Electronics Manufacturing

- 1.4. Other Service Types

-

2. Application

- 2.1. Consumer Electronics

- 2.2. Automotive

- 2.3. Industrial

- 2.4. Aerospace and Defense

- 2.5. Healthcare

- 2.6. IT and Telecom

- 2.7. Other Applications

Asia-Pacific Electronic Manufacturing Services Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Electronic Manufacturing Services Market Regional Market Share

Geographic Coverage of Asia-Pacific Electronic Manufacturing Services Market

Asia-Pacific Electronic Manufacturing Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Growing Trends of Miniaturization; Adoption of Emerging Technologies in IIoT (Industrial Internet of Things)

- 3.2.2 Blockchain

- 3.2.3 and Enhanced Communication

- 3.3. Market Restrains

- 3.3.1 Growing Trends of Miniaturization; Adoption of Emerging Technologies in IIoT (Industrial Internet of Things)

- 3.3.2 Blockchain

- 3.3.3 and Enhanced Communication

- 3.4. Market Trends

- 3.4.1. The Consumer Electronics Application Segment is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Electronic Manufacturing Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Electronics Design and Engineering

- 5.1.2. Electronics Assembly

- 5.1.3. Electronics Manufacturing

- 5.1.4. Other Service Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Consumer Electronics

- 5.2.2. Automotive

- 5.2.3. Industrial

- 5.2.4. Aerospace and Defense

- 5.2.5. Healthcare

- 5.2.6. IT and Telecom

- 5.2.7. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Benchmark Electronics Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hon Hai Precision Industry Co Ltd (Foxconn)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Flex Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sanmina Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Jabil Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 SIIX Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Nortech Systems Incorporated

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Celestica Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Integrated Micro-electronics Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Creation Technologies LP

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Wistron Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Plexus Corporation

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Sumitronics Corporatio

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Benchmark Electronics Inc

List of Figures

- Figure 1: Asia-Pacific Electronic Manufacturing Services Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Electronic Manufacturing Services Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Electronic Manufacturing Services Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: Asia-Pacific Electronic Manufacturing Services Market Volume Billion Forecast, by Service Type 2020 & 2033

- Table 3: Asia-Pacific Electronic Manufacturing Services Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Asia-Pacific Electronic Manufacturing Services Market Volume Billion Forecast, by Application 2020 & 2033

- Table 5: Asia-Pacific Electronic Manufacturing Services Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Asia-Pacific Electronic Manufacturing Services Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Asia-Pacific Electronic Manufacturing Services Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 8: Asia-Pacific Electronic Manufacturing Services Market Volume Billion Forecast, by Service Type 2020 & 2033

- Table 9: Asia-Pacific Electronic Manufacturing Services Market Revenue Million Forecast, by Application 2020 & 2033

- Table 10: Asia-Pacific Electronic Manufacturing Services Market Volume Billion Forecast, by Application 2020 & 2033

- Table 11: Asia-Pacific Electronic Manufacturing Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Asia-Pacific Electronic Manufacturing Services Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: China Asia-Pacific Electronic Manufacturing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: China Asia-Pacific Electronic Manufacturing Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Japan Asia-Pacific Electronic Manufacturing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Japan Asia-Pacific Electronic Manufacturing Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: South Korea Asia-Pacific Electronic Manufacturing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: South Korea Asia-Pacific Electronic Manufacturing Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: India Asia-Pacific Electronic Manufacturing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: India Asia-Pacific Electronic Manufacturing Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Australia Asia-Pacific Electronic Manufacturing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Australia Asia-Pacific Electronic Manufacturing Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: New Zealand Asia-Pacific Electronic Manufacturing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: New Zealand Asia-Pacific Electronic Manufacturing Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Indonesia Asia-Pacific Electronic Manufacturing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Indonesia Asia-Pacific Electronic Manufacturing Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Malaysia Asia-Pacific Electronic Manufacturing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Malaysia Asia-Pacific Electronic Manufacturing Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Singapore Asia-Pacific Electronic Manufacturing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Singapore Asia-Pacific Electronic Manufacturing Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Thailand Asia-Pacific Electronic Manufacturing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Thailand Asia-Pacific Electronic Manufacturing Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Vietnam Asia-Pacific Electronic Manufacturing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Vietnam Asia-Pacific Electronic Manufacturing Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 35: Philippines Asia-Pacific Electronic Manufacturing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Philippines Asia-Pacific Electronic Manufacturing Services Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Electronic Manufacturing Services Market?

The projected CAGR is approximately 6.20%.

2. Which companies are prominent players in the Asia-Pacific Electronic Manufacturing Services Market?

Key companies in the market include Benchmark Electronics Inc, Hon Hai Precision Industry Co Ltd (Foxconn), Flex Ltd, Sanmina Corporation, Jabil Inc, SIIX Corporation, Nortech Systems Incorporated, Celestica Inc, Integrated Micro-electronics Inc, Creation Technologies LP, Wistron Corporation, Plexus Corporation, Sumitronics Corporatio.

3. What are the main segments of the Asia-Pacific Electronic Manufacturing Services Market?

The market segments include Service Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 220.60 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Trends of Miniaturization; Adoption of Emerging Technologies in IIoT (Industrial Internet of Things). Blockchain. and Enhanced Communication.

6. What are the notable trends driving market growth?

The Consumer Electronics Application Segment is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Growing Trends of Miniaturization; Adoption of Emerging Technologies in IIoT (Industrial Internet of Things). Blockchain. and Enhanced Communication.

8. Can you provide examples of recent developments in the market?

February 2024: TSMC, Sony Semiconductor Solutions Corporation, DENSO Corporation, and Toyota Motor Corporation revealed plans for additional investments in Japan Advanced Semiconductor Manufacturing Inc. (JASM), a manufacturing subsidiary primarily owned by TSMC, located in Kumamoto Prefecture, Japan. This investment aims to establish a second fab, slated to commence operations by the close of 2027. Coupled with JASM's first fab, set to be operational in 2024, the collective investment in JASM is poised to surpass USD 20 billion, bolstered by significant backing from the Japanese government.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Electronic Manufacturing Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Electronic Manufacturing Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Electronic Manufacturing Services Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Electronic Manufacturing Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence