Key Insights

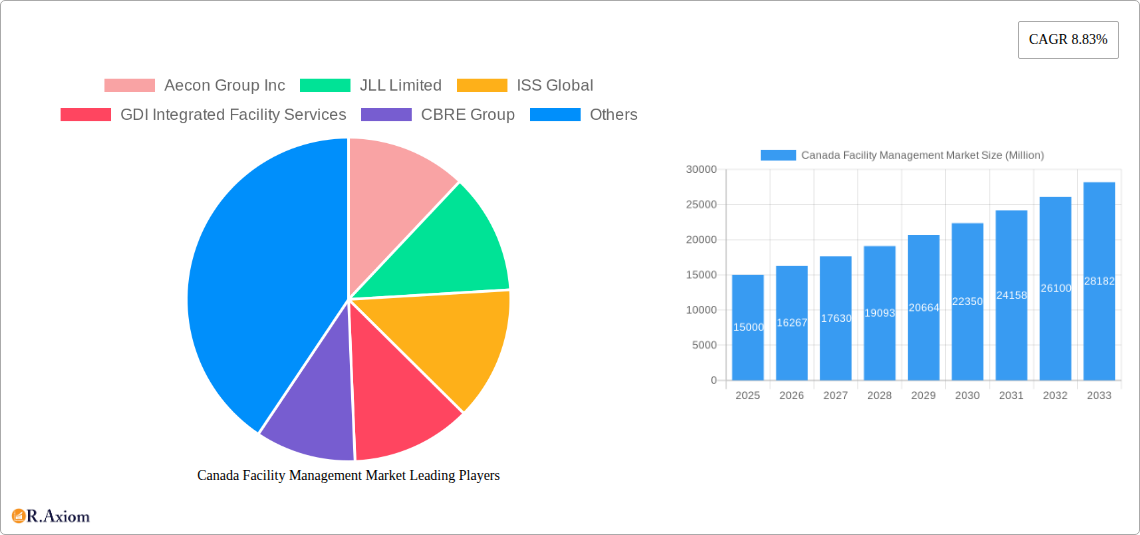

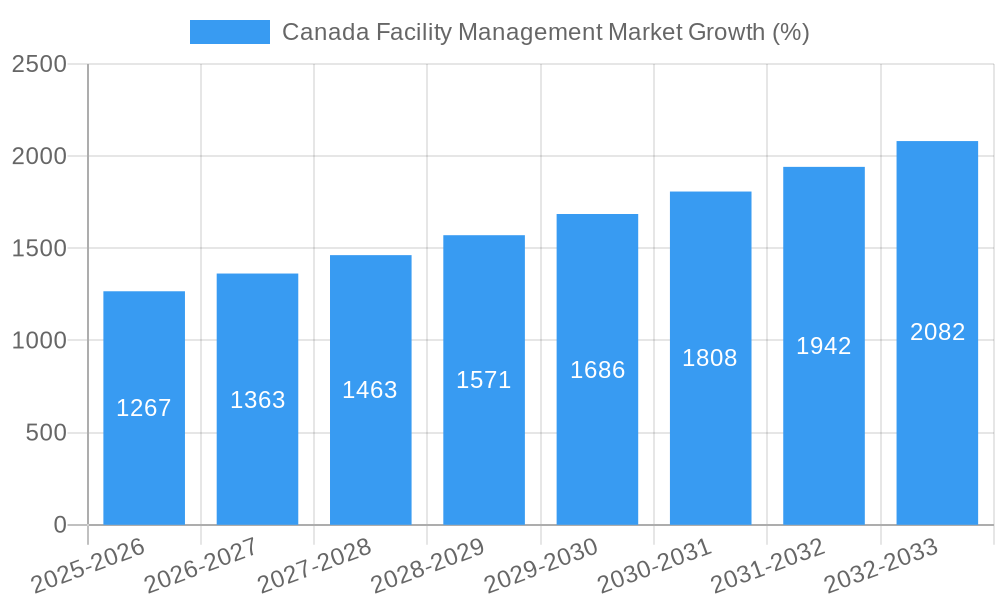

The Canadian Facility Management (FM) market, valued at approximately $XX million in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 8.83% from 2025 to 2033. This expansion is driven by several key factors. The increasing adoption of sustainable building practices and the growing demand for energy-efficient solutions are significantly boosting market demand. Furthermore, the rising complexity of building operations and the need for specialized expertise in areas like security, maintenance, and technology integration are compelling businesses and institutions to outsource FM services. The commercial sector currently dominates the market, followed by institutional and public/infrastructure segments, which are experiencing accelerated growth driven by government investments in infrastructure upgrades and modernization initiatives. The shift towards outsourced facility management is prominent, fuelled by cost optimization and access to specialized skill sets. This trend is particularly noticeable amongst larger organizations prioritizing efficiency and compliance. However, challenges remain, including finding and retaining skilled labor, managing rising energy costs, and complying with evolving environmental regulations.

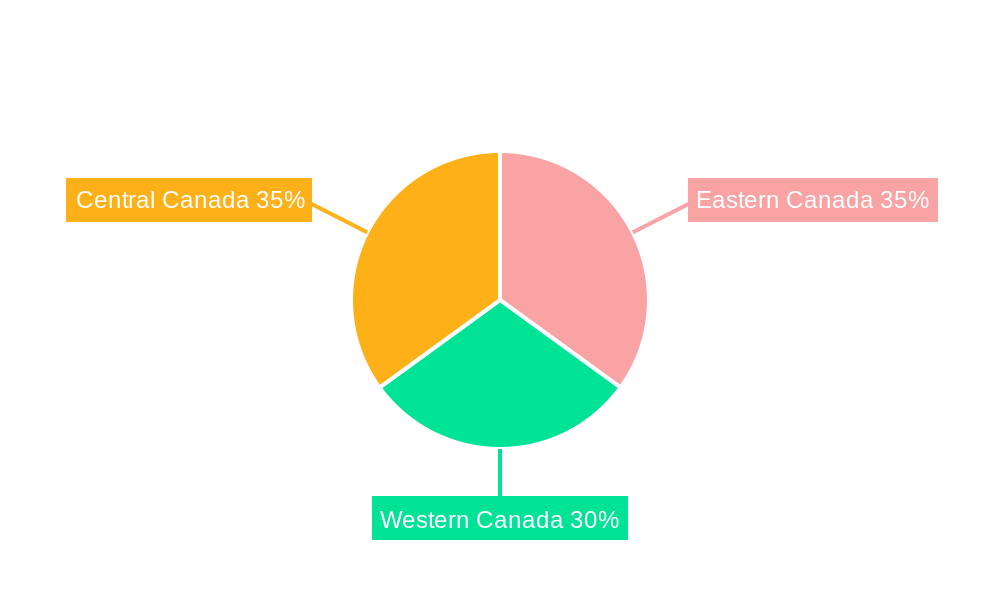

The segmentation of the Canadian FM market reveals further opportunities. Hard FM, encompassing building maintenance and repairs, commands a significant market share, while the Soft FM segment, incorporating services like catering, cleaning, and security, is witnessing rapid growth due to increased focus on workplace experience and employee well-being. Geographically, the market shows variations across Eastern, Western, and Central Canada, primarily influenced by regional economic conditions and infrastructure development projects. Key players such as Aecon Group Inc, JLL Limited, and ISS Global are actively competing and consolidating their presence through acquisitions and service expansions. The forecast period of 2025-2033 is expected to witness sustained market growth fueled by continued infrastructural investments and a growing emphasis on effective facility management strategies across all sectors in Canada.

Canada Facility Management Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Canada Facility Management Market, covering the period from 2019 to 2033. It offers actionable insights for industry stakeholders, investors, and businesses seeking to understand the market's dynamics, growth potential, and competitive landscape. The report leverages extensive data analysis and expert insights to offer a clear picture of current trends and future projections. The market size is valued at XX Million in 2025 and is projected to reach XX Million by 2033, exhibiting a CAGR of XX% during the forecast period (2025-2033).

Canada Facility Management Market Market Concentration & Innovation

The Canadian facility management market exhibits a moderately concentrated structure with several large multinational players and a significant number of smaller regional providers. Key players, including Aecon Group Inc, JLL Limited, ISS Global, GDI Integrated Facility Services, CBRE Group, Brookfield Global Integrated Solutions Canada LP, Cushman and Wakefield, ION Facility Services Inc, Black & McDonald, Ingersoll Rand (Trane), and Avison Young (Canada) Inc, hold significant market share, although precise figures are proprietary. Market share varies across segments (Hard FM, Soft FM, etc.), with some players dominating specific niches.

Innovation in the sector is driven by advancements in building automation systems (BAS), IoT integration, AI-powered predictive maintenance, and sustainable facility management practices. Stringent environmental regulations and growing corporate social responsibility (CSR) initiatives are further accelerating the adoption of green technologies. The regulatory framework, while generally supportive of sustainable practices, also places certain compliance burdens on facility managers. Product substitution is primarily driven by the availability of more efficient and cost-effective technologies. Mergers and acquisitions (M&A) activity is relatively high, as evidenced by the Dexterra Group Inc. acquisition of TRICOM Facility Services in 2022 (value not disclosed). These activities lead to increased market consolidation and expansion of service offerings.

Canada Facility Management Market Industry Trends & Insights

The Canadian facility management market is experiencing robust growth, fueled by several key trends. The increasing adoption of smart building technologies and digitalization, coupled with a rising demand for outsourced facility management services, is driving market expansion. The commercial sector remains a dominant end-user, driven by the need for efficient and cost-effective building operations, particularly in large office complexes and shopping malls. However, growth is also observed across institutional, public/infrastructure, and industrial sectors, reflecting the growing focus on optimized asset management and improved building performance across diverse applications. The preference for integrated facility management (IFM) solutions, which combine hard and soft FM services, is also on the rise. Competitive dynamics are intense, with major players competing on price, service quality, technological capabilities, and sustainability credentials. The market is witnessing a shift towards value-based contracts and performance-based agreements, emphasizing outcomes rather than solely on inputs. The overall market penetration of outsourced facility management services continues to grow, reflecting the increasing awareness of cost and efficiency benefits.

Dominant Markets & Segments in Canada Facility Management Market

Leading Region/Segment: The Ontario region dominates the market due to the concentration of commercial and industrial activities, followed by British Columbia and Quebec. Within segments, Outsourced Facility Management holds a larger share compared to In-house Facility Management due to cost savings and access to specialized expertise. The Commercial sector represents the largest end-user segment, driven by substantial investment in office buildings and commercial real estate.

Key Drivers:

- Economic Growth: Strong economic growth in major Canadian cities fuels demand for office space and industrial facilities.

- Infrastructure Development: Government investments in public infrastructure projects create opportunities for facility management services.

- Technological Advancements: Adoption of smart building technologies and digital solutions increases efficiency and optimizes operations.

- Sustainability Concerns: Growing focus on green buildings and environmental sustainability boosts demand for sustainable facility management practices.

The dominance of specific segments is further influenced by factors such as urbanization, government policies favoring sustainable infrastructure, and the increasing adoption of technology. The market is characterized by regional variations in growth rates, reflecting economic conditions and infrastructural development in different parts of Canada.

Canada Facility Management Market Product Developments

Recent product innovations focus on enhancing energy efficiency, integrating smart building technologies, and improving data analytics for predictive maintenance. For instance, the adoption of IoT sensors and AI-powered platforms enables real-time monitoring of building systems, leading to proactive maintenance and reduced operational costs. These innovations provide competitive advantages by increasing operational efficiency, reducing energy consumption, and enhancing the overall occupant experience. Market fit for these technologies is strong, as stakeholders are increasingly recognizing the value proposition of integrated and data-driven facility management solutions.

Report Scope & Segmentation Analysis

This report segments the Canadian facility management market based on:

Offering Type:

- Hard FM: Includes building maintenance, repairs, and operational services. Growth is projected at xx% CAGR, driven by increasing demand for reliable and efficient infrastructure support.

- Soft FM: Includes administrative and support services such as cleaning, security, and catering. Growth is projected at xx% CAGR due to focus on improving workplace environments and efficiency.

End-User:

- Commercial: Largest segment, driven by high concentration of office buildings and retail spaces. Projected growth is at xx% CAGR.

- Institutional: Includes educational institutions and healthcare facilities, exhibiting moderate growth at xx% CAGR.

- Public/Infrastructure: Growing sector due to government investments in infrastructure development, projected at xx% CAGR.

- Industrial: Includes manufacturing and logistics facilities, with growth projected at xx% CAGR.

- Other End-Users: Includes residential and mixed-use developments, demonstrating steady growth.

Facility Management Type:

- In-house Facility Management: This segment displays steady growth as organizations maintain some internal control over their facilities, exhibiting a xx% CAGR.

- Outsourced Facility Management: Larger and faster-growing segment driven by cost optimization and specialized expertise, projected at xx% CAGR.

Competitive dynamics vary across segments, with some players specializing in particular niches and others offering comprehensive solutions across multiple segments.

Key Drivers of Canada Facility Management Market Growth

The Canadian facility management market growth is driven by several factors. Technological advancements, including the adoption of smart building technologies, IoT, and AI-powered analytics, significantly contribute to improved efficiency and reduced costs. Furthermore, the increasing emphasis on sustainability, with governmental initiatives and corporate social responsibility initiatives promoting green buildings, fuels the demand for sustainable facility management practices. Robust economic growth in major Canadian cities, particularly in sectors like commercial real estate and manufacturing, contributes to a healthy demand for facility management services. Finally, government investments in large-scale infrastructure projects create substantial opportunities for growth in the public sector.

Challenges in the Canada Facility Management Market Sector

The Canadian facility management market faces certain challenges. Skilled labor shortages in specific trades and professions pose a significant hurdle, affecting service delivery and operational efficiency. Fluctuations in commodity prices and supply chain disruptions impact operational costs and affect profitability. Intense competition among numerous providers necessitates the adoption of innovative strategies and value-added services to maintain a competitive edge. Regulatory compliance requirements, while promoting sustainability, also add to operational complexity and potential costs. These challenges contribute to overall market uncertainty and could potentially hinder growth trajectories.

Emerging Opportunities in Canada Facility Management Market

Several emerging opportunities exist in the Canadian facility management market. The adoption of integrated facility management (IFM) solutions offers a pathway to greater operational efficiency and cost optimization. The increasing demand for sustainable building operations creates opportunities for providers offering green solutions and related services. The rising adoption of smart building technologies and data analytics can improve maintenance and energy management, opening new service avenues. Furthermore, expanding into underserved markets or geographic regions can offer growth potential. These opportunities present avenues for market expansion and enhanced profitability for established players and new entrants alike.

Leading Players in the Canada Facility Management Market Market

- Aecon Group Inc

- JLL Limited

- ISS Global

- GDI Integrated Facility Services

- CBRE Group

- Brookfield Global Integrated Solutions Canada LP

- Cushman and Wakefield

- ION Facility Services Inc

- Black & McDonald

- Ingersoll Rand (Trane)

- Avison Young (Canada) Inc

Key Developments in Canada Facility Management Market Industry

February 2022: Dexterra Group Inc. acquired TRICOM Facility Services, expanding its reach in contract janitorial and building maintenance services across major Canadian centers. This acquisition signifies consolidation within the market.

June 2021: Public Services and Procurement Canada (PSPC) renewed its contract for facility management at the Canadian High Arctic Research Station (CHARS), highlighting the importance of specialized services in niche sectors. This showcases the demand for comprehensive facility management in specialized environments.

Strategic Outlook for Canada Facility Management Market Market

The Canadian facility management market presents a compelling outlook for future growth. The continued adoption of smart technologies, increasing focus on sustainability, and strong economic growth in key sectors suggest significant market expansion potential. The demand for outsourced facility management services is also expected to increase, creating further opportunities for providers offering comprehensive and value-added solutions. Strategic investments in technology, talent development, and sustainable practices will be critical for success in this dynamic and evolving market.

Canada Facility Management Market Segmentation

-

1. Facility Management

- 1.1. In-house Facility Management

-

1.2. Outsourced Facility Management

- 1.2.1. Single FM

- 1.2.2. Bundled FM

- 1.2.3. Integrated FM

-

2. Offering Type

- 2.1. Hard FM

- 2.2. Soft FM

-

3. End-User

- 3.1. Commercial

- 3.2. Institutional

- 3.3. Public/Infrastructure

- 3.4. Industrial

- 3.5. Other End-Users

Canada Facility Management Market Segmentation By Geography

- 1. Canada

Canada Facility Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.83% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Trend Toward Commoditization of FM; Renewed Emphasis on Workplace Optimization and Co-living Spaces

- 3.3. Market Restrains

- 3.3.1. Growing Competition Expected to Impact Profit Margins of Existing Vendors

- 3.4. Market Trends

- 3.4.1. Outsourced Facility Management to Show Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Facility Management

- 5.1.1. In-house Facility Management

- 5.1.2. Outsourced Facility Management

- 5.1.2.1. Single FM

- 5.1.2.2. Bundled FM

- 5.1.2.3. Integrated FM

- 5.2. Market Analysis, Insights and Forecast - by Offering Type

- 5.2.1. Hard FM

- 5.2.2. Soft FM

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Commercial

- 5.3.2. Institutional

- 5.3.3. Public/Infrastructure

- 5.3.4. Industrial

- 5.3.5. Other End-Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Facility Management

- 6. Eastern Canada Canada Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 7. Western Canada Canada Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 8. Central Canada Canada Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Aecon Group Inc

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 JLL Limited

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 ISS Global

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 GDI Integrated Facility Services

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 CBRE Group

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Brookfield Global Integrated Solutions Canada LP

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Cushman and Wakefield

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 ION Facility Services Inc

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Black & McDonald

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Ingersoll Rand (Trane)

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 Avison Young (Canada) Inc

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.1 Aecon Group Inc

List of Figures

- Figure 1: Canada Facility Management Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Canada Facility Management Market Share (%) by Company 2024

List of Tables

- Table 1: Canada Facility Management Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Canada Facility Management Market Revenue Million Forecast, by Facility Management 2019 & 2032

- Table 3: Canada Facility Management Market Revenue Million Forecast, by Offering Type 2019 & 2032

- Table 4: Canada Facility Management Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 5: Canada Facility Management Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Canada Facility Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Eastern Canada Canada Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Western Canada Canada Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Central Canada Canada Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Canada Facility Management Market Revenue Million Forecast, by Facility Management 2019 & 2032

- Table 11: Canada Facility Management Market Revenue Million Forecast, by Offering Type 2019 & 2032

- Table 12: Canada Facility Management Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 13: Canada Facility Management Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Facility Management Market?

The projected CAGR is approximately 8.83%.

2. Which companies are prominent players in the Canada Facility Management Market?

Key companies in the market include Aecon Group Inc, JLL Limited, ISS Global, GDI Integrated Facility Services, CBRE Group, Brookfield Global Integrated Solutions Canada LP, Cushman and Wakefield, ION Facility Services Inc, Black & McDonald, Ingersoll Rand (Trane), Avison Young (Canada) Inc.

3. What are the main segments of the Canada Facility Management Market?

The market segments include Facility Management, Offering Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Trend Toward Commoditization of FM; Renewed Emphasis on Workplace Optimization and Co-living Spaces.

6. What are the notable trends driving market growth?

Outsourced Facility Management to Show Significant Growth.

7. Are there any restraints impacting market growth?

Growing Competition Expected to Impact Profit Margins of Existing Vendors.

8. Can you provide examples of recent developments in the market?

February 2022 - Dexterra Group Inc. announced the acquisition of a privately owned TRICOM Facility Services group of companies that delivers contract janitorial and associated building maintenance services and supplies custodial equipment and consumables to clients in major centers across Canada.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Facility Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Facility Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Facility Management Market?

To stay informed about further developments, trends, and reports in the Canada Facility Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence