Key Insights

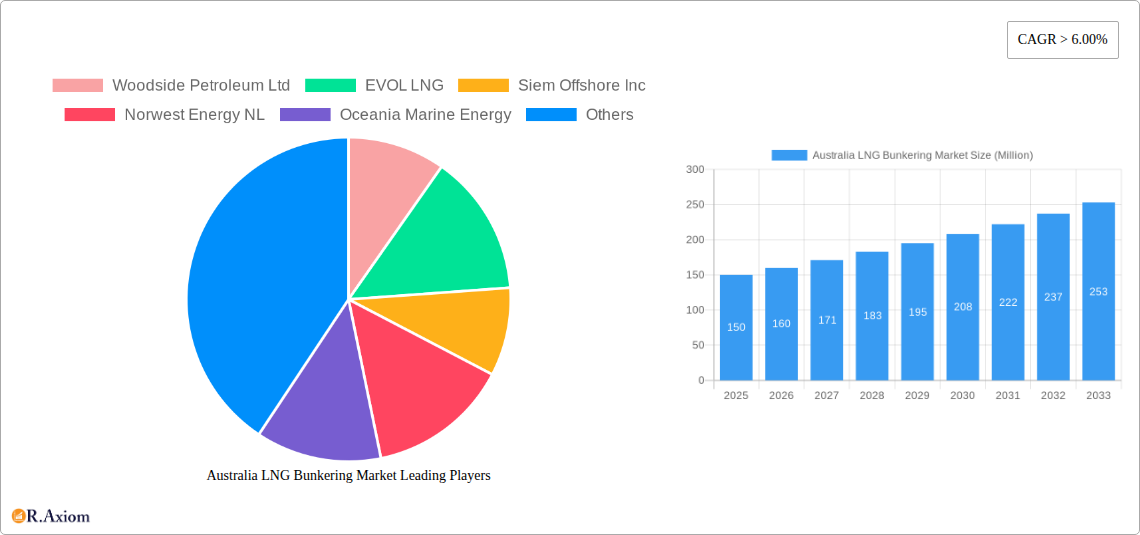

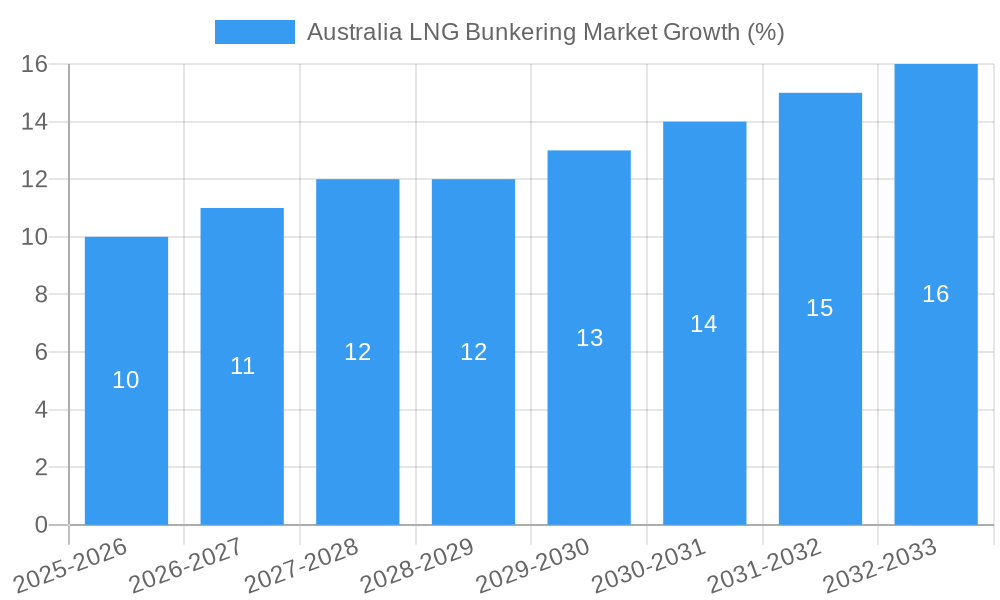

The Australian LNG bunkering market is experiencing robust growth, fueled by increasing demand for cleaner marine fuels and supportive government policies aimed at decarbonizing the maritime sector. With a Compound Annual Growth Rate (CAGR) exceeding 6% from 2019 to 2033, the market is projected to reach significant value within the forecast period. Several key drivers are propelling this expansion: the growing adoption of LNG as a lower-emission alternative to traditional marine fuels, the expansion of LNG infrastructure in Australian ports, and the increasing number of LNG-fueled vessels operating in the region. The market segmentation reveals a dynamic landscape with varying growth trajectories across different vessel types. While large-scale LNG bunkering currently dominates due to existing infrastructure and vessel sizes, the medium and small-scale segments are expected to witness significant growth driven by technological advancements in LNG storage and handling. Furthermore, the growing LNG bunkering activities are stimulating investment in related sectors, such as the construction and operation of LNG bunkering vessels and onshore LNG storage facilities. Leading players like Woodside Petroleum Ltd and EVOL LNG are actively shaping the market landscape, leading innovation, and establishing a strong foothold.

The market's growth, however, is subject to certain constraints. These include the initial high capital investment costs associated with LNG bunkering infrastructure, the need for specialized handling equipment and trained personnel, and the availability of suitable LNG supply chains to support widespread adoption. Furthermore, price fluctuations in LNG and competing alternative fuels pose challenges. Nevertheless, the overall outlook for the Australian LNG bunkering market remains positive. The strategic alignment of government incentives, technological progress, and industry investments strongly indicates a promising trajectory for sustainable growth throughout the forecast period. Market projections suggest substantial increases in market value year-over-year, reflecting the increasing adoption and importance of this cleaner fuel source in the Australian maritime sector. The strategic location of Australia and its growing LNG production further strengthens this market's prospects for sustained growth and investment.

Australia LNG Bunkering Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Australian LNG bunkering market, covering the period from 2019 to 2033. It offers crucial insights into market dynamics, growth drivers, challenges, and opportunities, equipping stakeholders with actionable intelligence for strategic decision-making. The report utilizes data from the historical period (2019-2024), with 2025 serving as the base and estimated year, and forecasts extending to 2033. Market values are expressed in Millions.

Australia LNG Bunkering Market Market Concentration & Innovation

This section analyzes the competitive landscape of the Australian LNG bunkering market, examining market concentration, innovation drivers, regulatory frameworks, and M&A activities. Key players such as Woodside Petroleum Ltd, EVOL LNG, Siem Offshore Inc, Norwest Energy NL, Oceania Marine Energy, Gas Energy Australia, and Kanfer Shipping (list not exhaustive) are evaluated for their market share and strategic moves. The report assesses the impact of regulatory frameworks on market development and identifies key innovation drivers, including technological advancements and evolving end-user preferences. Analysis of M&A activity will include deal values where available (xx Million if unavailable). The influence of product substitutes and end-user trends on market dynamics is also explored.

- Market Concentration: Analysis of market share held by major players. xx% market share held by top 3 players (estimated).

- Innovation Drivers: Focus on technological advancements in LNG bunkering technologies and infrastructure.

- Regulatory Framework: Assessment of the impact of government policies and regulations on market growth.

- Product Substitutes: Evaluation of alternative fuels and their impact on market competition.

- End-User Trends: Analysis of the shifting preferences of different end-user segments (Tanker Fleet, Container Fleet, Bulk & General Cargo Fleet, Ferries & OSV, Others).

- M&A Activities: Review of recent mergers and acquisitions, including deal values (xx Million for unavailable data).

Australia LNG Bunkering Market Industry Trends & Insights

This section delves into the key trends shaping the Australian LNG bunkering market. It examines market growth drivers, including rising demand for LNG as a marine fuel, government incentives promoting cleaner shipping, and increasing environmental regulations. The report analyzes technological disruptions, such as the development of eLNG bunkering solutions and advancements in LNG storage and handling. Consumer preferences are explored, considering the focus on reducing emissions and operational costs. Competitive dynamics are examined, with a focus on strategies employed by key players. The report provides quantified insights, including the Compound Annual Growth Rate (CAGR) and market penetration rates for various segments. xx% CAGR projected for the forecast period (estimate).

Dominant Markets & Segments in Australia LNG Bunkering Market

This section identifies the leading regions, countries, and segments within the Australian LNG bunkering market. The analysis considers the three types of LNG (Small-scale, Medium-scale, Large-scale) and end-user segments (Tanker Fleet, Container Fleet, Bulk & General Cargo Fleet, Ferries & OSV, Others). Key drivers for dominance are identified using bullet points. A detailed dominance analysis is provided, using paragraphs to explain the reasons behind the leading positions.

- Dominant Segment: Analysis will identify the fastest-growing segment among Small-scale, Medium-scale, and Large-scale LNG, and among Tanker Fleet, Container Fleet, Bulk & General Cargo Fleet, Ferries & OSV, and Others. Reasons for dominance will be discussed.

- Key Drivers for Dominance: Economic policies influencing fuel choices. Existing infrastructure supporting specific LNG scales and end-users. Port capacities and geographical considerations.

Australia LNG Bunkering Market Product Developments

This section summarizes the latest product innovations, applications, and competitive advantages in the Australian LNG bunkering market. Technological advancements, such as the development of more efficient LNG bunkering vessels and improved LNG storage technologies, are highlighted. The report analyses the market fit of new products and their impact on market competition, including advantages in terms of efficiency, cost-effectiveness, and environmental impact.

Report Scope & Segmentation Analysis

This report segments the Australian LNG bunkering market by Type (Small-scale LNG, Medium-scale LNG, Large-scale LNG) and End-User (Tanker Fleet, Container Fleet, Bulk & General Cargo Fleet, Ferries & OSV, Others). Each segment's growth projections, market sizes, and competitive dynamics are analyzed separately.

- By Type: Small-scale LNG, Medium-scale LNG, and Large-scale LNG market size and growth projections for each are provided (xx Million for unavailable data). Competitive analysis will be given for each type.

- By End-User: Tanker Fleet, Container Fleet, Bulk & General Cargo Fleet, Ferries & OSV, and Others; market size and growth projections will be detailed for each segment (xx Million for unavailable data). Analysis of competitive dynamics will be given for each.

Key Drivers of Australia LNG Bunkering Market Growth

This section outlines the key factors driving the growth of the Australian LNG bunkering market. These include technological advancements in LNG bunkering infrastructure, supportive government policies and incentives promoting the use of LNG as a cleaner fuel, and increasing environmental regulations aimed at reducing greenhouse gas emissions from shipping.

Challenges in the Australia LNG Bunkering Market Sector

This section addresses the challenges hindering the growth of the Australian LNG bunkering market. This includes regulatory hurdles related to LNG handling and safety, potential supply chain issues impacting LNG availability, and competitive pressures from alternative fuels. Quantifiable impacts of these challenges on market growth are discussed.

Emerging Opportunities in Australia LNG Bunkering Market

This section highlights emerging opportunities within the Australian LNG bunkering market. This may include expansion into new geographic markets, technological advancements in LNG bunkering, and changing consumer preferences towards sustainable shipping solutions.

Leading Players in the Australia LNG Bunkering Market Market

- Woodside Petroleum Ltd

- EVOL LNG

- Siem Offshore Inc

- Norwest Energy NL

- Oceania Marine Energy

- Gas Energy Australia

- Kanfer Shipping

- List Not Exhaustive

Key Developments in Australia LNG Bunkering Market Industry

- September 2022: Norwest Energy Ltd. acquires a 20% interest in Pilbara Clean Fuels Pty Ltd. (PCF), investing AUD 300,000 in an eLNG plant development.

- February 2022: BHP introduces the world's first LNG-fuelled Newcastlemax bulk carrier, chartering five such vessels and contracting Shell for LNG fuel supply.

Strategic Outlook for Australia LNG Bunkering Market Market

The Australian LNG bunkering market is poised for significant growth, driven by increasing demand for cleaner marine fuels, technological advancements, and supportive government policies. Future opportunities lie in expanding LNG bunkering infrastructure, developing innovative LNG bunkering solutions, and capitalizing on the growing adoption of LNG as a sustainable marine fuel. The market's growth potential is considerable, offering significant opportunities for investors and stakeholders.

Australia LNG Bunkering Market Segmentation

-

1. End-User

- 1.1. Tanker Fleet

- 1.2. Container Fleet

- 1.3. Bulk & General Cargo Fleet

- 1.4. Ferries & OSV

- 1.5. Others

Australia LNG Bunkering Market Segmentation By Geography

- 1. Australia

Australia LNG Bunkering Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 6.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Natural Gas Demand4.; Rising Pipeline Network and Associated Infrastructure Development

- 3.3. Market Restrains

- 3.3.1. 4.; Rising Shift toward Renewable Energy

- 3.4. Market Trends

- 3.4.1. Ferries and OSV to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia LNG Bunkering Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 5.1.1. Tanker Fleet

- 5.1.2. Container Fleet

- 5.1.3. Bulk & General Cargo Fleet

- 5.1.4. Ferries & OSV

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Woodside Petroleum Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 EVOL LNG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Siem Offshore Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Norwest Energy NL

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Oceania Marine Energy

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Gas Energy Australia

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kanfer Shipping *List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Woodside Petroleum Ltd

List of Figures

- Figure 1: Australia LNG Bunkering Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Australia LNG Bunkering Market Share (%) by Company 2024

List of Tables

- Table 1: Australia LNG Bunkering Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Australia LNG Bunkering Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 3: Australia LNG Bunkering Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Australia LNG Bunkering Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Australia LNG Bunkering Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 6: Australia LNG Bunkering Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia LNG Bunkering Market?

The projected CAGR is approximately > 6.00%.

2. Which companies are prominent players in the Australia LNG Bunkering Market?

Key companies in the market include Woodside Petroleum Ltd, EVOL LNG, Siem Offshore Inc, Norwest Energy NL, Oceania Marine Energy, Gas Energy Australia, Kanfer Shipping *List Not Exhaustive.

3. What are the main segments of the Australia LNG Bunkering Market?

The market segments include End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Natural Gas Demand4.; Rising Pipeline Network and Associated Infrastructure Development.

6. What are the notable trends driving market growth?

Ferries and OSV to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Rising Shift toward Renewable Energy.

8. Can you provide examples of recent developments in the market?

In September 2022, Norwest Energy Ltd., Perth, acquired a 20% interest in Pilbara Clean Fuels Pty Ltd. (PCF), a company developing an electrified LNG (eLNG) plant at Port Hedland. The company is expected to invest AUD 300,000 to fund an initial 6-month assessment program designed to progress the project. PCF has entered a development partnership with Technip Energies and selected Air Products Inc. as the preferred liquefaction technology licensor and core equipment supplier.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia LNG Bunkering Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia LNG Bunkering Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia LNG Bunkering Market?

To stay informed about further developments, trends, and reports in the Australia LNG Bunkering Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence