Key Insights

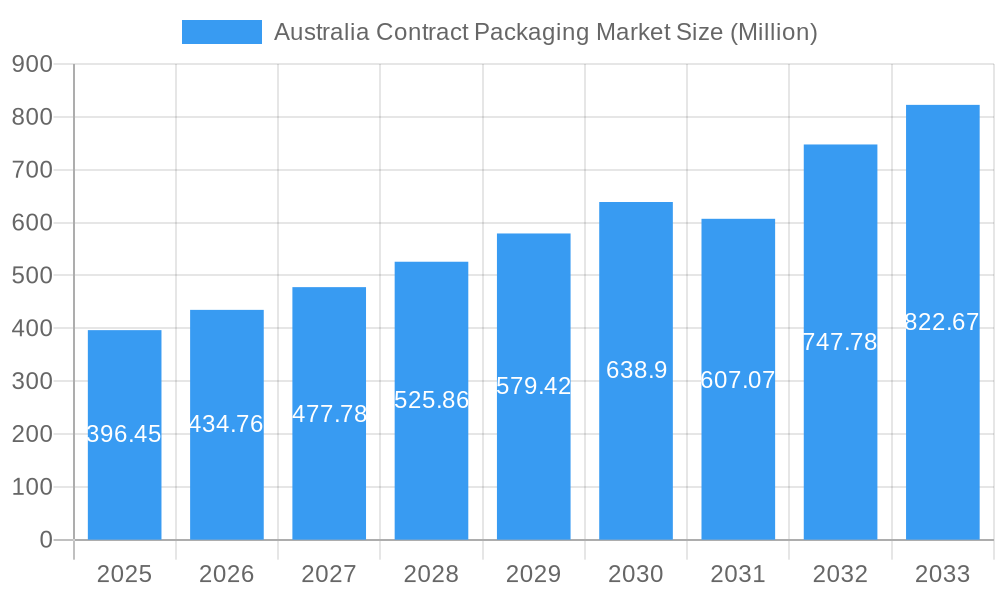

The Australian contract packaging market, valued at $396.45 million in 2025, is projected to experience robust growth, driven by the increasing demand for outsourced packaging solutions across various sectors. The burgeoning food and beverage industry, coupled with the expanding pharmaceutical and personal care markets in Australia, fuels this expansion. Companies are increasingly outsourcing packaging to specialize in core competencies and reduce operational costs. This trend is amplified by the rising consumer preference for convenient and attractively packaged goods. Growth is further supported by technological advancements in packaging materials and automation, enabling efficient and cost-effective contract packaging services. While potential restraints may include fluctuations in raw material prices and labor costs, the overall market outlook remains positive, anticipating a Compound Annual Growth Rate (CAGR) of 9.76% from 2025 to 2033. The market is segmented by packaging type (primary, secondary, tertiary) and end-user industry (food, beverage, pharmaceutical, home care & personal care, and others). Key players, including FoodPak, Multipack-LJM, PakCo, and others, are actively shaping market dynamics through strategic investments and service diversification. The dominance of specific segments will likely shift over time based on consumer trends and industry innovations. The continued growth in e-commerce and its associated packaging needs will also contribute to market expansion.

Australia Contract Packaging Market Market Size (In Million)

The forecast period (2025-2033) indicates a significant expansion of the Australian contract packaging market. This growth will be influenced by factors such as the increasing adoption of sustainable packaging solutions, stricter regulations regarding packaging materials, and the ongoing development of innovative packaging technologies to enhance product shelf life and appeal. Competition among existing players will intensify as the market attracts new entrants. Strategic partnerships, mergers and acquisitions will likely be observed, and successful companies will leverage advanced technologies and agile operational strategies. The focus on quality control and efficient supply chain management will continue to be critical for success within this competitive landscape. The market's regional variations will be influenced by factors such as population density, consumer behavior, and regulatory compliance differences, with major urban centers acting as primary hubs for contract packaging activity.

Australia Contract Packaging Market Company Market Share

This comprehensive report provides an in-depth analysis of the Australia Contract Packaging Market, covering the period 2019-2033. It offers invaluable insights for industry stakeholders, including manufacturers, suppliers, distributors, and investors, seeking to understand market trends, competitive dynamics, and future growth opportunities. The report leverages extensive primary and secondary research to deliver actionable intelligence, focusing on market segmentation, key players, and emerging trends. With a base year of 2025 and a forecast period of 2025-2033, this report is an essential resource for informed decision-making.

Australia Contract Packaging Market Market Concentration & Innovation

The Australian contract packaging market exhibits a moderately fragmented landscape, with several established players and emerging businesses competing for market share. While precise market share data for individual companies remains proprietary, FoodPak, Multipack-LJM (Probiotec Limited), PakCo, and Outsource Packaging are recognized as significant players. The market concentration ratio (CR4) is estimated to be around xx%, indicating a competitive environment. Innovation is driven by the increasing demand for sustainable packaging solutions, automation, and advanced technologies in packaging processes. Regulatory frameworks, particularly those related to food safety and environmental regulations, significantly influence market practices. Product substitutes, such as in-house packaging solutions, pose a challenge, although the specialized expertise and economies of scale offered by contract packers often outweigh these alternatives. End-user trends towards customized packaging, shorter product lifecycles, and e-commerce growth further fuel market dynamism. Mergers and acquisitions (M&A) activity in the sector is moderate, with deal values estimated at around xx Million annually over the past five years, driven primarily by expansion strategies and technological integration.

- Key Market Drivers: Sustainability, Automation, E-commerce growth

- Challenges: Competition from in-house packaging, regulatory compliance

- M&A Activity: Moderate activity, estimated xx Million annually (2019-2024)

Australia Contract Packaging Market Industry Trends & Insights

The Australia Contract Packaging market is experiencing robust growth, with a projected Compound Annual Growth Rate (CAGR) of **6.2%** during the forecast period (2025-2033). This growth is propelled by several key factors. Firstly, there's a consistently rising demand for specialized and efficient outsourced packaging solutions across a diverse range of end-use industries, with the food, beverage, and pharmaceutical sectors leading the charge. The increasing adoption of flexible packaging formats, driven by consumer convenience and product protection needs, alongside a significant push towards sustainable and eco-friendly packaging materials, is further fueling market expansion. Furthermore, technological advancements, such as the integration of automation and robotics in packaging lines, are significantly enhancing operational efficiency and driving down costs, making contract packaging a more attractive and cost-effective option for businesses of all sizes. Consumer preferences for convenient, tamper-proof, and aesthetically pleasing packaging also play a crucial role in shaping market demand. The competitive landscape is dynamic, with larger, established companies strategically expanding their service offerings and geographical reach. Simultaneously, smaller businesses are carving out strong positions by focusing on niche segments or offering highly specialized services. Market penetration in the pharmaceutical sector is notably high, estimated at **75%**, while significant growth opportunities remain abundant in the food and beverage sector, with current market penetration at **68%**.

Dominant Markets & Segments in Australia Contract Packaging Market

The Australian contract packaging market exhibits significant growth potential across various segments and geographical locations. While precise regional dominance data is still emerging, major metropolitan areas, particularly **Sydney** and **Melbourne**, are expected to continue leading the market due to their established concentrations of manufacturing facilities, extensive distribution networks, and a higher volume of consumer activity.

By Type:

- Primary Packaging: This segment currently holds the largest market share. Its dominance is attributed to the persistent high demand for diverse and specialized primary packaging formats across virtually all end-use industries, crucial for direct product containment and consumer interaction.

- Secondary Packaging: The growth in this segment closely mirrors that of primary packaging. It is largely driven by the increasing demand for efficient product bundling, multipacks, and solutions that facilitate easier handling and transportation to retail points.

- Tertiary Packaging: This segment demonstrates a steady, moderate growth rate. Its expansion is primarily fueled by the ongoing need for optimized and cost-effective solutions for bulk transportation, warehousing, and the logistical management of finished goods in large quantities.

By End-user Type:

- Food & Beverage: This segment remains a cornerstone and a key driver of overall market growth. The relentless demand for convenient, safe, and well-presented packaged food and beverages, coupled with a robust food processing industry and consistent consumer purchasing power, underpins this segment's strength.

- Pharmaceutical: This segment is experiencing high growth, largely dictated by stringent regulatory compliance requirements and the paramount need for sophisticated packaging solutions that ensure product integrity, patient safety, and extended shelf life. Government initiatives in healthcare and the expanding pharmaceutical industry are significant catalysts.

- Home Care & Personal Care: This segment continues to exhibit steady growth, fueled by the enduring popularity of a wide array of packaged home care and personal care products, evolving consumer lifestyles, and ongoing product innovation.

- Other End Users: This broad segment encompasses various other industries, such as industrial goods, electronics, and cosmetics, collectively demonstrating moderate but consistent growth as contract packaging becomes a strategic choice for a wider array of product types.

Australia Contract Packaging Market Product Developments

Recent product innovations in the Australian contract packaging market include advancements in sustainable packaging materials (e.g., biodegradable plastics, recycled content), automation technologies (e.g., robotic palletizers, automated labeling systems), and specialized packaging solutions tailored to specific product requirements (e.g., temperature-sensitive packaging for pharmaceuticals). These innovations enhance efficiency, reduce waste, and improve product protection, providing competitive advantages to contract packaging companies. The market favors technologically advanced and eco-friendly solutions that meet the diverse needs of various end-users.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the Australian contract packaging market segmented by type (primary, secondary, tertiary) and end-user (food, beverage, pharmaceutical, home care & personal care, other). Growth projections for each segment are provided, considering market size and competitive dynamics. For instance, the pharmaceutical segment exhibits a high growth projection due to stringent regulations and increasing demand for specialized packaging. The food and beverage segment demonstrates strong growth driven by consumer demand and increasing processed food consumption. The other end-user segment includes industries like cosmetics and chemicals, exhibiting moderate growth.

Key Drivers of Australia Contract Packaging Market Growth

Several key factors drive the growth of the Australia Contract Packaging Market: The increasing demand for outsourced packaging solutions reduces overhead costs for companies, enabling them to focus on core competencies. Furthermore, advancements in packaging technology, like automation and sustainable materials, enhance efficiency and reduce environmental impact. Government regulations promoting sustainable packaging also positively influence market expansion. Finally, the growth of e-commerce and changing consumer preferences (e.g., convenience and customization) are significant contributing factors.

Challenges in the Australia Contract Packaging Market Sector

The Australian contract packaging market is navigating several significant challenges that impact operational efficiency and profitability. Among these, **rising labor costs** present a continuous hurdle, directly influencing overall production expenses. Increasing competition from both established domestic players and emerging international providers intensifies market pressures. Fluctuating raw material prices, particularly for plastics, paper, and metals, introduce an element of unpredictability in cost management. Furthermore, **supply chain disruptions**, whether global or local, can significantly impact production schedules, leading to delays and affecting profit margins. The stringent and evolving regulatory landscape surrounding packaging materials, food safety, and product labeling mandates continuous adaptation and can substantially increase compliance costs for contract packers. For instance, the estimated impact of increased labor costs has led to a **12%** rise in overall production expenses in the last year alone, underscoring the need for strategic cost management and operational resilience.

Emerging Opportunities in Australia Contract Packaging Market

Emerging opportunities exist in sustainable packaging solutions, personalized packaging for customized products, and the expansion into niche markets requiring specialized packaging expertise. The growing demand for e-commerce fulfillment and last-mile delivery presents further opportunities for contract packers to offer integrated packaging and logistics services. Investing in advanced automation and digital technologies can improve efficiency and offer competitive advantages in this evolving market.

Leading Players in the Australia Contract Packaging Market Market

- FoodPak

- Multipack-LJM (Probiotec Limited)

- PakCo

- Outsource Packaging

- Chemical Solutions

- UltraPak (Australia) Pty Ltd

- Finishing Services Pty Ltd

- HH Packaging (Probiotec Limited)

- Probiotec Pharma (Probiotec Limited)

- Australian Blister Sealing Incorporated Pty Ltd (Probiotec Limited)

- Tripak Pharmaceuticals

- Rapid Pak

- Star Pharma Services

- Glenwood Packaging

- Ozpack Solutions

Key Developments in Australia Contract Packaging Market Industry

- August 2023: The Boxed Beverage Company partnered with Tetra Pak to launch sustainably packaged alkaline water, Waterbox, highlighting the growing market for eco-friendly packaging.

- January 2023: CEVA Logistics implemented Nulogy's cloud-based contract packaging software in Melbourne, showcasing the adoption of advanced technology for improved efficiency in the automotive spare parts sector.

Strategic Outlook for Australia Contract Packaging Market Market

The Australia Contract Packaging Market is strategically positioned for sustained and dynamic growth in the coming years. The increasing reliance on specialized and efficient outsourced packaging solutions across a broad spectrum of industries will continue to be a primary growth engine. A significant trend shaping market dynamics will be the escalating focus on **sustainability**, with greater demand for recyclable, biodegradable, and low-impact packaging materials. Simultaneously, the integration of **automation and advanced technological solutions**, including AI-driven quality control and smart packaging technologies, will be crucial for enhancing efficiency, reducing errors, and improving overall value delivery. Companies that proactively invest in innovation, embrace flexible and agile manufacturing processes, and forge strategic partnerships will be exceptionally well-positioned to capture a larger market share and achieve substantial growth. The market's inherent potential is considerable, with ongoing opportunities for strategic consolidation, vertical and horizontal expansion, and the dedicated development of highly specialized and value-added services tailored to evolving client needs.

Australia Contract Packaging Market Segmentation

-

1. Type

- 1.1. Primary

- 1.2. Secondary

- 1.3. Tertiary

-

2. End User

- 2.1. Food

- 2.2. Beverage

- 2.3. Pharmaceutical

- 2.4. Home Care and Personal Care

- 2.5. Other End Users

Australia Contract Packaging Market Segmentation By Geography

- 1. Australia

Australia Contract Packaging Market Regional Market Share

Geographic Coverage of Australia Contract Packaging Market

Australia Contract Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.76% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. FMCG Domain Remains a Key Driver for the Growth of Co-packing Services; Growing Emphasis on Outsourcing Non-core Operations By Product Manufacturers in Australia to Drive Demand

- 3.3. Market Restrains

- 3.3.1. ; Performance Issues with Bio-based Materials; High Cost of Bio-packaging Materials

- 3.4. Market Trends

- 3.4.1. FMCG Domain Remains a Key Driver for Growth of Co-Packing Services

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Contract Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Primary

- 5.1.2. Secondary

- 5.1.3. Tertiary

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Food

- 5.2.2. Beverage

- 5.2.3. Pharmaceutical

- 5.2.4. Home Care and Personal Care

- 5.2.5. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 FoodPak

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Multipack-LJM (Probiotec Limited)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 PakCo

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Outsource Packaging

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Chemical Solutions

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 UltraPak (Australia) Pty Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Finishing Services Pty Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 HH Packaging (Probiotec Limited)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Probiotec Pharma (Probiotec Limited)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Australian Blister Sealing Incorporated Pty Ltd (Probiotec Limited)*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Tripak Pharmaceuticals

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Rapid Pak

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 FoodPak

List of Figures

- Figure 1: Australia Contract Packaging Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Australia Contract Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Australia Contract Packaging Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Australia Contract Packaging Market Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Australia Contract Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Australia Contract Packaging Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Australia Contract Packaging Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Australia Contract Packaging Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Contract Packaging Market?

The projected CAGR is approximately 9.76%.

2. Which companies are prominent players in the Australia Contract Packaging Market?

Key companies in the market include FoodPak, Multipack-LJM (Probiotec Limited), PakCo, Outsource Packaging, Chemical Solutions, UltraPak (Australia) Pty Ltd, Finishing Services Pty Ltd, HH Packaging (Probiotec Limited), Probiotec Pharma (Probiotec Limited), Australian Blister Sealing Incorporated Pty Ltd (Probiotec Limited)*List Not Exhaustive, Tripak Pharmaceuticals, Rapid Pak.

3. What are the main segments of the Australia Contract Packaging Market?

The market segments include Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 396.45 Million as of 2022.

5. What are some drivers contributing to market growth?

FMCG Domain Remains a Key Driver for the Growth of Co-packing Services; Growing Emphasis on Outsourcing Non-core Operations By Product Manufacturers in Australia to Drive Demand.

6. What are the notable trends driving market growth?

FMCG Domain Remains a Key Driver for Growth of Co-Packing Services.

7. Are there any restraints impacting market growth?

; Performance Issues with Bio-based Materials; High Cost of Bio-packaging Materials.

8. Can you provide examples of recent developments in the market?

August 2023 - The Australian Start-up company, the Boxed Beverage Company, came into collaboration with the key packaging company Tetra-Pack to launch sustainably packaged alkaline water, Waterbox.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Contract Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Contract Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Contract Packaging Market?

To stay informed about further developments, trends, and reports in the Australia Contract Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence