Key Insights

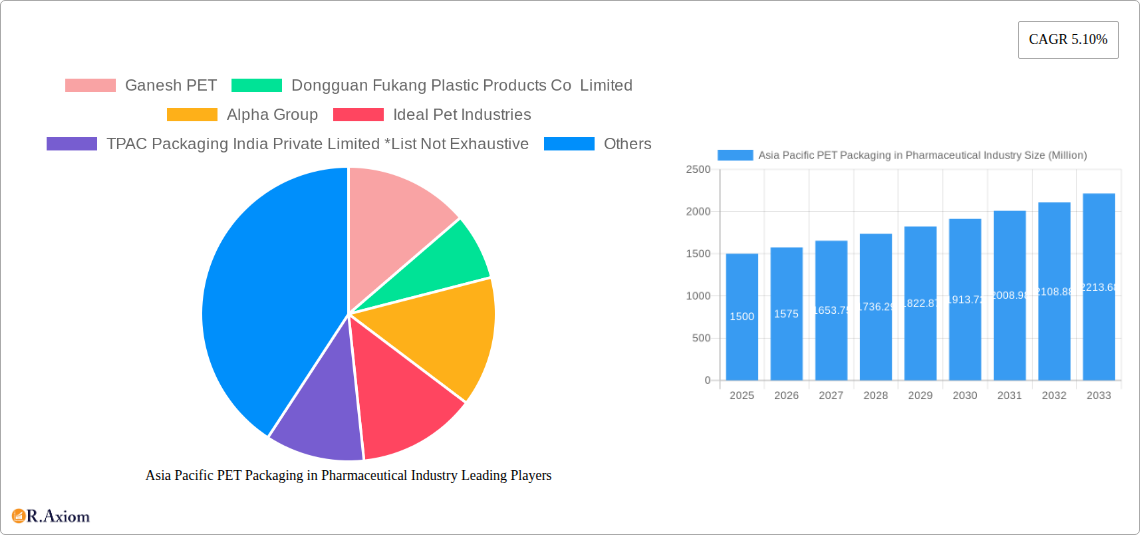

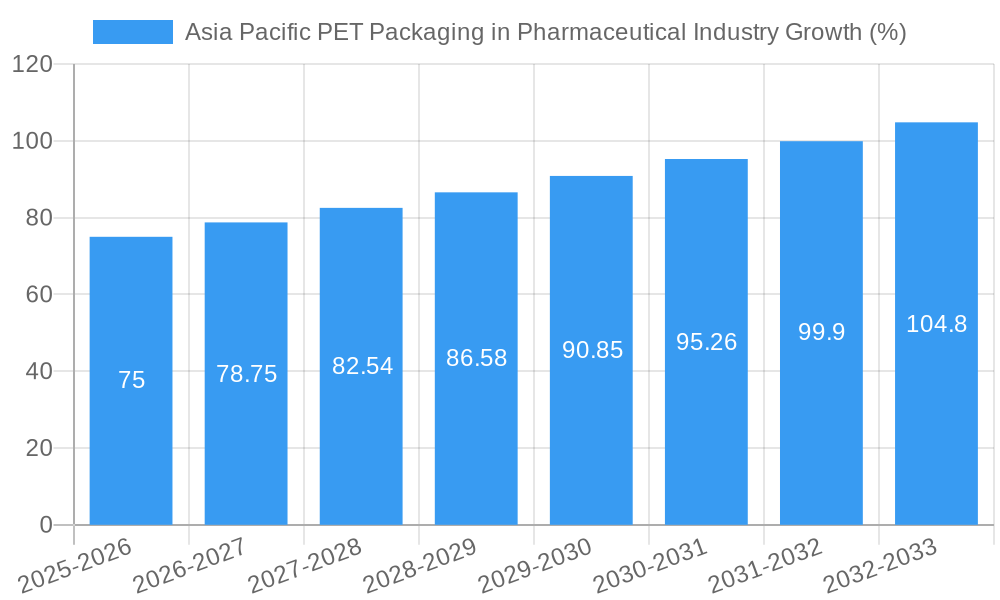

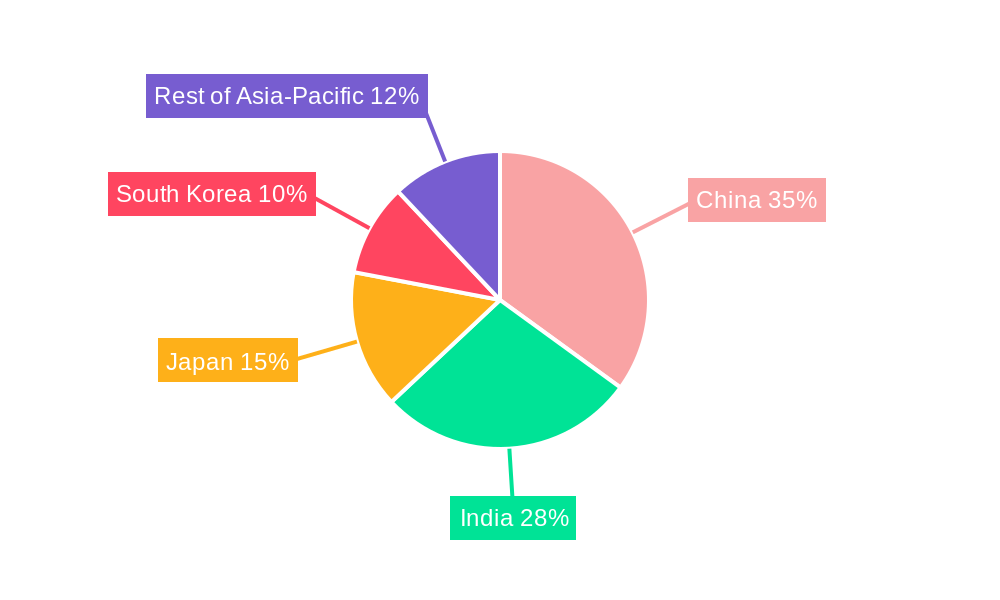

The Asia-Pacific pharmaceutical PET packaging market is experiencing robust growth, driven by the rising demand for pharmaceuticals across the region and the increasing preference for lightweight, cost-effective, and recyclable packaging solutions. The market's Compound Annual Growth Rate (CAGR) of 5.10% from 2019 to 2024 indicates a steadily expanding market, projected to continue its trajectory through 2033. Key drivers include the increasing prevalence of chronic diseases necessitating higher pharmaceutical consumption, advancements in drug delivery systems requiring specialized packaging, and a growing emphasis on sustainable and environmentally friendly packaging options. The segment dominated by tablet bottles and syrup bottles, reflecting the high volume of oral medications consumed. Amber-colored bottles hold a significant market share due to their light-blocking properties, crucial for preserving drug efficacy. Geographically, China and India are the major contributors to the market's growth, driven by large populations and expanding pharmaceutical industries. However, other countries like Japan and South Korea also contribute significantly, showcasing a diverse and expanding market across the region. While the market faces challenges such as fluctuating raw material prices and stringent regulatory compliance, the overall outlook remains positive, supported by continuous innovations in PET packaging technology and the rising demand for pharmaceutical products in the Asia-Pacific region. Companies like Ganesh PET, Dongguan Fukang Plastic Products, and Gerresheimer AG are key players shaping this dynamic market landscape through their diverse product offerings and geographical reach. The market is expected to see further growth driven by the increasing adoption of innovative packaging solutions that enhance product stability and convenience.

The future of Asia-Pacific pharmaceutical PET packaging is bright, fueled by sustained growth in pharmaceutical production and consumption. The increasing focus on sustainable practices within the pharmaceutical industry will further boost the demand for recyclable PET packaging materials. The market is expected to see further diversification in product types, with a greater focus on specialized packaging for injectables and other advanced drug delivery systems. This will require continuous innovation from manufacturers to adapt to evolving regulatory standards and consumer preferences. Further regional growth is expected, particularly within emerging markets, as healthcare infrastructure continues to improve and access to pharmaceuticals expands. This presents ample opportunities for market entrants and established players to invest and capitalize on this expanding and dynamic sector.

Asia Pacific PET Packaging in Pharmaceutical Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the Asia Pacific PET packaging market within the pharmaceutical industry, offering invaluable insights for stakeholders seeking to navigate this dynamic landscape. The study period spans 2019-2033, with 2025 serving as the base and estimated year. The forecast period covers 2025-2033, while the historical period encompasses 2019-2024. The report leverages extensive primary and secondary research to deliver actionable intelligence, crucial for informed strategic decision-making. The market is segmented by product type (Tablet Bottles, Syrup Bottles, Vials, Dropper Bottles, Handwash and Hand Sanitizer Bottles, Mouthwash Bottles, Other Product Types), color (Transparent, Green, Amber), and country (China, India, Japan, South Korea, Rest of Asia-Pacific). Key players analyzed include Ganesh PET, Dongguan Fukang Plastic Products Co Limited, Alpha Group, Ideal Pet Industries, TPAC Packaging India Private Limited, Senpet Polymers LLP, Total PET (Radico Khaitan Ltd), Takemoto Packaging Inc, AG Poly Packs Private Limited, Gerresheimer AG, and Kang-Jia Co Ltd. This is not an exhaustive list. The report projects a market value exceeding xx Million by 2033.

Asia Pacific PET Packaging in Pharmaceutical Industry Market Concentration & Innovation

This section analyzes the competitive landscape, highlighting market concentration, innovation drivers, regulatory frameworks, and market dynamics. The market exhibits a moderately concentrated structure, with the top five players holding an estimated xx% market share in 2025. Innovation is driven by the demand for lightweight, barrier-enhanced packaging, and sustainable solutions. Stringent regulatory frameworks, particularly concerning material safety and recyclability, shape industry practices. Substitute materials, such as glass and other polymers, present competitive challenges. End-user trends towards convenience and sustainability influence packaging design. M&A activity has been relatively moderate in recent years, with deal values averaging xx Million per transaction. Key innovation drivers include:

- Development of barrier PET to enhance product shelf life.

- Lightweighting initiatives to reduce material costs and carbon footprint.

- Focus on recyclability and sustainable sourcing of PET resin.

- Increased adoption of advanced printing and labeling technologies.

Asia Pacific PET Packaging in Pharmaceutical Industry Industry Trends & Insights

The Asia Pacific pharmaceutical PET packaging market is experiencing robust growth, driven by factors such as rising pharmaceutical consumption, expanding healthcare infrastructure, and increasing preference for convenient packaging formats. The market is projected to register a CAGR of xx% during the forecast period (2025-2033). This growth is further fueled by technological advancements, including improved barrier properties and sustainable packaging solutions. Consumer preferences for tamper-evident and child-resistant packaging are also significant drivers. Competitive dynamics are characterized by price competition, product differentiation, and strategic partnerships. Market penetration of PET packaging in the pharmaceutical sector is expected to reach xx% by 2033.

Dominant Markets & Segments in Asia Pacific PET Packaging in Pharmaceutical Industry

China and India dominate the Asia Pacific pharmaceutical PET packaging market, driven by their large pharmaceutical sectors and expanding populations. Japan and South Korea also represent significant markets.

Dominant Segments:

- Product Type: Tablet bottles and syrup bottles hold the largest market share due to high demand.

- Color: Transparent PET is the most prevalent, followed by amber for light-sensitive pharmaceuticals.

- Country: China holds the largest market share due to its extensive pharmaceutical manufacturing base and high consumption.

Key Drivers:

- China: Favorable government policies promoting domestic manufacturing and a robust pharmaceutical industry.

- India: Growing pharmaceutical exports and rising disposable incomes.

- Japan: Stringent quality standards driving demand for high-quality packaging.

- South Korea: Focus on innovative packaging solutions and technological advancements.

Asia Pacific PET Packaging in Pharmaceutical Industry Product Developments

Recent product innovations focus on enhancing barrier properties, improving recyclability, and incorporating features such as tamper evidence and child resistance. These innovations are driven by technological advancements in PET resin formulations and manufacturing processes. The market is witnessing a shift towards lightweight packaging to minimize environmental impact and reduce costs. These developments align with growing consumer and regulatory demands for sustainable and safe packaging solutions.

Report Scope & Segmentation Analysis

The report provides a comprehensive analysis of the Asia Pacific PET packaging market in the pharmaceutical industry, segmented by product type, color, and country. Each segment's growth projections, market size, and competitive dynamics are thoroughly analyzed. For example, the tablet bottle segment is expected to witness substantial growth due to the high demand for oral medications. The amber colored segment is growing steadily owing to its ability to protect light sensitive products. China and India represent the largest markets, benefiting from significant pharmaceutical manufacturing and consumption.

Key Drivers of Asia Pacific PET Packaging in Pharmaceutical Industry Growth

Several factors drive the growth of the Asia Pacific PET packaging market in the pharmaceutical industry:

- Rising pharmaceutical consumption: An aging population and increasing prevalence of chronic diseases fuel demand.

- Expanding healthcare infrastructure: Investments in hospitals and clinics create opportunities for packaging suppliers.

- Technological advancements: Innovations in PET resin and manufacturing techniques enhance product features.

- Government regulations: Emphasis on product safety and environmental sustainability promotes the adoption of advanced packaging solutions.

Challenges in the Asia Pacific PET Packaging in Pharmaceutical Industry Sector

The Asia Pacific PET packaging market faces challenges such as:

- Fluctuating raw material prices: PET resin price volatility impacts profitability.

- Intense competition: Numerous players compete, leading to price pressure.

- Stringent regulatory compliance: Meeting safety and environmental standards adds complexity.

- Supply chain disruptions: Geopolitical events and logistical issues can affect availability.

Emerging Opportunities in Asia Pacific PET Packaging in Pharmaceutical Industry

Emerging opportunities include:

- Growth in e-commerce: Increased online sales of pharmaceuticals drive demand for robust packaging.

- Focus on sustainable packaging: Demand for eco-friendly and recyclable solutions is rising.

- Innovation in barrier technology: Enhanced barrier properties expand applications for sensitive drugs.

- Expansion into emerging markets: Untapped potential exists in developing economies across Asia Pacific.

Leading Players in the Asia Pacific PET Packaging in Pharmaceutical Industry Market

- Ganesh PET

- Dongguan Fukang Plastic Products Co Limited

- Alpha Group

- Ideal Pet Industries

- TPAC Packaging India Private Limited

- Senpet Polymers LLP

- Total PET (Radico Khaitan Ltd)

- Takemoto Packaging Inc

- AG Poly Packs Private Limited

- Gerresheimer AG

- Kang-Jia Co Ltd

Key Developments in Asia Pacific PET Packaging in Pharmaceutical Industry Industry

- 2022 Q4: Ganesh PET launched a new line of recyclable PET bottles with improved barrier properties.

- 2023 Q1: A joint venture between Dongguan Fukang and a European company resulted in the introduction of a new sustainable PET packaging solution. (Further developments require specific data)

Strategic Outlook for Asia Pacific PET Packaging in Pharmaceutical Industry Market

The Asia Pacific PET packaging market in the pharmaceutical industry is poised for continued growth, driven by sustained demand for pharmaceuticals, technological advancements, and a growing focus on sustainability. Opportunities exist for companies that invest in innovation, build strong supply chains, and adapt to evolving regulatory landscapes. The market's future growth will be shaped by the ability of companies to meet the increasing demands for safe, sustainable, and cost-effective packaging solutions.

Asia Pacific PET Packaging in Pharmaceutical Industry Segmentation

-

1. Product Type

- 1.1. Tablet Bottles

- 1.2. Syrup Bottles

- 1.3. Vials

- 1.4. Dropper Bottles

- 1.5. Handwash and Hand Sanitizer Bottles

- 1.6. Mouthwash Bottles

- 1.7. Other Product Types

-

2. Color

- 2.1. Transparent

- 2.2. Green

- 2.3. Amber

Asia Pacific PET Packaging in Pharmaceutical Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific PET Packaging in Pharmaceutical Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing spending on healthcare and Pharmaceutical to augment the market growth

- 3.3. Market Restrains

- 3.3.1. Fluctuations in Raw Material Cost due to Suppliers’ Bargaining Power

- 3.4. Market Trends

- 3.4.1. Bottles to Witness Significant Growth Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific PET Packaging in Pharmaceutical Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Tablet Bottles

- 5.1.2. Syrup Bottles

- 5.1.3. Vials

- 5.1.4. Dropper Bottles

- 5.1.5. Handwash and Hand Sanitizer Bottles

- 5.1.6. Mouthwash Bottles

- 5.1.7. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Color

- 5.2.1. Transparent

- 5.2.2. Green

- 5.2.3. Amber

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. China Asia Pacific PET Packaging in Pharmaceutical Industry Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia Pacific PET Packaging in Pharmaceutical Industry Analysis, Insights and Forecast, 2019-2031

- 8. India Asia Pacific PET Packaging in Pharmaceutical Industry Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia Pacific PET Packaging in Pharmaceutical Industry Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia Pacific PET Packaging in Pharmaceutical Industry Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia Pacific PET Packaging in Pharmaceutical Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia Pacific PET Packaging in Pharmaceutical Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Ganesh PET

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Dongguan Fukang Plastic Products Co Limited

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Alpha Group

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Ideal Pet Industries

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 TPAC Packaging India Private Limited *List Not Exhaustive

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Senpet Polymers LLP

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Total PET (Radico Khaitan Ltd)

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Takemoto Packaging Inc

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 AG Poly Packs Private Limited

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Gerresheimer AG

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Kang-Jia Co Ltd

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.1 Ganesh PET

List of Figures

- Figure 1: Asia Pacific PET Packaging in Pharmaceutical Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia Pacific PET Packaging in Pharmaceutical Industry Share (%) by Company 2024

List of Tables

- Table 1: Asia Pacific PET Packaging in Pharmaceutical Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia Pacific PET Packaging in Pharmaceutical Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Asia Pacific PET Packaging in Pharmaceutical Industry Revenue Million Forecast, by Color 2019 & 2032

- Table 4: Asia Pacific PET Packaging in Pharmaceutical Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Asia Pacific PET Packaging in Pharmaceutical Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Asia Pacific PET Packaging in Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Japan Asia Pacific PET Packaging in Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India Asia Pacific PET Packaging in Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea Asia Pacific PET Packaging in Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Taiwan Asia Pacific PET Packaging in Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Australia Asia Pacific PET Packaging in Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Asia-Pacific Asia Pacific PET Packaging in Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Asia Pacific PET Packaging in Pharmaceutical Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 14: Asia Pacific PET Packaging in Pharmaceutical Industry Revenue Million Forecast, by Color 2019 & 2032

- Table 15: Asia Pacific PET Packaging in Pharmaceutical Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: China Asia Pacific PET Packaging in Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Japan Asia Pacific PET Packaging in Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Korea Asia Pacific PET Packaging in Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: India Asia Pacific PET Packaging in Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Australia Asia Pacific PET Packaging in Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: New Zealand Asia Pacific PET Packaging in Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Indonesia Asia Pacific PET Packaging in Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Malaysia Asia Pacific PET Packaging in Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Singapore Asia Pacific PET Packaging in Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Thailand Asia Pacific PET Packaging in Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Vietnam Asia Pacific PET Packaging in Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Philippines Asia Pacific PET Packaging in Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific PET Packaging in Pharmaceutical Industry?

The projected CAGR is approximately 5.10%.

2. Which companies are prominent players in the Asia Pacific PET Packaging in Pharmaceutical Industry?

Key companies in the market include Ganesh PET, Dongguan Fukang Plastic Products Co Limited, Alpha Group, Ideal Pet Industries, TPAC Packaging India Private Limited *List Not Exhaustive, Senpet Polymers LLP, Total PET (Radico Khaitan Ltd), Takemoto Packaging Inc, AG Poly Packs Private Limited, Gerresheimer AG, Kang-Jia Co Ltd.

3. What are the main segments of the Asia Pacific PET Packaging in Pharmaceutical Industry?

The market segments include Product Type, Color.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing spending on healthcare and Pharmaceutical to augment the market growth.

6. What are the notable trends driving market growth?

Bottles to Witness Significant Growth Rate.

7. Are there any restraints impacting market growth?

Fluctuations in Raw Material Cost due to Suppliers’ Bargaining Power.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific PET Packaging in Pharmaceutical Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific PET Packaging in Pharmaceutical Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific PET Packaging in Pharmaceutical Industry?

To stay informed about further developments, trends, and reports in the Asia Pacific PET Packaging in Pharmaceutical Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence