Key Insights

The global diesel generator market is projected for significant expansion, driven by increasing demand for reliable power backup across various sectors. With an estimated market size of $19.33 billion in 2025 and a Compound Annual Growth Rate (CAGR) of 9.9% through 2033, the industry is set for substantial growth. Key drivers include the essential need for uninterrupted power in commercial sectors like data centers and healthcare facilities, as well as industrial applications in developing economies facing grid instability. Residential demand for backup power and peak shaving for cost management further fuel market adoption. Technological advancements focusing on fuel efficiency, reduced emissions, and smart controls are also enhancing market vitality.

Diesel Generator Industry Market Size (In Billion)

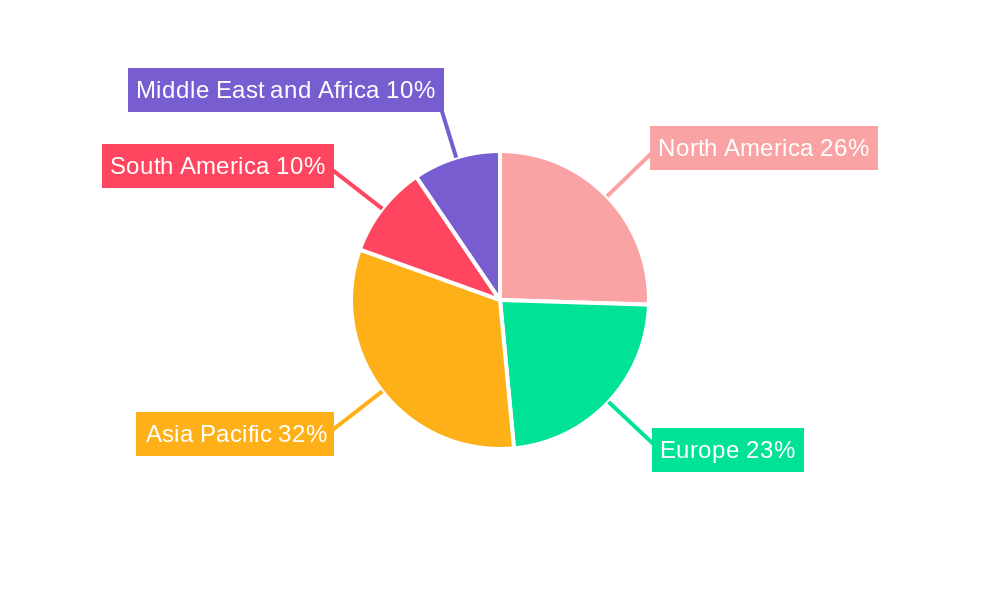

The market is segmented by capacity, with units between 75 and 375 kVA expected to dominate due to their versatility in commercial and small industrial applications. The commercial sector is anticipated to lead end-user demand, followed by the industrial segment. Standby backup power remains the primary application, highlighting the critical role of diesel generators in ensuring business continuity. Geographically, the Asia Pacific region, particularly China and India, is poised for rapid growth, driven by industrialization, urbanization, and infrastructure development. Mature markets in North America and Europe will continue to contribute through upgrades and replacements, especially in critical infrastructure. Key restraints include the rise of renewable energy, stringent environmental regulations, and initial capital and operational costs, necessitating strategic industry adaptation.

Diesel Generator Industry Company Market Share

This comprehensive report analyzes the global Diesel Generator Industry from 2019 to 2024, with projections through 2033. Based on a 2025 base year, the forecast period of 2025–2033 will detail market dynamics, technological advancements, and strategic opportunities. The report provides granular insights into market penetration, market share, and CAGR across capacity, end-user, and application segments. It examines key drivers, challenges, emerging opportunities, product developments, and strategic alliances of leading companies, including Doosan Corp, Kohler Co, Atlas Copco AB, Caterpillar Inc, Cummins Inc, Rolls-Royce Holding PLC, Kirloskar Oil Engines Ltd, Generac Holdings Inc, and Mitsubishi Heavy Industries Ltd, making it an essential resource for understanding the evolving diesel power generation landscape.

Diesel Generator Industry Market Concentration & Innovation

The global Diesel Generator Industry exhibits a moderate to high level of market concentration, with a few key players commanding significant market share. Leading companies such as Caterpillar Inc. and Cummins Inc. have established robust global networks and extensive product portfolios, contributing to their dominant positions. Innovation in the diesel generator market is primarily driven by stringent emission regulations, the demand for enhanced fuel efficiency, and the integration of smart technologies for remote monitoring and predictive maintenance. Regulatory frameworks, particularly those focused on environmental protection and emissions standards (e.g., EPA Tier 4, EU Stage V), are forcing manufacturers to invest heavily in R&D for cleaner and more efficient engine designs. The threat of product substitutes, such as natural gas generators, renewable energy sources coupled with battery storage, and hydrogen fuel cells, is increasing, pushing diesel generator manufacturers to innovate and differentiate their offerings. End-user trends indicate a growing preference for compact, silent, and highly reliable diesel generator sets, especially in commercial and industrial applications where uninterrupted power is critical. Mergers and acquisitions (M&A) activities, while not at a peak, play a strategic role in consolidating market presence and acquiring specialized technologies. For instance, the strategic alliance between Sterling Generators and Moteurs Baudouin exemplifies how collaborations can leverage existing strengths and expand market reach. The value of M&A deals within the broader power generation equipment sector, while not exclusively diesel, indicates significant investment aimed at expanding capabilities and market access.

Diesel Generator Industry Industry Trends & Insights

The Diesel Generator Industry is experiencing a dynamic period characterized by robust growth driven by increasing global energy demand, particularly in developing economies where grid infrastructure is still maturing. The projected CAGR for the forecast period is significant, reflecting the continued reliance on diesel generators for essential power supply across various sectors. Technological disruptions are reshaping the industry, with a notable trend towards more fuel-efficient engines, advanced emission control systems, and the integration of digital technologies. Smart connectivity and IoT integration are enabling remote monitoring, diagnostics, and optimized performance, leading to reduced operational costs and enhanced reliability. Consumer preferences are evolving, with a growing demand for quieter, more compact, and environmentally compliant diesel generator sets. This shift is particularly evident in urban areas and for applications where noise pollution is a concern. The competitive dynamics are intensifying as established players invest in innovation and new entrants explore niche markets or alternative technologies. The increasing adoption of hybrid power solutions, combining diesel generators with renewable energy sources and battery storage, is also a significant trend, offering a more sustainable and resilient power supply. Market penetration for advanced diesel generator technologies is steadily increasing as businesses and individuals recognize the long-term benefits of efficiency and compliance. The focus on standby and prime power applications remains strong, but there is a growing interest in peak shaving solutions to optimize energy costs and grid stability.

Dominant Markets & Segments in Diesel Generator Industry

The global Diesel Generator Industry is shaped by distinct regional strengths and segment dominance. Asia-Pacific, driven by rapid industrialization, infrastructure development, and a burgeoning population, currently holds a dominant position in the market. Countries like China and India represent significant demand centers due to their expanding manufacturing sectors and ongoing projects requiring reliable power solutions.

Within the Capacity segmentation:

- More Than 375 kVA generators are dominant, particularly in industrial and large commercial applications that require substantial power output for heavy machinery, data centers, and critical infrastructure. The growth in manufacturing, mining, and construction sectors fuels this segment.

- Between 75 and 375 kVA generators are also highly significant, catering to medium-sized businesses, commercial buildings, and educational institutions that require robust backup power. Economic policies promoting business growth and infrastructure upgrades are key drivers here.

- Less Than 75 kVA generators find strong demand in the residential sector for home backup power, and in smaller commercial establishments. The increasing frequency of power outages and the desire for energy independence are key drivers for this segment.

In terms of End User:

- Industrial sector remains the largest consumer of diesel generators, driven by the need for uninterrupted operations in manufacturing plants, oil and gas facilities, and mining sites. This segment's dominance is bolstered by investments in new industrial parks and the expansion of existing facilities.

- Commercial sector follows closely, encompassing retail spaces, hospitals, data centers, and telecommunication infrastructure, all of which are highly dependent on reliable backup power. The growth of e-commerce and the increasing reliance on digital infrastructure are significant contributors.

- Residential sector, while smaller in terms of individual unit capacity, represents a substantial market due to the sheer volume of households requiring backup power for essential services.

Regarding Application:

- Standby Backup Power is the most prevalent application, driven by the increasing unpredictability of grid power in many regions and the critical need to avoid costly downtime.

- Prime Power applications are significant in remote locations or areas with underdeveloped grid infrastructure, where diesel generators serve as the primary source of electricity.

- Peak Shaving Power is an emerging and growing application, particularly for large commercial and industrial users looking to reduce their electricity bills by generating their own power during peak demand periods when utility rates are highest.

Diesel Generator Industry Product Developments

Recent product developments in the Diesel Generator Industry highlight a strong focus on enhancing efficiency, reducing emissions, and integrating smart technologies. Manufacturers are introducing more compact and modular generator sets that offer greater flexibility and ease of installation. Advancements in engine design and emission control systems are crucial, with many new models adhering to the latest environmental standards. The integration of IoT capabilities allows for remote monitoring, predictive maintenance, and optimized fuel consumption, providing users with greater control and cost savings. For example, the Cummins MDCT genset with its range of kW ratings demonstrates a tailored approach to specific applications like marine, emphasizing durability and performance. Innovations are also seen in soundproofing technologies to meet stricter noise regulations and in the development of robust control panels offering advanced operational features and user interfaces, ensuring market fit and competitive advantage.

Report Scope & Segmentation Analysis

This report comprehensively segments the Diesel Generator Industry across key parameters. The Capacity segmentation includes: Less Than 75 kVA, Between 75 and 375 kVA, and More Than 375 kVA. Each segment is analyzed for market size, growth projections, and competitive dynamics, with the "More Than 375 kVA" segment anticipated to see robust growth driven by industrial expansion. The End User segmentation covers Residential, Commercial, and Industrial sectors, with the Industrial segment projected to maintain its leading position due to consistent demand from manufacturing and infrastructure projects. The Application segmentation analyzes Standby Backup Power, Prime Power, and Peak Shaving Power. Standby Backup Power is expected to continue dominating, though Peak Shaving Power is poised for significant expansion due to its cost-saving benefits for large consumers.

Key Drivers of Diesel Generator Industry Growth

The Diesel Generator Industry's growth is propelled by several critical factors. Foremost is the increasing global demand for reliable and uninterrupted power, especially in regions with developing grid infrastructure. Stringent government regulations mandating emissions control and fuel efficiency are also significant drivers, pushing manufacturers towards innovation and the adoption of cleaner technologies. The ongoing industrialization and urbanization trends worldwide necessitate robust power solutions, making diesel generators indispensable for manufacturing, construction, and commercial operations. Furthermore, the growing need for backup power in critical sectors like healthcare and telecommunications, coupled with the increasing frequency of extreme weather events that disrupt grid stability, bolsters demand for standby power solutions.

Challenges in the Diesel Generator Industry Sector

Despite strong growth, the Diesel Generator Industry faces several challenges. Increasingly stringent environmental regulations, particularly concerning emissions and noise pollution, necessitate significant R&D investments and can increase manufacturing costs. The rising price volatility of diesel fuel directly impacts the operational costs for end-users, creating a disincentive for extensive usage. The growing competition from alternative power sources, such as renewable energy with battery storage and hydrogen fuel cells, poses a long-term threat, driving the need for continuous innovation and adaptation. Supply chain disruptions, as experienced in recent years, can impact the availability of components and raw materials, leading to production delays and increased costs. Furthermore, the perception of diesel as a non-renewable energy source is leading to a push for decarbonization, creating market uncertainty for purely diesel-based solutions in the long run.

Emerging Opportunities in Diesel Generator Industry

The Diesel Generator Industry is ripe with emerging opportunities driven by technological advancements and evolving market needs. The development of hybrid power systems, integrating diesel generators with renewable energy sources and battery storage, presents a significant growth avenue. These systems offer enhanced reliability, reduced emissions, and optimized operational costs. The increasing adoption of IoT and smart technologies for remote monitoring, predictive maintenance, and energy management opens up opportunities for value-added services and data-driven solutions. The demand for compact, portable, and silent diesel generators is growing, particularly for residential and small commercial applications, creating a niche market. Furthermore, the ongoing infrastructure development in emerging economies, coupled with the need for reliable power in remote or off-grid locations, provides substantial market potential. Manufacturers focusing on compliance with future emission standards and offering adaptable solutions will be well-positioned to capitalize on these opportunities.

Leading Players in the Diesel Generator Industry Market

- Doosan Corp

- Kohler Co

- Atlas Copco AB

- Caterpillar Inc

- Cummins Inc

- Rolls-Royce Holding PLC

- Kirloskar Oil Engines Ltd

- Generac Holdings Inc

- Mitsubishi Heavy Industries Ltd

Key Developments in Diesel Generator Industry Industry

- June 2023: Sterling Generators formed a strategic alliance with Moteurs Baudouin, a French manufacturer of power generation, both gas and diesel engines. The collaboration will capitalize on Baudouin's tradition of engineering and producing high-quality diesel and petrol engines and Sterling Generators' fuel-efficient, sensibly engineered auxiliary power solutions that meet the most recent emission standards.

- May 2023: Cummins Inc. introduced the marine diesel cummins turbo (MDCT) genset. This durable genset can be equipped with either a low or high kW Cummins B4.5 auxiliary engine, resulting in genset ratings of 40 kWe - 80 kWe and 80 kWe - 110 kWe. The MDCT generator set is available for order, with delivery expected in late 2023.

- July 2022: Octopus Hydrogen and GeoPura collaborated to offer green hydrogen for cutting-edge clean technology that will replace polluting diesel generators. The agreement calls for the two companies to work together to provide viable alternatives to fossil fuels and speed the decarbonisation of various industries.

Strategic Outlook for Diesel Generator Industry Market

The strategic outlook for the Diesel Generator Industry is one of cautious optimism and continuous adaptation. While the long-term transition towards renewable energy is inevitable, diesel generators will remain crucial for ensuring grid stability, providing backup power, and supporting industrial operations, especially in the medium term. Key growth catalysts include ongoing investments in emerging economies, the increasing demand for resilient infrastructure, and the development of cleaner and more efficient diesel engine technologies. Manufacturers that focus on hybrid solutions, integrate smart technologies for enhanced operational efficiency, and comply with evolving environmental regulations will be best positioned for sustained success. Strategic partnerships and collaborations, such as the one between Sterling Generators and Moteurs Baudouin, will be instrumental in expanding market reach and technological capabilities. The industry must also proactively address the environmental concerns by optimizing fuel efficiency and exploring alternative fuels where feasible to maintain its relevance.

Diesel Generator Industry Segmentation

-

1. Capacity

- 1.1. Less Than 75 kVA

- 1.2. Between 75 and 375 kVA

- 1.3. More Than 375 kVA

-

2. End User

- 2.1. Residential

- 2.2. Commercial

- 2.3. Industrial

-

3. Application

- 3.1. Standby Backup Power

- 3.2. Prime Power

- 3.3. Peak Shaving Power

Diesel Generator Industry Segmentation By Geography

-

1. North America

- 1.1. United States of America

- 1.2. Canada

- 1.3. Rest of the North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. Norway

- 2.4. Italy

- 2.5. France

- 2.6. Rest of the Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. South Korea

- 3.4. Rest of the Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of the South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. United Arab Emirates

- 5.3. Iran

- 5.4. Rest of the Middle East and Africa

Diesel Generator Industry Regional Market Share

Geographic Coverage of Diesel Generator Industry

Diesel Generator Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 4.; The Increasing Demand for Uninterrupted and Reliable Power Supply4.; Increased Demand from the Commercial Sector

- 3.2.2 Including the Healthcare Industry

- 3.3. Market Restrains

- 3.3.1. 4.; The Growing Demand for Generators Based on Alternative Fuels

- 3.4. Market Trends

- 3.4.1. The Industrial Sector to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Diesel Generator Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Capacity

- 5.1.1. Less Than 75 kVA

- 5.1.2. Between 75 and 375 kVA

- 5.1.3. More Than 375 kVA

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.2.3. Industrial

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Standby Backup Power

- 5.3.2. Prime Power

- 5.3.3. Peak Shaving Power

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Capacity

- 6. North America Diesel Generator Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Capacity

- 6.1.1. Less Than 75 kVA

- 6.1.2. Between 75 and 375 kVA

- 6.1.3. More Than 375 kVA

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Residential

- 6.2.2. Commercial

- 6.2.3. Industrial

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Standby Backup Power

- 6.3.2. Prime Power

- 6.3.3. Peak Shaving Power

- 6.1. Market Analysis, Insights and Forecast - by Capacity

- 7. Europe Diesel Generator Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Capacity

- 7.1.1. Less Than 75 kVA

- 7.1.2. Between 75 and 375 kVA

- 7.1.3. More Than 375 kVA

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Residential

- 7.2.2. Commercial

- 7.2.3. Industrial

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Standby Backup Power

- 7.3.2. Prime Power

- 7.3.3. Peak Shaving Power

- 7.1. Market Analysis, Insights and Forecast - by Capacity

- 8. Asia Pacific Diesel Generator Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Capacity

- 8.1.1. Less Than 75 kVA

- 8.1.2. Between 75 and 375 kVA

- 8.1.3. More Than 375 kVA

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Residential

- 8.2.2. Commercial

- 8.2.3. Industrial

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Standby Backup Power

- 8.3.2. Prime Power

- 8.3.3. Peak Shaving Power

- 8.1. Market Analysis, Insights and Forecast - by Capacity

- 9. South America Diesel Generator Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Capacity

- 9.1.1. Less Than 75 kVA

- 9.1.2. Between 75 and 375 kVA

- 9.1.3. More Than 375 kVA

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Residential

- 9.2.2. Commercial

- 9.2.3. Industrial

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Standby Backup Power

- 9.3.2. Prime Power

- 9.3.3. Peak Shaving Power

- 9.1. Market Analysis, Insights and Forecast - by Capacity

- 10. Middle East and Africa Diesel Generator Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Capacity

- 10.1.1. Less Than 75 kVA

- 10.1.2. Between 75 and 375 kVA

- 10.1.3. More Than 375 kVA

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Residential

- 10.2.2. Commercial

- 10.2.3. Industrial

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Standby Backup Power

- 10.3.2. Prime Power

- 10.3.3. Peak Shaving Power

- 10.1. Market Analysis, Insights and Forecast - by Capacity

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Doosan Corp

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Kohler Co

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Atlas Copco AB

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Caterpillar Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Cummins Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Rolls-Royce Holding PLC*List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Kirloskar Oil Engines Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Generac Holdings Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Mitsubishi Heavy Industries Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Doosan Corp

List of Figures

- Figure 1: Global Diesel Generator Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Diesel Generator Industry Revenue (billion), by Capacity 2025 & 2033

- Figure 3: North America Diesel Generator Industry Revenue Share (%), by Capacity 2025 & 2033

- Figure 4: North America Diesel Generator Industry Revenue (billion), by End User 2025 & 2033

- Figure 5: North America Diesel Generator Industry Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Diesel Generator Industry Revenue (billion), by Application 2025 & 2033

- Figure 7: North America Diesel Generator Industry Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Diesel Generator Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Diesel Generator Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Diesel Generator Industry Revenue (billion), by Capacity 2025 & 2033

- Figure 11: Europe Diesel Generator Industry Revenue Share (%), by Capacity 2025 & 2033

- Figure 12: Europe Diesel Generator Industry Revenue (billion), by End User 2025 & 2033

- Figure 13: Europe Diesel Generator Industry Revenue Share (%), by End User 2025 & 2033

- Figure 14: Europe Diesel Generator Industry Revenue (billion), by Application 2025 & 2033

- Figure 15: Europe Diesel Generator Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Diesel Generator Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Diesel Generator Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Diesel Generator Industry Revenue (billion), by Capacity 2025 & 2033

- Figure 19: Asia Pacific Diesel Generator Industry Revenue Share (%), by Capacity 2025 & 2033

- Figure 20: Asia Pacific Diesel Generator Industry Revenue (billion), by End User 2025 & 2033

- Figure 21: Asia Pacific Diesel Generator Industry Revenue Share (%), by End User 2025 & 2033

- Figure 22: Asia Pacific Diesel Generator Industry Revenue (billion), by Application 2025 & 2033

- Figure 23: Asia Pacific Diesel Generator Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Asia Pacific Diesel Generator Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Diesel Generator Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Diesel Generator Industry Revenue (billion), by Capacity 2025 & 2033

- Figure 27: South America Diesel Generator Industry Revenue Share (%), by Capacity 2025 & 2033

- Figure 28: South America Diesel Generator Industry Revenue (billion), by End User 2025 & 2033

- Figure 29: South America Diesel Generator Industry Revenue Share (%), by End User 2025 & 2033

- Figure 30: South America Diesel Generator Industry Revenue (billion), by Application 2025 & 2033

- Figure 31: South America Diesel Generator Industry Revenue Share (%), by Application 2025 & 2033

- Figure 32: South America Diesel Generator Industry Revenue (billion), by Country 2025 & 2033

- Figure 33: South America Diesel Generator Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Diesel Generator Industry Revenue (billion), by Capacity 2025 & 2033

- Figure 35: Middle East and Africa Diesel Generator Industry Revenue Share (%), by Capacity 2025 & 2033

- Figure 36: Middle East and Africa Diesel Generator Industry Revenue (billion), by End User 2025 & 2033

- Figure 37: Middle East and Africa Diesel Generator Industry Revenue Share (%), by End User 2025 & 2033

- Figure 38: Middle East and Africa Diesel Generator Industry Revenue (billion), by Application 2025 & 2033

- Figure 39: Middle East and Africa Diesel Generator Industry Revenue Share (%), by Application 2025 & 2033

- Figure 40: Middle East and Africa Diesel Generator Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: Middle East and Africa Diesel Generator Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Diesel Generator Industry Revenue billion Forecast, by Capacity 2020 & 2033

- Table 2: Global Diesel Generator Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 3: Global Diesel Generator Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Global Diesel Generator Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Diesel Generator Industry Revenue billion Forecast, by Capacity 2020 & 2033

- Table 6: Global Diesel Generator Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 7: Global Diesel Generator Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 8: Global Diesel Generator Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States of America Diesel Generator Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Diesel Generator Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Rest of the North America Diesel Generator Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global Diesel Generator Industry Revenue billion Forecast, by Capacity 2020 & 2033

- Table 13: Global Diesel Generator Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 14: Global Diesel Generator Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 15: Global Diesel Generator Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Germany Diesel Generator Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Diesel Generator Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Norway Diesel Generator Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Italy Diesel Generator Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: France Diesel Generator Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Rest of the Europe Diesel Generator Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Global Diesel Generator Industry Revenue billion Forecast, by Capacity 2020 & 2033

- Table 23: Global Diesel Generator Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 24: Global Diesel Generator Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 25: Global Diesel Generator Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 26: China Diesel Generator Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: India Diesel Generator Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: South Korea Diesel Generator Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Rest of the Asia Pacific Diesel Generator Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Global Diesel Generator Industry Revenue billion Forecast, by Capacity 2020 & 2033

- Table 31: Global Diesel Generator Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 32: Global Diesel Generator Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 33: Global Diesel Generator Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 34: Brazil Diesel Generator Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Argentina Diesel Generator Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of the South America Diesel Generator Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global Diesel Generator Industry Revenue billion Forecast, by Capacity 2020 & 2033

- Table 38: Global Diesel Generator Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 39: Global Diesel Generator Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 40: Global Diesel Generator Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 41: Saudi Arabia Diesel Generator Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: United Arab Emirates Diesel Generator Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: Iran Diesel Generator Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: Rest of the Middle East and Africa Diesel Generator Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Diesel Generator Industry?

The projected CAGR is approximately 9.9%.

2. Which companies are prominent players in the Diesel Generator Industry?

Key companies in the market include Doosan Corp, Kohler Co, Atlas Copco AB, Caterpillar Inc, Cummins Inc, Rolls-Royce Holding PLC*List Not Exhaustive, Kirloskar Oil Engines Ltd, Generac Holdings Inc, Mitsubishi Heavy Industries Ltd.

3. What are the main segments of the Diesel Generator Industry?

The market segments include Capacity, End User, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 19.33 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; The Increasing Demand for Uninterrupted and Reliable Power Supply4.; Increased Demand from the Commercial Sector. Including the Healthcare Industry.

6. What are the notable trends driving market growth?

The Industrial Sector to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; The Growing Demand for Generators Based on Alternative Fuels.

8. Can you provide examples of recent developments in the market?

June 2023: Sterling Generators formed a strategic alliance with Moteurs Baudouin, a French manufacturer of power generation, both gas and diesel engines. The collaboration will capitalise on Baudouin's tradition of engineering and producing high-quality diesel and petrol engines and Sterling Generators' fuel-efficient, sensibly engineered auxiliary power solutions that meet the most recent emission standards.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Diesel Generator Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Diesel Generator Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Diesel Generator Industry?

To stay informed about further developments, trends, and reports in the Diesel Generator Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence