Key Insights

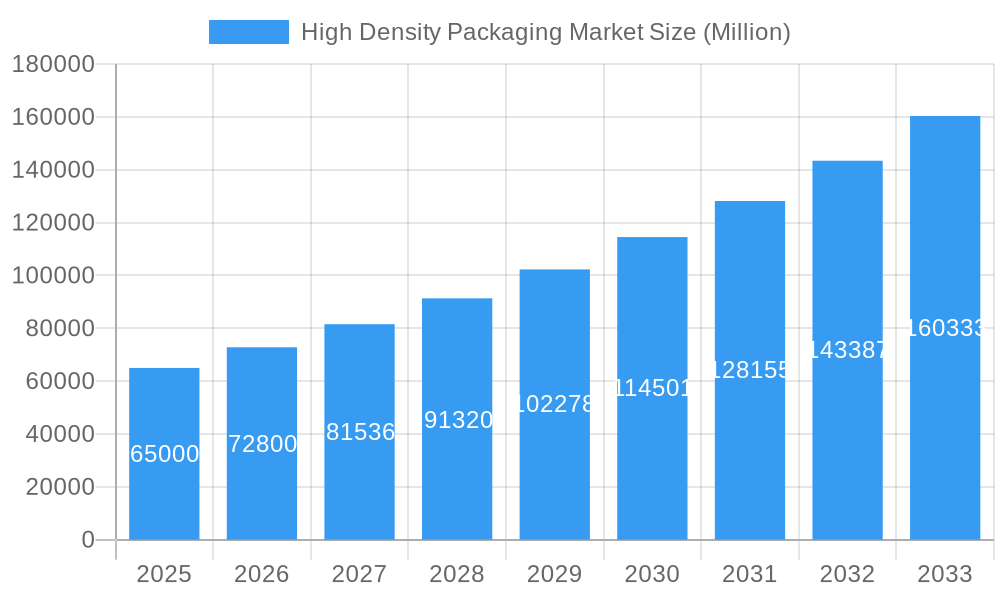

The High-Density Packaging Market is set for significant expansion, projected to reach USD 200.005 billion by 2033, with a robust Compound Annual Growth Rate (CAGR) of 5.7% from the base year 2025. This growth is fueled by the escalating demand for miniaturized, high-performance electronic components across diverse industries. Key sectors like consumer electronics, IT & telecom, and automotive are driving the need for advanced packaging solutions offering superior functionality and space efficiency. Innovations in techniques such as Micro Chiplets (MCP), System in Package (SIP), and 3D - Through-Silicon Via (TSV) are pivotal to this market's upward trajectory, enabling integrated functionalities for smaller form factors, enhanced processing power, and improved thermal management in next-generation devices.

High Density Packaging Market Market Size (In Billion)

While growth prospects are strong, challenges exist. High research and development costs for cutting-edge packaging technologies and complex manufacturing processes may influence market pace. Global supply chain disruptions and the increasing complexity of semiconductor manufacturing also present hurdles. However, the intrinsic value of high-density packaging in enabling faster, more powerful, and energy-efficient electronics for Artificial Intelligence, 5G infrastructure, and the Internet of Things (IoT) is expected to overcome these limitations. The market features intense competition among major players, fostering continuous innovation. The Asia Pacific region is anticipated to lead, supported by its strong manufacturing base and burgeoning demand for advanced electronics.

High Density Packaging Market Company Market Share

This report provides an in-depth analysis of the High-Density Packaging Market, offering projections and insights from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033. We examine market dynamics, competitive landscapes, technological advancements, and emerging trends to guide stakeholders. The high-density interconnect (HDI) packaging market, advanced semiconductor packaging market, and 3D IC packaging market are central to this analysis, driven by relentless innovation and increasing industry demand.

High Density Packaging Market Market Concentration & Innovation

The High Density Packaging Market is characterized by moderate to high concentration, with key players such as Samsung Group, NXP Semiconductors N.V., IBM Corporation, Toshiba Corporation, and Micron Technology holding significant market share. Innovation is the primary growth catalyst, fueled by the relentless pursuit of smaller, faster, and more power-efficient electronic components. Companies are heavily investing in Research and Development for advanced packaging techniques like 3D – TSV (Through-Silicon Via) and System-in-Package (SiP) to meet the escalating demands of high-performance computing, artificial intelligence, and the Internet of Things (IoT). Regulatory frameworks, primarily focusing on environmental standards and supply chain security, are influencing manufacturing processes and material selection. Product substitutes, while present in less sophisticated packaging solutions, are increasingly unable to match the performance and miniaturization benefits offered by high-density packaging. End-user trends, particularly the insatiable demand for miniaturized and powerful consumer electronics and advanced automotive systems, are shaping product roadmaps. Mergers and Acquisition (M&A) activities, with deal values reaching into the hundreds of millions, are observed as companies strategically consolidate to enhance their technological capabilities, expand their product portfolios, and gain a competitive edge. For instance, acquisitions focusing on SiP integration and advanced substrate technologies are prominent.

High Density Packaging Market Industry Trends & Insights

The global high density packaging market is experiencing robust expansion, driven by several intersecting trends and technological advancements. The ever-increasing demand for miniaturization in electronic devices, from smartphones and wearables to complex medical implants and advanced automotive electronics, is a primary growth engine. This necessitates packaging solutions that can house more functionality in smaller footprints, a core competency of high-density packaging. The rapid proliferation of the Internet of Things (IoT) ecosystem, with its vast network of connected devices, further amplifies the need for compact, high-performance, and energy-efficient packaging. Artificial Intelligence (AI) and Machine Learning (ML) applications, requiring immense processing power and data handling capabilities, are also a significant driver, pushing the boundaries of semiconductor integration through techniques like 3D – TSV packaging.

Technological disruptions are continuously reshaping the market. The advancement of fan-out wafer-level packaging, 2.5D and 3D integration, and the increasing sophistication of Multi-Chip Modules (MCM) and Multi-Chip Packages (MCP) are enabling unprecedented levels of performance and functionality. These innovations allow for the integration of diverse semiconductor components onto a single package, reducing form factor and improving signal integrity. Consumer preferences are evolving towards more integrated, powerful, and aesthetically pleasing electronic devices, directly influencing the demand for high-density packaging solutions that facilitate these design goals. The automotive sector, with its increasing integration of advanced driver-assistance systems (ADAS), autonomous driving technologies, and in-car infotainment systems, presents a substantial growth avenue, demanding robust and highly integrated electronic components. The IT & Telecom sector, with its continuous need for faster processors and more memory in servers, networking equipment, and mobile devices, also remains a cornerstone of market demand. The semiconductor packaging industry is witnessing a paradigm shift towards higher levels of integration and performance, with a projected Compound Annual Growth Rate (CAGR) of approximately 8.5% over the forecast period. Market penetration of advanced packaging techniques is steadily increasing, displacing older, less efficient methods. The competitive dynamics are intense, with key players constantly innovating and vying for market leadership through technological superiority, strategic partnerships, and capacity expansion.

Dominant Markets & Segments in High Density Packaging Market

The high density packaging market exhibits clear dominance across specific regions and application segments. Geographically, Asia Pacific, particularly countries like China, South Korea, Taiwan, and Japan, stands as the leading market due to its robust semiconductor manufacturing ecosystem, significant concentration of electronics assembly, and substantial domestic demand from consumer electronics and IT & Telecom sectors. Favorable government policies promoting semiconductor manufacturing and R&D, coupled with a vast pool of skilled labor, further solidify its leadership. The United States and Europe are significant markets, driven by innovation in sectors like Aerospace & Defence, Medical Devices, and Automotive, with a strong emphasis on advanced technologies and stringent quality standards.

Within packaging techniques, 3D – TSV (Through-Silicon Via) is emerging as a dominant and rapidly growing segment. Its ability to enable vertical integration of multiple dies offers unparalleled performance, miniaturization, and power efficiency, making it crucial for high-performance computing, AI accelerators, and advanced memory solutions. System-in-Package (SiP) also holds a significant market share, offering a cost-effective way to integrate diverse functionalities and technologies into a single package, catering to the complex needs of consumer electronics and IoT devices.

In terms of applications, Consumer Electronics remains the largest and most influential segment. The insatiable demand for smartphones, tablets, wearables, gaming consoles, and smart home devices with enhanced capabilities and smaller form factors directly fuels the growth of high-density packaging. The IT & Telecom sector is another colossal driver, encompassing servers, networking equipment, data centers, and mobile communication devices that require high-speed processing and massive data handling. The Automotive sector is a rapidly expanding segment, driven by the increasing electrification of vehicles, the integration of ADAS, autonomous driving systems, and sophisticated infotainment. The stringent reliability and performance requirements of this sector favor advanced packaging solutions. The Medical Devices segment is experiencing steady growth, with the increasing adoption of implantable devices, advanced imaging equipment, and wearable health monitors demanding miniaturized, high-performance, and highly reliable electronic components. The Aerospace & Defence sector, while smaller in volume, represents a high-value market segment due to its stringent reliability, performance, and ruggedization requirements for critical applications.

High Density Packaging Market Product Developments

Product developments in the High Density Packaging Market are characterized by a relentless push towards greater integration, enhanced performance, and improved power efficiency. Innovations in 3D – TSV packaging are enabling the stacking of multiple silicon dies vertically, leading to faster interconnect speeds and reduced form factors crucial for AI processors and high-bandwidth memory (HBM). System-in-Package (SiP) advancements are allowing for the integration of diverse components, including processors, memory, RF devices, and sensors, into a single module, catering to the complex needs of IoT devices and advanced consumer electronics. Wafer-level packaging techniques are continuously evolving to deliver cost-effective, high-density solutions. Competitive advantages stem from superior thermal management, reduced signal latency, and the ability to support higher pin counts, meeting the demanding specifications of next-generation electronic systems across all application domains.

Report Scope & Segmentation Analysis

This report meticulously analyzes the High Density Packaging Market, segmenting it across key dimensions to provide granular insights. The Packaging Technique segmentation includes: MCM (Multi-Chip Module), characterized by its flexibility in integrating different chip technologies; MCP (Multi-Chip Package), focusing on stacking multiple dies in a single package; SIP (System-in-Package), enabling the integration of diverse functionalities into one module; and 3D – TSV (Through-Silicon Via), representing the pinnacle of vertical integration for enhanced performance and miniaturization. The Application segmentation covers: Consumer Electronics, a high-volume segment driven by smartphones and wearables; Aerospace & Defence, demanding high reliability and performance; Medical Devices, requiring miniaturization and precision; IT & Telecom, serving the backbone of digital infrastructure; Automotive, a rapidly growing segment with increasing electronic complexity; and Other Applications, encompassing emerging and niche markets. Growth projections for each segment are detailed, with the 3D – TSV and Automotive applications expected to witness the highest CAGRs. Market sizes are estimated based on the current adoption rates and future demand forecasts within each segment.

Key Drivers of High Density Packaging Market Growth

The growth of the High Density Packaging Market is propelled by several interconnected factors. Technologically, the relentless miniaturization of electronic devices and the increasing complexity of integrated circuits necessitate advanced packaging solutions. The proliferation of the Internet of Things (IoT), with its billions of connected devices, demands compact, power-efficient, and cost-effective packaging. The exponential growth of data processing and AI workloads requires high-performance computing solutions enabled by advanced packaging techniques like 3D – TSV. Economically, the increasing disposable incomes in emerging economies are fueling demand for sophisticated consumer electronics. Regulatory factors, such as evolving environmental standards, are also indirectly driving innovation towards more efficient and sustainable packaging materials and processes. The automotive industry's transition towards electrification and autonomous driving is a significant economic driver, requiring advanced and reliable electronic components.

Challenges in the High Density Packaging Market Sector

Despite its promising growth, the High Density Packaging Market faces several significant challenges. The intricate nature of advanced packaging processes, particularly for 3D – TSV, leads to higher manufacturing costs compared to traditional packaging methods. Ensuring the reliability and yield of these complex structures, especially under harsh operating conditions, remains a persistent challenge. Supply chain disruptions, as witnessed in recent global events, can severely impact the availability of specialized materials and components, leading to production delays and increased costs. Intense competition among established players and the emergence of new entrants also puts pressure on pricing and profit margins. Furthermore, the continuous evolution of technology requires substantial and ongoing investment in R&D and manufacturing capabilities, posing a barrier for smaller players. The environmental impact of manufacturing processes and the need for sustainable materials are also growing concerns that require innovative solutions.

Emerging Opportunities in High Density Packaging Market

The High Density Packaging Market is ripe with emerging opportunities. The rapid advancement of AI and machine learning applications is creating immense demand for specialized packaging solutions that can support high-performance processors and memory stacks, such as advanced 3D – TSV integration. The burgeoning 5G and future 6G communication technologies will require advanced packaging for RF components, base stations, and user devices, enabling higher frequencies and data rates. The expanding Internet of Medical Things (IoMT) and the growing demand for wearable health monitoring devices present a significant opportunity for miniaturized, reliable, and high-performance medical-grade packaging. The continued electrification and increasing autonomy of vehicles are creating a substantial market for robust and integrated automotive-grade packaging solutions. Emerging applications in augmented reality (AR), virtual reality (VR), and advanced sensing technologies also promise significant growth potential.

Leading Players in the High Density Packaging Market Market

- Samsung Group

- NXP Semiconductors N V

- IBM Corporation

- Toshiba Corporation

- Fujitsu Ltd

- Micron Technology

- Hitachi Ltd

- Siliconware Precision Industries

- STMicroelectronics

- Amkor Technology

- Mentor - a Siemens Business

Key Developments in High Density Packaging Market Industry

- 2023: Micron Technology announces a breakthrough in HBM3E memory, enabling significant performance gains for AI workloads, leveraging advanced 3D stacking.

- 2023: Samsung Group expands its SiP manufacturing capabilities to meet the growing demand from the 5G and IoT markets.

- 2022: NXP Semiconductors invests heavily in advanced packaging technologies to support the automotive sector's increasing need for integrated ADAS solutions.

- 2022: Amkor Technology acquires a company specializing in fan-out wafer-level packaging, bolstering its portfolio for high-density interconnect solutions.

- 2021: IBM Corporation showcases advancements in 3D integration technologies for future server and AI applications.

- 2020: STMicroelectronics introduces new packaging solutions designed for enhanced thermal performance in consumer electronics.

Strategic Outlook for High Density Packaging Market Market

The strategic outlook for the High Density Packaging Market is exceptionally positive, driven by sustained innovation and expanding application horizons. The continued miniaturization trend, coupled with the ever-increasing demand for higher performance and greater functionality in electronic devices, will fuel market expansion. Key growth catalysts include the widespread adoption of 5G and its subsequent evolution, the rapid progress in AI and machine learning, and the increasing sophistication of the automotive sector. Companies that can offer advanced packaging solutions that address challenges in power efficiency, thermal management, and miniaturization, while also ensuring high reliability and cost-effectiveness, are poised for significant success. Strategic investments in R&D, capacity expansion, and strategic partnerships will be crucial for maintaining a competitive edge in this dynamic and high-growth industry. The market is expected to witness continued consolidation and technological advancements, paving the way for even more integrated and powerful electronic systems in the future.

High Density Packaging Market Segmentation

-

1. Packaging Technique

- 1.1. MCM

- 1.2. MCP

- 1.3. SIP

- 1.4. 3D - TSV

-

2. Application

- 2.1. Consumer Electronics

- 2.2. Aerospace & Defence

- 2.3. Medical Devices

- 2.4. IT & Telecom

- 2.5. Automotive

- 2.6. Other Applications

High Density Packaging Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

High Density Packaging Market Regional Market Share

Geographic Coverage of High Density Packaging Market

High Density Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Advancements in Consumer Electronic Products; Favourable Government Policies and Regulations in Developing Countries

- 3.3. Market Restrains

- 3.3.1. ; High Initial Investment and Increasing Complexity of IC Designs

- 3.4. Market Trends

- 3.4.1. High Application in Consumer Electronics Segment to Augment the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global High Density Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Packaging Technique

- 5.1.1. MCM

- 5.1.2. MCP

- 5.1.3. SIP

- 5.1.4. 3D - TSV

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Consumer Electronics

- 5.2.2. Aerospace & Defence

- 5.2.3. Medical Devices

- 5.2.4. IT & Telecom

- 5.2.5. Automotive

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Packaging Technique

- 6. North America High Density Packaging Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Packaging Technique

- 6.1.1. MCM

- 6.1.2. MCP

- 6.1.3. SIP

- 6.1.4. 3D - TSV

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Consumer Electronics

- 6.2.2. Aerospace & Defence

- 6.2.3. Medical Devices

- 6.2.4. IT & Telecom

- 6.2.5. Automotive

- 6.2.6. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Packaging Technique

- 7. Europe High Density Packaging Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Packaging Technique

- 7.1.1. MCM

- 7.1.2. MCP

- 7.1.3. SIP

- 7.1.4. 3D - TSV

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Consumer Electronics

- 7.2.2. Aerospace & Defence

- 7.2.3. Medical Devices

- 7.2.4. IT & Telecom

- 7.2.5. Automotive

- 7.2.6. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Packaging Technique

- 8. Asia Pacific High Density Packaging Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Packaging Technique

- 8.1.1. MCM

- 8.1.2. MCP

- 8.1.3. SIP

- 8.1.4. 3D - TSV

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Consumer Electronics

- 8.2.2. Aerospace & Defence

- 8.2.3. Medical Devices

- 8.2.4. IT & Telecom

- 8.2.5. Automotive

- 8.2.6. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Packaging Technique

- 9. Latin America High Density Packaging Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Packaging Technique

- 9.1.1. MCM

- 9.1.2. MCP

- 9.1.3. SIP

- 9.1.4. 3D - TSV

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Consumer Electronics

- 9.2.2. Aerospace & Defence

- 9.2.3. Medical Devices

- 9.2.4. IT & Telecom

- 9.2.5. Automotive

- 9.2.6. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Packaging Technique

- 10. Middle East and Africa High Density Packaging Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Packaging Technique

- 10.1.1. MCM

- 10.1.2. MCP

- 10.1.3. SIP

- 10.1.4. 3D - TSV

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Consumer Electronics

- 10.2.2. Aerospace & Defence

- 10.2.3. Medical Devices

- 10.2.4. IT & Telecom

- 10.2.5. Automotive

- 10.2.6. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Packaging Technique

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Samsung Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 NXP Semiconductors N V

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 IBM Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Toshiba Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Fujitsu Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Micron Technology

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Hitachi Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Siliconware Precision Industries

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 STMicroelectronics

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Amkor Technology

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Mentor - a Siemens Business*List Not Exhaustive

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Samsung Group

List of Figures

- Figure 1: Global High Density Packaging Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America High Density Packaging Market Revenue (billion), by Packaging Technique 2025 & 2033

- Figure 3: North America High Density Packaging Market Revenue Share (%), by Packaging Technique 2025 & 2033

- Figure 4: North America High Density Packaging Market Revenue (billion), by Application 2025 & 2033

- Figure 5: North America High Density Packaging Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America High Density Packaging Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America High Density Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe High Density Packaging Market Revenue (billion), by Packaging Technique 2025 & 2033

- Figure 9: Europe High Density Packaging Market Revenue Share (%), by Packaging Technique 2025 & 2033

- Figure 10: Europe High Density Packaging Market Revenue (billion), by Application 2025 & 2033

- Figure 11: Europe High Density Packaging Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe High Density Packaging Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe High Density Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific High Density Packaging Market Revenue (billion), by Packaging Technique 2025 & 2033

- Figure 15: Asia Pacific High Density Packaging Market Revenue Share (%), by Packaging Technique 2025 & 2033

- Figure 16: Asia Pacific High Density Packaging Market Revenue (billion), by Application 2025 & 2033

- Figure 17: Asia Pacific High Density Packaging Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific High Density Packaging Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific High Density Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America High Density Packaging Market Revenue (billion), by Packaging Technique 2025 & 2033

- Figure 21: Latin America High Density Packaging Market Revenue Share (%), by Packaging Technique 2025 & 2033

- Figure 22: Latin America High Density Packaging Market Revenue (billion), by Application 2025 & 2033

- Figure 23: Latin America High Density Packaging Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Latin America High Density Packaging Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Latin America High Density Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa High Density Packaging Market Revenue (billion), by Packaging Technique 2025 & 2033

- Figure 27: Middle East and Africa High Density Packaging Market Revenue Share (%), by Packaging Technique 2025 & 2033

- Figure 28: Middle East and Africa High Density Packaging Market Revenue (billion), by Application 2025 & 2033

- Figure 29: Middle East and Africa High Density Packaging Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa High Density Packaging Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa High Density Packaging Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global High Density Packaging Market Revenue billion Forecast, by Packaging Technique 2020 & 2033

- Table 2: Global High Density Packaging Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global High Density Packaging Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global High Density Packaging Market Revenue billion Forecast, by Packaging Technique 2020 & 2033

- Table 5: Global High Density Packaging Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Global High Density Packaging Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global High Density Packaging Market Revenue billion Forecast, by Packaging Technique 2020 & 2033

- Table 8: Global High Density Packaging Market Revenue billion Forecast, by Application 2020 & 2033

- Table 9: Global High Density Packaging Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global High Density Packaging Market Revenue billion Forecast, by Packaging Technique 2020 & 2033

- Table 11: Global High Density Packaging Market Revenue billion Forecast, by Application 2020 & 2033

- Table 12: Global High Density Packaging Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global High Density Packaging Market Revenue billion Forecast, by Packaging Technique 2020 & 2033

- Table 14: Global High Density Packaging Market Revenue billion Forecast, by Application 2020 & 2033

- Table 15: Global High Density Packaging Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global High Density Packaging Market Revenue billion Forecast, by Packaging Technique 2020 & 2033

- Table 17: Global High Density Packaging Market Revenue billion Forecast, by Application 2020 & 2033

- Table 18: Global High Density Packaging Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the High Density Packaging Market?

The projected CAGR is approximately 5.7%.

2. Which companies are prominent players in the High Density Packaging Market?

Key companies in the market include Samsung Group, NXP Semiconductors N V, IBM Corporation, Toshiba Corporation, Fujitsu Ltd, Micron Technology, Hitachi Ltd, Siliconware Precision Industries, STMicroelectronics, Amkor Technology, Mentor - a Siemens Business*List Not Exhaustive.

3. What are the main segments of the High Density Packaging Market?

The market segments include Packaging Technique, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 200.005 billion as of 2022.

5. What are some drivers contributing to market growth?

; Growing Advancements in Consumer Electronic Products; Favourable Government Policies and Regulations in Developing Countries.

6. What are the notable trends driving market growth?

High Application in Consumer Electronics Segment to Augment the Market Growth.

7. Are there any restraints impacting market growth?

; High Initial Investment and Increasing Complexity of IC Designs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "High Density Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the High Density Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the High Density Packaging Market?

To stay informed about further developments, trends, and reports in the High Density Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence