Key Insights

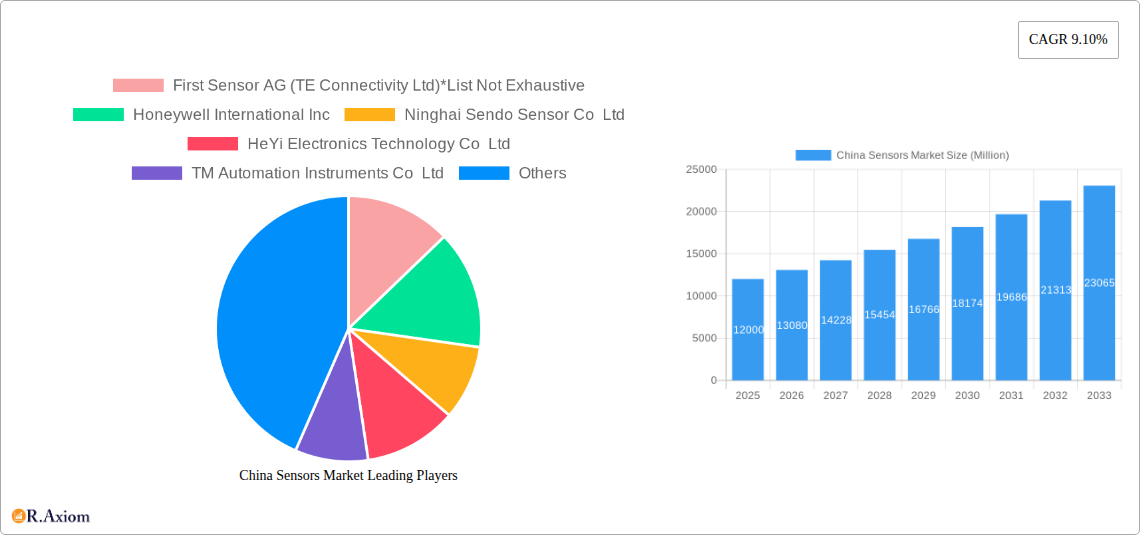

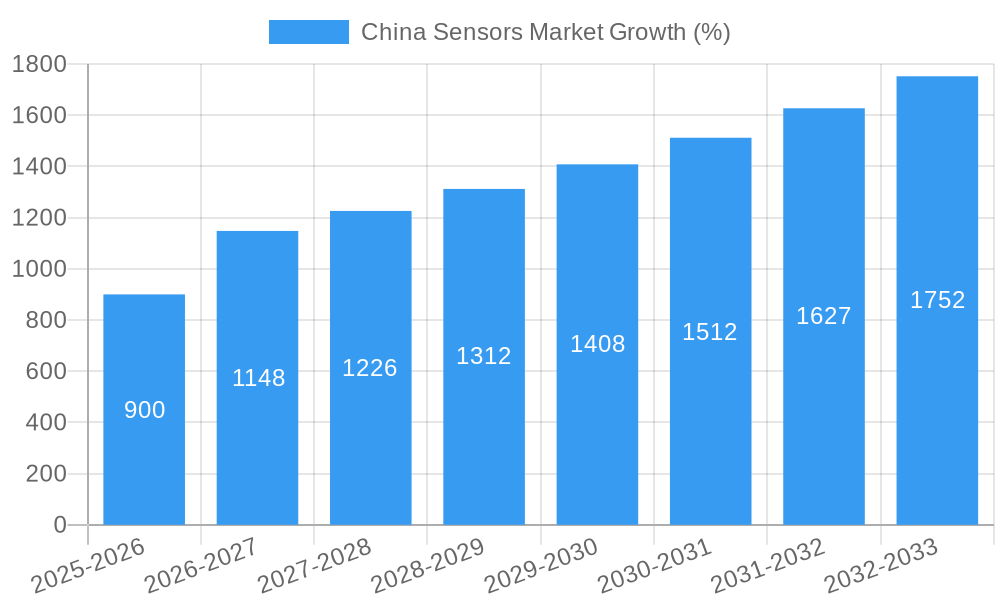

The China sensors market is experiencing robust growth, driven by the nation's rapid technological advancements and expanding industrial sectors. With a Compound Annual Growth Rate (CAGR) of 9.10% from 2019 to 2024, the market is projected to continue this trajectory through 2033. Key drivers include the burgeoning automotive industry's demand for advanced driver-assistance systems (ADAS) and autonomous vehicles, the proliferation of smart devices in consumer electronics, and the increasing automation within industrial settings. Growth is particularly strong in segments like automotive sensors (pressure, temperature, and proximity sensors for engine management and safety systems), consumer electronics sensors (for smartphones, wearables, and IoT devices), and industrial sensors used for process automation and monitoring. The adoption of advanced sensor technologies, such as lidar and radar, for applications like autonomous driving and industrial automation, is a significant trend. However, challenges like high initial investment costs and the complexities associated with sensor integration and data processing could act as potential restraints to some degree. The market's segmentation reveals a diverse range of sensor types, encompassing optical, electrical resistance, and biosensors, each catering to different applications across various end-user industries. China's strong manufacturing base and supportive government policies are further fueling market expansion. The dominance of specific sensor types (e.g., optical and electrical resistance) is likely due to their maturity and cost-effectiveness, while emerging technologies like biosensors are gaining traction due to their specific application needs in medical and wellness sectors.

The significant market size in 2025 (assuming a value between $10 billion to $15 billion based on the provided CAGR and considering the global sensor market size) further underscores the immense potential. The forecast period (2025-2033) anticipates continued growth, propelled by factors such as increased government investment in infrastructure projects and the continuous evolution of emerging technologies across multiple end-user segments. While competitive pressures exist among numerous domestic and international players, this dynamic landscape is expected to consolidate further in the coming years. The market is expected to see innovations in areas such as miniaturization, higher precision, and improved energy efficiency of sensors in the near future.

China Sensors Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the China sensors market, covering market size, growth projections, segmentation, key players, and emerging trends from 2019 to 2033. The study period is 2019-2033, with 2025 as the base and estimated year. The forecast period spans 2025-2033, and the historical period covers 2019-2024. This in-depth analysis is essential for industry stakeholders, investors, and businesses seeking to understand and capitalize on opportunities within this dynamic market. The report encompasses detailed breakdowns by parameters measured, mode of operation, and end-user industry, offering actionable insights for strategic decision-making.

China Sensors Market Market Concentration & Innovation

The China sensors market exhibits a moderately concentrated landscape, with both domestic and international players vying for market share. While a few multinational corporations hold significant positions, numerous smaller, specialized firms contribute significantly to innovation and market dynamism. Market concentration is further analyzed through metrics like the Herfindahl-Hirschman Index (HHI), calculating the relative market share of top players. The xx Million M&A deal value recorded during 2019-2024 reflects significant consolidation activity. Innovation is driven by government initiatives promoting technological advancement, coupled with the increasing demand for sophisticated sensor technologies across various end-user sectors.

- Market Share: Top 5 players account for approximately xx% of the market share (2024).

- M&A Activity: Significant M&A activity observed during 2019-2024, with a total deal value exceeding xx Million.

- Regulatory Framework: Favorable government policies and investment in R&D foster innovation, but stringent regulations surrounding data security and product safety present challenges.

- Product Substitutes: The emergence of alternative technologies and materials may impact market dynamics, requiring ongoing adaptation and innovation from incumbent players.

- End-User Trends: Growing adoption of IoT devices and smart technologies drives demand for high-performance sensors with improved accuracy, miniaturization, and power efficiency.

China Sensors Market Industry Trends & Insights

The China sensors market demonstrates robust growth, fueled by increasing automation, digitalization, and technological advancements across diverse sectors. The market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching a market value of xx Million by 2033. This expansion is primarily driven by the rising adoption of smart devices, the proliferation of IoT applications, and the growing emphasis on data-driven decision-making across various industries. Significant technological disruptions, particularly in areas like LiDAR and solid-state sensors, are reshaping market dynamics and creating new opportunities. Consumer preferences shift towards more accurate, reliable, and energy-efficient sensors, particularly in the automotive, consumer electronics, and industrial sectors. The competitive landscape is intensely dynamic, marked by both price competition and technological innovation, necessitating continuous product development and strategic partnerships for sustained success.

Dominant Markets & Segments in China Sensors Market

The China sensors market exhibits significant growth across various segments. Within the By Parameters Measured category, the Temperature and Pressure sensor segments are currently dominant, driven by wide-ranging applications across diverse industries. The By Mode of Operation segment showcases a strong preference for Optical and Electrical Resistance sensors, owing to their reliability, affordability, and wide-ranging compatibility across applications. In the By End-user Industry category, the Automotive segment displays high growth potential due to the increasing adoption of advanced driver-assistance systems (ADAS) and autonomous driving technologies. The Consumer Electronics segment witnesses consistent demand due to the rising penetration of smartphones, wearables, and smart home devices.

- Key Drivers in Dominant Segments:

- Automotive: Government support for electric vehicles and autonomous driving technologies

- Consumer Electronics: Rising disposable incomes and consumer demand for smart devices

- Industrial: Automation and Industry 4.0 initiatives

- Temperature Sensors: Wide-ranging applications across diverse industries

- Optical Sensors: Increasing adoption in automation and imaging applications.

China Sensors Market Product Developments

Recent product innovations focus on miniaturization, enhanced performance, and integration with smart technologies. Manufacturers are emphasizing the development of high-precision, low-power, and cost-effective sensors to meet the growing demand across diverse applications. The integration of advanced signal processing capabilities and artificial intelligence (AI) enhances sensor functionalities, leading to improved data analysis and decision-making. This trend towards miniaturization and smarter sensors perfectly aligns with the market's demand for seamless integration and enhanced performance.

Report Scope & Segmentation Analysis

This report comprehensively segments the China sensors market by parameters measured (temperature, pressure, level, flow, proximity, environmental, chemical, inertial, magnetic, vibration, other), mode of operation (optical, electrical resistance, biosensors, piezoresistive, image, capacitive, piezoelectric, lidar, radar, other), and end-user industry (automotive, consumer electronics, energy, industrial, medical and wellness, construction, agriculture and mining, aerospace, defense). Each segment's analysis includes market size, growth projections, and competitive dynamics, providing a granular understanding of the market landscape. Growth projections for each segment are detailed within the full report.

Key Drivers of China Sensors Market Growth

The growth of the China sensors market is propelled by several key factors: Firstly, the government's continuous investment in infrastructure and technological advancements fuels demand across various sectors. Secondly, increasing industrial automation and the proliferation of IoT devices drive the need for high-performance sensors. Thirdly, the rising adoption of electric vehicles and autonomous driving technologies boosts the demand for advanced sensors in the automotive industry. Finally, the expansion of the healthcare and wellness sectors fuels the growth of medical sensors.

Challenges in the China Sensors Market Sector

The China sensors market faces challenges such as intense competition, particularly from international players with established technologies and brand recognition. Supply chain disruptions and escalating raw material costs can impact profitability and market stability. Stringent regulatory requirements regarding data privacy and product safety can add to the operational complexity of businesses within the sector. Furthermore, ensuring the long-term reliability and accuracy of sensors in diverse operating conditions remains a significant ongoing challenge.

Emerging Opportunities in China Sensors Market

The market presents several promising opportunities. The expansion of 5G networks and the growth of IoT applications unlock new avenues for sensor deployment and data utilization. The increasing demand for environmentally friendly and sustainable solutions creates opportunities for sensors used in energy-efficient technologies and environmental monitoring. Advancements in AI and machine learning technologies are enhancing sensor capabilities, leading to the development of more intelligent and sophisticated applications. The increasing adoption of robotics and automation in various industries further strengthens the demand for advanced sensor technologies.

Leading Players in the China Sensors Market Market

- First Sensor AG (TE Connectivity Ltd)

- Honeywell International Inc

- Ninghai Sendo Sensor Co Ltd

- HeYi Electronics Technology Co Ltd

- TM Automation Instruments Co Ltd

- Novosense

- Trihero Group

- Cheemi Technology Co Ltd

- STMicroelectronics NV

- Amphenol Advanced Sensors

Key Developments in China Sensors Market Industry

- April 2022: Chinese meteorologists launched nationwide winter wheat monitoring using remote sensing satellite technology, improving forecast precision.

- January 2022: RoboSense showcased the world's first mass-produced automotive-grade solid-state LiDAR at CES 2022, highlighting advancements in LiDAR technology.

Strategic Outlook for China Sensors Market Market

The China sensors market holds immense future potential, driven by the continuous expansion of smart technologies, the increasing adoption of IoT devices, and the sustained government investment in infrastructure development and technological innovation. The market's growth trajectory is expected to remain positive, driven by strong demand from various sectors. Strategic players are focusing on innovation, partnerships, and diversification to capitalize on this growth opportunity.

China Sensors Market Segmentation

-

1. Parameters Measured

- 1.1. Temperature

- 1.2. Pressure

- 1.3. Level

- 1.4. Flow

- 1.5. Proximity

- 1.6. Environmental

- 1.7. Chemical

- 1.8. Inertial

- 1.9. Magnetic

- 1.10. Vibration

- 1.11. Other Parameters Measured

-

2. Mode of Operation

- 2.1. Optical

- 2.2. Electrical Resistance

- 2.3. Biosensors

- 2.4. Piezoresistive

- 2.5. Image

- 2.6. Capacitive

- 2.7. Piezoelectric

- 2.8. Lidar

- 2.9. Radar

- 2.10. Other Modes of Operation

-

3. End-user Industry

- 3.1. Automotive

-

3.2. Consumer Electronics

- 3.2.1. Smartphones

- 3.2.2. Tablets, Laptops, and Computers

- 3.2.3. Wearable Devices

- 3.2.4. Smart Appliances or Devices

- 3.2.5. Other Consumer Electronics

- 3.3. Energy

- 3.4. Industrial and Other

- 3.5. Medical and Wellness

- 3.6. Construction, Agriculture, and Mining

- 3.7. Aerospace

- 3.8. Defense

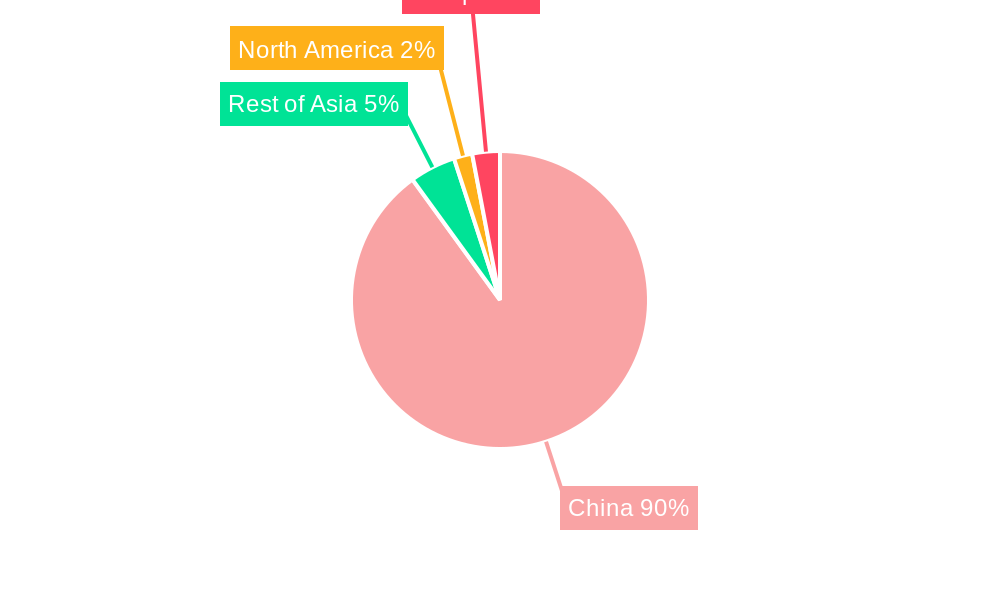

China Sensors Market Segmentation By Geography

- 1. China

China Sensors Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Emergence of Automation and Industry 4.; Technological Advancements and Decreasing Cost of Sensors

- 3.3. Market Restrains

- 3.3.1. High Initial Cost Involved

- 3.4. Market Trends

- 3.4.1. Automotive Industry is Expected to Hold a Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Sensors Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Parameters Measured

- 5.1.1. Temperature

- 5.1.2. Pressure

- 5.1.3. Level

- 5.1.4. Flow

- 5.1.5. Proximity

- 5.1.6. Environmental

- 5.1.7. Chemical

- 5.1.8. Inertial

- 5.1.9. Magnetic

- 5.1.10. Vibration

- 5.1.11. Other Parameters Measured

- 5.2. Market Analysis, Insights and Forecast - by Mode of Operation

- 5.2.1. Optical

- 5.2.2. Electrical Resistance

- 5.2.3. Biosensors

- 5.2.4. Piezoresistive

- 5.2.5. Image

- 5.2.6. Capacitive

- 5.2.7. Piezoelectric

- 5.2.8. Lidar

- 5.2.9. Radar

- 5.2.10. Other Modes of Operation

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Automotive

- 5.3.2. Consumer Electronics

- 5.3.2.1. Smartphones

- 5.3.2.2. Tablets, Laptops, and Computers

- 5.3.2.3. Wearable Devices

- 5.3.2.4. Smart Appliances or Devices

- 5.3.2.5. Other Consumer Electronics

- 5.3.3. Energy

- 5.3.4. Industrial and Other

- 5.3.5. Medical and Wellness

- 5.3.6. Construction, Agriculture, and Mining

- 5.3.7. Aerospace

- 5.3.8. Defense

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.1. Market Analysis, Insights and Forecast - by Parameters Measured

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 First Sensor AG (TE Connectivity Ltd)*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Honeywell International Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ninghai Sendo Sensor Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 HeYi Electronics Technology Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 TM Automation Instruments Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Novosense

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Trihero Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Cheemi Technology Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 STMicroelectronics NV

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Amphenol Advanced Sensors

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 First Sensor AG (TE Connectivity Ltd)*List Not Exhaustive

List of Figures

- Figure 1: China Sensors Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Sensors Market Share (%) by Company 2024

List of Tables

- Table 1: China Sensors Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Sensors Market Revenue Million Forecast, by Parameters Measured 2019 & 2032

- Table 3: China Sensors Market Revenue Million Forecast, by Mode of Operation 2019 & 2032

- Table 4: China Sensors Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 5: China Sensors Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: China Sensors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: China Sensors Market Revenue Million Forecast, by Parameters Measured 2019 & 2032

- Table 8: China Sensors Market Revenue Million Forecast, by Mode of Operation 2019 & 2032

- Table 9: China Sensors Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 10: China Sensors Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Sensors Market?

The projected CAGR is approximately 9.10%.

2. Which companies are prominent players in the China Sensors Market?

Key companies in the market include First Sensor AG (TE Connectivity Ltd)*List Not Exhaustive, Honeywell International Inc, Ninghai Sendo Sensor Co Ltd, HeYi Electronics Technology Co Ltd, TM Automation Instruments Co Ltd, Novosense, Trihero Group, Cheemi Technology Co Ltd, STMicroelectronics NV, Amphenol Advanced Sensors.

3. What are the main segments of the China Sensors Market?

The market segments include Parameters Measured, Mode of Operation, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Emergence of Automation and Industry 4.; Technological Advancements and Decreasing Cost of Sensors.

6. What are the notable trends driving market growth?

Automotive Industry is Expected to Hold a Significant Share.

7. Are there any restraints impacting market growth?

High Initial Cost Involved.

8. Can you provide examples of recent developments in the market?

April 2022 - Chinese meteorologists launched monitoring and assessment services for winter wheat distribution nationwide based on remote sensing satellite technology. The new satellite-powered service could address the previous lack-of-precision problems in weather forecasts for grain production.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Sensors Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Sensors Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Sensors Market?

To stay informed about further developments, trends, and reports in the China Sensors Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence