Key Insights

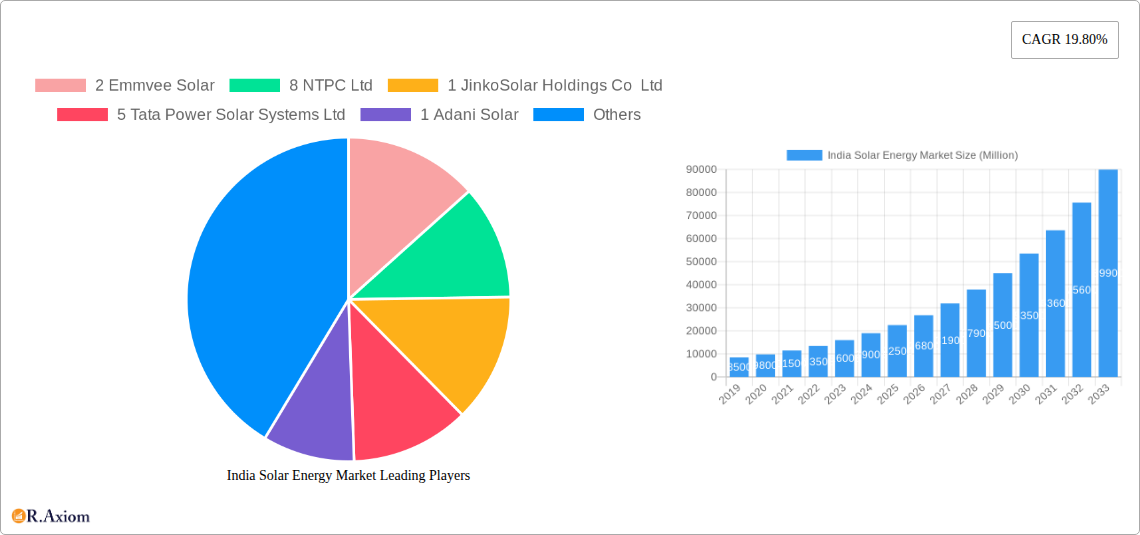

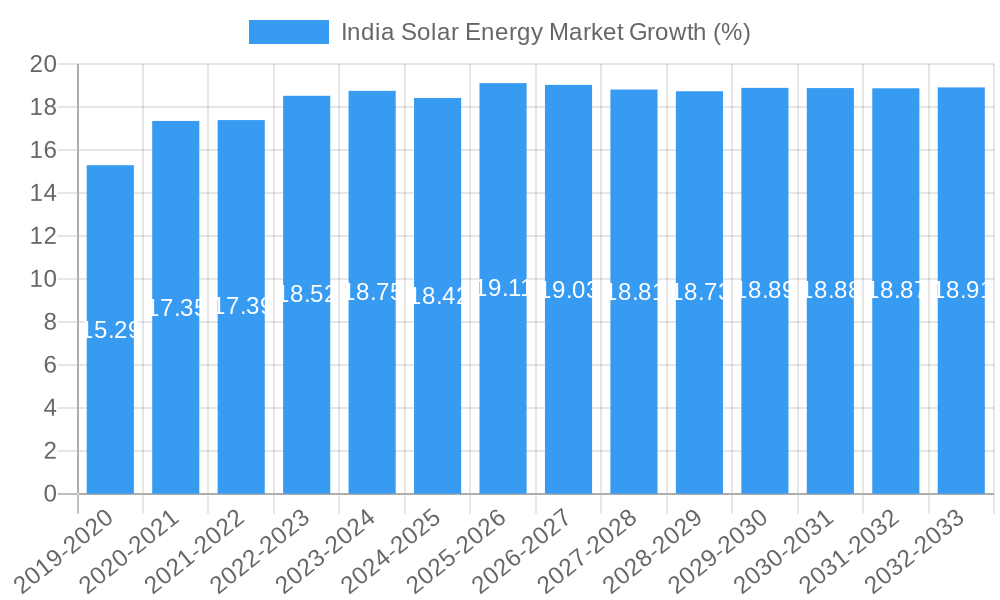

The Indian solar energy market is poised for remarkable expansion, projected to reach an estimated market size of approximately $25,000 million by 2025, fueled by a compelling Compound Annual Growth Rate (CAGR) of 19.80%. This robust growth trajectory is primarily driven by a confluence of supportive government policies, a growing imperative for energy security and independence, and the declining costs of solar technologies. Initiatives like the National Solar Mission and Production Linked Incentives (PLI) for solar PV manufacturing are significantly catalyzing domestic production and deployment, making solar power an increasingly attractive and competitive energy source for the nation. The rising awareness of environmental concerns and India's commitment to its climate targets further underscore the demand for clean energy solutions.

The market is witnessing a dynamic shift with both Solar Photovoltaic (PV) and Concentrated Solar Power (CSP) technologies playing crucial roles. Solar PV, in particular, is dominating the landscape due to its scalability and rapid deployment capabilities. Key market players, including domestic giants like NTPC Ltd., Tata Power Solar Systems Ltd., Adani Solar, Azure Power Global Ltd., ReNew Power Pvt Ltd., and Vikram Solar Limited, are actively expanding their capacities and contributing to the market's growth. Simultaneously, international companies such as JinkoSolar Holdings Co Ltd, Trina Solar Limited, and First Solar Inc. are making significant inroads, bringing advanced technologies and further intensifying competition. The market also presents strategic opportunities for companies like Emmvee Solar, Mahindra Susten Pvt Ltd., Sterling and Wilson Pvt Ltd., and SMA Solar Technology AG, highlighting a vibrant ecosystem of established and emerging players. The forecast period (2025-2033) is expected to see sustained high growth, solidifying India's position as a global leader in solar energy adoption.

This in-depth report offers a strategic analysis of the India Solar Energy Market, providing critical insights into its current landscape, historical performance, and future trajectory. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this report is an indispensable resource for industry stakeholders seeking to understand market concentration, innovation drivers, regulatory frameworks, competitive dynamics, and emerging opportunities. We delve into the dominant segments, key growth drivers, and significant challenges, offering actionable intelligence for investors, policymakers, and businesses operating within India's burgeoning renewable energy sector. With a focus on solar photovoltaic (PV) and concentrated solar power (CSP) technologies, this report leverages high-traffic keywords to enhance search visibility and deliver a comprehensive market overview.

India Solar Energy Market Market Concentration & Innovation

The India Solar Energy Market exhibits a dynamic and evolving concentration landscape, characterized by both the presence of large, established players and a growing influx of innovative domestic and international companies. Market concentration is influenced by significant government incentives, ambitious renewable energy targets, and substantial foreign investment. Innovation is a key differentiator, with companies actively investing in research and development to enhance solar panel efficiency, reduce manufacturing costs, and develop advanced solar energy storage solutions. The regulatory framework, guided by policies like the National Solar Mission and Production Linked Incentive (PLI) schemes, plays a crucial role in fostering innovation by creating a conducive environment for new technologies and business models. Product substitutes, while present in the broader energy market, are increasingly becoming less competitive against the rapidly declining costs and improving efficiency of solar energy. End-user trends demonstrate a strong shift towards clean energy adoption across residential, commercial, and industrial sectors, driven by environmental consciousness and cost savings. Mergers and acquisitions (M&A) activities are on the rise as companies seek to consolidate their market position, expand their service offerings, and gain access to new technologies and geographical markets. For instance, significant M&A deals in the renewable energy space, often involving solar projects, underscore the market's attractiveness and the strategic importance of consolidating assets and capabilities.

India Solar Energy Market Industry Trends & Insights

The India Solar Energy Market is on an unprecedented growth trajectory, driven by a confluence of favorable government policies, declining technology costs, and increasing environmental awareness. A projected Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period (2025-2033) highlights the immense potential of this sector. The Indian government's ambitious target of achieving 500 gigawatts (GW) of renewable energy capacity by 2030 acts as a significant catalyst, encouraging substantial investments in solar power generation. Technological disruptions, including advancements in solar panel efficiency (e.g., bifacial panels, perovskite solar cells), energy storage solutions (battery technology), and smart grid integration, are continuously enhancing the viability and attractiveness of solar energy. Consumer preferences are shifting rapidly, with both utility-scale developers and individual consumers increasingly opting for solar power due to its cost-effectiveness and environmental benefits. The competitive dynamics of the market are intensifying, with a blend of domestic titans and global leaders vying for market share. This intense competition fosters innovation and drives down prices, making solar energy more accessible. Market penetration is steadily increasing across all segments, from large-scale solar farms to rooftop solar installations, further solidifying solar energy's position as a cornerstone of India's energy future. The increasing demand for green energy solutions across various industries, coupled with a robust policy framework, is expected to sustain this high growth momentum.

Dominant Markets & Segments in India Solar Energy Market

Within the India Solar Energy Market, Solar Photovoltaic (PV) technology unequivocally dominates, driven by its widespread applicability, declining costs, and continuous technological advancements. Concentrated Solar Power (CSP), while promising for utility-scale applications, currently holds a smaller market share due to higher upfront costs and specific geographical requirements for optimal performance.

Dominance of Solar Photovoltaic (PV):

- Economic Policies: The Indian government's proactive economic policies, including financial incentives, tax benefits, and subsidies for solar PV installations, have been instrumental in driving its widespread adoption. The Production Linked Incentive (PLI) scheme for solar PV modules aims to boost domestic manufacturing, further strengthening the PV segment.

- Infrastructure Development: The robust development of transmission and distribution infrastructure, coupled with advancements in grid integration technologies, supports the seamless incorporation of solar PV power into the national grid. The availability of land for large-scale solar farms is also a key enabler.

- Technological Maturity and Cost Reduction: Solar PV technology has reached a significant level of maturity, leading to substantial reductions in manufacturing costs and improvements in energy conversion efficiency. This cost-competitiveness makes PV the most attractive option for a wide range of applications, from utility-scale projects to residential rooftop systems.

- Versatility and Scalability: Solar PV systems are highly versatile and scalable, catering to diverse energy needs. They can be deployed as small rooftop installations or as massive solar parks, making them suitable for both urban and rural electrification efforts.

- Growing Demand: The ever-increasing demand for electricity, coupled with the imperative to transition to cleaner energy sources, fuels the demand for solar PV solutions across residential, commercial, and industrial sectors.

Concentrated Solar Power (CSP) Segment:

While currently less dominant, CSP holds significant potential for large-scale, dispatchable solar power generation, particularly in regions with high direct normal irradiance (DNI).

- Potential for Energy Storage: CSP systems inherently integrate thermal energy storage, allowing for power generation even when the sun is not shining, thus providing a more stable and reliable power source compared to PV alone.

- Utility-Scale Applications: CSP is well-suited for large-scale power generation projects, contributing significantly to meeting the country's growing energy demands.

- Technological Advancements: Ongoing research and development in CSP technology, including improvements in heat transfer fluids and storage systems, are expected to enhance its efficiency and reduce costs in the future.

The overall dominance of Solar PV is underpinned by its immediate cost-effectiveness and ease of deployment, making it the primary driver of India's solar energy expansion.

India Solar Energy Market Product Developments

The India Solar Energy Market is witnessing a surge in product development focused on enhancing efficiency, reducing costs, and improving sustainability. Innovations in Solar Photovoltaic (PV) technology include the commercialization of bifacial solar panels, which capture sunlight from both sides, significantly increasing energy yield. Perovskite solar cells are emerging as a promising next-generation technology, offering the potential for higher efficiencies and lower manufacturing costs. Advancements in battery storage solutions are crucial for grid stability and the integration of intermittent solar power. For Concentrated Solar Power (CSP), developments are centered on improving thermal storage capacity and efficiency, as well as exploring novel collector designs. These product developments offer competitive advantages by improving the levelized cost of energy (LCOE), expanding the operational window of solar power, and contributing to a more robust and reliable renewable energy ecosystem.

Report Scope & Segmentation Analysis

This report meticulously segments the India Solar Energy Market into two primary technology categories: Solar Photovoltaic (PV) and Concentrated Solar Power (CSP). The Solar Photovoltaic (PV) segment is projected to experience robust growth, driven by its established cost-competitiveness, wide range of applications, and continuous technological improvements. It is expected to command the largest market share throughout the forecast period (2025-2033). The Concentrated Solar Power (CSP) segment, while smaller, is poised for steady growth, particularly in regions with high direct normal irradiance. Its unique advantage of integrated thermal energy storage makes it a valuable component for large-scale, dispatchable renewable energy generation. Competitive dynamics within each segment are influenced by manufacturing capabilities, technological innovation, and government policy support.

Key Drivers of India Solar Energy Market Growth

Several pivotal factors are propelling the growth of the India Solar Energy Market.

- Government Policies and Targets: Ambitious renewable energy targets, such as achieving 500 GW by 2030, coupled with supportive policies like tax incentives, subsidies, and the Production Linked Incentive (PLI) scheme, are major growth catalysts.

- Declining Technology Costs: The continuous reduction in the cost of solar PV modules and associated components has made solar energy increasingly competitive with conventional energy sources.

- Environmental Concerns and Sustainability Initiatives: Growing awareness of climate change and the imperative for sustainable development are driving the adoption of clean energy solutions across all sectors.

- Energy Security and Independence: Reducing reliance on imported fossil fuels and enhancing energy security are key national objectives that solar energy directly addresses.

- Technological Advancements: Innovations in solar panel efficiency, energy storage, and grid integration are improving the performance and reliability of solar power systems.

Challenges in the India Solar Energy Market Sector

Despite its strong growth, the India Solar Energy Market faces certain challenges.

- Grid Integration and Stability: Integrating large-scale, intermittent solar power into the existing grid infrastructure can pose challenges related to grid stability and reliability.

- Land Acquisition: The acquisition of large tracts of land for utility-scale solar projects can be a time-consuming and complex process.

- Supply Chain Dependencies: While domestic manufacturing is growing, reliance on imported components for certain parts of the solar value chain can be a concern.

- Financing and Investment Risks: Securing consistent and adequate financing for large renewable energy projects can sometimes be challenging, and policy uncertainties can impact investment sentiment.

- Transmission Infrastructure: Inadequate transmission infrastructure in certain regions can hinder the evacuation of power generated from solar farms.

Emerging Opportunities in India Solar Energy Market

The India Solar Energy Market presents numerous emerging opportunities for growth and innovation.

- Rooftop Solar Expansion: Significant untapped potential exists in the rooftop solar segment for residential, commercial, and industrial consumers, driven by declining costs and net-metering policies.

- Green Hydrogen Production: Solar energy is crucial for the electrolysis process in producing green hydrogen, a key element in the global decarbonization efforts, opening up a massive new market.

- Energy Storage Solutions: The increasing penetration of solar power necessitates advanced and affordable energy storage solutions, creating opportunities for battery manufacturers and technology developers.

- Floating Solar Projects: Utilizing water bodies for solar installations can overcome land constraints and improve panel efficiency due to cooling effects, presenting a unique opportunity.

- Off-Grid and Rural Electrification: Solar energy offers a viable solution for providing electricity to remote and off-grid areas, contributing to inclusive development.

Leading Players in the India Solar Energy Market Market

- Emmvee Solar

- NTPC Ltd

- JinkoSolar Holdings Co Ltd

- Tata Power Solar Systems Ltd

- Adani Solar

- Azure Power Global Ltd

- ReNew Power Pvt Ltd

- Trina Solar Limited

- Vikram Solar Limited

- First Solar Inc

- Mahindra Susten Pvt Ltd

- Sterling and Wilson Pvt Ltd

- SMA Solar Technology AG

- Hanwha Q Cells Co Ltd

Key Developments in India Solar Energy Market Industry

- December 2022: The Government of India, Solar Energy Corporation of India Limited (SECI), and the World Bank signed agreements for a USD 150 million International Bank for Reconstruction and Development (IBRD) loan, a USD 28 million Clean Technology Fund (CTF) loan, and a USD 22 million CTF grant to assist India in increasing its power generation capacity through cleaner and renewable energy sources. This agreement reaffirmed India's goal of reaching 500 gigawatts (GW) of renewable energy by 2030.

- September 2022: Amazon India announced three solar farm projects in Rajasthan with a total combined clean energy capacity of 420 megawatts (MW). The company's set of utility-scale renewable energy projects in India included a 210 MW project to be developed by ReNew Power, a 100 MW project by Amp Energy India, and a 110 MW project to be developed by Brookfield Renewable.

- January 2022: SJVN (Satluj Jal Vidyut Nigam Ltd) was awarded a 125-megawatt solar project in Uttar Pradesh following a bidding procedure conducted by the Uttar Pradesh New and Renewable Energy Development Agency (UPNEDA). The project included a 75 MW grid-connected solar project in Jalaun and a 50 MW solar project in the Kanpur and Dehat districts.

Strategic Outlook for India Solar Energy Market Market

- December 2022: The Government of India, Solar Energy Corporation of India Limited (SECI), and the World Bank signed agreements for a USD 150 million International Bank for Reconstruction and Development (IBRD) loan, a USD 28 million Clean Technology Fund (CTF) loan, and a USD 22 million CTF grant to assist India in increasing its power generation capacity through cleaner and renewable energy sources. This agreement reaffirmed India's goal of reaching 500 gigawatts (GW) of renewable energy by 2030.

- September 2022: Amazon India announced three solar farm projects in Rajasthan with a total combined clean energy capacity of 420 megawatts (MW). The company's set of utility-scale renewable energy projects in India included a 210 MW project to be developed by ReNew Power, a 100 MW project by Amp Energy India, and a 110 MW project to be developed by Brookfield Renewable.

- January 2022: SJVN (Satluj Jal Vidyut Nigam Ltd) was awarded a 125-megawatt solar project in Uttar Pradesh following a bidding procedure conducted by the Uttar Pradesh New and Renewable Energy Development Agency (UPNEDA). The project included a 75 MW grid-connected solar project in Jalaun and a 50 MW solar project in the Kanpur and Dehat districts.

Strategic Outlook for India Solar Energy Market Market

The strategic outlook for the India Solar Energy Market is exceptionally positive, driven by a robust government commitment to renewable energy, declining technology costs, and an increasing focus on sustainability. The market is expected to witness sustained growth, fueled by investments in utility-scale solar parks, a burgeoning rooftop solar segment, and the emerging opportunity in green hydrogen production. Advancements in energy storage technologies will further bolster the integration of solar power and enhance grid stability. Companies that focus on technological innovation, efficient project execution, and strategic partnerships will be well-positioned to capitalize on the vast opportunities presented by India's clean energy transition. The market's trajectory indicates a significant expansion of solar power's contribution to India's overall energy mix, solidifying its role in achieving energy security and environmental goals.

India Solar Energy Market Segmentation

-

1. Technology

- 1.1. Solar Photovoltaic (PV)

- 1.2. Concentrated Solar Power (CSP)

India Solar Energy Market Segmentation By Geography

- 1. India

India Solar Energy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 19.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Supportive Government Policies for Developing Solar Energy4.; Declining Cost of Solar Power Technology

- 3.3. Market Restrains

- 3.3.1. 4.; Unpredictability in the Continuity of Power Supply

- 3.4. Market Trends

- 3.4.1. Solar PV Segment is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Solar Energy Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Solar Photovoltaic (PV)

- 5.1.2. Concentrated Solar Power (CSP)

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. India

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North India India Solar Energy Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Solar Energy Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Solar Energy Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Solar Energy Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 2 Emmvee Solar

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 8 NTPC Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 1 JinkoSolar Holdings Co Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 5 Tata Power Solar Systems Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 1 Adani Solar

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 9 Azure Power Global Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 7 ReNew Power Pvt Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 5 Trina Solar Limited*List Not Exhaustive

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Domestic Players

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 6 Vikram Solar Limited

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Foreign Players

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 2 First Solar Inc

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 3 Mahindra Susten Pvt Ltd

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 4 Sterling and Wilson Pvt Ltd

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 4 SMA Solar Technology AG

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.16 3 Hanwha Q Cells Co Ltd

- 10.2.16.1. Overview

- 10.2.16.2. Products

- 10.2.16.3. SWOT Analysis

- 10.2.16.4. Recent Developments

- 10.2.16.5. Financials (Based on Availability)

- 10.2.1 2 Emmvee Solar

List of Figures

- Figure 1: India Solar Energy Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Solar Energy Market Share (%) by Company 2024

List of Tables

- Table 1: India Solar Energy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Solar Energy Market Volume Megawatt Forecast, by Region 2019 & 2032

- Table 3: India Solar Energy Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 4: India Solar Energy Market Volume Megawatt Forecast, by Technology 2019 & 2032

- Table 5: India Solar Energy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: India Solar Energy Market Volume Megawatt Forecast, by Region 2019 & 2032

- Table 7: India Solar Energy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: India Solar Energy Market Volume Megawatt Forecast, by Country 2019 & 2032

- Table 9: North India India Solar Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: North India India Solar Energy Market Volume (Megawatt) Forecast, by Application 2019 & 2032

- Table 11: South India India Solar Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: South India India Solar Energy Market Volume (Megawatt) Forecast, by Application 2019 & 2032

- Table 13: East India India Solar Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: East India India Solar Energy Market Volume (Megawatt) Forecast, by Application 2019 & 2032

- Table 15: West India India Solar Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: West India India Solar Energy Market Volume (Megawatt) Forecast, by Application 2019 & 2032

- Table 17: India Solar Energy Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 18: India Solar Energy Market Volume Megawatt Forecast, by Technology 2019 & 2032

- Table 19: India Solar Energy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: India Solar Energy Market Volume Megawatt Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Solar Energy Market?

The projected CAGR is approximately 19.80%.

2. Which companies are prominent players in the India Solar Energy Market?

Key companies in the market include 2 Emmvee Solar, 8 NTPC Ltd, 1 JinkoSolar Holdings Co Ltd, 5 Tata Power Solar Systems Ltd, 1 Adani Solar, 9 Azure Power Global Ltd, 7 ReNew Power Pvt Ltd, 5 Trina Solar Limited*List Not Exhaustive, Domestic Players, 6 Vikram Solar Limited, Foreign Players, 2 First Solar Inc, 3 Mahindra Susten Pvt Ltd, 4 Sterling and Wilson Pvt Ltd, 4 SMA Solar Technology AG, 3 Hanwha Q Cells Co Ltd.

3. What are the main segments of the India Solar Energy Market?

The market segments include Technology.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Supportive Government Policies for Developing Solar Energy4.; Declining Cost of Solar Power Technology.

6. What are the notable trends driving market growth?

Solar PV Segment is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Unpredictability in the Continuity of Power Supply.

8. Can you provide examples of recent developments in the market?

December 2022: The Government of India, Solar Energy Corporation of India Limited (SECI), and the World Bank signed agreements for a USD 150 million International Bank for Reconstruction and Development (IBRD) loan, a USD 28 million Clean Technology Fund (CTF) loan, and a USD 22 million CTF grant to assist India in increasing its power generation capacity through cleaner and renewable energy sources. The agreement reaffirmed India's goal of reaching 500 gigatons (GW) of renewable energy by 2030.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Megawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Solar Energy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Solar Energy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Solar Energy Market?

To stay informed about further developments, trends, and reports in the India Solar Energy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence