Key Insights

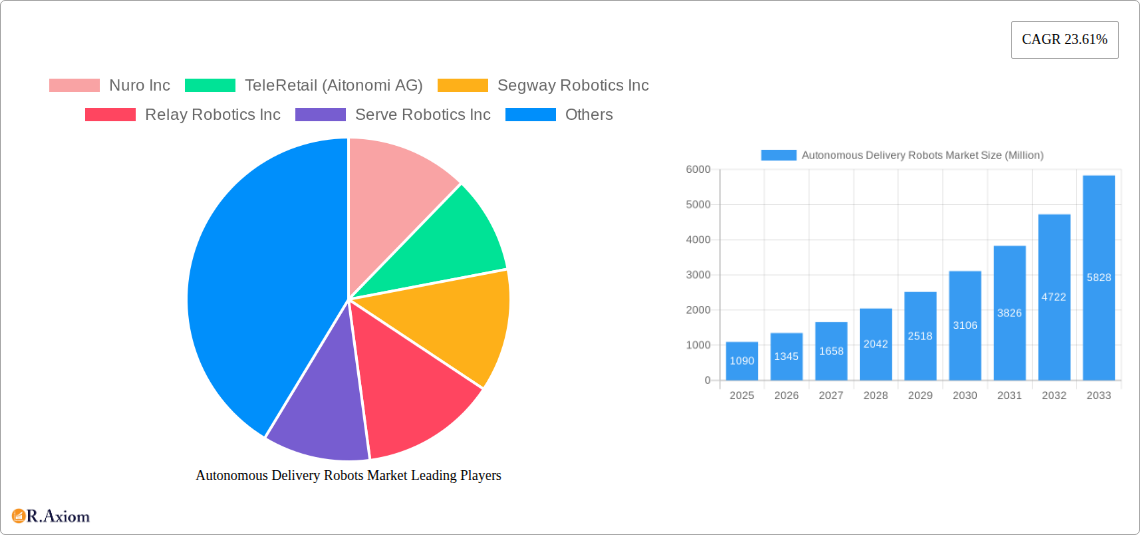

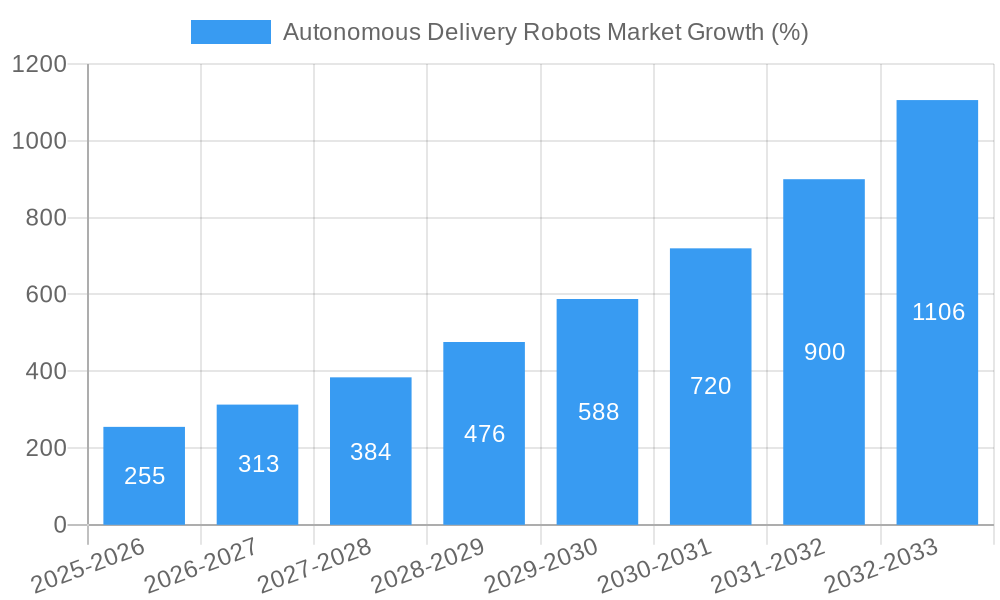

The Autonomous Delivery Robots market is experiencing rapid growth, projected to reach $1.09 billion in 2025 and exhibiting a remarkable Compound Annual Growth Rate (CAGR) of 23.61% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing demand for faster and more efficient last-mile delivery solutions, particularly in urban areas grappling with traffic congestion and labor shortages, is a primary catalyst. E-commerce's continued surge further amplifies this need, pushing businesses to explore automated alternatives for cost-effective and timely delivery. Technological advancements, including improvements in navigation, sensor technology, and AI-powered route optimization, are also contributing significantly to market growth. Furthermore, rising labor costs and the desire for enhanced customer experience are driving adoption across various sectors, including healthcare (medication delivery), hospitality (room service), and retail & logistics (package delivery).

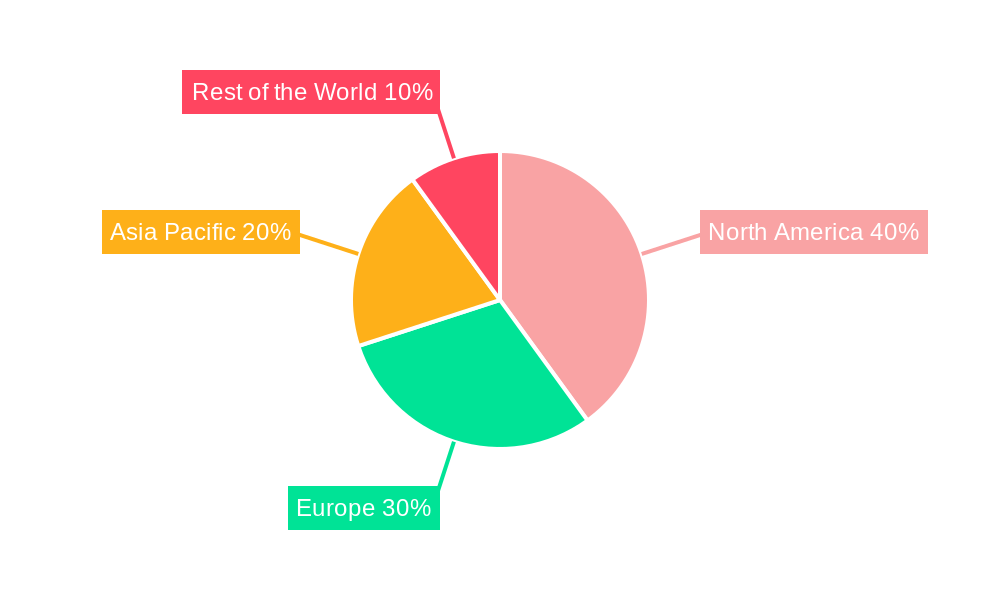

However, challenges remain. High initial investment costs associated with robot acquisition and infrastructure development pose a significant barrier to entry for smaller businesses. Regulatory hurdles and safety concerns surrounding autonomous navigation in public spaces also require careful consideration. Despite these restraints, the long-term outlook for the autonomous delivery robot market remains exceptionally positive. Continued innovation, decreasing production costs, and growing consumer acceptance will likely drive market expansion across diverse geographical regions, with North America and Europe expected to maintain significant market shares due to early adoption and robust technological infrastructure. The increasing presence of key players like Nuro, Starship Technologies, and others fosters competition and innovation, accelerating the market's trajectory. The market's segmentation by end-users reflects the broad applicability and diverse opportunities within this rapidly evolving sector.

Autonomous Delivery Robots Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Autonomous Delivery Robots Market, offering valuable insights for stakeholders across the industry. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages historical data (2019-2024) to project future market trends and growth. The report analyzes market concentration, innovation, industry trends, dominant segments, product developments, and key challenges and opportunities, providing a holistic view of this rapidly evolving sector.

Autonomous Delivery Robots Market Concentration & Innovation

The Autonomous Delivery Robots market is characterized by a moderately fragmented competitive landscape with several key players vying for market share. While a few dominant companies exist, numerous startups and established robotics firms are actively contributing to innovation. Market concentration is expected to shift slightly towards consolidation as larger players acquire smaller firms and benefit from economies of scale. The market share of the top five companies in 2025 is estimated to be xx%, with Nuro Inc and Starship Technologies holding a significant share. M&A activity has been a key driver, with deals valued at an estimated xx Million in 2024. Innovation is driven by advancements in AI, sensor technology, and navigation systems, enhancing robot autonomy, efficiency, and safety. Regulatory frameworks vary across regions, impacting market penetration and deployment strategies. Product substitutes, primarily human-based delivery services, face increasing pressure due to cost optimization and efficiency gains offered by autonomous robots. End-user trends favor automation to improve operational efficiency and reduce labor costs across industries.

- Key Market Concentration Metrics (2025):

- Top 5 Companies Market Share: xx%

- Average M&A Deal Value (2024): xx Million

- Innovation Drivers: AI advancements, sensor technologies, improved navigation systems.

- Regulatory Landscape: Varying regulations across different regions impact adoption.

- Product Substitutes: Human-based delivery services facing increasing competitive pressure.

- M&A Activity: Significant activity driving market consolidation and innovation.

Autonomous Delivery Robots Market Industry Trends & Insights

The Autonomous Delivery Robots market is experiencing robust growth, driven by the increasing demand for faster, more efficient, and cost-effective delivery solutions across various sectors. The market is witnessing a surge in technological advancements such as improved battery life, enhanced navigation capabilities, and the integration of advanced AI algorithms for route optimization and obstacle avoidance. Consumer preferences for contactless delivery, particularly amplified by recent global events, significantly boost market adoption. Competitive dynamics are intensifying, with companies investing heavily in R&D to improve their offerings and secure market share. The market is projected to witness a CAGR of xx% during the forecast period (2025-2033), with market penetration expected to reach xx% by 2033. The increasing adoption of autonomous delivery robots in various sectors, particularly in e-commerce and logistics, is a key driver of this growth. This, coupled with rising labor costs and advancements in technology, is set to propel the market to a valuation of xx Million by 2033. The increasing prevalence of smart cities and urban planning initiatives, focused on improving logistics and traffic flow, also presents a supportive backdrop for market expansion.

Dominant Markets & Segments in Autonomous Delivery Robots Market

The Retail & Logistics segment dominates the Autonomous Delivery Robots market, driven by the rising e-commerce industry and the need for efficient last-mile delivery solutions. North America and Europe are currently the leading regions, with significant investments and technological advancements fueling market growth.

- Key Drivers for Retail & Logistics Dominance:

- E-commerce boom: Driving demand for efficient and cost-effective last-mile delivery solutions.

- Labor shortages: Autonomous robots offer a solution to address labor cost issues and increasing demand for timely delivery.

- Technological advancements: Enhanced capabilities like improved navigation and obstacle avoidance.

- Regional Dominance:

- North America: High adoption rates, robust technological infrastructure, supportive regulatory environment, and significant investments in autonomous technologies.

- Europe: Growing demand in major metropolitan areas with dense populations, coupled with governmental support and initiatives to improve logistic efficiency within smart cities.

- Asia-Pacific: Significant potential for growth, though currently lagging behind North America and Europe due to infrastructural challenges and regulatory hurdles.

Autonomous Delivery Robots Market Product Developments

Recent innovations in autonomous delivery robots focus on improving payload capacity, increasing operational range, enhancing navigation precision, and integrating advanced safety features. Robots are becoming more adaptable to diverse terrains and weather conditions, expanding their practical applications. The integration of AI and machine learning is improving route optimization, obstacle avoidance, and overall efficiency. These advancements are enhancing market fit by addressing various customer needs and requirements, fostering increased market adoption.

Report Scope & Segmentation Analysis

This report segments the Autonomous Delivery Robots market by end-users: Healthcare, Hospitality, and Retail & Logistics.

Healthcare: This segment focuses on the use of robots for delivering medication, medical supplies, and samples within hospitals and healthcare facilities. Growth is driven by the need for improved efficiency and reduced risk of infection transmission. Market size is projected to reach xx Million by 2033. Competitive dynamics are driven by regulatory compliance and data security concerns.

Hospitality: The hospitality segment encompasses robots used for room service, food delivery, and guest services within hotels and restaurants. Market growth is driven by rising automation trends within the hospitality sector and the need to improve customer experience. Market size in 2033 is estimated at xx Million. Competition centers around robot aesthetics, reliability, and integration with existing hotel systems.

Retail & Logistics: This segment, the largest by far, covers robots for last-mile delivery, warehouse automation, and retail operations. The market is driven by the e-commerce boom and rising demand for fast and efficient delivery. This segment is projected to reach xx Million by 2033. Competitive dynamics are extremely intense, with frequent innovations and price competition.

Key Drivers of Autonomous Delivery Robots Market Growth

The growth of the Autonomous Delivery Robots market is fueled by several key factors, including:

- Rising e-commerce: The exponential growth of online shopping necessitates efficient and cost-effective delivery solutions.

- Labor shortages and rising labor costs: Autonomous robots offer a viable alternative to human labor, particularly for last-mile delivery.

- Advancements in technology: Improvements in AI, sensor technology, and battery life are enhancing the capabilities of these robots.

- Government initiatives and supportive regulations: Several governments are actively promoting the adoption of autonomous technologies.

Challenges in the Autonomous Delivery Robots Market Sector

The Autonomous Delivery Robots market faces several challenges, including:

- High initial investment costs: The procurement and deployment of these robots require significant upfront capital.

- Regulatory hurdles and safety concerns: Clear and consistent regulations are needed to ensure safety and address liability issues.

- Infrastructure limitations: The effectiveness of these robots is dependent on suitable infrastructure, such as well-maintained sidewalks and roads.

- Security risks: Data breaches and potential misuse are significant security concerns. These challenges may lead to a slower-than-expected market penetration rate, potentially impacting overall market growth.

Emerging Opportunities in Autonomous Delivery Robots Market

Emerging opportunities in the Autonomous Delivery Robots market include:

- Expansion into new markets: The adoption of these robots is expanding beyond urban areas into suburban and rural settings.

- Integration with existing logistics systems: Seamless integration with existing delivery networks will enhance efficiency.

- Development of specialized robots: Robots are being designed for specific delivery needs, such as medical supplies or hazardous materials.

- Growing partnerships and collaborations: Strategic alliances are driving innovation and market expansion.

Leading Players in the Autonomous Delivery Robots Market Market

- Nuro Inc

- TeleRetail (Aitonomi AG)

- Segway Robotics Inc

- Relay Robotics Inc

- Serve Robotics Inc

- Starship Technologies

- Ottonomy IO

- Neolix

- Eliport

- Aethon Inc

- Kiwibot

- Postmates Inc

Key Developments in Autonomous Delivery Robots Market Industry

- September 2022: Magna and Cartken announced a partnership for the production of autonomous delivery robots.

- January 2023: Ottonomy launched autonomous delivery robots in multiple locations (Cincinnati/Northern Kentucky International Airport, Rome Fiumicino International Airport, Pittsburgh) and secured partnerships with Posten Norge (Norway) and Goggo (Madrid, Spain) for first/last-mile deliveries. Further launches are planned for 2023 in Europe, the USA, and Asia.

Strategic Outlook for Autonomous Delivery Robots Market Market

The future of the Autonomous Delivery Robots market is bright, with significant growth potential driven by technological advancements, increasing demand for efficient delivery solutions, and supportive government policies. The market is expected to witness continuous innovation, leading to more sophisticated, reliable, and cost-effective robots. Strategic partnerships and collaborations will play a crucial role in shaping the market landscape. The focus will shift towards enhanced safety features, improved security measures, and seamless integration with existing infrastructure to unlock the full potential of autonomous delivery robots.

Autonomous Delivery Robots Market Segmentation

-

1. End Users

- 1.1. Healthcare

- 1.2. Hospitality

- 1.3. Retail & Logistics

Autonomous Delivery Robots Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Autonomous Delivery Robots Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 23.61% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Need to Manage Last-mile Deliveries; Growing Automation in the Logistics Industry

- 3.3. Market Restrains

- 3.3.1. Data Privacy Concerns; Organizational and Infrastructural Facility of Healthcare Institutions Affecting Implementation

- 3.4. Market Trends

- 3.4.1. Healthcare Segment is Expected to Register a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Autonomous Delivery Robots Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End Users

- 5.1.1. Healthcare

- 5.1.2. Hospitality

- 5.1.3. Retail & Logistics

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by End Users

- 6. North America Autonomous Delivery Robots Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by End Users

- 6.1.1. Healthcare

- 6.1.2. Hospitality

- 6.1.3. Retail & Logistics

- 6.1. Market Analysis, Insights and Forecast - by End Users

- 7. Europe Autonomous Delivery Robots Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by End Users

- 7.1.1. Healthcare

- 7.1.2. Hospitality

- 7.1.3. Retail & Logistics

- 7.1. Market Analysis, Insights and Forecast - by End Users

- 8. Asia Pacific Autonomous Delivery Robots Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by End Users

- 8.1.1. Healthcare

- 8.1.2. Hospitality

- 8.1.3. Retail & Logistics

- 8.1. Market Analysis, Insights and Forecast - by End Users

- 9. Rest of the World Autonomous Delivery Robots Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by End Users

- 9.1.1. Healthcare

- 9.1.2. Hospitality

- 9.1.3. Retail & Logistics

- 9.1. Market Analysis, Insights and Forecast - by End Users

- 10. North America Autonomous Delivery Robots Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Europe Autonomous Delivery Robots Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Asia Pacific Autonomous Delivery Robots Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Rest of the World Autonomous Delivery Robots Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Nuro Inc

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 TeleRetail (Aitonomi AG)

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Segway Robotics Inc

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Relay Robotics Inc

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Serve Robotics Inc

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Starship Technologies

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Ottonomy IO

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Neolix*List Not Exhaustive

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Eliport

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Aethon Inc

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Kiwibot

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.12 Postmates Inc

- 14.2.12.1. Overview

- 14.2.12.2. Products

- 14.2.12.3. SWOT Analysis

- 14.2.12.4. Recent Developments

- 14.2.12.5. Financials (Based on Availability)

- 14.2.1 Nuro Inc

List of Figures

- Figure 1: Global Autonomous Delivery Robots Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Autonomous Delivery Robots Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Autonomous Delivery Robots Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Autonomous Delivery Robots Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Autonomous Delivery Robots Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Autonomous Delivery Robots Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Autonomous Delivery Robots Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Autonomous Delivery Robots Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Autonomous Delivery Robots Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Autonomous Delivery Robots Market Revenue (Million), by End Users 2024 & 2032

- Figure 11: North America Autonomous Delivery Robots Market Revenue Share (%), by End Users 2024 & 2032

- Figure 12: North America Autonomous Delivery Robots Market Revenue (Million), by Country 2024 & 2032

- Figure 13: North America Autonomous Delivery Robots Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Autonomous Delivery Robots Market Revenue (Million), by End Users 2024 & 2032

- Figure 15: Europe Autonomous Delivery Robots Market Revenue Share (%), by End Users 2024 & 2032

- Figure 16: Europe Autonomous Delivery Robots Market Revenue (Million), by Country 2024 & 2032

- Figure 17: Europe Autonomous Delivery Robots Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Asia Pacific Autonomous Delivery Robots Market Revenue (Million), by End Users 2024 & 2032

- Figure 19: Asia Pacific Autonomous Delivery Robots Market Revenue Share (%), by End Users 2024 & 2032

- Figure 20: Asia Pacific Autonomous Delivery Robots Market Revenue (Million), by Country 2024 & 2032

- Figure 21: Asia Pacific Autonomous Delivery Robots Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Rest of the World Autonomous Delivery Robots Market Revenue (Million), by End Users 2024 & 2032

- Figure 23: Rest of the World Autonomous Delivery Robots Market Revenue Share (%), by End Users 2024 & 2032

- Figure 24: Rest of the World Autonomous Delivery Robots Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Rest of the World Autonomous Delivery Robots Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Autonomous Delivery Robots Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Autonomous Delivery Robots Market Revenue Million Forecast, by End Users 2019 & 2032

- Table 3: Global Autonomous Delivery Robots Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Autonomous Delivery Robots Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Autonomous Delivery Robots Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Global Autonomous Delivery Robots Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Autonomous Delivery Robots Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Autonomous Delivery Robots Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Autonomous Delivery Robots Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Autonomous Delivery Robots Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Autonomous Delivery Robots Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Autonomous Delivery Robots Market Revenue Million Forecast, by End Users 2019 & 2032

- Table 13: Global Autonomous Delivery Robots Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global Autonomous Delivery Robots Market Revenue Million Forecast, by End Users 2019 & 2032

- Table 15: Global Autonomous Delivery Robots Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Autonomous Delivery Robots Market Revenue Million Forecast, by End Users 2019 & 2032

- Table 17: Global Autonomous Delivery Robots Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Autonomous Delivery Robots Market Revenue Million Forecast, by End Users 2019 & 2032

- Table 19: Global Autonomous Delivery Robots Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Autonomous Delivery Robots Market?

The projected CAGR is approximately 23.61%.

2. Which companies are prominent players in the Autonomous Delivery Robots Market?

Key companies in the market include Nuro Inc, TeleRetail (Aitonomi AG), Segway Robotics Inc, Relay Robotics Inc, Serve Robotics Inc, Starship Technologies, Ottonomy IO, Neolix*List Not Exhaustive, Eliport, Aethon Inc, Kiwibot, Postmates Inc.

3. What are the main segments of the Autonomous Delivery Robots Market?

The market segments include End Users.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.09 Million as of 2022.

5. What are some drivers contributing to market growth?

Need to Manage Last-mile Deliveries; Growing Automation in the Logistics Industry.

6. What are the notable trends driving market growth?

Healthcare Segment is Expected to Register a Significant Growth.

7. Are there any restraints impacting market growth?

Data Privacy Concerns; Organizational and Infrastructural Facility of Healthcare Institutions Affecting Implementation.

8. Can you provide examples of recent developments in the market?

January 2023: Ottonomy launched autonomous delivery robots at Cincinnati/Northern Kentucky, Rome Fiumicino International Airport, and Pittsburgh. In addition, Ottonomy robots are utilized by Posten Norge in Norway, Oslo, and Goggo in Madrid, Spain, for automating first-mile and last-mile deliveries. Ottonomy is also working with industry partners in Canada and Saudi Arabia, with more launches planned for 2023 in Europe, the USA, and Asia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Autonomous Delivery Robots Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Autonomous Delivery Robots Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Autonomous Delivery Robots Market?

To stay informed about further developments, trends, and reports in the Autonomous Delivery Robots Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence