Key Insights

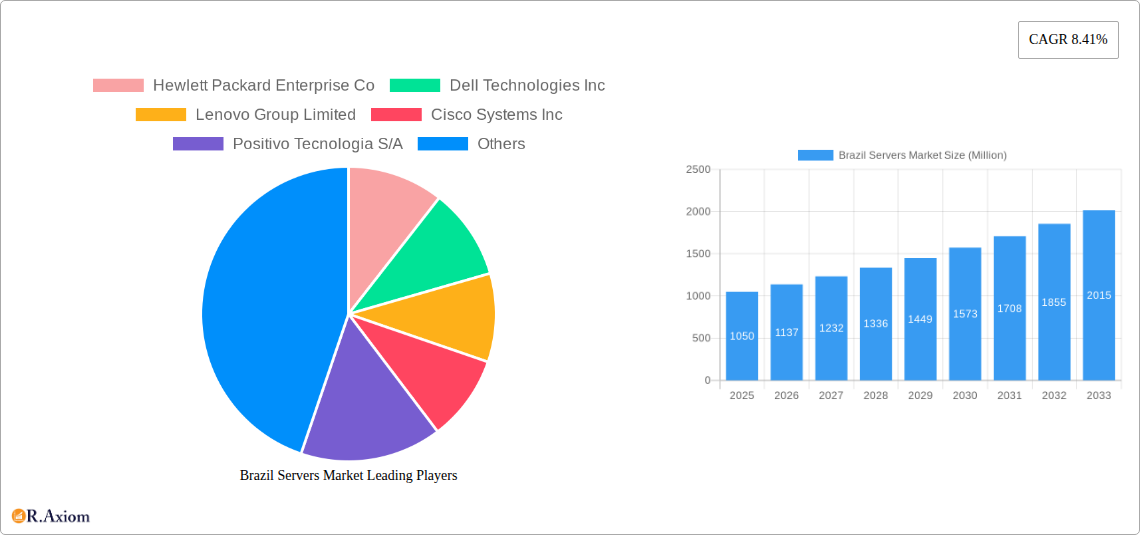

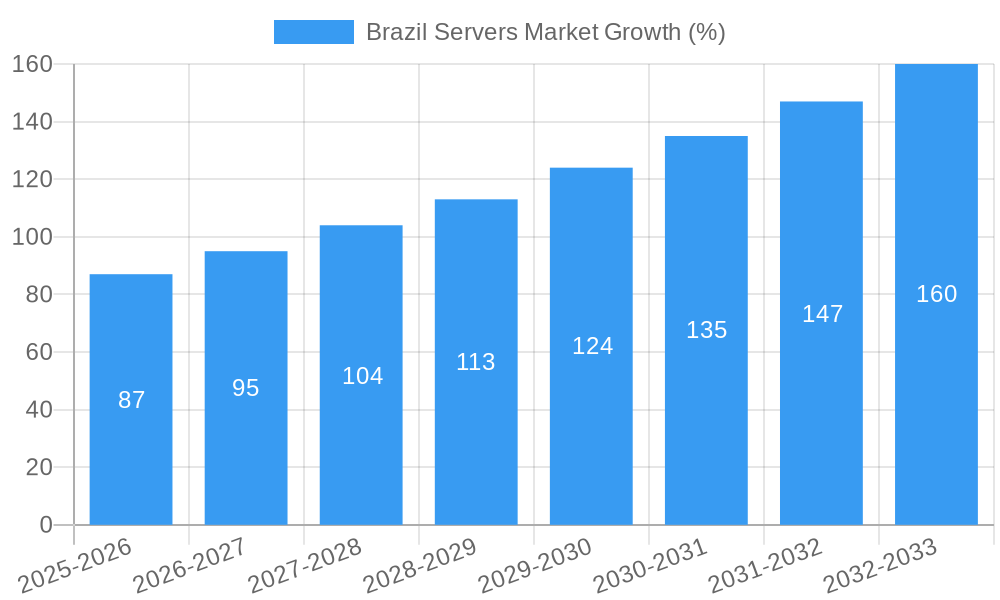

The Brazil servers market, valued at approximately $1.05 billion in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 8.41% from 2025 to 2033. This expansion is driven by several key factors. Firstly, the increasing adoption of cloud computing and big data analytics within Brazilian businesses is fueling demand for high-performance servers capable of handling large volumes of data. Secondly, the government's ongoing initiatives to promote digital transformation across various sectors, including finance, healthcare, and education, are creating a favorable environment for server market growth. Furthermore, the expansion of 5G networks and the rising popularity of edge computing are contributing to increased server deployment across diverse geographical locations. However, economic fluctuations and the potential for import restrictions could pose challenges to sustained market growth. Major players like Hewlett Packard Enterprise, Dell Technologies, Lenovo, and Cisco are actively competing in this market, offering a diverse range of server solutions tailored to the specific needs of Brazilian businesses and government agencies. The market is segmented by server type (rack, tower, blade), processing power, application, and end-user industry, offering ample opportunities for targeted market penetration.

The forecast period from 2025 to 2033 suggests a continuous upward trajectory for the Brazil servers market. While specific segmental breakdowns and regional data are unavailable, a logical estimation based on the overall CAGR and the influential factors mentioned previously suggests significant growth in both the enterprise and government sectors. The adoption of advanced server technologies like AI-optimized servers and high-density configurations is expected to drive premiumization within the market, increasing the average selling price and further contributing to revenue growth. Competition amongst the major players is likely to remain intense, prompting innovation and the introduction of cost-effective, high-performance server solutions to cater to the varying demands of Brazilian consumers. Monitoring macroeconomic conditions and government policies will be crucial in accurately forecasting the market's future performance.

Brazil Servers Market: Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Brazil servers market, covering market size, segmentation, key players, growth drivers, challenges, and future opportunities. The study period spans from 2019 to 2033, with 2025 as the base year and estimated year. The forecast period is 2025-2033, and the historical period encompasses 2019-2024. The report offers actionable insights for industry stakeholders, investors, and businesses operating or planning to enter the Brazilian server market.

Brazil Servers Market Concentration & Innovation

The Brazilian servers market exhibits a moderately concentrated landscape, with a few global giants holding significant market share. Hewlett Packard Enterprise, Dell Technologies, Lenovo, and Cisco collectively account for approximately xx% of the market in 2025. However, the presence of domestic players like Positivo Tecnologia indicates a degree of competition. Innovation is driven by the increasing demand for high-performance computing, cloud services, and AI applications. The regulatory framework, while generally supportive of technological advancements, requires attention to data privacy and security regulations. Product substitutes, such as cloud-based services, pose a competitive threat, especially for smaller players. End-user trends show a strong preference for energy-efficient and scalable solutions. M&A activity remains moderate, with deal values averaging xx Million in the past five years.

- Market Share (2025 Estimate):

- Hewlett Packard Enterprise: xx%

- Dell Technologies: xx%

- Lenovo: xx%

- Cisco: xx%

- Others: xx%

- Average M&A Deal Value (2020-2024): xx Million

Brazil Servers Market Industry Trends & Insights

The Brazilian servers market is experiencing robust growth, driven by the expanding digital economy, increasing government investments in ICT infrastructure, and the rising adoption of cloud computing and big data analytics. The CAGR for the period 2025-2033 is estimated at xx%. Technological disruptions, such as the rise of edge computing and AI, are reshaping the market landscape. Consumer preferences are shifting towards energy-efficient, scalable, and secure server solutions. The competitive dynamics are characterized by intense price competition and a focus on value-added services. Market penetration of cloud-based server solutions is expected to reach xx% by 2033, while on-premise servers will continue to dominate the market.

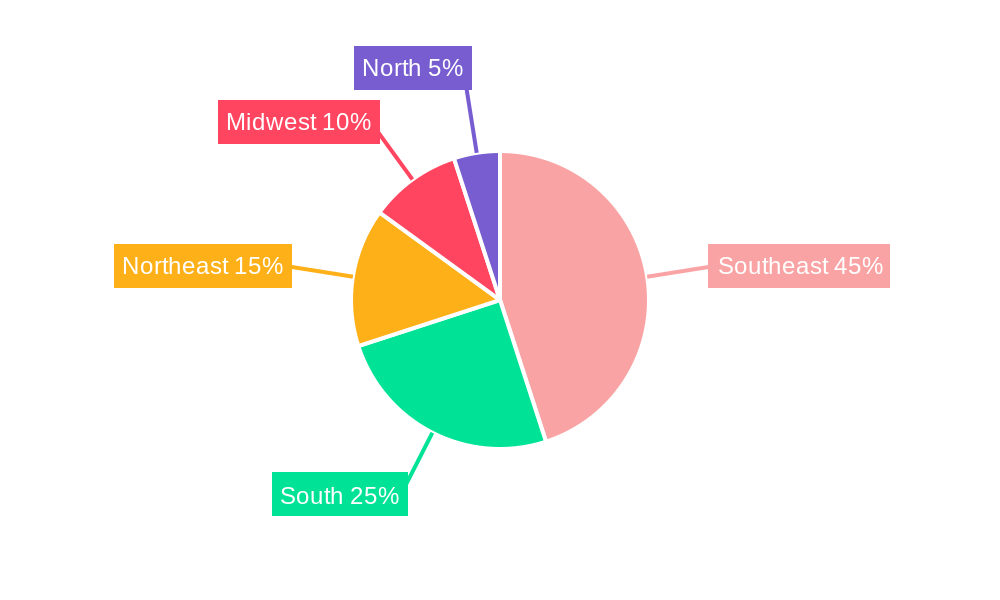

Dominant Markets & Segments in Brazil Servers Market

The southeastern region of Brazil, encompassing major cities like São Paulo and Rio de Janeiro, represents the most dominant market for servers due to its high concentration of businesses, advanced infrastructure, and significant IT investments.

- Key Drivers of Southeastern Dominance:

- Concentrated business activity and high IT spending

- Advanced digital infrastructure (broadband penetration, data centers)

- Supportive government policies promoting digital transformation

The enterprise segment, encompassing large corporations and government institutions, constitutes the largest market segment, followed by the small and medium-sized enterprises (SMEs) segment. The high demand for data storage and processing capacity in these segments is driving market growth.

Brazil Servers Market Product Developments

Recent product innovations focus on enhancing processing power, energy efficiency, and security features. The integration of AI and machine learning capabilities into server solutions is gaining traction. Key competitive advantages include superior performance, reliability, and cost-effectiveness. The market is witnessing a gradual shift towards rack-optimized and blade servers due to their space-saving and energy-efficient features.

Report Scope & Segmentation Analysis

This report segments the Brazil servers market based on server type (rack servers, blade servers, tower servers, etc.), end-user (enterprise, SME, government), and geography (Southeast, Northeast, South, etc.). Each segment's growth projections, market sizes, and competitive dynamics are analyzed. The enterprise segment is projected to grow at a CAGR of xx% during the forecast period, while the SME segment is anticipated to exhibit a CAGR of xx%. The geographical segmentation reflects the varying levels of IT development and infrastructure across different regions of Brazil.

Key Drivers of Brazil Servers Market Growth

Several factors fuel the growth of the Brazilian servers market:

- Rising digitalization: Increased internet penetration and the adoption of digital technologies are driving demand for robust server infrastructure.

- Government initiatives: Government investments in digital infrastructure and initiatives to promote digital transformation are boosting market growth.

- Expanding cloud computing adoption: Cloud computing is gaining significant traction, leading to increased demand for cloud-based servers.

Challenges in the Brazil Servers Market Sector

The Brazilian servers market faces several challenges:

- Economic volatility: Economic fluctuations can impact IT spending and hinder market growth.

- Infrastructure limitations: Limited access to reliable power and internet connectivity in certain regions can impede market expansion.

- High import tariffs: High import duties on server components can increase costs and reduce competitiveness.

Emerging Opportunities in Brazil Servers Market

Emerging opportunities include the growing adoption of edge computing and AI-powered solutions, as well as the expanding market for hyperscale data centers. The increasing demand for data security and cybersecurity services presents significant growth potential. The rise of 5G technology will further drive demand for advanced server infrastructure.

Leading Players in the Brazil Servers Market

- Hewlett Packard Enterprise Co

- Dell Technologies Inc

- Lenovo Group Limited

- Cisco Systems Inc

- Positivo Tecnologia S/A

- Oracle Corporation

- Super Micro Computer Inc

- IBM Corporation

- Fujitsu Limited

- Huawei Technologies Co Ltd

Key Developments in Brazil Servers Market Industry

- May 2024: IBM unveiled the IBM Power S1012 server, offering a 3X performance boost compared to its predecessor.

- October 2023: BWS IoT partnered with Emnify to scale IoT connections to one million devices by 2024.

Strategic Outlook for Brazil Servers Market

The Brazilian servers market is poised for continued growth, driven by technological advancements, government initiatives, and the expanding digital economy. Opportunities exist in cloud computing, edge computing, AI, and data security. Companies with strong technological capabilities, robust distribution networks, and a focus on customer service will be best positioned to succeed in this dynamic market.

Brazil Servers Market Segmentation

-

1. Operating System

- 1.1. Linux

- 1.2. Windows

- 1.3. UNIX

- 1.4. Other Operating Systems ((i5/OS, z/OS, etc.)

-

2. Server Class

- 2.1. High-end Server

- 2.2. Mid-range Server

- 2.3. Volume Server

-

3. Server Type

- 3.1. Blade

- 3.2. Multi-node

- 3.3. Tower

- 3.4. Rack Optimized

-

4. End-user Industry

- 4.1. IT and Telecommunications

- 4.2. BFSI

- 4.3. Manufacturing

- 4.4. Retail

- 4.5. Healthcare

- 4.6. Media and Entertainment

- 4.7. Other End-user Verticals

Brazil Servers Market Segmentation By Geography

- 1. Brazil

Brazil Servers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.41% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Surge of Fintech and Crypto Exchanges in Brazil; Application of AI and Big Data Analytics in the Healthcare Industry

- 3.3. Market Restrains

- 3.3.1. The Surge of Fintech and Crypto Exchanges in Brazil; Application of AI and Big Data Analytics in the Healthcare Industry

- 3.4. Market Trends

- 3.4.1. IT and Telecommunications Industry to Witness Major Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Servers Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Operating System

- 5.1.1. Linux

- 5.1.2. Windows

- 5.1.3. UNIX

- 5.1.4. Other Operating Systems ((i5/OS, z/OS, etc.)

- 5.2. Market Analysis, Insights and Forecast - by Server Class

- 5.2.1. High-end Server

- 5.2.2. Mid-range Server

- 5.2.3. Volume Server

- 5.3. Market Analysis, Insights and Forecast - by Server Type

- 5.3.1. Blade

- 5.3.2. Multi-node

- 5.3.3. Tower

- 5.3.4. Rack Optimized

- 5.4. Market Analysis, Insights and Forecast - by End-user Industry

- 5.4.1. IT and Telecommunications

- 5.4.2. BFSI

- 5.4.3. Manufacturing

- 5.4.4. Retail

- 5.4.5. Healthcare

- 5.4.6. Media and Entertainment

- 5.4.7. Other End-user Verticals

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Operating System

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Hewlett Packard Enterprise Co

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Dell Technologies Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Lenovo Group Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Cisco Systems Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Positivo Tecnologia S/A

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Oracle Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Super Micro Computer Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 IBM Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Fujitsu Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Huawei Technologies Co Ltd7 3 Import and Export Analysis in Brazi

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Hewlett Packard Enterprise Co

List of Figures

- Figure 1: Brazil Servers Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Brazil Servers Market Share (%) by Company 2024

List of Tables

- Table 1: Brazil Servers Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Brazil Servers Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Brazil Servers Market Revenue Million Forecast, by Operating System 2019 & 2032

- Table 4: Brazil Servers Market Volume Billion Forecast, by Operating System 2019 & 2032

- Table 5: Brazil Servers Market Revenue Million Forecast, by Server Class 2019 & 2032

- Table 6: Brazil Servers Market Volume Billion Forecast, by Server Class 2019 & 2032

- Table 7: Brazil Servers Market Revenue Million Forecast, by Server Type 2019 & 2032

- Table 8: Brazil Servers Market Volume Billion Forecast, by Server Type 2019 & 2032

- Table 9: Brazil Servers Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 10: Brazil Servers Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 11: Brazil Servers Market Revenue Million Forecast, by Region 2019 & 2032

- Table 12: Brazil Servers Market Volume Billion Forecast, by Region 2019 & 2032

- Table 13: Brazil Servers Market Revenue Million Forecast, by Operating System 2019 & 2032

- Table 14: Brazil Servers Market Volume Billion Forecast, by Operating System 2019 & 2032

- Table 15: Brazil Servers Market Revenue Million Forecast, by Server Class 2019 & 2032

- Table 16: Brazil Servers Market Volume Billion Forecast, by Server Class 2019 & 2032

- Table 17: Brazil Servers Market Revenue Million Forecast, by Server Type 2019 & 2032

- Table 18: Brazil Servers Market Volume Billion Forecast, by Server Type 2019 & 2032

- Table 19: Brazil Servers Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 20: Brazil Servers Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 21: Brazil Servers Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Brazil Servers Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Servers Market?

The projected CAGR is approximately 8.41%.

2. Which companies are prominent players in the Brazil Servers Market?

Key companies in the market include Hewlett Packard Enterprise Co, Dell Technologies Inc, Lenovo Group Limited, Cisco Systems Inc, Positivo Tecnologia S/A, Oracle Corporation, Super Micro Computer Inc, IBM Corporation, Fujitsu Limited, Huawei Technologies Co Ltd7 3 Import and Export Analysis in Brazi.

3. What are the main segments of the Brazil Servers Market?

The market segments include Operating System, Server Class, Server Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.05 Million as of 2022.

5. What are some drivers contributing to market growth?

The Surge of Fintech and Crypto Exchanges in Brazil; Application of AI and Big Data Analytics in the Healthcare Industry.

6. What are the notable trends driving market growth?

IT and Telecommunications Industry to Witness Major Growth.

7. Are there any restraints impacting market growth?

The Surge of Fintech and Crypto Exchanges in Brazil; Application of AI and Big Data Analytics in the Healthcare Industry.

8. Can you provide examples of recent developments in the market?

May 2024: IBM unveiled its latest addition to its server lineup, the IBM Power S1012. This new system, powered by the cutting-edge Power10 processor, boasts a 1-socket, half-wide design. It is a performance powerhouse, offering a remarkable 3X boost in performance per core compared to its predecessor, the Power S812. This enhancement amplifies AI workloads and seamlessly extends its reach from the core to the cloud and even the edge, promising heightened business value across diverse industries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Servers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Servers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Servers Market?

To stay informed about further developments, trends, and reports in the Brazil Servers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence