Key Insights

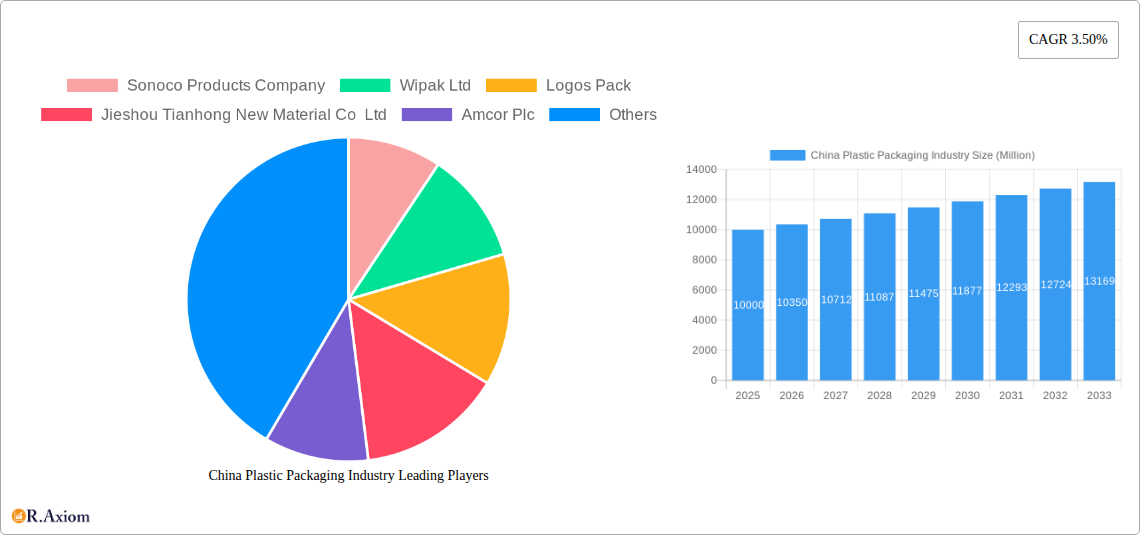

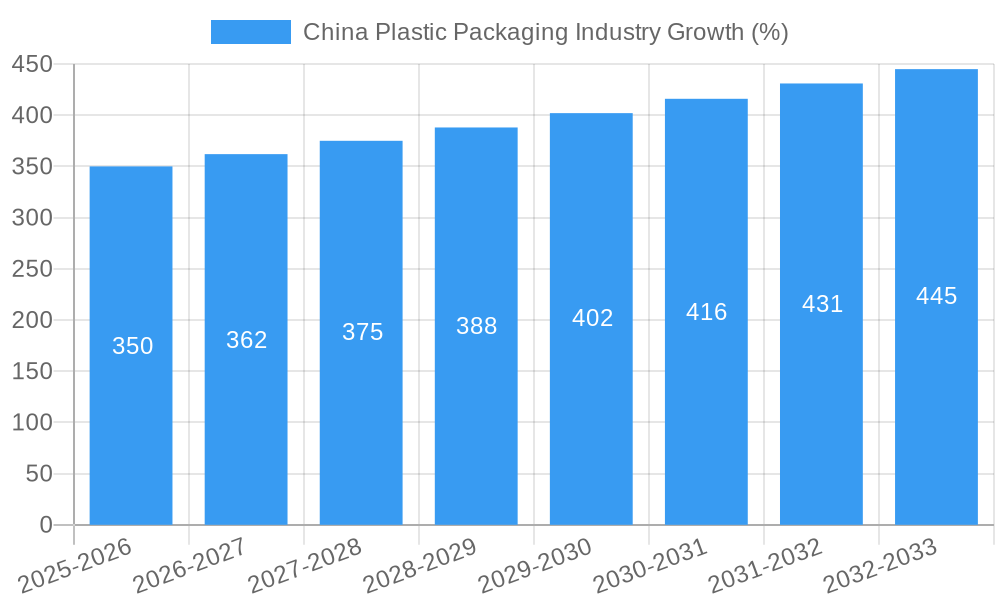

The China plastic packaging industry, valued at approximately $XX million in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 3.50% from 2025 to 2033. This expansion is fueled by several key factors. The burgeoning food and beverage sector, coupled with rising consumer demand for packaged goods, is a significant driver. Increased adoption of plastic packaging across various industries, including pharmaceuticals and personal care, contributes to market expansion. Furthermore, advancements in plastic packaging technology, such as lightweighting and improved barrier properties, are enhancing the appeal and functionality of plastic packaging solutions. However, growing environmental concerns regarding plastic waste and increasing government regulations aimed at promoting sustainable packaging alternatives pose significant challenges to the industry's growth trajectory. These regulatory pressures are pushing manufacturers to explore eco-friendly alternatives, such as biodegradable and compostable plastics, and to adopt circular economy models focusing on recycling and waste reduction.

The industry segmentation reveals a diverse landscape. Bags, pouches, and films dominate the packaging product segment, reflecting the widespread use of flexible packaging. Polyethylene (HDPE, LDPE, LLDPE) and polypropylene (CPP and BOPP) are the leading materials due to their cost-effectiveness and versatility. The food and beverage sector remains the largest end-user industry, reflecting China’s large and growing consumer market. Key players in this competitive market include Sonoco Products Company, Wipak Ltd, Amcor Plc, and Berry Global, among others. These companies are strategically investing in innovation and capacity expansion to meet the rising demand and address the evolving regulatory landscape. Competition is intense, with both domestic and international players vying for market share. The future of the industry hinges on its ability to balance growth with sustainability, adopting innovative solutions that minimize environmental impact while meeting the packaging needs of a rapidly expanding economy.

China Plastic Packaging Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the China plastic packaging industry, offering invaluable insights for stakeholders seeking to navigate this dynamic market. The report covers the period from 2019 to 2033, with a focus on the base year 2025 and a forecast extending to 2033. Key segments analyzed include packaging products (bags, pouches, films, etc.), materials (polyethylene, polypropylene, etc.), and end-user industries (food, beverages, pharmaceuticals, etc.). Leading players like Sonoco Products Company, Amcor Plc, Berry Global, and Sealed Air Corporation are profiled, alongside significant Chinese players. The report's detailed analysis encompasses market size, growth drivers, challenges, opportunities, and future trends, providing actionable intelligence for strategic decision-making.

China Plastic Packaging Industry Market Concentration & Innovation

This section analyzes the competitive landscape of the Chinese plastic packaging market, exploring market concentration, innovation drivers, regulatory influences, and market dynamics. We examine the market share of key players, M&A activity, and the impact of product substitutes and evolving end-user trends. The analysis will reveal the level of market fragmentation and identify dominant players. We also evaluate the influence of regulatory frameworks on innovation and growth, highlighting the role of environmental regulations and food safety standards. Data points such as market share percentages for top players and aggregate values of M&A deals within the study period will be included. For instance, we will investigate the impact of increased demand for sustainable packaging solutions on the competitive landscape and the role of technological advancements in driving innovation within the industry. The analysis will further explore the impact of government policies and economic factors on market concentration, providing insights into the strategies employed by leading players to maintain their market positions. The total value of M&A deals in the studied period is estimated to be around XX Million.

China Plastic Packaging Industry Industry Trends & Insights

This section delves into the key trends and insights shaping the China plastic packaging market. We will explore the market growth drivers, analyzing factors such as economic growth, urbanization, changing consumer preferences, and technological advancements. The analysis will include a detailed assessment of the Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033), highlighting periods of accelerated growth and identifying potential deceleration points. We will also investigate market penetration rates of various packaging types across different end-user industries, offering insights into the adoption rates of innovative solutions. Specific examples of technological disruptions, such as the rise of sustainable packaging materials and automated packaging lines, will be discussed. The competitive dynamics will be analyzed, examining the strategies employed by leading players to gain market share and maintain a competitive edge. The analysis will shed light on emerging trends, such as the increasing preference for flexible packaging and customized packaging solutions. The market size is predicted to reach XX Million by 2033.

Dominant Markets & Segments in China Plastic Packaging Industry

This section identifies the dominant segments within the China plastic packaging market, analyzing leading regions, countries, and specific product categories.

By Packaging Product: The report analyzes the market share and growth potential of bags, pouches, tray lidding films, blister base films, wrapping films, and forming webs. We will highlight the most dominant product categories based on factors like market size and growth rate.

By Material: We will examine the market share and trends for polyethylene (HDPE, LDPE, LLDPE), biaxially oriented polyethylene terephthalate (BOPET), polypropylene (CPP and BOPP), polyvinyl chloride (PVC), and other materials (EVOH, polystyrene (PS), and nylon). The analysis will identify the most commonly used materials and their drivers.

By End-user Industry: The report analyzes market dominance across food, beverages, pharmaceuticals and medical, personal care and home care, and other end-user industries. This section will explore the factors driving demand within each sector, including government regulations, consumer preferences, and economic conditions. We will pinpoint the fastest growing end-user segment and analyze the key drivers for growth, such as economic policies that incentivize production and consumption, and infrastructure development supporting the efficient movement of goods and supplies. The most dominant market segment in terms of market size and growth is expected to be the food and beverage industry.

China Plastic Packaging Industry Product Developments

This section summarizes recent product innovations, applications, and their competitive advantages. The focus will be on technological trends and market fit, highlighting how new products address unmet needs or improve existing solutions. Examples of innovations will include advancements in material science (e.g., biodegradable plastics), improved barrier properties of films and advanced packaging designs tailored to specific end-user needs. We will analyze the impact of these product developments on market competition and consumer choice.

Report Scope & Segmentation Analysis

This report provides a detailed segmentation analysis of the China plastic packaging industry across various parameters.

By Packaging Product: The report covers bags, pouches, tray lidding films, blister base films, wrapping films, and forming webs, projecting growth rates and market size for each segment. Competitive dynamics, including market share and key players, will also be considered.

By Material: The report analyzes the market size and growth projections for polyethylene (HDPE, LDPE, LLDPE), BOPET, polypropylene (CPP and BOPP), PVC, and other materials, outlining the competitive landscape and relevant technological advancements.

By End-user Industry: Growth projections, market sizes, and competitive dynamics are provided for food, beverages, pharmaceuticals and medical, personal care and home care, and other end-user industries. This section will analyze the specific needs and preferences of each end-user segment in terms of packaging requirements.

Key Drivers of China Plastic Packaging Industry Growth

The growth of the China plastic packaging industry is driven by several key factors. Firstly, the expanding food and beverage sector, coupled with rising consumer spending and changing lifestyles, fuels demand for diverse packaging solutions. Secondly, advancements in packaging technology and the introduction of sustainable and eco-friendly materials are also significant drivers. Thirdly, supportive government policies and infrastructure development contribute to the industry's expansion.

Challenges in the China Plastic Packaging Industry Sector

The China plastic packaging industry faces challenges such as environmental concerns related to plastic waste, stringent government regulations on plastic usage, fluctuations in raw material prices, and intense competition. These factors can impact production costs and profitability, potentially leading to reduced market growth. The impact of these challenges is estimated to be a reduction of XX Million in market value per year.

Emerging Opportunities in China Plastic Packaging Industry

Emerging opportunities exist in the development and adoption of sustainable and biodegradable packaging materials, catering to the growing consumer preference for eco-friendly products. Furthermore, the increasing demand for customized packaging solutions and e-commerce growth present significant opportunities for expansion. New technologies, such as smart packaging and innovative materials with enhanced barrier properties, also offer substantial potential.

Leading Players in the China Plastic Packaging Industry Market

- Sonoco Products Company

- Wipak Ltd

- Logos Pack

- Jieshou Tianhong New Material Co Ltd

- Amcor Plc

- Tetra Laval

- Qingdao Haoyu Packing Co Ltd

- Berry Global

- Sealed Air Corporation

- Silgan Holdings

Key Developments in China Plastic Packaging Industry Industry

- February 2022: Liquidbox expands its single-material, flexible packaging solution, Liquidure, into the APAC region, aiming to meet growing demand in China and other countries. This signifies a significant move towards sustainable packaging solutions and increased competition in the region.

Strategic Outlook for China Plastic Packaging Industry Market

The future of the China plastic packaging industry looks promising, driven by sustained economic growth, rising consumption, and technological advancements. The shift towards sustainable and eco-friendly packaging solutions will continue to shape the market, creating both challenges and opportunities for industry players. Companies that invest in innovation and adapt to changing consumer preferences will be best positioned for success. The market is projected to experience substantial growth in the coming years, driven by the factors mentioned above.

China Plastic Packaging Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

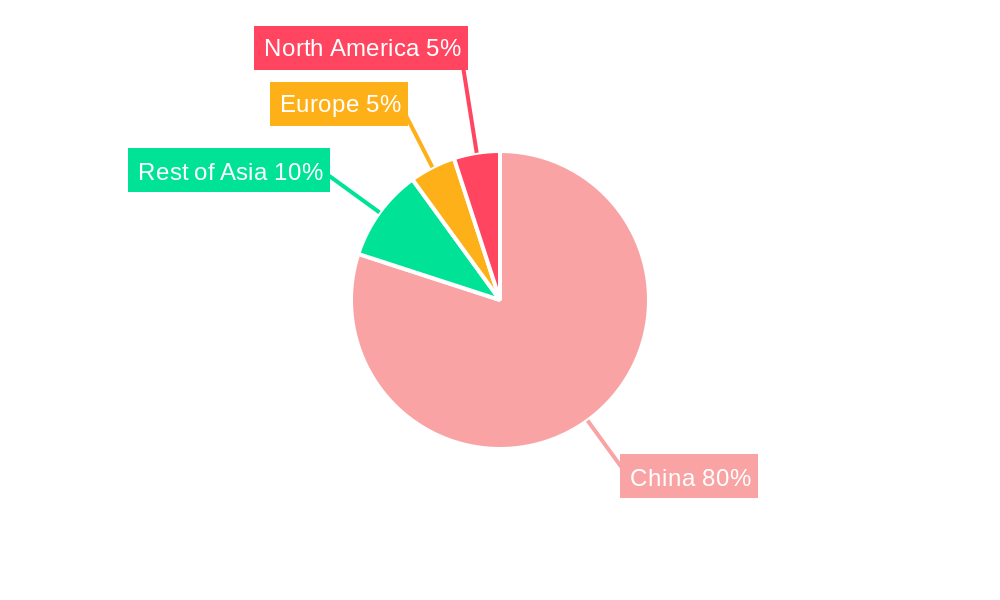

China Plastic Packaging Industry Segmentation By Geography

- 1. China

China Plastic Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand from E-commerce Industry; Increasing Adoption of Lightweight-packaging Methods

- 3.3. Market Restrains

- 3.3.1. ; Environmental Legislations For Recycling

- 3.4. Market Trends

- 3.4.1. E-commerce Industry is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Plastic Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. China

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Sonoco Products Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Wipak Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Logos Pack

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Jieshou Tianhong New Material Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Amcor Plc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Tetra Laval

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Qingdao Haoyu Packing Co Ltd*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Berry Global

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sealed Air Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Silgan Holdings

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Sonoco Products Company

List of Figures

- Figure 1: China Plastic Packaging Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Plastic Packaging Industry Share (%) by Company 2024

List of Tables

- Table 1: China Plastic Packaging Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Plastic Packaging Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: China Plastic Packaging Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: China Plastic Packaging Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: China Plastic Packaging Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: China Plastic Packaging Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: China Plastic Packaging Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: China Plastic Packaging Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: China Plastic Packaging Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 10: China Plastic Packaging Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 11: China Plastic Packaging Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 12: China Plastic Packaging Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 13: China Plastic Packaging Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 14: China Plastic Packaging Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Plastic Packaging Industry?

The projected CAGR is approximately 3.50%.

2. Which companies are prominent players in the China Plastic Packaging Industry?

Key companies in the market include Sonoco Products Company, Wipak Ltd, Logos Pack, Jieshou Tianhong New Material Co Ltd, Amcor Plc, Tetra Laval, Qingdao Haoyu Packing Co Ltd*List Not Exhaustive, Berry Global, Sealed Air Corporation, Silgan Holdings.

3. What are the main segments of the China Plastic Packaging Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand from E-commerce Industry; Increasing Adoption of Lightweight-packaging Methods.

6. What are the notable trends driving market growth?

E-commerce Industry is Driving the Market.

7. Are there any restraints impacting market growth?

; Environmental Legislations For Recycling.

8. Can you provide examples of recent developments in the market?

February 2022: Liquidbox, a US-based liquid packaging and dispensing solution provider, expanded Liquidure, a single-material, flexible packaging solution for its global customers. The company plans to begin manufacturing solutions at its Asia-Pacific (APAC) region bag sites to meet growing demand in China, India, and other countries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Plastic Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Plastic Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Plastic Packaging Industry?

To stay informed about further developments, trends, and reports in the China Plastic Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence