Key Insights

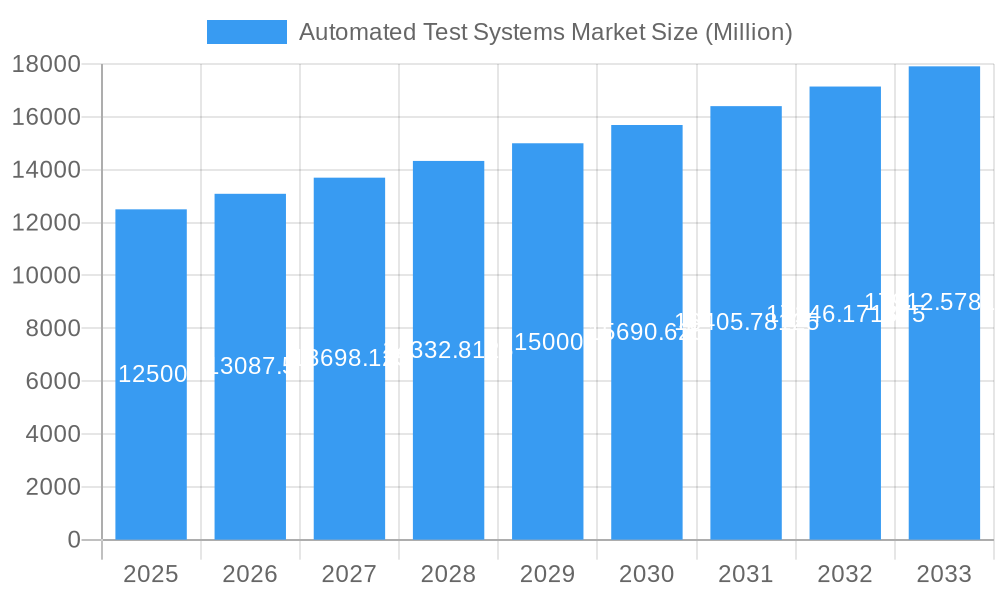

The Automated Test Systems Market is projected for substantial growth, with an estimated market size of $9.86 billion by 2025, expanding at a Compound Annual Growth Rate (CAGR) of 7.72% through the forecast period (2025-2033). This expansion is driven by the increasing complexity and miniaturization of electronic devices across diverse sectors, necessitating advanced and efficient testing solutions. High demand for reliable electronic components in consumer electronics, automotive, and aerospace industries are key accelerators. Continuous technological advancements in semiconductors and integrated circuits further amplify the need for sophisticated test equipment. Automation in manufacturing is crucial for competitive advantage, boosting adoption of automated test systems to ensure quality, reduce costs, and accelerate time-to-market. The proliferation of IoT, 5G infrastructure, and advanced driver-assistance systems (ADAS) in automotive presents significant growth opportunities.

Automated Test Systems Market Market Size (In Billion)

Key market drivers include demand for Memory and Non-memory test equipment, catering to varied semiconductor manufacturing needs. The Consumer Electronics and Automotive end-user industries are expected to dominate market revenue due to high-volume production and stringent quality control. While technological innovation fuels growth, high initial investment for sophisticated systems and the need for skilled labor may present challenges. However, ongoing R&D efforts focusing on cost reduction and enhanced user-friendliness are anticipated to mitigate these concerns. Geographically, Asia Pacific, led by China and South Korea, is expected to lead due to its strong electronics manufacturing base, followed by North America and Europe, significant for advanced automotive and aerospace sectors. Leading players like Advantest Corporation, National Instruments Corporation, and Chroma ATE Inc. are investing in R&D and strategic partnerships to expand their market presence through innovative testing solutions.

Automated Test Systems Market Company Market Share

This report provides an in-depth analysis of the global Automated Test Systems Market, offering critical insights into market dynamics, growth drivers, segmentation, and the competitive landscape. Utilizing high-traffic keywords such as "automated testing," "ATE systems," "semiconductor testing," "automotive testing," and "aerospace testing," this report is designed to inform industry stakeholders and investors. The study covers the historical period from 2019 to 2024, with a base year of 2025, and forecasts for 2025–2033. Market valuation for 2025 is estimated at $9.86 billion, with projected growth to $XX billion by 2033, exhibiting a CAGR of 7.72%.

Automated Test Systems Market Market Concentration & Innovation

The Automated Test Systems Market is characterized by a moderate level of concentration, with a few key players holding significant market share. However, the landscape is dynamic, fueled by continuous innovation in areas such as artificial intelligence (AI) for test optimization, machine learning for predictive maintenance of test equipment, and the integration of Industry 4.0 technologies. Regulatory frameworks, particularly concerning safety and compliance in sectors like automotive and aerospace, also play a crucial role in shaping product development and adoption. The threat of product substitutes, while present in some niche applications, is generally mitigated by the specialized nature and high performance requirements of automated test solutions. End-user trends, driven by increasing demand for sophisticated electronic devices and stringent quality control, are propelling the market forward. Merger and acquisition (M&A) activities, such as the November 2022 acquisition of InTouch Automation by Lear Corporation for an undisclosed sum, highlight strategic moves by established companies to enhance their capabilities in automated testing and Industry 4.0 solutions, indicating a growing consolidation and a focus on integrated offerings.

Automated Test Systems Market Industry Trends & Insights

The Automated Test Systems Market is experiencing robust growth, driven by several interconnected trends. The ever-increasing complexity and miniaturization of electronic components across all end-user industries, from consumer electronics to automotive and aerospace, necessitates sophisticated and highly accurate testing solutions. The "Internet of Things" (IoT) revolution, with its proliferation of connected devices, further amplifies the need for comprehensive automated testing to ensure reliability and performance. Furthermore, the drive towards higher manufacturing efficiency and reduced time-to-market compels companies to invest in advanced ATE systems that can handle high-volume production and complex test routines. Technological disruptions, including the adoption of AI and machine learning for intelligent test pattern generation and anomaly detection, are transforming the testing process, making it more efficient and cost-effective. Consumer preferences for premium, reliable, and feature-rich products indirectly push manufacturers to implement stringent quality control measures, thereby boosting demand for automated test systems. The competitive dynamics within the market are intense, with companies focusing on technological differentiation, strategic partnerships, and expanding their global footprints. The market penetration of automated test solutions is expected to deepen significantly as smaller enterprises also recognize the benefits of automation in maintaining competitiveness. The November 2022 announcement by Cohu, Inc. regarding a leading MEMS sensor manufacturer’s adoption of its Sense+ platform for its gyroscopic sensors exemplifies the ongoing innovation in high-accuracy, high-throughput MEMS testing, showcasing how advanced architectures can deliver substantial improvements in test accuracy and flexibility.

Dominant Markets & Segments in Automated Test Systems Market

The Automated Test Systems Market is segmented by type of test equipment and end-user industry.

By Type of Test Equipment:

- Memory Test Equipment: Crucial for testing RAM, Flash memory, and other memory chips, this segment is driven by the burgeoning demand for memory in smartphones, data centers, and automotive electronics.

- Non-Memory Test Equipment: This broad category encompasses testing for microprocessors, GPUs, ASICs, and other complex integrated circuits, vital for performance and functionality verification. Key drivers include the continuous innovation in high-performance computing and AI accelerators.

- Discrete Test Equipment: Used for testing individual components like transistors, diodes, and resistors, this segment remains significant due to the foundational role of discrete components in virtually all electronic devices.

- Test Handlers: Essential for automating the physical handling of components during the testing process, improving throughput and reducing manual errors. The demand is closely linked to the overall growth in semiconductor manufacturing volume.

By End-user Industry:

- Consumer Electronics: The largest segment, driven by the insatiable demand for smartphones, tablets, wearables, and smart home devices, all requiring rigorous testing for functionality, performance, and reliability. Economic policies supporting domestic manufacturing and increased disposable incomes in developing regions are significant drivers.

- IT and Telecommunications: The expansion of 5G networks, cloud computing infrastructure, and data centers fuels the demand for testing high-performance networking equipment, servers, and communication modules. Infrastructure development and government investments in digital transformation are key enablers.

- Automotive: The rapid electrification of vehicles, the development of Advanced Driver-Assistance Systems (ADAS), and the increasing integration of electronics in modern cars make this a high-growth segment. Stringent safety regulations and the pursuit of autonomous driving technologies are major catalysts. The April 2022 mandate by the Indian Government for mandatory vehicle fitness testing through automated stations from June 1, 2024, for various vehicle categories will significantly boost the automotive testing segment in the region.

- Aerospace and Defense: This segment demands exceptionally high reliability and performance from electronic components used in aircraft, satellites, and defense systems. Strict quality control, long product lifecycles, and advanced technological requirements dominate this market. Government spending on defense and space exploration initiatives are primary drivers.

- Healthcare: The increasing use of sophisticated medical devices, from diagnostic equipment to implantable sensors, requires advanced automated testing to ensure patient safety and device efficacy. Regulatory compliance and the growing adoption of telemedicine are key factors.

Automated Test Systems Market Product Developments

Key product developments in the Automated Test Systems Market focus on enhancing accuracy, speed, and flexibility. Innovations include modular test platforms that allow for easy reconfiguration to test various device types, AI-driven test optimization for reduced test time and cost, and advanced signal integrity solutions for high-frequency testing. Companies are also developing integrated solutions that combine test equipment with advanced data analytics and cloud connectivity. These developments aim to address the increasing complexity of semiconductor devices and the demand for faster time-to-market.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Automated Test Systems Market, segmented by:

- Type of Test Equipment: Memory, Non-memory, Discrete, and Test Handlers. Each segment's growth is influenced by the specific demands of the underlying electronic components and devices they are designed to test.

- End-user Industry: Aerospace and Defense, Consumer Electronics, IT and Telecommunications, Automotive, Healthcare, and Other End-user Industries. Projections for each segment consider their respective market trends, technological advancements, and regulatory landscapes.

The market segmentation offers granular insights into the specific growth trajectories, market sizes, and competitive dynamics within each category, enabling targeted strategic planning.

Key Drivers of Automated Test Systems Market Growth

The growth of the Automated Test Systems Market is propelled by several key factors:

- Increasing Complexity of Electronic Devices: Miniaturization, higher integration of functionalities, and advanced architectures in semiconductors necessitate more sophisticated testing solutions.

- Rising Demand for High-Quality Products: Consumers and industries expect reliable and high-performance electronic products, driving stringent quality control measures.

- Advancements in AI and Machine Learning: Integration of AI and ML into ATE systems enhances test efficiency, reduces costs, and enables predictive diagnostics.

- Growth of Key End-user Industries: The burgeoning automotive, consumer electronics, and IT/telecommunications sectors are major consumers of automated test equipment.

- Industry 4.0 Adoption: The push for smart manufacturing and increased automation across industries directly translates to a higher demand for integrated testing solutions.

Challenges in the Automated Test Systems Market Sector

Despite its strong growth prospects, the Automated Test Systems Market faces certain challenges:

- High Initial Investment Costs: Advanced ATE systems can require significant capital expenditure, posing a barrier for smaller companies.

- Talent Shortage: A lack of skilled engineers and technicians proficient in operating and maintaining complex automated test equipment can hinder adoption.

- Rapid Technological Obsolescence: The fast-paced evolution of electronic components requires continuous upgrades and investment in newer testing technologies.

- Global Supply Chain Disruptions: Geopolitical factors and logistical challenges can impact the availability and cost of critical components for ATE systems.

- Stringent Regulatory Compliance: Meeting evolving safety and performance standards across different industries and regions adds complexity and cost to test system development.

Emerging Opportunities in Automated Test Systems Market

Several emerging opportunities are poised to shape the future of the Automated Test Systems Market:

- AI-Powered Test Optimization: Development of more intelligent ATE that can self-learn, adapt test patterns, and optimize test strategies for maximum efficiency.

- Edge Computing for Testing: Implementing testing capabilities closer to the point of data generation to enable real-time analysis and faster decision-making.

- Advanced Packaging and Heterogeneous Integration Testing: As semiconductor packaging becomes more complex, specialized ATE solutions will be required to test these integrated systems.

- Growth in Emerging Economies: Increasing industrialization and adoption of advanced technologies in developing nations present significant untapped market potential.

- Sustainable and Energy-Efficient Testing: Developing ATE solutions that minimize power consumption and environmental impact will gain prominence.

Leading Players in the Automated Test Systems Market Market

- Star Technologies

- Astronics Corporation

- Advantest Corporation

- National Instruments Corporation

- SPEA SpA

- Roos Instruments Inc

- Samsung Semiconductor Inc

- Xcerra Corporation

- Aeroflex Inc

- Virginia Panel Corporation

- MAC Panel Company

- Chroma ATE Inc

Key Developments in Automated Test Systems Market Industry

- November 2022: Lear Corporation acquired InTouch Automation, a supplier of Industry 4.0 technologies and complex automated testing equipment for automotive seat manufacturing, strengthening its position in automotive e-systems testing and automation.

- November 2022: Cohu, Inc. announced that a top global MEMS sensor manufacturer selected its Sense+ MEMS test platform for evaluating gyroscopic sensors, highlighting advancements in test accuracy, high-throughput capabilities, and platform adaptability for sophisticated MEMS devices.

- May 2022: National Instruments Corporation (NI) released its new Battery Test System (BTS) for electric vehicles (EVs), aiming to enhance customization, automation, and data linkage in EV battery testing for Tier 1 suppliers and automakers.

- April 2022: The Indian Government announced plans to make fitness testing of vehicles through Automated Testing Stations mandatory from next year, with specific deadlines for different vehicle categories in 2024, indicating a significant surge in demand for automotive testing solutions in the region.

Strategic Outlook for Automated Test Systems Market Market

The strategic outlook for the Automated Test Systems Market remains highly positive, driven by the relentless pace of technological innovation and the expanding applications of electronics across diverse sectors. The increasing demand for higher performance, greater reliability, and faster development cycles will continue to fuel investments in advanced ATE. Companies that focus on developing AI-integrated, flexible, and scalable test solutions, while also addressing the specific needs of high-growth segments like automotive electrification and 5G infrastructure, are well-positioned for success. Strategic partnerships and acquisitions will likely continue to play a crucial role in consolidating market share and expanding technological capabilities. The global push towards Industry 4.0 and smart manufacturing further solidifies the indispensable role of automated testing in modern production environments.

Automated Test Systems Market Segmentation

-

1. Type of Test Equipment

- 1.1. Memory

- 1.2. Non - memory

- 1.3. Discrete

- 1.4. Test Handlers

-

2. End-user Industry

- 2.1. Aerospace and Defense

- 2.2. Consumer Electronics

- 2.3. IT and Telecommunications

- 2.4. Automotive

- 2.5. Healthcare

- 2.6. Other End-user Industries

Automated Test Systems Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. Japan

- 3.2. China

- 3.3. South Korea

- 3.4. Rest of Asia Pacific

-

4. Latin America

- 4.1. Mexico

- 4.2. Brazil

- 4.3. Rest of Latin America

- 5. Middle East

Automated Test Systems Market Regional Market Share

Geographic Coverage of Automated Test Systems Market

Automated Test Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.72% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in Consumer Electronics Sales and Explosion of IOT; Increased Focus on Sophisticated Testing Methods Leading to Multiple Test Cases

- 3.3. Market Restrains

- 3.3.1. High Costs Associated With Testing Equipment

- 3.4. Market Trends

- 3.4.1. Aerospace and Defence is Expected to Hold a Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automated Test Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Test Equipment

- 5.1.1. Memory

- 5.1.2. Non - memory

- 5.1.3. Discrete

- 5.1.4. Test Handlers

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Aerospace and Defense

- 5.2.2. Consumer Electronics

- 5.2.3. IT and Telecommunications

- 5.2.4. Automotive

- 5.2.5. Healthcare

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type of Test Equipment

- 6. North America Automated Test Systems Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type of Test Equipment

- 6.1.1. Memory

- 6.1.2. Non - memory

- 6.1.3. Discrete

- 6.1.4. Test Handlers

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Aerospace and Defense

- 6.2.2. Consumer Electronics

- 6.2.3. IT and Telecommunications

- 6.2.4. Automotive

- 6.2.5. Healthcare

- 6.2.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Type of Test Equipment

- 7. Europe Automated Test Systems Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type of Test Equipment

- 7.1.1. Memory

- 7.1.2. Non - memory

- 7.1.3. Discrete

- 7.1.4. Test Handlers

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Aerospace and Defense

- 7.2.2. Consumer Electronics

- 7.2.3. IT and Telecommunications

- 7.2.4. Automotive

- 7.2.5. Healthcare

- 7.2.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Type of Test Equipment

- 8. Asia Pacific Automated Test Systems Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type of Test Equipment

- 8.1.1. Memory

- 8.1.2. Non - memory

- 8.1.3. Discrete

- 8.1.4. Test Handlers

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Aerospace and Defense

- 8.2.2. Consumer Electronics

- 8.2.3. IT and Telecommunications

- 8.2.4. Automotive

- 8.2.5. Healthcare

- 8.2.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Type of Test Equipment

- 9. Latin America Automated Test Systems Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type of Test Equipment

- 9.1.1. Memory

- 9.1.2. Non - memory

- 9.1.3. Discrete

- 9.1.4. Test Handlers

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Aerospace and Defense

- 9.2.2. Consumer Electronics

- 9.2.3. IT and Telecommunications

- 9.2.4. Automotive

- 9.2.5. Healthcare

- 9.2.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Type of Test Equipment

- 10. Middle East Automated Test Systems Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type of Test Equipment

- 10.1.1. Memory

- 10.1.2. Non - memory

- 10.1.3. Discrete

- 10.1.4. Test Handlers

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Aerospace and Defense

- 10.2.2. Consumer Electronics

- 10.2.3. IT and Telecommunications

- 10.2.4. Automotive

- 10.2.5. Healthcare

- 10.2.6. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Type of Test Equipment

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Star Technologies

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Astronics Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Advantest Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 National Instruments Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 SPEA SpA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Roos Instruments Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Samsung Semiconductor Inc *List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Xcerra Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Aeroflex Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Virginia Panel Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 MAC Panel Company

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Chroma ATE Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Star Technologies

List of Figures

- Figure 1: Global Automated Test Systems Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Automated Test Systems Market Revenue (billion), by Type of Test Equipment 2025 & 2033

- Figure 3: North America Automated Test Systems Market Revenue Share (%), by Type of Test Equipment 2025 & 2033

- Figure 4: North America Automated Test Systems Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 5: North America Automated Test Systems Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America Automated Test Systems Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Automated Test Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Automated Test Systems Market Revenue (billion), by Type of Test Equipment 2025 & 2033

- Figure 9: Europe Automated Test Systems Market Revenue Share (%), by Type of Test Equipment 2025 & 2033

- Figure 10: Europe Automated Test Systems Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 11: Europe Automated Test Systems Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe Automated Test Systems Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Automated Test Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Automated Test Systems Market Revenue (billion), by Type of Test Equipment 2025 & 2033

- Figure 15: Asia Pacific Automated Test Systems Market Revenue Share (%), by Type of Test Equipment 2025 & 2033

- Figure 16: Asia Pacific Automated Test Systems Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 17: Asia Pacific Automated Test Systems Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Asia Pacific Automated Test Systems Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Automated Test Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Automated Test Systems Market Revenue (billion), by Type of Test Equipment 2025 & 2033

- Figure 21: Latin America Automated Test Systems Market Revenue Share (%), by Type of Test Equipment 2025 & 2033

- Figure 22: Latin America Automated Test Systems Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 23: Latin America Automated Test Systems Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Latin America Automated Test Systems Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Latin America Automated Test Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Automated Test Systems Market Revenue (billion), by Type of Test Equipment 2025 & 2033

- Figure 27: Middle East Automated Test Systems Market Revenue Share (%), by Type of Test Equipment 2025 & 2033

- Figure 28: Middle East Automated Test Systems Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 29: Middle East Automated Test Systems Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East Automated Test Systems Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East Automated Test Systems Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automated Test Systems Market Revenue billion Forecast, by Type of Test Equipment 2020 & 2033

- Table 2: Global Automated Test Systems Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Automated Test Systems Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Automated Test Systems Market Revenue billion Forecast, by Type of Test Equipment 2020 & 2033

- Table 5: Global Automated Test Systems Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Automated Test Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Automated Test Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Automated Test Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Global Automated Test Systems Market Revenue billion Forecast, by Type of Test Equipment 2020 & 2033

- Table 10: Global Automated Test Systems Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 11: Global Automated Test Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Automated Test Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Germany Automated Test Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: France Automated Test Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Italy Automated Test Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Automated Test Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Global Automated Test Systems Market Revenue billion Forecast, by Type of Test Equipment 2020 & 2033

- Table 18: Global Automated Test Systems Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 19: Global Automated Test Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 20: Japan Automated Test Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: China Automated Test Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: South Korea Automated Test Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Rest of Asia Pacific Automated Test Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Global Automated Test Systems Market Revenue billion Forecast, by Type of Test Equipment 2020 & 2033

- Table 25: Global Automated Test Systems Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 26: Global Automated Test Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 27: Mexico Automated Test Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Brazil Automated Test Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Rest of Latin America Automated Test Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Global Automated Test Systems Market Revenue billion Forecast, by Type of Test Equipment 2020 & 2033

- Table 31: Global Automated Test Systems Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 32: Global Automated Test Systems Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automated Test Systems Market?

The projected CAGR is approximately 7.72%.

2. Which companies are prominent players in the Automated Test Systems Market?

Key companies in the market include Star Technologies, Astronics Corporation, Advantest Corporation, National Instruments Corporation, SPEA SpA, Roos Instruments Inc, Samsung Semiconductor Inc *List Not Exhaustive, Xcerra Corporation, Aeroflex Inc, Virginia Panel Corporation, MAC Panel Company, Chroma ATE Inc.

3. What are the main segments of the Automated Test Systems Market?

The market segments include Type of Test Equipment, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.86 billion as of 2022.

5. What are some drivers contributing to market growth?

Growth in Consumer Electronics Sales and Explosion of IOT; Increased Focus on Sophisticated Testing Methods Leading to Multiple Test Cases.

6. What are the notable trends driving market growth?

Aerospace and Defence is Expected to Hold a Significant Market Share.

7. Are there any restraints impacting market growth?

High Costs Associated With Testing Equipment.

8. Can you provide examples of recent developments in the market?

November 2022: Lear Corporation, one of the global leaders in seating and e-systems technology, announced the strategic acquisition of InTouch Automation, a supplier of Industry 4.0 technologies and complex automated testing equipment utilized in manufacturing automobile seats.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automated Test Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automated Test Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automated Test Systems Market?

To stay informed about further developments, trends, and reports in the Automated Test Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence