Key Insights

The North American athletic footwear market is poised for substantial growth, driven by heightened consumer health consciousness, increased engagement in fitness activities, and the prevailing trend of athletic-inspired fashion. Projections indicate sustained expansion within this key segment of the global sporting goods industry. The market is forecast to grow at a Compound Annual Growth Rate (CAGR) of 4.18%, reaching a market size of 121.34 billion by 2025 (base year: 2025). Key growth drivers include the robust performance of running shoes and the expanding online retail channel. Market segmentation is observed across product types (running, sport, trekking/hiking, others), end-users (men, women, children), and distribution channels (supermarkets/hypermarkets, online retail, others).

Athletic Footwear Market in North America Market Size (In Billion)

Leading athletic footwear brands, including Nike, Adidas, Under Armour, and New Balance, actively compete, fostering innovation and implementing aggressive marketing strategies. While supply chain complexities and economic volatility present potential challenges, the long-term market outlook remains positive. This optimism is supported by ongoing advancements in footwear design and material technology, which enhance performance and comfort. The growing consumer preference for premium, technologically advanced footwear is a significant factor, supporting higher price points and contributing to market value.

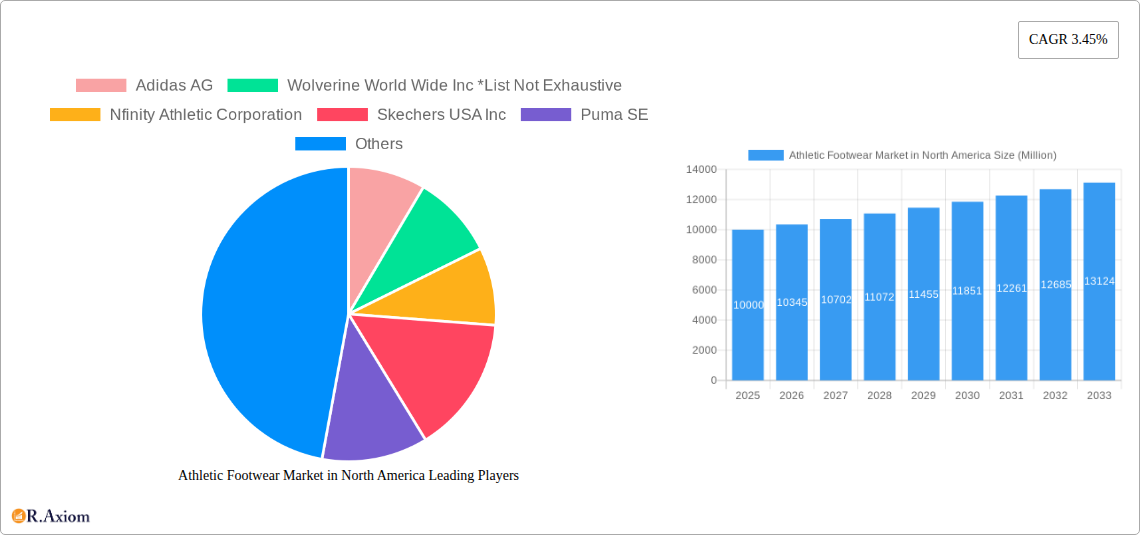

Athletic Footwear Market in North America Company Market Share

The established presence of major brands creates a considerable barrier to entry for new participants. However, the rise of niche brands targeting specific sports or consumer demographics offers distinct growth avenues. The increasing reliance on e-commerce platforms and the demand for personalized shopping experiences are transforming the distribution landscape. Future market expansion will be contingent upon sustained economic prosperity, evolving consumer preferences, and continuous product innovation. The well-developed infrastructure and high disposable incomes in the North American region provide a strong foundation for continued growth in the athletic footwear sector. Strategic alliances, influencer collaborations, and targeted marketing campaigns are crucial for success in this intensely competitive yet profitable market. Additionally, growing environmental awareness is influencing consumer purchasing decisions, underscoring the importance of developing sustainable materials and manufacturing processes.

Athletic Footwear Market in North America: A Comprehensive Market Analysis (2019-2033)

This comprehensive report provides an in-depth analysis of the North American athletic footwear market, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. The study covers the period from 2019 to 2033, with a focus on the estimated year 2025. It segments the market by product type, end-user, and distribution channel, offering detailed analysis of market size, growth drivers, challenges, and future opportunities. The report also profiles key players in the market, including Adidas AG, Wolverine World Wide Inc, Nfinity Athletic Corporation, Skechers USA Inc, Puma SE, Avia, Under Armour Inc, Nike Inc, New Balance Athletics Inc, and ASICS Corporation.

Athletic Footwear Market in North America Market Concentration & Innovation

The North American athletic footwear market is characterized by a high degree of concentration, with a few dominant players holding significant market share. Nike Inc and Adidas AG, for instance, collectively account for a substantial portion (xx%) of the total market revenue in 2025. This concentration is driven by strong brand recognition, extensive distribution networks, and significant investments in research and development. However, smaller players and niche brands continue to innovate, focusing on sustainable materials, technological advancements, and specialized product offerings to carve out market share.

- Market Share: Nike Inc (xx%), Adidas AG (xx%), Others (xx%) (Estimated for 2025)

- Innovation Drivers: Technological advancements in materials science (e.g., sustainable materials, enhanced cushioning), personalized fit technologies, and data-driven product development.

- Regulatory Frameworks: Regulations related to product safety, labeling, and environmental compliance influence market dynamics.

- Product Substitutes: Casual footwear and other forms of athletic apparel compete for consumer spending.

- End-User Trends: Increasing health consciousness, participation in fitness activities, and rising disposable incomes drive market growth across various end-user segments.

- M&A Activities: The market has witnessed several mergers and acquisitions in recent years, with deal values totaling approximately xx Million USD in the historical period (2019-2024). These activities aim to expand market reach, enhance product portfolios, and gain access to new technologies.

Athletic Footwear Market in North America Industry Trends & Insights

The North American athletic footwear market exhibits strong growth potential, driven by several key trends. The market experienced a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024) and is projected to grow at a CAGR of xx% during the forecast period (2025-2033). Technological disruptions, such as the integration of smart technologies and personalized fitness tracking features in footwear, are reshaping the landscape. Consumer preferences are shifting towards sustainable and ethically produced athletic shoes, driving innovation in materials and manufacturing processes. Competitive dynamics are intensified by ongoing product launches, brand endorsements, and marketing campaigns. Market penetration of e-commerce channels is significantly increasing, changing the retail landscape and influencing consumer behavior.

Dominant Markets & Segments in Athletic Footwear Market in North America

The US dominates the North American athletic footwear market, driven by its large population, high disposable incomes, and established sporting culture. Within the product type segment, running shoes and sport shoes constitute the largest revenue shares.

By Product Type: Running shoes lead the market due to high participation in running and fitness activities; Sport shoes represent a substantial segment, benefiting from participation in various sports and leisure activities. The trekking/hiking shoes segment experiences steady growth, driven by the popularity of outdoor activities.

By End-user: The men's segment holds the largest market share, reflecting higher participation in sports and fitness activities. The women’s segment is experiencing rapid growth, driven by increased female participation in sports and fitness. The children's segment shows robust growth, influenced by growing awareness of the importance of physical activity among children.

By Distribution Channel: Online retail stores are gaining prominence due to convenience and accessibility, though supermarkets and hypermarkets still maintain significant market share, particularly for mainstream brands.

Key Drivers: Strong economic conditions, well-developed sporting infrastructure, and a culture that embraces fitness and athletic activities contribute to the market's dominance.

Athletic Footwear Market in North America Product Developments

Recent years have witnessed significant product innovations in the North American athletic footwear market. Key trends include the integration of advanced cushioning technologies for enhanced comfort and performance, the use of sustainable and recycled materials to address environmental concerns, and the incorporation of smart technologies to track fitness metrics and provide personalized feedback. These innovations cater to evolving consumer preferences and demands, driving competition and market growth.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the North American athletic footwear market, segmented by product type (running shoes, sport shoes, trekking/hiking shoes, other product types), end-user (men, women, children), and distribution channel (supermarkets/hypermarkets, online retail stores, other distribution channels). Each segment is analyzed based on market size, growth projections, competitive dynamics, and key trends. For instance, the online retail segment is projected to experience significant growth driven by increased e-commerce adoption.

Key Drivers of Athletic Footwear Market in North America Growth

The North American athletic footwear market's growth is fueled by several factors, including rising health awareness, increasing participation in fitness and sports, technological advancements in shoe design and materials, and the growing influence of e-commerce channels. Favorable economic conditions and government initiatives promoting healthy lifestyles further contribute to the market's expansion.

Challenges in the Athletic Footwear Market in North America Sector

The North American athletic footwear market faces challenges such as intense competition, increasing raw material costs, supply chain disruptions, and evolving consumer preferences. The market also experiences fluctuations depending on economic conditions and seasonal trends.

Emerging Opportunities in Athletic Footwear Market in North America

Emerging opportunities include the increasing demand for sustainable and ethically sourced athletic footwear, the growing integration of smart technologies into footwear, and the expansion into niche market segments, such as specialized sports footwear or performance-enhancing footwear.

Leading Players in the Athletic Footwear Market in North America Market

- Adidas AG

- Wolverine World Wide Inc

- Nfinity Athletic Corporation

- Skechers USA Inc

- Puma SE

- Avia

- Under Armour Inc

- Nike Inc

- New Balance Athletics Inc

- ASICS Corporation

Key Developments in Athletic Footwear Market in North America Industry

- April 2021: Reebok launched a vegan and sustainable version of its Nano X1 training shoes.

- March 2022: Lululemon launched the Blisfeel running shoes for women.

- September 2022: Under Armour launched UA HOVR Phantom 3 running shoes.

Strategic Outlook for Athletic Footwear Market in North America Market

The North American athletic footwear market exhibits strong growth potential, driven by several factors. Continued innovation in product design and materials, the rising adoption of e-commerce, and the increasing health consciousness among consumers will contribute to market expansion. Opportunities exist for brands to capitalize on emerging trends, such as sustainable materials and smart footwear technology, to gain competitive advantage and drive market share.

Athletic Footwear Market in North America Segmentation

-

1. Product Type

- 1.1. Running Shoes

- 1.2. Sport Shoes

- 1.3. Trekking/Hiking Shoes

- 1.4. Other Product Types

-

2. End user

- 2.1. Men

- 2.2. Women

- 2.3. Children

-

3. Distribution Channel

- 3.1. Supermarkets/Hypermarkets

- 3.2. Online Retail Stores

- 3.3. Others Distribution Channel

-

4. Geography

- 4.1. United States

- 4.2. Canada

- 4.3. Mexico

- 4.4. Rest of North America

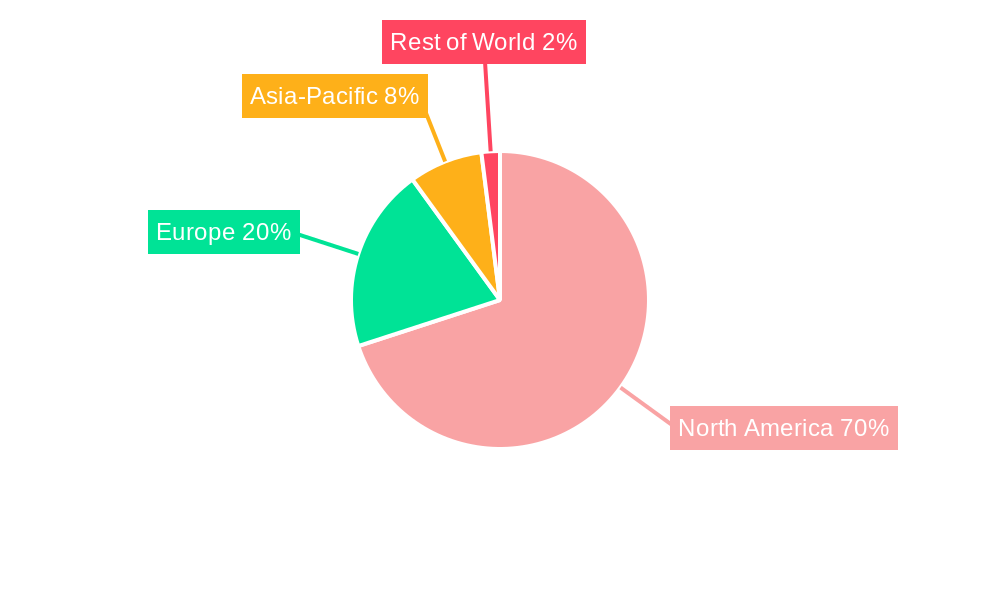

Athletic Footwear Market in North America Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

Athletic Footwear Market in North America Regional Market Share

Geographic Coverage of Athletic Footwear Market in North America

Athletic Footwear Market in North America REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.18% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Sports Participation and Flourishing Demand for Sports Apparel; Rising Innovation in Athleisure Products

- 3.3. Market Restrains

- 3.3.1. Penetration of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Growing Fitness Conscious Consumers

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Athletic Footwear Market in North America Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Running Shoes

- 5.1.2. Sport Shoes

- 5.1.3. Trekking/Hiking Shoes

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End user

- 5.2.1. Men

- 5.2.2. Women

- 5.2.3. Children

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets/Hypermarkets

- 5.3.2. Online Retail Stores

- 5.3.3. Others Distribution Channel

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.5.2. Canada

- 5.5.3. Mexico

- 5.5.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United States Athletic Footwear Market in North America Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Running Shoes

- 6.1.2. Sport Shoes

- 6.1.3. Trekking/Hiking Shoes

- 6.1.4. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by End user

- 6.2.1. Men

- 6.2.2. Women

- 6.2.3. Children

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Supermarkets/Hypermarkets

- 6.3.2. Online Retail Stores

- 6.3.3. Others Distribution Channel

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. United States

- 6.4.2. Canada

- 6.4.3. Mexico

- 6.4.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Canada Athletic Footwear Market in North America Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Running Shoes

- 7.1.2. Sport Shoes

- 7.1.3. Trekking/Hiking Shoes

- 7.1.4. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by End user

- 7.2.1. Men

- 7.2.2. Women

- 7.2.3. Children

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Supermarkets/Hypermarkets

- 7.3.2. Online Retail Stores

- 7.3.3. Others Distribution Channel

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. United States

- 7.4.2. Canada

- 7.4.3. Mexico

- 7.4.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Mexico Athletic Footwear Market in North America Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Running Shoes

- 8.1.2. Sport Shoes

- 8.1.3. Trekking/Hiking Shoes

- 8.1.4. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by End user

- 8.2.1. Men

- 8.2.2. Women

- 8.2.3. Children

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Supermarkets/Hypermarkets

- 8.3.2. Online Retail Stores

- 8.3.3. Others Distribution Channel

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. United States

- 8.4.2. Canada

- 8.4.3. Mexico

- 8.4.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of North America Athletic Footwear Market in North America Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Running Shoes

- 9.1.2. Sport Shoes

- 9.1.3. Trekking/Hiking Shoes

- 9.1.4. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by End user

- 9.2.1. Men

- 9.2.2. Women

- 9.2.3. Children

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Supermarkets/Hypermarkets

- 9.3.2. Online Retail Stores

- 9.3.3. Others Distribution Channel

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. United States

- 9.4.2. Canada

- 9.4.3. Mexico

- 9.4.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Adidas AG

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Wolverine World Wide Inc *List Not Exhaustive

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Nfinity Athletic Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Skechers USA Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Puma SE

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Avia

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Under Armour Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Nike Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 New Balance Athletics Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 ASICS Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Adidas AG

List of Figures

- Figure 1: Athletic Footwear Market in North America Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Athletic Footwear Market in North America Share (%) by Company 2025

List of Tables

- Table 1: Athletic Footwear Market in North America Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Athletic Footwear Market in North America Volume K Units Forecast, by Product Type 2020 & 2033

- Table 3: Athletic Footwear Market in North America Revenue billion Forecast, by End user 2020 & 2033

- Table 4: Athletic Footwear Market in North America Volume K Units Forecast, by End user 2020 & 2033

- Table 5: Athletic Footwear Market in North America Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Athletic Footwear Market in North America Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 7: Athletic Footwear Market in North America Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Athletic Footwear Market in North America Volume K Units Forecast, by Geography 2020 & 2033

- Table 9: Athletic Footwear Market in North America Revenue billion Forecast, by Region 2020 & 2033

- Table 10: Athletic Footwear Market in North America Volume K Units Forecast, by Region 2020 & 2033

- Table 11: Athletic Footwear Market in North America Revenue billion Forecast, by Product Type 2020 & 2033

- Table 12: Athletic Footwear Market in North America Volume K Units Forecast, by Product Type 2020 & 2033

- Table 13: Athletic Footwear Market in North America Revenue billion Forecast, by End user 2020 & 2033

- Table 14: Athletic Footwear Market in North America Volume K Units Forecast, by End user 2020 & 2033

- Table 15: Athletic Footwear Market in North America Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 16: Athletic Footwear Market in North America Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 17: Athletic Footwear Market in North America Revenue billion Forecast, by Geography 2020 & 2033

- Table 18: Athletic Footwear Market in North America Volume K Units Forecast, by Geography 2020 & 2033

- Table 19: Athletic Footwear Market in North America Revenue billion Forecast, by Country 2020 & 2033

- Table 20: Athletic Footwear Market in North America Volume K Units Forecast, by Country 2020 & 2033

- Table 21: Athletic Footwear Market in North America Revenue billion Forecast, by Product Type 2020 & 2033

- Table 22: Athletic Footwear Market in North America Volume K Units Forecast, by Product Type 2020 & 2033

- Table 23: Athletic Footwear Market in North America Revenue billion Forecast, by End user 2020 & 2033

- Table 24: Athletic Footwear Market in North America Volume K Units Forecast, by End user 2020 & 2033

- Table 25: Athletic Footwear Market in North America Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 26: Athletic Footwear Market in North America Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 27: Athletic Footwear Market in North America Revenue billion Forecast, by Geography 2020 & 2033

- Table 28: Athletic Footwear Market in North America Volume K Units Forecast, by Geography 2020 & 2033

- Table 29: Athletic Footwear Market in North America Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Athletic Footwear Market in North America Volume K Units Forecast, by Country 2020 & 2033

- Table 31: Athletic Footwear Market in North America Revenue billion Forecast, by Product Type 2020 & 2033

- Table 32: Athletic Footwear Market in North America Volume K Units Forecast, by Product Type 2020 & 2033

- Table 33: Athletic Footwear Market in North America Revenue billion Forecast, by End user 2020 & 2033

- Table 34: Athletic Footwear Market in North America Volume K Units Forecast, by End user 2020 & 2033

- Table 35: Athletic Footwear Market in North America Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 36: Athletic Footwear Market in North America Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 37: Athletic Footwear Market in North America Revenue billion Forecast, by Geography 2020 & 2033

- Table 38: Athletic Footwear Market in North America Volume K Units Forecast, by Geography 2020 & 2033

- Table 39: Athletic Footwear Market in North America Revenue billion Forecast, by Country 2020 & 2033

- Table 40: Athletic Footwear Market in North America Volume K Units Forecast, by Country 2020 & 2033

- Table 41: Athletic Footwear Market in North America Revenue billion Forecast, by Product Type 2020 & 2033

- Table 42: Athletic Footwear Market in North America Volume K Units Forecast, by Product Type 2020 & 2033

- Table 43: Athletic Footwear Market in North America Revenue billion Forecast, by End user 2020 & 2033

- Table 44: Athletic Footwear Market in North America Volume K Units Forecast, by End user 2020 & 2033

- Table 45: Athletic Footwear Market in North America Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 46: Athletic Footwear Market in North America Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 47: Athletic Footwear Market in North America Revenue billion Forecast, by Geography 2020 & 2033

- Table 48: Athletic Footwear Market in North America Volume K Units Forecast, by Geography 2020 & 2033

- Table 49: Athletic Footwear Market in North America Revenue billion Forecast, by Country 2020 & 2033

- Table 50: Athletic Footwear Market in North America Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Athletic Footwear Market in North America?

The projected CAGR is approximately 4.18%.

2. Which companies are prominent players in the Athletic Footwear Market in North America?

Key companies in the market include Adidas AG, Wolverine World Wide Inc *List Not Exhaustive, Nfinity Athletic Corporation, Skechers USA Inc, Puma SE, Avia, Under Armour Inc, Nike Inc, New Balance Athletics Inc, ASICS Corporation.

3. What are the main segments of the Athletic Footwear Market in North America?

The market segments include Product Type, End user, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 121.34 billion as of 2022.

5. What are some drivers contributing to market growth?

Increased Sports Participation and Flourishing Demand for Sports Apparel; Rising Innovation in Athleisure Products.

6. What are the notable trends driving market growth?

Growing Fitness Conscious Consumers.

7. Are there any restraints impacting market growth?

Penetration of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

In March 2022, Lululemon launched the first ever running shoes for women called Blisfeel across North America, Mainland China, and the United Kingdom. The running shoes will retail for USD 148.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Athletic Footwear Market in North America," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Athletic Footwear Market in North America report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Athletic Footwear Market in North America?

To stay informed about further developments, trends, and reports in the Athletic Footwear Market in North America, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence