Key Insights

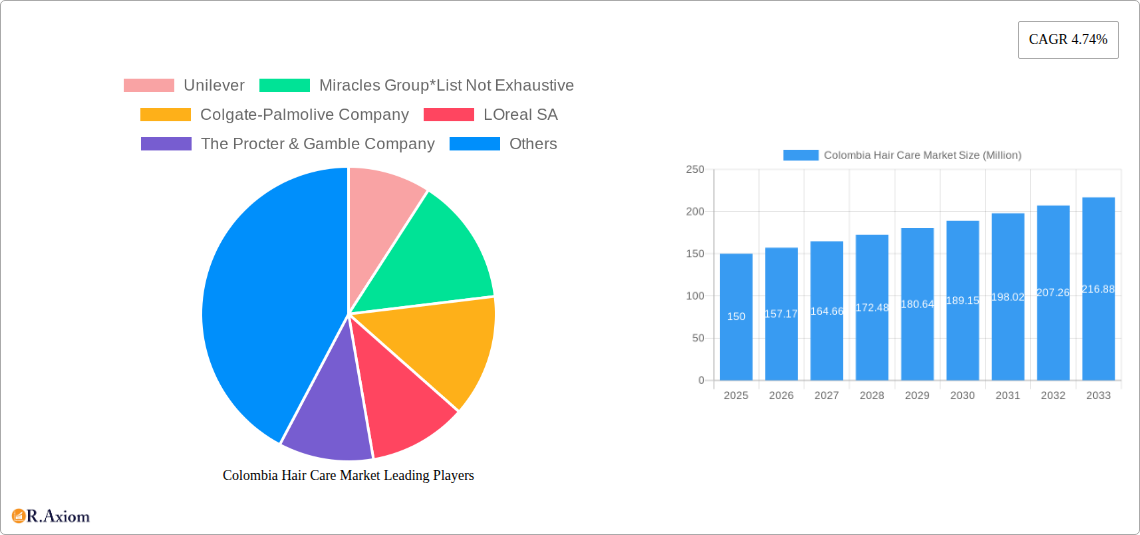

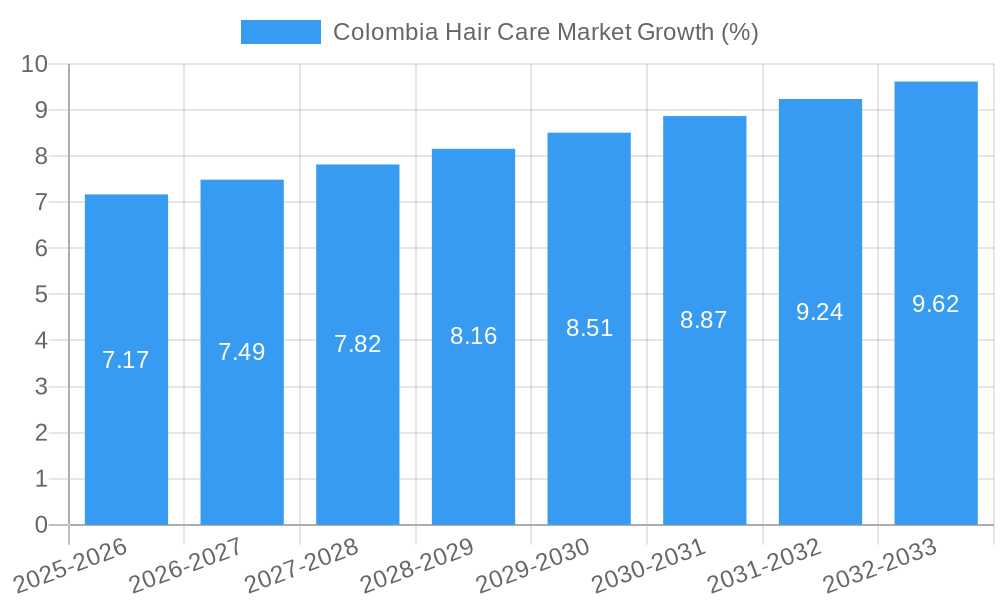

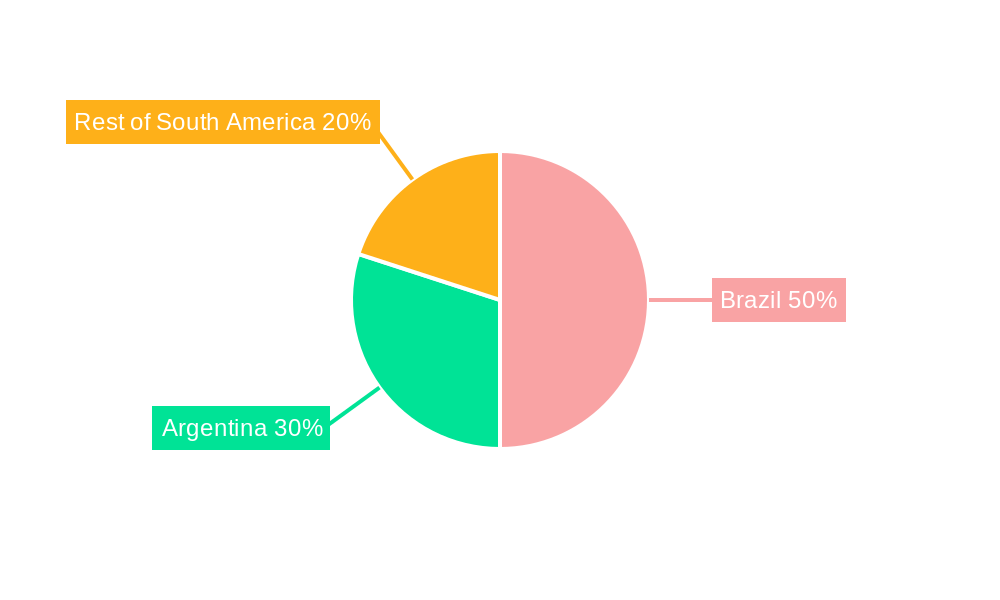

The Colombia hair care market, valued at approximately $XX million in 2025, is projected to experience robust growth, driven by rising disposable incomes, increasing awareness of hair care products, and a growing preference for premium and specialized hair care solutions. The market's 4.74% CAGR indicates a steady expansion over the forecast period (2025-2033). Key growth drivers include the rising popularity of natural and organic hair care products, fueled by a growing health-conscious population. Furthermore, the increasing penetration of e-commerce channels is creating new opportunities for brands to reach a wider consumer base. The market is segmented by product type (shampoo, conditioner, hair oil and serum, others) and distribution channel (supermarket/hypermarket, convenience stores, specialty stores, online stores, other distribution channels). Major players like Unilever, L'Oréal, and Procter & Gamble hold significant market share, although smaller, niche brands focusing on natural ingredients and specialized hair types are gaining traction. The market's segmentation reflects diverse consumer preferences and purchasing behaviors, with online sales expected to grow considerably. Constraints on growth might include economic fluctuations impacting consumer spending and intense competition among established and emerging players. Brazil and Argentina, within the South American region, represent significant sub-markets, further enhancing the market's overall growth trajectory. The market's strong growth potential is attracting both international and domestic investment, leading to innovation in product offerings and distribution strategies.

Considering the given CAGR of 4.74% and a 2025 market value of $XX million (we must assume a value here as it's not explicitly provided in the prompt), the market is expected to show sustained growth across different segments. The shampoo segment will likely maintain its largest share due to its mass appeal, while the hair oil and serum segments are poised for higher growth due to increasing consumer demand for specialized hair care. Online stores are anticipated to gain significant market share as e-commerce penetration increases and convenience becomes a priority for consumers. The competitive landscape is expected to remain dynamic, with mergers and acquisitions, product innovations, and strategic marketing initiatives shaping the market’s future. Understanding the nuances of these trends is crucial for brands to position themselves effectively within the growing Colombian hair care market.

Colombia Hair Care Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Colombia hair care market, offering invaluable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic landscape. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period spanning 2025-2033, this report delivers actionable intelligence for strategic decision-making. The market size is projected at xx Million in 2025 and is expected to reach xx Million by 2033.

Colombia Hair Care Market Concentration & Innovation

This section analyzes the competitive landscape of the Colombian hair care market, examining market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and M&A activities. Key players like Unilever, Unilever, L'Oréal SA, L'Oréal SA, The Procter & Gamble Company, The Procter & Gamble Company, Henkel AG & Company KGaA, Henkel AG & Company KGaA, Colgate-Palmolive Company, Colgate-Palmolive Company, and Miracles Group, along with others like Maria Salome SAS Laboratory and Quala SA, contribute to the market's dynamism.

- Market Concentration: The market exhibits a moderately concentrated structure, with a few major players holding significant market share (estimated at xx% collectively in 2025). Smaller, local players, however, contribute significantly to the overall market size.

- Innovation Drivers: Increasing consumer demand for natural, organic, and specialized hair care products fuels innovation. Technological advancements in formulations (e.g., incorporating advanced ingredients, sustainable packaging) drive product differentiation.

- Regulatory Framework: The Colombian regulatory landscape for cosmetics and personal care products influences product formulation and labeling requirements. Compliance with these regulations is crucial for market entry and sustained success.

- Product Substitutes: The availability of homemade remedies and traditional hair care practices presents a level of substitution, although branded products continue to dominate due to perceived quality and convenience.

- End-User Trends: Growing awareness of hair health and the increasing adoption of sophisticated hair care routines drives demand for premium and specialized products.

- M&A Activities: Consolidation within the market is anticipated, particularly through acquisitions of smaller, niche players by larger multinational corporations. While precise M&A deal values are unavailable for this specific market segment, we expect significant activity in the coming years, with predicted deal values exceeding xx Million during the forecast period.

Colombia Hair Care Market Industry Trends & Insights

This section delves into the major growth drivers, technological disruptions, consumer preferences, and competitive dynamics shaping the Colombian hair care market. The market is poised for robust growth, driven by factors such as rising disposable incomes, increasing urbanization, and a growing preference for personal care products.

The market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market penetration for specific product segments, such as premium hair care products, is expected to increase significantly, with penetration rates projected to reach xx% by 2033. Key trends include a surge in demand for natural and organic products, increasing adoption of online shopping, and the growing influence of social media influencers on purchasing decisions. Competitive dynamics are characterized by intense rivalry among established players and the emergence of new entrants offering innovative products and services. Technological advancements, such as AI-powered personalized recommendations and smart beauty devices, are transforming the consumer experience and driving market growth.

Dominant Markets & Segments in Colombia Hair Care Market

The Colombian hair care market demonstrates strong regional variation, with major cities and densely populated areas exhibiting higher consumption rates. Within product segments, shampoo remains the dominant category, followed by conditioners and hair oils/serums.

By Type:

- Shampoo: This segment enjoys the largest market share due to its widespread use and accessibility across various price points. High demand is driven by frequent usage and availability in diverse formats.

- Conditioner: Growing awareness of hair health and the increasing desire for smooth, manageable hair propel the growth of this segment.

- Hair Oil and Serum: This segment witnesses strong growth, fueled by increasing popularity of hair treatments and the focus on hair repair and nourishment.

- Others: This segment encompasses styling products, hair colorants, and other specialized treatments, showing moderate growth driven by increasing product variety and evolving hair care routines.

By Distribution Channel:

- Supermarket/Hypermarket: These channels remain the dominant distribution channel due to wide reach and accessibility.

- Convenience Stores: Contribute significantly to market reach, particularly for smaller packaged products and impulse purchases.

- Specialty Stores: Focus on premium or niche products catering to specialized needs, growing in popularity.

- Online Stores: This channel experiences rapid growth fueled by increasing internet penetration and the convenience of online shopping.

- Other Distribution Channels: Salons, beauty supply stores, and direct sales contribute to the overall market.

Key drivers for growth across all segments include the rising middle class, greater disposable income, and increased awareness of hair care routines. The availability of affordable products from both international and local brands also contributes to market expansion.

Colombia Hair Care Market Product Developments

Recent product innovations focus on natural and organic ingredients, sustainable packaging, and personalized solutions. Formulations incorporating advanced technologies, such as keratin treatments and hair growth stimulants, are gaining traction. Companies are emphasizing convenience through travel-sized formats and innovative application methods. The market displays a strong preference for products that cater to specific hair types (e.g., curly, straight, damaged) and address concerns such as hair fall, dryness, and frizz.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the Colombian hair care market, segmented by product type (Shampoo, Conditioner, Hair Oil & Serum, Others) and distribution channel (Supermarket/Hypermarket, Convenience Stores, Specialty Stores, Online Stores, Other Distribution Channels). Each segment's market size, growth projections, and competitive dynamics are detailed within the report, providing a clear understanding of market opportunities and potential risks.

Key Drivers of Colombia Hair Care Market Growth

The Colombian hair care market's growth is driven by several factors: rising disposable incomes, increasing urbanization leading to greater exposure to branded products, growing awareness of hair care and health, and the increasing preference for convenient, high-quality products. Technological advancements in formulations and distribution channels also contribute significantly. Government initiatives promoting local manufacturing and the increasing popularity of online shopping further support market growth.

Challenges in the Colombia Hair Care Market Sector

Challenges include the presence of counterfeit products, fluctuating exchange rates affecting import costs, and intense competition from established international and local players. Supply chain disruptions, particularly in sourcing raw materials, also pose a challenge. Moreover, evolving consumer preferences require brands to constantly innovate and adapt to maintain market relevance.

Emerging Opportunities in Colombia Hair Care Market

Emerging opportunities lie in the increasing demand for natural and organic products, the growing popularity of hair care treatments and services, and the expanding online sales channel. There is potential for growth in niche segments, such as products targeting specific hair types or addressing unique hair concerns. The adoption of personalized hair care solutions and the use of advanced technologies in product formulation present significant growth avenues.

Leading Players in the Colombia Hair Care Market Market

- Unilever

- Miracles Group

- Colgate-Palmolive Company

- L'Oréal SA

- The Procter & Gamble Company

- Henkel AG & Company KGaA

- Maria Salome SAS Laboratory

- Quala SA

Key Developments in Colombia Hair Care Market Industry

- 2022 Q4: Unilever launches a new line of sustainable hair care products.

- 2023 Q1: L'Oréal SA invests in a local Colombian manufacturer to expand production capacity.

- 2023 Q2: A new entrant enters the market with an innovative hair growth product line.

- (Further key developments to be added)

Strategic Outlook for Colombia Hair Care Market Market

The Colombian hair care market presents a compelling opportunity for both established and emerging players. Continued growth is anticipated, fueled by increasing consumer spending, rising awareness of hair health, and technological innovations. Companies that adapt to evolving consumer preferences, prioritize sustainability, and leverage digital channels will be best positioned for success. The market's dynamism necessitates agile strategies and a focus on product differentiation to capture market share and achieve sustained growth.

Colombia Hair Care Market Segmentation

-

1. Type

- 1.1. Shampoo

- 1.2. Conditioner

- 1.3. Hair Oil and Serum

- 1.4. Others

-

2. Distribution Channel

- 2.1. Supermarket/Hypermarket

- 2.2. Convenience Stores

- 2.3. Specialty Stores

- 2.4. Online Stores

- 2.5. Other Distribution Channels

Colombia Hair Care Market Segmentation By Geography

- 1. Colombia

Colombia Hair Care Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.74% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for Natural/Organic Beauty and Personal Care Products; Skincare Trends Revolutionizing Beauty Industry

- 3.3. Market Restrains

- 3.3.1. Counterfeiting In the Cosmetics And Personal Care Sector

- 3.4. Market Trends

- 3.4.1. Demand for Organic/Natural Products is Rising Rapidly

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Colombia Hair Care Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Shampoo

- 5.1.2. Conditioner

- 5.1.3. Hair Oil and Serum

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarket/Hypermarket

- 5.2.2. Convenience Stores

- 5.2.3. Specialty Stores

- 5.2.4. Online Stores

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Colombia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Brazil Colombia Hair Care Market Analysis, Insights and Forecast, 2019-2031

- 7. Argentina Colombia Hair Care Market Analysis, Insights and Forecast, 2019-2031

- 8. Rest of South America Colombia Hair Care Market Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Unilever

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Miracles Group*List Not Exhaustive

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Colgate-Palmolive Company

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 LOreal SA

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 The Procter & Gamble Company

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Henkel AG & Company KGaA

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Maria Salome SAS Laboratory

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Quala SA

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.1 Unilever

List of Figures

- Figure 1: Colombia Hair Care Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Colombia Hair Care Market Share (%) by Company 2024

List of Tables

- Table 1: Colombia Hair Care Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Colombia Hair Care Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Colombia Hair Care Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Colombia Hair Care Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Colombia Hair Care Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Brazil Colombia Hair Care Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Argentina Colombia Hair Care Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Rest of South America Colombia Hair Care Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Colombia Hair Care Market Revenue Million Forecast, by Type 2019 & 2032

- Table 10: Colombia Hair Care Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 11: Colombia Hair Care Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Colombia Hair Care Market?

The projected CAGR is approximately 4.74%.

2. Which companies are prominent players in the Colombia Hair Care Market?

Key companies in the market include Unilever, Miracles Group*List Not Exhaustive, Colgate-Palmolive Company, LOreal SA, The Procter & Gamble Company, Henkel AG & Company KGaA, Maria Salome SAS Laboratory, Quala SA.

3. What are the main segments of the Colombia Hair Care Market?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Demand for Natural/Organic Beauty and Personal Care Products; Skincare Trends Revolutionizing Beauty Industry.

6. What are the notable trends driving market growth?

Demand for Organic/Natural Products is Rising Rapidly.

7. Are there any restraints impacting market growth?

Counterfeiting In the Cosmetics And Personal Care Sector.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Colombia Hair Care Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Colombia Hair Care Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Colombia Hair Care Market?

To stay informed about further developments, trends, and reports in the Colombia Hair Care Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence