Key Insights

The China LNG Bunkering Market is set for significant expansion, currently valued at USD 1.62 billion. Projected to grow at a Compound Annual Growth Rate (CAGR) of 30.5% from 2025 to 2033, this growth is driven by stringent environmental regulations and China's commitment to reducing carbon emissions in its vast shipping industry. The increasing adoption of Liquefied Natural Gas (LNG) as an eco-friendly alternative to heavy fuel oil and marine diesel oil is a primary driver. The continuous development of LNG bunkering infrastructure, including dedicated terminals and a rising fleet of LNG-powered vessels, reinforces market confidence. Supportive government policies promoting cleaner marine fuels and the development of a robust LNG supply chain are also key factors in this market's evolution.

China LNG Bunkering Market Market Size (In Billion)

The market is segmented by end-user, with the Tanker Fleet, Container Fleet, and Bulk and General Cargo Fleet segments expected to lead LNG bunkering demand. Escalating global trade and China's crucial position in maritime logistics underscore the need for efficient and compliant shipping solutions. Ferries and Offshore Support Vessels (OSVs) are also emerging segments, increasingly adopting LNG to meet strict emission standards, particularly in coastal and inland waterway operations. Leading industry players, including ENN Energy Holdings Ltd, JERA Co Inc, Total S.A., China National Offshore Oil Corporation (CNOOC), and China Petroleum & Chemical Corporation (Sinopec), are actively investing in enhancing their LNG bunkering capacity and supply networks. The market's strong domestic demand and supply ecosystem within China are central to this expansion.

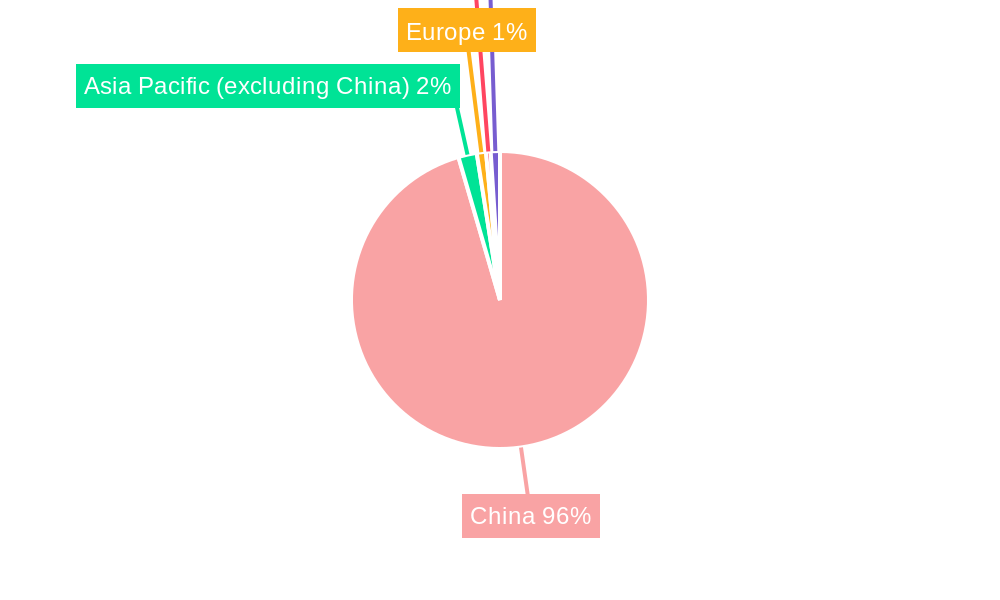

China LNG Bunkering Market Company Market Share

China LNG Bunkering Market: Navigating the Green Shipping Revolution (2019-2033)

Report Description:

Dive deep into the rapidly evolving China LNG Bunkering Market with this comprehensive, SEO-optimized report. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this analysis provides unparalleled insights into the growth trajectory, key players, and transformative trends shaping the future of maritime fuel in China. As global pressure mounts for decarbonization and China champions its "carbon neutral by 2060" agenda, the demand for cleaner fuel alternatives like Liquefied Natural Gas (LNG) in the shipping sector is set to explode. This report offers a granular view of market concentration, innovation drivers, regulatory frameworks, dominant segments (including Tanker Fleet, Container Fleet, Bulk and General Cargo Fleet, Ferries and OSV, and Others), product developments, and the strategic imperatives for stakeholders. Featuring analysis of pivotal industry developments such as the launch of China's first LNG bunkering vessel, "Huanghai Sino," and government subsidies, this report equips industry leaders, investors, and policymakers with the actionable intelligence needed to capitalize on this burgeoning market. Explore market share estimations, CAGR projections, and M&A activities to inform your strategic decisions in this dynamic landscape.

China LNG Bunkering Market Market Concentration & Innovation

The China LNG Bunkering Market is characterized by a moderate level of market concentration, with a few dominant players gradually expanding their footprint. Innovation is a key driver, fueled by governmental push for cleaner shipping and technological advancements in bunkering infrastructure. Regulatory frameworks are becoming increasingly supportive, with clear policy directives aimed at promoting LNG adoption for vessels. Product substitutes, primarily heavy fuel oil (HFO) and marine gas oil (MGO), still hold significant market share, but their dominance is waning due to environmental regulations and rising fuel costs. End-user trends indicate a strong shift towards LNG adoption across various fleet types, driven by operational cost savings and compliance with emissions standards. Mergers and acquisitions (M&A) activities are expected to increase as companies seek to consolidate market positions and secure supply chains. For instance, strategic partnerships and joint ventures are crucial for developing new bunkering terminals and expanding service networks. Estimated M&A deal values are projected to grow significantly in the forecast period, reflecting the market's potential.

China LNG Bunkering Market Industry Trends & Insights

The China LNG Bunkering Market is experiencing robust growth, propelled by a confluence of factors including stringent environmental regulations, favorable government policies, and increasing adoption of LNG as a marine fuel. The projected Compound Annual Growth Rate (CAGR) for the market is substantial, indicating a rapid expansion in demand for LNG bunkering services. Technological disruptions are transforming the bunkering process, with the development of more efficient and safer bunkering vessels and onshore facilities. Consumer preferences are undeniably leaning towards cleaner fuels, with shipowners prioritizing compliance with International Maritime Organization (IMO) emission standards and seeking to reduce their carbon footprint. Competitive dynamics are intensifying, with both established energy giants and specialized LNG providers vying for market share. Market penetration of LNG as a marine fuel in China is still in its nascent stages but is projected to witness exponential growth. The ongoing transition to cleaner energy solutions is a significant market growth driver, with significant investments being channeled into the development of LNG infrastructure along key Chinese coastlines and inland waterways.

Dominant Markets & Segments in China LNG Bunkering Market

The Tanker Fleet segment is emerging as a dominant force within the China LNG Bunkering Market. This dominance is driven by several key factors, including the sheer volume of tanker operations along China's extensive coastline and its integral role in the global supply chain. The economic policies supporting the modernization of China's maritime industry, coupled with significant investments in port infrastructure development, have created a conducive environment for LNG bunkering adoption by tanker operators.

- Tanker Fleet: This segment benefits from large vessel sizes, leading to higher fuel consumption, making the switch to LNG economically viable due to potential cost savings and reduced emissions. The growing demand for cleaner fuels in petrochemical and product tanker operations is a significant driver.

- Container Fleet: As global trade continues to expand, the container fleet represents another substantial growth area. Shipping lines are increasingly pressured to meet environmental regulations and customer demands for sustainable logistics. The expansion of LNG-powered container vessels is a clear indicator of this trend.

- Bulk and General Cargo Fleet: While historically slower to adopt new fuels, the bulk and general cargo segment is also showing increasing interest in LNG. This is driven by a combination of regulatory compliance and the desire to future-proof operations against potential carbon taxes and stricter emissions controls.

- Ferries and OSV (Offshore Support Vessels): These segments, particularly ferries operating on domestic routes and OSVs supporting China’s offshore energy exploration, are prime candidates for LNG adoption due to shorter route distances and consistent operational patterns, making refueling logistics more manageable.

- Others: This segment includes specialized vessels and emerging applications where LNG can offer significant environmental and operational benefits.

China LNG Bunkering Market Product Developments

Product developments in the China LNG Bunkering Market are focused on enhancing efficiency, safety, and accessibility. Innovations include the design and deployment of advanced LNG bunkering vessels, such as the "Huanghai Sino," capable of providing flexible and efficient refueling services. Terminal infrastructure is also seeing upgrades, with the development of shore-to-ship refueling solutions and the integration of LNG storage facilities at key ports. Competitive advantages are being gained through the provision of integrated logistics solutions, customized refueling plans, and competitive pricing strategies. Technological trends emphasize the adoption of digital solutions for managing bunkering operations and ensuring seamless supply chain integration.

Report Scope & Segmentation Analysis

This report meticulously analyzes the China LNG Bunkering Market across key end-user segments.

- Tanker Fleet: This segment is projected to exhibit strong growth, driven by the increasing number of LNG-powered tankers and stringent emissions regulations for fuel transportation. Market size for this segment is expected to reach substantial figures by 2033.

- Container Fleet: The container fleet segment is anticipated to witness significant expansion as major shipping lines invest in LNG-fueled container vessels to meet sustainability targets and reduce operational costs.

- Bulk and General Cargo Fleet: While this segment's adoption rate may be slower, the growing environmental consciousness and potential for long-term cost savings are expected to drive its market penetration.

- Ferries and OSV: These segments, often operating on fixed routes or supporting localized operations, present immediate opportunities for LNG bunkering due to predictable fuel demands and easier logistical planning.

- Others: This encompasses a diverse range of vessels and emerging applications, offering niche growth opportunities and showcasing the versatility of LNG as a marine fuel.

Key Drivers of China LNG Bunkering Market Growth

The growth of the China LNG Bunkering Market is underpinned by several critical drivers. The Chinese government's commitment to becoming carbon neutral by 2060 is a monumental policy driver, directly incentivizing the adoption of cleaner fuels like LNG for maritime transport. This is complemented by substantial investments in LNG bunkering infrastructure, including ports and specialized vessels, which are crucial for the market's development. Technological advancements in LNG liquefaction, transportation, and bunkering technologies are making the fuel more accessible and cost-effective. Furthermore, the inherent environmental benefits of LNG, such as significant reductions in SOx, NOx, and particulate matter emissions, make it an attractive alternative for shipowners facing increasingly strict international and domestic regulations.

Challenges in the China LNG Bunkering Market Sector

Despite its promising outlook, the China LNG Bunkering Market faces several challenges. The significant upfront investment required for building LNG bunkering infrastructure and converting vessels to LNG power remains a substantial barrier. Fluctuations in global LNG prices and supply chain vulnerabilities can impact the economic viability of LNG as a fuel. Regulatory fragmentation and the need for standardized bunkering procedures across different ports can create operational complexities. Moreover, the perceived safety risks associated with handling LNG, though often overstated with modern technology, can still influence adoption rates. Competition from alternative low-carbon fuels, such as methanol and ammonia, also presents a long-term challenge.

Emerging Opportunities in China LNG Bunkering Market

Emerging opportunities in the China LNG Bunkering Market are abundant and diverse. The expansion of LNG bunkering services to inland waterways and riverine ports presents a significant untapped market. The development of multimodal logistics solutions integrating LNG-powered vessels with other transport modes offers synergistic growth. Innovations in smaller-scale LNG bunkering solutions for specialized vessels and offshore platforms are creating new niche markets. Furthermore, the growing demand for sustainable shipping from global trade partners is pushing Chinese shipping companies to accelerate their LNG adoption, creating a ripple effect for the bunkering market. The increasing availability of domestically produced LNG will also bolster supply security and potentially lower costs.

Leading Players in the China LNG Bunkering Market Market

- ENN Energy Holdings Ltd

- JERA Co Inc

- Total S A

- China National Offshore Oil Corporation (CNOOC)

- China Merchants Energy Shipping Co Ltd

- China Petroleum & Chemical Corporation (Sinopec)

- China National Petroleum Corporation (CNPC)

- Shanghai LNG

- China National Chemical Corporation (ChemChina)

- China Gas Holdings Limited

Key Developments in China LNG Bunkering Market Industry

- 2021: The Chinese government announced its ambitious goal to achieve carbon neutrality by 2060, significantly boosting the impetus for developing and adopting cleaner fuels like LNG in the shipping sector.

- 2022: China's inaugural LNG bunkering vessel, the "Huanghai Sino," was successfully put into operation, marking a critical milestone in establishing domestic LNG supply capabilities, particularly within the economically vital Yangtze River Delta region.

- 2023: The Chinese government unveiled new subsidy programs specifically targeting LNG bunkering facilities and vessels, designed to accelerate market development and encourage wider adoption of LNG as a marine fuel.

Strategic Outlook for China LNG Bunkering Market Market

The strategic outlook for the China LNG Bunkering Market is exceptionally positive, driven by a potent combination of government policy, technological advancement, and increasing market demand. The nation's unwavering commitment to its carbon neutrality goals will continue to be a primary catalyst, fostering significant investment in LNG infrastructure and vessel conversion. Opportunities for expansion into inland waterways and smaller ports will unlock new revenue streams. Collaboration between energy companies, shipping operators, and port authorities will be crucial for developing integrated and efficient bunkering networks. The market is poised for sustained, high-growth trajectory as China solidifies its position as a global leader in green shipping.

China LNG Bunkering Market Segmentation

-

1. End-User

- 1.1. Tanker Fleet

- 1.2. Container Fleet

- 1.3. Bulk and General Cargo Fleet

- 1.4. Ferries and OSV

- 1.5. Others

China LNG Bunkering Market Segmentation By Geography

- 1. China

China LNG Bunkering Market Regional Market Share

Geographic Coverage of China LNG Bunkering Market

China LNG Bunkering Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 30.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Investments in Wind and Solar Energy 4.; Supportive Government Policies in Developing Renewable Energy

- 3.3. Market Restrains

- 3.3.1. 4.; Limited Land And Limited Power Capacity By Variable Renewable Energy Sources

- 3.4. Market Trends

- 3.4.1. Ferries and OSV Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China LNG Bunkering Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 5.1.1. Tanker Fleet

- 5.1.2. Container Fleet

- 5.1.3. Bulk and General Cargo Fleet

- 5.1.4. Ferries and OSV

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. China

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ENN Energy Holdings Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 JERA Co Inc*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Total S A

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 China National Offshore Oil Corporation (CNOOC)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 China Merchants Energy Shipping Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 China Petroleum & Chemical Corporation (Sinopec)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 China National Petroleum Corporation (CNPC)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Shanghai LNG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 China National Chemical Corporation (ChemChina)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 China Gas Holdings Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 ENN Energy Holdings Ltd

List of Figures

- Figure 1: China LNG Bunkering Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: China LNG Bunkering Market Share (%) by Company 2025

List of Tables

- Table 1: China LNG Bunkering Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 2: China LNG Bunkering Market Volume K Tons Forecast, by End-User 2020 & 2033

- Table 3: China LNG Bunkering Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: China LNG Bunkering Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 5: China LNG Bunkering Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 6: China LNG Bunkering Market Volume K Tons Forecast, by End-User 2020 & 2033

- Table 7: China LNG Bunkering Market Revenue billion Forecast, by Country 2020 & 2033

- Table 8: China LNG Bunkering Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China LNG Bunkering Market?

The projected CAGR is approximately 30.5%.

2. Which companies are prominent players in the China LNG Bunkering Market?

Key companies in the market include ENN Energy Holdings Ltd, JERA Co Inc*List Not Exhaustive, Total S A, China National Offshore Oil Corporation (CNOOC), China Merchants Energy Shipping Co Ltd, China Petroleum & Chemical Corporation (Sinopec), China National Petroleum Corporation (CNPC), Shanghai LNG, China National Chemical Corporation (ChemChina), China Gas Holdings Limited.

3. What are the main segments of the China LNG Bunkering Market?

The market segments include End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.62 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Investments in Wind and Solar Energy 4.; Supportive Government Policies in Developing Renewable Energy.

6. What are the notable trends driving market growth?

Ferries and OSV Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Limited Land And Limited Power Capacity By Variable Renewable Energy Sources.

8. Can you provide examples of recent developments in the market?

In 2021, the Chinese government announced its to become carbon neutral by 2060. This is expected to further drive the development of the LNG bunkering market in China.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China LNG Bunkering Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China LNG Bunkering Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China LNG Bunkering Market?

To stay informed about further developments, trends, and reports in the China LNG Bunkering Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence