Key Insights

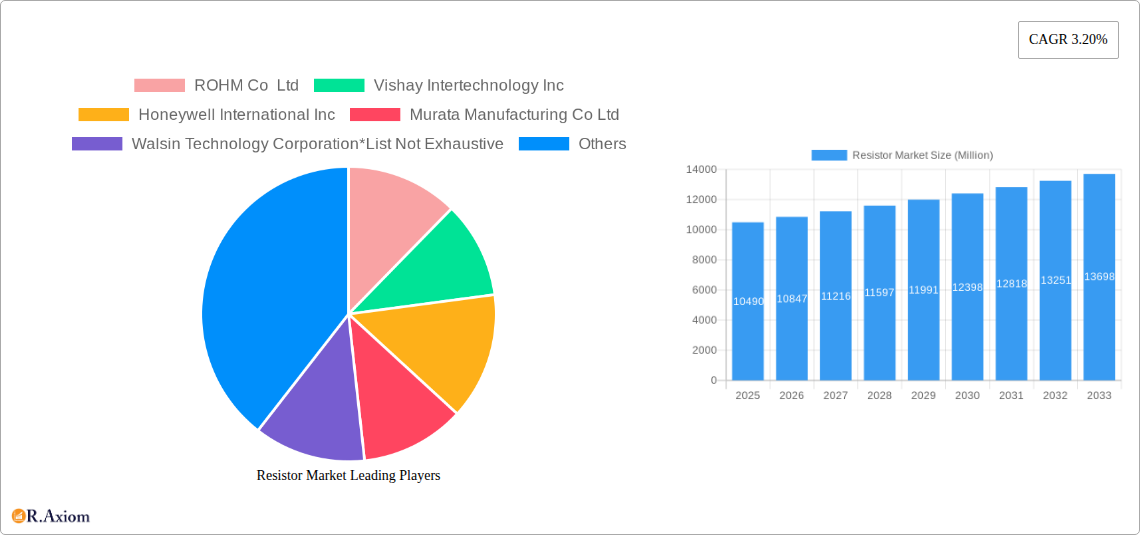

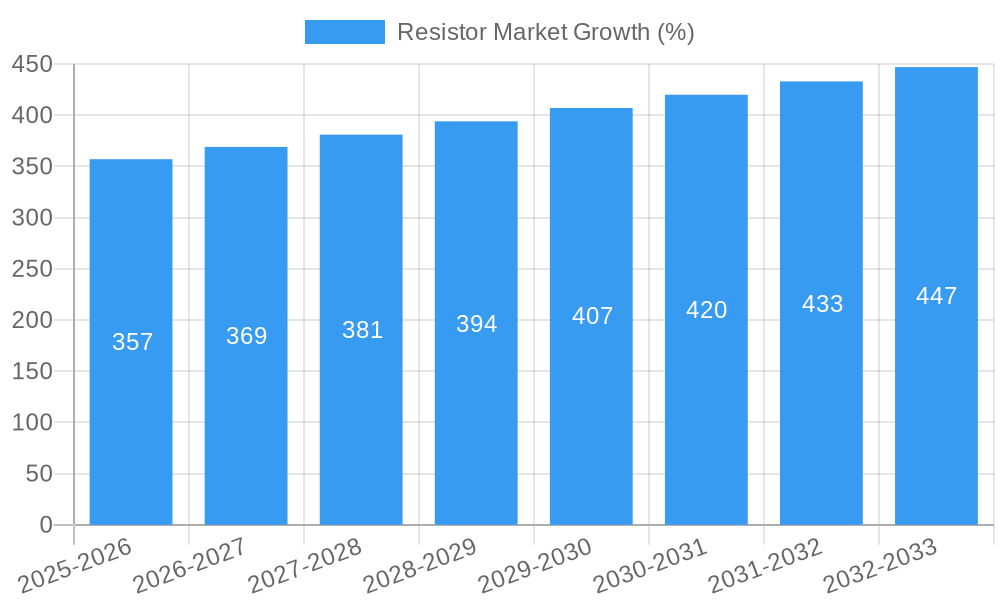

The global resistor market, valued at $10.49 billion in 2025, is projected to experience steady growth, driven by the increasing demand for electronic components across diverse sectors. A Compound Annual Growth Rate (CAGR) of 3.20% from 2025 to 2033 indicates a robust expansion, fueled primarily by the burgeoning automotive, consumer electronics, and industrial automation sectors. The automotive industry's push towards electric vehicles and advanced driver-assistance systems (ADAS) is a significant driver, demanding high-performance resistors for power management and safety systems. Similarly, the rising adoption of IoT devices and smart technologies in consumer electronics is boosting demand for miniaturized and high-precision resistors. Further growth stems from the expansion of 5G infrastructure and the increasing complexity of communication networks, which necessitate advanced resistor technologies. While competitive pricing pressures and the potential for technological disruption pose some challenges, the market's resilience is underpinned by its crucial role in virtually all electronic devices. Specific segment growth will vary; for example, surface-mounted chip resistors are expected to maintain strong growth due to their space-saving advantages in miniaturized devices, while the wire wound segment will experience slower growth given its niche applications. Key players such as ROHM, Vishay, and Murata are well-positioned to capitalize on this growth, focusing on innovation, diversification, and strategic acquisitions to maintain market leadership. Geographic expansion, particularly in developing economies of Asia Pacific, will further fuel market expansion in the coming years.

The resistor market segmentation reveals significant opportunities within specific end-user industries. The automotive segment, with its demand for reliable and high-performance resistors in power management and safety systems, is a key growth driver. Similarly, the aerospace and defense sectors require robust and highly reliable resistors for mission-critical applications. The communications industry's investment in 5G infrastructure and advanced communication technologies translates to a heightened demand for high-frequency resistors. The increasing sophistication of consumer electronics and computing devices necessitates high-precision resistors for various applications, driving growth in this segment as well. The “Other End-user Industries” segment, encompassing medical, industrial, and energy sectors, also contributes significantly, reflecting the ubiquitous nature of resistors across various applications. The market's diversity, combined with consistent technological advancements and the increasing electronic component density in modern devices, ensures long-term growth prospects.

Resistor Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the global resistor market, covering market size, segmentation, key players, growth drivers, challenges, and future opportunities. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. The forecast period is 2025-2033, and the historical period covers 2019-2024. This report is invaluable for industry stakeholders, investors, and anyone seeking to understand the dynamics of this crucial electronic component market.

Resistor Market Market Concentration & Innovation

The resistor market exhibits a moderately concentrated landscape, with several major players holding significant market share. The top ten companies—ROHM Co Ltd, Vishay Intertechnology Inc, Honeywell International Inc, Murata Manufacturing Co Ltd, Walsin Technology Corporation, TT Electronics, Viking Tech Corporation, KOA Speer Electronics Inc, Yageo Corporation, and TE Connectivity Ltd—account for approximately xx% of the global market in 2025. However, the presence of numerous smaller players fosters competition and innovation.

Market share fluctuations are influenced by factors such as technological advancements, M&A activities, and shifts in end-user demand. Recent M&A deals, while not publicly disclosed in detail for all players, suggest a consolidation trend in the market, with deal values ranging from xx Million to xx Million annually, depending on the size and scope of the acquisitions.

- Innovation Drivers: Miniaturization, improved precision, enhanced power handling capabilities, and the development of specialized resistors for specific applications are key drivers of innovation.

- Regulatory Frameworks: Compliance with international standards and regulations regarding safety and performance is paramount. Stringent environmental regulations are also driving the development of eco-friendly resistor materials and manufacturing processes.

- Product Substitutes: While resistors are essential components, potential substitutes include alternative circuit designs and integrated circuits, depending on the specific application.

- End-User Trends: The increasing demand for electronics in various sectors, especially automotive, consumer electronics, and communications, is driving market growth. Furthermore, the demand for higher-precision and specialized resistors is shaping product development.

- M&A Activities: Strategic acquisitions and mergers among resistor manufacturers are reshaping the market landscape, leading to increased consolidation and competition.

Resistor Market Industry Trends & Insights

The global resistor market is experiencing robust growth, driven by several key factors. The market is expected to register a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by the rising demand for electronics across various end-user industries. The increasing penetration of electronic devices in diverse applications, coupled with technological advancements leading to smaller, more efficient, and specialized resistors, is a significant market driver.

Technological disruptions, such as the development of advanced materials and manufacturing processes, are enhancing resistor performance and reliability. Consumer preferences are shifting towards smaller, more energy-efficient, and higher-precision resistors. Competitive dynamics are intense, with manufacturers focusing on innovation, cost optimization, and supply chain diversification to maintain a competitive edge. Market penetration is highest in developed regions, but emerging markets present significant growth potential. The increasing adoption of electric vehicles and renewable energy technologies is also creating substantial opportunities for the resistor market.

Dominant Markets & Segments in Resistor Market

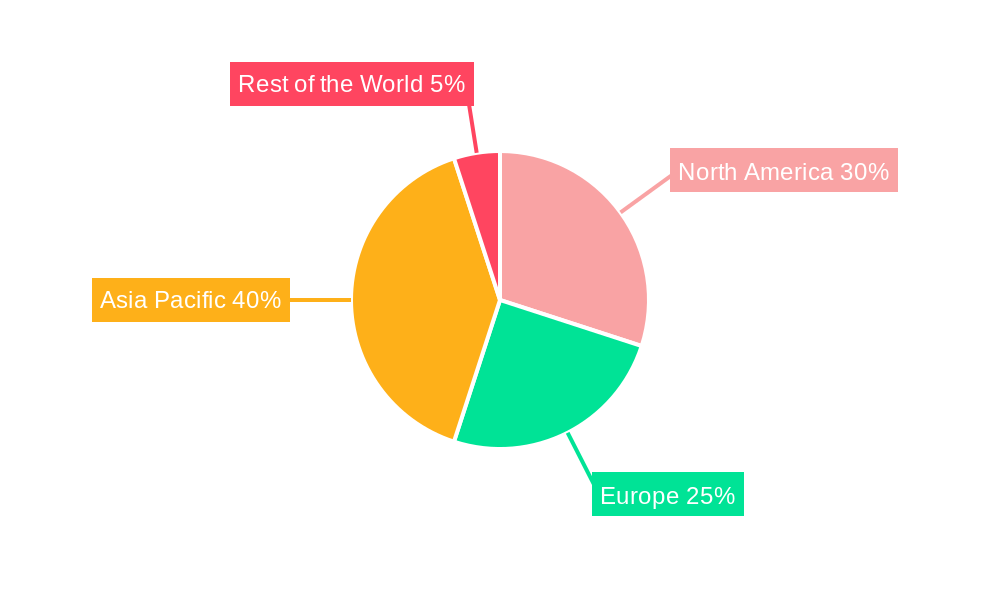

The Asia-Pacific region dominates the global resistor market, driven by robust growth in electronics manufacturing and consumption within countries like China, Japan, and South Korea.

Key Drivers in the Asia-Pacific Region:

- Strong economic growth and increasing disposable income.

- Favorable government policies supporting electronics manufacturing.

- A large and expanding consumer electronics market.

- Development of robust infrastructure to support the electronics industry.

Dominant Segments:

- Type: Surface-mounted chip resistors (SMD) hold the largest market share due to their miniaturization and automation-friendly features.

- End-User Industry: The consumer electronics and computing segment is the largest end-user industry, driven by the proliferation of smartphones, computers, and other electronic gadgets. The automotive sector is experiencing rapid growth due to the increasing adoption of advanced driver-assistance systems (ADAS) and electric vehicles.

Detailed analysis reveals that within the types of resistors, surface-mounted chip resistors dominate due to their size and ease of integration into modern devices. Within end-user industries, the automotive segment is experiencing the fastest growth, propelled by the rise of electric vehicles and advanced driver-assistance systems.

Resistor Market Product Developments

Recent product developments in the resistor market focus on improving performance, miniaturization, and energy efficiency. Manufacturers are introducing new materials, such as high-temperature ceramics, to enhance resistor performance in demanding applications. There's also an increased focus on developing advanced packaging techniques to reduce size and improve integration. These advancements enhance the competitive advantages of companies by catering to the evolving needs of various industries. The trend toward higher power densities and improved precision is particularly significant.

Report Scope & Segmentation Analysis

This report segments the resistor market by type (Surface-mounted Chips, Network, Wirewound, Film/Oxide/Foil, Carbon) and end-user industry (Automotive, Aerospace and Defense, Communications, Consumer Electronics and Computing, Other End-user Industries (Medical, Industrial, Energy and Power)). Each segment's growth projection, market size, and competitive dynamics are analyzed in detail. For instance, the surface-mounted chip resistor segment is expected to exhibit significant growth due to its widespread adoption in modern electronics. Similarly, the automotive segment is projected to witness robust expansion driven by the burgeoning electric vehicle market. The competitive landscape within each segment varies, with some segments being more concentrated than others.

Key Drivers of Resistor Market Growth

The resistor market's growth is propelled by several key factors:

- Technological advancements: Miniaturization, improved precision, and enhanced power handling capabilities are driving demand.

- Economic growth: Rising disposable income and increased spending on electronics in developing economies are boosting market growth.

- Stringent regulatory frameworks: Regulations regarding electronic component safety and performance are creating opportunities for advanced, compliant resistor solutions. For example, the increasing adoption of stricter automotive safety standards drives demand for high-reliability resistors.

Challenges in the Resistor Market Sector

Several challenges hinder the growth of the resistor market:

- Supply chain disruptions: Global events and geopolitical uncertainties can cause fluctuations in the availability of raw materials and manufacturing capacity, impacting production and pricing. These disruptions can lead to increased costs and potential delays in product delivery.

- Intense competition: The market is highly competitive, with numerous players vying for market share. This leads to price pressure and necessitates continuous innovation to remain competitive.

- Fluctuations in raw material prices: The prices of raw materials, such as metals and ceramics, can fluctuate significantly, impacting the overall cost of resistor production.

Emerging Opportunities in Resistor Market

Emerging opportunities in the resistor market include:

- Growth in the electric vehicle market: The increasing demand for EVs drives the need for high-performance resistors in power electronics and charging systems.

- Expansion of 5G infrastructure: The rollout of 5G networks necessitates specialized resistors that can handle high frequencies and power demands.

- Development of new applications: The emergence of IoT devices and smart technologies opens new possibilities for resistor applications in various fields.

Leading Players in the Resistor Market Market

- ROHM Co Ltd (ROHM Co Ltd)

- Vishay Intertechnology Inc (Vishay Intertechnology Inc)

- Honeywell International Inc (Honeywell International Inc)

- Murata Manufacturing Co Ltd (Murata Manufacturing Co Ltd)

- Walsin Technology Corporation

- TT Electronics (TT Electronics)

- Viking Tech Corporation (Viking Tech Corporation)

- KOA Speer Electronics Inc (KOA Speer Electronics Inc)

- Yageo Corporation (Yageo Corporation)

- TE Connectivity Ltd (TE Connectivity Ltd)

- Bourns Inc (Bourns Inc)

- Susumu International U S A (Susumu International U S A)

- Ohmite Manufacturing Company (Ohmite Manufacturing Company)

- Panasonic Corporation (Panasonic Corporation)

Key Developments in Resistor Market Industry

- August 2023: Texas Instruments (TI) launched new current sensing solutions, including a low-drift Hall-effect current sensor and current shunt monitors with integrated shunt resistors. This enhances accuracy, integration, and design efficiency.

- March 2023: Vishay Intertechnology, Inc. upgraded its Vishay Draloric RCS0805 e3 anti-surge thick film resistor with a higher power rating (0.5W), enabling space savings in various industries.

Strategic Outlook for Resistor Market Market

The resistor market is poised for sustained growth driven by the continuous expansion of electronic applications across diverse sectors. Technological advancements, particularly in miniaturization, precision, and power handling, will further fuel market expansion. Emerging technologies like electric vehicles, renewable energy, and the IoT will create substantial opportunities for specialized resistor solutions. Companies that focus on innovation, supply chain resilience, and strategic partnerships are best positioned to capitalize on the market's future potential.

Resistor Market Segmentation

-

1. Type

- 1.1. Surface-mounted Chips

- 1.2. Network

- 1.3. Wirewound

- 1.4. Film/Oxide/Foil

- 1.5. Carbon

-

2. End-User Industry

- 2.1. Automotive

- 2.2. Aerospace and Defense

- 2.3. Communications

- 2.4. Consumer Electronics and Computing

- 2.5. Other En

Resistor Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Resistor Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand from the Automotive Industry; Growing Demand for High-performance Electronics

- 3.3. Market Restrains

- 3.3.1. Growth in the Metal Prices to Impact Production Cost

- 3.4. Market Trends

- 3.4.1. Consumer Electronics Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Resistor Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Surface-mounted Chips

- 5.1.2. Network

- 5.1.3. Wirewound

- 5.1.4. Film/Oxide/Foil

- 5.1.5. Carbon

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Automotive

- 5.2.2. Aerospace and Defense

- 5.2.3. Communications

- 5.2.4. Consumer Electronics and Computing

- 5.2.5. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Resistor Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Surface-mounted Chips

- 6.1.2. Network

- 6.1.3. Wirewound

- 6.1.4. Film/Oxide/Foil

- 6.1.5. Carbon

- 6.2. Market Analysis, Insights and Forecast - by End-User Industry

- 6.2.1. Automotive

- 6.2.2. Aerospace and Defense

- 6.2.3. Communications

- 6.2.4. Consumer Electronics and Computing

- 6.2.5. Other En

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Resistor Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Surface-mounted Chips

- 7.1.2. Network

- 7.1.3. Wirewound

- 7.1.4. Film/Oxide/Foil

- 7.1.5. Carbon

- 7.2. Market Analysis, Insights and Forecast - by End-User Industry

- 7.2.1. Automotive

- 7.2.2. Aerospace and Defense

- 7.2.3. Communications

- 7.2.4. Consumer Electronics and Computing

- 7.2.5. Other En

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Resistor Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Surface-mounted Chips

- 8.1.2. Network

- 8.1.3. Wirewound

- 8.1.4. Film/Oxide/Foil

- 8.1.5. Carbon

- 8.2. Market Analysis, Insights and Forecast - by End-User Industry

- 8.2.1. Automotive

- 8.2.2. Aerospace and Defense

- 8.2.3. Communications

- 8.2.4. Consumer Electronics and Computing

- 8.2.5. Other En

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Resistor Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Surface-mounted Chips

- 9.1.2. Network

- 9.1.3. Wirewound

- 9.1.4. Film/Oxide/Foil

- 9.1.5. Carbon

- 9.2. Market Analysis, Insights and Forecast - by End-User Industry

- 9.2.1. Automotive

- 9.2.2. Aerospace and Defense

- 9.2.3. Communications

- 9.2.4. Consumer Electronics and Computing

- 9.2.5. Other En

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. North America Resistor Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Europe Resistor Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Asia Pacific Resistor Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Rest of the World Resistor Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 ROHM Co Ltd

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Vishay Intertechnology Inc

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Honeywell International Inc

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Murata Manufacturing Co Ltd

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Walsin Technology Corporation*List Not Exhaustive

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 TT Electronics

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Viking Tech Corporation

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 KOA Speer Electronics Inc

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Yageo Corporation

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 TE Connectivity Ltd

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Bourns Inc

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.12 Susumu International U S A

- 14.2.12.1. Overview

- 14.2.12.2. Products

- 14.2.12.3. SWOT Analysis

- 14.2.12.4. Recent Developments

- 14.2.12.5. Financials (Based on Availability)

- 14.2.13 Ohmite Manufacturing Company

- 14.2.13.1. Overview

- 14.2.13.2. Products

- 14.2.13.3. SWOT Analysis

- 14.2.13.4. Recent Developments

- 14.2.13.5. Financials (Based on Availability)

- 14.2.14 Panasonic Corporation

- 14.2.14.1. Overview

- 14.2.14.2. Products

- 14.2.14.3. SWOT Analysis

- 14.2.14.4. Recent Developments

- 14.2.14.5. Financials (Based on Availability)

- 14.2.1 ROHM Co Ltd

List of Figures

- Figure 1: Global Resistor Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Resistor Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Resistor Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Resistor Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Resistor Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Resistor Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Resistor Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Resistor Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Resistor Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Resistor Market Revenue (Million), by Type 2024 & 2032

- Figure 11: North America Resistor Market Revenue Share (%), by Type 2024 & 2032

- Figure 12: North America Resistor Market Revenue (Million), by End-User Industry 2024 & 2032

- Figure 13: North America Resistor Market Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 14: North America Resistor Market Revenue (Million), by Country 2024 & 2032

- Figure 15: North America Resistor Market Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Resistor Market Revenue (Million), by Type 2024 & 2032

- Figure 17: Europe Resistor Market Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Resistor Market Revenue (Million), by End-User Industry 2024 & 2032

- Figure 19: Europe Resistor Market Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 20: Europe Resistor Market Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe Resistor Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Asia Pacific Resistor Market Revenue (Million), by Type 2024 & 2032

- Figure 23: Asia Pacific Resistor Market Revenue Share (%), by Type 2024 & 2032

- Figure 24: Asia Pacific Resistor Market Revenue (Million), by End-User Industry 2024 & 2032

- Figure 25: Asia Pacific Resistor Market Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 26: Asia Pacific Resistor Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Asia Pacific Resistor Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Rest of the World Resistor Market Revenue (Million), by Type 2024 & 2032

- Figure 29: Rest of the World Resistor Market Revenue Share (%), by Type 2024 & 2032

- Figure 30: Rest of the World Resistor Market Revenue (Million), by End-User Industry 2024 & 2032

- Figure 31: Rest of the World Resistor Market Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 32: Rest of the World Resistor Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Rest of the World Resistor Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Resistor Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Resistor Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Resistor Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 4: Global Resistor Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Resistor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Resistor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Resistor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Resistor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Resistor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Resistor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Resistor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Resistor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Resistor Market Revenue Million Forecast, by Type 2019 & 2032

- Table 14: Global Resistor Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 15: Global Resistor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Resistor Market Revenue Million Forecast, by Type 2019 & 2032

- Table 17: Global Resistor Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 18: Global Resistor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Global Resistor Market Revenue Million Forecast, by Type 2019 & 2032

- Table 20: Global Resistor Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 21: Global Resistor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Resistor Market Revenue Million Forecast, by Type 2019 & 2032

- Table 23: Global Resistor Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 24: Global Resistor Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Resistor Market?

The projected CAGR is approximately 3.20%.

2. Which companies are prominent players in the Resistor Market?

Key companies in the market include ROHM Co Ltd, Vishay Intertechnology Inc, Honeywell International Inc, Murata Manufacturing Co Ltd, Walsin Technology Corporation*List Not Exhaustive, TT Electronics, Viking Tech Corporation, KOA Speer Electronics Inc, Yageo Corporation, TE Connectivity Ltd, Bourns Inc, Susumu International U S A, Ohmite Manufacturing Company, Panasonic Corporation.

3. What are the main segments of the Resistor Market?

The market segments include Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.49 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand from the Automotive Industry; Growing Demand for High-performance Electronics.

6. What are the notable trends driving market growth?

Consumer Electronics Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

Growth in the Metal Prices to Impact Production Cost.

8. Can you provide examples of recent developments in the market?

August 2023: Texas Instruments (TI) has announced the introduction of new current sensing solutions, which have been specifically designed to enhance accuracy and integration while also streamlining the overall design process. As part of this release, TI is offering two innovative products: a Hall-effect current sensor, renowned for its remarkably low drift within TI's product range, and new current shunt monitors that incorporate a shunt resistor.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Resistor Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Resistor Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Resistor Market?

To stay informed about further developments, trends, and reports in the Resistor Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence