Key Insights

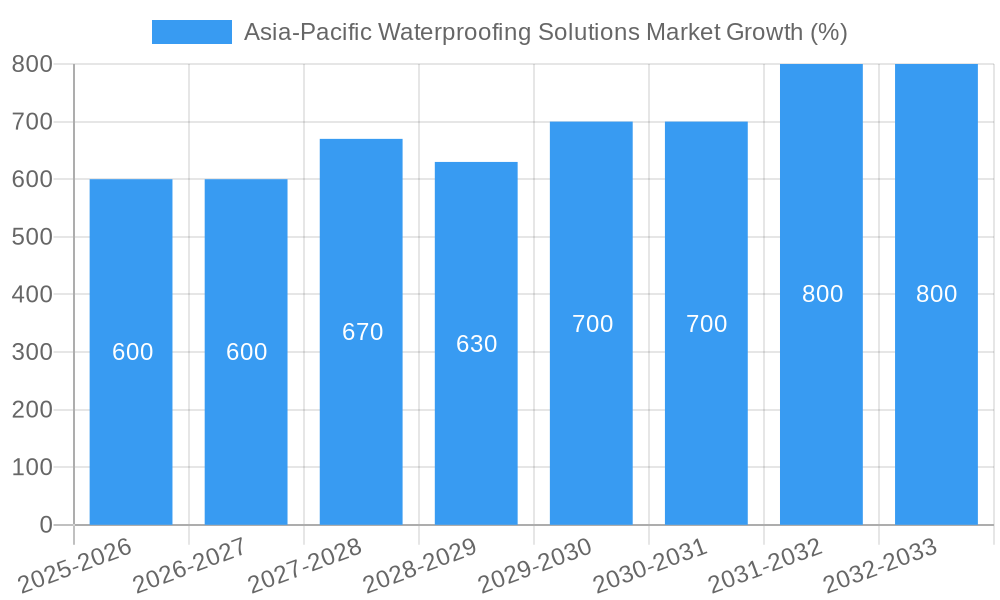

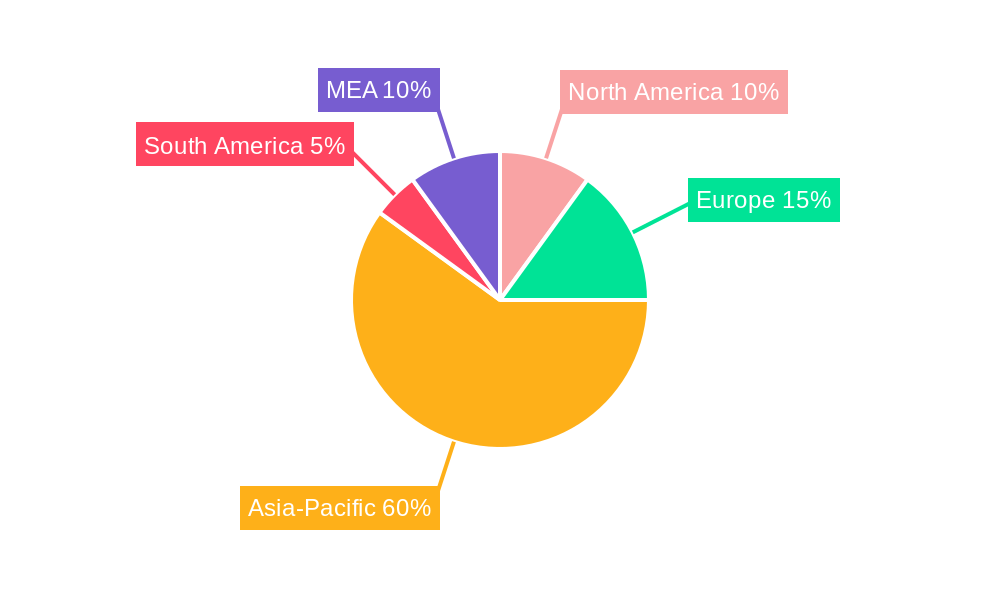

The Asia-Pacific waterproofing solutions market is experiencing robust growth, driven by escalating urbanization, infrastructure development, and increasing awareness of the importance of building durability and longevity. The region's unique climate conditions, characterized by high humidity, monsoons, and seismic activity, necessitate robust waterproofing solutions across diverse construction projects – from residential buildings and commercial complexes to industrial facilities and infrastructure projects like dams and bridges. Over the historical period (2019-2024), the market demonstrated consistent expansion, fueled by strong government investments in infrastructure development across various countries in the region. This trend is expected to continue through the forecast period (2025-2033). Factors such as rising disposable incomes, improving construction standards, and a growing preference for energy-efficient buildings are further stimulating market demand. The market is segmented by product type (bituminous membranes, polymeric membranes, cement-based waterproofing, and others), application (roofing, basements, walls, and others), and end-user (residential, commercial, industrial, and infrastructure). While the exact market size for 2025 is unavailable, a reasonable estimation based on historical growth and current market dynamics places it within a range of 8 to 10 billion USD. Competition is intense, with both established international players and local manufacturers vying for market share, leading to innovation in product offerings and pricing strategies. The market is expected to witness a Compound Annual Growth Rate (CAGR) of approximately 6-8% during the forecast period, exceeding the global average, highlighting the region's unique growth potential.

The continued growth of the Asia-Pacific waterproofing solutions market is underpinned by several key factors. Government initiatives promoting sustainable construction practices and stricter building codes are driving the adoption of high-performance waterproofing solutions. The increasing prevalence of extreme weather events further underscores the necessity of reliable waterproofing to mitigate damage and ensure building safety. Moreover, technological advancements are leading to the development of innovative waterproofing materials with improved durability, energy efficiency, and environmental sustainability. This technological progress, combined with rising awareness among consumers and construction professionals about the long-term benefits of proper waterproofing, will continue to propel market growth in the coming years. Specific regional differences within Asia-Pacific, reflecting varied levels of economic development and construction activity, will contribute to variations in market performance across countries.

This detailed report provides a comprehensive analysis of the Asia-Pacific waterproofing solutions market, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025, this report delves into market dynamics, growth drivers, competitive landscape, and future projections. The report utilizes a robust methodology incorporating extensive primary and secondary research, ensuring accuracy and reliability of data. The total market value in 2025 is estimated at xx Million and is projected to reach xx Million by 2033.

Asia-Pacific Waterproofing Solutions Market Market Concentration & Innovation

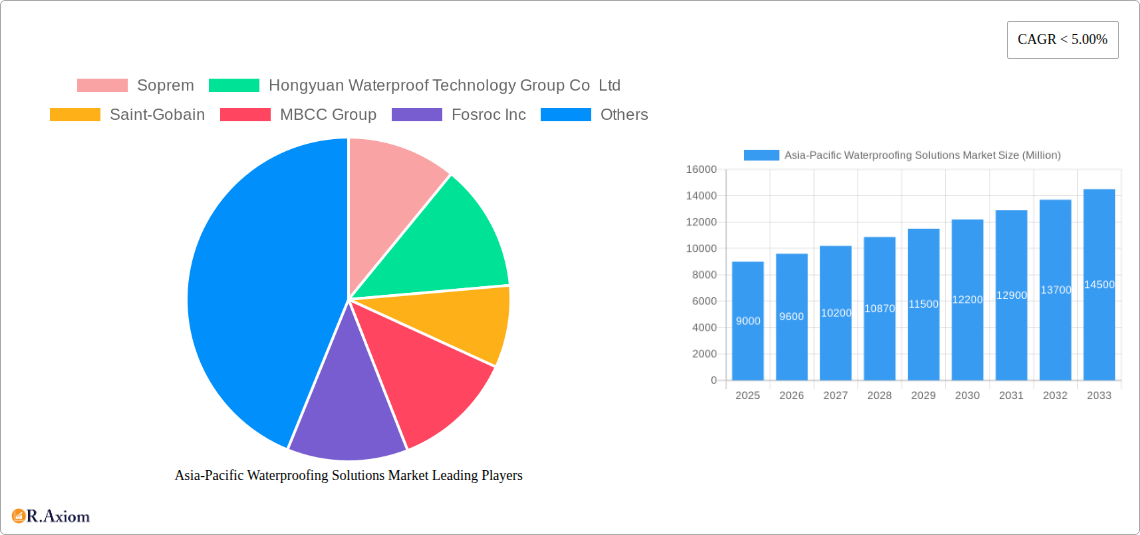

The Asia-Pacific waterproofing solutions market exhibits a moderately concentrated landscape, with several major players holding significant market share. Key players such as Sika AG, Saint-Gobain, and Oriental Yuhong compete fiercely, driving innovation and market expansion. The market share of the top 5 players is estimated to be approximately xx%. Recent mergers and acquisitions (M&A) activity, such as Sika's acquisition of MBCC Group in May 2023, significantly reshaped the competitive landscape. This deal, valued at xx Million, underscores the consolidation trend and the pursuit of enhanced market position within the waterproofing sector.

- Market Concentration: Moderately concentrated, with top 5 players holding xx% market share.

- Innovation Drivers: Stringent building codes, increasing urbanization, and the demand for sustainable building materials.

- Regulatory Frameworks: Vary across countries, influencing product standards and market access.

- Product Substitutes: Limited substitutes exist, but advancements in alternative technologies pose a potential threat.

- End-User Trends: Growing preference for eco-friendly and high-performance waterproofing solutions.

- M&A Activities: Significant M&A activity, reflecting consolidation and expansion strategies. Example: Sika's acquisition of MBCC Group (May 2023), valued at xx Million.

Asia-Pacific Waterproofing Solutions Market Industry Trends & Insights

The Asia-Pacific waterproofing solutions market is experiencing robust growth, driven by rapid urbanization, infrastructure development, and rising construction activity across the region. The market is projected to register a CAGR of xx% during the forecast period (2025-2033). Technological advancements, such as the introduction of advanced polymer-based membranes and self-healing materials, are enhancing product performance and market penetration. Consumer preferences are shifting towards sustainable and environmentally friendly solutions, influencing product development and marketing strategies. The competitive dynamics are intense, with companies focusing on innovation, cost optimization, and strategic partnerships to gain a competitive edge. Market penetration of advanced waterproofing solutions remains relatively low, presenting significant growth opportunities.

Dominant Markets & Segments in Asia-Pacific Waterproofing Solutions Market

The Infrastructure and Residential segments are the dominant end-use sectors in the Asia-Pacific waterproofing solutions market, driven by extensive infrastructure projects and the growing demand for housing. Within sub-products, Chemicals hold a larger market share compared to Loose Laid Sheet, due to the versatility and adaptability of chemical-based solutions to various applications and substrates. China and India are the leading countries, owing to their rapid economic growth, increasing construction activity, and large population base.

- Leading Region: China

- Leading Country: China and India

- Dominant End-Use Sectors: Infrastructure and Residential

- Dominant Sub-Product: Chemicals

Key Drivers for Dominant Segments & Countries:

- Infrastructure: Government investments in large-scale infrastructure projects such as roads, bridges, and railways.

- Residential: Rising disposable incomes, urbanization, and the demand for new housing units.

- China & India: Rapid economic growth, substantial construction activity, and favorable government policies.

Asia-Pacific Waterproofing Solutions Market Product Developments

Recent product innovations focus on enhancing durability, sustainability, and ease of application. Self-healing membranes, advanced polymer-based coatings, and bio-based waterproofing solutions are gaining traction. These advancements address the need for longer-lasting, environmentally friendly, and cost-effective solutions. The market fit of these innovations depends on factors like cost, regulatory compliance, and consumer awareness.

Report Scope & Segmentation Analysis

This report segments the Asia-Pacific waterproofing solutions market by end-use sector (Commercial, Industrial & Institutional, Infrastructure, Residential) and sub-product (Chemicals, Loose Laid Sheet). Each segment's growth projections, market sizes, and competitive dynamics are thoroughly analyzed.

End-Use Sector: Each sector exhibits distinct growth trajectories based on factors such as construction activity, infrastructure spending, and regional economic conditions. The Infrastructure sector shows the highest growth due to extensive infrastructure development projects, while the Residential sector follows closely owing to rising urbanization and housing demands.

Sub-Product: The Chemicals segment is projected to dominate due to its versatility and adaptability in various applications. The Loose Laid Sheet segment, while smaller, is expected to grow steadily due to its ease of installation in certain applications.

Key Drivers of Asia-Pacific Waterproofing Solutions Market Growth

Several factors propel the growth of the Asia-Pacific waterproofing solutions market. These include rapid urbanization leading to increased construction activity, government investments in infrastructure projects across multiple countries, growing awareness of the importance of building durability and longevity, and the rising adoption of sustainable building practices. Furthermore, technological advancements in waterproofing materials are pushing the market forward.

Challenges in the Asia-Pacific Waterproofing Solutions Market Sector

The Asia-Pacific waterproofing solutions market faces challenges, including fluctuating raw material prices impacting profitability, stringent regulatory compliance requirements across diverse national contexts, and the potential for supply chain disruptions impacting project timelines and costs. The intensity of competition also necessitates constant innovation and efficient cost management strategies.

Emerging Opportunities in Asia-Pacific Waterproofing Solutions Market

Emerging opportunities exist in the development and adoption of innovative, eco-friendly waterproofing solutions. The rising demand for sustainable building materials and growing awareness of environmental concerns present a significant opportunity for manufacturers. Expansion into underserved markets and exploring collaborations with local construction firms also holds substantial potential for growth.

Leading Players in the Asia-Pacific Waterproofing Solutions Market Market

- Soprem

- Hongyuan Waterproof Technology Group Co Ltd

- Saint-Gobain

- MBCC Group

- Fosroc Inc

- Ardex Group

- Sika AG

- Keshun Waterproof Technology Co ltd

- Lonseal Corporation

- Oriental Yuhong

Key Developments in Asia-Pacific Waterproofing Solutions Market Industry

- May 2023: Oriental Yuhong signed a strategic cooperation agreement with Hebei Aorun Shunda Group, expanding its research capabilities in waterproofing membranes and thermal insulation coatings.

- May 2023: Sika acquired MBCC Group, significantly altering the market landscape through consolidation.

- March 2023: Oriental Yuhong partnered with Luoyang Longfeng Construction Investment Co., Ltd., furthering its portfolio development in building products, including waterproofing solutions.

Strategic Outlook for Asia-Pacific Waterproofing Solutions Market Market

The Asia-Pacific waterproofing solutions market is poised for significant growth, driven by the factors outlined above. Strategic partnerships, technological innovation, and a focus on sustainable solutions will be crucial for companies seeking to capitalize on this market’s potential. The market’s future will likely be defined by a balance between consolidation, technological advancement, and a growing demand for environmentally responsible waterproofing solutions.

Asia-Pacific Waterproofing Solutions Market Segmentation

-

1. End Use Sector

- 1.1. Commercial

- 1.2. Industrial and Institutional

- 1.3. Infrastructure

- 1.4. Residential

-

2. Sub Product

-

2.1. Chemicals

-

2.1.1. By Technology

- 2.1.1.1. Epoxy-based

- 2.1.1.2. Polyurethane-based

- 2.1.1.3. Water-based

- 2.1.1.4. Other Technologies

-

2.1.1. By Technology

-

2.2. Membranes

- 2.2.1. Cold Liquid Applied

- 2.2.2. Fully Adhered Sheet

- 2.2.3. Hot Liquid Applied

- 2.2.4. Loose Laid Sheet

-

2.1. Chemicals

Asia-Pacific Waterproofing Solutions Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Waterproofing Solutions Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of < 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Banning/ Limiting Use of Plastics used in packaging applications

- 3.3. Market Restrains

- 3.3.1. ; Harmful Amines in Dyes; Paperless Green Initiatives

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Waterproofing Solutions Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End Use Sector

- 5.1.1. Commercial

- 5.1.2. Industrial and Institutional

- 5.1.3. Infrastructure

- 5.1.4. Residential

- 5.2. Market Analysis, Insights and Forecast - by Sub Product

- 5.2.1. Chemicals

- 5.2.1.1. By Technology

- 5.2.1.1.1. Epoxy-based

- 5.2.1.1.2. Polyurethane-based

- 5.2.1.1.3. Water-based

- 5.2.1.1.4. Other Technologies

- 5.2.1.1. By Technology

- 5.2.2. Membranes

- 5.2.2.1. Cold Liquid Applied

- 5.2.2.2. Fully Adhered Sheet

- 5.2.2.3. Hot Liquid Applied

- 5.2.2.4. Loose Laid Sheet

- 5.2.1. Chemicals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by End Use Sector

- 6. China Asia-Pacific Waterproofing Solutions Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia-Pacific Waterproofing Solutions Market Analysis, Insights and Forecast, 2019-2031

- 8. India Asia-Pacific Waterproofing Solutions Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia-Pacific Waterproofing Solutions Market Analysis, Insights and Forecast, 2019-2031

- 10. Southeast Asia Asia-Pacific Waterproofing Solutions Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia-Pacific Waterproofing Solutions Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia-Pacific Waterproofing Solutions Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Soprem

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Hongyuan Waterproof Technology Group Co Ltd

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Saint-Gobain

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 MBCC Group

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Fosroc Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Ardex Group

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Sika AG

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Keshun Waterproof Technology Co ltd

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Lonseal Corporation

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Oriental Yuhong

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Soprem

List of Figures

- Figure 1: Asia-Pacific Waterproofing Solutions Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Waterproofing Solutions Market Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Waterproofing Solutions Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Waterproofing Solutions Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: Asia-Pacific Waterproofing Solutions Market Revenue Million Forecast, by End Use Sector 2019 & 2032

- Table 4: Asia-Pacific Waterproofing Solutions Market Volume K Tons Forecast, by End Use Sector 2019 & 2032

- Table 5: Asia-Pacific Waterproofing Solutions Market Revenue Million Forecast, by Sub Product 2019 & 2032

- Table 6: Asia-Pacific Waterproofing Solutions Market Volume K Tons Forecast, by Sub Product 2019 & 2032

- Table 7: Asia-Pacific Waterproofing Solutions Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Asia-Pacific Waterproofing Solutions Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 9: Asia-Pacific Waterproofing Solutions Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Asia-Pacific Waterproofing Solutions Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 11: China Asia-Pacific Waterproofing Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: China Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 13: Japan Asia-Pacific Waterproofing Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Japan Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 15: India Asia-Pacific Waterproofing Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: India Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 17: South Korea Asia-Pacific Waterproofing Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Korea Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 19: Southeast Asia Asia-Pacific Waterproofing Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Southeast Asia Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 21: Australia Asia-Pacific Waterproofing Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Australia Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 23: Rest of Asia-Pacific Asia-Pacific Waterproofing Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Asia-Pacific Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 25: Asia-Pacific Waterproofing Solutions Market Revenue Million Forecast, by End Use Sector 2019 & 2032

- Table 26: Asia-Pacific Waterproofing Solutions Market Volume K Tons Forecast, by End Use Sector 2019 & 2032

- Table 27: Asia-Pacific Waterproofing Solutions Market Revenue Million Forecast, by Sub Product 2019 & 2032

- Table 28: Asia-Pacific Waterproofing Solutions Market Volume K Tons Forecast, by Sub Product 2019 & 2032

- Table 29: Asia-Pacific Waterproofing Solutions Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Asia-Pacific Waterproofing Solutions Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 31: China Asia-Pacific Waterproofing Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: China Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 33: Japan Asia-Pacific Waterproofing Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Japan Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 35: South Korea Asia-Pacific Waterproofing Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: South Korea Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 37: India Asia-Pacific Waterproofing Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: India Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 39: Australia Asia-Pacific Waterproofing Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Australia Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 41: New Zealand Asia-Pacific Waterproofing Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: New Zealand Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 43: Indonesia Asia-Pacific Waterproofing Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Indonesia Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 45: Malaysia Asia-Pacific Waterproofing Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Malaysia Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 47: Singapore Asia-Pacific Waterproofing Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Singapore Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 49: Thailand Asia-Pacific Waterproofing Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Thailand Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 51: Vietnam Asia-Pacific Waterproofing Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Vietnam Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 53: Philippines Asia-Pacific Waterproofing Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Philippines Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Waterproofing Solutions Market?

The projected CAGR is approximately < 5.00%.

2. Which companies are prominent players in the Asia-Pacific Waterproofing Solutions Market?

Key companies in the market include Soprem, Hongyuan Waterproof Technology Group Co Ltd, Saint-Gobain, MBCC Group, Fosroc Inc, Ardex Group, Sika AG, Keshun Waterproof Technology Co ltd, Lonseal Corporation, Oriental Yuhong.

3. What are the main segments of the Asia-Pacific Waterproofing Solutions Market?

The market segments include End Use Sector, Sub Product.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Banning/ Limiting Use of Plastics used in packaging applications.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

; Harmful Amines in Dyes; Paperless Green Initiatives.

8. Can you provide examples of recent developments in the market?

May 2023: Oriental Yuhong signed a strategic cooperation agreement with Hebei Aorun Shunda Group to collaborate on multi-dimensional research in the fields of waterproofing membranes and thermal insulation coatings, among other solutions.May 2023: Sika, a global leader in construction chemicals, acquired the MBCC Group, including its waterproofing solutions, anchors & grouts, flooring resins, repair & rehabilitation chemicals, and other businesses, with the exception of its concrete admixture operations in Europe, North America, Australia, and New Zealand.March 2023: To further develop its portfolio of building products, including waterproofing solutions, Oriental Yuhong initiated a strategic cooperation agreement with Luoyang Longfeng Construction Investment Co., Ltd. This agreement is expected to result in the exchange of resources in the field of construction materials.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Waterproofing Solutions Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Waterproofing Solutions Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Waterproofing Solutions Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Waterproofing Solutions Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence