Key Insights

The Chinese banking sector is poised for significant expansion, with a projected market size of approximately $5,500 million by 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of 10.00% through 2033. This growth is primarily fueled by a burgeoning digital economy and increasing consumer demand for sophisticated financial products. Key drivers include the accelerating adoption of digital banking services, the continuous innovation in payment technologies, and a growing middle class with higher disposable incomes. Furthermore, government initiatives aimed at financial inclusion and the development of the fintech ecosystem are providing substantial tailwinds. The market is experiencing a pronounced trend towards digital transformation, with a surge in mobile banking, online lending platforms, and the integration of AI and blockchain technologies to enhance operational efficiency and customer experience. The demand for transactional and savings accounts remains strong, complemented by a rapidly growing appetite for credit cards and various loan products, especially those catering to small and medium-sized enterprises (SMEs) and consumer financing.

Banking Industry in China Market Size (In Billion)

However, the sector is not without its challenges. Stricter regulatory frameworks introduced to manage financial risks and ensure market stability, coupled with increasing competition from non-bank financial institutions and fintech disruptors, present considerable restraints. These factors necessitate continuous adaptation and investment in robust compliance and cybersecurity measures. The market is segmenting into specialized offerings, with product innovation being crucial across transactional accounts, savings accounts, debit cards, credit cards, and loans. The industry's reliance on sophisticated software and evolving hardware infrastructure highlights the importance of technology providers. Channels are also diversifying, with direct sales and distributor networks playing vital roles alongside the dominant digital platforms. Major players like Industrial and Commercial Bank of China (ICBC), China Construction Bank (CCB), and Shanghai Pudong Development Bank are actively investing in digital capabilities and expanding their product portfolios to maintain market leadership in this dynamic and competitive landscape.

Banking Industry in China Company Market Share

Banking Industry in China: Market Concentration & Innovation

The Chinese banking industry exhibits a moderately concentrated market structure, dominated by large state-owned commercial banks such as Industrial and Commercial Bank of China (ICBC), China Construction Bank (CCB), Agricultural Bank of China (ABC), and Bank of China (BOC). These giants collectively hold a significant market share, exceeding 50 Million in assets and impacting millions of customer accounts. However, the landscape is increasingly dynamic with the rise of agile joint-stock commercial banks like Shanghai Pudong Development Bank, CITIC Bank, China Everbright Bank, and Ping An Bank, alongside specialized financial institutions and a growing presence of digital-native challengers. Innovation is a key differentiator, driven by rapid advancements in fintech, mobile banking, and big data analytics. Regulatory frameworks, while evolving to promote stability and competition, also play a crucial role in shaping innovation pathways. Product substitutes are becoming more prevalent, with fintech platforms offering alternative payment, lending, and investment solutions. End-user trends are strongly aligned with digital adoption, demanding seamless online experiences, personalized services, and instant accessibility. Mergers and acquisitions (M&A) activity, valued at approximately $500 Million in recent years, aims to consolidate market positions, acquire new technologies, and expand customer bases, particularly in the digital banking and wealth management segments.

Banking Industry in China Industry Trends & Insights

The Chinese banking industry is poised for robust growth, projected to achieve a Compound Annual Growth Rate (CAGR) of 8.5% from 2025 to 2033. This expansion is fueled by several key drivers. China's sustained economic development, increasing disposable incomes, and a growing middle class are significantly boosting demand for a wide array of banking products and services, from transactional accounts and savings to complex loan facilities and investment products. Technological disruptions are at the forefront of this transformation. The widespread adoption of mobile payments, digital wallets, and advanced AI-driven customer service platforms is fundamentally reshaping how consumers interact with their banks. Banks are investing heavily in upgrading their IT infrastructure, developing sophisticated data analytics capabilities for personalized offerings, and embracing cloud computing to enhance efficiency and scalability. Consumer preferences are rapidly shifting towards digital-first banking experiences. Customers now expect seamless, intuitive, and personalized interactions across all channels, demanding 24/7 accessibility and on-demand services. This has led to a significant increase in the market penetration of digital banking services, with over 75% of consumers in major urban centers now actively using mobile banking apps for their daily financial needs. Competitive dynamics are intensifying. While traditional banks are modernizing their operations, they face growing competition from agile fintech companies and digital banks that can offer more innovative and customer-centric solutions. This competitive pressure is driving further investment in technology and a renewed focus on customer experience. The expansion of the digital economy, the government's emphasis on financial inclusion, and the ongoing urbanization further contribute to the industry's growth trajectory, creating a dynamic and evolving market.

Dominant Markets & Segments in Banking Industry in China

The dominant market within China's banking sector is unequivocally driven by Transactional Accounts and Savings Accounts. These foundational products form the bedrock of customer relationships and hold the largest market share, exceeding $80 Million in total deposits. Their dominance is underpinned by fundamental economic policies and widespread infrastructure development that ensures access to banking services across urban and rural areas. The extensive network of branches and ATMs, coupled with the ubiquitous adoption of mobile banking, makes these accounts indispensable for daily financial management for hundreds of millions of individuals and businesses.

In terms of Loans, the market is segmented into retail and corporate lending. Corporate lending, particularly to large state-owned enterprises and key industrial sectors, remains a significant contributor to the banking industry's revenue, with outstanding loan values estimated at $120 Million. However, retail lending, encompassing mortgages, auto loans, and personal loans, is experiencing rapid growth, driven by rising consumer spending and a burgeoning middle class.

The Debit Card segment is also highly dominant, with market penetration exceeding 90% among bank account holders, facilitating billions of transactions annually valued in the tens of millions of dollars. Credit Cards, while a growing segment with significant market penetration among urban dwellers, still represent a smaller portion of overall transaction volume compared to debit cards, with annual spending estimated in the tens of millions of dollars.

The Industry segments powering the banking sector are overwhelmingly Software and Services. Software development for core banking systems, mobile applications, cybersecurity, and AI-driven analytics is a multi-billion dollar industry. Banking services, including wealth management, investment banking, and insurance, also constitute a substantial revenue stream, with the wealth management sector alone managing assets worth over $30 Million. Hardware plays a supporting role, primarily in ATMs and data center infrastructure.

The primary Channel for customer interaction remains Direct Sales, especially for complex financial products and corporate banking. However, Distributor channels, through partnerships with fintech companies and payment aggregators, are gaining traction, expanding reach and offering specialized services. Digital channels are increasingly becoming the preferred method for routine transactions and customer service.

Banking Industry in China Product Developments

Product innovation in China's banking sector is heavily influenced by fintech integration. Banks are rolling out advanced AI-powered chatbots for customer service, personalized wealth management platforms leveraging big data analytics, and seamless digital onboarding processes for new accounts and loans. The development of embedded finance solutions, integrating banking services into non-financial platforms, is a key trend, enhancing user experience and driving competitive advantage. These developments focus on providing faster, more convenient, and highly tailored financial solutions.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the banking industry in China, segmented across key product categories: Transactional Accounts, Savings Accounts, Debit Cards, Credit Cards, Loans, and Other Products (including insurance, investment, and wealth management). It also analyzes the industry from the perspective of supporting sectors: Hardware, Software, and Services, and examines the predominant distribution channels: Direct Sales and Distributor networks. Each segment's market size, growth projections, and competitive dynamics are detailed, offering insights into their relative importance and future potential within the evolving Chinese financial landscape.

Key Drivers of Banking Industry in China Growth

The primary growth drivers for the Chinese banking industry include the country's robust economic expansion, leading to increased disposable income and demand for financial services. The rapid adoption of digital technologies and fintech innovation is transforming customer engagement and operational efficiency. Government initiatives promoting financial inclusion and supporting the digital economy are creating new market opportunities. Furthermore, the ongoing urbanization trend and the growth of the middle class are significantly expanding the customer base for banking products.

Challenges in the Banking Industry in China Sector

Significant challenges facing the Chinese banking sector include evolving regulatory landscapes that require continuous adaptation and compliance. Intense competition from both traditional banks and agile fintech firms necessitates constant innovation and customer-centric strategies. Rising cybersecurity threats demand substantial investment in robust security measures. Additionally, managing the non-performing loan ratio, particularly in certain economic downturns, remains a key concern for financial stability.

Emerging Opportunities in Banking Industry in China

Emerging opportunities lie in the continued expansion of digital banking services, catering to the preferences of younger, tech-savvy demographics. The growth of green finance and sustainable investment products presents a significant new market. Leveraging big data and AI for hyper-personalized financial advice and product offerings is another key area. Furthermore, expanding into underserved rural markets through digital channels offers considerable potential for market penetration.

Leading Players in the Banking Industry in China Market

Key Developments in Banking Industry in China Industry

Strategic Outlook for Banking Industry in China Market

The strategic outlook for China's banking industry is one of continued digital transformation and customer-centric innovation. Banks will focus on leveraging advanced technologies like AI and big data to deliver highly personalized financial solutions and enhance operational efficiency. Strategic partnerships with fintech firms will remain crucial for expanding service offerings and market reach. The industry is expected to see further consolidation and specialization, with a strong emphasis on sustainable finance and catering to the evolving needs of a digitally native consumer base.

- Industrial and Commercial Bank of China (ICBC)

- China Construction Bank (CCB)

- Agricultural Bank of China (ABC)

- Bank of China (BOC)

- Shanghai Pudong Development Bank

- CITIC Bank

- China Everbright Bank

- Ping An Bank

- Bank of Communications

- China Merchants Bank

- 2023: Increased investment in AI and blockchain technologies for fraud detection and enhanced customer service.

- 2023: Launch of new digital-only banking platforms by major institutions to capture younger demographics.

- 2024: Significant push towards green finance initiatives and sustainable lending practices.

- 2024: Further integration of embedded finance solutions across various e-commerce platforms.

- 2024: Regulatory adjustments focusing on data privacy and cybersecurity protocols.

Banking Industry in China Segmentation

-

1. Product

- 1.1. Transactional Accounts

- 1.2. Savings Accounts

- 1.3. Debit Cards

- 1.4. Credit Cards

- 1.5. Loans

- 1.6. Other Products

-

2. Industry

- 2.1. Hardware

- 2.2. Software

- 2.3. Services

-

3. Channel

- 3.1. Direct Sales

- 3.2. Distributor

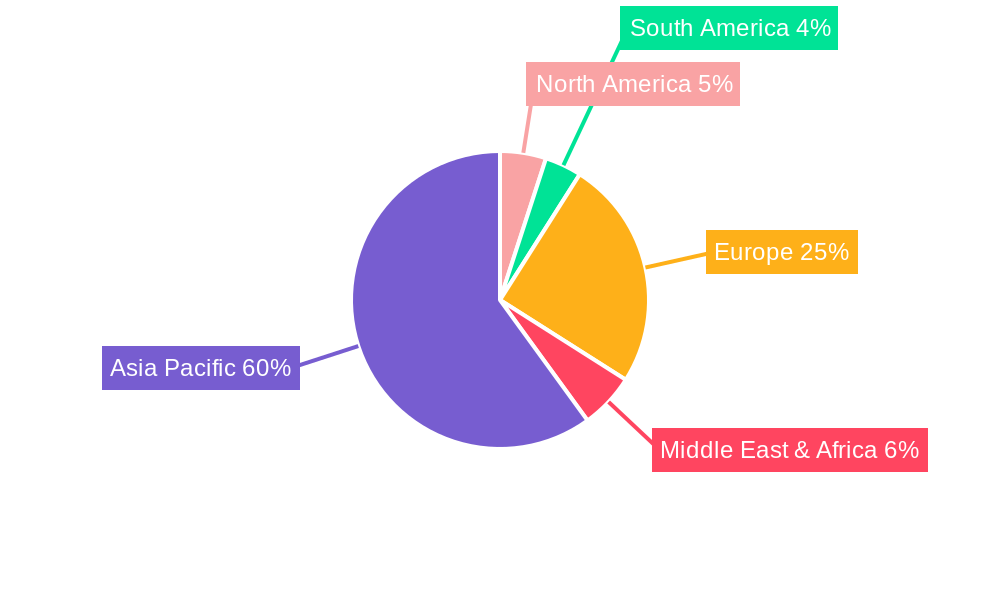

Banking Industry in China Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Banking Industry in China Regional Market Share

Geographic Coverage of Banking Industry in China

Banking Industry in China REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Guaranteed Protection Drives The Market

- 3.3. Market Restrains

- 3.3.1. Long and Costly Legal Procedures

- 3.4. Market Trends

- 3.4.1. Technology and Digitalization Trends are Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Banking Industry in China Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Transactional Accounts

- 5.1.2. Savings Accounts

- 5.1.3. Debit Cards

- 5.1.4. Credit Cards

- 5.1.5. Loans

- 5.1.6. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Industry

- 5.2.1. Hardware

- 5.2.2. Software

- 5.2.3. Services

- 5.3. Market Analysis, Insights and Forecast - by Channel

- 5.3.1. Direct Sales

- 5.3.2. Distributor

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Banking Industry in China Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Transactional Accounts

- 6.1.2. Savings Accounts

- 6.1.3. Debit Cards

- 6.1.4. Credit Cards

- 6.1.5. Loans

- 6.1.6. Other Products

- 6.2. Market Analysis, Insights and Forecast - by Industry

- 6.2.1. Hardware

- 6.2.2. Software

- 6.2.3. Services

- 6.3. Market Analysis, Insights and Forecast - by Channel

- 6.3.1. Direct Sales

- 6.3.2. Distributor

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. South America Banking Industry in China Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Transactional Accounts

- 7.1.2. Savings Accounts

- 7.1.3. Debit Cards

- 7.1.4. Credit Cards

- 7.1.5. Loans

- 7.1.6. Other Products

- 7.2. Market Analysis, Insights and Forecast - by Industry

- 7.2.1. Hardware

- 7.2.2. Software

- 7.2.3. Services

- 7.3. Market Analysis, Insights and Forecast - by Channel

- 7.3.1. Direct Sales

- 7.3.2. Distributor

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Europe Banking Industry in China Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Transactional Accounts

- 8.1.2. Savings Accounts

- 8.1.3. Debit Cards

- 8.1.4. Credit Cards

- 8.1.5. Loans

- 8.1.6. Other Products

- 8.2. Market Analysis, Insights and Forecast - by Industry

- 8.2.1. Hardware

- 8.2.2. Software

- 8.2.3. Services

- 8.3. Market Analysis, Insights and Forecast - by Channel

- 8.3.1. Direct Sales

- 8.3.2. Distributor

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East & Africa Banking Industry in China Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Transactional Accounts

- 9.1.2. Savings Accounts

- 9.1.3. Debit Cards

- 9.1.4. Credit Cards

- 9.1.5. Loans

- 9.1.6. Other Products

- 9.2. Market Analysis, Insights and Forecast - by Industry

- 9.2.1. Hardware

- 9.2.2. Software

- 9.2.3. Services

- 9.3. Market Analysis, Insights and Forecast - by Channel

- 9.3.1. Direct Sales

- 9.3.2. Distributor

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Asia Pacific Banking Industry in China Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Transactional Accounts

- 10.1.2. Savings Accounts

- 10.1.3. Debit Cards

- 10.1.4. Credit Cards

- 10.1.5. Loans

- 10.1.6. Other Products

- 10.2. Market Analysis, Insights and Forecast - by Industry

- 10.2.1. Hardware

- 10.2.2. Software

- 10.2.3. Services

- 10.3. Market Analysis, Insights and Forecast - by Channel

- 10.3.1. Direct Sales

- 10.3.2. Distributor

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Industrial and Commercial Bank of China (ICBC)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 China Construction Bank (CCB)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Shanghai Pudong Development Bank

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 CITIC Bank

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Agricultural Bank of China (ABC)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 China Everbright Bank

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Bank of China (BOC)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Ping An Bank

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bank of Communications

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 China Merchants Bank

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Industrial and Commercial Bank of China (ICBC)

List of Figures

- Figure 1: Global Banking Industry in China Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Banking Industry in China Revenue (Million), by Product 2025 & 2033

- Figure 3: North America Banking Industry in China Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America Banking Industry in China Revenue (Million), by Industry 2025 & 2033

- Figure 5: North America Banking Industry in China Revenue Share (%), by Industry 2025 & 2033

- Figure 6: North America Banking Industry in China Revenue (Million), by Channel 2025 & 2033

- Figure 7: North America Banking Industry in China Revenue Share (%), by Channel 2025 & 2033

- Figure 8: North America Banking Industry in China Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Banking Industry in China Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Banking Industry in China Revenue (Million), by Product 2025 & 2033

- Figure 11: South America Banking Industry in China Revenue Share (%), by Product 2025 & 2033

- Figure 12: South America Banking Industry in China Revenue (Million), by Industry 2025 & 2033

- Figure 13: South America Banking Industry in China Revenue Share (%), by Industry 2025 & 2033

- Figure 14: South America Banking Industry in China Revenue (Million), by Channel 2025 & 2033

- Figure 15: South America Banking Industry in China Revenue Share (%), by Channel 2025 & 2033

- Figure 16: South America Banking Industry in China Revenue (Million), by Country 2025 & 2033

- Figure 17: South America Banking Industry in China Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Banking Industry in China Revenue (Million), by Product 2025 & 2033

- Figure 19: Europe Banking Industry in China Revenue Share (%), by Product 2025 & 2033

- Figure 20: Europe Banking Industry in China Revenue (Million), by Industry 2025 & 2033

- Figure 21: Europe Banking Industry in China Revenue Share (%), by Industry 2025 & 2033

- Figure 22: Europe Banking Industry in China Revenue (Million), by Channel 2025 & 2033

- Figure 23: Europe Banking Industry in China Revenue Share (%), by Channel 2025 & 2033

- Figure 24: Europe Banking Industry in China Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe Banking Industry in China Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa Banking Industry in China Revenue (Million), by Product 2025 & 2033

- Figure 27: Middle East & Africa Banking Industry in China Revenue Share (%), by Product 2025 & 2033

- Figure 28: Middle East & Africa Banking Industry in China Revenue (Million), by Industry 2025 & 2033

- Figure 29: Middle East & Africa Banking Industry in China Revenue Share (%), by Industry 2025 & 2033

- Figure 30: Middle East & Africa Banking Industry in China Revenue (Million), by Channel 2025 & 2033

- Figure 31: Middle East & Africa Banking Industry in China Revenue Share (%), by Channel 2025 & 2033

- Figure 32: Middle East & Africa Banking Industry in China Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East & Africa Banking Industry in China Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Banking Industry in China Revenue (Million), by Product 2025 & 2033

- Figure 35: Asia Pacific Banking Industry in China Revenue Share (%), by Product 2025 & 2033

- Figure 36: Asia Pacific Banking Industry in China Revenue (Million), by Industry 2025 & 2033

- Figure 37: Asia Pacific Banking Industry in China Revenue Share (%), by Industry 2025 & 2033

- Figure 38: Asia Pacific Banking Industry in China Revenue (Million), by Channel 2025 & 2033

- Figure 39: Asia Pacific Banking Industry in China Revenue Share (%), by Channel 2025 & 2033

- Figure 40: Asia Pacific Banking Industry in China Revenue (Million), by Country 2025 & 2033

- Figure 41: Asia Pacific Banking Industry in China Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Banking Industry in China Revenue Million Forecast, by Product 2020 & 2033

- Table 2: Global Banking Industry in China Revenue Million Forecast, by Industry 2020 & 2033

- Table 3: Global Banking Industry in China Revenue Million Forecast, by Channel 2020 & 2033

- Table 4: Global Banking Industry in China Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Banking Industry in China Revenue Million Forecast, by Product 2020 & 2033

- Table 6: Global Banking Industry in China Revenue Million Forecast, by Industry 2020 & 2033

- Table 7: Global Banking Industry in China Revenue Million Forecast, by Channel 2020 & 2033

- Table 8: Global Banking Industry in China Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Banking Industry in China Revenue Million Forecast, by Product 2020 & 2033

- Table 13: Global Banking Industry in China Revenue Million Forecast, by Industry 2020 & 2033

- Table 14: Global Banking Industry in China Revenue Million Forecast, by Channel 2020 & 2033

- Table 15: Global Banking Industry in China Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Brazil Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Argentina Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Banking Industry in China Revenue Million Forecast, by Product 2020 & 2033

- Table 20: Global Banking Industry in China Revenue Million Forecast, by Industry 2020 & 2033

- Table 21: Global Banking Industry in China Revenue Million Forecast, by Channel 2020 & 2033

- Table 22: Global Banking Industry in China Revenue Million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: France Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Italy Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Spain Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Russia Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Benelux Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Nordics Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Banking Industry in China Revenue Million Forecast, by Product 2020 & 2033

- Table 33: Global Banking Industry in China Revenue Million Forecast, by Industry 2020 & 2033

- Table 34: Global Banking Industry in China Revenue Million Forecast, by Channel 2020 & 2033

- Table 35: Global Banking Industry in China Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Turkey Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Israel Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: GCC Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: North Africa Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: South Africa Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global Banking Industry in China Revenue Million Forecast, by Product 2020 & 2033

- Table 43: Global Banking Industry in China Revenue Million Forecast, by Industry 2020 & 2033

- Table 44: Global Banking Industry in China Revenue Million Forecast, by Channel 2020 & 2033

- Table 45: Global Banking Industry in China Revenue Million Forecast, by Country 2020 & 2033

- Table 46: China Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: India Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: South Korea Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Oceania Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Banking Industry in China?

The projected CAGR is approximately 10.00%.

2. Which companies are prominent players in the Banking Industry in China?

Key companies in the market include Industrial and Commercial Bank of China (ICBC) , China Construction Bank (CCB) , Shanghai Pudong Development Bank , CITIC Bank, Agricultural Bank of China (ABC) , China Everbright Bank , Bank of China (BOC) , Ping An Bank , Bank of Communications , China Merchants Bank .

3. What are the main segments of the Banking Industry in China?

The market segments include Product, Industry, Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Guaranteed Protection Drives The Market.

6. What are the notable trends driving market growth?

Technology and Digitalization Trends are Driving the Market.

7. Are there any restraints impacting market growth?

Long and Costly Legal Procedures.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Banking Industry in China," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Banking Industry in China report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Banking Industry in China?

To stay informed about further developments, trends, and reports in the Banking Industry in China, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence