Key Insights

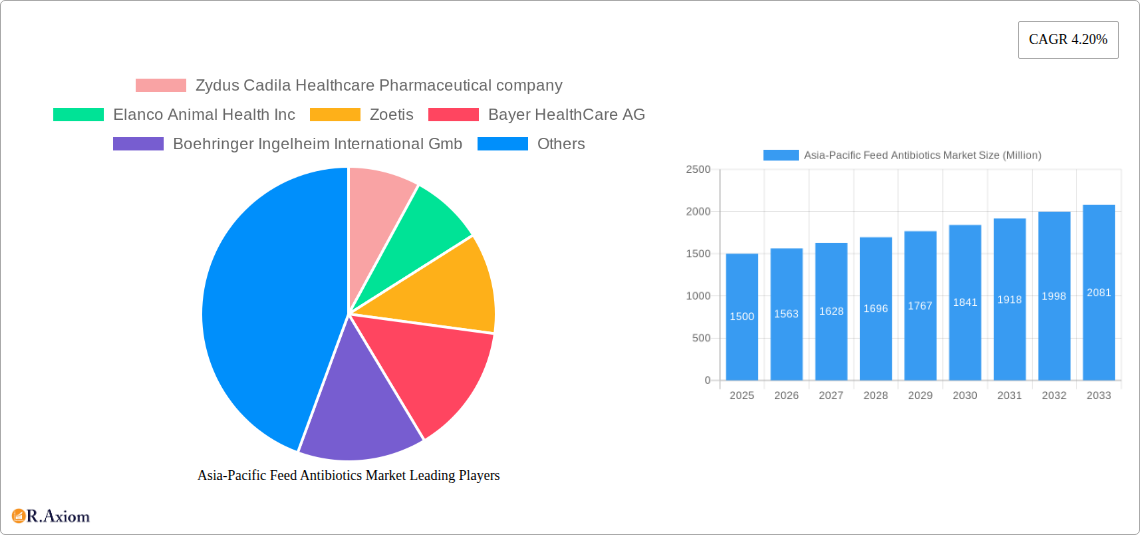

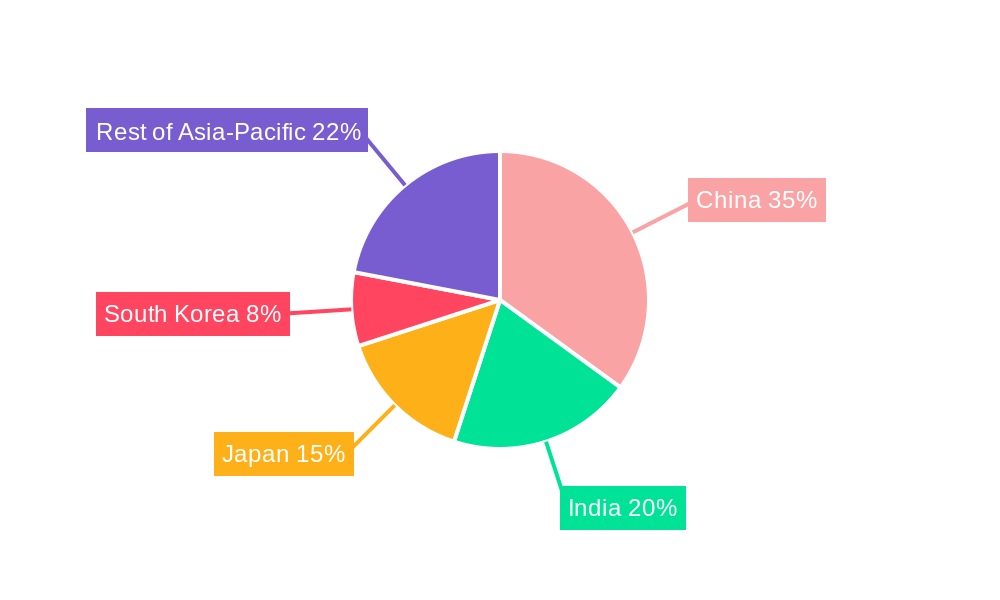

The Asia-Pacific feed antibiotics market, valued at $1.35 billion in 2025, is projected to grow at a compound annual growth rate (CAGR) of 4.2% from 2025 to 2033. This growth is propelled by the expanding livestock and aquaculture sectors, driven by increasing global demand for animal protein and intensified farming practices. Advancements in antibiotic formulations, enhancing efficacy and safety, also contribute significantly. The market is segmented by animal type (ruminants, poultry, swine, aquaculture, others) and antibiotic class (tetracyclines, penicillins, sulfonamides, macrolides, aminoglycosides, cephalosporins, others). While poultry and swine currently lead, aquaculture is poised for substantial expansion due to rising seafood demand. However, concerns over antibiotic resistance and stringent regulations present challenges. Government initiatives promoting responsible use and the development of alternatives are reshaping the landscape. Key players are investing in innovation and market expansion. China, India, and Japan are anticipated to remain dominant markets due to their large agricultural sectors.

Asia-Pacific Feed Antibiotics Market Market Size (In Billion)

Market growth will be influenced by raw material price fluctuations, disease control effectiveness, and evolving consumer preferences. Government regulations will continue to shape antibiotic usage and the adoption of alternative management strategies. Companies are focusing on R&D for novel antibiotics and alternative therapies to combat antibiotic resistance. Increased demand for specialized antibiotics for specific animal species and conditions will drive product diversification. A trend towards sustainable and responsible antibiotic use will boost demand for biosecurity measures and alternative treatments. Industry stakeholders are committed to responsible antibiotic stewardship across the Asia-Pacific region.

Asia-Pacific Feed Antibiotics Market Company Market Share

This comprehensive report analyzes the Asia-Pacific feed antibiotics market, offering critical insights for stakeholders. Covering 2019-2033, with 2025 as the base year and a forecast period of 2025-2033, it details market dynamics, growth drivers, challenges, and opportunities. The analysis includes segmentation by animal type (ruminant, poultry, swine, aquaculture, others) and antibiotic type (tetracyclines, penicillins, sulfonamides, macrolides, aminoglycosides, cephalosporins, others).

Asia-Pacific Feed Antibiotics Market Concentration & Innovation

This section analyzes the competitive landscape of the Asia-Pacific feed antibiotics market, assessing market concentration through metrics like market share held by key players. We examine innovation drivers, including technological advancements in antibiotic formulation and delivery systems, and the influence of regulatory frameworks and evolving end-user trends. The impact of mergers and acquisitions (M&A) activities on market consolidation and innovation is also explored. The analysis includes an assessment of the value of significant M&A deals during the study period (2019-2024) with an estimated xx Million value in M&A deals during this period. The report further evaluates the impact of substitute products and their potential to disrupt the market. Market share data for major players will be provided, highlighting the dominance of companies like Zoetis and Merck Animal Health, who hold an estimated xx% and xx% market share, respectively, in 2025. The increasing demand for disease-resistant antibiotics and the growing adoption of sustainable livestock farming are impacting the level of market innovation.

Asia-Pacific Feed Antibiotics Market Industry Trends & Insights

This section delves into the key trends shaping the Asia-Pacific feed antibiotics market. We analyze market growth drivers, including the rising demand for animal protein, increasing livestock production, and the growing awareness of animal health and disease prevention. The report assesses the impact of technological disruptions, such as the development of novel antibiotic formulations and advanced delivery systems, on market growth. Consumer preferences towards antibiotic-free or reduced antibiotic use are analyzed, along with their influence on market dynamics. The competitive dynamics are explored, including pricing strategies, product differentiation, and the emergence of new players. The report projects a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), with market penetration expected to reach xx% by 2033. The increasing prevalence of antibiotic-resistant bacteria is also expected to affect the market.

Dominant Markets & Segments in Asia-Pacific Feed Antibiotics Market

This section identifies the leading regions, countries, and segments within the Asia-Pacific feed antibiotics market. We provide a detailed analysis of the dominance of specific segments, exploring the underlying drivers.

Dominant Animal Type Segments:

- Poultry: High poultry consumption in countries like China and India, coupled with intensive farming practices, makes this segment the largest. Key drivers include rising population, increasing disposable incomes and government support.

- Swine: Rapid growth in swine production across several Asian nations fuels substantial demand. Economic growth and increasing pork consumption are significant contributing factors.

- Ruminant: While smaller compared to poultry and swine, this segment shows steady growth driven by increasing demand for dairy products and beef.

Dominant Antibiotic Type Segments:

- Tetracyclines: Wide usage due to broad-spectrum activity and cost-effectiveness makes this a dominant segment. However, increasing regulatory scrutiny and the rise of antibiotic resistance are significant challenges.

- Penicillins: Although facing similar regulatory pressures as tetracyclines, the widespread use of Penicillins in poultry farming continues to drive growth.

- Sulfonamides: Continued demand for cost-effective solutions in aquaculture fuels growth within this segment. However, the rise of alternative therapies limits the long-term outlook.

China and India emerge as the dominant markets due to their large livestock populations, intensive farming practices, and robust economic growth.

Asia-Pacific Feed Antibiotics Market Product Developments

Recent product innovations focus on developing novel antibiotic formulations with improved efficacy, reduced side effects, and targeted delivery mechanisms. There is a growing emphasis on developing antibiotics with reduced environmental impact. Companies are also exploring alternatives to traditional antibiotics, such as probiotics and bacteriophages, to address the growing concerns about antibiotic resistance. The market is witnessing a shift towards more sustainable and responsible use of antibiotics.

Report Scope & Segmentation Analysis

This report segments the Asia-Pacific feed antibiotics market by animal type (ruminant, poultry, swine, aquaculture, others) and antibiotic type (tetracyclines, penicillins, sulfonamides, macrolides, aminoglycosides, cephalosporins, others). Each segment's growth projections, market sizes (in Million), and competitive dynamics are detailed. The market size for poultry feed antibiotics in 2025 is estimated at xx Million, while the swine segment is projected to reach xx Million by 2033. The tetracycline segment is projected to have the largest market share in 2025, while the macrolide segment is expected to exhibit the fastest growth rate during the forecast period. Competitive dynamics within each segment vary; however, larger multinational companies tend to dominate.

Key Drivers of Asia-Pacific Feed Antibiotics Market Growth

The Asia-Pacific feed antibiotics market is propelled by several factors. Firstly, the rising demand for animal protein due to increasing population and rising incomes drives growth. Secondly, the intensification of livestock farming practices necessitates the use of antibiotics for disease prevention and treatment. Finally, supportive government policies and investments in the agricultural sector further stimulate market growth.

Challenges in the Asia-Pacific Feed Antibiotics Market Sector

Significant challenges impede the growth of the Asia-Pacific feed antibiotics market. Firstly, increasing concerns regarding antibiotic resistance, leading to stricter regulations and limitations on antibiotic use, pose a major hurdle. Secondly, fluctuating raw material prices and supply chain disruptions negatively affect profitability. Thirdly, intense competition among established players and the emergence of new entrants create price pressures. The estimated impact of these challenges on market growth is a reduction in CAGR by approximately xx% by 2033.

Emerging Opportunities in Asia-Pacific Feed Antibiotics Market

Despite challenges, several opportunities exist. The growing demand for antibiotic-free and organically produced animal products presents a significant opportunity for companies offering alternative solutions. The development and adoption of advanced antibiotic delivery systems and improved formulations enhance market prospects. Moreover, expanding into emerging markets within the Asia-Pacific region offers further growth potential.

Leading Players in the Asia-Pacific Feed Antibiotics Market Market

Key Developments in Asia-Pacific Feed Antibiotics Market Industry

- January 2023: Zoetis launched a new antibiotic formulation for poultry.

- June 2022: Elanco Animal Health acquired a smaller competitor, expanding its product portfolio.

- November 2021: New regulations regarding antibiotic use in livestock farming were implemented in several Asian countries.

- March 2020: A major disruption in the supply chain due to the pandemic.

Strategic Outlook for Asia-Pacific Feed Antibiotics Market Market

The Asia-Pacific feed antibiotics market is poised for continued growth, driven by increasing livestock production and the rising demand for animal protein. However, the market's trajectory will be significantly influenced by the evolving regulatory landscape and the ongoing challenges posed by antibiotic resistance. Companies focusing on innovation, sustainable practices, and the development of alternatives to traditional antibiotics are best positioned for success. The long-term outlook remains positive, but companies must adapt to the changing dynamics of the market.

Asia-Pacific Feed Antibiotics Market Segmentation

-

1. Type

- 1.1. Tetracyclines

- 1.2. Penicillins

- 1.3. Sulfonamides

- 1.4. Macrolides

- 1.5. Aminoglycosides

- 1.6. Cephalosporins

- 1.7. Others

-

2. Animal Type

- 2.1. Ruminant

- 2.2. Poultry

- 2.3. Swine

- 2.4. Aquaculture

- 2.5. Others

-

3. Geography

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Australia

- 3.5. Rest of Asia Pacific

Asia-Pacific Feed Antibiotics Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. Australia

- 5. Rest of Asia Pacific

Asia-Pacific Feed Antibiotics Market Regional Market Share

Geographic Coverage of Asia-Pacific Feed Antibiotics Market

Asia-Pacific Feed Antibiotics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health

- 3.3. Market Restrains

- 3.3.1. Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth

- 3.4. Market Trends

- 3.4.1. Increased Meat Consumption

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Feed Antibiotics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Tetracyclines

- 5.1.2. Penicillins

- 5.1.3. Sulfonamides

- 5.1.4. Macrolides

- 5.1.5. Aminoglycosides

- 5.1.6. Cephalosporins

- 5.1.7. Others

- 5.2. Market Analysis, Insights and Forecast - by Animal Type

- 5.2.1. Ruminant

- 5.2.2. Poultry

- 5.2.3. Swine

- 5.2.4. Aquaculture

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. Australia

- 5.3.5. Rest of Asia Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. Australia

- 5.4.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. China Asia-Pacific Feed Antibiotics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Tetracyclines

- 6.1.2. Penicillins

- 6.1.3. Sulfonamides

- 6.1.4. Macrolides

- 6.1.5. Aminoglycosides

- 6.1.6. Cephalosporins

- 6.1.7. Others

- 6.2. Market Analysis, Insights and Forecast - by Animal Type

- 6.2.1. Ruminant

- 6.2.2. Poultry

- 6.2.3. Swine

- 6.2.4. Aquaculture

- 6.2.5. Others

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. India

- 6.3.3. Japan

- 6.3.4. Australia

- 6.3.5. Rest of Asia Pacific

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. India Asia-Pacific Feed Antibiotics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Tetracyclines

- 7.1.2. Penicillins

- 7.1.3. Sulfonamides

- 7.1.4. Macrolides

- 7.1.5. Aminoglycosides

- 7.1.6. Cephalosporins

- 7.1.7. Others

- 7.2. Market Analysis, Insights and Forecast - by Animal Type

- 7.2.1. Ruminant

- 7.2.2. Poultry

- 7.2.3. Swine

- 7.2.4. Aquaculture

- 7.2.5. Others

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. India

- 7.3.3. Japan

- 7.3.4. Australia

- 7.3.5. Rest of Asia Pacific

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Japan Asia-Pacific Feed Antibiotics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Tetracyclines

- 8.1.2. Penicillins

- 8.1.3. Sulfonamides

- 8.1.4. Macrolides

- 8.1.5. Aminoglycosides

- 8.1.6. Cephalosporins

- 8.1.7. Others

- 8.2. Market Analysis, Insights and Forecast - by Animal Type

- 8.2.1. Ruminant

- 8.2.2. Poultry

- 8.2.3. Swine

- 8.2.4. Aquaculture

- 8.2.5. Others

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. India

- 8.3.3. Japan

- 8.3.4. Australia

- 8.3.5. Rest of Asia Pacific

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Australia Asia-Pacific Feed Antibiotics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Tetracyclines

- 9.1.2. Penicillins

- 9.1.3. Sulfonamides

- 9.1.4. Macrolides

- 9.1.5. Aminoglycosides

- 9.1.6. Cephalosporins

- 9.1.7. Others

- 9.2. Market Analysis, Insights and Forecast - by Animal Type

- 9.2.1. Ruminant

- 9.2.2. Poultry

- 9.2.3. Swine

- 9.2.4. Aquaculture

- 9.2.5. Others

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. India

- 9.3.3. Japan

- 9.3.4. Australia

- 9.3.5. Rest of Asia Pacific

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of Asia Pacific Asia-Pacific Feed Antibiotics Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Tetracyclines

- 10.1.2. Penicillins

- 10.1.3. Sulfonamides

- 10.1.4. Macrolides

- 10.1.5. Aminoglycosides

- 10.1.6. Cephalosporins

- 10.1.7. Others

- 10.2. Market Analysis, Insights and Forecast - by Animal Type

- 10.2.1. Ruminant

- 10.2.2. Poultry

- 10.2.3. Swine

- 10.2.4. Aquaculture

- 10.2.5. Others

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. India

- 10.3.3. Japan

- 10.3.4. Australia

- 10.3.5. Rest of Asia Pacific

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Zydus Cadila Healthcare Pharmaceutical company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Elanco Animal Health Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Zoetis

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Bayer HealthCare AG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Boehringer Ingelheim International Gmb

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Virbac Animal Health Pvt Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Merck Animal Health

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Zydus Cadila Healthcare Pharmaceutical company

List of Figures

- Figure 1: Asia-Pacific Feed Antibiotics Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Feed Antibiotics Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Feed Antibiotics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Asia-Pacific Feed Antibiotics Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 3: Asia-Pacific Feed Antibiotics Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Asia-Pacific Feed Antibiotics Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Asia-Pacific Feed Antibiotics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Asia-Pacific Feed Antibiotics Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 7: Asia-Pacific Feed Antibiotics Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Asia-Pacific Feed Antibiotics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Asia-Pacific Feed Antibiotics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 10: Asia-Pacific Feed Antibiotics Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 11: Asia-Pacific Feed Antibiotics Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Asia-Pacific Feed Antibiotics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Asia-Pacific Feed Antibiotics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Asia-Pacific Feed Antibiotics Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 15: Asia-Pacific Feed Antibiotics Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Asia-Pacific Feed Antibiotics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Asia-Pacific Feed Antibiotics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 18: Asia-Pacific Feed Antibiotics Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 19: Asia-Pacific Feed Antibiotics Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Asia-Pacific Feed Antibiotics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Asia-Pacific Feed Antibiotics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 22: Asia-Pacific Feed Antibiotics Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 23: Asia-Pacific Feed Antibiotics Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 24: Asia-Pacific Feed Antibiotics Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Feed Antibiotics Market?

The projected CAGR is approximately 4.2%.

2. Which companies are prominent players in the Asia-Pacific Feed Antibiotics Market?

Key companies in the market include Zydus Cadila Healthcare Pharmaceutical company, Elanco Animal Health Inc, Zoetis, Bayer HealthCare AG, Boehringer Ingelheim International Gmb, Virbac Animal Health Pvt Ltd, Merck Animal Health.

3. What are the main segments of the Asia-Pacific Feed Antibiotics Market?

The market segments include Type, Animal Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.35 billion as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health.

6. What are the notable trends driving market growth?

Increased Meat Consumption.

7. Are there any restraints impacting market growth?

Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Feed Antibiotics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Feed Antibiotics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Feed Antibiotics Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Feed Antibiotics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence