Key Insights

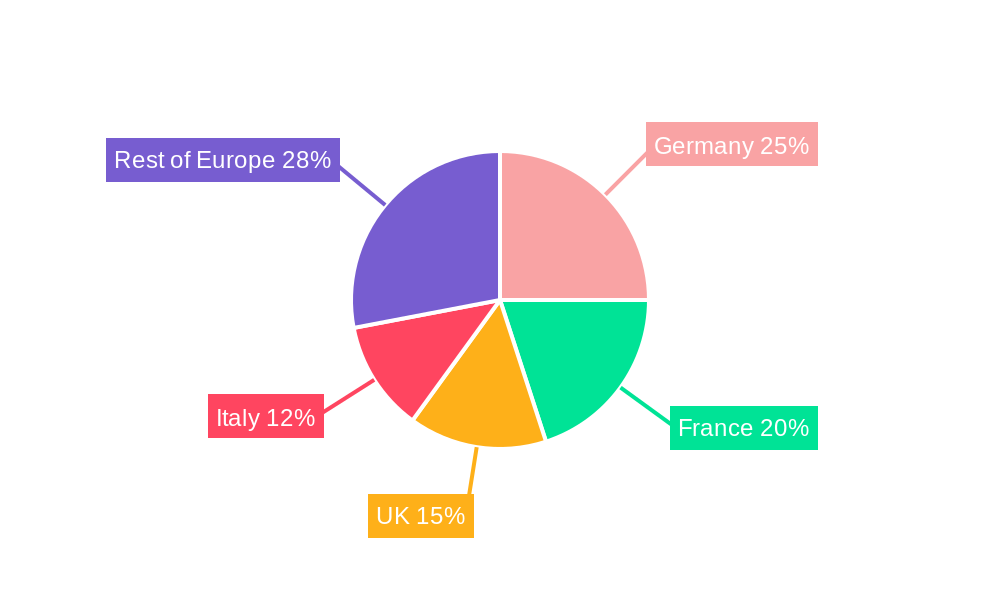

The European bancassurance market, valued at €656 million in 2025, is projected to experience steady growth, driven by several key factors. Increasing consumer demand for bundled financial products offering convenience and cost-effectiveness fuels this expansion. The rise in digitalization within the banking sector facilitates easier product distribution and customer engagement, further enhancing market appeal. Strategic partnerships between banks and insurance providers, leveraging existing customer bases and distribution networks, are also crucial drivers. However, regulatory changes impacting insurance product offerings and intensifying competition among established players and fintech disruptors present significant challenges. The market segmentation, largely split between life and non-life insurance, showcases diverse growth trajectories reflecting evolving consumer risk profiles and preferences. Leading players like Allianz, AXA, and Generali are expected to maintain strong positions, capitalizing on their extensive networks and brand recognition, while smaller players are likely to focus on niche segments or innovative product offerings. The geographical distribution across major European markets such as Germany, France, UK, and Italy will reflect the varying levels of financial literacy, insurance penetration, and economic conditions in each region. Given the projected 4.56% CAGR, the market size is expected to exceed €800 million by 2030.

Bancassurance In Europe Market Size (In Million)

The market's future growth hinges on adapting to the evolving landscape. Innovative product development tailored to specific customer needs, including personalized insurance solutions and digital-first distribution channels, will be crucial for success. Furthermore, robust risk management practices and compliance with stringent regulations are essential for maintaining market stability and investor confidence. The increasing focus on sustainable and ethical financial practices will also influence consumer preferences and shape the product offerings of key players. The successful integration of technological advancements in areas like AI and data analytics will enable more effective risk assessment, customer service, and fraud prevention, significantly impacting competitiveness within the sector. Continuous monitoring of regulatory changes and evolving market dynamics will be key for long-term success in this competitive landscape.

Bancassurance In Europe Company Market Share

Bancassurance in Europe: Market Analysis & Forecast (2019-2033)

This comprehensive report provides an in-depth analysis of the Bancassurance market in Europe, covering the period 2019-2033. It offers invaluable insights into market dynamics, competitive landscape, and future growth potential, making it an essential resource for industry stakeholders, investors, and strategic planners. The report leverages a robust methodology, incorporating historical data (2019-2024), an estimated year (2025), and a forecast period (2025-2033), with a base year of 2025. Key players analyzed include AG Insurance, Credit Agricole, Aviva, AXA, BNP Paribas Cardif, Zurich, Intesa Sanpaolo, CNP Assurances, Allianz, and Generali (list not exhaustive). The report segments the market by type of insurance: Life Insurance and Non-life Insurance.

Bancassurance In Europe Market Concentration & Innovation

The European bancassurance market exhibits a moderately concentrated landscape, with a few major players holding significant market share. While precise market share figures vary by segment and country, leading players such as AXA and Allianz command substantial portions, estimated to be in the xx% range (aggregated across both Life and Non-Life insurance). However, a significant number of smaller and regional banks and insurers are active, particularly within specific national markets. This creates a complex ecosystem characterized by both intense competition and opportunities for niche players.

Market innovation is driven by several factors:

- Technological advancements: Digitalization, including AI and big data analytics, is enabling personalized product offerings and improved customer service.

- Regulatory changes: Evolving regulations (e.g., PSD2, GDPR) are impacting data security and customer privacy, stimulating innovation in compliant solutions.

- Consumer demands: Growing demand for customized and digitally-accessible insurance products is a powerful catalyst for innovation.

- Mergers and Acquisitions (M&A): Strategic M&A activity, representing an estimated xx Million in deal value during the historical period, has led to market consolidation and the introduction of new products and services. Key examples include the Talanx and Bank Millennium partnership.

Bancassurance In Europe Industry Trends & Insights

The European bancassurance market is experiencing robust growth, projected at a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by several factors:

- Increasing insurance penetration: Rising disposable incomes and heightened awareness of financial protection needs are boosting demand for insurance products.

- Expanding digital channels: The shift to digital platforms is expanding accessibility and enhancing customer engagement, resulting in increased market penetration.

- Strategic partnerships: Collaborations between banks and insurers, such as the Admiral Seguros and ING Spain venture, are accelerating product development and market reach.

- Government initiatives: Favorable regulatory policies and government support for the financial services sector are contributing positively to market expansion.

- Competitive landscape: The competitive dynamics are shaping product differentiation, pricing strategies, and overall market growth.

Dominant Markets & Segments in Bancassurance In Europe

While the entire European market is experiencing growth, certain regions and segments demonstrate stronger performance.

Dominant Region: Western Europe, including countries like Germany, France, and the UK, currently maintains the largest market share owing to higher insurance penetration and advanced financial infrastructure. However, Central and Eastern Europe are expected to exhibit higher growth rates due to increasing insurance awareness and economic development.

Dominant Segment: Life insurance, driven by increasing demand for retirement planning and long-term financial security, is projected to account for a larger market share than Non-Life insurance throughout the forecast period. However, both segments are anticipated to show considerable growth.

Key Drivers:

- Stronger economic performance in certain regions drives higher consumer spending and insurance demand.

- Favorable demographic trends, including aging populations, increase demand for life insurance products.

- Developed infrastructure supports efficient distribution channels and customer service.

- Government policies that encourage financial inclusion and insurance penetration influence market growth.

Bancassurance In Europe Product Developments

The bancassurance sector is witnessing significant product innovation, driven primarily by technology. Embedded insurance, offered through digital platforms and integrated into other financial services, is gaining traction. Companies are leveraging AI and big data to personalize products and improve risk assessment, leading to more competitive pricing and targeted offerings. This focus on customer-centricity is further enhanced by seamless digital experiences and personalized risk management tools.

Report Scope & Segmentation Analysis

This report segments the Bancassurance market in Europe by Type of Insurance:

Life Insurance: This segment encompasses various products such as term life insurance, whole life insurance, and annuities. The market size is projected to reach xx Million by 2033, driven by growing awareness of retirement planning needs and increasing life expectancies. Competitive dynamics are intense, with established players vying for market share through product innovation and strategic partnerships.

Non-life Insurance: This segment includes motor, home, and health insurance products. This segment is anticipated to grow to xx Million by 2033, driven by increasing vehicle ownership, rising property values, and evolving healthcare needs. The competitive landscape is characterized by both large multinational insurers and niche players.

Key Drivers of Bancassurance In Europe Growth

Several factors underpin the growth of the European Bancassurance market:

- Technological advancements: Digitalization, AI-powered risk assessment, and personalized product offerings improve customer experience and efficiency.

- Economic growth: Rising disposable incomes across various European economies increase demand for insurance products.

- Favorable regulatory environment: Supportive government policies and regulations foster a healthy industry ecosystem.

Challenges in the Bancassurance In Europe Sector

The sector faces certain challenges:

- Intense competition: The presence of numerous established players and emerging competitors puts pressure on pricing and profitability. Estimated losses from competitive pressures are in the range of xx Million annually.

- Regulatory complexities: Evolving regulations regarding data privacy and consumer protection necessitate significant investment in compliance.

- Economic uncertainty: Macroeconomic fluctuations can impact consumer spending and insurance demand.

Emerging Opportunities in Bancassurance In Europe

Emerging opportunities include:

- Expansion into underserved markets: Untapped potential exists in Central and Eastern Europe.

- Growth of embedded insurance: Integrating insurance into other digital platforms creates new revenue streams.

- Leveraging AI and data analytics: Personalized products and efficient risk management enhance competitiveness.

Leading Players in the Bancassurance In Europe Market

Key Developments in Bancassurance In Europe Industry

- June 2023: Admiral Seguros and ING Spain launched ING Orange Auto Insurance, a digital bancassurance venture.

- February 2023: Talanx signed a ten-year bancassurance deal with Bank Millennium in Poland, expanding its life and non-motor insurance portfolio.

Strategic Outlook for Bancassurance In Europe Market

The European bancassurance market presents a promising outlook. Continued technological innovation, strategic partnerships, and favorable regulatory environments will drive significant growth throughout the forecast period. Companies that effectively adapt to evolving consumer preferences and leverage digital technologies will be best positioned to capture market share and achieve sustainable success. The focus on digitalization and personalized offerings will define the future of the market.

Bancassurance In Europe Segmentation

-

1. Type of Insurance

- 1.1. Life Insurance

- 1.2. Non-life Insurance

Bancassurance In Europe Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Bancassurance In Europe Regional Market Share

Geographic Coverage of Bancassurance In Europe

Bancassurance In Europe REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.56% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Regulatory and Technological Developments

- 3.3. Market Restrains

- 3.3.1. Competition from Other Distribution Channels

- 3.4. Market Trends

- 3.4.1. The Rising Need for Non-Life Insurance is Propelling Expansion in the Bancassurance Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Bancassurance In Europe Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Insurance

- 5.1.1. Life Insurance

- 5.1.2. Non-life Insurance

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type of Insurance

- 6. North America Bancassurance In Europe Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type of Insurance

- 6.1.1. Life Insurance

- 6.1.2. Non-life Insurance

- 6.1. Market Analysis, Insights and Forecast - by Type of Insurance

- 7. South America Bancassurance In Europe Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type of Insurance

- 7.1.1. Life Insurance

- 7.1.2. Non-life Insurance

- 7.1. Market Analysis, Insights and Forecast - by Type of Insurance

- 8. Europe Bancassurance In Europe Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type of Insurance

- 8.1.1. Life Insurance

- 8.1.2. Non-life Insurance

- 8.1. Market Analysis, Insights and Forecast - by Type of Insurance

- 9. Middle East & Africa Bancassurance In Europe Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type of Insurance

- 9.1.1. Life Insurance

- 9.1.2. Non-life Insurance

- 9.1. Market Analysis, Insights and Forecast - by Type of Insurance

- 10. Asia Pacific Bancassurance In Europe Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type of Insurance

- 10.1.1. Life Insurance

- 10.1.2. Non-life Insurance

- 10.1. Market Analysis, Insights and Forecast - by Type of Insurance

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 AG Insurance

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Credit Agricole

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Aviva**List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 AXA

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 BNP Paribas Cardif

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Zurich

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Intesa Sanpaolo

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 CNP Assurances

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Allianz

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Generali

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 AG Insurance

List of Figures

- Figure 1: Global Bancassurance In Europe Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Bancassurance In Europe Revenue (Million), by Type of Insurance 2025 & 2033

- Figure 3: North America Bancassurance In Europe Revenue Share (%), by Type of Insurance 2025 & 2033

- Figure 4: North America Bancassurance In Europe Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Bancassurance In Europe Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America Bancassurance In Europe Revenue (Million), by Type of Insurance 2025 & 2033

- Figure 7: South America Bancassurance In Europe Revenue Share (%), by Type of Insurance 2025 & 2033

- Figure 8: South America Bancassurance In Europe Revenue (Million), by Country 2025 & 2033

- Figure 9: South America Bancassurance In Europe Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Bancassurance In Europe Revenue (Million), by Type of Insurance 2025 & 2033

- Figure 11: Europe Bancassurance In Europe Revenue Share (%), by Type of Insurance 2025 & 2033

- Figure 12: Europe Bancassurance In Europe Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Bancassurance In Europe Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa Bancassurance In Europe Revenue (Million), by Type of Insurance 2025 & 2033

- Figure 15: Middle East & Africa Bancassurance In Europe Revenue Share (%), by Type of Insurance 2025 & 2033

- Figure 16: Middle East & Africa Bancassurance In Europe Revenue (Million), by Country 2025 & 2033

- Figure 17: Middle East & Africa Bancassurance In Europe Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Bancassurance In Europe Revenue (Million), by Type of Insurance 2025 & 2033

- Figure 19: Asia Pacific Bancassurance In Europe Revenue Share (%), by Type of Insurance 2025 & 2033

- Figure 20: Asia Pacific Bancassurance In Europe Revenue (Million), by Country 2025 & 2033

- Figure 21: Asia Pacific Bancassurance In Europe Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Bancassurance In Europe Revenue Million Forecast, by Type of Insurance 2020 & 2033

- Table 2: Global Bancassurance In Europe Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Bancassurance In Europe Revenue Million Forecast, by Type of Insurance 2020 & 2033

- Table 4: Global Bancassurance In Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Bancassurance In Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Bancassurance In Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Mexico Bancassurance In Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global Bancassurance In Europe Revenue Million Forecast, by Type of Insurance 2020 & 2033

- Table 9: Global Bancassurance In Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Brazil Bancassurance In Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Argentina Bancassurance In Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America Bancassurance In Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global Bancassurance In Europe Revenue Million Forecast, by Type of Insurance 2020 & 2033

- Table 14: Global Bancassurance In Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Bancassurance In Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Bancassurance In Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Bancassurance In Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Italy Bancassurance In Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Spain Bancassurance In Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Russia Bancassurance In Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Benelux Bancassurance In Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Nordics Bancassurance In Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Bancassurance In Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Bancassurance In Europe Revenue Million Forecast, by Type of Insurance 2020 & 2033

- Table 25: Global Bancassurance In Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Turkey Bancassurance In Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Israel Bancassurance In Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: GCC Bancassurance In Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: North Africa Bancassurance In Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Africa Bancassurance In Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa Bancassurance In Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Bancassurance In Europe Revenue Million Forecast, by Type of Insurance 2020 & 2033

- Table 33: Global Bancassurance In Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 34: China Bancassurance In Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: India Bancassurance In Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Japan Bancassurance In Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: South Korea Bancassurance In Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: ASEAN Bancassurance In Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Oceania Bancassurance In Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific Bancassurance In Europe Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bancassurance In Europe?

The projected CAGR is approximately 4.56%.

2. Which companies are prominent players in the Bancassurance In Europe?

Key companies in the market include AG Insurance, Credit Agricole, Aviva**List Not Exhaustive, AXA, BNP Paribas Cardif, Zurich, Intesa Sanpaolo, CNP Assurances, Allianz, Generali.

3. What are the main segments of the Bancassurance In Europe?

The market segments include Type of Insurance.

4. Can you provide details about the market size?

The market size is estimated to be USD 656 Million as of 2022.

5. What are some drivers contributing to market growth?

Regulatory and Technological Developments.

6. What are the notable trends driving market growth?

The Rising Need for Non-Life Insurance is Propelling Expansion in the Bancassurance Market.

7. Are there any restraints impacting market growth?

Competition from Other Distribution Channels.

8. Can you provide examples of recent developments in the market?

June 2023: Admiral Seguros collaborated with ING Spain for a digital bancassurance venture. The collaboration stemmed from Admiral Group's expansion of its distribution network with insurance solutions. This joint partnership led to the creation of ING Orange Auto Insurance, a digital product designed to revolutionize the insurance sector.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Bancassurance In Europe," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Bancassurance In Europe report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Bancassurance In Europe?

To stay informed about further developments, trends, and reports in the Bancassurance In Europe, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence