Key Insights

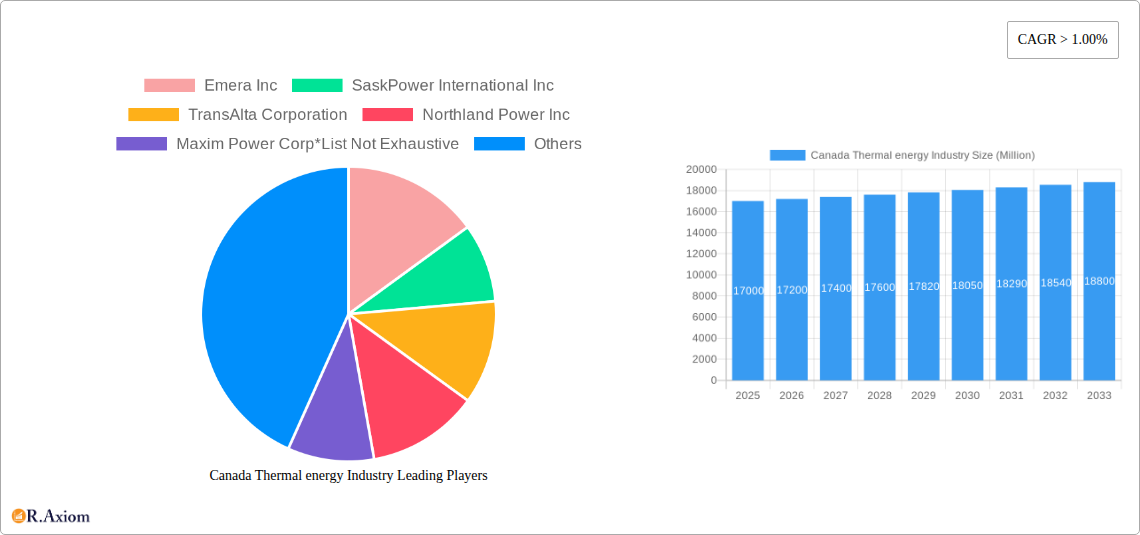

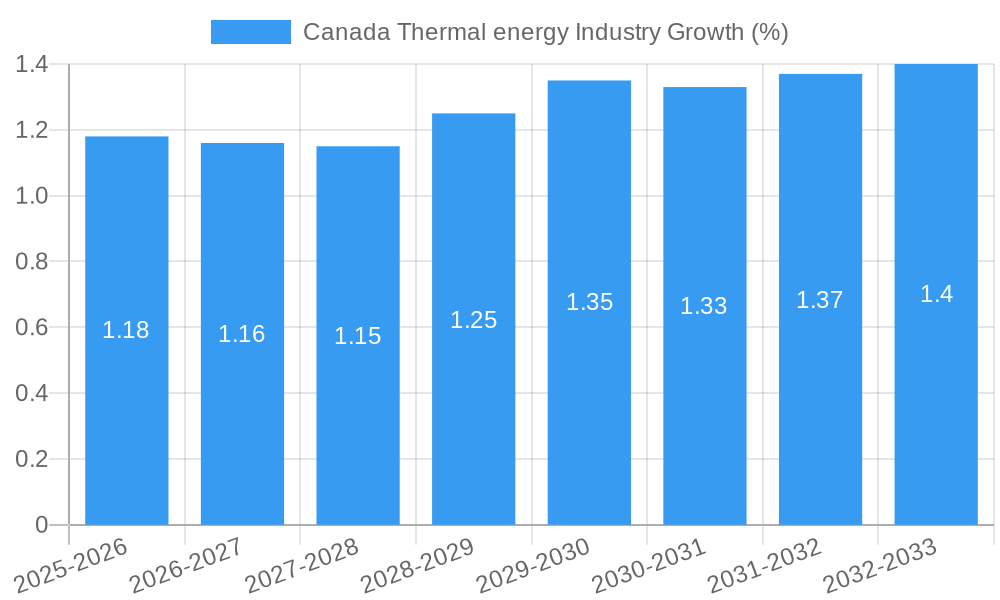

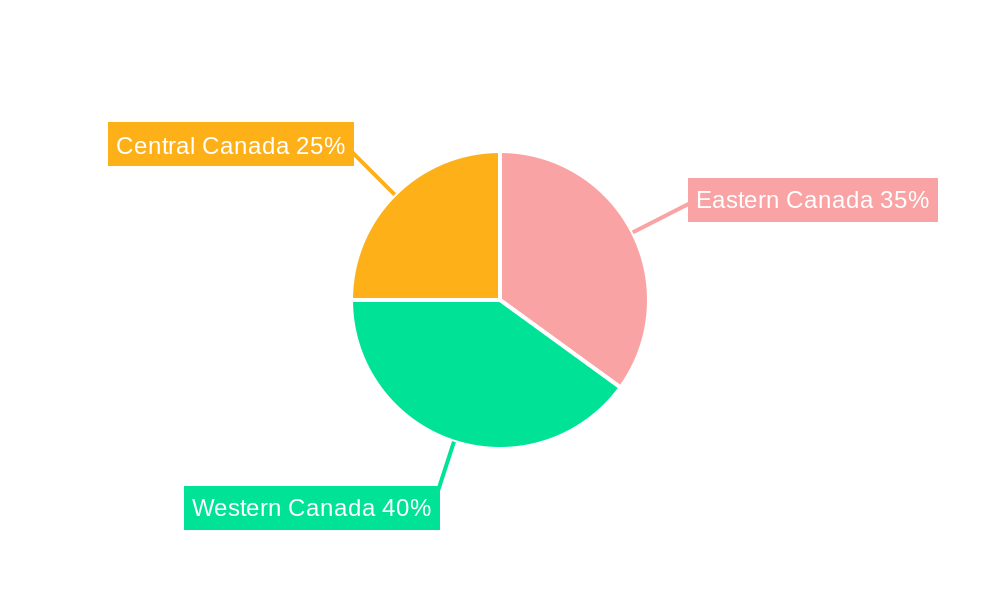

The Canadian thermal energy industry, encompassing sources like oil, natural gas, nuclear, and coal, presents a dynamic market landscape projected for significant growth over the next decade. While precise market sizing for 2025 is unavailable, a reasonable estimation, considering a CAGR of over 1% and a multi-billion dollar market size (XX million) indicates a 2025 market valuation in the range of $15-20 billion CAD. This growth is fueled by increasing energy demands driven by industrial expansion, population growth, and robust economic activity across Canada's diverse regions (Eastern, Western, and Central Canada). The industry's evolution is significantly influenced by government policies promoting energy diversification, investments in upgrading existing infrastructure, and a growing focus on carbon capture and storage technologies to mitigate environmental concerns. However, challenges such as fluctuating fuel prices, stringent environmental regulations increasingly restricting the use of coal, and the competitive pressure from renewable energy sources pose potential restraints. The sector's segmentation, with significant players like Emera Inc, SaskPower International Inc, and Ontario Power Generation Inc., highlights a competitive environment with opportunities for strategic mergers, acquisitions, and technological advancements.

The forecast period (2025-2033) suggests a continuation of growth, though at a potentially moderated pace compared to previous years. As Canada transitions towards a cleaner energy mix, the thermal energy sector is likely to see a shift in its composition, with a decreased reliance on coal and a possible increase in natural gas usage, alongside investments in carbon capture technologies. This transition will significantly impact the market's structure and the strategies employed by major players. Regional variations in energy consumption patterns and regulatory frameworks will continue to influence investment decisions and market dynamics across Eastern, Western, and Central Canada. The industry will experience continued pressure to increase efficiency, reduce emissions, and adapt to a changing regulatory landscape.

Canada Thermal Energy Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Canadian thermal energy industry, covering market trends, key players, and future growth prospects from 2019 to 2033. The study period spans from 2019-2024 (Historical Period), with 2025 as the base and estimated year, and forecasts extending to 2033 (Forecast Period). This report is essential for industry stakeholders, investors, and policymakers seeking a clear understanding of this dynamic sector.

Canada Thermal energy Industry Market Concentration & Innovation

This section analyzes the market concentration, innovation landscape, regulatory environment, and competitive dynamics within the Canadian thermal energy sector. The industry exhibits a moderately concentrated structure, with several major players holding significant market share. However, the emergence of smaller, innovative companies, particularly in the SMR sector, is increasing competition.

Market Share: Emera Inc., SaskPower International Inc., TransAlta Corporation, and Ontario Power Generation Inc. collectively hold an estimated xx% market share in 2025, based on xx Million in revenue. Precise figures are unavailable due to varied reporting methodologies.

M&A Activity: The past five years have witnessed a moderate level of M&A activity, primarily driven by consolidation amongst smaller players and expansion into renewable energy sources. Total M&A deal value is estimated at xx Million for the period 2019-2024.

Innovation Drivers: Government incentives for clean energy technologies, increasing carbon regulations, and the growing demand for reliable energy sources are pushing innovation within the sector. Significant investments in R&D are focused on small modular reactors (SMRs) and improved energy efficiency.

Regulatory Framework: Federal and provincial regulations significantly influence the industry, impacting fuel sourcing, emission standards, and grid integration. The regulatory landscape is continuously evolving, necessitating continuous adaptation by market players.

Product Substitutes: Renewable energy sources, such as wind, solar, and hydro, pose the most significant competitive threat. However, thermal energy remains crucial for baseload power and certain industrial processes.

End-User Trends: A growing focus on sustainability and decarbonization is driving demand for cleaner thermal energy solutions. Industrial users are increasingly seeking energy-efficient technologies to reduce operational costs and environmental impact.

Canada Thermal energy Industry Industry Trends & Insights

The Canadian thermal energy market is undergoing significant transformation driven by a combination of factors. The overall market size is expected to reach xx Million by 2033. This growth is fueled by several key trends:

- Market Growth Drivers: Increased energy demand from industrialization and population growth, coupled with government policies promoting energy security and diversification, are driving market expansion.

- Technological Disruptions: The development and deployment of SMR technologies represent a significant technological disruption, offering a cleaner and potentially more cost-effective alternative to traditional thermal energy sources.

- Consumer Preferences: Growing consumer awareness of environmental issues is increasingly influencing energy choices, prompting a shift toward cleaner and more sustainable energy options.

- Competitive Dynamics: Increased competition, especially from renewable energy providers, is pushing companies to innovate, improve efficiency, and reduce their environmental footprint. The compound annual growth rate (CAGR) for the forecast period (2025-2033) is projected at xx%. Market penetration of SMRs is anticipated to reach xx% by 2033.

Dominant Markets & Segments in Canada Thermal energy Industry

The Canadian thermal energy market is geographically diverse, with varying levels of reliance on different energy sources across provinces. Natural gas currently dominates the market, driven by its abundance and relative affordability.

Natural Gas: This segment holds the largest market share, benefiting from extensive pipeline infrastructure and relatively low production costs. Key drivers include abundant reserves, established distribution networks, and government support for natural gas infrastructure development.

Nuclear: Nuclear power generation plays a significant role, especially in Ontario. The upcoming deployment of SMRs is expected to further solidify this segment's position. Key drivers are the high energy output per unit, low greenhouse gas emissions, and ongoing government support for nuclear research and development.

Coal: The coal segment is declining due to stricter environmental regulations and a shift towards cleaner energy sources. Key challenges include high carbon emissions, increasing environmental concerns, and phasing out of coal-fired power plants.

Oil: This segment primarily fuels industrial processes and has limited use in electricity generation. Key drivers include the existing oil sands infrastructure and industrial demand, while challenges include sustainability concerns and volatile oil prices.

Canada Thermal energy Industry Product Developments

Significant product developments are focused on improving the efficiency and reducing the environmental impact of thermal energy generation. This includes advancements in combustion technologies, carbon capture and storage (CCS) systems, and the development of SMRs. These innovations are aimed at meeting stricter environmental regulations and enhancing the competitiveness of thermal energy in a rapidly evolving energy landscape. The emphasis is on reducing emissions, increasing energy efficiency, and ensuring reliable and cost-effective energy supply.

Report Scope & Segmentation Analysis

This report segments the Canadian thermal energy market by energy source: Oil, Natural Gas, Nuclear, and Coal. Each segment is analyzed based on capacity, generation, market size, and future growth projections. The competitive dynamics within each segment are also explored.

Oil: This segment is expected to maintain a relatively stable size in the forecast period, with limited growth due to the shift towards cleaner energy sources. Competition is primarily among existing players in the oil and gas sector.

Natural Gas: This segment is projected to experience moderate growth, driven by increased demand for electricity generation and industrial applications. Competition is intensifying with the rise of renewable energy sources.

Nuclear: This segment is anticipated to show significant growth, primarily driven by the development and deployment of SMR technologies. Competition will increase with more SMR projects coming online.

Coal: This segment is anticipated to decline significantly due to environmental regulations and the transition to cleaner energy sources. Competition is limited, with existing coal-fired power plants gradually being phased out.

Key Drivers of Canada Thermal energy Industry Growth

Several factors drive growth in the Canadian thermal energy industry: increasing energy demand from a growing population and industrial sector; government policies supporting energy security and diversification; and technological advancements in efficiency and cleaner energy technologies (including SMRs). Further, infrastructure development and investment in existing thermal generation facilities contribute to growth.

Challenges in the Canada Thermal energy Industry Sector

The industry faces significant challenges, including stringent environmental regulations increasing operational costs; supply chain disruptions impacting the availability and cost of fuel and equipment; and intense competition from renewable energy sources. These factors can lead to reduced profitability and hinder market expansion. The carbon tax and other environmental regulations place significant financial burdens on thermal energy producers.

Emerging Opportunities in Canada Thermal energy Industry

The Canadian thermal energy industry presents several opportunities, notably the development and deployment of SMRs; integration of carbon capture and storage (CCS) technologies; and exploration of innovative energy storage solutions. These advancements create potential for sustainable growth and improved energy efficiency in the years to come. Moreover, the potential for exporting SMR technology represents a major growth opportunity.

Leading Players in the Canada Thermal energy Industry Market

- Emera Inc.

- SaskPower International Inc.

- TransAlta Corporation

- Northland Power Inc.

- Maxim Power Corp

- Ontario Power Generation Inc

- Atco Power Ltd

Key Developments in Canada Thermal energy Industry Industry

October 2022: The Canada Infrastructure Bank (CIB) committed USD 721 Million to the development and construction of Canada's first SMR (300 MW), signifying a major investment in SMR technology and positioning Canada as a global hub.

January 2023: X-energy Canada and Invest Alberta signed a memorandum of understanding to explore the deployment of Xe-100 SMRs, potentially supporting heavy industries like oil sands operations. This signifies further progress in SMR development and the pursuit of clean energy solutions for heavy industries.

Strategic Outlook for Canada Thermal energy Industry Market

The Canadian thermal energy industry is poised for continued growth, albeit with a significant focus on decarbonization and sustainability. The deployment of SMR technology presents a pivotal opportunity for cleaner and more efficient thermal energy production. Government policies supporting clean energy, combined with technological advancements, will shape the industry's future trajectory. Continued investment in research and development, alongside infrastructure upgrades, will be crucial for maintaining competitiveness and ensuring a reliable energy supply for years to come.

Canada Thermal energy Industry Segmentation

-

1. Source

- 1.1. Oil

- 1.2. Natural Gas

- 1.3. Nuclear

- 1.4. Coal

Canada Thermal energy Industry Segmentation By Geography

- 1. Canada

Canada Thermal energy Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 1.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Renewables Capacity in Thailand4.; Rising Modernization of Existing Transmission and Distribution Infrastructure

- 3.3. Market Restrains

- 3.3.1. 4.; Huge Capital Expenditure Required for Carrying out Modernization of Existing Facilities

- 3.4. Market Trends

- 3.4.1. Natural Gas Based Thermal Power to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Thermal energy Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. Oil

- 5.1.2. Natural Gas

- 5.1.3. Nuclear

- 5.1.4. Coal

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. Eastern Canada Canada Thermal energy Industry Analysis, Insights and Forecast, 2019-2031

- 7. Western Canada Canada Thermal energy Industry Analysis, Insights and Forecast, 2019-2031

- 8. Central Canada Canada Thermal energy Industry Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Emera Inc

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 SaskPower International Inc

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 TransAlta Corporation

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Northland Power Inc

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Maxim Power Corp*List Not Exhaustive

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Ontario Power Generation Inc

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Atco Power Ltd

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.1 Emera Inc

List of Figures

- Figure 1: Canada Thermal energy Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Canada Thermal energy Industry Share (%) by Company 2024

List of Tables

- Table 1: Canada Thermal energy Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Canada Thermal energy Industry Revenue Million Forecast, by Source 2019 & 2032

- Table 3: Canada Thermal energy Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Canada Thermal energy Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Eastern Canada Canada Thermal energy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Western Canada Canada Thermal energy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Central Canada Canada Thermal energy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Thermal energy Industry Revenue Million Forecast, by Source 2019 & 2032

- Table 9: Canada Thermal energy Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Thermal energy Industry?

The projected CAGR is approximately > 1.00%.

2. Which companies are prominent players in the Canada Thermal energy Industry?

Key companies in the market include Emera Inc, SaskPower International Inc, TransAlta Corporation, Northland Power Inc, Maxim Power Corp*List Not Exhaustive, Ontario Power Generation Inc, Atco Power Ltd.

3. What are the main segments of the Canada Thermal energy Industry?

The market segments include Source.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Renewables Capacity in Thailand4.; Rising Modernization of Existing Transmission and Distribution Infrastructure.

6. What are the notable trends driving market growth?

Natural Gas Based Thermal Power to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Huge Capital Expenditure Required for Carrying out Modernization of Existing Facilities.

8. Can you provide examples of recent developments in the market?

January 2023: X-energy Canada and Invest Alberta signed a memorandum of understanding to find ways for the Xe-small modular reactor ("SMR") to be used in Canada without hurting the economy.Xe-100 is a high-temperature gas-cooled reactor. This clean energy solution would support heavy industries, including oil sand operations, petrochemicals, and other industrial processes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Thermal energy Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Thermal energy Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Thermal energy Industry?

To stay informed about further developments, trends, and reports in the Canada Thermal energy Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence