Key Insights

The Asian mutual funds market is poised for significant expansion, driven by rising disposable incomes, a growing middle class, and enhanced financial literacy. With a projected Compound Annual Growth Rate (CAGR) of 12.1%, the market is estimated to reach $614 billion by 2025. Key growth catalysts include the increasing preference for diversified investment portfolios, government-led financial inclusion initiatives, and the widespread adoption of advanced investment platforms. Emerging trends such as fintech innovation, sustainable ESG investing, and demand for tailored investment solutions are redefining the market landscape. While regulatory shifts and geopolitical factors pose potential challenges, the long-term outlook remains robust, with substantial growth anticipated through 2033. The market is segmented by asset class (equity, debt, hybrid), investor type (retail, institutional), and key geographies including India, China, Japan, and Southeast Asia.

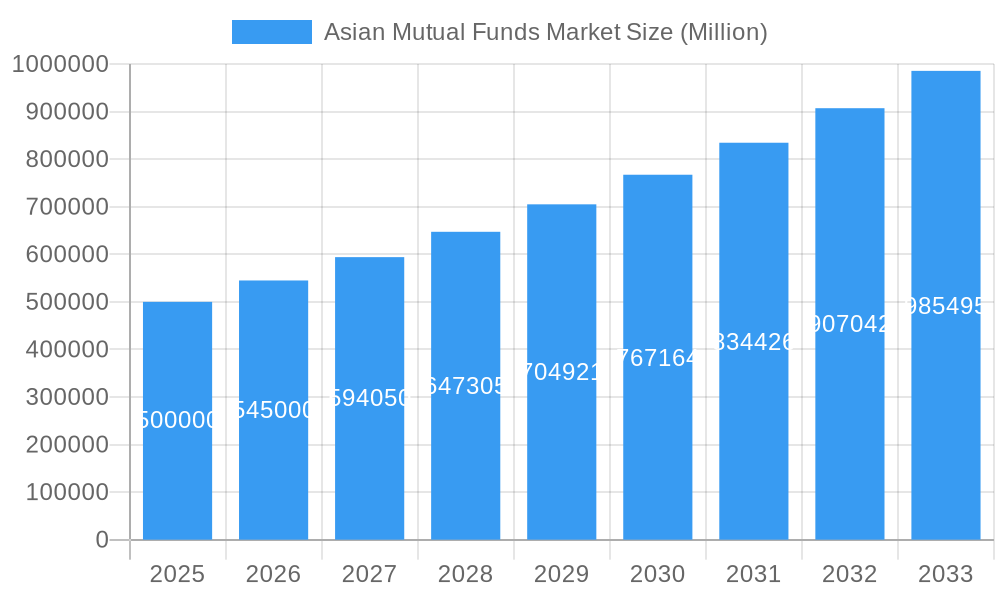

Asian Mutual Funds Market Market Size (In Billion)

Leading asset managers such as E Fund Management, Bosera Asset Management, HDFC Mutual Fund, BlackRock, and Fidelity Investments are actively shaping the competitive environment through innovation and expanded product offerings. The substantial market size, projected at $614 billion in 2025, signifies immense investment potential within the Asian mutual funds sector. Continuous growth throughout the forecast period (2025-2033) is expected, propelled by favorable demographics and escalating economic activity across the region. While growth rates will vary across Asian nations due to distinct economic conditions and market maturity, the overall trajectory points towards sustained advancement. The competitive arena is dynamic, with established firms contending with agile fintech disruptors and new market entrants, emphasizing the need for strategic agility and technological investment to secure market leadership.

Asian Mutual Funds Market Company Market Share

Asian Mutual Funds Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asian Mutual Funds Market, covering the period 2019-2033, with a focus on market dynamics, key players, and future growth prospects. The report leverages a robust data collection methodology, incorporating both primary and secondary research, to offer actionable insights for industry stakeholders. The base year for this report is 2025, with estimations for 2025 and forecasts extending to 2033. The historical period covered is 2019-2024. This report is crucial for investors, fund managers, financial analysts, and regulatory bodies seeking a detailed understanding of this dynamic market.

Asian Mutual Funds Market Market Concentration & Innovation

This section analyzes the competitive landscape of the Asian mutual funds market, examining market concentration, innovation drivers, regulatory frameworks, and M&A activities. The market is characterized by a mix of both large multinational firms and regional players. Market share data reveals a relatively concentrated market with the top 10 players accounting for approximately XX% of the total market in 2024. However, smaller, specialized firms are gaining traction by focusing on niche segments and leveraging technological advancements.

- Market Concentration: The top five players—BlackRock, Fidelity Investments, Invesco, E fund Management, and Bosera Asset Management—held a combined market share of approximately XX% in 2024. This is expected to slightly decrease to XX% by 2033 due to increased competition and market fragmentation.

- Innovation Drivers: Technological advancements, such as robo-advisors and AI-driven portfolio management tools, are driving innovation, improving efficiency, and reducing costs for fund managers. Regulatory changes also fuel innovation, encouraging the development of sustainable and ethical investment products.

- Regulatory Frameworks: Varying regulatory landscapes across Asian nations create both opportunities and challenges for mutual fund companies. Compliance costs and differing regulations impact market entry strategies and operational efficiency.

- Product Substitutes: Alternative investment vehicles, such as exchange-traded funds (ETFs) and direct stock investments, pose competitive pressures to traditional mutual funds.

- End-User Trends: Growing demand for diversified portfolios, personalized investment solutions, and increased awareness of ESG (Environmental, Social, and Governance) factors are influencing investor preferences.

- M&A Activities: The Asian mutual funds market has witnessed several mergers and acquisitions in recent years, with total deal values exceeding $XX Million in 2024. These M&A activities reflect consolidation trends and the pursuit of economies of scale.

Asian Mutual Funds Market Industry Trends & Insights

The Asian mutual funds market is experiencing robust growth, driven by a combination of factors including rising disposable incomes, increasing financial literacy, favorable government policies, and a growing preference for professional investment management. The market is estimated to reach $XX Million in 2025 and is projected to grow at a Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033. This growth is further bolstered by the increasing penetration of mutual funds among the young and tech-savvy investor demographic. Technological disruptions, such as the rise of fintech and digital platforms, are reshaping the distribution channels and accessibility of mutual funds. Consumer preferences are also shifting towards sustainable and ethical investment options, reflecting a growing environmental and social consciousness. The competitive landscape is characterized by intense rivalry among established players and the emergence of innovative fintech companies offering disruptive investment solutions. The market penetration is projected to increase from XX% in 2024 to XX% in 2033.

Dominant Markets & Segments in Asian Mutual Funds Market

The Asian mutual funds market demonstrates significant regional variations in terms of growth and development. China and India currently hold the largest market shares, propelled by their substantial populations, rapidly expanding economies, and growing middle class. However, other markets, such as South Korea, Singapore, and Japan, are also witnessing notable growth, albeit at different paces.

- Key Drivers in China: Government policies promoting financial inclusion, expanding infrastructure development, and a growing pool of high-net-worth individuals are driving growth in China.

- Key Drivers in India: A large and young population, favorable demographic trends, and increasing financial literacy are pushing India's mutual funds market to grow.

- Dominance Analysis: While China currently leads in terms of overall market size, India's growth trajectory suggests it will progressively claim a larger market share in the coming years. The growth in other Asian markets is heavily dependent on economic stability, regulatory clarity, and the penetration of financial literacy.

Asian Mutual Funds Market Product Developments

Significant product innovations are shaping the Asian mutual funds market. This includes the rise of thematic funds focusing on specific sectors (like the HDFC Defence Fund) or investment styles (like ESG funds) as well as the increasing adoption of passively managed products, such as exchange-traded funds (ETFs). These innovations cater to evolving investor preferences for diversified, transparent, and cost-effective investment solutions and enhance the competitive edge of firms adopting them.

Report Scope & Segmentation Analysis

This report segments the Asian mutual funds market based on several parameters, including:

- By Product Type: Equity funds, debt funds, hybrid funds, money market funds, etc. Equity funds are currently the largest segment and are anticipated to maintain this position throughout the forecast period, however, the debt fund segment is predicted to experience strong growth, particularly in markets with higher interest rate environments.

- By Investor Type: Retail investors, institutional investors, high-net-worth individuals. Retail investors currently dominate the market, but institutional investors play a crucial role in driving market liquidity.

- By Distribution Channel: Online platforms, financial advisors, banks. Online distribution is rapidly gaining popularity, especially among younger investors.

Each segment's growth trajectory, market size, and competitive dynamics are analyzed in detail within the complete report.

Key Drivers of Asian Mutual Funds Market Growth

Several key factors are driving the growth of the Asian mutual funds market:

- Rising Disposable Incomes: Increasing disposable incomes in many Asian countries are fuelling investment in financial products.

- Growing Middle Class: The expansion of the middle class is leading to a higher propensity for investment.

- Favorable Government Policies: Supportive regulatory frameworks and government initiatives are fostering the growth of the mutual funds industry.

- Technological Advancements: Fintech innovation and online investment platforms improve market access and efficiency.

Challenges in the Asian Mutual Funds Market Sector

The Asian mutual funds market faces several challenges:

- Regulatory Hurdles: Differing regulatory frameworks and compliance costs across different Asian markets create obstacles for fund managers.

- Geopolitical Risks: Regional political and economic uncertainties can negatively affect investor sentiment and market stability.

- Competitive Pressures: Intense competition among established players and new entrants creates pressures on profitability and market share.

Emerging Opportunities in Asian Mutual Funds Market

Several emerging trends present significant opportunities:

- Growing Demand for ESG Funds: Increased awareness of environmental, social, and governance (ESG) issues is driving demand for sustainable investments.

- Expansion into Underserved Markets: Untapped potential exists in less developed Asian markets with limited financial inclusion.

- Fintech Integration: The integration of Fintech and AI can create innovative products and distribution channels.

Leading Players in the Asian Mutual Funds Market Market

- E fund Management

- Bosera Asset Management

- HDFC Mutual Fund

- ICICI Prudential Mutual Fund

- T Rowe Price

- BlackRock

- Goldman Sachs

- Matthews Asia Funds

- Fidelity Investments

- Invesco (List Not Exhaustive)

Key Developments in Asian Mutual Funds Market Industry

- 2022: HDFC Mutual Fund filed a scheme information document (SID) with SEBI to launch India's first Defence Fund.

- 2021: Fidelity International merged six funds as part of its fund offering review to better meet evolving client needs.

Strategic Outlook for Asian Mutual Funds Market Market

The Asian mutual funds market is poised for continued growth, driven by favorable demographic trends, increasing financial literacy, and the adoption of innovative technologies. The expansion into new markets and the development of specialized products, particularly in the ESG space, offer significant opportunities for growth. However, careful navigation of regulatory challenges and geopolitical risks will be critical for sustained success in this dynamic market.

Asian Mutual Funds Market Segmentation

-

1. Fund Type

- 1.1. Equity

- 1.2. Bond

- 1.3. Hybrid

- 1.4. Money Market

- 1.5. Others

-

2. Geography

- 2.1. China

- 2.2. India

- 2.3. Singapore

- 2.4. Taiwan

- 2.5. Hong Kong

- 2.6. Korea

- 2.7. Rest of Asia-Pacific

Asian Mutual Funds Market Segmentation By Geography

- 1. China

- 2. India

- 3. Singapore

- 4. Taiwan

- 5. Hong Kong

- 6. Korea

- 7. Rest of Asia Pacific

Asian Mutual Funds Market Regional Market Share

Geographic Coverage of Asian Mutual Funds Market

Asian Mutual Funds Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Rising inflation will create opportunities

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Asian Mutual Funds Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Fund Type

- 5.1.1. Equity

- 5.1.2. Bond

- 5.1.3. Hybrid

- 5.1.4. Money Market

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. China

- 5.2.2. India

- 5.2.3. Singapore

- 5.2.4. Taiwan

- 5.2.5. Hong Kong

- 5.2.6. Korea

- 5.2.7. Rest of Asia-Pacific

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Singapore

- 5.3.4. Taiwan

- 5.3.5. Hong Kong

- 5.3.6. Korea

- 5.3.7. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Fund Type

- 6. China Asian Mutual Funds Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Fund Type

- 6.1.1. Equity

- 6.1.2. Bond

- 6.1.3. Hybrid

- 6.1.4. Money Market

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. China

- 6.2.2. India

- 6.2.3. Singapore

- 6.2.4. Taiwan

- 6.2.5. Hong Kong

- 6.2.6. Korea

- 6.2.7. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Fund Type

- 7. India Asian Mutual Funds Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Fund Type

- 7.1.1. Equity

- 7.1.2. Bond

- 7.1.3. Hybrid

- 7.1.4. Money Market

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. China

- 7.2.2. India

- 7.2.3. Singapore

- 7.2.4. Taiwan

- 7.2.5. Hong Kong

- 7.2.6. Korea

- 7.2.7. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Fund Type

- 8. Singapore Asian Mutual Funds Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Fund Type

- 8.1.1. Equity

- 8.1.2. Bond

- 8.1.3. Hybrid

- 8.1.4. Money Market

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. China

- 8.2.2. India

- 8.2.3. Singapore

- 8.2.4. Taiwan

- 8.2.5. Hong Kong

- 8.2.6. Korea

- 8.2.7. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Fund Type

- 9. Taiwan Asian Mutual Funds Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Fund Type

- 9.1.1. Equity

- 9.1.2. Bond

- 9.1.3. Hybrid

- 9.1.4. Money Market

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. China

- 9.2.2. India

- 9.2.3. Singapore

- 9.2.4. Taiwan

- 9.2.5. Hong Kong

- 9.2.6. Korea

- 9.2.7. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Fund Type

- 10. Hong Kong Asian Mutual Funds Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Fund Type

- 10.1.1. Equity

- 10.1.2. Bond

- 10.1.3. Hybrid

- 10.1.4. Money Market

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. China

- 10.2.2. India

- 10.2.3. Singapore

- 10.2.4. Taiwan

- 10.2.5. Hong Kong

- 10.2.6. Korea

- 10.2.7. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Fund Type

- 11. Korea Asian Mutual Funds Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Fund Type

- 11.1.1. Equity

- 11.1.2. Bond

- 11.1.3. Hybrid

- 11.1.4. Money Market

- 11.1.5. Others

- 11.2. Market Analysis, Insights and Forecast - by Geography

- 11.2.1. China

- 11.2.2. India

- 11.2.3. Singapore

- 11.2.4. Taiwan

- 11.2.5. Hong Kong

- 11.2.6. Korea

- 11.2.7. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Fund Type

- 12. Rest of Asia Pacific Asian Mutual Funds Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Fund Type

- 12.1.1. Equity

- 12.1.2. Bond

- 12.1.3. Hybrid

- 12.1.4. Money Market

- 12.1.5. Others

- 12.2. Market Analysis, Insights and Forecast - by Geography

- 12.2.1. China

- 12.2.2. India

- 12.2.3. Singapore

- 12.2.4. Taiwan

- 12.2.5. Hong Kong

- 12.2.6. Korea

- 12.2.7. Rest of Asia-Pacific

- 12.1. Market Analysis, Insights and Forecast - by Fund Type

- 13. Competitive Analysis

- 13.1. Global Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 E fund Management

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Bosera Asset management

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 HDFC Mutual Fund

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 ICICI Prudential Mutual Fund

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 T Rowe Price

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 BlackRock

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Goldman Sachs

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Matthews Asia Funds

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Fidelity Investments

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Invesco**List Not Exhaustive

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 E fund Management

List of Figures

- Figure 1: Global Asian Mutual Funds Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: China Asian Mutual Funds Market Revenue (billion), by Fund Type 2025 & 2033

- Figure 3: China Asian Mutual Funds Market Revenue Share (%), by Fund Type 2025 & 2033

- Figure 4: China Asian Mutual Funds Market Revenue (billion), by Geography 2025 & 2033

- Figure 5: China Asian Mutual Funds Market Revenue Share (%), by Geography 2025 & 2033

- Figure 6: China Asian Mutual Funds Market Revenue (billion), by Country 2025 & 2033

- Figure 7: China Asian Mutual Funds Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: India Asian Mutual Funds Market Revenue (billion), by Fund Type 2025 & 2033

- Figure 9: India Asian Mutual Funds Market Revenue Share (%), by Fund Type 2025 & 2033

- Figure 10: India Asian Mutual Funds Market Revenue (billion), by Geography 2025 & 2033

- Figure 11: India Asian Mutual Funds Market Revenue Share (%), by Geography 2025 & 2033

- Figure 12: India Asian Mutual Funds Market Revenue (billion), by Country 2025 & 2033

- Figure 13: India Asian Mutual Funds Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Singapore Asian Mutual Funds Market Revenue (billion), by Fund Type 2025 & 2033

- Figure 15: Singapore Asian Mutual Funds Market Revenue Share (%), by Fund Type 2025 & 2033

- Figure 16: Singapore Asian Mutual Funds Market Revenue (billion), by Geography 2025 & 2033

- Figure 17: Singapore Asian Mutual Funds Market Revenue Share (%), by Geography 2025 & 2033

- Figure 18: Singapore Asian Mutual Funds Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Singapore Asian Mutual Funds Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Taiwan Asian Mutual Funds Market Revenue (billion), by Fund Type 2025 & 2033

- Figure 21: Taiwan Asian Mutual Funds Market Revenue Share (%), by Fund Type 2025 & 2033

- Figure 22: Taiwan Asian Mutual Funds Market Revenue (billion), by Geography 2025 & 2033

- Figure 23: Taiwan Asian Mutual Funds Market Revenue Share (%), by Geography 2025 & 2033

- Figure 24: Taiwan Asian Mutual Funds Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Taiwan Asian Mutual Funds Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Hong Kong Asian Mutual Funds Market Revenue (billion), by Fund Type 2025 & 2033

- Figure 27: Hong Kong Asian Mutual Funds Market Revenue Share (%), by Fund Type 2025 & 2033

- Figure 28: Hong Kong Asian Mutual Funds Market Revenue (billion), by Geography 2025 & 2033

- Figure 29: Hong Kong Asian Mutual Funds Market Revenue Share (%), by Geography 2025 & 2033

- Figure 30: Hong Kong Asian Mutual Funds Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Hong Kong Asian Mutual Funds Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Korea Asian Mutual Funds Market Revenue (billion), by Fund Type 2025 & 2033

- Figure 33: Korea Asian Mutual Funds Market Revenue Share (%), by Fund Type 2025 & 2033

- Figure 34: Korea Asian Mutual Funds Market Revenue (billion), by Geography 2025 & 2033

- Figure 35: Korea Asian Mutual Funds Market Revenue Share (%), by Geography 2025 & 2033

- Figure 36: Korea Asian Mutual Funds Market Revenue (billion), by Country 2025 & 2033

- Figure 37: Korea Asian Mutual Funds Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Rest of Asia Pacific Asian Mutual Funds Market Revenue (billion), by Fund Type 2025 & 2033

- Figure 39: Rest of Asia Pacific Asian Mutual Funds Market Revenue Share (%), by Fund Type 2025 & 2033

- Figure 40: Rest of Asia Pacific Asian Mutual Funds Market Revenue (billion), by Geography 2025 & 2033

- Figure 41: Rest of Asia Pacific Asian Mutual Funds Market Revenue Share (%), by Geography 2025 & 2033

- Figure 42: Rest of Asia Pacific Asian Mutual Funds Market Revenue (billion), by Country 2025 & 2033

- Figure 43: Rest of Asia Pacific Asian Mutual Funds Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Asian Mutual Funds Market Revenue billion Forecast, by Fund Type 2020 & 2033

- Table 2: Global Asian Mutual Funds Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 3: Global Asian Mutual Funds Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Asian Mutual Funds Market Revenue billion Forecast, by Fund Type 2020 & 2033

- Table 5: Global Asian Mutual Funds Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: Global Asian Mutual Funds Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Asian Mutual Funds Market Revenue billion Forecast, by Fund Type 2020 & 2033

- Table 8: Global Asian Mutual Funds Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 9: Global Asian Mutual Funds Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Asian Mutual Funds Market Revenue billion Forecast, by Fund Type 2020 & 2033

- Table 11: Global Asian Mutual Funds Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Global Asian Mutual Funds Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Asian Mutual Funds Market Revenue billion Forecast, by Fund Type 2020 & 2033

- Table 14: Global Asian Mutual Funds Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: Global Asian Mutual Funds Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Asian Mutual Funds Market Revenue billion Forecast, by Fund Type 2020 & 2033

- Table 17: Global Asian Mutual Funds Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 18: Global Asian Mutual Funds Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Global Asian Mutual Funds Market Revenue billion Forecast, by Fund Type 2020 & 2033

- Table 20: Global Asian Mutual Funds Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 21: Global Asian Mutual Funds Market Revenue billion Forecast, by Country 2020 & 2033

- Table 22: Global Asian Mutual Funds Market Revenue billion Forecast, by Fund Type 2020 & 2033

- Table 23: Global Asian Mutual Funds Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 24: Global Asian Mutual Funds Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asian Mutual Funds Market?

The projected CAGR is approximately 12.1%.

2. Which companies are prominent players in the Asian Mutual Funds Market?

Key companies in the market include E fund Management, Bosera Asset management, HDFC Mutual Fund, ICICI Prudential Mutual Fund, T Rowe Price, BlackRock, Goldman Sachs, Matthews Asia Funds, Fidelity Investments, Invesco**List Not Exhaustive.

3. What are the main segments of the Asian Mutual Funds Market?

The market segments include Fund Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 614 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Rising inflation will create opportunities.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In 2022, HDFC Mutual Fund has filed a scheme information document (SID) with SEBI to come up with India's first Defence Fund. Called the HDFC Defence Fund, it will be an open-ended equity scheme that will be investing in defence & allied sector companies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asian Mutual Funds Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asian Mutual Funds Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asian Mutual Funds Market?

To stay informed about further developments, trends, and reports in the Asian Mutual Funds Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence