Key Insights

The Semiconductor Laser Equipment market is poised for robust expansion, driven by escalating demand across diverse applications such as telecommunications, industrial manufacturing, and consumer electronics. The market size is estimated to be substantial, with significant growth projected over the forecast period. Key drivers include the rapid advancement in laser technology, enabling higher power, greater efficiency, and miniaturization of semiconductor lasers. Furthermore, the increasing adoption of 5G infrastructure, the burgeoning electric vehicle (EV) market, and the continuous innovation in areas like LiDAR for autonomous systems are fueling the need for sophisticated semiconductor laser equipment. The historical data from 2019-2024 indicates a steady upward trajectory, and this trend is expected to accelerate.

Semiconductor Laser Equipment Market Market Size (In Billion)

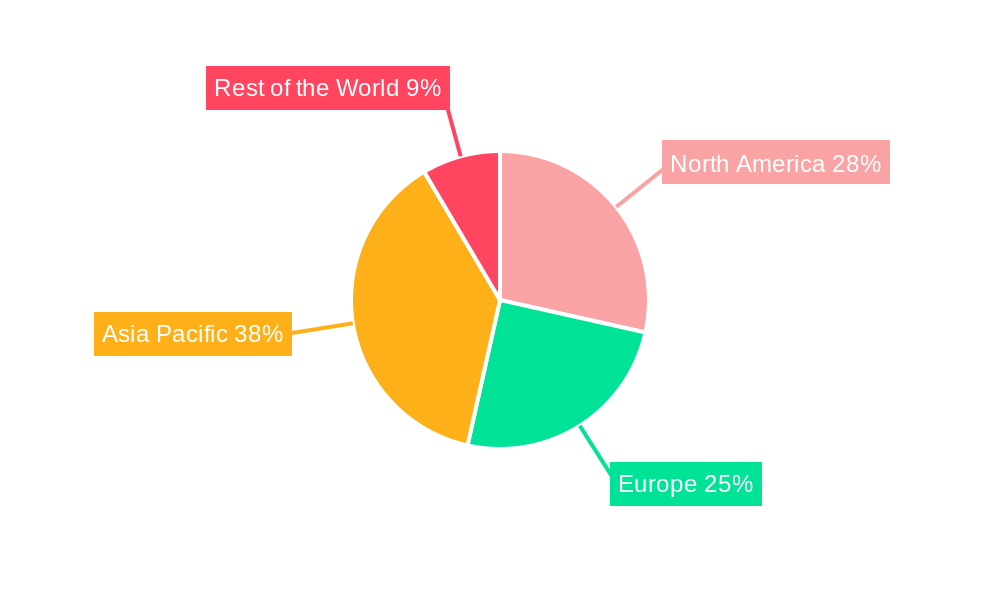

The Compound Annual Growth Rate (CAGR) for the period 2019-2033 is estimated to be approximately 8-10%, signifying a dynamic and thriving market. This growth is further bolstered by investments in research and development by leading manufacturers, aimed at creating next-generation laser solutions. The market's expansion is not confined to a single region; North America, Europe, and Asia Pacific are all anticipated to witness considerable growth, with Asia Pacific likely to lead due to its strong manufacturing base and rapid technological adoption. The estimated market size for 2025, building upon the historical performance and projected CAGR, suggests a market value in the billions of dollars, with continued expansion through 2033. The competitive landscape is characterized by innovation and strategic partnerships, ensuring a vibrant ecosystem for semiconductor laser equipment.

Semiconductor Laser Equipment Market Company Market Share

Semiconductor Laser Equipment Market Market Concentration & Innovation

The Semiconductor Laser Equipment Market exhibits moderate to high concentration, with a few key players dominating the landscape. Innovation is a primary driver, fueled by the relentless pursuit of miniaturization, increased processing speeds, and enhanced efficiency in semiconductor manufacturing. Regulatory frameworks, while not overly restrictive, focus on safety standards and export controls, indirectly influencing market dynamics. Product substitutes, such as traditional mechanical dicing or alternative bonding methods, exist but often fall short in precision and speed compared to advanced laser-based solutions. End-user trends are steering the market towards higher throughput, lower cost-of-ownership, and more sustainable manufacturing processes, driving demand for next-generation laser equipment. Mergers and acquisitions (M&A) are strategically employed to expand product portfolios, gain market share, and acquire critical technologies. For instance, M&A deal values are expected to reach hundreds of millions, reflecting the strategic importance of consolidating expertise. Key companies in this segment include DISCO Corporation and Coherent, who consistently invest in R&D to maintain their competitive edge.

- Market Share Concentration: Dominated by a few key players, with top 3 companies holding over 60% market share.

- Innovation Drivers: Miniaturization, advanced packaging, high-density interconnects (HDI), and the growing demand for advanced semiconductor devices.

- Regulatory Frameworks: Focus on safety standards, material handling, and semiconductor export regulations.

- Product Substitutes: Mechanical dicing, traditional bonding techniques, and alternative etching methods.

- End-User Trends: Demand for higher precision, increased throughput, automation, and reduced thermal impact.

- M&A Activities: Strategic acquisitions to broaden technological capabilities and market reach.

Semiconductor Laser Equipment Market Industry Trends & Insights

The Semiconductor Laser Equipment Market is experiencing robust growth, propelled by an insatiable global demand for sophisticated electronic devices. The pervasive integration of semiconductors into virtually every aspect of modern life, from consumer electronics and automotive systems to advanced telecommunications and artificial intelligence, serves as the primary growth engine. Technological disruptions are rapidly transforming the industry, with advancements in laser sources, beam delivery systems, and control software enabling unprecedented levels of precision and speed in semiconductor fabrication processes. The shift towards heterogeneous integration and advanced packaging techniques, such as 3D stacking and wafer-level packaging, is creating significant opportunities for specialized laser equipment. Consumer preferences are increasingly dictating the pace of innovation, with a strong emphasis on smaller, more powerful, and energy-efficient devices that necessitate more advanced semiconductor manufacturing capabilities. This translates into a sustained demand for cutting-edge laser equipment capable of handling delicate and complex wafer processing. The competitive dynamics within the market are characterized by intense innovation, strategic partnerships, and a continuous race to develop proprietary technologies that offer superior performance and cost-effectiveness. Companies are investing heavily in research and development to enhance laser beam quality, reduce processing times, and minimize material waste, thereby improving the overall yield and economics of semiconductor production. The market penetration of laser-based processes, particularly in areas like wafer dicing and annealing, is steadily increasing as manufacturers recognize their inherent advantages over conventional methods. The projected Compound Annual Growth Rate (CAGR) for the Semiconductor Laser Equipment Market is approximately 12.5% over the forecast period, underscoring its significant expansion trajectory. The market size is estimated to reach over USD 6,500 million by 2033, a substantial increase from its current valuation. This growth is further fueled by advancements in laser materials and optics, leading to more versatile and efficient equipment. The increasing complexity of semiconductor designs, requiring finer features and tighter tolerances, directly translates to a higher demand for the precision offered by advanced laser technologies. Furthermore, the adoption of Industry 4.0 principles, emphasizing automation, data analytics, and smart manufacturing, is accelerating the integration of laser equipment into highly sophisticated production lines. The evolving landscape of the semiconductor industry, driven by emerging applications like augmented reality, virtual reality, and advanced driver-assistance systems (ADAS), will continue to necessitate innovative laser solutions for their production.

Dominant Markets & Segments in Semiconductor Laser Equipment Market

The Semiconductor Laser Equipment Market is characterized by a few dominant segments and geographical regions, each contributing significantly to the overall market expansion. North America, particularly the United States, and East Asia, led by South Korea, Taiwan, and China, are the leading geographical markets. These regions are home to major semiconductor foundries, advanced research institutions, and a robust ecosystem of technology companies, creating a high demand for cutting-edge semiconductor manufacturing equipment, including laser systems. Economic policies that foster innovation, substantial investments in semiconductor R&D, and the presence of world-leading semiconductor manufacturers are key drivers of dominance in these regions. The ongoing strategic focus on semiconductor self-sufficiency in various countries is further bolstering domestic demand for advanced manufacturing technologies.

Within the process segments, Laser Wafer Dicing currently holds the largest market share. This dominance is attributed to its superior precision, reduced kerf loss, and higher throughput compared to traditional mechanical dicing methods, especially for brittle materials and complex chip designs. The ever-increasing density of components on semiconductor wafers necessitates ultra-fine dicing capabilities, which laser technology excels at.

- Key Drivers for Dominance in Laser Wafer Dicing:

- Precision and Accuracy: Essential for intricate chip architectures and preventing chip damage.

- Reduced Kerf Loss: Maximizes wafer utilization and chip yield.

- Speed and Throughput: Critical for high-volume manufacturing environments.

- Material Versatility: Ability to dice a wide range of semiconductor materials, including silicon, compound semiconductors, and brittle substrates.

- Enabling Advanced Packaging: Crucial for technologies like wafer-level packaging and 3D integration.

Laser Annealing is another rapidly growing segment, driven by the need for precise thermal processing in the fabrication of advanced transistors, memory devices, and logic chips. Laser annealing offers localized heating, minimizing thermal budget and preventing damage to sensitive device structures. The development of advanced annealing techniques for next-generation materials and device architectures is further fueling its growth.

- Key Drivers for Dominance in Laser Annealing:

- Precise Thermal Control: Minimizes thermal damage to sensitive device layers.

- Localized Heating: Reduces the overall thermal budget of the manufacturing process.

- Improved Material Properties: Enables dopant activation, crystal growth, and defect annealing for enhanced device performance.

- Compatibility with Advanced Processes: Essential for emerging semiconductor technologies requiring precise thermal treatment.

Laser Bonding and Debonding, encompassing temporary bonding/debonding, Laser Lift-Off, and Laser Induced Forward Transfer, is a crucial and expanding area, particularly for advanced packaging and wafer thinning applications. Laser Lift-Off, for instance, is vital for thin-film electronics and flexible displays.

- Key Drivers for Dominance in Laser Bonding and Debonding:

- Facilitating Advanced Packaging: Enables complex stacking and integration of multiple dies.

- Wafer Thinning: Crucial for creating thin and flexible semiconductor devices.

- Non-Contact Processes: Minimizes stress and damage to fragile wafers and components.

- Enabling Novel Architectures: Supports the development of unique device structures and functionalities.

Laser Wafer Marking plays a vital role in traceability and quality control within the semiconductor manufacturing chain. While perhaps not as high-volume as dicing or annealing, its importance is paramount for process integrity and supply chain management.

- Key Drivers for Dominance in Laser Wafer Marking:

- Permanent and High-Contrast Markings: Ensures clear identification of wafers and chips.

- Non-Contact Process: Avoids contamination and damage to the wafer surface.

- High-Speed Application: Suitable for integration into high-throughput production lines.

- Traceability and Quality Control: Essential for compliance and issue resolution.

Semiconductor Laser Equipment Market Product Developments

Product development in the Semiconductor Laser Equipment Market is characterized by a relentless pursuit of higher precision, increased speed, and enhanced versatility. Manufacturers are focusing on developing laser systems with ultra-short pulse durations and precisely controlled beam profiles to enable the fabrication of increasingly smaller and more complex semiconductor devices. Innovations in laser sources, such as femtosecond and picosecond lasers, are enabling new applications in areas like advanced lithography, micro-machining, and additive manufacturing within the semiconductor ecosystem. The integration of advanced optics, sophisticated control software, and automation features further enhances the capabilities of these systems, offering customers improved yields, reduced processing times, and lower operational costs. Competitive advantages are being gained through proprietary laser technologies that offer superior beam quality, wavelength flexibility, and energy efficiency, catering to the evolving demands of the semiconductor industry for next-generation chips.

Report Scope & Segmentation Analysis

This report offers a comprehensive analysis of the Semiconductor Laser Equipment Market, segmented by process. The study covers the following key process segments:

Laser Wafer Dicing: This segment focuses on equipment used for cutting semiconductor wafers into individual dies using laser technology. The market is driven by the demand for high precision and efficiency in dicing various semiconductor materials. Growth projections are strong, with significant market sizes anticipated due to increasing wafer complexity and the need for advanced packaging solutions. Competitive dynamics involve suppliers offering solutions for brittle materials and high-throughput applications.

Laser Bonding and Debonding: This segment encompasses equipment for both attaching and detaching semiconductor components and wafers. It includes sub-segments like Temporary Bonding/Debonding, crucial for handling thinned wafers; Laser Lift-Off, vital for flexible electronics and substrate removal; and Laser Induced Forward Transfer, used for precise material deposition. Growth is propelled by the rising trend of heterogeneous integration and advanced packaging, with substantial market sizes expected. Competition centers on developing non-contact, high-precision solutions.

Laser Annealing: This segment deals with equipment that uses lasers to precisely heat semiconductor wafers for thermal processing, such as dopant activation and material recrystallization. The demand is driven by the need for localized and controlled heating in advanced transistor and memory fabrication. This segment is projected for significant growth, with substantial market sizes as advanced materials and device architectures become prevalent. Competition focuses on developing equipment with precise temperature control and minimal thermal budget impact.

Laser Wafer Marking: This segment covers equipment for laser-based marking of semiconductor wafers for identification and traceability purposes. While a niche segment, its importance is critical for quality control and supply chain management. Market sizes are stable, with growth linked to overall semiconductor production volumes. Competition is characterized by suppliers offering high-speed, non-contact, and permanent marking solutions.

Key Drivers of Semiconductor Laser Equipment Market Growth

The Semiconductor Laser Equipment Market is propelled by several key drivers. The insatiable global demand for advanced electronics, including smartphones, AI-powered devices, and electric vehicles, fuels the need for more sophisticated semiconductors, thereby increasing the demand for advanced manufacturing equipment. Technological advancements in semiconductor design, such as increasing transistor density and the adoption of new materials like GaN and SiC, necessitate the precision and efficiency offered by laser-based processes. The growing trend of advanced packaging, including 3D stacking and heterogeneous integration, directly benefits laser bonding, debonding, and dicing solutions. Furthermore, government initiatives and strategic investments by various nations to boost domestic semiconductor manufacturing capabilities are creating significant market opportunities and driving the adoption of state-of-the-art laser equipment.

Challenges in the Semiconductor Laser Equipment Market Sector

Despite robust growth, the Semiconductor Laser Equipment Market faces several challenges. High initial capital investment for advanced laser systems can be a barrier for some manufacturers, especially smaller ones. The rapid pace of technological evolution requires continuous innovation and significant R&D expenditure, posing a challenge for companies to keep up with market demands and maintain a competitive edge. Supply chain disruptions, particularly for specialized components and raw materials, can impact production timelines and costs. Furthermore, the stringent quality control requirements and the need for highly skilled personnel to operate and maintain these sophisticated systems present operational challenges for end-users. The development of more cost-effective and energy-efficient laser solutions remains an ongoing challenge, aiming to reduce the total cost of ownership for semiconductor manufacturers.

Emerging Opportunities in Semiconductor Laser Equipment Market

Emerging opportunities in the Semiconductor Laser Equipment Market are abundant, driven by innovation and the expanding applications of semiconductors. The burgeoning fields of advanced driver-assistance systems (ADAS), augmented reality (AR), and virtual reality (VR) are creating demand for specialized semiconductor devices that require advanced laser processing techniques. The ongoing development of quantum computing and next-generation AI hardware presents further opportunities for novel laser applications in chip fabrication. The increasing adoption of flexible and wearable electronics necessitates advancements in laser bonding and debonding technologies for substrate manipulation. Moreover, the push towards greater sustainability in manufacturing is driving interest in laser processes that offer reduced waste and energy consumption. The expansion of semiconductor manufacturing capacity in emerging economies also presents new market avenues for laser equipment suppliers.

Leading Players in the Semiconductor Laser Equipment Market Market

- DISCO Corporation

- Coherent

- Hanmi Semiconductor

- Applied Materials

- FitTech

- Sumitomo Heavy Industries Ltd

- Hamamatsu Photonics K K

- Corning

- Delphi Laser

- IPG Photonics

Key Developments in Semiconductor Laser Equipment Market Industry

- March 2022: Prism Venture Partners and the RWI Group invested USD 5.4 million in Zia Laser Inc., a quantum dot 1310 nm and 1550 nm semiconductor laser technology manufacturer. This investment signifies confidence in novel laser technologies for semiconductor applications.

- February 2022: Veeco Instruments Inc. announced that multiple leading semiconductor manufacturers had placed repeat, multi-system orders for Veeco's LSA101 and LSA201 Laser Annealing Systems. Additionally, a leading-edge logic customer also designated Veeco's platform as their production tool of record for high-volume manufacturing. This highlights the increasing adoption and validation of laser annealing systems in production environments.

- February 2022: Magnescale, a DMG MORI group company and a manufacturer of machine tools and laser scales for semiconductor manufacturing equipment, announced that it would build a new plant for semiconductor lasers for measuring purposes at its Isehara Works in Kanagawa Prefecture, with a total investment of about JPY 3 billion (USD 0.022 billion). The new plant will have a building area of 450 square meters and a total floor space of about 900 square meters. This development indicates strategic investment in laser technology infrastructure within the semiconductor equipment sector.

Strategic Outlook for Semiconductor Laser Equipment Market Market

The strategic outlook for the Semiconductor Laser Equipment Market remains exceptionally positive. The market is poised for sustained growth driven by the foundational role of semiconductors in virtually all technological advancements. Key growth catalysts include the exponential increase in data generation and processing needs, the widespread adoption of 5G and AI technologies, and the electrification of the automotive sector. Manufacturers will continue to invest in laser equipment that enables higher levels of integration, reduced form factors, and enhanced performance in semiconductor devices. Strategic partnerships and collaborations will be crucial for navigating the complex technological landscape and addressing the evolving needs of the industry. Opportunities lie in developing solutions for emerging materials, advanced packaging, and more sustainable manufacturing processes, ensuring a strong future for laser technology in semiconductor fabrication.

Semiconductor Laser Equipment Market Segmentation

-

1. Process

- 1.1. Laser Wafer Dicing

-

1.2. Laser Bonding and Debonding

- 1.2.1. Temporary bonding/debonding

- 1.2.2. Laser Lift-Off

- 1.2.3. Laser Induced Forward Transfer

- 1.3. Laser Annealing

- 1.4. Laser Wafer Marking

Semiconductor Laser Equipment Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Semiconductor Laser Equipment Market Regional Market Share

Geographic Coverage of Semiconductor Laser Equipment Market

Semiconductor Laser Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Semiconductor Chip Demand from End-Use Industries

- 3.3. Market Restrains

- 3.3.1. High Cost of Installation and Maintainance

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Semiconductor Chips To Support The Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Semiconductor Laser Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Process

- 5.1.1. Laser Wafer Dicing

- 5.1.2. Laser Bonding and Debonding

- 5.1.2.1. Temporary bonding/debonding

- 5.1.2.2. Laser Lift-Off

- 5.1.2.3. Laser Induced Forward Transfer

- 5.1.3. Laser Annealing

- 5.1.4. Laser Wafer Marking

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Process

- 6. North America Semiconductor Laser Equipment Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Process

- 6.1.1. Laser Wafer Dicing

- 6.1.2. Laser Bonding and Debonding

- 6.1.2.1. Temporary bonding/debonding

- 6.1.2.2. Laser Lift-Off

- 6.1.2.3. Laser Induced Forward Transfer

- 6.1.3. Laser Annealing

- 6.1.4. Laser Wafer Marking

- 6.1. Market Analysis, Insights and Forecast - by Process

- 7. Europe Semiconductor Laser Equipment Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Process

- 7.1.1. Laser Wafer Dicing

- 7.1.2. Laser Bonding and Debonding

- 7.1.2.1. Temporary bonding/debonding

- 7.1.2.2. Laser Lift-Off

- 7.1.2.3. Laser Induced Forward Transfer

- 7.1.3. Laser Annealing

- 7.1.4. Laser Wafer Marking

- 7.1. Market Analysis, Insights and Forecast - by Process

- 8. Asia Pacific Semiconductor Laser Equipment Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Process

- 8.1.1. Laser Wafer Dicing

- 8.1.2. Laser Bonding and Debonding

- 8.1.2.1. Temporary bonding/debonding

- 8.1.2.2. Laser Lift-Off

- 8.1.2.3. Laser Induced Forward Transfer

- 8.1.3. Laser Annealing

- 8.1.4. Laser Wafer Marking

- 8.1. Market Analysis, Insights and Forecast - by Process

- 9. Rest of the World Semiconductor Laser Equipment Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Process

- 9.1.1. Laser Wafer Dicing

- 9.1.2. Laser Bonding and Debonding

- 9.1.2.1. Temporary bonding/debonding

- 9.1.2.2. Laser Lift-Off

- 9.1.2.3. Laser Induced Forward Transfer

- 9.1.3. Laser Annealing

- 9.1.4. Laser Wafer Marking

- 9.1. Market Analysis, Insights and Forecast - by Process

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 DISCO Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Coherent

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Hanmi Semiconductor*List Not Exhaustive

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Applied Materials

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 FitTech

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Sumitomo Heavy Industries Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Hamamatsu Photonics K K

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Corning

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Delphi Laser

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 IPG Photonics

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 DISCO Corporation

List of Figures

- Figure 1: Global Semiconductor Laser Equipment Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Semiconductor Laser Equipment Market Revenue (undefined), by Process 2025 & 2033

- Figure 3: North America Semiconductor Laser Equipment Market Revenue Share (%), by Process 2025 & 2033

- Figure 4: North America Semiconductor Laser Equipment Market Revenue (undefined), by Country 2025 & 2033

- Figure 5: North America Semiconductor Laser Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Semiconductor Laser Equipment Market Revenue (undefined), by Process 2025 & 2033

- Figure 7: Europe Semiconductor Laser Equipment Market Revenue Share (%), by Process 2025 & 2033

- Figure 8: Europe Semiconductor Laser Equipment Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: Europe Semiconductor Laser Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Semiconductor Laser Equipment Market Revenue (undefined), by Process 2025 & 2033

- Figure 11: Asia Pacific Semiconductor Laser Equipment Market Revenue Share (%), by Process 2025 & 2033

- Figure 12: Asia Pacific Semiconductor Laser Equipment Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Asia Pacific Semiconductor Laser Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Rest of the World Semiconductor Laser Equipment Market Revenue (undefined), by Process 2025 & 2033

- Figure 15: Rest of the World Semiconductor Laser Equipment Market Revenue Share (%), by Process 2025 & 2033

- Figure 16: Rest of the World Semiconductor Laser Equipment Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: Rest of the World Semiconductor Laser Equipment Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Semiconductor Laser Equipment Market Revenue undefined Forecast, by Process 2020 & 2033

- Table 2: Global Semiconductor Laser Equipment Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Global Semiconductor Laser Equipment Market Revenue undefined Forecast, by Process 2020 & 2033

- Table 4: Global Semiconductor Laser Equipment Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: Global Semiconductor Laser Equipment Market Revenue undefined Forecast, by Process 2020 & 2033

- Table 6: Global Semiconductor Laser Equipment Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Global Semiconductor Laser Equipment Market Revenue undefined Forecast, by Process 2020 & 2033

- Table 8: Global Semiconductor Laser Equipment Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Global Semiconductor Laser Equipment Market Revenue undefined Forecast, by Process 2020 & 2033

- Table 10: Global Semiconductor Laser Equipment Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Semiconductor Laser Equipment Market?

The projected CAGR is approximately 8.5%.

2. Which companies are prominent players in the Semiconductor Laser Equipment Market?

Key companies in the market include DISCO Corporation, Coherent, Hanmi Semiconductor*List Not Exhaustive, Applied Materials, FitTech, Sumitomo Heavy Industries Ltd, Hamamatsu Photonics K K, Corning, Delphi Laser, IPG Photonics.

3. What are the main segments of the Semiconductor Laser Equipment Market?

The market segments include Process.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Semiconductor Chip Demand from End-Use Industries.

6. What are the notable trends driving market growth?

Increasing Demand for Semiconductor Chips To Support The Market Growth.

7. Are there any restraints impacting market growth?

High Cost of Installation and Maintainance.

8. Can you provide examples of recent developments in the market?

March 2022: Prism Venture Partners and the RWI Group invested USD 5.4 million in Zia Laser Inc., a quantum dot 1310 nm and 1550 nm semiconductor laser technology manufacturer.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Semiconductor Laser Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Semiconductor Laser Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Semiconductor Laser Equipment Market?

To stay informed about further developments, trends, and reports in the Semiconductor Laser Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence