Key Insights

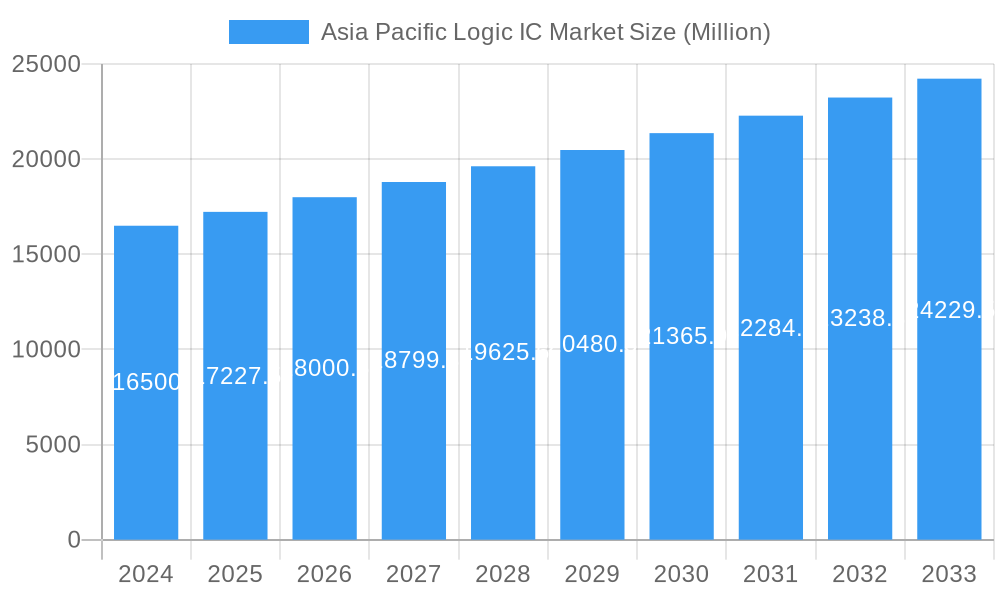

The Asia Pacific Logic IC market is poised for significant expansion, with an estimated market size of $16.5 billion in 2024 and projected to grow at a robust CAGR of 4.5% through 2033. This growth is propelled by a confluence of escalating demand from the consumer electronics sector, the burgeoning automotive industry's increasing reliance on sophisticated control systems, and the rapid digitalization of IT and telecommunications infrastructure across the region. The increasing adoption of advanced manufacturing and automation technologies further fuels the need for high-performance logic integrated circuits. Key segments driving this expansion include TTL and CMOS logic types, with ASICs and ASSPs leading in product types, catering to the diverse and evolving needs of these end-use industries. The region's dynamic economic landscape and its central role in global manufacturing contribute to its dominant position in the logic IC market.

Asia Pacific Logic IC Market Market Size (In Billion)

The market is characterized by a strong trend towards miniaturization, increased power efficiency, and enhanced processing capabilities in logic ICs. This is in response to the ever-growing demand for smarter, more connected devices in consumer electronics, advanced driver-assistance systems (ADAS) in automotive, and the proliferation of 5G and AI in telecommunications. While the growth trajectory is promising, potential restraints such as supply chain volatilities and the high cost of advanced manufacturing technologies could pose challenges. However, the sustained investment in research and development by leading companies like Microchip Technology, Toshiba Electronic Devices, and Texas Instruments, coupled with the sheer volume of manufacturing and consumption in countries like China, Japan, and India, is expected to propel the Asia Pacific Logic IC market to new heights. The continued innovation and adaptation by these key players will be crucial in navigating these challenges and capitalizing on the immense opportunities presented.

Asia Pacific Logic IC Market Company Market Share

Here's a detailed, SEO-optimized report description for the Asia Pacific Logic IC Market, designed for immediate use without modification:

Asia Pacific Logic IC Market: Comprehensive Market Analysis and Forecast (2019-2033)

This in-depth report provides a definitive analysis of the Asia Pacific Logic Integrated Circuit (IC) market, offering critical insights into its historical performance, current landscape, and future trajectory. Spanning from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, this study meticulously examines market dynamics, segmentation, key players, and emerging trends. The report leverages high-traffic keywords such as "Asia Pacific logic IC," "semiconductor market," "integrated circuits," "ASIC," "CMOS," "automotive electronics," "consumer electronics," and "IT & Telecommunications" to ensure maximum search visibility and engagement with industry stakeholders, including manufacturers, suppliers, investors, and policymakers.

Asia Pacific Logic IC Market Market Concentration & Innovation

The Asia Pacific logic IC market exhibits a moderate to high level of concentration, driven by a few dominant global players alongside several regional manufacturers. Innovation is the primary catalyst for market growth, fueled by relentless research and development in areas such as advanced packaging, power efficiency, and miniaturization of logic ICs. Regulatory frameworks, while evolving, generally support the semiconductor industry through incentives and trade agreements, though varying national policies can present localized challenges. Product substitutes, while present in certain niche applications, are largely outpaced by the performance and integration capabilities of advanced logic ICs. End-user trends are heavily skewed towards increased demand for smart, connected devices across consumer electronics, automotive, and industrial sectors, directly impacting the types of logic ICs required. Mergers and acquisitions (M&A) activity, with deal values in the billions, plays a significant role in consolidating market share and acquiring innovative technologies.

- Market Share Dynamics: Dominated by major global players with established manufacturing capabilities and R&D investments.

- Innovation Drivers: Advancements in process technology, AI-specific logic, and ultra-low power consumption.

- Regulatory Influence: Government initiatives promoting domestic semiconductor manufacturing and R&D are crucial.

- Substitute Landscape: Limited substitutes for high-performance logic ICs due to unique integration and processing power.

- End-User Evolution: Growing demand for edge computing, IoT devices, and autonomous systems.

- M&A Activity: Strategic acquisitions to gain access to patented technologies and expand product portfolios.

Asia Pacific Logic IC Market Industry Trends & Insights

The Asia Pacific logic IC market is experiencing robust growth, propelled by an insatiable demand from a multitude of burgeoning industries. The CAGR for this sector is projected to be substantial, reflecting the increasing integration of logic ICs into everyday life and advanced technological applications. Key market growth drivers include the rapid expansion of the automotive sector, particularly with the proliferation of electric vehicles (EVs) and advanced driver-assistance systems (ADAS), which rely heavily on sophisticated logic ICs for control, processing, and communication. The consumer electronics segment continues its upward trajectory, with a sustained demand for smartphones, smart home devices, wearables, and gaming consoles, all of which are powered by complex logic chips. Furthermore, the IT & Telecommunications sector, driven by 5G deployments, cloud computing, and the Internet of Things (IoT), presents a significant avenue for logic IC adoption. Technological disruptions, such as advancements in artificial intelligence (AI) and machine learning (ML), are creating new markets for specialized logic ICs designed for high-performance computing and inference. The increasing adoption of AI at the edge, for instance, necessitates powerful yet energy-efficient logic solutions that can process data locally. Consumer preferences are shifting towards more personalized, connected, and intelligent devices, pushing manufacturers to embed more advanced logic capabilities. The competitive dynamics within the Asia Pacific logic IC market are intense, characterized by fierce price competition, a constant race for technological superiority, and strategic partnerships. Companies are investing heavily in R&D to develop next-generation logic ICs that offer higher performance, lower power consumption, and greater functionality. The increasing sophistication of design tools and manufacturing processes, coupled with the growing need for custom solutions (ASICs), are also shaping the market landscape. The market penetration of advanced logic ICs is expected to deepen across all application segments, as their benefits in terms of speed, efficiency, and integration become indispensable for product innovation and competitive advantage. The development of smaller, more powerful, and more energy-efficient logic chips is paramount, particularly for mobile and portable devices, as well as for the burgeoning IoT ecosystem.

Dominant Markets & Segments in Asia Pacific Logic IC Market

The Asia Pacific logic IC market is characterized by distinct regional dominance and segment leadership, driven by a confluence of economic policies, infrastructure development, and specific industry needs.

Dominant Regions & Countries: The Asia Pacific region itself is the powerhouse of the global logic IC market, with China, South Korea, Japan, and Taiwan leading in terms of both production and consumption. These countries possess highly developed semiconductor ecosystems, significant manufacturing capacities, and a massive domestic demand for electronic components.

- China: Driven by its extensive manufacturing base and government initiatives to boost domestic semiconductor production, China is a dominant consumer and increasingly a producer of logic ICs. Its vast consumer electronics and automotive industries fuel demand.

- South Korea: Home to global leaders in memory and logic chips, South Korea plays a pivotal role in innovation and advanced manufacturing. Its strong presence in consumer electronics and telecommunications ensures continuous demand.

- Japan: A historical leader in electronics, Japan continues to be a significant player, particularly in automotive and industrial applications, leveraging its expertise in high-reliability and specialized logic ICs.

- Taiwan: A global hub for semiconductor manufacturing, particularly for advanced logic ICs through foundries, Taiwan's influence extends across the entire supply chain.

Dominant Segments:

Type: CMOS (Complementary Metal-Oxide Semiconductor) CMOS technology dominates the logic IC market due to its low power consumption, high noise immunity, and scalability, making it ideal for a wide range of applications from microprocessors to memory. The rapid advancements in CMOS process nodes continue to enable smaller, faster, and more power-efficient logic chips, catering to the ever-increasing demands of modern electronic devices.

- Key Drivers: Pervasive use in microprocessors, memory, and system-on-chips (SoCs); continuous scaling of fabrication processes.

Product Type: ASIC (Application-Specific Integrated Circuit) The demand for ASICs is soaring as companies seek customized solutions for specific applications, offering advantages in performance, power efficiency, and cost for high-volume products. The increasing complexity of advanced functionalities in areas like AI, automotive, and telecommunications fuels the need for tailor-made ICs.

- Key Drivers: Need for optimized performance in specialized applications; rising complexity of consumer electronics and automotive systems.

Application: Consumer Electronics This segment remains a cornerstone of the logic IC market, driven by the relentless innovation in smartphones, tablets, smart home devices, wearables, and gaming consoles. The demand for enhanced processing power, connectivity, and multimedia capabilities continuously drives the adoption of advanced logic ICs.

- Key Drivers: Proliferation of smart devices, demand for enhanced features and performance, evolving consumer lifestyles.

Application: Automotive The automotive sector is a rapidly growing application for logic ICs, fueled by the transition to electric vehicles, the development of autonomous driving systems, in-car infotainment, and advanced driver-assistance systems (ADAS). Logic ICs are crucial for control units, sensor processing, communication modules, and infotainment systems, demanding high reliability and performance.

- Key Drivers: Electrification of vehicles, advancements in ADAS and autonomous driving, increasing in-car electronics and connectivity.

Application: IT & Telecommunications This segment is driven by the ongoing expansion of 5G networks, cloud computing infrastructure, data centers, and the Internet of Things (IoT). High-performance processors, network interface controllers, and signal processing ICs are essential for meeting the growing demand for data transmission, processing, and connectivity.

- Key Drivers: 5G deployment, growth of cloud computing and data centers, expansion of IoT ecosystems.

Asia Pacific Logic IC Market Product Developments

The Asia Pacific logic IC market is witnessing a surge in product innovations, particularly in advanced process technologies and specialized architectures. Companies are focusing on developing ultra-low power consumption logic ICs for IoT devices and wearables, alongside high-performance processors for AI acceleration and automotive applications. The integration of multiple functionalities onto a single chip (SoC) and the development of application-specific integrated circuits (ASICs) are key trends, offering enhanced performance, power efficiency, and cost-effectiveness for specialized needs. Competitive advantages are being carved out through superior processing speeds, reduced energy footprints, and enhanced integration capabilities, catering to the evolving demands of consumer electronics, automotive, and telecommunications sectors.

Report Scope & Segmentation Analysis

This report meticulously segments the Asia Pacific logic IC market by Type, Product Type, and Application.

- Type Segmentation: Analyzes the market share and growth prospects for TTL (Transistor Transistor Logic), CMOS (Complementary Metal Oxide Semiconductor), and Mixed-Signal ICs. The CMOS segment is expected to lead, driven by its wide applicability and continuous technological advancements. Mixed-signal ICs are crucial for bridging the analog and digital worlds in numerous applications.

- Product Type Segmentation: Examines the market dynamics of ASIC, ASSP (Application-Specific Standard Product), and PLD (Programmable Logic Device). ASICs are projected for significant growth due to the increasing demand for custom solutions, while ASSPs cater to broader market needs.

- Application Segmentation: Provides detailed analysis for Consumer Electronics, Automotive, IT & Telecommunications, Manufacturing and Automation, and Other Applications. The automotive and consumer electronics segments are anticipated to exhibit the highest growth rates, followed closely by IT & Telecommunications.

Key Drivers of Asia Pacific Logic IC Market Growth

The Asia Pacific logic IC market's expansion is underpinned by several potent growth drivers.

- Technological Advancements: Continuous innovation in semiconductor manufacturing, including advanced node scaling and new material sciences, leads to higher performance and efficiency in logic ICs. The proliferation of AI and IoT technologies mandates more sophisticated processing capabilities.

- Economic Growth & Consumer Demand: The robust economic growth across Asia Pacific fuels demand for consumer electronics, smartphones, and smart home devices, all of which rely heavily on logic ICs.

- Automotive Electrification & Autonomy: The rapid adoption of electric vehicles and the development of autonomous driving systems are significant catalysts, requiring advanced logic ICs for control, sensing, and communication.

- Digital Transformation: The ongoing digital transformation across industries, including manufacturing, healthcare, and telecommunications, drives the need for enhanced computing power and connectivity, thus boosting logic IC consumption.

Challenges in the Asia Pacific Logic IC Market Sector

Despite its strong growth trajectory, the Asia Pacific logic IC market faces several significant challenges.

- Supply Chain Disruptions: Geopolitical tensions, natural disasters, and the inherent complexity of the semiconductor supply chain can lead to production delays and component shortages, impacting market stability.

- Intensifying Competition & Price Pressure: The market is highly competitive, with numerous players vying for market share, leading to considerable price pressure, especially for commoditized logic ICs.

- Talent Shortage: A growing shortage of skilled engineers and technicians in semiconductor design, manufacturing, and R&D poses a constraint on innovation and production capacity expansion.

- Increasing R&D Costs: The development of next-generation logic ICs requires substantial investments in research and development, which can be a barrier for smaller players and necessitate strategic alliances or M&A activities.

Emerging Opportunities in Asia Pacific Logic IC Market

The Asia Pacific logic IC market is ripe with emerging opportunities driven by new technologies and evolving consumer needs.

- AI and Machine Learning: The growing demand for AI-accelerated computing at the edge and in data centers presents a significant opportunity for specialized AI logic ICs.

- 5G Infrastructure and Devices: The ongoing rollout of 5G networks globally, with Asia Pacific at the forefront, creates a robust demand for high-performance logic ICs in base stations, network equipment, and 5G-enabled devices.

- Smart Manufacturing & Industry 4.0: The increasing adoption of automation and smart technologies in manufacturing processes requires advanced logic ICs for control systems, robotics, and industrial IoT applications.

- Sustainable Technologies: Growing global emphasis on sustainability is driving demand for energy-efficient logic ICs, particularly in applications like electric vehicles, renewable energy systems, and smart grids.

Leading Players in the Asia Pacific Logic IC Market Market

- Microchip Technology Inc

- Nexperia

- Toshiba Electronic Devices and Storage Corporation

- ON SEMICONDUCTOR CORPORATION

- Broadcom Inc

- STMicroelectronics NV

- Renesas Electronics Corporation

- Texas Instruments Incorporated

- Analog Devices Inc

- NXP Semiconductor Inc

- Intel Corporation

Key Developments in Asia Pacific Logic IC Market Industry

- October 2022: Samsung Electronics unveiled several cutting-edge logic chip technologies, including the Exynos Auto V920, 5G Exynos Modem 5300, and QD OLED DDI. These innovations play a crucial role in diverse industries, spanning automotive, mobile devices, and home appliances. These product launches align with the company's strategy to attain accelerated growth in memory and logic semiconductor segments.

- July 2022: Siemens EDA introduced the latest iteration of its mixed-signal IC verification tool during the Design Automation Conference (DAC). Given the growing demand for mixed-signal designs among ASIC and SoC designers, this verification tool equips designers with enhanced capabilities to thoroughly validate their designs.

Strategic Outlook for Asia Pacific Logic IC Market Market

The strategic outlook for the Asia Pacific logic IC market is exceptionally bright, characterized by sustained demand and continuous technological innovation. Key growth catalysts include the accelerating adoption of artificial intelligence, the widespread implementation of 5G technologies, and the rapid expansion of the electric vehicle market. As these trends mature, the demand for high-performance, energy-efficient, and specialized logic ICs will only intensify. Furthermore, government support for domestic semiconductor manufacturing and research in key Asia Pacific nations is expected to foster a more resilient and innovative ecosystem. The market's future potential lies in its ability to cater to these evolving technological landscapes, offering tailored solutions for complex applications and solidifying its position as a global semiconductor powerhouse.

Asia Pacific Logic IC Market Segmentation

-

1. Type

- 1.1. TTL (Transistor Transistor Logic)

- 1.2. CMOS (Complementry Metal Oxide Semiconductor)

- 1.3. Mixed-Signal IC

-

2. Product Type

- 2.1. ASIC

- 2.2. ASSP

- 2.3. PLD

-

3. Application

- 3.1. Consumer Electronics

- 3.2. Automotive

- 3.3. IT & Telecommunications

- 3.4. Manufacturing and Automation

- 3.5. Other Ap

Asia Pacific Logic IC Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Logic IC Market Regional Market Share

Geographic Coverage of Asia Pacific Logic IC Market

Asia Pacific Logic IC Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption of Automation & Robotics; A Growing Penetration of Consumer Electronic Devices

- 3.3. Market Restrains

- 3.3.1. Design Comlexity & Reliability

- 3.4. Market Trends

- 3.4.1. IT & Telecommunications to Hold a Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Logic IC Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. TTL (Transistor Transistor Logic)

- 5.1.2. CMOS (Complementry Metal Oxide Semiconductor)

- 5.1.3. Mixed-Signal IC

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. ASIC

- 5.2.2. ASSP

- 5.2.3. PLD

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Consumer Electronics

- 5.3.2. Automotive

- 5.3.3. IT & Telecommunications

- 5.3.4. Manufacturing and Automation

- 5.3.5. Other Ap

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Microchip Technology Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nexperia

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Toshiba Electronic Devices and Storage Corporation*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 ON SEMICONDUCTOR CORPORATION

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Broadcom Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 STMicroelectronics NV

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Renesas Electronics Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Texas Instruments Incorporated

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Analog Devices Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 NXP Semiconductor Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Intel Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Microchip Technology Inc

List of Figures

- Figure 1: Asia Pacific Logic IC Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Logic IC Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Logic IC Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Asia Pacific Logic IC Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 3: Asia Pacific Logic IC Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: Asia Pacific Logic IC Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Asia Pacific Logic IC Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Asia Pacific Logic IC Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 7: Asia Pacific Logic IC Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 8: Asia Pacific Logic IC Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: China Asia Pacific Logic IC Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Japan Asia Pacific Logic IC Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: South Korea Asia Pacific Logic IC Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: India Asia Pacific Logic IC Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Australia Asia Pacific Logic IC Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: New Zealand Asia Pacific Logic IC Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Indonesia Asia Pacific Logic IC Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Malaysia Asia Pacific Logic IC Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Singapore Asia Pacific Logic IC Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Thailand Asia Pacific Logic IC Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Vietnam Asia Pacific Logic IC Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Philippines Asia Pacific Logic IC Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Logic IC Market?

The projected CAGR is approximately 4.5%.

2. Which companies are prominent players in the Asia Pacific Logic IC Market?

Key companies in the market include Microchip Technology Inc, Nexperia, Toshiba Electronic Devices and Storage Corporation*List Not Exhaustive, ON SEMICONDUCTOR CORPORATION, Broadcom Inc, STMicroelectronics NV, Renesas Electronics Corporation, Texas Instruments Incorporated, Analog Devices Inc, NXP Semiconductor Inc, Intel Corporation.

3. What are the main segments of the Asia Pacific Logic IC Market?

The market segments include Type, Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption of Automation & Robotics; A Growing Penetration of Consumer Electronic Devices.

6. What are the notable trends driving market growth?

IT & Telecommunications to Hold a Significant Market Share.

7. Are there any restraints impacting market growth?

Design Comlexity & Reliability.

8. Can you provide examples of recent developments in the market?

October 2022: Samsung Electronics unveiled several cutting-edge logic chip technologies, including the Exynos Auto V920, 5G Exynos Modem 5300, and QD OLED DDI. These innovations play a crucial role in diverse industries, spanning automotive, mobile devices, and home appliances. These product launches align with the company's strategy to attain accelerated growth in memory and logic semiconductor segments.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Logic IC Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Logic IC Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Logic IC Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Logic IC Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence