Key Insights

The Automatic Mounter Wafer Equipment market is poised for significant expansion, projected to reach $130 million by 2033, driven by a compelling compound annual growth rate (CAGR) of 5.44% from 2025 to 2033. This growth is fueled by escalating demand for advanced semiconductor devices across smartphones, automotive electronics, and high-performance computing. Consequently, the need for efficient and precise wafer handling solutions is increasing, promoting the adoption of automatic mounter wafer equipment to enhance productivity and reduce operational costs in semiconductor manufacturing. Advances in wafer sizes, particularly the growing prevalence of 300mm wafers, further contribute to market expansion, with the 300mm wafer equipment segment expected to lead due to its compatibility with leading-edge fabrication processes. Key industry players are investing in R&D to improve equipment precision, speed, and automation, reinforcing market growth. While high initial investments and stringent regulatory compliance present challenges, the market outlook remains optimistic, with substantial opportunities anticipated, especially in the Asia-Pacific region due to its robust semiconductor manufacturing base. Intense competition among established players like Takatori Corporation, LINTEC Corporation, Longhill Industries Limited, Disco Corporation, and Nitto Denko Corporation fosters innovation and competitive pricing.

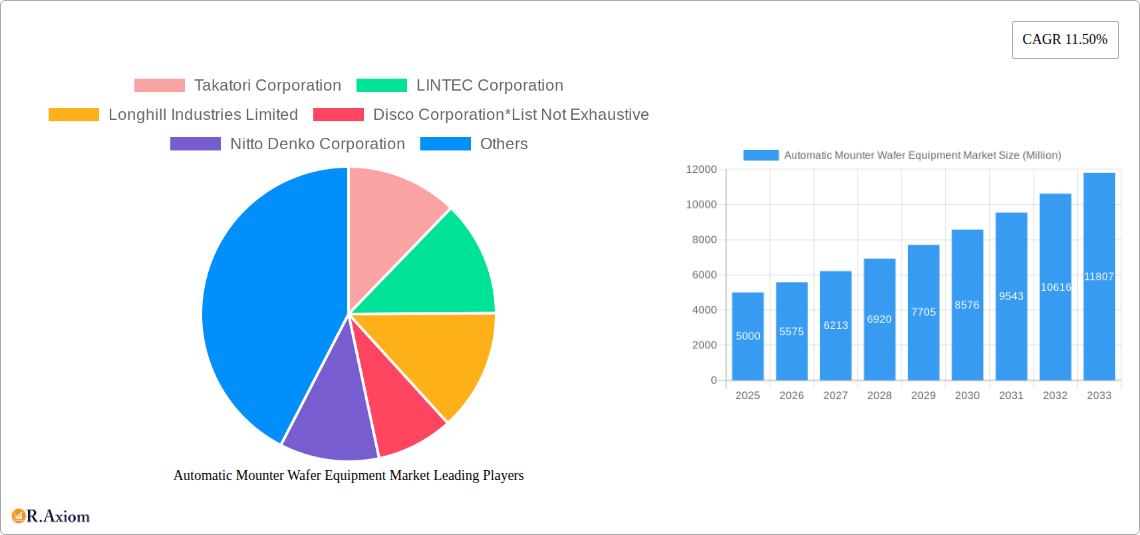

Automatic Mounter Wafer Equipment Market Market Size (In Million)

Market segmentation highlights significant contributions from foundries and the memory chip sector, illustrating the broad applicability of automatic mounter wafer equipment. The ongoing miniaturization of electronic components and the rising demand for higher-performance devices are expected to sustain this growth trajectory. While specific segment and regional figures are not detailed, industry trends suggest a substantial increase in market value within the forecast period. Technological advancements and the increasing need for automation in wafer fabrication indicate a promising future for the automatic mounter wafer equipment market. North America and Europe are expected to witness steady growth, supported by technological innovation and established semiconductor manufacturers. However, the Asia-Pacific region, encompassing countries like Taiwan, South Korea, and China, is projected to maintain its leading market share owing to the concentration of major semiconductor fabrication facilities.

Automatic Mounter Wafer Equipment Market Company Market Share

This report offers a comprehensive analysis of the Automatic Mounter Wafer Equipment market, providing critical insights for stakeholders, investors, and decision-makers. The study period spans 2019-2033, with 2025 serving as the base and estimated year. The forecast period is from 2025-2033, with the historical period covering 2019-2024.

Automatic Mounter Wafer Equipment Market Concentration & Innovation

The Automatic Mounter Wafer Equipment market exhibits a moderately concentrated landscape, with key players such as Takatori Corporation, LINTEC Corporation, Longhill Industries Limited, Disco Corporation, Nitto Denko Corporation, and others holding significant market share. However, the presence of several smaller, specialized players indicates a dynamic competitive environment. Market share analysis reveals that the top five players collectively account for approximately xx% of the global market in 2025, indicating room for expansion and potential disruption.

Innovation is a crucial driver in this market, fueled by the ongoing demand for higher precision, faster throughput, and improved automation in semiconductor manufacturing. Key innovations include the development of advanced vision systems, robotic handling mechanisms, and AI-driven process optimization. Regulatory frameworks, such as those related to environmental compliance and safety standards, significantly influence equipment design and manufacturing. Product substitutes, although limited, include manual mounting processes, which are becoming increasingly obsolete due to limitations in speed, precision, and cost-effectiveness. End-user trends show a growing preference for automated solutions that improve efficiency and reduce operational costs. M&A activities within the industry have been relatively moderate in recent years, with deal values averaging approximately xx Million annually. Future M&A activity is expected to increase as companies seek to expand their product portfolios and geographical reach.

Automatic Mounter Wafer Equipment Market Industry Trends & Insights

The Automatic Mounter Wafer Equipment market is projected to witness robust growth during the forecast period, driven by several key factors. The increasing demand for advanced semiconductor devices in various applications, including consumer electronics, automotive, and 5G infrastructure, is a primary growth driver. This demand translates into a significant need for high-throughput, high-precision wafer mounting equipment. Technological disruptions, such as the adoption of advanced materials and manufacturing processes (e.g., EUV lithography), are creating opportunities for manufacturers to develop next-generation mounting solutions. Consumer preferences are increasingly focused on smaller, faster, and more energy-efficient devices, which necessitate improved manufacturing efficiency. Competitive dynamics are characterized by intense innovation and a focus on differentiation through superior technology and service offerings. The Compound Annual Growth Rate (CAGR) for the market is estimated at xx% during the forecast period (2025-2033), with market penetration reaching approximately xx% by 2033.

Dominant Markets & Segments in Automatic Mounter Wafer Equipment Market

The Asia-Pacific region, particularly countries like China, South Korea, and Taiwan, dominates the Automatic Mounter Wafer Equipment market due to the high concentration of semiconductor manufacturing facilities and strong government support for the industry. Within this region, 300 mm wafer size holds the highest market share, driven by the widespread adoption of advanced semiconductor technologies.

- Key Drivers for Asia-Pacific Dominance:

- Strong government investment in semiconductor manufacturing infrastructure.

- High concentration of leading semiconductor foundries and manufacturers.

- Favorable economic policies promoting technological innovation.

- Abundant skilled labor in the region.

The Foundries segment within the end-user category accounts for the largest share of the market, reflecting the high demand for automated wafer mounting solutions in large-scale semiconductor manufacturing. The 300mm wafer segment dominates due to its prevalence in advanced chip manufacturing.

Automatic Mounter Wafer Equipment Market Product Developments

Recent product innovations in automatic mounter wafer equipment focus on improving precision, speed, and flexibility. Manufacturers are increasingly integrating advanced vision systems, robotic arms, and AI-driven algorithms to enhance mounting accuracy and throughput. These advancements are crucial for meeting the growing demands of high-volume, high-precision semiconductor manufacturing. The market fit for these innovations is excellent, driven by the need for higher efficiency and lower operational costs in the semiconductor industry.

Report Scope & Segmentation Analysis

This report segments the Automatic Mounter Wafer Equipment market by wafer size (300 mm, 200 mm, 150 mm) and end-user (Foundries, Inter-level Dielectric Material, Memory).

By Wafer Size: The 300 mm segment is projected to witness the highest growth, driven by the increasing adoption of advanced manufacturing processes. The 200 mm and 150 mm segments are expected to maintain stable growth, largely due to their continued usage in certain applications.

By End-User: The Foundries segment is expected to dominate the market, driven by the high volume of wafer processing in semiconductor fabrication plants. The Inter-level Dielectric Material and Memory segments are expected to show moderate growth. Competitive dynamics within each segment vary, with a mix of established players and emerging technology providers.

Key Drivers of Automatic Mounter Wafer Equipment Market Growth

Technological advancements in semiconductor manufacturing, coupled with the rising demand for high-performance electronics, are primary drivers of market growth. Economic factors, such as increased investments in research and development and favorable government policies, also contribute significantly. Stringent regulatory requirements concerning product safety and environmental standards further influence market dynamics.

Challenges in the Automatic Mounter Wafer Equipment Market Sector

The market faces challenges including high capital expenditure requirements for equipment acquisition, stringent regulatory compliance, and intense competition from established players and new entrants. Supply chain disruptions can significantly affect production timelines and costs. The complexity of the technology adds to challenges related to maintenance and repair.

Emerging Opportunities in Automatic Mounter Wafer Equipment Market

Emerging opportunities include the growing demand for advanced packaging technologies, the increasing adoption of automation in semiconductor manufacturing, and the expansion of the market into new geographic regions. The development of AI-powered solutions for process optimization presents a significant opportunity for growth.

Leading Players in the Automatic Mounter Wafer Equipment Market Market

- Takatori Corporation

- LINTEC Corporation

- Longhill Industries Limited

- Disco Corporation

- Nitto Denko Corporation

Key Developments in Automatic Mounter Wafer Equipment Market Industry

- 2022-Q4: Disco Corporation announced the launch of its new high-precision automatic wafer mounter, featuring AI-driven defect detection.

- 2023-Q1: Takatori Corporation and LINTEC Corporation formed a strategic partnership to jointly develop advanced wafer mounting solutions for the next generation of semiconductor manufacturing.

- 2024-Q3: Nitto Denko Corporation expanded its manufacturing capacity to address the growing demand for its wafer mounting equipment. (Further details on specific events would populate this section in the full report)

Strategic Outlook for Automatic Mounter Wafer Equipment Market Market

The Automatic Mounter Wafer Equipment market is poised for sustained growth, driven by ongoing technological advancements and the increasing demand for sophisticated electronics. Future opportunities lie in the development of innovative, high-throughput solutions tailored to the evolving needs of semiconductor manufacturers and the expanding applications of advanced semiconductor devices. The continued adoption of automation and artificial intelligence in semiconductor fabrication processes will shape the future trajectory of the market.

Automatic Mounter Wafer Equipment Market Segmentation

-

1. Wafer Size

- 1.1. 300 mm

- 1.2. 200 mm

- 1.3. 150 mm

-

2. End-User

- 2.1. Foundries

- 2.2. Inter-level Dielectric Material

- 2.3. Memory

Automatic Mounter Wafer Equipment Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Automatic Mounter Wafer Equipment Market Regional Market Share

Geographic Coverage of Automatic Mounter Wafer Equipment Market

Automatic Mounter Wafer Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.44% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Proliferation of IoT will be Significant Driver of the Market; Demand for Efficient Production of Defect-Free Chips

- 3.3. Market Restrains

- 3.3.1. ; Complexity of Technological Transitions will Act as a Restraint

- 3.4. Market Trends

- 3.4.1. Proliferation of IoT will be Significant Driver of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automatic Mounter Wafer Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Wafer Size

- 5.1.1. 300 mm

- 5.1.2. 200 mm

- 5.1.3. 150 mm

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Foundries

- 5.2.2. Inter-level Dielectric Material

- 5.2.3. Memory

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Wafer Size

- 6. North America Automatic Mounter Wafer Equipment Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Wafer Size

- 6.1.1. 300 mm

- 6.1.2. 200 mm

- 6.1.3. 150 mm

- 6.2. Market Analysis, Insights and Forecast - by End-User

- 6.2.1. Foundries

- 6.2.2. Inter-level Dielectric Material

- 6.2.3. Memory

- 6.1. Market Analysis, Insights and Forecast - by Wafer Size

- 7. Europe Automatic Mounter Wafer Equipment Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Wafer Size

- 7.1.1. 300 mm

- 7.1.2. 200 mm

- 7.1.3. 150 mm

- 7.2. Market Analysis, Insights and Forecast - by End-User

- 7.2.1. Foundries

- 7.2.2. Inter-level Dielectric Material

- 7.2.3. Memory

- 7.1. Market Analysis, Insights and Forecast - by Wafer Size

- 8. Asia Pacific Automatic Mounter Wafer Equipment Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Wafer Size

- 8.1.1. 300 mm

- 8.1.2. 200 mm

- 8.1.3. 150 mm

- 8.2. Market Analysis, Insights and Forecast - by End-User

- 8.2.1. Foundries

- 8.2.2. Inter-level Dielectric Material

- 8.2.3. Memory

- 8.1. Market Analysis, Insights and Forecast - by Wafer Size

- 9. Rest of the World Automatic Mounter Wafer Equipment Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Wafer Size

- 9.1.1. 300 mm

- 9.1.2. 200 mm

- 9.1.3. 150 mm

- 9.2. Market Analysis, Insights and Forecast - by End-User

- 9.2.1. Foundries

- 9.2.2. Inter-level Dielectric Material

- 9.2.3. Memory

- 9.1. Market Analysis, Insights and Forecast - by Wafer Size

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Takatori Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 LINTEC Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Longhill Industries Limited

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Disco Corporation*List Not Exhaustive

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Nitto Denko Corporation

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.1 Takatori Corporation

List of Figures

- Figure 1: Global Automatic Mounter Wafer Equipment Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Automatic Mounter Wafer Equipment Market Revenue (million), by Wafer Size 2025 & 2033

- Figure 3: North America Automatic Mounter Wafer Equipment Market Revenue Share (%), by Wafer Size 2025 & 2033

- Figure 4: North America Automatic Mounter Wafer Equipment Market Revenue (million), by End-User 2025 & 2033

- Figure 5: North America Automatic Mounter Wafer Equipment Market Revenue Share (%), by End-User 2025 & 2033

- Figure 6: North America Automatic Mounter Wafer Equipment Market Revenue (million), by Country 2025 & 2033

- Figure 7: North America Automatic Mounter Wafer Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Automatic Mounter Wafer Equipment Market Revenue (million), by Wafer Size 2025 & 2033

- Figure 9: Europe Automatic Mounter Wafer Equipment Market Revenue Share (%), by Wafer Size 2025 & 2033

- Figure 10: Europe Automatic Mounter Wafer Equipment Market Revenue (million), by End-User 2025 & 2033

- Figure 11: Europe Automatic Mounter Wafer Equipment Market Revenue Share (%), by End-User 2025 & 2033

- Figure 12: Europe Automatic Mounter Wafer Equipment Market Revenue (million), by Country 2025 & 2033

- Figure 13: Europe Automatic Mounter Wafer Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Automatic Mounter Wafer Equipment Market Revenue (million), by Wafer Size 2025 & 2033

- Figure 15: Asia Pacific Automatic Mounter Wafer Equipment Market Revenue Share (%), by Wafer Size 2025 & 2033

- Figure 16: Asia Pacific Automatic Mounter Wafer Equipment Market Revenue (million), by End-User 2025 & 2033

- Figure 17: Asia Pacific Automatic Mounter Wafer Equipment Market Revenue Share (%), by End-User 2025 & 2033

- Figure 18: Asia Pacific Automatic Mounter Wafer Equipment Market Revenue (million), by Country 2025 & 2033

- Figure 19: Asia Pacific Automatic Mounter Wafer Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Automatic Mounter Wafer Equipment Market Revenue (million), by Wafer Size 2025 & 2033

- Figure 21: Rest of the World Automatic Mounter Wafer Equipment Market Revenue Share (%), by Wafer Size 2025 & 2033

- Figure 22: Rest of the World Automatic Mounter Wafer Equipment Market Revenue (million), by End-User 2025 & 2033

- Figure 23: Rest of the World Automatic Mounter Wafer Equipment Market Revenue Share (%), by End-User 2025 & 2033

- Figure 24: Rest of the World Automatic Mounter Wafer Equipment Market Revenue (million), by Country 2025 & 2033

- Figure 25: Rest of the World Automatic Mounter Wafer Equipment Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automatic Mounter Wafer Equipment Market Revenue million Forecast, by Wafer Size 2020 & 2033

- Table 2: Global Automatic Mounter Wafer Equipment Market Revenue million Forecast, by End-User 2020 & 2033

- Table 3: Global Automatic Mounter Wafer Equipment Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Global Automatic Mounter Wafer Equipment Market Revenue million Forecast, by Wafer Size 2020 & 2033

- Table 5: Global Automatic Mounter Wafer Equipment Market Revenue million Forecast, by End-User 2020 & 2033

- Table 6: Global Automatic Mounter Wafer Equipment Market Revenue million Forecast, by Country 2020 & 2033

- Table 7: Global Automatic Mounter Wafer Equipment Market Revenue million Forecast, by Wafer Size 2020 & 2033

- Table 8: Global Automatic Mounter Wafer Equipment Market Revenue million Forecast, by End-User 2020 & 2033

- Table 9: Global Automatic Mounter Wafer Equipment Market Revenue million Forecast, by Country 2020 & 2033

- Table 10: Global Automatic Mounter Wafer Equipment Market Revenue million Forecast, by Wafer Size 2020 & 2033

- Table 11: Global Automatic Mounter Wafer Equipment Market Revenue million Forecast, by End-User 2020 & 2033

- Table 12: Global Automatic Mounter Wafer Equipment Market Revenue million Forecast, by Country 2020 & 2033

- Table 13: Global Automatic Mounter Wafer Equipment Market Revenue million Forecast, by Wafer Size 2020 & 2033

- Table 14: Global Automatic Mounter Wafer Equipment Market Revenue million Forecast, by End-User 2020 & 2033

- Table 15: Global Automatic Mounter Wafer Equipment Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automatic Mounter Wafer Equipment Market?

The projected CAGR is approximately 5.44%.

2. Which companies are prominent players in the Automatic Mounter Wafer Equipment Market?

Key companies in the market include Takatori Corporation, LINTEC Corporation, Longhill Industries Limited, Disco Corporation*List Not Exhaustive, Nitto Denko Corporation.

3. What are the main segments of the Automatic Mounter Wafer Equipment Market?

The market segments include Wafer Size, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 130 million as of 2022.

5. What are some drivers contributing to market growth?

; Proliferation of IoT will be Significant Driver of the Market; Demand for Efficient Production of Defect-Free Chips.

6. What are the notable trends driving market growth?

Proliferation of IoT will be Significant Driver of the Market.

7. Are there any restraints impacting market growth?

; Complexity of Technological Transitions will Act as a Restraint.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automatic Mounter Wafer Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automatic Mounter Wafer Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automatic Mounter Wafer Equipment Market?

To stay informed about further developments, trends, and reports in the Automatic Mounter Wafer Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence