Key Insights

The North American handbags market is forecast to reach $14.91 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 9.4%. This expansion is propelled by rising disposable incomes, particularly among young professionals and millennials, driving demand for luxury and designer accessories. The growth of e-commerce further enhances market accessibility, offering a broader selection of styles and brands. Evolving fashion trends, characterized by the cyclical return of classic designs and the introduction of new aesthetics, contribute to market vitality. The market is segmented by distribution channels, including online and offline retail, and by product type, such as satchels, clutches, tote bags, and sling bags. While online channels offer significant growth opportunities due to their reach and convenience, physical stores remain crucial for their experiential value and brand prestige. Key industry players include established luxury houses like LVMH and Kering, as well as emerging brands like Michael Kors.

North America Handbags Market Market Size (In Billion)

Market challenges include the volatility of raw material costs, impacting profitability. Economic slowdowns and shifts in consumer spending can negatively affect demand, especially for premium products. The growing consumer preference for sustainable and ethically produced goods requires manufacturers to adapt their sourcing and production methods. Based on a projected CAGR of 9.4% from 2025 to 2033, the market's value is expected to rise substantially. Continued innovation in design, materials, and targeted marketing strategies will foster this growth. North America, comprising the United States, Canada, and Mexico, represents the largest market share, supported by robust consumer spending and a well-developed luxury retail infrastructure.

North America Handbags Market Company Market Share

North America Handbags Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the North America handbags market, covering the period from 2019 to 2033. It offers valuable insights into market size, segmentation, growth drivers, challenges, and key players, equipping stakeholders with actionable intelligence for strategic decision-making. The report utilizes data from the historical period (2019-2024), base year (2025), and estimated year (2025) to forecast market trends until 2033.

North America Handbags Market Concentration & Innovation

The North America handbags market exhibits a moderately concentrated landscape, dominated by established luxury brands and emerging players catering to diverse consumer preferences. Key players like LVMH Moet Hennessy Louis Vuitton, Kering SA, Tapestry Inc, Burberry Group Plc, and Hermes International S A hold significant market share, leveraging their brand recognition and extensive distribution networks. However, smaller brands and online retailers are gaining traction, particularly in niche segments. Market share data for 2024 suggests LVMH holds approximately xx% market share, followed by Kering SA at xx%, and Tapestry Inc at xx%. These figures are projections and could vary based on final data.

Innovation is a crucial driver in this market, fueled by technological advancements in materials, manufacturing processes, and design. The rise of e-commerce and social media marketing has significantly altered distribution channels and consumer engagement. Regulatory frameworks concerning materials sourcing, labor practices, and environmental sustainability are increasingly shaping market dynamics. Product substitutes, such as vegan leather alternatives, are gaining popularity, presenting both challenges and opportunities. Furthermore, ongoing mergers and acquisitions (M&A) activities among players are reshaping the competitive landscape, with deal values reaching an estimated xx Million in 2024. Examples include:

- Strategic acquisitions to expand product portfolios and geographic reach.

- Consolidation among smaller players to enhance competitiveness.

- Investments in technological innovation to improve manufacturing and marketing capabilities.

North America Handbags Market Industry Trends & Insights

The North America handbags market is experiencing robust growth, driven by several factors. Rising disposable incomes, particularly among millennials and Gen Z, fuel demand for high-quality and fashionable handbags. Technological advancements, such as the use of sustainable materials and personalized customization options, enhance product appeal and create new market opportunities. Consumer preferences are shifting towards eco-friendly and ethically produced handbags, increasing demand for vegan and recycled materials. Furthermore, the increasing popularity of online shopping channels, facilitated by enhanced e-commerce platforms and digital marketing strategies, significantly contributes to market expansion. The market is expected to achieve a CAGR of xx% during the forecast period (2025-2033), with market penetration expected to reach xx% by 2033. This growth is further fueled by the competitive dynamics, including new product launches, brand collaborations, and marketing campaigns that drive consumer engagement and preference.

Dominant Markets & Segments in North America Handbags Market

The United States is the dominant market within North America, accounting for the largest share of the total market value due to its larger population, high disposable income levels, and established retail infrastructure. Within the market segmentation, the following trends are observed:

By Distribution Channel:

- Online Stores: This segment is experiencing rapid growth due to the increasing adoption of e-commerce and online shopping convenience. Key drivers include ease of access, wider product selection, competitive pricing, and targeted advertising.

- Offline Stores: While facing pressure from online channels, this segment remains significant due to the tangible experience of physically examining products and the immediate gratification of purchase. However, the growth rate is slower compared to online stores, mainly affected by higher operating costs and limited geographical reach.

By Type:

- Tote Bags: The tote bag segment remains popular due to its practicality and versatility, catering to both casual and professional use.

- Satchel Bags: The satchel segment maintains a strong position among consumers who prefer structured, elegant bags.

- Clutch Bags: This segment targets customers who seek stylish and compact accessories for formal events.

- Sling Bags: This segment is seeing continued growth due to its practicality and casual style.

- Others: This encompasses niche handbag styles with their own unique appeal, contributing to overall market diversity.

North America Handbags Market Product Developments

The North America handbags market is witnessing continuous product innovation, focused on materials, design, and functionality. Technological advancements include the use of sustainable materials like recycled leather and innovative vegan alternatives. Smart handbag designs integrating technology features, such as tracking devices and wireless charging capabilities, are starting to gain traction. Brands are increasingly emphasizing personalization options, offering customizable designs and monogram services. These developments respond to changing consumer preferences, creating new value propositions and enhancing competitiveness.

Report Scope & Segmentation Analysis

This report segments the North America handbags market by distribution channel (Online Stores and Offline Stores) and by type (Satchel, Clutch, Tote Bag, Sling Bag, and Others). Each segment's growth projections, market sizes, and competitive dynamics are analyzed in detail. Market size projections for 2033 are estimated at xx Million for online stores and xx Million for offline stores across different handbag types, reflecting the anticipated growth rate and consumer behavior changes. Competitive dynamics within each segment are analyzed, including the presence of key players, their market share, and their strategies for growth and innovation.

Key Drivers of North America Handbags Market Growth

Several factors are driving the growth of the North America handbags market:

- Rising Disposable Incomes: Increased purchasing power among consumers, especially younger demographics, fuels demand for higher-priced handbags.

- Fashion Trends: The ever-evolving fashion landscape drives demand for new styles and designs, stimulating continuous product innovation.

- E-commerce Growth: The expansion of online retail channels provides increased access and convenience for consumers.

Challenges in the North America Handbags Market Sector

The North America handbags market faces challenges such as:

- Intense Competition: The market is characterized by numerous players, creating intense competition for market share.

- Supply Chain Disruptions: Global supply chain vulnerabilities impact production costs and product availability.

- Economic Fluctuations: Economic downturns can reduce consumer spending and affect market demand.

Emerging Opportunities in North America Handbags Market

Several opportunities exist in the North America handbags market:

- Sustainable and Ethical Products: Growing consumer preference for environmentally friendly and ethically sourced products presents a significant opportunity for brands.

- Personalization and Customization: Offering bespoke designs and monogram services enhances customer loyalty and boosts sales.

- Technological Integration: Integrating smart features into handbags could generate new revenue streams and attract tech-savvy consumers.

Leading Players in the North America Handbags Market Market

Key Developments in North America Handbags Market Industry

- March 2022: Aranyani, an Indian luxury handbag brand, expands into the United States, launching its products in New York. This signifies the growing interest in international luxury brands within the North American market.

- September 2021: Pixie Mood redesigns its website and launches its Fall/Winter '21 collection. This demonstrates the importance of online presence and continuous product innovation for brands.

- October 2020: Schutz, a Brazilian brand, launches its handbag line in the United States, introducing new collections featuring croc-embossed leathers and chains. This highlights the growing influence of international brands and the demand for unique designs.

Strategic Outlook for North America Handbags Market Market

The North America handbags market is poised for continued growth, driven by several factors. Increasing consumer spending, particularly among younger demographics, combined with a growing preference for high-quality, stylish, and sustainable products will fuel market expansion. The adoption of innovative technologies, such as smart materials and personalization options, will further enhance product appeal and create new market niches. Brands that successfully adapt to evolving consumer preferences, leverage digital marketing channels, and prioritize sustainability will be best positioned for long-term success in this dynamic market.

North America Handbags Market Segmentation

-

1. Type

- 1.1. Satchel

- 1.2. Clutch

- 1.3. Tote Bag

- 1.4. Sling Bag

- 1.5. Others

-

2. Distibution Channel

- 2.1. Online Stores

- 2.2. Offline Stores

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

- 3.4. Rest of North America

North America Handbags Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

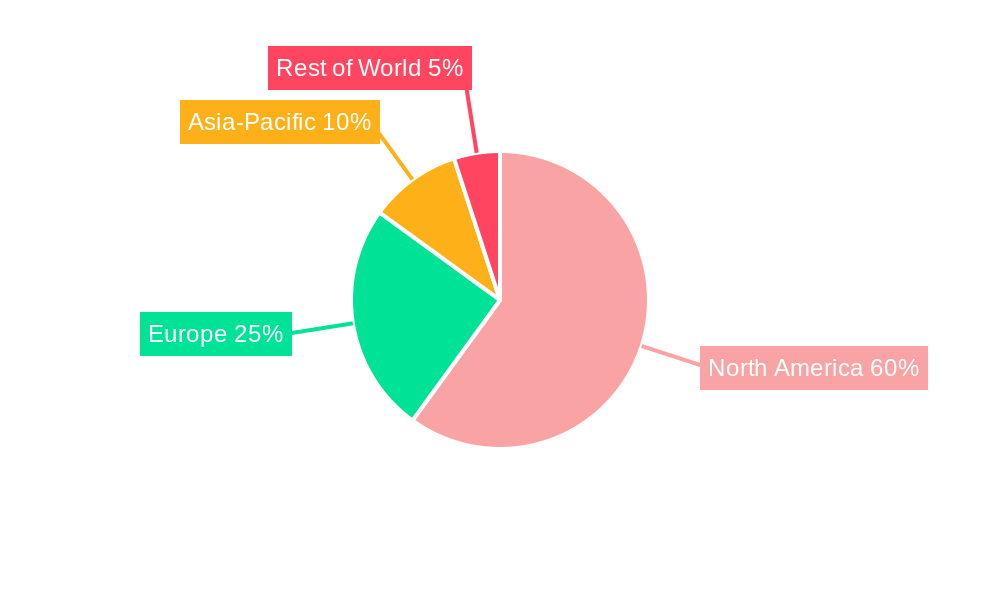

North America Handbags Market Regional Market Share

Geographic Coverage of North America Handbags Market

North America Handbags Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Popularity of Snus as Harmless Cigerette Substitute; Availability of Variety of Flavors

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations in Some Countries; Risks Associated with Over Consumption of Snus

- 3.4. Market Trends

- 3.4.1. Increase in Demand for Luxury Handbags

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Handbags Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Satchel

- 5.1.2. Clutch

- 5.1.3. Tote Bag

- 5.1.4. Sling Bag

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 5.2.1. Online Stores

- 5.2.2. Offline Stores

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Handbags Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Satchel

- 6.1.2. Clutch

- 6.1.3. Tote Bag

- 6.1.4. Sling Bag

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 6.2.1. Online Stores

- 6.2.2. Offline Stores

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Canada North America Handbags Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Satchel

- 7.1.2. Clutch

- 7.1.3. Tote Bag

- 7.1.4. Sling Bag

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 7.2.1. Online Stores

- 7.2.2. Offline Stores

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Mexico North America Handbags Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Satchel

- 8.1.2. Clutch

- 8.1.3. Tote Bag

- 8.1.4. Sling Bag

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 8.2.1. Online Stores

- 8.2.2. Offline Stores

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.3.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of North America North America Handbags Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Satchel

- 9.1.2. Clutch

- 9.1.3. Tote Bag

- 9.1.4. Sling Bag

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 9.2.1. Online Stores

- 9.2.2. Offline Stores

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United States

- 9.3.2. Canada

- 9.3.3. Mexico

- 9.3.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 LVMH Moet Hennessy Louis Vuitton

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Kering SA

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Tapestry Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Burberry Group Plc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Hermes International S A

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Tory Burch LLC*List Not Exhaustive

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Pixie Mood

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Michael Kors (USA) Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Fossil Group Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Prada Holding SpA

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 LVMH Moet Hennessy Louis Vuitton

List of Figures

- Figure 1: North America Handbags Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Handbags Market Share (%) by Company 2025

List of Tables

- Table 1: North America Handbags Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: North America Handbags Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 3: North America Handbags Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: North America Handbags Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: North America Handbags Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: North America Handbags Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 7: North America Handbags Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: North America Handbags Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: North America Handbags Market Revenue billion Forecast, by Type 2020 & 2033

- Table 10: North America Handbags Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 11: North America Handbags Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: North America Handbags Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: North America Handbags Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: North America Handbags Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 15: North America Handbags Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: North America Handbags Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: North America Handbags Market Revenue billion Forecast, by Type 2020 & 2033

- Table 18: North America Handbags Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 19: North America Handbags Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: North America Handbags Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Handbags Market?

The projected CAGR is approximately 9.4%.

2. Which companies are prominent players in the North America Handbags Market?

Key companies in the market include LVMH Moet Hennessy Louis Vuitton, Kering SA, Tapestry Inc, Burberry Group Plc, Hermes International S A, Tory Burch LLC*List Not Exhaustive, Pixie Mood, Michael Kors (USA) Inc, Fossil Group Inc, Prada Holding SpA.

3. What are the main segments of the North America Handbags Market?

The market segments include Type, Distibution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.91 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Popularity of Snus as Harmless Cigerette Substitute; Availability of Variety of Flavors.

6. What are the notable trends driving market growth?

Increase in Demand for Luxury Handbags.

7. Are there any restraints impacting market growth?

Stringent Government Regulations in Some Countries; Risks Associated with Over Consumption of Snus.

8. Can you provide examples of recent developments in the market?

In March 2022, Aranyani, an Indian luxury handbag brand expanded its presence in the United States and launched its products in New York at the Consulate General of India.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Handbags Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Handbags Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Handbags Market?

To stay informed about further developments, trends, and reports in the North America Handbags Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence