Key Insights

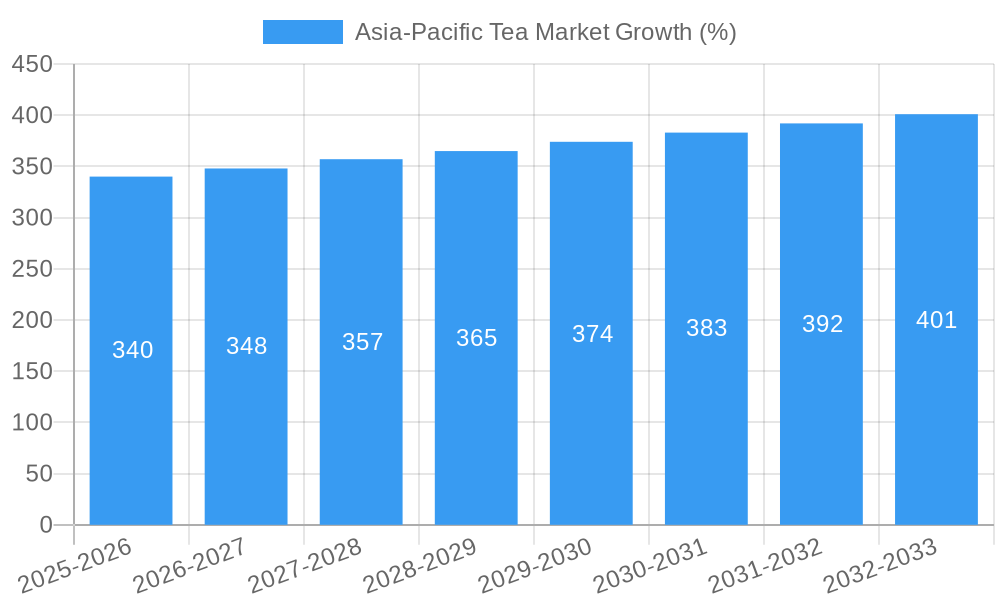

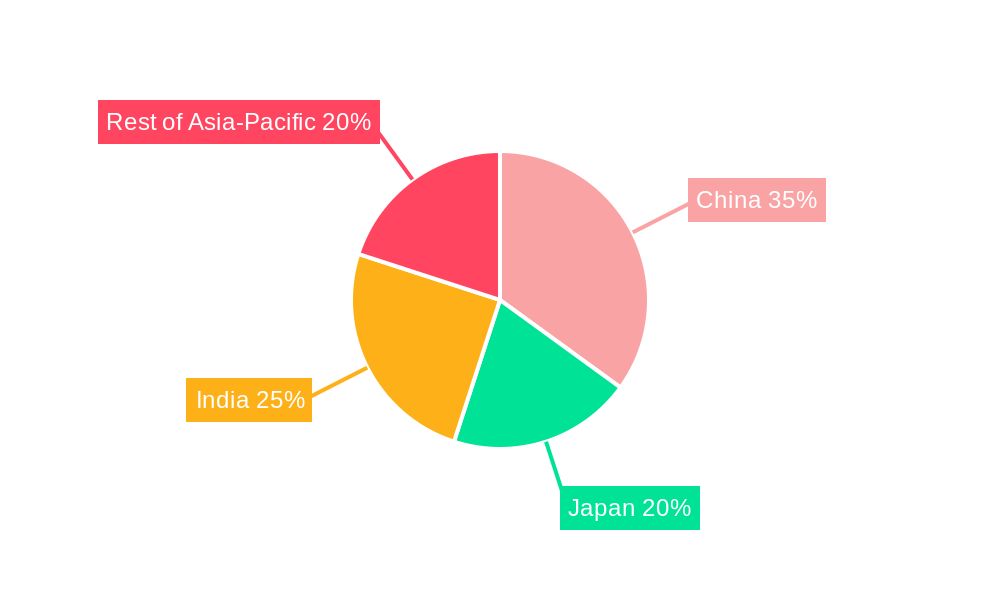

The Asia-Pacific tea market, valued at approximately $XX million in 2025, is projected to experience robust growth, driven by increasing health consciousness, diverse product offerings, and a strong tea-drinking culture prevalent across the region. A compound annual growth rate (CAGR) of 3.40% from 2025 to 2033 indicates a significant expansion of this market, with the final market value expected to reach approximately $YY million by 2033 (This YY value is a projection based on the given CAGR and 2025 market size; a precise calculation requires the actual 2025 market size value which is missing from the prompt). Key growth drivers include the rising popularity of premium and specialized teas, such as green tea and herbal infusions, fueled by increasing awareness of their health benefits. Furthermore, the expansion of online retail channels provides convenient access to a wider range of tea products, stimulating market growth. However, factors such as fluctuating raw material prices and intense competition among established and emerging players might pose challenges to market expansion. The segmentation reveals significant market share held by black tea within the product type segment and leaf tea within the form segment, indicating the dominance of traditional tea types. China, Japan, and India are expected to be the leading national markets within the Asia-Pacific region, contributing significantly to the overall market size due to their established tea cultivation and consumption habits.

The market is segmented across various forms (leaf tea, CTC tea), product types (black tea, green tea, herbal tea, others), distribution channels (supermarkets, convenience stores, specialty stores, online), and countries (China, Japan, India, Australia, Rest of Asia-Pacific). The competitive landscape is dynamic, featuring both global giants like Unilever and Tata Global Beverages, alongside regional and specialized players such as Organic India and Dilmah. Future growth will be influenced by evolving consumer preferences, innovations in tea blends and packaging, and strategic partnerships among players across the supply chain. Understanding these dynamics will be crucial for companies seeking to capitalize on the expanding opportunities within the Asia-Pacific tea market. The continued focus on sustainability and ethical sourcing practices will also play a crucial role in shaping the future of this market.

This in-depth report provides a comprehensive analysis of the Asia-Pacific tea market, covering the period 2019-2033. It offers valuable insights into market dynamics, growth drivers, challenges, and opportunities, enabling stakeholders to make informed strategic decisions. The report leverages extensive data and analysis to forecast market size and trends, encompassing key segments and leading players. With a focus on actionable intelligence, this report is an essential resource for businesses operating in or seeking entry into this dynamic market.

Asia-Pacific Tea Market Concentration & Innovation

This section analyzes the competitive landscape of the Asia-Pacific tea market, examining market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and mergers & acquisitions (M&A) activities. The market is characterized by a mix of large multinational corporations and smaller regional players. Market share is distributed across these companies, with the top 5 players holding approximately xx% of the market in 2025 (Estimated Year).

Market Concentration: The market displays a moderately concentrated structure, with a few dominant players and numerous smaller players. The Herfindahl-Hirschman Index (HHI) is estimated to be xx in 2025, indicating a moderately concentrated market.

Innovation Drivers: Growing consumer demand for premium and specialized teas, including organic, herbal, and functional teas, fuels innovation. Technological advancements in tea processing and packaging also contribute to market evolution.

Regulatory Frameworks: Varying regulations across countries in the Asia-Pacific region regarding food safety, labeling, and organic certification impact market dynamics.

Product Substitutes: Coffee, other beverages, and functional drinks compete with tea, necessitating continuous innovation to maintain market share.

End-User Trends: Health-conscious consumers are increasingly driving demand for teas perceived as having health benefits. This has prompted innovation in the product offerings and formulations.

M&A Activities: The tea market has witnessed significant M&A activity in recent years, with deal values totaling approximately xx Million in the 2019-2024 historical period. These activities primarily focus on expanding market reach, strengthening brand portfolios, and accessing new technologies.

Asia-Pacific Tea Market Industry Trends & Insights

The Asia-Pacific tea market is experiencing robust growth, driven by factors such as rising disposable incomes, increasing health awareness, and evolving consumer preferences. The market exhibited a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033). Market penetration of tea in various segments, like ready-to-drink (RTD) tea, is also increasing steadily. Technological disruptions, such as online retail and improved processing techniques, are transforming the market landscape. Competitive dynamics are shaped by price competition, brand loyalty, and product differentiation. Changing consumer preferences towards convenience and premiumization are influencing product innovation and marketing strategies. The premium tea segment is experiencing comparatively higher growth rates driven by increasing consumer interest in high-quality, specialty teas.

Dominant Markets & Segments in Asia-Pacific Tea Market

China, India, and Japan are the dominant markets in the Asia-Pacific tea market. Black tea remains the most popular product type, followed by green tea and herbal tea. Supermarkets/hypermarkets are the leading distribution channel.

Leading Region: East Asia accounts for the largest market share due to high tea consumption and a large population.

Dominant Countries:

- China: High domestic consumption, extensive tea production, and robust export market. Key drivers include strong cultural affinity for tea, established tea production infrastructure, and government support for the tea industry.

- India: Large-scale tea production, significant export market, and increasing domestic consumption fueled by growing disposable incomes.

- Japan: Sophisticated tea culture, high per capita consumption, and a strong preference for premium green teas.

Dominant Segments:

- Product Type: Black tea holds the largest market share due to its widespread appeal and affordability.

- Form: Loose leaf tea and CTC tea segments display robust growth.

- Distribution Channel: Supermarkets/hypermarkets maintain the largest market share owing to their extensive reach and established distribution networks.

Asia-Pacific Tea Market Product Developments

The Asia-Pacific tea market witnesses continuous product innovation, driven by consumer demand for diverse flavors, health benefits, and convenient formats. Ready-to-drink (RTD) teas are gaining traction, alongside single-serve sachets and innovative packaging solutions designed for convenience. The focus is also on premiumization, with the introduction of organic, fair-trade, and specialty teas. Technological advances, such as improved processing techniques and sustainable packaging, are playing a pivotal role in shaping the market.

Report Scope & Segmentation Analysis

This report segments the Asia-Pacific tea market based on form (leaf tea, CTC tea), product type (black tea, green tea, herbal tea, others), distribution channel (supermarkets/hypermarkets, convenience/grocery stores, specialty stores, online retail stores, other distribution channels), and country (China, Japan, India, Australia, Rest of Asia-Pacific). Each segment is analyzed in detail, with growth projections, market sizes, and competitive dynamics provided for the study period (2019-2033). The market size for each segment is projected based on historical data, current market trends, and expert analysis, with projected values ranging from xx Million to xx Million across different segments and years.

Key Drivers of Asia-Pacific Tea Market Growth

Several factors drive the growth of the Asia-Pacific tea market. Rising disposable incomes are increasing consumer spending on premium and specialized teas. Growing health consciousness fuels demand for teas with perceived health benefits, such as antioxidants and functional properties. The expanding middle class across many Asian countries is broadening the consumer base for tea. Government initiatives supporting the tea industry in several countries provide further stimulus for growth.

Challenges in the Asia-Pacific Tea Market Sector

The Asia-Pacific tea market faces challenges such as fluctuating raw material prices, intense competition, and variations in regulatory frameworks across different countries. Supply chain disruptions can impact the availability and cost of tea products. Counterfeit products pose a challenge to brand integrity. Consumer preference shifts towards other beverages present an ongoing competitive pressure.

Emerging Opportunities in Asia-Pacific Tea Market

The Asia-Pacific tea market presents numerous opportunities. The growing demand for convenient formats, such as RTD teas and single-serve sachets, offers potential for expansion. The increasing popularity of functional teas with health benefits creates new avenues for product innovation. The rise of e-commerce platforms opens up opportunities for online sales and broader market reach. Untapped markets in certain regions of Asia-Pacific offer scope for new market entry.

Leading Players in the Asia-Pacific Tea Market Market

- Organic India

- Golden Moon Tea

- Dilmah Ceylon Tea Company PLC

- The Hain Celestial Group Inc

- Unilever PLC

- Tata Global Beverages

- James Finlay

- The Republic of Tea

- R Twining and Company Limited

- Mcleod Russel

Key Developments in Asia-Pacific Tea Market Industry

- November 2022: Numi Organic Tea launched a roasted Japanese green tea line.

- October 2022: Luxmi Tea Company launched 15 new tea variants.

- September 2022: Dabur entered the tea market with Dabur Vedic Tea.

Strategic Outlook for Asia-Pacific Tea Market Market

The Asia-Pacific tea market is poised for continued growth driven by rising consumer demand, product innovation, and expanding distribution channels. Opportunities exist in developing premium segments, focusing on health and wellness, and leveraging e-commerce channels. Addressing the challenges of supply chain management and maintaining brand integrity is crucial for long-term success. Strategic partnerships and investments in research and development will strengthen the competitiveness of players in this market.

Asia-Pacific Tea Market Segmentation

-

1. Form

- 1.1. Leaf Tea

- 1.2. CTC Tea

-

2. Product Type

- 2.1. Black Tea

- 2.2. Green Tea

- 2.3. Herbal Tea

- 2.4. Others

-

3. Distribution Channel

- 3.1. Supermarkets/Hypermarkets

- 3.2. Convenience/Grocery Stores

- 3.3. Specialty Stores

- 3.4. Online Retail Stores

- 3.5. Other Distribution Channels

Asia-Pacific Tea Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Tea Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Consumers are increasingly concerned about the environmental and social impact of their purchases. This has led to a higher demand for ethically sourced teas that are fair trade certified and produced using sustainable farming practices

- 3.3. Market Restrains

- 3.3.1 Growing popularity of alternative beverages

- 3.3.2 such as specialty coffees

- 3.3.3 energy drinks

- 3.3.4 herbal infusions

- 3.3.5 and flavored water

- 3.3.6 competes directly with tea

- 3.3.7 particularly among younger consumers who are looking for new and trendy option

- 3.4. Market Trends

- 3.4.1 Consumers are increasingly looking for teas that are organic

- 3.4.2 free from pesticides

- 3.4.3 and made with natural ingredients. The move towards clean labels is driving the market for organic and ethically sourced teas

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Tea Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Leaf Tea

- 5.1.2. CTC Tea

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Black Tea

- 5.2.2. Green Tea

- 5.2.3. Herbal Tea

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets/Hypermarkets

- 5.3.2. Convenience/Grocery Stores

- 5.3.3. Specialty Stores

- 5.3.4. Online Retail Stores

- 5.3.5. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. China Asia-Pacific Tea Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia-Pacific Tea Market Analysis, Insights and Forecast, 2019-2031

- 8. India Asia-Pacific Tea Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia-Pacific Tea Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia-Pacific Tea Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia-Pacific Tea Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia-Pacific Tea Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Organic India

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Golden Moon Tea

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Dilmah Ceylon Tea Company PLC

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 The Hain Celestial Group Inc

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Unilever PLC

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Tata Global Beverages

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 James Finlay

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 The Republic of Tea

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 R Twining and Company Limited

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Mcleod Russel

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Organic India

List of Figures

- Figure 1: Asia-Pacific Tea Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Tea Market Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Tea Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Tea Market Volume K Litres Forecast, by Region 2019 & 2032

- Table 3: Asia-Pacific Tea Market Revenue Million Forecast, by Form 2019 & 2032

- Table 4: Asia-Pacific Tea Market Volume K Litres Forecast, by Form 2019 & 2032

- Table 5: Asia-Pacific Tea Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 6: Asia-Pacific Tea Market Volume K Litres Forecast, by Product Type 2019 & 2032

- Table 7: Asia-Pacific Tea Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 8: Asia-Pacific Tea Market Volume K Litres Forecast, by Distribution Channel 2019 & 2032

- Table 9: Asia-Pacific Tea Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Asia-Pacific Tea Market Volume K Litres Forecast, by Region 2019 & 2032

- Table 11: Asia-Pacific Tea Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Asia-Pacific Tea Market Volume K Litres Forecast, by Country 2019 & 2032

- Table 13: China Asia-Pacific Tea Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: China Asia-Pacific Tea Market Volume (K Litres) Forecast, by Application 2019 & 2032

- Table 15: Japan Asia-Pacific Tea Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Japan Asia-Pacific Tea Market Volume (K Litres) Forecast, by Application 2019 & 2032

- Table 17: India Asia-Pacific Tea Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: India Asia-Pacific Tea Market Volume (K Litres) Forecast, by Application 2019 & 2032

- Table 19: South Korea Asia-Pacific Tea Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: South Korea Asia-Pacific Tea Market Volume (K Litres) Forecast, by Application 2019 & 2032

- Table 21: Taiwan Asia-Pacific Tea Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Taiwan Asia-Pacific Tea Market Volume (K Litres) Forecast, by Application 2019 & 2032

- Table 23: Australia Asia-Pacific Tea Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Australia Asia-Pacific Tea Market Volume (K Litres) Forecast, by Application 2019 & 2032

- Table 25: Rest of Asia-Pacific Asia-Pacific Tea Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of Asia-Pacific Asia-Pacific Tea Market Volume (K Litres) Forecast, by Application 2019 & 2032

- Table 27: Asia-Pacific Tea Market Revenue Million Forecast, by Form 2019 & 2032

- Table 28: Asia-Pacific Tea Market Volume K Litres Forecast, by Form 2019 & 2032

- Table 29: Asia-Pacific Tea Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 30: Asia-Pacific Tea Market Volume K Litres Forecast, by Product Type 2019 & 2032

- Table 31: Asia-Pacific Tea Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 32: Asia-Pacific Tea Market Volume K Litres Forecast, by Distribution Channel 2019 & 2032

- Table 33: Asia-Pacific Tea Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Asia-Pacific Tea Market Volume K Litres Forecast, by Country 2019 & 2032

- Table 35: China Asia-Pacific Tea Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: China Asia-Pacific Tea Market Volume (K Litres) Forecast, by Application 2019 & 2032

- Table 37: Japan Asia-Pacific Tea Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Japan Asia-Pacific Tea Market Volume (K Litres) Forecast, by Application 2019 & 2032

- Table 39: South Korea Asia-Pacific Tea Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: South Korea Asia-Pacific Tea Market Volume (K Litres) Forecast, by Application 2019 & 2032

- Table 41: India Asia-Pacific Tea Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: India Asia-Pacific Tea Market Volume (K Litres) Forecast, by Application 2019 & 2032

- Table 43: Australia Asia-Pacific Tea Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Australia Asia-Pacific Tea Market Volume (K Litres) Forecast, by Application 2019 & 2032

- Table 45: New Zealand Asia-Pacific Tea Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: New Zealand Asia-Pacific Tea Market Volume (K Litres) Forecast, by Application 2019 & 2032

- Table 47: Indonesia Asia-Pacific Tea Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Indonesia Asia-Pacific Tea Market Volume (K Litres) Forecast, by Application 2019 & 2032

- Table 49: Malaysia Asia-Pacific Tea Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Malaysia Asia-Pacific Tea Market Volume (K Litres) Forecast, by Application 2019 & 2032

- Table 51: Singapore Asia-Pacific Tea Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Singapore Asia-Pacific Tea Market Volume (K Litres) Forecast, by Application 2019 & 2032

- Table 53: Thailand Asia-Pacific Tea Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Thailand Asia-Pacific Tea Market Volume (K Litres) Forecast, by Application 2019 & 2032

- Table 55: Vietnam Asia-Pacific Tea Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Vietnam Asia-Pacific Tea Market Volume (K Litres) Forecast, by Application 2019 & 2032

- Table 57: Philippines Asia-Pacific Tea Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Philippines Asia-Pacific Tea Market Volume (K Litres) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Tea Market?

The projected CAGR is approximately 3.40%.

2. Which companies are prominent players in the Asia-Pacific Tea Market?

Key companies in the market include Organic India, Golden Moon Tea, Dilmah Ceylon Tea Company PLC, The Hain Celestial Group Inc, Unilever PLC, Tata Global Beverages, James Finlay, The Republic of Tea, R Twining and Company Limited, Mcleod Russel.

3. What are the main segments of the Asia-Pacific Tea Market?

The market segments include Form, Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Consumers are increasingly concerned about the environmental and social impact of their purchases. This has led to a higher demand for ethically sourced teas that are fair trade certified and produced using sustainable farming practices.

6. What are the notable trends driving market growth?

Consumers are increasingly looking for teas that are organic. free from pesticides. and made with natural ingredients. The move towards clean labels is driving the market for organic and ethically sourced teas.

7. Are there any restraints impacting market growth?

Growing popularity of alternative beverages. such as specialty coffees. energy drinks. herbal infusions. and flavored water. competes directly with tea. particularly among younger consumers who are looking for new and trendy option.

8. Can you provide examples of recent developments in the market?

In November 2022, Numi Organic Tea launched a roasted Japanese green tea line featuring small-batched processed and custom-sized whole-leaf grade organic tea sourced from Japan.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Litres.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Tea Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Tea Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Tea Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Tea Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence