Key Insights

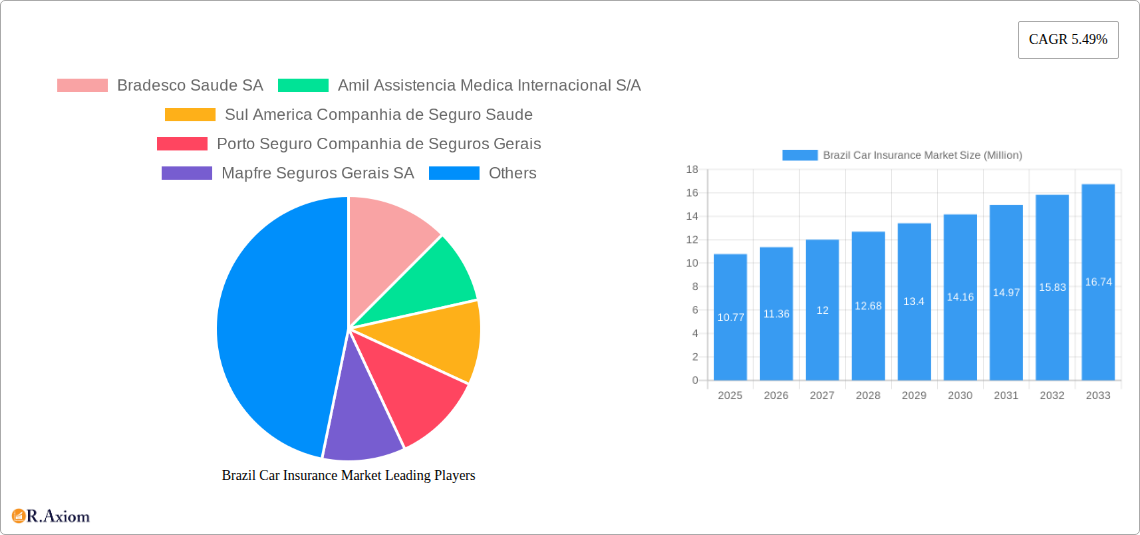

The Brazil Car Insurance Market is poised for significant growth, projected to reach an estimated value of $10.77 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 5.49% expected throughout the forecast period (2025-2033). This expansion is primarily driven by a confluence of factors including increasing vehicle ownership, a growing awareness of financial protection against road incidents, and evolving regulatory landscapes that encourage comprehensive insurance adoption. The market's dynamism is further fueled by the increasing demand for both Third-Party Liability Coverage and more comprehensive Collision, Comprehensive, and Other Optional Coverage. Personal vehicles constitute a substantial segment, reflecting the burgeoning middle class and their increasing reliance on private transportation.

Brazil Car Insurance Market Market Size (In Million)

Key trends shaping the market include the rapid digital transformation of distribution channels, with online platforms and direct sales experiencing accelerated adoption, offering greater convenience and competitive pricing to consumers. While individual agents and brokers remain vital, their role is increasingly complemented by digital intermediaries. The market also benefits from strategic partnerships between insurance providers and financial institutions like banks, enhancing accessibility. However, certain restraints, such as the economic sensitivity of insurance premiums for a portion of the population and the presence of informal insurance arrangements in some regions, pose challenges. Nevertheless, the overarching positive trajectory is supported by a competitive landscape featuring major players like Bradesco Saúde SA, Amil Assistência Médica Internacional S/A, Sul América Companhia de Seguro Saúde, Porto Seguro Companhia de Seguros Gerais, and Mapfre Seguros Gerais SA, alongside international giants like Allianz Seguros SA and Tokio Marine Seguradora SA, all vying to capture market share across Brazil.

Brazil Car Insurance Market Company Market Share

This in-depth report provides a detailed examination of the Brazil Car Insurance Market, offering critical insights into market dynamics, growth drivers, and future opportunities. Covering the historical period from 2019 to 2024 and projecting growth through 2033 with a base year of 2025, this study is indispensable for stakeholders seeking to understand and capitalize on the evolving Brazilian auto insurance landscape. With a focus on market concentration, innovation, industry trends, dominant segments, and key players, this report equips industry leaders with actionable intelligence for strategic decision-making.

Brazil Car Insurance Market Market Concentration & Innovation

The Brazil Car Insurance Market exhibits a moderate to high market concentration, with a few key players dominating the landscape. Leading companies such as Bradesco Saude SA, Amil Assistencia Medica Internacional S/A, Sul America Companhia de Seguro Saude, Porto Seguro Companhia de Seguros Gerais, Mapfre Seguros Gerais SA, Notre Dame Intermedica Saude SA, Tokio Marine Seguradora SA, Allianz Seguros SA, Itau Seguros, and HDI Seguros hold significant market share, estimated to be between 70-80% collectively for the top 10. Innovation is a key differentiator, driven by InsurTech advancements and the increasing adoption of data analytics and AI for personalized pricing and risk assessment. Regulatory frameworks, while evolving, can sometimes present barriers but also foster innovation in compliance. Product substitutes include self-insurance and third-party liability-only policies, but comprehensive coverage remains highly sought after. End-user trends highlight a growing demand for digitalized policy management and transparent pricing. Mergers and acquisitions (M&A) are a recurring theme, with recent activities indicating a strategic consolidation to enhance market reach and technological capabilities, though specific deal values are often undisclosed.

Brazil Car Insurance Market Industry Trends & Insights

The Brazil Car Insurance Market is poised for substantial growth, driven by a confluence of economic, technological, and demographic factors. The Compound Annual Growth Rate (CAGR) is projected to be robust, estimated between 8-10% during the forecast period. Market penetration, while already significant, is expected to deepen as disposable incomes rise and vehicle ownership continues to expand across various economic strata. Technological disruptions are at the forefront of this evolution. The increasing integration of telematics devices in vehicles allows for real-time data collection on driving behavior, paving the way for usage-based insurance (UBI) models. This not only enables more accurate risk assessment but also empowers drivers with the ability to influence their premiums through safe driving practices. InsurTech startups are playing a pivotal role in this transformation, introducing innovative platforms that streamline the policy application, claims processing, and customer service experience. Online distribution channels are gaining significant traction, catering to the growing preference for digital convenience among consumers.

Consumer preferences are shifting towards personalized insurance solutions that reflect individual risk profiles rather than standardized offerings. This demand is further fueled by a greater awareness of the benefits of comprehensive coverage, especially in a country with diverse road conditions and a high rate of vehicle theft. The competitive dynamics are intensifying, with established insurers investing heavily in digital transformation to maintain their market share against agile InsurTech players. Furthermore, the government's focus on infrastructure development and economic stability indirectly supports the automotive sector, consequently boosting the demand for car insurance. The increasing adoption of electric and hybrid vehicles also presents a new segment with unique insurance needs, encouraging insurers to develop specialized products and pricing strategies. The expansion of the middle class, coupled with growing urbanization, will continue to drive vehicle sales and, by extension, the car insurance market.

Dominant Markets & Segments in Brazil Car Insurance Market

The Brazil Car Insurance Market is characterized by the dominance of certain segments and applications, driven by economic realities and consumer behavior.

Coverage:

Collision/Comprehensive/Other Optional Coverage: This segment is the most dominant, accounting for an estimated 60-70% of the total market value.

- Key Drivers: Increasing vehicle values, concerns about theft and vandalism, and the desire for comprehensive financial protection against unforeseen accidents and damages. Government initiatives promoting vehicle safety also indirectly boost demand for this broader coverage.

- Dominance Analysis: Brazilians recognize the significant financial implications of vehicle damage or loss. The high incidence of car theft and accidents in urban centers further compels consumers to opt for comprehensive policies, providing peace of mind and financial security. Insurers are actively marketing these products, often bundling them with additional services like roadside assistance.

Third-Party Liability Coverage: While essential and mandated, this segment holds a smaller, though significant, market share, estimated at 30-40%.

- Key Drivers: Legal compliance and the need to cover damages or injuries caused to third parties.

- Dominance Analysis: This coverage is a foundational requirement for vehicle registration and operation. While it represents a crucial part of the market, consumer preference often leans towards more extensive coverage when budget allows, due to the significant financial and legal ramifications of causing harm to others.

Application:

Personal Vehicles: This segment unequivocally dominates the market, representing approximately 80-85% of the total car insurance market.

- Key Drivers: Growing middle class, increasing vehicle ownership for personal mobility and convenience, and favorable financing options for car purchases.

- Dominance Analysis: Brazil has a vast population, and the aspiration for private vehicle ownership is a strong societal trend. As more individuals and families acquire cars for daily commuting, leisure, and family travel, the demand for insuring these assets escalates. The rising per capita income further empowers individuals to purchase and insure their vehicles.

Commercial Vehicles: This segment, while smaller at an estimated 15-20%, is experiencing steady growth.

- Key Drivers: Expansion of logistics and delivery services, e-commerce growth, and the operational needs of businesses.

- Dominance Analysis: The burgeoning e-commerce sector and the increasing need for goods transportation are fueling the demand for commercial vehicle insurance. Businesses require robust coverage to protect their fleets and ensure operational continuity, making this a vital, albeit secondary, segment.

Distribution Channel:

Brokers: This channel remains a dominant force, accounting for an estimated 35-40% of sales.

- Key Drivers: Expertise in navigating complex insurance products, personalized advice, and access to a wide range of insurers.

- Dominance Analysis: Insurance brokers play a crucial role in educating consumers about their options and tailoring policies to specific needs. Their trusted advisory status, particularly for more complex or high-value policies, solidifies their position in the market.

Individual Agents: Holding a significant share of approximately 25-30%.

- Key Drivers: Direct customer relationships, local market knowledge, and personal selling approach.

- Dominance Analysis: Individual agents often build strong, long-term relationships with clients, offering a personalized touch that resonates with many Brazilian consumers. Their accessibility and familiarity within communities contribute to their sustained market presence.

Online: This channel is experiencing rapid growth and is estimated to hold 20-25% of the market.

- Key Drivers: Convenience, speed, transparency, and often competitive pricing.

- Dominance Analysis: The increasing digital literacy and comfort with online transactions among Brazilians are driving the surge in online insurance purchases. Insurers are investing in user-friendly digital platforms to capture this growing segment of tech-savvy consumers.

Direct Sales & Banks: These channels collectively account for approximately 10-15% of the market share.

- Key Drivers: Convenience for existing banking customers, bundled product offerings, and direct insurer outreach.

- Dominance Analysis: Banks leverage their extensive customer base to offer insurance as an add-on service. Direct sales by insurers, while less dominant than intermediary channels, are also important for building brand loyalty and reaching specific customer segments.

Brazil Car Insurance Market Product Developments

Product development in the Brazil Car Insurance Market is increasingly focused on personalized and technology-driven solutions. Insurers are leveraging telematics and data analytics to offer usage-based insurance (UBI) and pay-as-you-drive (PAYD) policies, rewarding safe drivers with lower premiums. The integration of AI in claims processing is accelerating settlement times and improving customer satisfaction. Furthermore, there's a growing emphasis on eco-friendly coverage options for electric and hybrid vehicles, along with expanded cyber insurance components to address the increasing digital threats faced by drivers and vehicle systems. These innovations aim to enhance customer engagement, reduce fraud, and provide greater value, thereby strengthening competitive advantages in a dynamic market.

Report Scope & Segmentation Analysis

The Brazil Car Insurance Market is segmented based on Coverage, Application, and Distribution Channel.

Coverage: This segmentation includes Third-Party Liability Coverage and Collision/Comprehensive/Other Optional Coverage. Third-Party Liability is expected to see a steady CAGR of around 7-8%, driven by mandatory regulations. Collision/Comprehensive/Other Optional Coverage, however, is projected for higher growth, with a CAGR of 9-11%, fueled by increasing vehicle values and consumer demand for broader protection.

Application: The market is divided into Personal Vehicles and Commercial Vehicles. Personal Vehicles, the dominant segment, is forecast to grow at a CAGR of 8-10%, driven by rising car ownership. Commercial Vehicles, though smaller, is anticipated to expand at a slightly higher CAGR of 9-11% due to the growth in logistics and e-commerce.

Distribution Channel: Segmentation includes Direct Sales, Individual Agents, Brokers, Banks, Online, and Other Distribution Channels. The Online channel is projected for the highest growth, with a CAGR of 15-20%, as digital adoption accelerates. Brokers and Individual Agents will maintain strong positions with CAGRs of 7-9%, while Banks and Direct Sales will see moderate growth of 6-8%.

Key Drivers of Brazil Car Insurance Market Growth

Several factors are propelling the growth of the Brazil Car Insurance Market. Economic recovery and increasing disposable incomes are leading to higher vehicle ownership. Technological advancements, particularly InsurTech innovations like telematics and AI, are enabling personalized and efficient insurance solutions, such as usage-based insurance (UBI). Favorable regulatory changes aimed at simplifying insurance processes and promoting competition also contribute to market expansion. Furthermore, a growing awareness among consumers about the importance of financial protection against vehicle-related risks, including theft and accidents, is a significant driver. The continuous expansion of the automotive sector, coupled with the increasing sophistication of vehicle technology, necessitates more comprehensive and specialized insurance products.

Challenges in the Brazil Car Insurance Market Sector

Despite robust growth potential, the Brazil Car Insurance Market faces several challenges. High levels of vehicle theft and fraud continue to strain insurer profitability and increase operational costs. Regulatory complexities and evolving compliance requirements can sometimes hinder innovation and market entry for new players. Economic volatility and inflationary pressures can impact consumer affordability of insurance premiums, potentially leading to a decline in the purchase of comprehensive coverage. Intense competition from established players and agile InsurTech startups creates pressure on pricing and margins. Furthermore, the underdeveloped infrastructure in certain regions can complicate claims processing and roadside assistance services.

Emerging Opportunities in Brazil Car Insurance Market

The Brazil Car Insurance Market is ripe with emerging opportunities. The rapid adoption of electric and hybrid vehicles presents a new segment requiring specialized insurance products and services. The burgeoning InsurTech landscape offers avenues for innovation in areas such as blockchain for fraud detection, IoT for predictive maintenance, and AI-powered customer service platforms. The increasing urbanization and the rise of ride-sharing services create demand for flexible and on-demand insurance solutions. Moreover, a growing segment of the population is becoming more digitally savvy, presenting an opportunity for insurers to expand their online distribution channels and offer personalized digital experiences. The demand for cyber insurance for connected vehicles is also on the rise, reflecting the growing concern over digital security.

Leading Players in the Brazil Car Insurance Market Market

- Bradesco Saude SA

- Amil Assistencia Medica Internacional S/A

- Sul America Companhia de Seguro Saude

- Porto Seguro Companhia de Seguros Gerais

- Mapfre Seguros Gerais SA

- Notre Dame Intermedica Saude SA

- Tokio Marine Seguradora SA

- Allianz Seguros SA

- Itau Seguros

- HDI Seguros

Key Developments in Brazil Car Insurance Market Industry

- June 2023: Brazil is set to partially introduce a federal diesel tax this year to bring down automobile costs for the general public. Tax credits will be offered as incentives to automobile manufacturers who opt to bring down the prices of their respective models, potentially stimulating new vehicle sales and subsequent insurance demand.

- April 2023: Justos, a Brazil-based auto InsurTech startup, raised USD 5.5 million in funding. Justus distinguishes itself by offering auto insurance with more driver-friendly pricing. The company utilizes machine learning to create models that can predict claims, and consequently, charges an individualized value for each driver, showcasing a significant trend towards personalized risk assessment and pricing.

Strategic Outlook for Brazil Car Insurance Market Market

The strategic outlook for the Brazil Car Insurance Market is highly optimistic, driven by ongoing technological advancements and evolving consumer demands. The continued adoption of telematics and data analytics will enable insurers to offer more tailored, competitive, and personalized products, fostering greater customer loyalty. The rise of InsurTech startups will continue to push traditional players towards digital transformation, leading to improved operational efficiencies and enhanced customer experiences. The increasing focus on sustainability and the growth of the electric vehicle market present new opportunities for specialized insurance offerings. Strategic investments in online distribution channels and user-friendly digital platforms will be crucial for capturing market share. Furthermore, a proactive approach to risk management and fraud detection will be paramount for long-term profitability in this dynamic market.

Brazil Car Insurance Market Segmentation

-

1. Coverage

- 1.1. Third-Party Liability Coverage

- 1.2. Collision/Comprehensive/Other Optional Coverage

-

2. Application

- 2.1. Personal Vehicles

- 2.2. Commercial Vehicles

-

3. Distribution Channel

- 3.1. Direct Sales

- 3.2. Individual Agents

- 3.3. Brokers

- 3.4. Banks

- 3.5. Online

- 3.6. Other Distribution Channels

Brazil Car Insurance Market Segmentation By Geography

- 1. Brazil

Brazil Car Insurance Market Regional Market Share

Geographic Coverage of Brazil Car Insurance Market

Brazil Car Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.49% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The adoption of Digital Channels for Purchasing and Managing Insurance Policies; Increasing Awareness of the Importance of Car Insurance for Financial Protection

- 3.3. Market Restrains

- 3.3.1. The adoption of Digital Channels for Purchasing and Managing Insurance Policies; Increasing Awareness of the Importance of Car Insurance for Financial Protection

- 3.4. Market Trends

- 3.4.1. Increasing Registrations of Electric Vehicles in Brazil

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Car Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Coverage

- 5.1.1. Third-Party Liability Coverage

- 5.1.2. Collision/Comprehensive/Other Optional Coverage

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Personal Vehicles

- 5.2.2. Commercial Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Direct Sales

- 5.3.2. Individual Agents

- 5.3.3. Brokers

- 5.3.4. Banks

- 5.3.5. Online

- 5.3.6. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Coverage

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Bradesco Saude SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Amil Assistencia Medica Internacional S/A

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sul America Companhia de Seguro Saude

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Porto Seguro Companhia de Seguros Gerais

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Mapfre Seguros Gerais SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Notre Dame Intermedica Saude SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Tokio Marine Seguradora SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Allianz Seguros SA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Itau Seguros

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 HDI Seguros**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Bradesco Saude SA

List of Figures

- Figure 1: Brazil Car Insurance Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Brazil Car Insurance Market Share (%) by Company 2025

List of Tables

- Table 1: Brazil Car Insurance Market Revenue Million Forecast, by Coverage 2020 & 2033

- Table 2: Brazil Car Insurance Market Volume Billion Forecast, by Coverage 2020 & 2033

- Table 3: Brazil Car Insurance Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Brazil Car Insurance Market Volume Billion Forecast, by Application 2020 & 2033

- Table 5: Brazil Car Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Brazil Car Insurance Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: Brazil Car Insurance Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Brazil Car Insurance Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Brazil Car Insurance Market Revenue Million Forecast, by Coverage 2020 & 2033

- Table 10: Brazil Car Insurance Market Volume Billion Forecast, by Coverage 2020 & 2033

- Table 11: Brazil Car Insurance Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Brazil Car Insurance Market Volume Billion Forecast, by Application 2020 & 2033

- Table 13: Brazil Car Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 14: Brazil Car Insurance Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 15: Brazil Car Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Brazil Car Insurance Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Car Insurance Market?

The projected CAGR is approximately 5.49%.

2. Which companies are prominent players in the Brazil Car Insurance Market?

Key companies in the market include Bradesco Saude SA, Amil Assistencia Medica Internacional S/A, Sul America Companhia de Seguro Saude, Porto Seguro Companhia de Seguros Gerais, Mapfre Seguros Gerais SA, Notre Dame Intermedica Saude SA, Tokio Marine Seguradora SA, Allianz Seguros SA, Itau Seguros, HDI Seguros**List Not Exhaustive.

3. What are the main segments of the Brazil Car Insurance Market?

The market segments include Coverage, Application, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.77 Million as of 2022.

5. What are some drivers contributing to market growth?

The adoption of Digital Channels for Purchasing and Managing Insurance Policies; Increasing Awareness of the Importance of Car Insurance for Financial Protection.

6. What are the notable trends driving market growth?

Increasing Registrations of Electric Vehicles in Brazil.

7. Are there any restraints impacting market growth?

The adoption of Digital Channels for Purchasing and Managing Insurance Policies; Increasing Awareness of the Importance of Car Insurance for Financial Protection.

8. Can you provide examples of recent developments in the market?

June 2023: Brazil is all set to partially introduce a federal diesel tax this year to bring down automobile costs for the people at large. Tax credits would be offered as incentives to automobile manufacturers who opt to bring down the prices of their respective models.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Car Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Car Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Car Insurance Market?

To stay informed about further developments, trends, and reports in the Brazil Car Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence