Key Insights

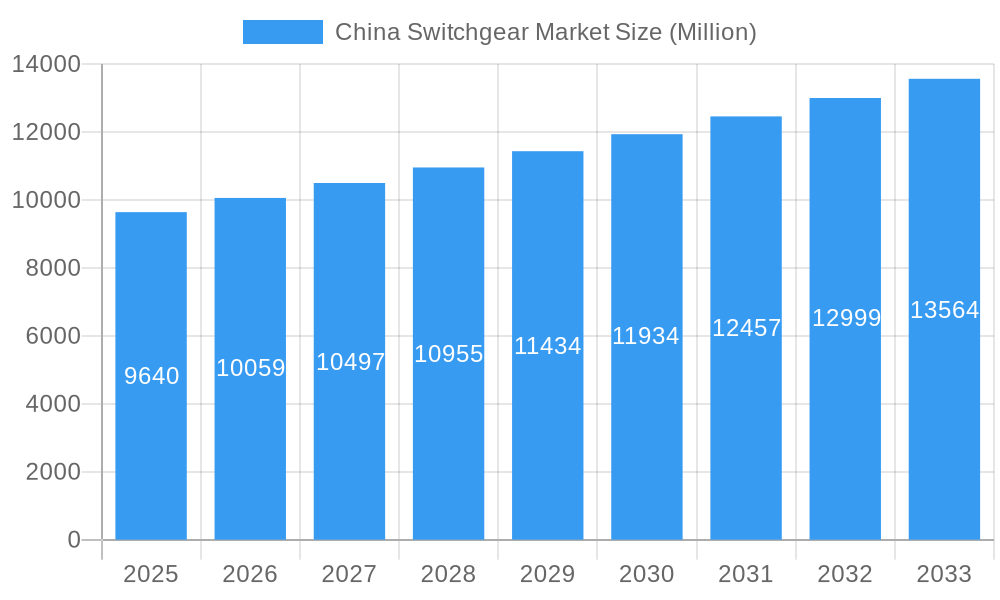

The China Switchgear Market is poised for significant expansion, with an estimated market size of USD 9.64 billion in 2025. The sector is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.39% throughout the forecast period of 2025-2033. This robust growth is primarily driven by substantial investments in smart grid development, the ongoing expansion of renewable energy infrastructure, and the increasing demand for reliable power distribution solutions across industrial, commercial, and residential sectors. China's commitment to modernizing its power grid, enhancing energy efficiency, and integrating a higher proportion of renewable energy sources such as solar and wind power directly fuels the demand for advanced switchgear technologies. The "drivers" category, though unstated, would encompass these critical elements pushing market growth.

China Switchgear Market Market Size (In Billion)

The market is segmented by voltage into low-voltage, medium-voltage, and high-voltage categories, with further segmentation by insulation type into Gas Insulated Switchgear (GIS), Air Insulated Switchgear (AIS), and other insulation types. Installation preferences vary between indoor and outdoor applications, catering to diverse environmental and operational needs. Key end-user industries contributing to this demand include the commercial, residential, and industrial sectors, each with unique power distribution requirements. Leading global and domestic players like ABB Ltd, Hitachi Energy Ltd, Siemens AG, and Mitsubishi Electric Corporation are actively participating in this dynamic market. The "restrains" for the market, while not explicitly defined, might include factors such as stringent environmental regulations, the need for substantial upfront capital investment, and potential supply chain complexities for certain advanced components. Trends such as the increasing adoption of digital substations, enhanced monitoring and control capabilities, and the development of eco-friendly insulation materials are shaping the future landscape of the China switchgear market.

China Switchgear Market Company Market Share

This in-depth report provides a detailed analysis of the China Switchgear Market, offering critical insights for industry stakeholders, investors, and decision-makers. Covering the historical period from 2019 to 2024, with a base and estimated year of 2025, and a comprehensive forecast period extending to 2033, this study delves into market dynamics, trends, competitive landscape, and future growth opportunities. The market is segmented by voltage (Low-Voltage, Medium-Voltage, High-Voltage), insulation (Gas Insulated Switchgear (GIS), Air Insulated Switchgear (AIS), Other Insulation Types), installation (Indoor, Outdoor), and end-user industry (Commercial, Residential, Industrial). With an estimated market size of USD 15,000 Million in 2025, growing at a CAGR of XX% through 2033, this report is an indispensable resource for understanding the evolving China switchgear landscape.

China Switchgear Market Market Concentration & Innovation

The China Switchgear Market is characterized by a moderate level of concentration, with several global and domestic players vying for market share. Innovation plays a crucial role in this competitive arena, driven by the increasing demand for smart grid technologies, advanced automation, and enhanced safety features in electrical infrastructure. Regulatory frameworks, such as stringent environmental standards and grid modernization initiatives, significantly influence product development and market entry strategies.

- Innovation Drivers:

- Development of smart and connected switchgear solutions.

- Integration of digital technologies for remote monitoring and control.

- Emphasis on eco-friendly and sustainable insulation materials.

- Advancements in arc-flash mitigation and fault detection.

- Regulatory Frameworks:

- National standards for electrical safety and performance.

- Government incentives for renewable energy integration.

- Policies promoting grid modernization and smart grid deployment.

- Product Substitutes:

- Emergence of decentralized energy solutions impacting traditional switchgear demand.

- Advancements in circuit breaker technology offering alternative protection mechanisms.

- End-User Trends:

- Growing preference for compact and modular switchgear designs.

- Demand for high-reliability and low-maintenance solutions.

- Increased adoption in data centers and critical infrastructure projects.

- M&A Activities:

- Strategic acquisitions by major players to expand product portfolios and market reach.

- Consolidation efforts aimed at achieving economies of scale and technological synergy. Deal values in M&A activities are expected to be in the range of USD 50 Million to USD 200 Million.

China Switchgear Market Industry Trends & Insights

The China Switchgear Market is experiencing robust growth, fueled by the nation's relentless pursuit of industrial expansion, urbanization, and the transition towards sustainable energy sources. This dynamic market is witnessing significant technological advancements and evolving consumer preferences, shaping the competitive landscape. The ongoing investment in upgrading and expanding the national power grid, coupled with the burgeoning renewable energy sector, presents substantial opportunities for switchgear manufacturers. The market is expected to reach an estimated USD 15,000 Million in 2025, projecting a Compound Annual Growth Rate (CAGR) of XX% through 2033. This growth is underpinned by several key trends.

Technological disruptions are at the forefront, with the integration of digital technologies such as the Internet of Things (IoT), artificial intelligence (AI), and advanced analytics revolutionizing switchgear functionalities. Smart switchgear, capable of real-time monitoring, predictive maintenance, and remote diagnostics, is gaining traction. This shift towards intelligent grid management enhances operational efficiency, reduces downtime, and improves grid resilience. The adoption of Gas Insulated Switchgear (GIS) is also on the rise, particularly for high-voltage applications and in space-constrained urban environments, due to its superior insulation properties and enhanced safety.

Consumer preferences are increasingly leaning towards solutions that offer enhanced reliability, safety, and energy efficiency. End-user industries, including manufacturing, transportation, and renewable energy, are demanding switchgear that can withstand harsh operating conditions and minimize energy losses. The residential and commercial sectors are also witnessing a growing demand for low-voltage switchgear that aligns with smart home technologies and energy management systems. Furthermore, the government's strong emphasis on environmental sustainability is driving the demand for eco-friendly switchgear, with reduced greenhouse gas emissions and efficient energy utilization.

Competitive dynamics are intensifying, with both established global players and emerging domestic manufacturers competing fiercely. Strategic partnerships, mergers, and acquisitions are common as companies seek to gain a competitive edge through technological innovation, expanded product portfolios, and wider market penetration. The market penetration of advanced switchgear technologies is expected to reach XX% by 2033, driven by these factors. The overall market scenario points towards a sustained period of growth and transformation, with innovation and sustainability acting as key differentiators.

Dominant Markets & Segments in China Switchgear Market

The China Switchgear Market exhibits strong dominance across several segments, driven by extensive infrastructure development, industrialization, and policy initiatives.

Leading Region/Country: China itself represents the dominant market, owing to its massive industrial base, rapid urbanization, and significant investments in power generation and transmission infrastructure. The sheer scale of its energy needs and ongoing grid modernization projects make it the epicenter of switchgear demand.

Dominant Voltage Segment:

- High-Voltage Switchgear: This segment holds a commanding position, primarily due to the extensive development of ultra-high voltage (UHV) transmission lines, large-scale power generation projects (including thermal, hydro, and nuclear), and the expansion of inter-provincial power grids. The construction of substations for these grids significantly drives demand for high-voltage switchgear.

- Key Drivers: Government investments in UHV transmission, expansion of power generation capacity, grid stability requirements for national energy security.

- Medium-Voltage Switchgear: This segment is also a major contributor, essential for power distribution within industrial facilities, commercial complexes, and urban areas. The growing number of manufacturing plants, infrastructure projects, and the increasing complexity of distribution networks fuel its demand.

- Key Drivers: Industrial growth, urbanization, expansion of commercial infrastructure, smart grid deployment for distribution networks.

- High-Voltage Switchgear: This segment holds a commanding position, primarily due to the extensive development of ultra-high voltage (UHV) transmission lines, large-scale power generation projects (including thermal, hydro, and nuclear), and the expansion of inter-provincial power grids. The construction of substations for these grids significantly drives demand for high-voltage switchgear.

Dominant Insulation Type:

- Gas Insulated Switchgear (GIS): GIS is experiencing remarkable growth and dominance, particularly in urban areas and space-constrained substations, due to its compact size, enhanced safety, reliability, and lower environmental impact compared to Air Insulated Switchgear (AIS) for certain applications. Its adoption is crucial for High-Voltage and Medium-Voltage applications where space and environmental considerations are paramount.

- Key Drivers: Urbanization, need for compact substations, high reliability requirements, enhanced safety standards.

- Air Insulated Switchgear (AIS): While still a significant segment, AIS is more prevalent in traditional outdoor substations where space is not a constraint. Its cost-effectiveness for certain applications ensures its continued market presence.

- Key Drivers: Cost-effectiveness, established technology, suitability for outdoor installations.

- Gas Insulated Switchgear (GIS): GIS is experiencing remarkable growth and dominance, particularly in urban areas and space-constrained substations, due to its compact size, enhanced safety, reliability, and lower environmental impact compared to Air Insulated Switchgear (AIS) for certain applications. Its adoption is crucial for High-Voltage and Medium-Voltage applications where space and environmental considerations are paramount.

Dominant Installation Type:

- Indoor Installation: This segment is particularly strong, especially for low and medium-voltage switchgear within commercial buildings, industrial plants, and residential complexes. The need for protection from environmental factors and enhanced security drives the preference for indoor installations.

- Key Drivers: Protection from weather elements, security, integration within building infrastructure, demand from commercial and industrial sectors.

- Indoor Installation: This segment is particularly strong, especially for low and medium-voltage switchgear within commercial buildings, industrial plants, and residential complexes. The need for protection from environmental factors and enhanced security drives the preference for indoor installations.

Dominant End-user Industry:

- Industrial: This sector is the largest consumer of switchgear, encompassing heavy industries like manufacturing, mining, oil & gas, and chemical processing. The constant need for reliable power supply, expansion of production facilities, and upgrades to existing infrastructure drives substantial demand. The industrial sector is expected to account for over 40% of the market share.

- Key Drivers: Manufacturing expansion, infrastructure development, automation in industrial processes, energy-intensive operations.

- Commercial: The burgeoning commercial sector, including data centers, shopping malls, office buildings, and transportation hubs, represents a significant growth area. These facilities require sophisticated switchgear solutions to ensure continuous power supply and manage complex electrical loads.

- Key Drivers: Growth in the service sector, infrastructure development for retail and IT, demand for reliable power in commercial establishments.

- Industrial: This sector is the largest consumer of switchgear, encompassing heavy industries like manufacturing, mining, oil & gas, and chemical processing. The constant need for reliable power supply, expansion of production facilities, and upgrades to existing infrastructure drives substantial demand. The industrial sector is expected to account for over 40% of the market share.

China Switchgear Market Product Developments

Product developments in the China Switchgear Market are focused on enhancing intelligence, reliability, and sustainability. Manufacturers are introducing smart switchgear with integrated digital capabilities for remote monitoring, control, and diagnostics, supporting grid modernization. Innovations include the development of advanced insulation materials for improved efficiency and reduced environmental impact, alongside compact and modular designs for space optimization. Competitive advantages are being gained through enhanced arc-flash protection, increased fault current withstand capabilities, and seamless integration with renewable energy sources. These advancements cater to the growing demand for safer, more efficient, and resilient electrical infrastructure.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the China Switchgear Market, segmented across key parameters.

- Voltage: The market is analyzed by Low-Voltage Switchgear, Medium-Voltage Switchgear, and High-Voltage Switchgear. Low-voltage switchgear caters to residential and smaller commercial needs, while medium-voltage serves industrial and distribution networks. High-voltage switchgear is critical for transmission and large-scale power generation.

- Insulation: Key insulation types examined include Gas Insulated Switchgear (GIS), Air Insulated Switchgear (AIS), and Other Insulation Types. GIS is gaining prominence for its compact design and reliability, while AIS remains relevant for traditional applications.

- Installation: The analysis covers Indoor and Outdoor installations, reflecting the diverse requirements of different environments and applications.

- End-user Industry: The report segments the market by Commercial, Residential, and Industrial end-users, providing insights into the specific demands and growth trajectories of each sector. Growth projections for these segments are estimated to range from XX% to XX% by 2033.

Key Drivers of China Switchgear Market Growth

The China Switchgear Market's growth is propelled by a confluence of robust drivers, primarily stemming from the nation's expansive economic development and its strategic energy policies.

- Massive Infrastructure Investment: Continuous government and private sector investment in upgrading and expanding the national power grid, including the construction of new power plants and ultra-high voltage transmission lines, directly fuels the demand for switchgear.

- Rapid Urbanization and Industrialization: The ongoing expansion of cities and the growth of manufacturing sectors necessitate the development of reliable and efficient electrical distribution networks, requiring a substantial supply of switchgear.

- Renewable Energy Integration: China's ambitious targets for renewable energy generation (solar, wind) require sophisticated grid infrastructure to connect these decentralized sources, driving demand for advanced switchgear solutions capable of managing intermittent power flows.

- Technological Advancements: The adoption of smart grid technologies, automation, and digital solutions is creating new market opportunities for intelligent and high-performance switchgear.

Challenges in the China Switchgear Market Sector

Despite its robust growth, the China Switchgear Market faces several challenges that could impede its full potential.

- Intense Competition and Price Pressures: The presence of numerous domestic and international players leads to fierce competition, often resulting in significant price pressures and reduced profit margins for manufacturers.

- Supply Chain Disruptions: Global and domestic supply chain vulnerabilities, including the availability of raw materials like copper and specialized components, can lead to production delays and increased costs.

- Evolving Regulatory Landscape: While regulations drive innovation, the complexity and frequent changes in environmental and safety standards can pose compliance challenges and necessitate significant R&D investment.

- Technological Obsolescence: The rapid pace of technological advancements requires continuous investment in R&D to keep products competitive, leading to the risk of existing technologies becoming obsolete.

Emerging Opportunities in China Switchgear Market

The China Switchgear Market is ripe with emerging opportunities, driven by evolving energy needs and technological advancements.

- Smart Grid Deployment: The nationwide push for smart grids presents a significant opportunity for manufacturers offering intelligent switchgear with IoT capabilities, advanced analytics, and remote monitoring functionalities.

- Renewable Energy Infrastructure: The continued growth of solar and wind power projects creates demand for specialized switchgear solutions designed for renewable energy integration, including high-voltage and medium-voltage systems for grid connection.

- Energy Storage Solutions: The increasing adoption of battery energy storage systems (BESS) will require compatible switchgear for seamless integration with the grid, opening up new product development avenues.

- Green and Sustainable Switchgear: Growing environmental consciousness and stricter regulations are creating demand for eco-friendly switchgear, such as those utilizing SF6 alternatives or advanced insulation technologies.

Leading Players in the China Switchgear Market Market

- ABB Ltd

- Hitachi Energy Ltd

- KOHL Gmbh

- Toshiba International Corporation

- Mitsubishi Electric Corporation

- Siemens AG

- Larson & Turbo Limited

- General Electric Company

- Hyosung Heavy Industries Corp

- SGC SwitchGear Company

Key Developments in China Switchgear Market Industry

- October 2023: China’s transmission grid developer, State Grid of China Corporation (SGCC), announced the completion of the 1,000 kV Fuzhou–Xiamen ultra-high voltage alternating current power transmission and conversion project, also known as the Fujian North-South Transmission Project. This project, involving a new 1,000 kV double-circuit line and a 6 GW substation, enhances the operational capacity of the eastern power grid and highlights the demand for advanced high-voltage switchgear.

- July 2022: Hitachi Energy was selected to supply China's Tuci offshore wind power project with WindSTAR transformers and a high-voltage hybrid switchgear plug and switch system (PASS). This development underscores the growing role of switchgear in enabling reliable and efficient offshore wind power integration at 66 kV, contributing to the optimization of local energy structures.

Strategic Outlook for China Switchgear Market Market

The strategic outlook for the China Switchgear Market is exceptionally positive, driven by the nation's commitment to a sustainable energy future and its continuous infrastructure development. The ongoing transition towards a greener economy, with significant investments in renewable energy sources like solar and wind, will necessitate a robust and intelligent grid infrastructure, directly boosting the demand for advanced switchgear solutions. The push for smart grid technologies, including digitalization, automation, and AI-driven grid management, presents substantial growth opportunities for manufacturers offering innovative and connected switchgear. Furthermore, the modernization of existing power grids and the construction of new transmission and distribution networks, particularly ultra-high voltage (UHV) lines, will sustain the demand for high-voltage and medium-voltage switchgear. Strategic partnerships, research and development in eco-friendly insulation technologies, and the expansion into emerging applications like electric vehicle charging infrastructure and energy storage systems will be crucial for companies to capitalize on the market's vast potential and maintain a competitive edge.

China Switchgear Market Segmentation

-

1. Type

-

1.1. Voltage

- 1.1.1. Low-Voltage

- 1.1.2. Medium-Voltage

- 1.1.3. High-Voltage

-

1.2. Insulation

- 1.2.1. Gas Insulated Switchgear (GIS)

- 1.2.2. Air Insulated Switchgear (AIS)

- 1.2.3. Other Insulation Types

-

1.3. Installation

- 1.3.1. Indoor

- 1.3.2. Outdoor

-

1.1. Voltage

-

2. End-user Industry

- 2.1. Commertial

- 2.2. Residential

- 2.3. Industrial

China Switchgear Market Segmentation By Geography

- 1. China

China Switchgear Market Regional Market Share

Geographic Coverage of China Switchgear Market

China Switchgear Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.39% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Electricity Generation and Consumption4.; Rising Emphasis on Renewable Energy Generation

- 3.3. Market Restrains

- 3.3.1. 4.; Stringent Environmental and Safety Regulations

- 3.4. Market Trends

- 3.4.1. Industrial Sector is Expected to Witness a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Switchgear Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Voltage

- 5.1.1.1. Low-Voltage

- 5.1.1.2. Medium-Voltage

- 5.1.1.3. High-Voltage

- 5.1.2. Insulation

- 5.1.2.1. Gas Insulated Switchgear (GIS)

- 5.1.2.2. Air Insulated Switchgear (AIS)

- 5.1.2.3. Other Insulation Types

- 5.1.3. Installation

- 5.1.3.1. Indoor

- 5.1.3.2. Outdoor

- 5.1.1. Voltage

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Commertial

- 5.2.2. Residential

- 5.2.3. Industrial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ABB Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hitachi Energy Ltd*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 KOHL Gmbh

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Toshiba International Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Mitsubishi Electric Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Siemens AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Larson & Turbo Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 General Electric Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Hyosung Heavy Industries Corp

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 SGC SwitchGear Company

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 ABB Ltd

List of Figures

- Figure 1: China Switchgear Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China Switchgear Market Share (%) by Company 2025

List of Tables

- Table 1: China Switchgear Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: China Switchgear Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: China Switchgear Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: China Switchgear Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: China Switchgear Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: China Switchgear Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Switchgear Market?

The projected CAGR is approximately 4.39%.

2. Which companies are prominent players in the China Switchgear Market?

Key companies in the market include ABB Ltd, Hitachi Energy Ltd*List Not Exhaustive, KOHL Gmbh, Toshiba International Corporation, Mitsubishi Electric Corporation, Siemens AG, Larson & Turbo Limited, General Electric Company, Hyosung Heavy Industries Corp, SGC SwitchGear Company.

3. What are the main segments of the China Switchgear Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.64 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Electricity Generation and Consumption4.; Rising Emphasis on Renewable Energy Generation.

6. What are the notable trends driving market growth?

Industrial Sector is Expected to Witness a Significant Growth.

7. Are there any restraints impacting market growth?

4.; Stringent Environmental and Safety Regulations.

8. Can you provide examples of recent developments in the market?

October 2023: China’s transmission grid developer, State Grid of China Corporation (SGCC), has announced the completion of the 1,000 kV Fuzhou–Xiamen ultra-high voltage alternating current power transmission and conversion project, also known as the Fujian North-South Transmission Project. This allows the line to be put into operation as scheduled before the end of 2023. The project involved the construction of a new 1,000 kV double-circuit line spanning 238 km and 832 towers, besides a 6 GW substation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Switchgear Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Switchgear Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Switchgear Market?

To stay informed about further developments, trends, and reports in the China Switchgear Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence